Global Industrial Protective Clothing Market By Type (Disposable, Durable), By Application (Heat & Flame Protection, Chemical Defending Protective Clothing, Mechanical Protective Clothing, Others ), By End-use (Healthcare, Manufacturing, Chemicals, Construction, Food Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 45853

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

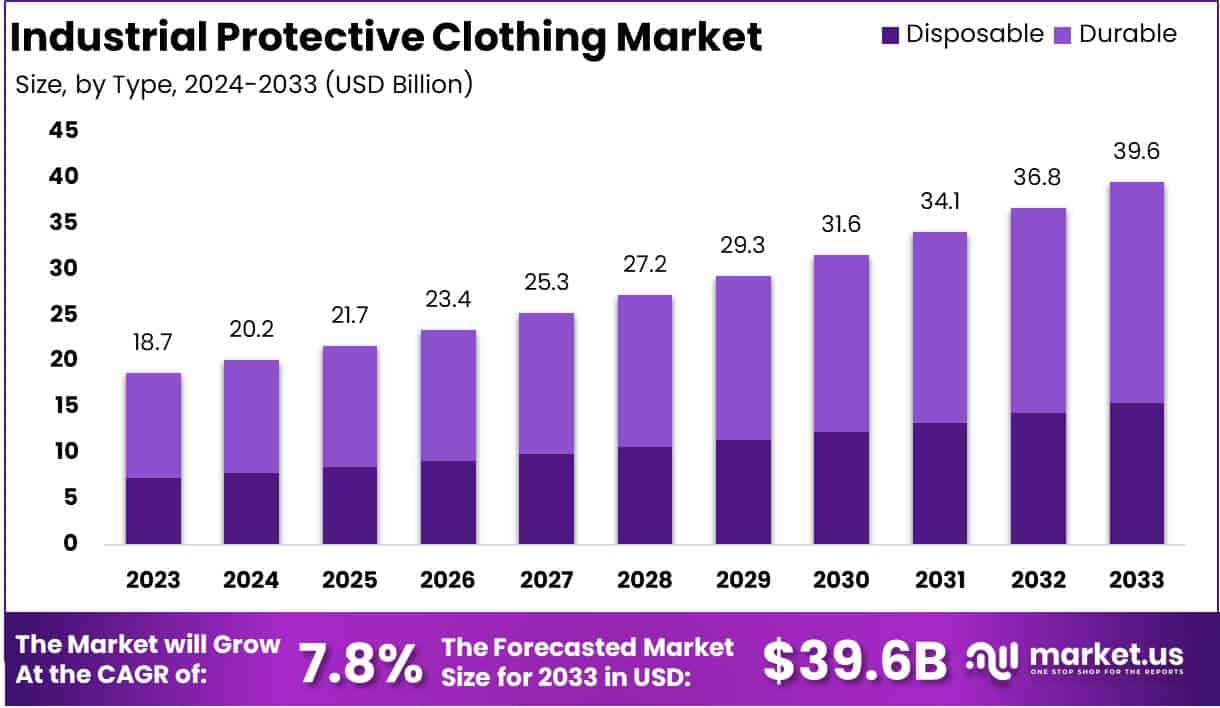

The Global Industrial Protective Clothing Market size is expected to be worth around USD 39.6 Billion by 2033, from USD 18.7 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

Industrial Protective Clothing refers to specialized garments designed to protect workers from hazardous environments, injuries, or exposures in industrial settings. These garments include flame-resistant clothing, chemical protective suits, high-visibility apparel, and garments that guard against electric arc flash, extreme temperatures, or biological agents.

The primary objective of this clothing is to enhance worker safety, ensuring compliance with occupational safety standards and minimizing the risk of workplace accidents or health issues.

The Industrial Protective Clothing Market encompasses the global demand, production, distribution, and consumption of protective apparel used across various industries, such as manufacturing, construction, chemicals, pharmaceuticals, oil & gas, and mining. The market includes a wide array of protective clothing, segmented by materials (e.g., aramid, polyolefin, polyamide), product types, and applications.

It involves various stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. The market’s scope extends to both durable clothing that offers prolonged protection and disposable apparel used for short-term applications.

The growth of the Industrial Protective Clothing Market is primarily driven by stringent regulatory requirements and safety norms implemented by government bodies like OSHA (Occupational Safety and Health Administration), ANSI (American National Standards Institute), and others globally. Additionally, the rising awareness of workplace safety among employers and employees is fueling the demand for protective clothing.

Technological advancements, such as the development of smart fabrics and innovative designs that enhance comfort and performance, are also propelling market growth. Expanding industrialization, particularly in emerging economies, further supports the increased adoption of protective clothing across various sectors, contributing to a steady market expansion.

The demand for industrial protective clothing is robust across several high-risk sectors like oil & gas, chemical processing, and construction, where workers are exposed to dangerous chemicals, flames, or physical hazards. Recent trends show a surge in demand for flame-resistant and chemical-resistant clothing due to the increased focus on fire safety and chemical handling protocols.

The market presents notable opportunities through the adoption of sustainable and eco-friendly materials, catering to the rising preference for green manufacturing practices. Manufacturers are exploring biodegradable or recyclable materials to align with global sustainability trends, creating a niche for environmentally conscious protective clothing.

Moreover, the integration of smart technology, like sensors embedded in protective garments to monitor worker vitals or environmental hazards, represents a lucrative growth area. Geographic expansion into underserved regions and developing economies, where industrialization is accelerating, also offers untapped potential for market players looking to expand their global footprint.

According to DuPont, Tyvek® 800 garments offer superior protection against low-concentration, water-based inorganic chemicals, combining advanced fabric technology with enhanced garment design. These coveralls meet rigorous safety standards—Type 3/4/5/6, suitable for pressurized liquids, aerosols, and solid particles as small as 1.0 micron.

They also provide effective protection in industrial cleaning, chemical packaging, waste treatment, and environmental remediation. Tyvek® 800 meets U.S. standards for blood and viral penetration (ASTM F1670, F1671), ensuring safety against bloodborne pathogens. Enhanced features include a self-adhesive chin flap, serged and over-taped seams, elastic thumb loops, and latex-free manufacturing post-January 2023, ensuring durability and comfort.

According to the Department of Energy, effective workplace safety programs can yield a return of $4 to $6 for every $1 invested, driven by reduced injury and illness costs. In the Industrial Protective Clothing market, indirect incident costs can be up to 10 times higher than direct costs, underscoring the critical need for robust protective measures. This dynamic, combined with stringent regulatory requirements, is accelerating demand across sectors like manufacturing, construction, and chemicals.

According to ScienceDirect, construction workers in U.S. workplaces are 5.57 times more likely to face fatal incidents compared to non-construction workers, with a 95% confidence interval (CI) ranging from 5.45 to 5.65, indicating statistical significance.

Additionally, wearing PPE can lead to a 30% reduction in fall accidents, underscoring the critical role of industrial protective clothing in enhancing safety outcomes.

According to the Department of Energy, investments in effective workplace safety programs, including industrial protective clothing, can yield $4 to $6 in savings for every $1 spent, primarily through reduced direct costs. Indirect costs, however, can be up to 10 times the direct costs, underscoring the crucial role of safety compliance in cost management and risk mitigation.

Key Takeaways

- The Global Industrial Protective Clothing Market is projected to expand from USD 18.7 billion in 2023 to USD 39.6 billion by 2033, driven by a 7.8% CAGR.

- The Global Industrial Protective Clothing Market is projected to expand from USD 18.7 billion in 2023 to USD 39.6 billion by 2033, driven by a 7.8% CAGR.

- Durable protective clothing dominates with a 61% market share, benefiting from its extensive use in high-risk industries like oil & gas and manufacturing.

- Heat & flame protection leads with a 34% share, primarily driven by demand in sectors such as oil & gas, metalworking, and firefighting.

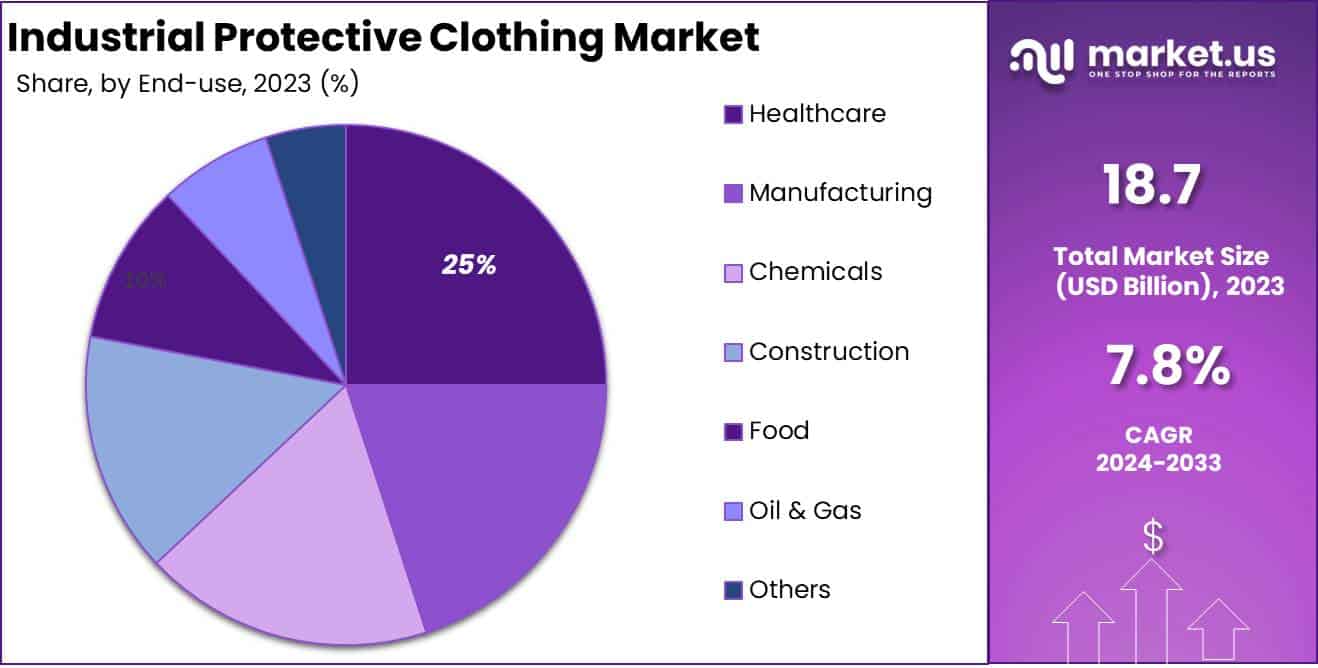

- The healthcare sector holds a 25% share, fueled by increasing demand for personal protective equipment (PPE) due to ongoing infection control measures.

- North America commands a 35% share, supported by stringent safety regulations and widespread adoption of advanced protective apparel.

By Type Analysis

Durable Segment Dominates the Industrial Protective Clothing Market, Capturing 61% Share

In 2023, Durable protective clothing held a dominant position in the type segment of the Industrial Protective Clothing Market, capturing more than 61% of the market share. The segment’s leadership can be attributed to its widespread application across industries such as oil & gas, manufacturing, and construction, where long-lasting protection is critical.

Durable protective clothing, which includes flame-resistant suits, chemical-resistant overalls, and arc-flash protective gear, offers enhanced safety and longevity, making it a preferred choice for industries with frequent exposure to hazardous environments. Its cost-effectiveness over time, combined with growing investments in worker safety, has reinforced demand in this segment.

The Disposable segment accounted for approximately 39% of the Industrial Protective Clothing Market in 2023. This segment has seen significant uptake, particularly in sectors like healthcare, pharmaceuticals, and food processing, where temporary yet effective protection is essential.

The increasing focus on hygiene, cross-contamination prevention, and infection control exacerbated by the COVID-19 pandemic has propelled demand for disposable protective clothing.

Additionally, regulatory requirements for short-term yet reliable protection in chemical labs and cleanrooms contribute to its growing adoption. While this segment is smaller than durable clothing, it remains vital due to its cost-efficiency, ease of use, and compliance with stringent safety protocols.

By Product Analysis

Heat & Flame Protection Dominates the Industrial Protective Clothing Market, Capturing 34% Share

In 2023, Heat & Flame Protection held a dominant position in the product type segment of the Industrial Protective Clothing Market, capturing more than 34% of the market share. This segment’s leadership is driven by high demand in industries such as oil & gas, metalworking, and firefighting, where exposure to extreme heat and flames is a constant risk.

The adoption of flame-resistant clothing, including jackets, overalls, and suits made with advanced materials like Nomex® and Kevlar®, contributes to the segment’s growth. The emphasis on worker safety, combined with stringent regulatory standards, ensures sustained demand for heat and flame-resistant apparel in this category.

The Chemical Defending Protective Clothing segment accounted for 26% of the market in 2023. This segment is essential in sectors like chemical manufacturing, pharmaceuticals, and hazardous material handling, where protection against chemical splashes, gases, and spills is crucial.

The rising focus on safety compliance and the growing awareness of chemical hazards have bolstered demand in this segment, with products like chemical-resistant suits and gloves being widely utilized.

Mechanical Protective Clothing held 22% of the market share in 2023, driven by demand in construction, mining, and heavy machinery industries. This segment includes protective gear that shields workers from abrasions, cuts, and impact, enhancing safety in physically demanding environments.

The increasing adoption of impact-resistant gloves, cut-resistant sleeves, and heavy-duty jackets has contributed to the segment’s steady growth.

The Others category represented 18% of the market share in 2023, covering protective clothing used in diverse applications, such as electrical safety, visibility enhancement, and biological defense. While smaller in share compared to other segments, this category plays a crucial role in specialized industries like healthcare, defense, and utilities, where tailored protection is necessary.

By End-Use Analysis

Healthcare Dominates the Industrial Protective Clothing Market, Capturing 25% Share

In 2023, Healthcare held a dominant position in the end-use segment of the Industrial Protective Clothing Market, capturing more than 25% of the market share. The segment’s growth is primarily driven by increased demand for personal protective equipment (PPE), especially due to the ongoing emphasis on infection control, hygiene, and worker safety in healthcare facilities.

The rising adoption of disposable protective garments, such as gowns, coveralls, and gloves, has further fueled demand in this sector, making healthcare a leading contributor to the overall market.

The Manufacturing segment accounted for 20% of the market share in 2023. The need for diverse protective clothing, including flame-resistant, chemical-resistant, and mechanical protective apparel, drives this demand.

As manufacturing activities expand globally, safety regulations and compliance requirements are boosting the adoption of protective clothing across sectors such as automotive, electronics, and machinery manufacturing.

The Chemicals segment accounted for 18% of the market in 2023. With stringent safety requirements in handling hazardous substances, chemical-resistant clothing, such as suits, gloves, and aprons, is a vital part of this segment. Growing chemical production, combined with regulatory mandates for worker safety, contributes significantly to market demand.

Construction held 15% of the market share in 2023. The demand for mechanical protective clothing, high-visibility apparel, and helmets is driven by ongoing infrastructure projects and increased safety awareness in the sector. The segment benefits from rising investments in both residential and commercial construction.

The Food segment represented 10% of the market in 2023, driven by the need for protective clothing that ensures food safety and hygiene. Clothing like aprons, hairnets, and gloves are widely used to comply with stringent health regulations in food processing and handling facilities.

The Oil & Gas segment accounted for 7% of the market share in 2023. The segment relies heavily on flame-resistant and chemical-protective clothing to protect workers from the extreme hazards of the industry, such as fires, chemical spills, and toxic exposure.

The Others category accounted for 5% of the market in 2023, including sectors like utilities, mining, and logistics. This segment encompasses specialized protective clothing tailored to meet safety requirements in various challenging work environments.

Key Market Segments

By Type

- Disposable

- Durable

By Product Type

- Heat & Flame Protection

- Chemical Defending Protective Clothing

- Mechanical Protective Clothing

- Others

By End-Use

- Healthcare

- Manufacturing

- Chemicals

- Construction

- Food

- Oil & Gas

- Others

Driver

Rising Focus on Workplace Safety Standards

The primary driver for the growth of the global industrial protective clothing market in 2024 is the increasing emphasis on workplace safety regulations worldwide. As industries face rising scrutiny from regulatory bodies, there is a greater need to ensure employee safety through adequate protective clothing, such as flame-resistant gear, chemical-resistant suits, and high-visibility apparel.

Regulations set by organizations at both national and international levels are prompting companies to adopt more stringent safety measures.

This compliance-driven demand is expected to sustain market growth throughout 2024. For example, in the European Union and North America, updated safety regulations require employers to provide protective clothing to prevent injuries and reduce occupational hazards. This drives sustained investments in protective apparel across industries like oil & gas, manufacturing, and construction.

The push for safety has gained urgency in high-risk industries, as evidenced by the increasing number of occupational accidents recorded globally. Companies are therefore not only obligated but also motivated to invest in high-quality protective clothing to safeguard workers, ensure operational continuity, and reduce potential legal liabilities.

Consequently, there is an accelerated uptake of industrial protective clothing in markets like Asia-Pacific, which is rapidly industrializing and witnessing increased safety compliance.

This regulatory emphasis is set to expand the industrial protective clothing market’s footprint, as companies prioritize worker safety to maintain productivity and minimize disruption. Enhanced safety awareness, coupled with regulatory support, is propelling a steady increase in demand for personal protective equipment (PPE), further fostering market expansion in 2024.

Restraint

High Cost of Advanced Protective Clothing

While the industrial protective clothing market is poised for growth, high costs associated with advanced protective clothing act as a significant restraint. Materials like Nomex, Kevlar, and other high-performance fibers, which offer superior protection against extreme hazards, are expensive to manufacture.

This cost is often passed on to end-users, making it challenging for small and medium-sized enterprises (SMEs) to adopt comprehensive protective measures, especially in cost-sensitive markets.

While larger corporations may afford high-grade protective clothing, SMEs often struggle to meet safety standards due to financial constraints. This limits the overall market penetration of advanced protective solutions, despite their effectiveness.

Furthermore, the cost factor is exacerbated by the frequent need to replace protective clothing due to wear and tear, further adding to operational expenses. In developing regions where low-cost alternatives are more appealing, the adoption of top-tier protective clothing is slower. This gap between demand for cost-effective solutions and the high price of advanced options results in market friction, potentially slowing growth.

Manufacturers aiming to expand their market share must balance product innovation with cost-efficiency to make protective clothing accessible to a broader customer base.

Unless cost-related issues are addressed through government subsidies or innovative pricing models, this restraint is likely to persist, hindering rapid adoption and impacting overall market growth in 2024.

Opportunity

Technological Advancements in Protective Clothing

Technological innovation presents a significant opportunity for the industrial protective clothing market in 2024. The integration of smart textiles, which can monitor vital signs, detect environmental hazards, or self-adjust to temperature changes, is revolutionizing protective clothing.

These innovations not only enhance worker safety but also boost efficiency by providing real-time data for proactive risk management.

As industries adopt digital transformation strategies, there is a strong potential for the adoption of smart protective clothing, which aligns with broader industrial automation trends. This advancement could significantly increase demand, particularly in sectors like mining, oil & gas, and chemical processing, where rapid responses to hazards are critical.

Moreover, innovations in sustainable protective clothing, such as the use of recyclable materials or biodegradable fibers, are gaining traction. These advancements address environmental concerns while maintaining safety standards, making protective clothing more appealing to environmentally conscious buyers.

Enhanced fabric durability, lightweight materials, and improved comfort also add to user appeal, facilitating wider adoption. As companies invest in R&D to develop multi-functional, durable, and sustainable products, the market is likely to witness a shift towards premium, tech-enhanced protective apparel.

The growing focus on sustainability, coupled with increased awareness of the benefits of smart textiles, presents a promising growth opportunity for the market, allowing it to cater to evolving customer demands while promoting safer workplaces.

Trends

Growing Adoption of Fire-Resistant Protective Clothing

In 2024, a notable trend shaping the industrial protective clothing market is the increasing adoption of fire-resistant protective clothing across various industries. This surge is largely driven by industries prone to fire-related hazards, such as oil & gas, manufacturing, and electrical utility sectors.

Fire-resistant apparel, designed to withstand high temperatures and prevent burns, is becoming a standard requirement in these sectors due to stringent safety norms and a rising focus on minimizing occupational injuries.

Recent advancements in fire-resistant fabrics, which offer enhanced comfort, breathability, and durability, are also contributing to the trend. These attributes make them more appealing to users, fostering increased adoption.

The trend is also supported by growing investments in infrastructure development, particularly in emerging economies. The construction industry, a major consumer of fire-resistant clothing, is expanding rapidly in regions like Asia-Pacific and Latin America, where governments are pushing large-scale projects.

The rise in industrial fires and the associated risks have further compelled employers to adopt advanced fire-resistant protective gear as a preventive measure.

Additionally, the awareness of potential life-threatening risks has driven industries to prioritize fire safety more than ever. As this trend continues to gain momentum, manufacturers are expected to focus on product innovations that combine safety with comfort, thereby enhancing the appeal of fire-resistant clothing and sustaining market growth in 2024.

Regional Analysis

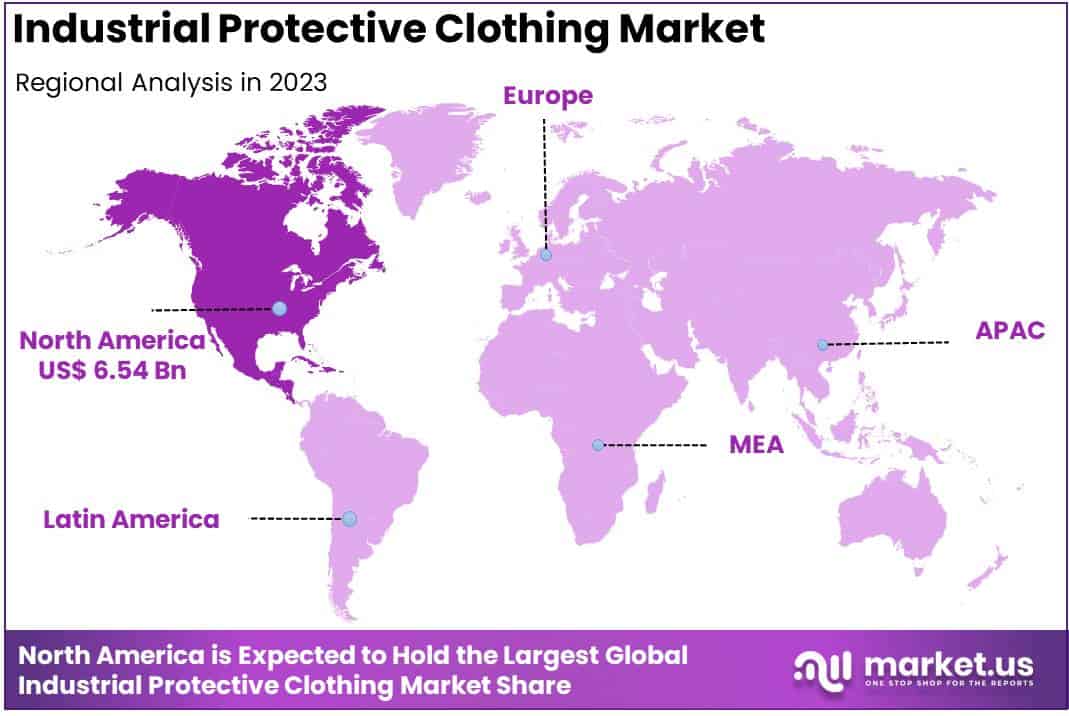

North America Leads Industrial Protective Clothing Market with Largest Share of 35%

North America holds the dominant position in the global industrial protective clothing market, accounting for 35% of the total share in 2023, translating to a market value of approximately USD 6.54 billion.

The region’s leadership is driven by stringent safety regulations and extensive adoption of protective apparel across industries such as oil & gas, pharmaceuticals, and manufacturing. Regulatory bodies mandate compliance with strict safety standards, driving consistent demand for high-quality protective clothing.

Europe remains a significant player in the industrial protective clothing market, with robust growth attributed to strong workplace safety laws, particularly in the EU. The region’s focus on reducing occupational hazards, along with the rising adoption of sustainable protective clothing solutions, is boosting demand.

Countries like Germany, France, and the UK are among the key markets, driven by their well-established industrial sectors, especially in chemicals, construction, and manufacturing.

The emphasis on green protective clothing and adherence to rigorous safety norms propels consistent demand across the region. Europe is expected to continue its steady growth trajectory as safety standards evolve and new industries emerge.

Asia-Pacific is experiencing the fastest growth in the industrial protective clothing market, supported by rapid industrialization and increasing safety awareness. The expanding manufacturing and construction sectors, particularly in China, India, and Japan, are fueling demand.

Governments in the region are strengthening occupational safety regulations, resulting in heightened adoption of protective clothing.

Additionally, the rise of large-scale infrastructure projects and manufacturing hubs is increasing demand for both basic and advanced protective clothing solutions. The region’s cost-competitive production capabilities and growing export activities further enhance its market growth prospects, making Asia-Pacific a critical focus area for global market expansion.

The Middle East & Africa region is witnessing a gradual increase in demand for industrial protective clothing, driven by expanding oil & gas activities, construction projects, and growing regulatory compliance. Countries like Saudi Arabia, the UAE, and South Africa are at the forefront of this demand, as industries align with global safety standards to reduce workplace risks.

While adoption rates are slower compared to more mature markets, rising government investments in infrastructure and industrial development are boosting demand for protective apparel. This trend is expected to continue, with market players targeting the region for strategic expansions to capitalize on growing safety awareness.

Latin America is experiencing moderate growth in the industrial protective clothing market, led by countries like Brazil, Mexico, and Argentina. The region’s growing mining, oil & gas, and agriculture sectors contribute significantly to the demand for protective clothing.

While regulatory frameworks are less stringent compared to North America and Europe, there is a noticeable shift towards improved workplace safety standards, especially in high-risk industries.

Investments in infrastructure and energy projects, coupled with a focus on worker safety, are driving the market. As regional economies recover and industrial activities rise, Latin America’s demand for industrial protective clothing is expected to grow steadily.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Industrial Protective Clothing Market in 2024 is characterized by a highly competitive landscape with a mix of well-established players and emerging companies driving innovation and market expansion. W. L. Gore & Associates, Inc., known for its GORE-TEX® fabric technology, continues to hold a strong position by leveraging advanced material science, focusing on breathable, waterproof, and durable protective garments.

Honeywell International Inc. remains a key market leader, offering a broad portfolio that integrates advanced personal protective equipment (PPE) solutions, including smart apparel that enhances worker safety through real-time data tracking.

Lakeland Industries, Inc. maintains its presence by providing a comprehensive range of flame-resistant and chemical-protective apparel, with a focus on cost-effective solutions suitable for high-risk industries like oil & gas and chemical manufacturing.

Meanwhile, PBI Performance Products, Inc. emphasizes high-performance fibers known for their exceptional heat and flame resistance, catering particularly to the firefighting and defense sectors.

Kimberly-Clark has strengthened its position through a strong focus on disposable protective clothing, catering to sectors like healthcare and laboratories, where single-use garments are critical.

Bennett Safetywear Ltd. and Ansell Ltd are notable for their expertise in hand and body protection, providing tailored solutions to mitigate specific industrial hazards. Teijin Limited and Australian Defense Apparel are expanding their market footprint through innovative fabrics that balance protection, comfort, and sustainability.

Workwear Outfitters, LLC and DuPont continue to drive innovation with advanced materials like Kevlar® and Nomex®, ensuring consistent demand across high-risk industries

Additionally, TenCate Protective remains focused on advanced fire-resistant clothing, serving the military, law enforcement, and emergency response markets. Collectively, these key players, along with others, emphasize R&D, technological integration, and strategic partnerships to gain a competitive edge in the evolving market.

Top Key Players in the Market

- W. L. Gore & Associates, Inc.

- Honeywell International Inc.

- Lakeland Industries, Inc.

- PBI Performance Products, Inc.

- Kimberly-Clark

- Bennett Safetywear Ltd.

- Ansell Ltd

- Teijin Limited

- Australian Defense Apparel

- Workwear Outfitters, LLC

- DuPont

- TenCate Protective

- Other Key Players

Recent Developments

- In May 16, 2023, Protective Industrial Products, Inc. (PIP®), a leading global provider of personal protective equipment (PPE), announced it had signed a definitive agreement to acquire ISM Heinrich Krämer GmbH & Co. KG (ISM) based in Lippstadt, Germany. The acquisition is expected to be finalized by the end of May, expanding PIP’s global presence. PIP®, backed by Odyssey Investment Partners, operates over 30 locations worldwide.

- In April 8, 2024, Ansell Limited announced a binding agreement to acquire the personal protective equipment (PPE) business of Kimberly-Clark (KCPPE) for $6.401 billion in cash. This acquisition aims to strengthen Ansell’s portfolio in the PPE sector.

- In 2023, DuPont™ introduced Tyvek® 800 coveralls, designed with enhanced protection against low-concentration, water-based inorganic chemicals. These coveralls offer durability and comfort while meeting high safety standards. They are suitable for industrial cleaning, waste treatment, and environmental remediation.

- In 2022, Toray Industries, Inc., launched LIVMOA™ 4500AS disposable protective clothing in Japan. The product meets JIS T 8115 Type 4 standards for spray-tight chemical protection and provides superior dust protection and breathability. Toray aims to sell 500,000 units by 2025.

Report Scope

Report Features Description Market Value (2023) USD 18.7 Billion Forecast Revenue (2033) USD 39.6 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Disposable, Durable), By Application (Heat & Flame Protection, Chemical Defending Protective Clothing, Mechanical Protective Clothing, Others ), By End-use (Healthcare, Manufacturing, Chemicals, Construction, Food Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape W. L. Gore & Associates, Inc., Honeywell International Inc., Lakeland Industries, Inc., PBI Performance Products, Inc., Kimberly-Clark, Bennett Safetywear Ltd., Ansell Ltd, Teijin Limited, Australian Defense Apparel, Workwear Outfitters, LLC, DuPont, TenCate Protective, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: Which segment has the largest share in the Industrial protective clothing Market?A: In the Industrial protective clothing Market, vendors should focus on grabbing business opportunities from the Durable Clothing segment as it accounted for the largest market share in the base year.

Industrial Protective Clothing MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Protective Clothing MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- РВІ Performance Products Inc.

- Ѕоlvау Ѕ.А.

- Коnіnklіјkе Теn Саtе nv (ТеnСаtе)

- Теіјіn Аrаmіd В.V.

- Еvоnіk Industries

- Gunеі Chemical Іnduѕtrу Co. Ltd.

- Нuntѕmаn International LLС.

- Каnеkа Corporation

- Other Key Players