Global Industrial Air Compressor Market By Type (Positive Displacement, and Dynamic Displacement), By Design (Stationary, and Portable), By Operating Mode (Electric, and Internal Combustion Engine) By Technology (Oil-Injected, and Oil-Free) By Coolant Type (Air-Cooled, and Water-Cooled), By Power Range (Up to 50 KW, 51-250 KW, 251-500 KW, and Above 500 KW), By Pressure Range (Up to 20 Bar, 21-100 Bar, and Above 100 Bar), By End-use (Chemical and Petrochemical, Healthcare and Medical, Metals and Mining, Oil and Gas, Automotive and Transportation, Food And Beverage, Energy And Power, Building And Construction, and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118071

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

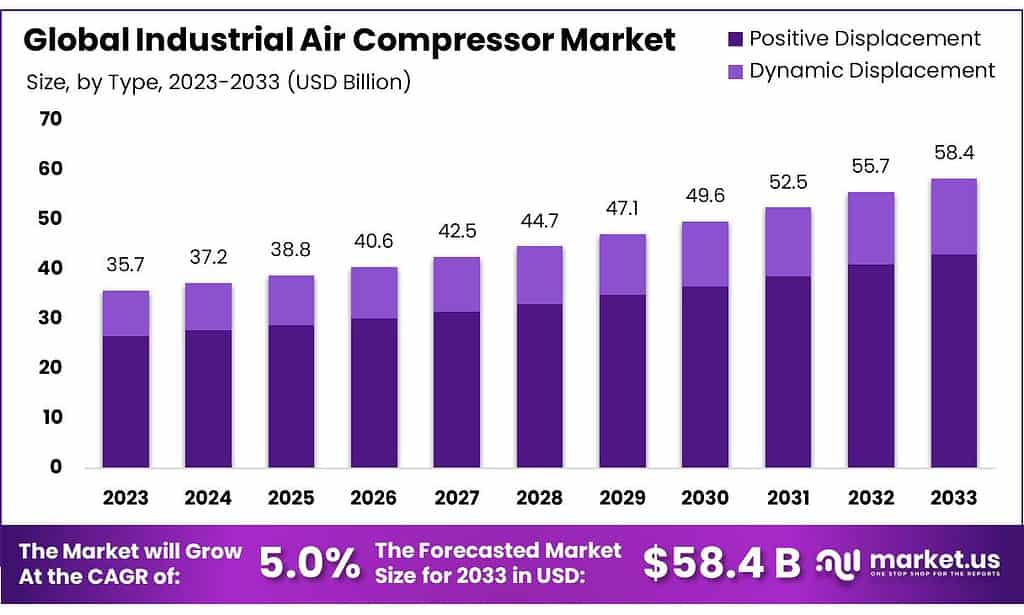

The global Industrial Air Compressor Market size is expected to be worth around USD 58.4 billion by 2033, from USD 35.7 billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2023 to 2033.

Industrial air compressors serve as essential equipment in a wide range of industrial applications, playing a critical role in generating compressed air for various processes across diverse industries. These robust machines are designed to compress atmospheric air to higher pressures, providing a reliable and continuous supply of compressed air for powering pneumatic tools, machinery, and equipment.

Industrial air compressors are characterized by their versatility, efficiency, and durability, making them indispensable in manufacturing plants, construction sites, automotive workshops, and other industrial settings. The demand for energy-efficient solutions, coupled with stringent environmental regulations, is expected to propel the market growth positively.

Key Takeaways

- The global industrial air compressor market will be valued at US$ 35.7 billion in 2023.

- The global industrial air compressor market is projected to reach US$ 58.4 billion by 2033.

- Among types, positive displacement accounted for the largest market share of 74.6%.

- Among designs, stationary industrial air compressors accounted for the majority of the market share with 62.5%.

- Among coolant types, air-cooled held the majority of the market share at 79.0%.

- Among end-users, chemicals & petrochemicals accounted for the majority of revenue share in 2023.

- Asia Pacific held the largest market share, with 37.0% in industrial air compressors in 2023.

By Type

Positive Displacement Accounted for The Largest Market Share

The global industrial air compressor market is segmented based on type into positive displacement, and dynamic displacement. Among both, positive displacement held the majority of the revenue share of 74.6% in 2023. This significant market dominance can be attributed to several factors.

Positive displacement compressors, characterized by their ability to deliver a fixed volume of air per cycle, offer inherent advantages such as consistent pressure output and suitability for a wide range of industrial applications. Moreover, their robust design, reliability, and relatively simpler operation make them preferred choices across diverse industries, including manufacturing, automotive, oil & gas, and construction.

Additionally, advancements in positive displacement compressor technologies, coupled with increasing demand for compressed air in industrial processes, have further fueled their market penetration and revenue growth, underscoring their pivotal role in shaping the trajectory of the global industrial air compressor market.

Design Analysis

The market is segregated into stationary and portable. Among both designs, the stationary air compressors are more popular and thus account for the largest market share of 62.5% in 2023. This preference underscores a prevailing trend favoring stability and consistent performance in various industrial and commercial applications.

Stationary air compressors offer robustness and reliability, catering to the demands of continuous operations across diverse sectors such as manufacturing, construction, and automotive. Their stationary nature aligns with the requirements of fixed installations and centralized pneumatic systems, where a consistent air supply is imperative.

Operating Mode Analysis

The market is segregated into electric and internal combustion engines. Among both modes, the electric held the major share of the market. Electric compressors offer enhanced efficiency and reliability, particularly in indoor settings where emissions and noise levels must be minimized.

Secondly, electric models align with the growing emphasis on sustainability and environmental consciousness, as they produce fewer pollutants and contribute to lower carbon footprints compared to their internal combustion counterparts. Additionally, advancements in electric motor technology have led to improved performance and energy efficiency, making electric compressors more cost-effective over their operational lifespan.

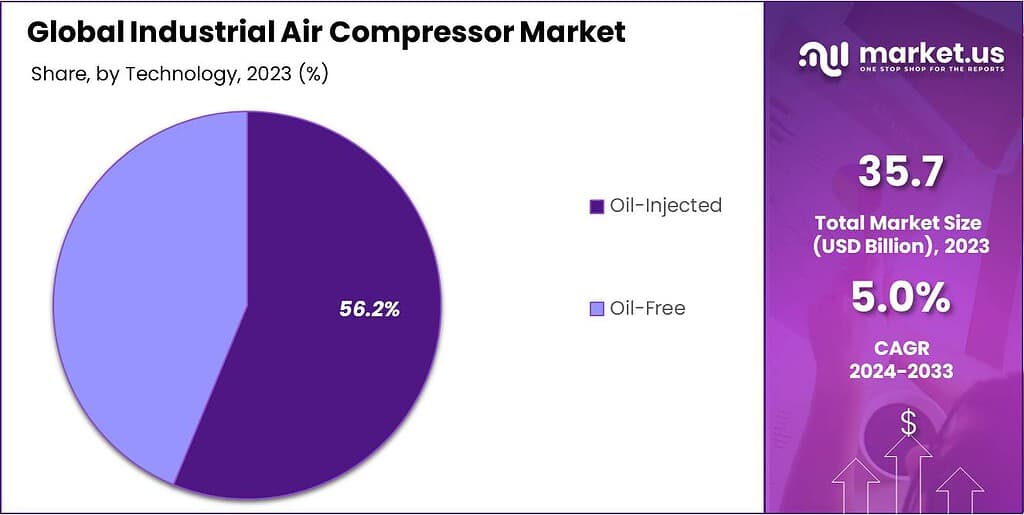

Technology Analysis

The Demand for Gluten-Free Industrial Air Compressors is Boosting Owing to Growing Consumer Awareness

The market is further divided into oil-injected and oil-free. Among these, oil-injected accounted for the largest market share in 2023. Firstly, oil-injected compressors are renowned for their superior performance in high-demand industrial applications, where they excel in providing consistent and reliable air compression.

Moreover, their design allows for efficient cooling, resulting in enhanced durability and prolonged operational lifespan, which are paramount considerations for industries prioritizing equipment longevity and cost-effectiveness. Additionally, the initial investment for oil-injected compressors is often lower compared to their oil-free counterparts, making them a preferred choice for businesses aiming to optimize capital expenditure while maintaining productivity levels.

Coolant Type Analysis

The Dominance of Air-Cooled Industrial Air Compressors is Attributed to Their Versatility, Affordability, Efficiency

Based on end-use global industrial air compressor market is segmented into air-cooled and water-cooled. Among these, air-cooled held the majority of the market share at 79.0%. air-cooled compressors offer greater installation flexibility, as they do not require access to water sources or intricate cooling systems, making them more convenient for a wider range of industrial settings.

Secondly, they typically require lower maintenance costs and have simpler upkeep procedures compared to their water-cooled counterparts, thus appealing to businesses seeking cost-effective solutions. Additionally, air-cooled compressors often boast higher energy efficiency, translating to reduced operational expenses over time, which is a significant consideration for companies aiming to optimize their operational costs. Hence, the combination of versatility, affordability, efficiency, and technological advancements collectively contributes to the substantial market dominance of air-cooled industrial air compressors.

End-Use Analysis

Supermarkets/Hypermarkets Account for The Majority of The Revenue Share In The Industrial Air Compressor Market.

The market is segregated into chemical & petrochemical, healthcare & medical, metals & mining, oil & gas, automotive & transportation, food & beverage, energy & power, building & construction, and others. Among these, chemicals & petrochemicals accounted for the majority of revenue share in 2023.

This is the chemical & petrochemical industry that plays a fundamental role in numerous downstream industries, serving as a foundational component for the manufacturing of various essential products ranging from plastics and pharmaceuticals to fertilizers and textiles. Moreover, advancements in technology and process innovation within this sector have bolstered efficiency and productivity, driving cost reductions and enhancing competitiveness.

Additionally, increasing global demand for chemical products, fueled by rapid industrialization, urbanization, and consumer preferences, has spurred market growth. Furthermore, strategic investments in research and development, coupled with a focus on sustainability and environmental responsibility, have positioned chemical & petrochemical companies favorably, enabling them to capitalize on emerging market opportunities.

Key Market Segments

By Product Type

- Positive Displacement

- Reciprocating

- Rotary

- Screw

- Scroll

- Others

- Dynamic Displacement

- Centrifugal

- Axial

By Design

- Stationary

- Portable

By Operating Mode

- Electric

- Internal Combustion Engine

By Technology

- Oil-Injected

- Oil-Free

By Coolant Type

- Air-cooled

- Water-cooled

By Power Range

- Up to 50 KW

- 51-250 KW

- 251-500 KW

- Above 500 KW

By Pressure Range

- Up to 20 Bar

- 21-100 Bar

- Above 100 Bar

By End-Use

- Chemical & Petrochemical

- Healthcare & Medical

- Metals & Mining

- Oil & Gas

- Automotive & Transportation

- Food & Beverage

- Energy & Power

- Building & Construction

- Others

Drivers

Energy Efficiency and Technological Advancements

The global industrial air compressor market is experiencing substantial growth due to the growing emphasis on energy efficiency and the integration of advanced technologies. Manufacturers and end-users are increasingly prioritizing energy-efficient solutions to mitigate operational costs and comply with stringent environmental regulations. Advanced air compressors, equipped with variable speed technology and energy recovery systems, offer significant energy savings and reduced carbon footprint, aligning with global sustainability goals.

Technological innovations, such as IoT-enabled predictive maintenance and smart control systems, enhance the performance and reliability of air compressors. The integration of such advanced features attracts industries seeking to optimize their energy consumption and operational efficiency, thereby driving market growth.

Technological innovations in the design and manufacturing of industrial air compressors have led to the development of systems that offer superior performance with reduced energy consumption. Features such as variable speed drives (VSD), which adjust the motor speed to match the demand for compressed air, and advanced control systems that optimize operation and minimize idle time, are at the forefront of these advancements. Such technologies significantly enhance the energy efficiency of air compressors, leading to substantial cost savings over the lifespan of the equipment and contributing to the sustainability goals of industries.

Restraints

High Initial Investment and Maintenance Costs

High initial investment and maintenance costs represent significant market restraints in the industrial air compressor market. These factors can pose substantial barriers to entry for new market participants and may limit the adoption rate among potential users, particularly small and medium-sized enterprises (SMEs) that often operate with limited capital budgets.

The purchase of industrial air compressors involves a considerable upfront investment, not only in terms of the purchase price of the equipment itself but also regarding the infrastructure modifications required to accommodate these systems. The complexity and scale of industrial air compressors, especially those designed for high-capacity and specialized applications, necessitate substantial initial outlays. These expenses are compounded by the need for auxiliary components such as dryers, filters, and distribution systems, further elevating the total cost of ownership.

Moreover, the maintenance costs associated with industrial air compressors can be significant over the lifespan of the equipment. Regular servicing, replacement of worn parts, and repairs to ensure optimal performance and prevent breakdowns contribute to ongoing operational expenses. For oil-lubricated compressors, the costs of oil, filters, and disposal of used oil add to the maintenance burden.

While oil-free compressors eliminate the direct costs associated with oil, they may require more sophisticated maintenance procedures and specialized technicians, which can also be costly. The high initial and maintenance costs are further accentuated by the energy consumption of air compressors, which can account for a considerable portion of industrial energy expenses.

Opportunity

Rising Demand in Emerging Markets from Across Industries

Emerging markets present significant opportunities for the global industrial air compressor market, driven by rapid industrialization, economic growth, and infrastructure development. Countries in Asia-Pacific and Latin America are experiencing substantial expansion in manufacturing, construction, and energy sectors, which require extensive use of industrial air compressors.

The growth trajectory of these economies characterized by increased investments in industrial and infrastructure projects offers lucrative opportunities for the air compressor market expansion. The demographic and economic shifts in these regions, including urbanization and growing middle-class populations, fuel the demand for consumer goods, automobiles, and modernized infrastructure, which require extensive manufacturing capabilities supported by industrial air compressors.

Furthermore, governments in emerging markets are implementing policies to attract foreign investments and promote industrial growth, creating a conducive environment for the deployment of air compressors in various industries. The untapped potential in emerging markets provides manufacturers with the opportunity to establish a foothold, expand their customer base, and achieve growth beyond developed markets. Additionally, tailoring products and services to meet the specific needs and challenges of these regions can enhance competitiveness and market penetration.

Trends

Integration of IoT and Remote Monitoring

In the evolving landscape of the global industrial air compressor market, the integration of the Internet of Things (IoT) and remote monitoring technologies represents a paradigm shift, significantly impacting operational efficiencies, predictive maintenance, and energy management. This trend is reshaping the industry, offering unprecedented levels of control, optimization, and insight into air compressor systems’ performance and health.

IoT-enabled air compressors are equipped with sensors that collect real-time data on various parameters such as temperature, pressure, humidity, and flow rates. This data is transmitted to a centralized system for analysis, enabling operators to monitor performance continuously and make adjustments in real time. By ensuring compressors operate within optimal parameters, industries can significantly reduce downtime, increase productivity, and extend the lifespan of their equipment. Furthermore, remote monitoring allows for the management of multiple compressors across different locations, streamlining operations and facilitating centralized control.

The industrial air compressor market has traditionally focused on enhancing physical components and maximizing output efficiency. However, the advent of digitalization has pivoted the market’s emphasis towards smart technologies. IoT and remote monitoring are at the forefront of this transformation, serving as the backbone for Industry 4.0 initiatives across manufacturing and industrial sectors.

Geopolitical Impact Analysis

Owing to Geopolitical Tensions Supply Chain Activities Was Disrupted

The global industrial air compressor market, a critical component of numerous industries including manufacturing, oil and gas, and construction, is increasingly influenced by the complexities of geopolitics. Current geopolitical events and tensions have a profound impact on this market, affecting supply chains, regulatory environments, energy prices, and investment flows. These factors collectively shape market trends, demand dynamics, and strategic decisions by companies operating within this space.

One of the most immediate impacts of geopolitical tensions is on the supply chain. The industrial air compressor market relies on a global network of suppliers for components and raw materials. Geopolitical conflicts or trade disputes can disrupt these supply chains, leading to shortages of critical components or raw materials, increased costs, and delayed production timelines. For example, tariffs imposed due to trade wars can increase the cost of imported components, squeezing the profit margins of air compressor manufacturers and prompting a reassessment of sourcing strategies.

Geopolitical shifts often result in regulatory changes that can impact the industrial air compressor market. New trade agreements, sanctions, and environmental regulations can alter market dynamics, affecting how companies operate and compete globally. Sanctions in certain countries can restrict market access, forcing companies to seek alternative markets or suppliers. Conversely, new trade agreements can open up markets, providing growth opportunities for air compressor manufacturers.

Regional Analysis

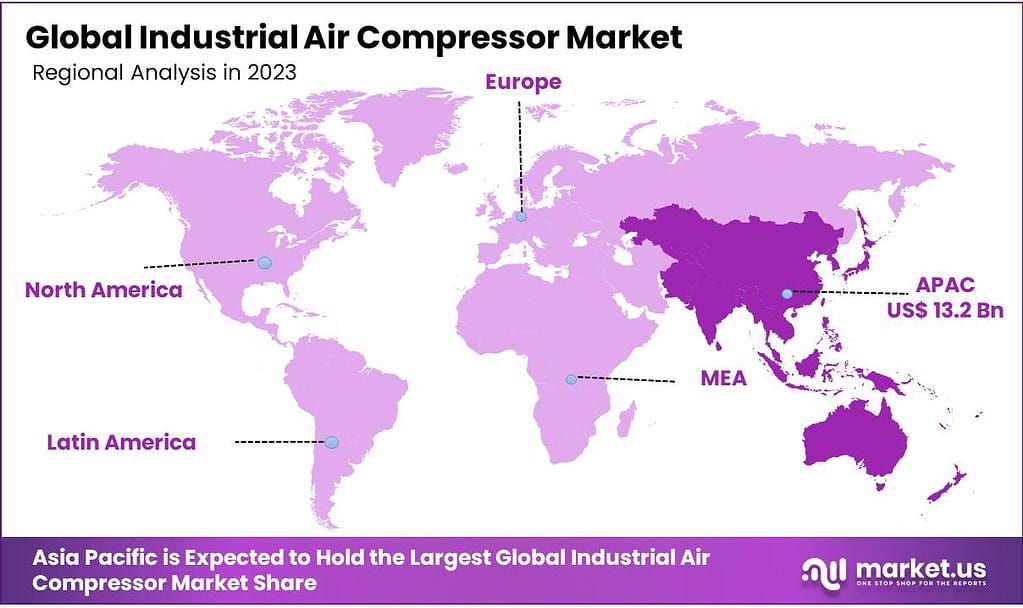

Asia Pacific was the Most Lucrative Region in the Global Industrial Air Compressor Market as of 2023.

Asia Pacific held the largest market share, with 37.0% in industrial air compressors in 2023. It can be attributed that rapid industrialization across countries such as China, India, and Japan has driven the demand for industrial air compressors in various sectors including manufacturing, construction, and automotive.

Additionally, the burgeoning infrastructure development projects in the region necessitate the use of compressed air for various applications such as pneumatic tools and machinery. Moreover, the increasing focus on energy efficiency and sustainability has led to the adoption of advanced air compressor technologies in the region. Furthermore, supportive government initiatives and investments in infrastructure development further propel the market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies Are Strongly Focusing On Product Innovation and Diversification.

Manufacturers in the industrial air compressor market are evolving in response to several key trends and factors shaping the industry landscape. There’s a notable shift towards the development and adoption of more energy-efficient and environmentally friendly compressor technologies. This includes the integration of variable speed drives, advanced control systems, and innovative designs to optimize energy consumption and reduce carbon footprint.

Moreover, there’s an increasing emphasis on digitalization and connectivity in air compressor systems, enabling remote monitoring, predictive maintenance, and real-time performance optimization. Companies are leveraging IoT (Internet of Things) technologies, data analytics, and cloud platforms to offer enhanced value-added services to customers, such as predictive maintenance solutions and performance optimization insights.

Market Key Players

Companies are exploring opportunities in emerging markets and investing in research and development to innovate new compressor technologies, improve efficiency, and enhance reliability. Collaborations and partnerships with other industry players, as well as academic and research institutions, are also becoming more prevalent to drive innovation and accelerate market growth. Companies in the industrial air compressor market are adapting to changing customer demands, technological advancements, and market dynamics to stay competitive and capitalize on emerging opportunities.

- Siemens AG

- Hitachi, Ltd

- Mitsubishi Electric Corporation

- Baker Hughes Company

- KOBELCO COMPRESSORS CORPORATION

- Atlas Copco AB

- Doosan Group

- Danfoss A/S

- Ingersoll Rand Inc.

- Sulzer Ltd.

- Kirloskar Pneumatic Co Ltd

- FS-Curtis

- Kaeser Kompressoren, Inc.

- BOGE KOMPRESSOREN

- Elliott Group

- Others

Recent Development

- In August 2023, BOGE completed the acquisition of INMATEC Gase Technologie GmbH & Co. KG, a prominent manufacturer specializing in nitrogen and oxygen generators.

- In November 2022, Atlas Copco acquired the operational assets of Northeast Compressor, a company based in upstate New York, USA. Northeast Compressor specializes in the sale of air compressors, associated equipment, and services to a diverse array of industrial clients.

Report Scope

Report Features Description Market Value (2023) US$ 35.7 Bn Forecast Revenue (2033) US$ 58.4 Bn CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Positive Displacement, and Dynamic Displacement), By Design (Stationary, and Portable), By Operating Mode (Electric, and Internal Combustion Engine) By Technology (Oil-Injected, and Oil-Free) By Coolant Type (Air-cooled, and Water-Cooled), By Power Range (Up to 50 KW, 51-250 KW, 251-500 KW, and Above 500 KW), By Pressure Range (Up to 20 Bar, 21-100 Bar, and Above 100 Bar), By End-use (Chemical & Petrochemical, Healthcare & Medical, Metals & Mining, Oil & Gas, Automotive & Transportation, Food & Beverage, Energy & Power, Building & Construction, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Siemens AG, Hitachi, Ltd, Mitsubishi Electric Corporation, Baker Hughes Company, KOBELCO COMPRESSORS CORPORATION, Atlas Copco AB, Doosan Group, Danfoss A/S, Ingersoll Rand Inc., Sulzer Ltd., Kirloskar Pneumatic Co Ltd, FS-Curtis, Kaeser Kompressoren, Inc., BOGE KOMPRESSOREN, Elliott Group, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Industrial Air Compressor Market?Industrial Air Compressor Market size is expected to be worth around USD 58.4 billion by 2033, from USD 35.7 billion in 2023

What CAGR is projected for the Industrial Air Compressor Market?The Industrial Air Compressor Market is expected to grow at 5.0% CAGR (2023-2033).Name the major industry players in the Industrial Air Compressor Market?Siemens AG, Hitachi, Ltd, Mitsubishi Electric Corporation, Baker Hughes Company, KOBELCO COMPRESSORS CORPORATION, Atlas Copco AB, Doosan Group, Danfoss A/S, Ingersoll Rand Inc., Sulzer Ltd., Kirloskar Pneumatic Co Ltd, FS-Curtis, Kaeser Kompressoren, Inc., BOGE KOMPRESSOREN, Elliott Group, Others

Industrial Air Compressor MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Air Compressor MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- Hitachi, Ltd

- Mitsubishi Electric Corporation

- Baker Hughes Company

- KOBELCO COMPRESSORS CORPORATION

- Atlas Copco AB

- Doosan Group

- Danfoss A/S

- Ingersoll Rand Inc.

- Sulzer Ltd.

- Kirloskar Pneumatic Co Ltd

- FS-Curtis

- Kaeser Kompressoren, Inc.

- BOGE KOMPRESSOREN

- Elliott Group

- Others