Global In-Game Advertising Platform Market Size, Share and Analysis Report By Platform Type (Software Development Kits (SDKs), Ad Serving Platforms, Analytics & Measurement Platforms, Others), By Ad Format (Static In-Game Ads, Dynamic In-Game Ads, Others), By Platform (Mobile, PC, Console), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177421

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Platform Type Analysis

- By Ad Format Analysis

- By Platform Analysis

- Regional Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

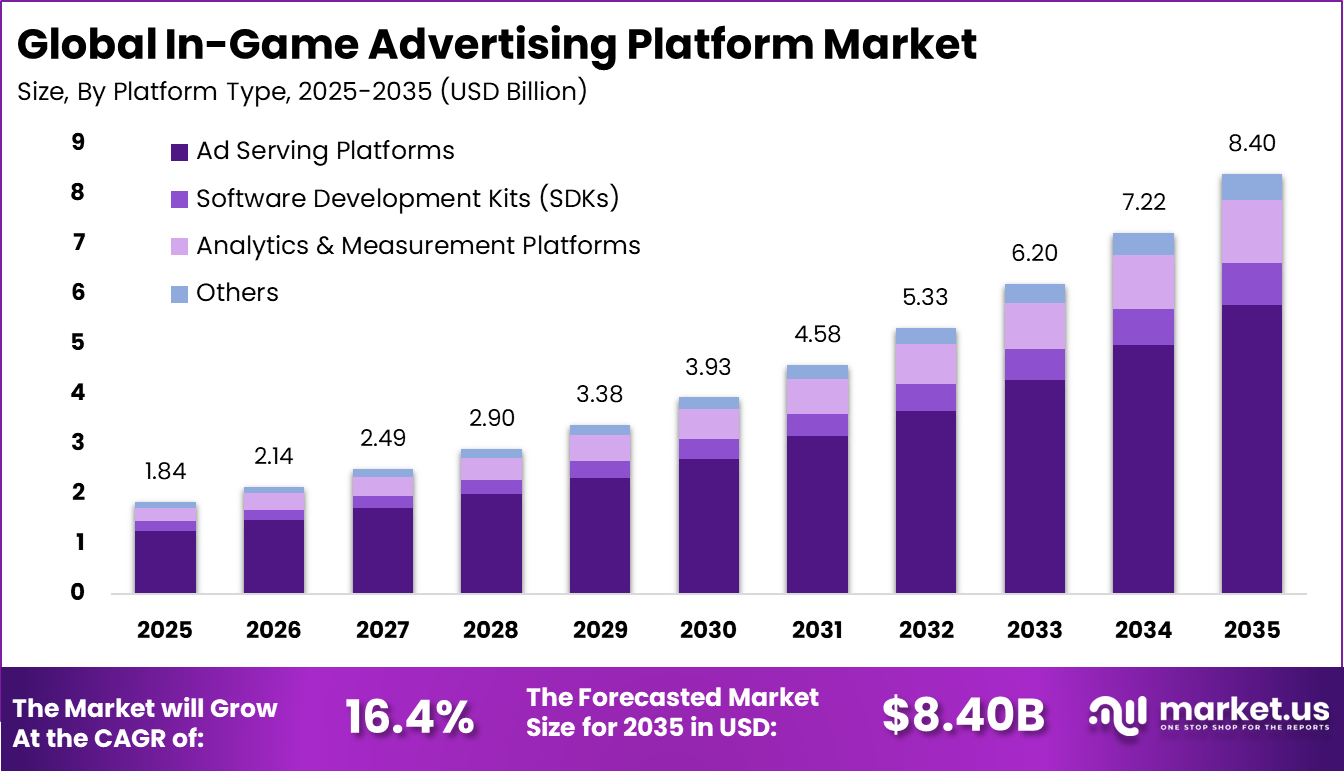

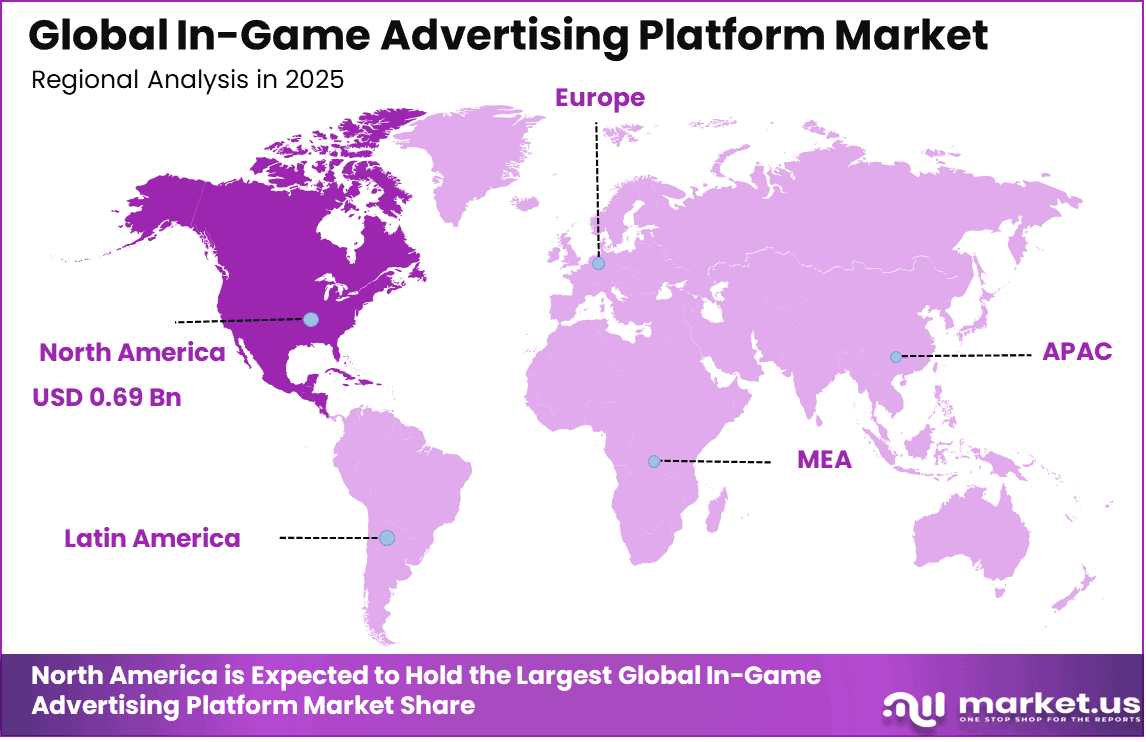

The Global In-Game Advertising Platform Market size is expected to be worth around USD 8.40 billion by 2035, from USD 1.84 billion in 2025, growing at a CAGR of 16.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38% share, holding USD 0.69billion in revenue.

The In Game Advertising Platform Market refers to software platforms that enable brands to deliver advertisements directly within video game environments. These platforms support ad placements such as dynamic billboards, branded objects, video overlays, and interactive experiences that appear during gameplay. In game advertising is designed to integrate naturally into the gaming environment without interrupting the player experience.

The market has gained importance as gaming becomes a mainstream digital media channel with high engagement levels. In game advertising platforms operate across console, PC, and mobile games, with strong alignment to online and live service game models. Unlike traditional digital ads, these placements benefit from longer exposure times and immersive context. Industry data indicates that gamers spend an average of 7 to 9 hours per week playing games, creating extended brand visibility opportunities.

One of the primary driving factors is the rapid growth of the global gaming population. Gaming audiences now span multiple age groups and regions, making games attractive to advertisers seeking broad and diverse reach. Traditional ad channels face saturation and declining attention spans. In game environments offer controlled and engaging spaces where ads are more likely to be noticed.

For instance, in July 2025, Google supercharged AdMob with fresh mediation updates, onboarding bidding partners like Unity and boosting eCPMs for immersive in-game formats. Publishers are seeing smoother revenue flows, proving why it’s still the go-to for seamless mobile game ads.

Demand for in game advertising platforms is increasing among brands seeking alternatives to traditional digital advertising. Advertisers are drawn to gaming due to high engagement and lower ad avoidance. Studies show that in game ads can achieve brand recall rates above 60% when well integrated into gameplay. This performance drives growing advertiser interest.

Key Takeaway

- By platform type, ad serving platforms led the In-Game Advertising Platform Market with a 68.9% share, supported by demand for centralized campaign management and real time ad delivery.

- By ad format, dynamic in game ads accounted for 52.8% of total adoption, reflecting preference for programmatic and context based advertising placements.

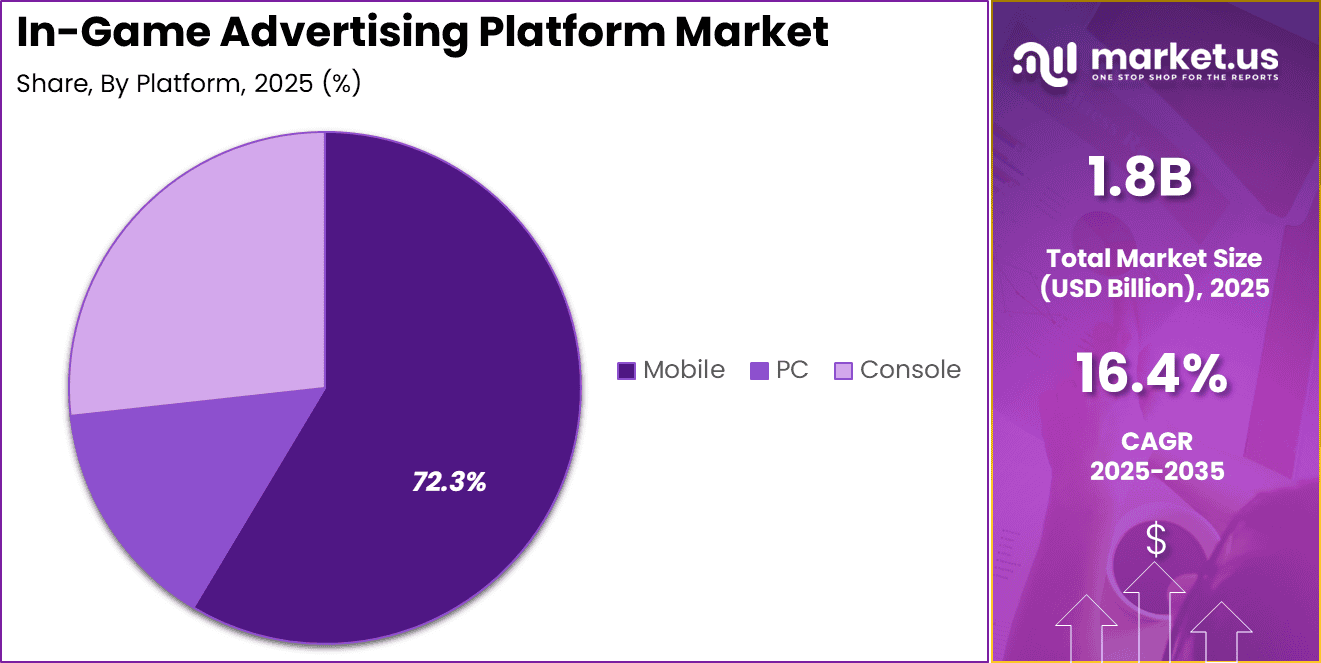

- By platform, mobile gaming dominated with a 72.3% share, driven by high smartphone penetration and strong user engagement levels.

- Regionally, North America held a 38% share of the market, supported by advanced digital advertising infrastructure.

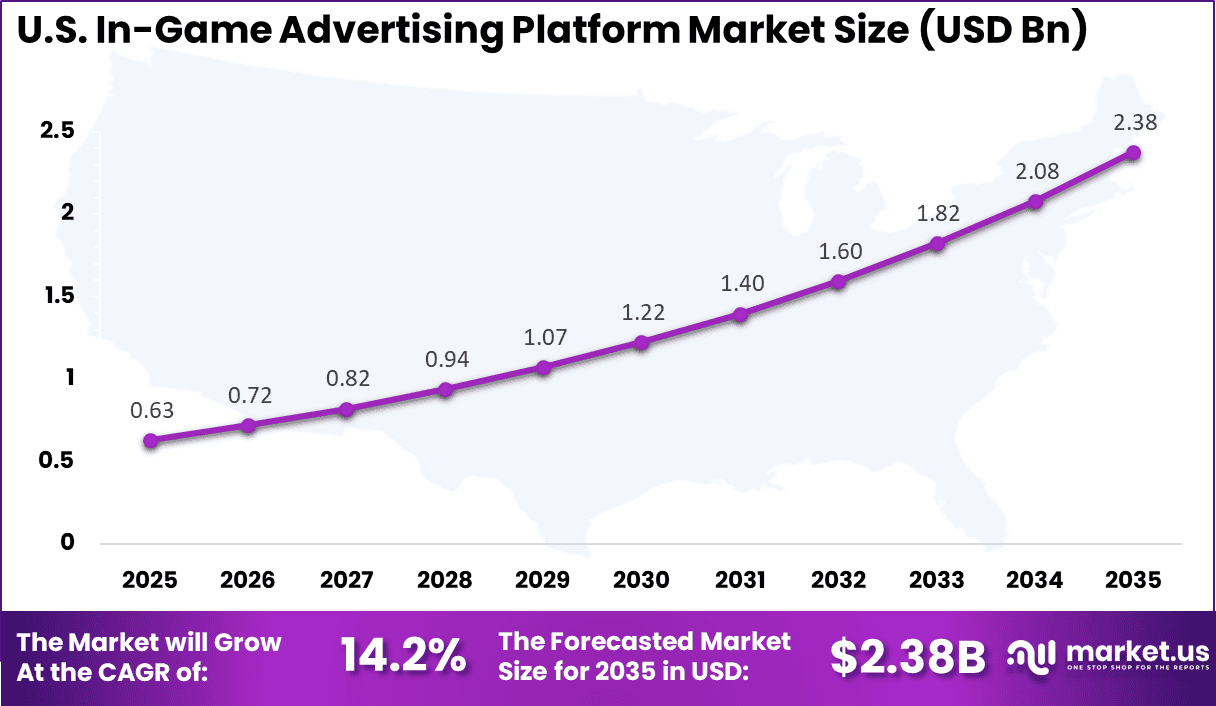

- In the US, the market reached USD 0.63 billion and recorded a CAGR of 14.2%, reflecting steady growth in mobile gaming and brand participation.

Key Insights Summary

- The number of mobile game advertisers increased by 60.4% year over year, reaching 259,700 in 2024, and is projected to exceed 300,000 in 2025.

- Creative output expanded significantly, with ad assets rising by 15.4% to 46.2 million in 2024, reflecting strong content production activity.

- More than 80% of media buyers plan to maintain or increase in game advertising budgets, and 83% aim for full adoption of the format by 2025.

- AppLovin and Google AdMob together account for 52% of Android market share, indicating high platform concentration in mobile monetization.

- Around 51% of mobile gamers report neutral attitudes toward in game ads, while 38% express a positive response.

- Approximately 74% of US mobile gamers are willing to watch video ads in exchange for in app rewards or content.

- About 82% of players prefer free games supported by advertising rather than paid versions without ads, reinforcing the strength of the free to play model.

- Product placements receive 85% positive sentiment and native ads receive 83%, yet only 21% to 23% of players report recently seeing these formats, suggesting underutilization.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rapid growth of mobile and online gaming user base +4.2% Asia Pacific, North America Short to medium term Increasing advertiser shift toward digital and interactive channels +3.6% North America, Europe Medium term Rising demand for immersive and non-intrusive ad formats +3.1% Global Medium term Expansion of free-to-play game monetization models +2.8% Global Medium term Growth of esports, streaming, and virtual gaming environments +2.7% North America, Europe Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Player resistance to intrusive or disruptive ads -3.1% Global Short term Data privacy and user tracking restrictions -2.6% Europe, North America Medium term Revenue share disputes between publishers and ad platforms -2.2% Global Medium term Volatility in gaming engagement and title popularity -1.9% Global Medium term Ad fraud and brand safety concerns -1.7% Global Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Digital advertising technology providers Very High Medium Global Strong programmatic growth potential Game publishers and developers High Medium Asia Pacific, North America Monetization enhancement opportunity Media and entertainment technology firms Medium Medium North America, Europe Cross-platform expansion Private equity firms Medium Medium North America, Europe Platform consolidation strategies Venture capital investors High High North America Innovation in immersive ad formats Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Programmatic ad serving and real-time bidding systems +4.5% Automated ad placement Global Short to medium term AI-driven audience targeting and personalization +3.8% Improved campaign performance North America, Europe Medium term Dynamic in-game ad insertion technology +3.4% Seamless brand integration Global Medium term Cloud-based analytics and performance dashboards +2.7% Campaign optimization Global Medium to long term Integration with VR, AR, and immersive environments +2.0% Next-generation ad formats North America, Asia Pacific Long term By Platform Type Analysis

By platform type, ad serving platforms accounted for 68.9% of adoption. These platforms manage ad inventory, placement logic, and delivery across multiple games. Centralized ad serving reduces operational complexity for developers. It also enables advertisers to run campaigns at scale.

Ad serving platforms support programmatic buying and targeting. Campaigns can be optimized based on player location, device type, and session behavior. This increases efficiency and return on ad spend. As ad volumes grow, robust serving infrastructure remains critical.

Reliability and latency performance are key requirements. Ads must load seamlessly without affecting gameplay. Leading platforms invest in low latency delivery and uptime assurance. This has reinforced the dominance of ad serving solutions.

For Instance, in February 2026, Anzu launched click-enabled intrinsic in-game ad formats for its serving platform, letting mobile devs mix clickable and non-clickable ads right in gameplay. This boosts fill rates by up to 50% without hurting player experience, using smart taps like double-tap to avoid misclicks and draw performance budgets.

By Ad Format Analysis

By ad format, dynamic in-game ads held a share of 52.8%. These ads adapt in real time based on campaign parameters. Examples include billboards, banners, and branded objects within game worlds. Dynamic formats allow frequent creative refresh without code changes.

Advertisers prefer dynamic ads due to improved relevance. Messaging can be aligned with regional events or time sensitive promotions. This flexibility improves engagement outcomes. It also reduces creative fatigue among players.

Measurement has improved alongside dynamic formats. Impression tracking and viewability metrics are now more accurate. This supports performance based pricing models. As accountability increases, dynamic ads continue to gain preference.

For instance, in August 2025, Unity Ads made its Ad Quality tool free, focusing on dynamic in-game ads that adapt to player behavior for better experiences. This transparency helps devs control ad flow in real-time, cutting poor creatives and lifting engagement in Unity-powered games worldwide.

By Platform Analysis

By platform, mobile gaming represented 72.3% of adoption. Mobile games account for a large share of global gaming time. High session frequency creates repeated exposure opportunities. This makes mobile the primary channel for in-game advertising.

Mobile platforms support diverse ad formats. Integration with device level data enhances targeting accuracy. Advertisers can reach users during natural gameplay pauses. This improves acceptance compared to interruptive formats.

Monetization pressure has also driven mobile adoption. Many games rely on free to play models. In-game ads provide a sustainable revenue stream. As mobile gaming expands, advertising platforms remain closely tied to this segment.

For Instance, in November 2025, Chartboost updated its Unity mediation SDK with fullscreen ad queuing and adaptive banners for mobile games. Publishers can now stack multiple ads during natural breaks, boosting revenue without extra coding in high-traffic mobile titles.

Regional Analysis

North America accounted for 38% of market adoption, supported by strong digital advertising spend and high gaming penetration. The region benefits from advanced ad technology ecosystems. Advertisers actively test innovative formats within games.

For instance, in July 2025, Google launched major AdMob mediation updates, including new bidding partners like Unity and ironSource, enhanced eCPM tools, and preparation for immersive in-game ads later in 2025. These advancements boost publisher revenue and seamless ad integration, solidifying North American dominance in mobile in-game advertising ecosystems.

The United States leads regional activity, with spending reaching USD 0.63 Bn and a CAGR of 14.2%. Brands increasingly allocate budgets to gaming audiences. Measurement transparency has improved confidence in the channel.

Ongoing innovation continues to support growth. Integration with broader digital ad stacks has improved campaign planning. As advertisers seek immersive environments, in-game advertising platforms remain strategically important.

For instance, in August 2025, Unity made its Ad Quality tool free for developers, setting a new standard for in-game advertising through enhanced transparency and player experience control. This innovation helps developers protect user engagement while optimizing ad performance, reinforcing U.S. leadership in quality-driven mobile gaming monetization.

Emerging Trends Analysis

An emerging trend in the in-game advertising platform market is the rise of rewarded and value exchange ads. These formats offer players incentives such as in-game currency or extra lives in exchange for engaging with branded content. Rewarded formats align advertising with positive user experience and can improve engagement metrics.

Another trend is the use of programmatic advertising within game environments. Automated ad buying and optimisation enable real time targeting and dynamic pricing. Programmatic approaches increase efficiency and allow advertisers to scale across multiple titles and player segments.

Growth Factors Analysis

One of the key growth factors for the in-game advertising platform market is cross-platform gaming expansion. As players engage on mobile, console, PC, and cloud devices, ad inventory and reach grow proportionally. Multi platform environments increase the value of advertising ecosystems.

Another growth factor is rising brand focus on younger demographic engagement. Traditional media channels have declining influence among younger audiences who spend significant time in gaming environments. In-game advertising platforms offer direct access to these audiences with measurable engagement metrics, supporting long term advertising investment.

Opportunity Analysis

A significant opportunity in the in-game advertising platform market lies in personalised and contextual ad delivery. Platforms that leverage player behaviour, session data, and real time context can deliver ads that are relevant and timely. Personalisation improves ad effectiveness while respecting user preferences. This capability enhances advertiser ROI and increases platform attractiveness.

Another opportunity is integration with esports and livestreaming ecosystems. In-game ads can be synchronised with live broadcasts, highlight reels, and event sponsorships. This creates multi touchpoint exposure across gaming and audience engagement channels. Convergence with competitive gaming increases inventory and monetisation potential.

Challenge Analysis

A major challenge for the in-game advertising platform market is ensuring privacy compliance and ethical data usage. Delivering personalised ads often involves processing behavioural data, which must comply with data protection regulations such as GDPR and CCPA. Platforms must implement secure and transparent practices that protect player privacy. Failure to do so can lead to regulatory risk and reputational harm.

Another challenge is compatibility across diverse game engines and platforms. Games operate on different technologies, each with unique constraints on ad rendering and performance impact. Ensuring smooth integration without affecting gameplay performance requires technical expertise and coordination with developers.

Key Market Segments

By Platform Type

- Software Development Kits (SDKs)

- Ad Serving Platforms

- Analytics & Measurement Platforms

- Others

By Ad Format

- Static In-Game Ads

- Dynamic In-Game Ads

- Others

By Platform

- Mobile

- PC

- Console

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Mobile and performance-driven ad networks such as Unity Ads, Google AdMob, and AppLovin dominate the in-game advertising platform market. Their solutions support rewarded video, interstitial, and banner formats across casual and mid-core games. Advanced targeting and real-time bidding improve monetization efficiency. ironSource and Vungle strengthen mediation and user acquisition capabilities. Demand is driven by the rapid growth of free-to-play gaming models.

Brand-focused and immersive in-game advertising providers such as Anzu, Bidstack, and Frameplay emphasize non-disruptive placements within gameplay environments. AdInMo and Bloxbiz focus on programmatic and contextual brand integration. These platforms support dynamic ad insertion and measurable brand impact. Adoption is supported by rising advertiser demand for immersive digital experiences.

User engagement and monetization platforms such as AdColony, Chartboost, and Tapjoy offer hybrid monetization models. Aarki and Digital Turbine strengthen programmatic optimization and data-driven targeting. Other vendors expand innovation and regional reach. This competitive landscape supports steady expansion of in-game advertising across mobile, PC, and console platforms.

Top Key Players in the Market

- Unity Ads

- Google AdMob

- ironSource

- AppLovin

- Vungle

- Anzu

- AdColony

- Chartboost

- Tapjoy

- Aarki

- Digital Turbine

- Bidstack

- AdInMo

- Frameplay

- Bloxbiz

- Others

Recent Developments

- In August 2025, Unity Ads made its Ad Quality tool free for developers, setting a new benchmark for transparent in-game advertising. This move helps game creators protect player experience while boosting ad revenue through better control and measurement, reinforcing Unity’s dominant position in the ecosystem.

- In November 2025, AppLovin fully exited gaming by selling its app portfolio to Tripledot Studios, doubling down on its AXON 2.0 ad engine for in-game and mobile monetization. This pivot positions AppLovin to capture more of the $47B CTV ad market by 2028 through gamified experiences.

Report Scope

Report Features Description Market Value (2025) USD 1.8 Bn Forecast Revenue (2035) USD 8.4 Bn CAGR(2025-2035) 16.4% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform Type (Software Development Kits (SDKs), Ad Serving Platforms, Analytics & Measurement Platforms, Others), By Ad Format (Static In-Game Ads, Dynamic In-Game Ads, Others), By Platform (Mobile, PC, Console) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unity Ads, Google AdMob, ironSource, AppLovin, Vungle, Anzu, AdColony, Chartboost, Tapjoy, Aarki, Digital Turbine, Bidstack, AdInMo, Frameplay, Bloxbiz, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In-Game Advertising Platform MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

In-Game Advertising Platform MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Unity Ads

- Google AdMob

- ironSource

- AppLovin

- Vungle

- Anzu

- AdColony

- Chartboost

- Tapjoy

- Aarki

- Digital Turbine

- Bidstack

- AdInMo

- Frameplay

- Bloxbiz

- Others