Global Industrial Dust Collectors Market By Type (Baghouse Dust Collector, Cartridge Dust Collector, Wet Scrubbers, Inertial Separators, Electrostatic Precipitator, Others), By Mechanism (Dry, Wet), By Mobility (Portable, Fixed), By End-Use Industry (Cement, Food & Beverage, Pharmaceutical, Energy & Power, Steel, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 13798

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

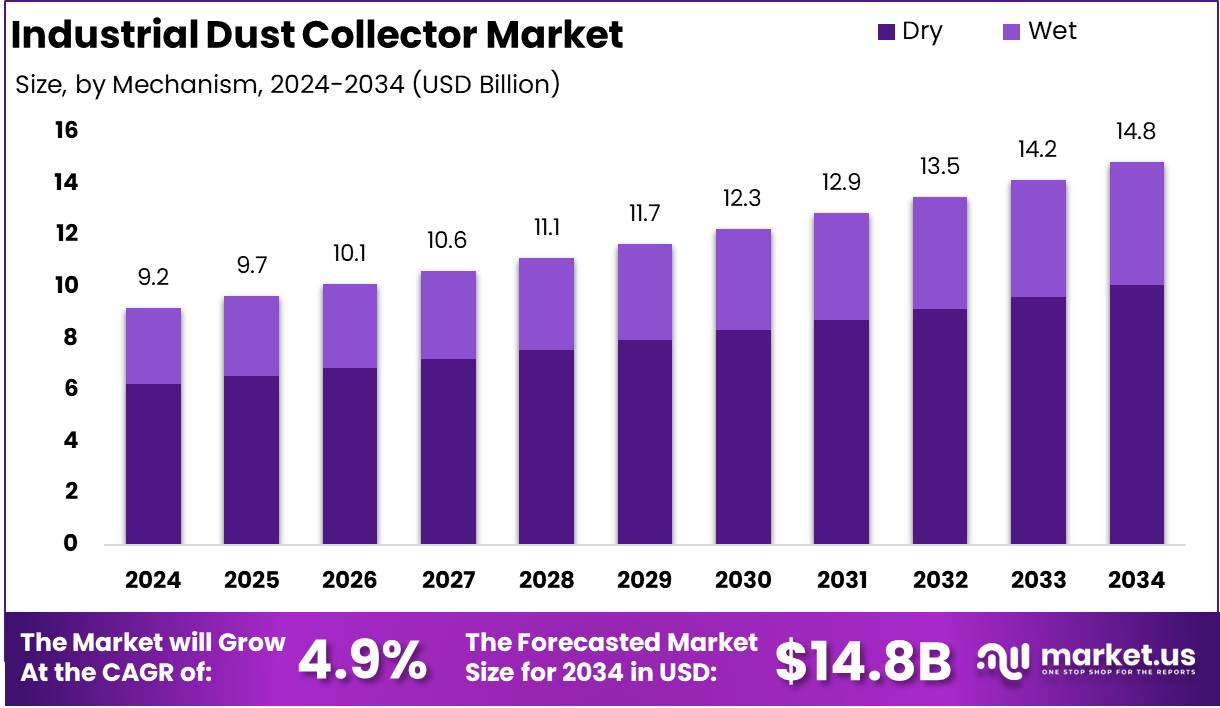

The Global Industrial Dust Collector Market size is expected to be worth around USD 14.8 Billion by 2034 from USD 9.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

An industrial dust collector is a robust system engineered to enhance air quality in manufacturing and processing facilities by capturing, filtering, and removing airborne dust and particulate matter generated during industrial operations. These systems are critical in maintaining occupational health and safety, ensuring compliance with environmental regulations, and improving overall equipment efficiency.

Industrial dust collectors operate using various filtration mechanisms such as baghouse, cartridge, cyclone, wet scrubbers, or electrostatic precipitators depending on the nature and volume of particulates involved. Their deployment spans a broad array of industries, including pharmaceuticals, cement, food and beverage, metalworking, woodworking, and chemical processing.

The industrial dust collector market encompasses the global supply and demand ecosystem for dust collection systems and related components, serving multiple end-use industries. This market includes system manufacturers, component suppliers, distributors, and service providers offering installation, maintenance, and retrofitting solutions. Market dynamics are shaped by regulatory standards, technological advancements, industrial growth patterns, and environmental concerns.

Product segmentation typically includes baghouse dust collectors, cartridge collectors, cyclone collectors, wet scrubbers, and others, each tailored to specific industrial needs and particulate characteristics. The market’s structure is also influenced by innovation trends such as IoT-enabled monitoring, automation, and energy-efficient filtration technologies.

The growth of the industrial dust collector market can be attributed to increasingly stringent air quality regulations imposed by occupational and environmental safety agencies across major industrial economies. The rising awareness regarding worker health and safety, combined with initiatives promoting sustainable manufacturing practices, has led to heightened demand for advanced dust management systems.

Demand for industrial dust collectors is expected to witness sustained growth across both developed and developing regions, driven by the resurgence of infrastructure and industrial development projects. Industries such as metal fabrication, cement, and pharmaceuticals are increasingly adopting dust collection systems to ensure process reliability and regulatory compliance. The shift toward automation and Industry 4.0 integration is also creating demand for smart dust collectors with real-time monitoring and analytics capabilities.

Significant opportunities exist in the development of energy-efficient, low-maintenance dust collection systems that cater to emerging markets with limited operational budgets. Furthermore, advancements in modular and portable dust collector designs present growth potential in small-to-medium enterprises (SMEs) seeking scalable solutions.

Strategic investments in R&D to create high-performance filtration media, integration of AI-based control systems, and expansion into industries with previously low penetration such as agriculture and renewable energy are expected to unlock new revenue streams. The growing emphasis on green manufacturing and decarbonization initiatives also positions the dust collector market as a key enabler in achieving industrial sustainability goals.

According to Matsushima, modern systems can remove up to 99% of particulates from gas streams, particularly fine particles. However, efficiency decreases for particles smaller than 10 micrometers, as such particles may bypass the filtration process.

According to Buy Metal Online, the Industrial Dust Collector Market is anticipated to witness stable growth, driven by rising steel production and its extensive downstream applications. In 2023, China alone produced 1,019,080 thousand tonnes of steel, accounting for 53.8% of global output.

This steel is primarily consumed across diverse sectors 52% in building and infrastructure, 16% in mechanical equipment, 12% in the automotive industry, 10% in metal products, 5% in other transport, 3% in electrical equipment, and 2% in domestic appliances. The expanding footprint of these industries intensifies the demand for efficient dust collection systems to maintain regulatory compliance and ensure workplace safety, thereby reinforcing the market’s long-term growth trajectory.

Key Takeaways

- The global industrial dust collector market is projected to reach USD 14.8 billion by 2034, rising from USD 9.2 billion in 2024, with a CAGR of 4.9% during the forecast period from 2025 to 2034.

- Baghouse dust collectors held the dominant position in the market in 2024, capturing a 26.8% share, driven by their high filtration efficiency and suitability across a wide range of industrial applications.

- The dry mechanism segment led the market in 2024 with a 67.9% share, owing to its cost-effectiveness, lower maintenance requirements, and widespread use in environments where moisture handling is a concern.

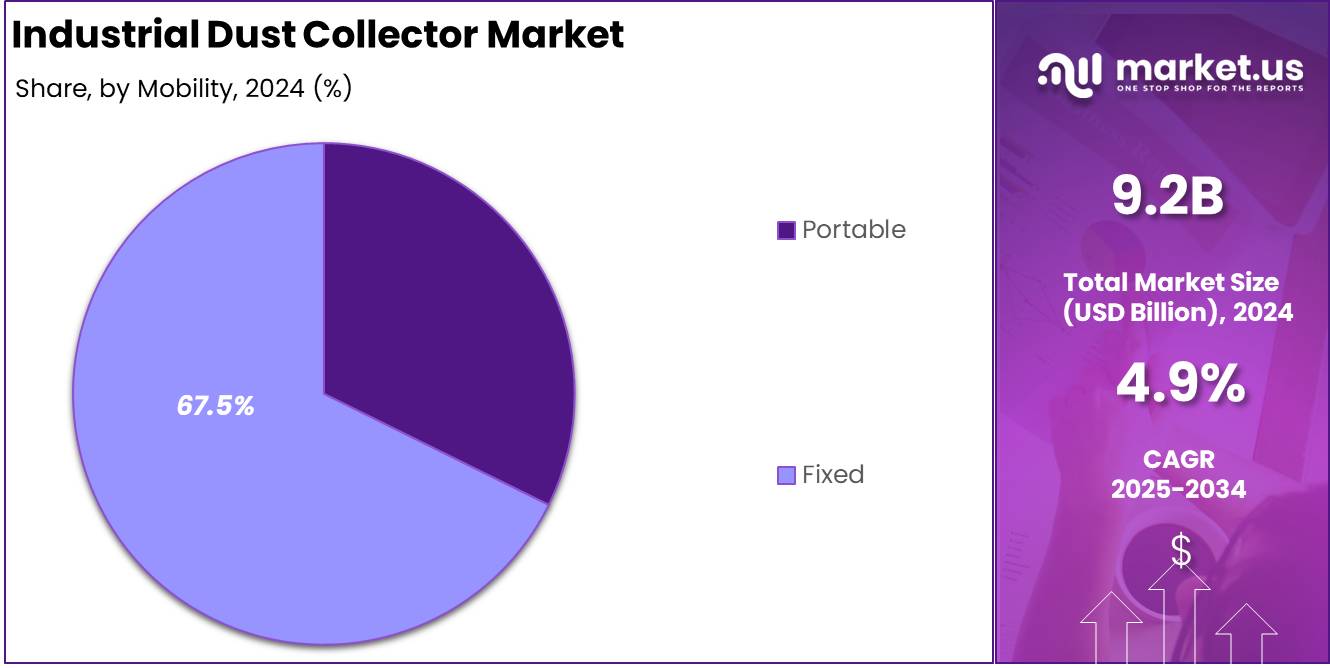

- fixed dust collectors accounted for the majority share of 67.5% in 2024, primarily due to their integration in large-scale, continuous industrial operations requiring permanent air filtration infrastructure.

- The cement sector emerged as the largest contributor to market demand in 2024, representing a 26.2% share, attributed to stringent air pollution regulations and the sector’s high particulate emissions.

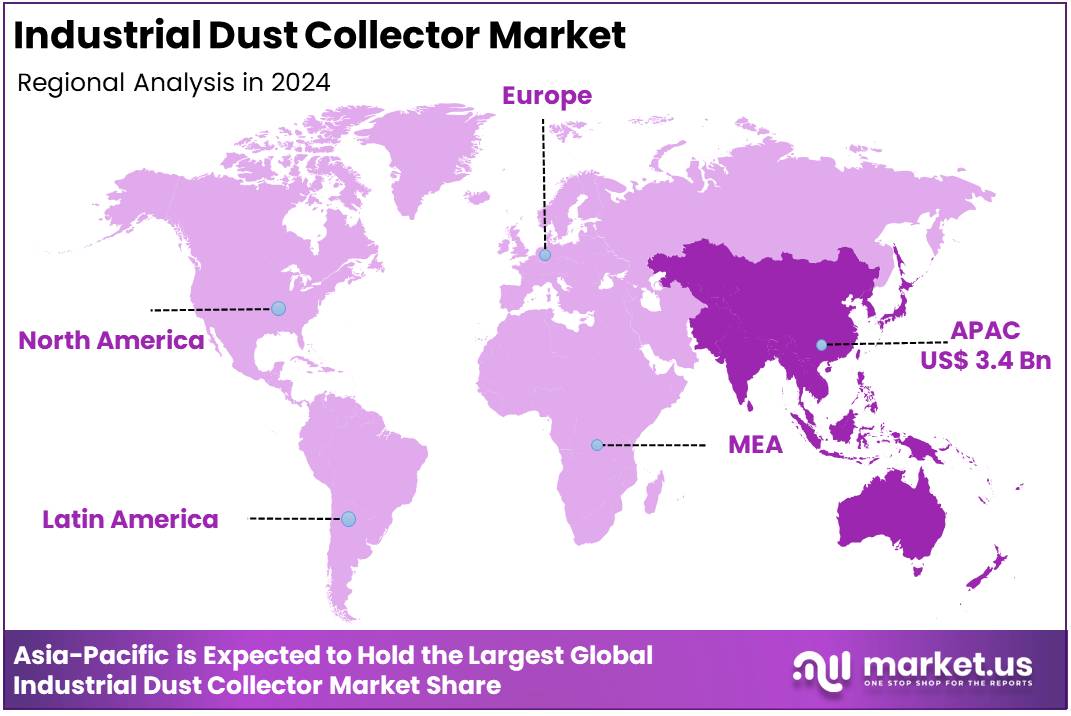

- Asia-Pacific dominated the regional landscape in 2024, holding a 37.0% market share, equivalent to USD 3.4 billion, supported by rapid industrialization, infrastructure development, and environmental regulations in countries such as China and India.

By Type Analysis

Baghouse Dust Collectors Dominate Industrial Dust Collector Market with 26.8% Share in 2024

In 2024, Baghouse Dust Collectors secured the leading position in the industrial dust collector market, accounting for over 26.8% of the total share. This dominance can be attributed to their high filtration efficiency, robust operational life, and ability to handle large volumes of fine and coarse particulate matter.

Their widespread deployment in cement production, metalworking, and pharmaceutical manufacturing is supported by their capability to meet stringent air quality and environmental regulations. These systems are particularly effective in harsh industrial environments, offering consistent performance and ease of maintenance.

Cartridge Dust Collectors represented the second-largest market share, driven by their compact structure, ease of installation, and superior filtration of fine particles. Their lower energy consumption and modular design make them especially suitable for cleanrooms, electronics, and precision manufacturing applications where space is limited and air purity is critical. These collectors are gaining popularity for their efficient pulse-cleaning mechanisms and cost-effectiveness in small to mid-sized operations.

Wet Scrubbers also experienced notable demand, particularly in industries dealing with gas-phase pollutants, moisture-rich particulates, and explosive dusts. These systems are commonly used in chemical processing, mining, and power generation, offering dual functionality by capturing both particulate matter and harmful gases. Compliance with evolving environmental norms, especially related to gaseous emissions, continues to support their adoption.

Inertial Separators remained relevant in applications requiring pre-filtration or removal of larger particulate matter, such as in agriculture, cement, and woodworking industries. Known for their low maintenance, cost-efficiency, and rugged design, these systems are typically used as the first stage in dust control setups where high dust loads are present.

Electrostatic Precipitators (ESPs) maintained their importance in large-scale industrial operations, particularly in coal-fired power plants and metal smelting units. Their ability to capture fine particulate matter with minimal pressure drop and long service life ensures their continued use, despite high capital costs that may hinder adoption in small-scale facilities.

The Others segment, comprising thermal oxidizers, hybrid systems, and portable units, accounted for a niche but growing portion of the market. These technologies are gaining attention for their adaptability in specialized industrial environments, where conventional systems are less effective. Increasing demand for custom-engineered and space-saving dust control solutions is expected to support further growth in this category.

By Mechanism Analysis

Dry Mechanism Dominate Industrial Dust Collector Market with 67.9% Share in 2024

In 2024, Dry mechanism held a dominant market position in the Industrial Dust Collector market, capturing more than 67.9% share. This segment has remained the preferred choice due to its effective filtration performance, low maintenance requirements, and suitability across a wide range of industrial applications.

Dry dust collectors, particularly those using filters like baghouses and cartridge systems, offer long-term cost efficiency and operational reliability. Industries such as cement, metal processing, woodworking, and pharmaceuticals rely heavily on dry collectors to maintain air quality, reduce occupational hazards, and meet stringent environmental regulations.

Moreover, the demand for dry dust collectors has been significantly driven by tightening emission control standards globally. The adoption of advanced filtration media and automated cleaning mechanisms has improved their overall efficiency and lifespan.

Their ability to handle fine and hazardous particulate matter with high collection efficiency often above 99% has positioned them as the primary solution in dust-intensive sectors. Their dominance is expected to remain strong, supported by continued industrial growth in developing economies and ongoing modernization of older facilities in mature markets.

On the other hand, the Wet mechanism accounted for a comparatively smaller share in 2024 but continues to serve niche applications. Wet dust collectors are primarily utilized where dust particles are combustible, sticky, or extremely fine conditions under which dry collectors may underperform or pose fire risks. Industries such as chemical processing, foundries, and certain food manufacturing sectors find value in wet scrubbers due to their ability to neutralize explosive particles and control odors and gaseous emissions.

By Mobility Analysis

Fixed Dominate Industrial Dust Collector Market with 67.5% Share in 2024

In 2024, Fixed systems held a dominant market position in the Industrial Dust Collector market by mobility, capturing more than 67.5% share. Fixed industrial dust collectors are widely installed in large-scale manufacturing plants, processing units, and continuous production environments where high-volume dust generation occurs.

These systems are permanently installed and integrated into the facility’s air management infrastructure, offering powerful and consistent performance over extended periods. Their superior capability to manage large particulate loads and their long service life make them a preferred solution for industries such as cement, steel, power generation, and mining.

The dominance of fixed dust collectors can be attributed to their efficiency in centralized operations and ability to serve multiple dust collection points simultaneously. Furthermore, with growing industrialization and stricter environmental compliance regulations, many large manufacturing plants are upgrading their facilities with high-capacity, fixed dust collection units to ensure regulatory adherence and operational safety. Technological advancements, such as automated filter cleaning and real-time monitoring, have further enhanced their appeal and effectiveness in high-demand environments.

Portable dust collectors accounted for a smaller share of the market in 2024 but play a vital role in smaller-scale or temporary applications. These mobile units are used across workshops, fabrication units, and maintenance environments where flexibility and ease of relocation are essential. Portable systems are particularly useful for capturing dust at the source in confined or variable workspaces, offering operational agility that fixed systems cannot.

Despite their lower market share, portable dust collectors are gaining traction in industries where mobility, modularity, and cost-effectiveness are prioritized. Their demand is expected to grow gradually, driven by the rise of small-to-medium enterprises, on-site fabrication activities, and short-term industrial projects requiring localized dust control solutions.

By End-Use Industry Analysis

Cement Dominate Industrial Dust Collector Market with 26.2% Share in 2024

In 2024, the Cement industry held a dominant position in the Industrial Dust Collector market by end-use industry, capturing more than 26.2% share. Cement manufacturing involves extensive handling of raw materials such as limestone, clay, and clinker, which generate large volumes of dust. To control air pollution and meet environmental regulations, cement plants rely heavily on dust collectors, particularly baghouse systems, due to their high dust filtration efficiency and reliability in harsh operating environments. Their continuous use during raw material processing, kiln operations, and packaging contributes significantly to overall market demand.

The Mining industry represented another key segment, driven by the need for dust control in material extraction, crushing, and handling operations. Dust collectors are essential in improving air quality and protecting worker safety in underground and open-pit mining sites. Baghouse and cartridge filters are commonly used due to their high collection efficiency and ability to operate in rugged conditions.

The Steel industry also accounted for a significant portion of the market, as steel manufacturing processessuch as smelting, casting, and rolling emit fine and hazardous particulates. Dust collectors play a critical role in managing emissions, protecting equipment, and maintaining compliance with air quality standards. Fixed dry systems, particularly baghouse collectors, are standard installations in steel plants for their durability and efficiency.

In the Energy & Power sector, especially coal-fired power plants, dust collectors are installed to capture fly ash and fine dust from combustion processes. Increasing emphasis on emission control and regulatory enforcement has sustained the demand for robust dust collection solutions in this segment.

The Food & Beverage industry utilizes dust collectors to manage dust from grain processing, flour handling, sugar refining, and packaging lines. While the volume of dust is comparatively lower, the need for clean processing environments and compliance with food safety regulations supports steady adoption of smaller-scale dust collection systems.

The Pharmaceutical industry demands high-performance dust collectors for powder handling, tablet manufacturing, and chemical processing. Strict hygiene and contamination control requirements lead to the use of compact, cleanroom-compatible systems.

The Others segment, including textiles, woodworking, and chemical processing, continues to contribute to market demand based on their operational needs and safety regulations. While these segments have lower individual shares, their collective demand adds diversity and depth to the overall industrial dust collector market.

Key Market Segments

By Type

- Baghouse Dust Collector

- Cartridge Dust Collector

- Wet Scrubbers

- Inertial Separators

- Electrostatic Precipitator

- Others

By Mechanism

- Dry

- Wet

By Mobility

- Portable

- Fixed

By End-Use Industry

- Food & Beverage

- Pharmaceutical

- Energy & Power

- Steel

- Cement

- Mining

- Others

Driver

Strengthening Environmental Regulations

The growing stringency of environmental and workplace safety regulations has emerged as a primary driver for the global industrial dust collector market in 2024. Regulatory bodies across regions, such as the Occupational Safety and Health Administration (OSHA) and the European Union’s directives on industrial emissions, have significantly increased enforcement actions to mitigate air pollution and ensure workplace safety. Industrial dust collectors play a critical role in minimizing airborne particulate matter, hazardous dust, and combustion risks within manufacturing and processing facilities.

As compliance becomes non-negotiable, industries are compelled to invest in efficient dust collection systems to meet regulatory thresholds and avoid potential penalties or shutdowns. This legislative pressure is particularly intense in high-pollution sectors such as cement, chemical processing, and metal fabrication, where particulate emissions are substantial and consistent.

In 2024, the industrial dust collector market has seen increased adoption of advanced systems such as baghouse filters, cartridge collectors, and wet scrubbers, especially in developing economies experiencing rapid industrialization and stricter enforcement of air quality standards. Furthermore, national governments have been offering tax incentives and subsidies to encourage industries to install emission control technologies, thus indirectly stimulating market growth.

The direct correlation between regulatory pressure and capital investment in air filtration solutions solidifies this factor as a leading force shaping the market landscape. As industries continue to prioritize sustainability and environmental stewardship, the implementation of robust dust collection solutions is expected to accelerate further, reinforcing their role as essential components in modern industrial operations.

Restraint

High Capital and Operational Costs

Despite favorable demand drivers, the high capital investment and operational expenditure associated with industrial dust collectors act as a significant restraint in 2024. These systems, particularly high-efficiency models designed for continuous operations in harsh industrial environments, require substantial upfront investment.

Beyond procurement, installation involves engineering assessments, ductwork integration, structural modifications, and customization all of which add to total project costs. This financial burden is especially pronounced for small and medium-sized enterprises (SMEs) operating under constrained budgets. Moreover, recurring expenses linked to maintenance, filter replacement, energy consumption, and skilled labor requirements further escalate the total cost of ownership (TCO), making dust collection systems less appealing to cost-sensitive sectors.

In the context of economic volatility and tightened capital flows especially in emerging markets the adoption of industrial dust collectors remains limited by affordability concerns. Industries may delay or scale down installations, particularly in low-margin operations such as woodworking, food processing, or textiles, where return on investment (ROI) timelines are extended.

Additionally, while automation and digital monitoring technologies offer long-term savings, they increase the initial investment, thereby raising the adoption barrier for smaller businesses. This cost-related inertia slows down the pace of technological upgrades and replacement cycles across the market. Consequently, while the regulatory environment remains supportive, the economic feasibility of implementing and maintaining dust collector systems continues to challenge market expansion, potentially moderating growth prospects in the near to mid-term horizon.

Opportunity

Rise of Smart and Energy-Efficient

The integration of Industry 4.0 technologies and smart automation solutions presents a major growth opportunity for the industrial dust collector market in 2024. As industrial facilities increasingly adopt connected systems and digital infrastructure, the demand for intelligent dust collectors capable of real-time monitoring, predictive maintenance, and energy optimization has surged. These next-generation systems are equipped with sensors, IoT modules, and programmable logic controllers (PLCs), enabling facilities to track filter performance, pressure drops, airflow rates, and energy consumption.

The automation of filtration processes not only enhances efficiency but also significantly reduces downtime and maintenance costs. This technological convergence is creating a favorable environment for the proliferation of smart dust collection solutions across manufacturing sectors.

Additionally, the emphasis on sustainability and energy conservation is driving the development of energy-efficient models that minimize electricity consumption without compromising filtration performance. Variable frequency drives (VFDs), pulse-jet cleaning systems, and optimized airflow control mechanisms are being integrated into modern dust collectors to lower operational costs and meet environmental targets. With energy costs constituting a substantial portion of total operating expenses, these innovations are increasingly viewed as strategic investments.

The global trend toward green manufacturing further amplifies this opportunity, encouraging industries to invest in systems that align with ESG (Environmental, Social, and Governance) commitments. This shift toward digital and energy-conscious solutions is poised to transform the traditional dust collector landscape, opening new avenues for market participants and accelerating adoption across multiple verticals.

Trends

Expansion of the Pharmaceutical and Food Processing Sectors

A prominent trend influencing the industrial dust collector market in 2024 is the rapid expansion of the pharmaceutical and food processing industries, both of which demand strict hygiene and contamination control standards. In these sectors, airborne particulate matter can compromise product integrity, introduce biological hazards, and result in regulatory non-compliance.

Consequently, manufacturers are increasingly investing in dust collection systems that ensure clean processing environments and reduce cross-contamination risks. Dust collectors with HEPA-grade filtration and stainless-steel housings are witnessing higher adoption in cleanroom and sanitary applications, where maintaining stringent air purity levels is paramount.

The ongoing global focus on health security, post-pandemic supply chain resilience, and rising demand for processed foods and pharmaceutical products has led to the construction and modernization of production facilities. This trend is particularly evident in emerging economies experiencing both population growth and rising healthcare awareness. These shifts necessitate dust management systems not only to comply with food safety and pharmaceutical manufacturing standards but also to sustain uninterrupted production.

According to recent assessments, investments in dust collection solutions in these sectors have grown by over 20% year-on-year, reflecting their strategic importance in quality assurance and regulatory compliance. The expansion of these hygiene-sensitive industries is expected to sustain long-term demand for customized and high-efficiency dust collection technologies, making this sectoral growth a critical trend in the evolution of the global industrial dust collector market.

Regional Analysis

Asia-Pacific Leads the Industrial Dust Collector Market with the Largest Market Share of 37.0% in 2024

In 2024, the Asia-Pacific region emerged as the leading market for industrial dust collectors, accounting for the largest share of 37.0%, equivalent to a market value of USD 3.4 billion. This dominance can be attributed to rapid industrialization, particularly in countries such as China, India, South Korea, and Southeast Asian nations, where expanding manufacturing sectors and stringent environmental regulations are driving the demand for advanced air pollution control systems.

The presence of large-scale industries across cement, metal processing, food and beverages, and pharmaceuticals further contributes to the region’s high adoption rate. The implementation of national emission norms and an increased focus on occupational safety standards are propelling market growth across both developed and emerging economies in the region.

North America continues to represent a significant share of the industrial dust collector market, driven by the presence of well-established industries and mature regulatory frameworks governing workplace safety and emissions control. Technological advancements in dust collection systems and their adoption across industries such as wood processing, mining, and chemicals have sustained market demand. The United States accounts for the majority of regional revenue, supported by modernization initiatives in manufacturing and increasing retrofitting activities in aging industrial facilities.

Europe follows closely, with consistent demand emerging from Germany, France, and the United Kingdom. The region benefits from strong environmental directives, such as the EU’s Industrial Emissions Directive (IED), promoting the integration of dust collection equipment into industrial infrastructure.

The Middle East & Africa region is experiencing gradual growth, supported by investments in infrastructure, oil and gas processing, and cement industries, particularly in countries such as Saudi Arabia, the UAE, and South Africa. Although the market share remains modest compared to developed regions, increasing awareness about environmental health and growing industrial activities are contributing to steady market development.

Latin America, driven by economies such as Brazil and Mexico, is also witnessing growth in dust collector adoption, fueled by the expansion of mining and construction sectors. However, the region faces challenges related to economic volatility and limited regulatory enforcement, which may hinder market penetration in certain areas. Collectively, these regional dynamics outline a diverse and evolving global industrial dust collector market, with Asia-Pacific firmly positioned as the primary growth engine.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the global Industrial Dust Collector Market in 2024 is characterized by the strategic positioning and technological capabilities of several key players. FLSmidth continues to assert its market presence through advanced filtration technologies integrated into cement and mining operations, leveraging its global footprint to offer comprehensive air pollution control systems.

Hamon, known for its engineering expertise in environmental solutions, maintains a stronghold in thermal power and heavy industries by delivering customized dust collection systems that align with evolving emission norms.

Camfil AB, with its strong focus on innovation and sustainability, remains a prominent player by introducing energy-efficient dust collectors designed for industrial indoor air quality management. Thermax Ltd., with deep roots in energy and environment solutions, has enhanced its market position through turnkey projects and robust after-sales services, particularly in developing economies.

Kelin Environmental Protection Technology Co. Ltd., a key Chinese manufacturer, has expanded its influence in Asia-Pacific through low-cost, high-efficiency systems tailored for localized industrial processes.

KC Cottrell, based in South Korea, continues to capitalize on its electrostatic precipitator and bag filter technologies, catering to both new installations and retrofit projects. Nederman Holding AB, with a strong emphasis on occupational health, reinforces its standing through smart dust collection systems embedded with IoT capabilities, particularly for manufacturing and automotive industries.

Sumitomo Heavy Industries, Ltd. leverages its engineering strength to deliver high-capacity dust collectors for large-scale industrial applications, while Donaldson Company, Inc. dominates with its diverse product portfolio and strong distribution network across North America and Europe. Babcock & Wilcox Enterprises, Inc. maintains relevance by offering integrated emissions control systems designed for utility and industrial boilers, ensuring compliance with stringent regulatory standard

Top Key Players in the Market

- FLSmidth

- Hamon

- Camfil AB

- Thermax Ltd.

- Kelin Environmental Protection Technology Co. Ltd.

- KC Cottrell

- Nederman Holding AB

- Sumitomo Heavy Industries, Ltd.

- Donaldson Company, Inc.

- Babcock & Wilcox Enterprises, Inc.

Recent Developments

- In 2024, Donaldson India Filtration Systems Pvt. Ltd. introduced its new experience centre in Pune on 6th March. This modern facility reflects the company’s strong focus on digital innovation in filtration. Visitors can explore real-time demonstrations of dust collection systems, including the iCue Connected Filtration Service. This IoT-based solution helps users track and manage dust collector performance from a remote location, improving efficiency and maintenance planning.

- In 2023, Nederman launched a cloud-connected IIoT platform aimed at boosting performance of industrial filtration systems. Designed for industries like welding and woodworking, the platform allows real-time monitoring. Alongside this, the company introduced the FS series dust collectors, known for compact design and reduced power consumption, making them suitable for energy-conscious businesses.

- In 2023, Camfil developed GSX dust collectors, built with crossflow airflow technology and a specially designed baffle system. These features ensure even air movement across filters, helping extend filter life and lower replacement needs. The units also meet OSHA guidelines for air quality and, when equipped with explosion vents, follow NFPA and ATEX standards to handle combustible dust hazards effectively.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Billion Forecast Revenue (2034) USD 14.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Baghouse Dust Collector, Cartridge Dust Collector, Wet Scrubbers, Inertial Separators, Electrostatic Precipitator, Others), By Mechanism (Dry, Wet), By Mobility (Portable, Fixed), By End-Use Industry (Cement, Food & Beverage, Pharmaceutical, Energy & Power, Steel, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FLSmidth, Hamon, Camfil AB, Thermax Ltd., Kelin Environmental Protection Technology Co. Ltd., KC Cottrell, Nederman Holding AB, Sumitomo Heavy Industries, Ltd., Donaldson Company, Inc., Babcock & Wilcox Enterprises, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Dust Collector MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Dust Collector MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FLSmidth

- Hamon

- Camfil AB

- Thermax Ltd.

- Kelin Environmental Protection Technology Co. Ltd.

- KC Cottrell

- Nederman Holding AB

- Sumitomo Heavy Industries, Ltd.

- Donaldson Company, Inc.

- Babcock & Wilcox Enterprises, Inc.