Global Industrial Agitators Market By Product Type(Top Entry, Side Entry, Bottom Entry, Portable, Static), By Model Type(Large Tank, Portable, Drum, Others), By Mounting(Top Mounting, Side Mounting, Bottom Mounting), By Form(Solid Sloid Mixture, Solid-liquid Mixture, Liquid Gas Mixture, Liquid Liquid Mixture), By Application(Chemical, Water and Wastewater Treatment, Oil, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 52260

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

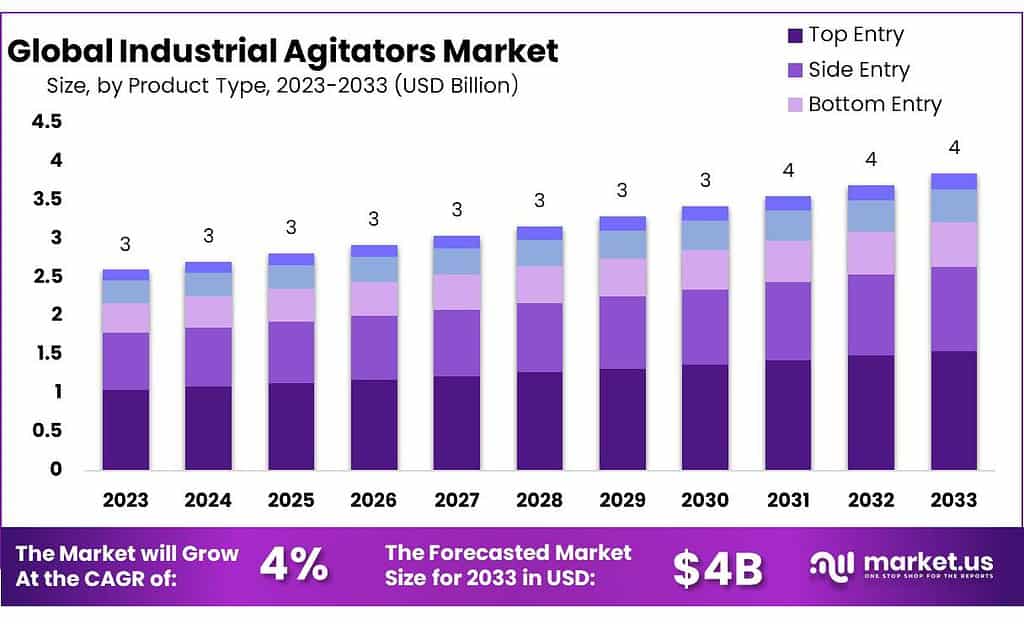

The Industrial Agitators Market size is expected to be worth around USD 4 billion by 2033, from USD 3 Bn in 2023, growing at a CAGR of 4% during the forecast period from 2023 to 2033.

Industrial agitators refer to mechanical devices employed in various industries to facilitate the mixing, blending, and homogenization of liquids, slurries, or powders. These devices are designed to enhance the efficiency of industrial processes by ensuring uniform distribution of components and preventing settling or separation of substances within a mixture.

Industrial agitators come in different types, including top entry, side entry, bottom entry, portable, and static, each tailored to specific applications and process requirements. These agitators play a crucial role in diverse sectors such as chemical processing, pharmaceuticals, food and beverage, water treatment, and many others, contributing to improved product quality, process consistency, and overall operational efficiency in industrial settings.

Key Takeaways

- Market Growth: The Industrial Agitators Market is set to reach USD 4 billion by 2033, growing at a CAGR of 4% from USD 3 billion in 2023.

- Top Entry Dominance: In 2023, Top Entry agitators held a significant market share of over 40.3%, showcasing their efficiency in diverse industrial applications.

- Large Tank Model Leadership: The Large Tank model type secured a commanding position with a share exceeding 45.5% in 2023, emphasizing its efficiency in handling substantial volumes.

- Top Mounting Preference: Top Mounting agitators dominated the market in 2023, securing over 51.2% share, highlighting their widespread preference for efficient and adaptable industrial processes.

- Solid Mixture Significance: Solid Mixture agitators took center stage in 2023, capturing a substantial market share of over 56.4%, underscoring their effectiveness in handling processes involving solid materials.

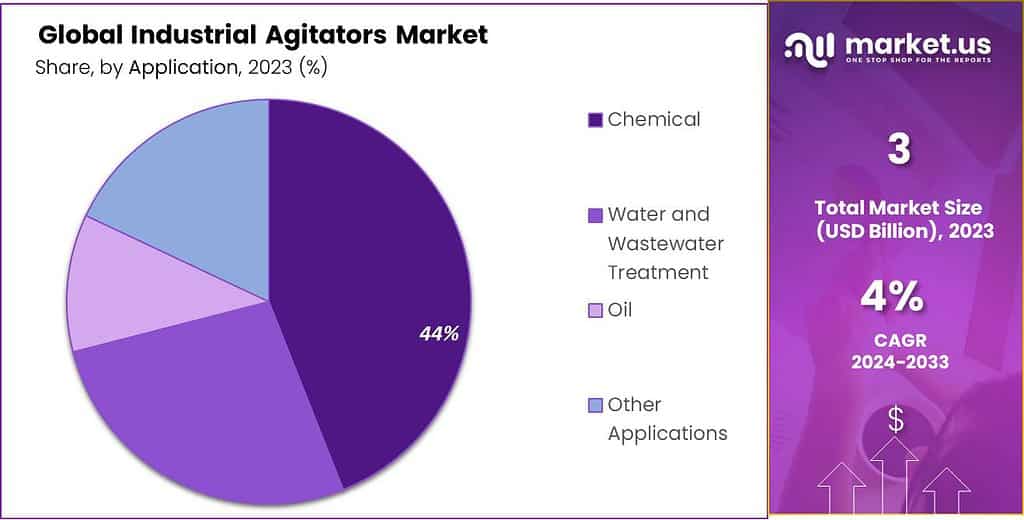

- Chemical Application Dominance: The Chemical application segment showcased robust dominance in 2023, securing a substantial market position with a share exceeding 44.4%, reflecting the pivotal role of agitators in chemical processes.

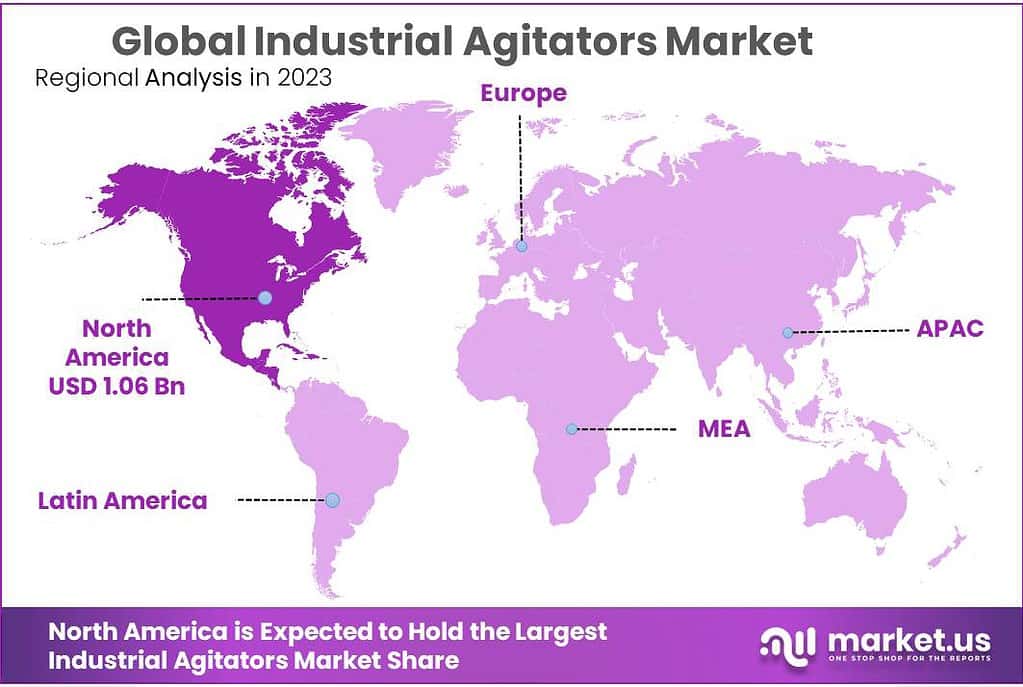

- North America Regional Dominance: North America held over 41% revenue share in 2023, driven by demand from process industries for reliable and efficient agitators.

Product Type Analysis

In 2023, the industrial agitators market witnessed a notable dominance of the Top Entry segment, securing a commanding market position with a substantial share of over 40.3%. This robust performance can be attributed to the efficiency and versatility of top-entry agitators in various industrial applications.

Side Entry agitators, on the other hand, exhibited a significant presence, accounting for a noteworthy share of the market. Their widespread usage in specific industries contributed to this standing, offering tailored solutions to meet industry-specific agitation requirements.

Bottom-entry agitators also played a substantial role in the market landscape, maintaining a considerable market share. Their application in processes requiring effective mixing from the bottom proved to be crucial in sustaining their market presence.

The Portable agitators segment experienced steady growth, reflecting the demand for mobility and flexibility in industrial mixing operations. The convenience of easily relocating these agitators to different processing units resonated well with end-users across diverse industries.

Static agitators, characterized by their fixed position, retained a significant market share, appealing to industries where continuous and stable mixing processes are paramount. Their reliability and low maintenance requirements contributed to their enduring appeal in the market.

By Model Type

In 2023, the industrial agitators market witnessed a notable dominance of the Large Tank segment, securing a commanding market position with a substantial share of over 45.5%. This signifies the widespread adoption of large tank agitators across various industries, owing to their capacity to efficiently mix substantial volumes of liquids or materials in industrial processes.

Portable agitators emerged as a significant player in the market, capturing considerable market share. The flexibility and convenience offered by portable models for on-the-go mixing applications contributed to their popularity among end-users in diverse industrial settings.

Drum agitators also played a substantial role in the market landscape, maintaining a noteworthy market share. These agitators are tailored for applications involving drum containers, showcasing their relevance in industries where smaller batches or specific container sizes are prevalent.

The Other model types category showcased a diverse range of agitators, contributing collectively to the market. This category encompasses innovative and specialized agitator models designed to meet unique industry requirements, showcasing the adaptability of agitator technology to various industrial contexts.

By Mounting

In 2023, the industrial agitators market saw a significant dominance of the Top Mounting segment, securing a robust market position with a share exceeding 51.2%. This highlights the widespread preference for top-mounted agitators, showcasing their efficiency and adaptability in various industrial processes.

Side Mounting agitators emerged as a substantial player in the market, capturing a noteworthy market share. Their specific application in industries requiring lateral agitation contributed to their prominence in the market.

Bottom-mounting agitators also played a significant role, maintaining a considerable market share. These agitators are favored in processes where mixing from the bottom is critical, reflecting their importance in specific industrial applications.

By Form

In 2023, the industrial agitators market experienced a notable dominance of the Solid Mixture segment, securing a substantial market position with a share exceeding 56.4%. This underscores the significance of agitators in processes involving solid materials, showcasing their effectiveness in mixing and homogenizing solid mixtures.

Solid-liquid mixture agitators emerged as a significant player in the market, capturing a noteworthy share. Their versatility in handling processes where solids need to be efficiently blended with liquids contributed to their widespread adoption across various industries.

Liquid-gas mixture agitators also played a significant role, maintaining a considerable market share. These agitators are crucial in industries where the efficient dispersion and blending of gases into liquid phases are essential for optimal process performance.

The Liquid-Liquid Mixture segment showcased its importance, contributing to the overall market landscape. Agitators designed for mixing different liquid components demonstrated their relevance in industries requiring precise and uniform blending of liquid substances.

Application Analysis

In 2023, the industrial agitators market showcased a robust dominance in the Chemical application segment, securing a substantial market position with a share exceeding 44.4%. This underscores the pivotal role of agitators in chemical processes, where efficient mixing is essential for producing high-quality and consistent chemical products.

Water and Wastewater Treatment emerged as a significant player in the market, capturing a noteworthy share. Agitators in this application segment play a crucial role in ensuring effective treatment processes, contributing to the overall quality and safety of water resources.

The Oil application segment also played a substantial role, maintaining a considerable market share. Agitators in the oil industry are crucial for processes such as blending, emulsification, and suspension, impacting the overall efficiency and quality of oil-related products.

Other Applications contributed to the overall market landscape, encompassing diverse industries with unique mixing needs. Agitators tailored for specific applications outside the primary chemical, water, and oil sectors demonstrated their versatility in addressing a wide range of industrial processes.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Top Entry

- Side Entry

- Bottom Entry

- Portable

- Static

By Model Type

- Large Tank

- Portable

- Drum

- Others

By Mounting

- Top Mounting

- Side Mounting

- Bottom Mounting

By Form

- Solid Sloid Mixture

- Solid-liquid Mixture

- Liquid Gas Mixture

- Liquid Liquid Mixture

By Application

- Chemical

- Water and Wastewater Treatment

- Oil

- Other Applications

Drivers

One major trend shaping the Industrial Agitators Market is the escalating demand for energy-efficient and technologically advanced solutions. Companies are increasingly emphasizing optimizing their mixing processes, driving industrial agitator manufacturers to innovate.

These innovations aim to develop industrial mixers that consume less power while maximizing flow, achieving rapid mixing, and incorporating other advancements. Processes like mixing, blending, fluid handling, and thermal heat transfer are pivotal for production, compelling industries to seek more efficient and cost-effective mixing technologies.

For instance, in 2022, SPX FLOW introduced the APV Flex-Mix Pilot industrial Mixer tailored for the food & beverage sector. This innovation allowed companies to conduct small-scale pilot batches, accommodating low to high-viscosity product samples using a single unit. This proved beneficial for companies focusing on small-scale production or craft producers, enabling them to efficiently test various products in smaller batches.

This approach not only helped in cost reduction but also minimized waste during the testing phase due to the production of smaller batches. Overall, the trend gravitates towards smarter, energy-efficient, and cost-effective solutions, addressing the industry’s evolving needs while minimizing resource wastage during testing phases.

Restraints

A significant restraint in the Industrial Agitators Market is the high costs associated with maintenance and repairs of these systems. The initial investment required for industrial agitators poses a considerable barrier, particularly for smaller agitator companies. The costs vary based on the size, materials, and complexity of the industrial mixers, making it a substantial financial commitment for businesses.

Additionally, the maintenance process for these agitators involves regular replacement of worn parts, lubricant changes, and addressing various components like bearings and seals. Any wear or fault in these components can lead to additional expenses for the client, impacting the operational costs. Maintenance activities encompass a wide range of tasks, from simple adjustments to troubleshooting, repairs, and even complete replacements of certain parts, resulting in added expenses for businesses.

Over time, however, the impact of this restraint should lessen due to continuous advances in agitation technology. As technology develops and opportunities expand for the industrial agitators market, maintenance costs could become less burdensome and reliability improved, thus mitigating financial strain associated with maintenance expenses in this market. With enhanced technology and greater opportunities, maintenance expenses in Industrial Agitators Market should become easier to bear.

Opportunities

An emerging opportunity in the Industrial Agitators Market arises from the heightened utilization of industrial mixing technologies across various applications. Technological advancements have ushered in more efficient and precise industrial mixers capable of delivering enhanced control and accuracy in mixing processes. This technological evolution aligns with the escalating demand from industries aiming to refine their manufacturing procedures and achieve greater product uniformity.

The growing demand for industrial mixers creates a significant opening for agitator companies to innovate and introduce improved mixing equipment. Companies are now seeking new and advanced mixing solutions that can seamlessly integrate into their manufacturing processes. This surge in demand offers agitator manufacturers the chance to develop and offer novel mixing equipment tailored to meet diverse industry requirements effectively.

Market trends indicate an increasing need for tailored mixing solutions designed specifically to address industry requirements, with pharmaceutical, chemical and food & beverage producers seeking solutions tailored specifically for their unique production requirements. Agitator companies see an opportunity to provide customized products designed to address each sector’s specific requirements.

Sulzer recently unveiled their SSF150 Industrial Agitator from SALOMIX’s SALOMIX range in June 2022; this launch signifies the rising importance of industrial agitators across various industrial processes while attesting to industry’s ability to adjust to evolving demands and technologies, creating a promising opportunity for agitator manufacturers to meet different sectors’ requirements effectively.

Challenges

A notable challenge emerging in the Industrial Agitators Market is the increasing trend towards renting industrial mixers as an alternative to purchasing them outright. Some users or buyers of industrial agitators find it challenging to afford the upfront costs associated with buying these systems. Moreover, for certain projects or shorter-term requirements, investing in a permanent industrial mixer might not be cost-effective or practical.

As a solution, the rental option for industrial mixers is gaining traction in the market. Renting offers a swift and economical way to meet temporary mixing needs without incurring the substantial costs associated with a capital purchase. This alternative enables purchasers to fulfill their mixing requirements at a significantly reduced expense compared to buying the equipment outright.

This trend towards renting industrial mixers becomes particularly beneficial amid scenarios where end-user industries are either contemplating or have already reduced their capital expenditure budgets. The flexibility and cost-effectiveness of renting provide a viable solution for industries navigating budget constraints or those with short-term project needs, allowing them to access high-quality industrial mixers without making a significant financial commitment.

Regional Analysis

North America held the highest revenue share at over 41% in 2023. The region’s growth is also driven by rising demand for reliable, efficient, and custom-made agitators from the process industries.

The Asia Pacific is expected to grow the fastest due to its strong economies like Japan, India, and China. This shift away from traditional utilization capacity towards the ability to fulfill orders efficiently and promptly is expected to increase the regional manufacturing sector and thereby boost the demand for industrial agitators.

Due to the growth of the manufacturing sector, the industrial agitator market has gained importance. The demand is growing rapidly due to rapid growth in Brazil’s food and beverage industry and the expanding oil & gas sector.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Key companies are involved in research and development activities to create products that meet the requirements of the government. Market participants can create innovative products through intense competition.

These products can efficiently provide faster cycle times for mixing or agitation processes. Industry players are looking to include an agitator in mixing or blending applications to make their integration into different systems easier. Partnerships and strategic investments are expected to be the best ways to access emerging markets quickly.

Маrkеt Кеу Рlауеrѕ

- Suzler Ltd.

- Xylem Inc.

- SPX Corp.

- EKATO Group

- Philadelphia Mixing Solutions, Ltd.

- Fluid Kotthoff GmbH

- SPX Flow

- Zucchetti Srl

- MIXEL

- INOXPA

- Other Key Players

Recent Developments

In September 2022,SPX Flow announced their latest product offering, the APV Flex-Mix&trade Pilot Mixer, enabling food and beverage companies to test small pilot batches of low to high viscosity item samples on one single machine.

Report Scope

Report Features Description Market Value (2022) US$ 3 Bn Forecast Revenue (2032) US$ 4 Bn CAGR (2023-2032) 4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Top Entry, Side Entry, Bottom Entry, Portable, Static), By Model Type(Large Tank, Portable, Drum, Others), By Mounting(Top Mounting, Side Mounting, Bottom Mounting), By Form(Solid Sloid Mixture, Solid-liquid Mixture, Liquid Gas Mixture, Liquid Liquid Mixture), By Application(Chemical, Water and Wastewater Treatment, Oil, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Suzler Ltd., Xylem Inc., SPX Corp., EKATO Group, Philadelphia Mixing Solutions, Ltd., Fluid Kotthoff GmbH, SPX Flow, Zucchetti Srl, MIXEL, INOXPA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Industrial Agitators Market?The Industrial Agitators Market size is expected to be worth around USD 4 billion by 2033, from USD 3 Bn in 2023

What CAGR is projected for the Industrial Agitators Market?The Industrial Agitators Market is expected to grow at 4% CAGR (2023-2032).Name the major industry players in the Industrial Agitators Market?Suzler Ltd., Xylem Inc., SPX Corp., EKATO Group, Philadelphia Mixing Solutions, Ltd., Fluid Kotthoff GmbH, SPX Flow, Zucchetti Srl, MIXEL, INOXPA, Other Key Players

Industrial Agitators MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Agitators MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Suzler Ltd.

- Xylem Inc.

- SPX Corp.

- EKATO Group

- Philadelphia Mixing Solutions, Ltd.

- Fluid Kotthoff GmbH

- SPX Flow

- Zucchetti Srl

- MIXEL

- INOXPA

- Other Key Players