Global In-Camera Visual Effects Market Size, Share Analysis Report By Component (Hardware (LED Volume Displays (Curved & Flat Walls), Camera Tracking Systems, Rendering Servers & GPUs, Cameras (Cinematic/Volumetric), Lighting & Sensors, Others), Software (Real-Time Engines, Camera Tracking & Calibration Software, Scene Management & Previs Tools, Virtual Set Design Software), Services (System Integration, Support & Consulting, Training)), By Application (Film & Television, Commercial Advertising, Live Broadcast & Events, Automotive Product Visualization, Architecture / Real Estate Walkthroughs, Others), By Technology (LED Volume Technology, Real-Time Rendering Engines, Camera Tracking Systems), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151841

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

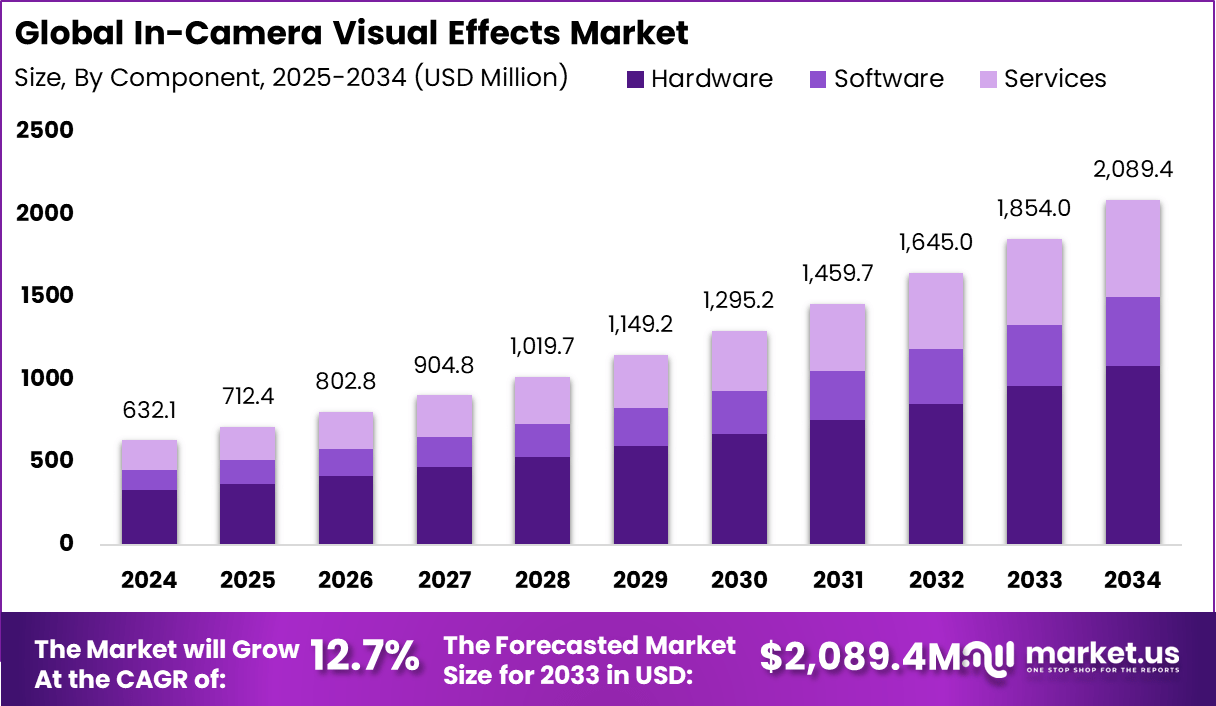

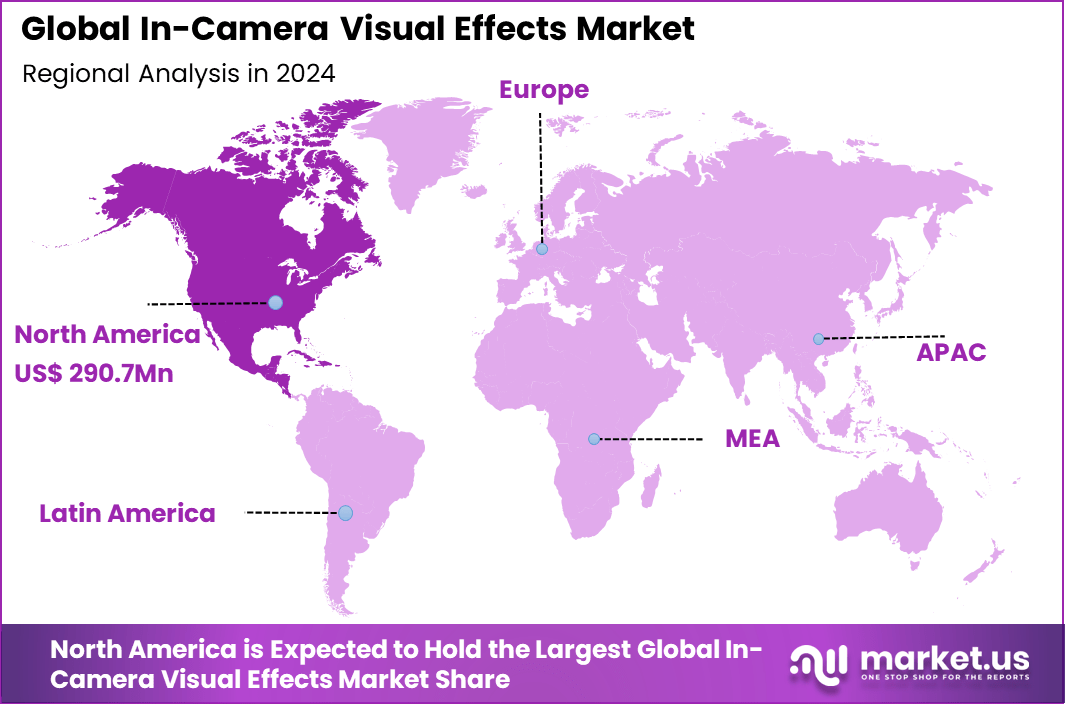

The Global In-Camera Visual Effects Market size is expected to be worth around USD 2,089.4 Million By 2034, from USD 632.1 Million in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46% share, holding USD 290.7 Million revenue.

The In-Camera Visual Effects market is being driven by the rising demand for high-quality visual content and the increasing need to streamline production timelines. The adoption of IC-VFX helps reduce post-production time, eliminate reshoots, and support creative flexibility by allowing real-time visual feedback. Content creators are moving away from traditional green screens and embracing LED volumes and game engines that enable dynamic, photorealistic environments on set.

Demand for IC-VFX has increased significantly across film, advertising, and episodic TV segments. The technology supports faster project completion, better visual consistency, and reduced logistics complexity. It also aligns with evolving viewer expectations for more immersive and lifelike content. High-end productions and commercial studios are increasingly integrating IC-VFX into their standard workflows, which has strengthened the market outlook and encouraged further experimentation with hybrid filming models.

The adoption of emerging technologies such as real-time rendering engines, high-resolution LED volumes, volumetric capture, and AI-assisted camera tracking has accelerated IC-VFX growth. These tools enable on-set visualization with cinematic precision, helping directors and production crews make quicker creative decisions.

Volumetric imaging and AI analytics also enhance realism, performance accuracy, and scene interactivity. These innovations have shifted the IC-VFX approach from niche applications to scalable mainstream production tools. The primary reasons behind the adoption of IC-VFX include cost savings, fewer post-production hours, and improved actor engagement.

Directors benefit from immediate visual context during filming, which improves scene framing and emotional authenticity. Teams can work more efficiently by removing the need for extensive location shoots and environmental adjustments. In a controlled studio setting, safety risks, weather concerns, and scheduling conflicts are minimized, enhancing the overall efficiency of the production process.

As per the latest insights from Market.us, The Visual Effects (VFX) Market is projected to experience substantial growth, reaching a value of approximately USD 28,073.92 million by 2033, up from USD 10,440.5 million in 2023. This expansion reflects a compound annual growth rate (CAGR) of 10.7% over the forecast period from 2024 to 2033.

In parallel, the Global AI in Visual Effects Market is undergoing an accelerated transformation, with expectations to reach around USD 9.6 billion by 2033, rising from USD 1.6 billion in 2023. This represents a robust CAGR of 19.6% from 2024 to 2033.

Investment opportunities are emerging in LED volume studios, virtual production platforms, and AI-based visual previsualization tools. Venture capital and studio investments are increasingly directed toward turnkey virtual production solutions that integrate rendering software, tracking systems, and stage hardware. Growth potential is especially high in expanding regional markets where demand for locally produced, high-quality digital content is increasing.

Key Insight Summary

- The global ICVFX market is projected to rise from USD 632.1 million in 2024 to USD 2,089.4 million by 2034, reflecting a strong CAGR of 12.7%. This growth is driven by rising demand for real-time, photorealistic virtual production.

- In 2024, North America led the market with over 46% share, generating about USD 290.7 million. The region’s lead is backed by its advanced film industry and early adoption of virtual production technologies.

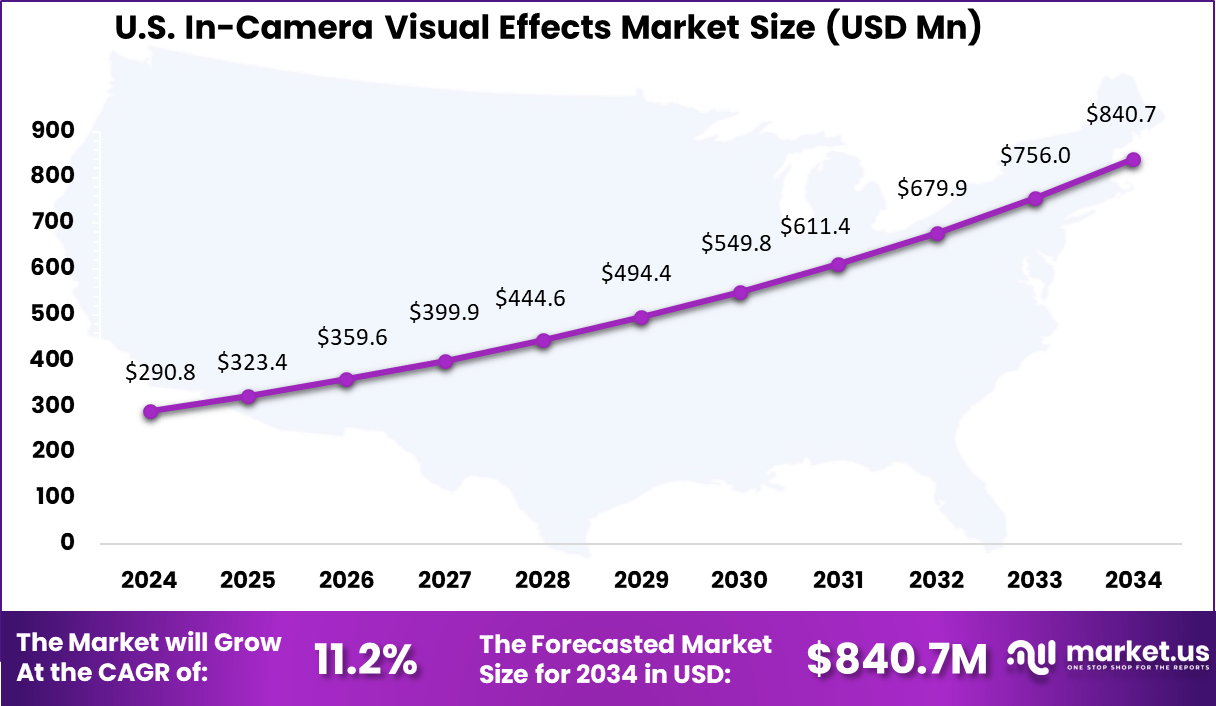

- The U.S. market alone generated USD 290.8 million in 2024 and is expected to grow at a CAGR of 11.2%. Strong studio investments and technology integration are boosting domestic demand.

- By component, hardware accounted for 52% of the market. High-quality LED walls, tracking systems, and rendering tools are central to delivering immersive on-set environments.

- Film & television applications led with 43% share in 2024, as studios increasingly adopt in-camera VFX to reduce post-production costs and accelerate timelines.

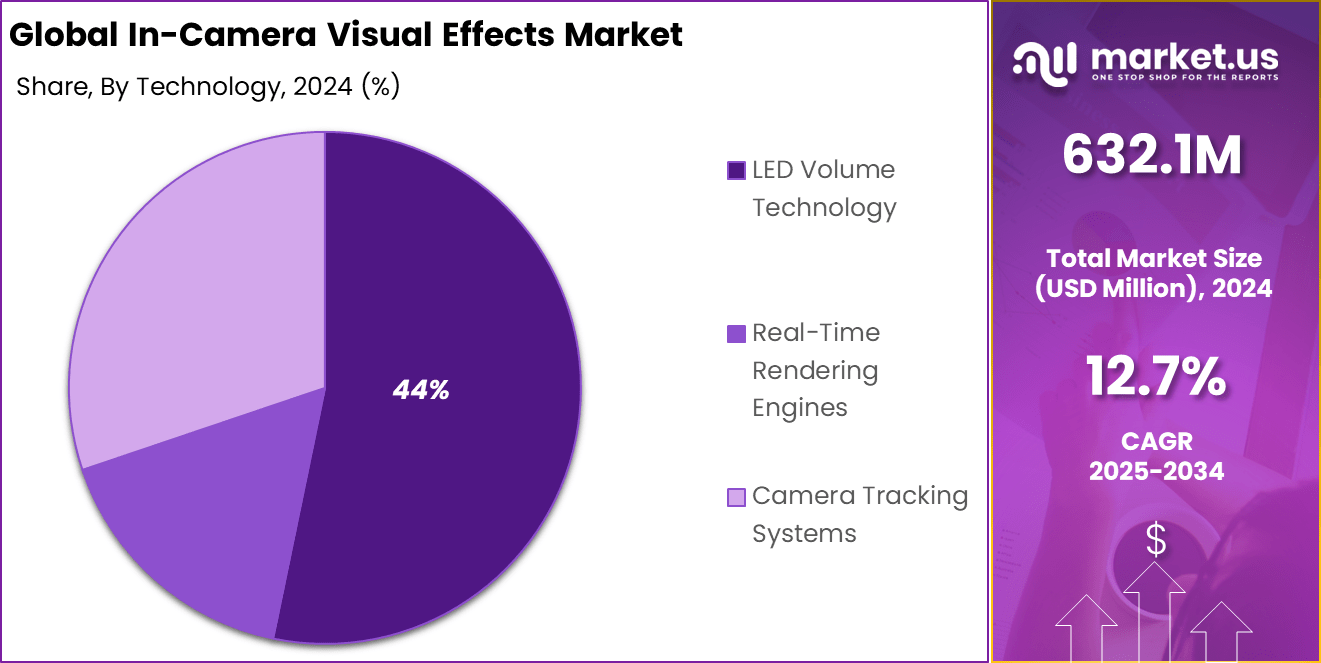

- By technology, LED volume technology captured 44% of the market. Its ability to create dynamic, real-time backdrops is revolutionizing the way visual content is produced.

US Market Size

The U.S. In-Camera Visual Effects Market was valued at USD 290.8 Million in 2024 and is anticipated to reach approximately USD 840.7 Million by 2034, expanding at a compound annual growth rate (CAGR) of 11.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 46% share and generating USD 290.7 million in revenue. This leadership is primarily driven by the presence of well-established film and television production hubs in cities like Los Angeles, Vancouver, and Atlanta.

These locations offer strong infrastructure for virtual production, with a high number of LED volume studios already operational. The region also benefits from government-backed tax incentives and grants that support digital content creation, which has significantly boosted the adoption of in-camera visual effects (IC-VFX) in major and independent productions.

North America’s dominance is further supported by close integration between technology firms, VFX vendors, and creative studios. This collaborative environment accelerates the development and implementation of real-time rendering systems, camera tracking tools, and volumetric capture solutions.

The availability of skilled professionals, combined with investment in R&D and virtual production education, enhances the region’s ability to maintain leadership. As demand for immersive content continues to rise, North America remains the primary launchpad for innovations in IC-VFX workflows.

By Component Analysis

In 2024, the Hardware segment held a dominant market position, capturing more than a 52% share. This dominance can be attributed to the foundational role of physical equipment in enabling in-camera visual effects.

Components such as LED volume displays (both curved and flat), camera tracking systems, rendering servers, GPUs, cinematic and volumetric cameras, lighting equipment, and motion sensors are critical in creating immersive virtual environments on set.

The prominence of the hardware segment is further reinforced by its role as the foundation upon which software and services rely. Without reliable LED volumes and motion capture systems, real-time rendering engines and calibration tools cannot operate effectively.

Studios investing in virtual production systems prioritize hardware build-outs first, knowing that these physical assets enable creative flexibility, eliminate reshoots, and significantly enhance on-set decision-making. The concentrated capital expenditure and tangible nature of these assets have cemented hardware as the key driver of IC-VFX deployment.

By Application Analysis

In 2024, Film & Television segment held a dominant position in the In‑Camera Visual Effects market, capturing more than a 43 % share. This leadership reflects the segment’s insatiable demand for high‑quality, immersive visual experiences that enhance storytelling.

Filmmakers and television producers have increasingly relied on on‑set virtual production setups – such as LED volumes and real‑time rendering- to reduce dependence on green screens and to provide actors and directors with immediate visual context. This has enabled richer creative control, faster decision‑making, and fewer reshoots. The result is a streamlined production flow that optimizes both quality and efficiency.

The Film & Television segment continues to lead because it represents the origin of virtual production innovation. The success of high‑profile projects utilizing LED‑volume systems and game‑engine rendering has sparked a paradigm shift across legacy studios and streaming networks alike. Large‑scale productions require cutting‑edge visual fidelity and dynamic environments, and IC‑VFX delivers precisely that.

By Technology Analysis

In 2024, LED Volume Technology segment held a dominant market position, capturing more than a 44 % share of the In‑Camera Visual Effects market. Its leadership is directly tied to the foundational role LED volumes play in virtual production.

These large, high-resolution LED walls – often curved or flat – provide photorealistic environments that can be captured live on set, reducing the need for green screen setups and extensive post-production compositing. Film, television, and advertising industries have embraced this technology because it delivers immersive visuals, realistic lighting interactions, and enhanced creative control during filming.

The segment’s dominance is further anchored in the rapid evolution of LED panel technology. Improvements in refresh rate, color accuracy, and panel durability have made it feasible to shoot close-up scenes and complex visual sequences without compromise.

Investments in LED volumes have surged – not only in major studios but also in smaller virtual production facilities – highlighting its scalability and reliability as a core infrastructure component. As production teams strive for immediate feedback and on‑set realism, LED volumes remain at the heart of this transformation.

Key Market Segments

By Component

- Hardware

- LED Volume Displays (Curved & Flat Walls)

- Camera Tracking Systems

- Rendering Servers & GPUs

- Cameras (Cinematic/Volumetric)

- Lighting & Sensors

- Others

- Software

- Real-Time Engines

- Camera Tracking & Calibration Software

- Scene Management & Previs Tools

- Virtual Set Design Software

- Services

- System Integration

- Support & Consulting

- Training

By Application

- Film & Television

- Commercial Advertising

- Live Broadcast & Events

- Automotive Product Visualization

- Architecture / Real Estate Walkthroughs

- Others

By Technology

- LED Volume Technology

- Real-Time Rendering Engines

- Camera Tracking Systems

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Real-Time Integration of Virtual Sets

The evolution of in-camera VFX is increasingly being shaped by the adoption of real-time virtual sets within LED volume environments. These environments allow actors to perform against photorealistic 3D backdrops projected in real time, eliminating the disconnect between green screen shooting and post-production editing.

By merging live-action with game engine-generated backgrounds, directors and cinematographers are now able to make on-set decisions that reflect the final look of a scene. This reduces the risk of inconsistencies and accelerates the overall shooting timeline. In 2025, this trend is becoming more prominent due to the increased availability of advanced rendering engines and LED wall technologies.

Production teams are now able to manipulate lighting, weather conditions, and scenery changes dynamically, all during principal photography. As a result, productions are not only saving time and resources but are also achieving higher-quality visuals with better storytelling impact. This real-time innovation is expected to fundamentally reshape how content is produced across film, television, and advertising industries.

Driver

Enhanced Creative Control and Efficiency

One of the primary factors accelerating the adoption of in-camera visual effects is the enhanced creative control it offers. Real-time rendering systems provide directors with immediate visual feedback, allowing them to adjust virtual environments, lighting setups, and camera angles without waiting for post-production.

This control translates into faster decision-making and improved alignment between creative vision and execution, ultimately reducing the number of reshoots and delays. Moreover, the convergence of virtual production tools such as camera tracking systems and motion capture has streamlined complex workflows.

This efficiency is especially critical in high-budget productions where time-sensitive schedules are crucial. By integrating visual effects on-set, teams can validate scenes immediately and maintain production momentum. Consequently, the dependency on external post-production facilities is reduced, creating a more agile and cohesive production cycle.

Restraint

High Hardware and Skill Costs

Despite its technical advantages, the high upfront investment required for in-camera VFX remains a key restraint. Establishing a virtual production environment involves procuring high-resolution LED panels, camera tracking systems, and real-time rendering infrastructure. These elements, combined with the need for robust computing power, make the initial setup expensive, especially for small and mid-sized studios.

In addition to hardware, the technology demands a specialized skill set. Trained professionals in virtual cinematography, Unreal Engine operation, and VFX compositing are essential to run the systems effectively. The scarcity of such talent further limits adoption in emerging markets. This dual challenge of capital intensity and talent availability slows down the democratization of ICVFX, despite its growing industry relevance.

Opportunity

AI-Assisted Tracking and Neural Rendering

Artificial intelligence is opening new frontiers for in-camera VFX through innovations in camera tracking and rendering techniques. AI-driven tracking systems are capable of learning motion behavior and automatically adjusting for parallax errors, which improves accuracy during virtual set integration. This technology minimizes the need for manual calibration and enhances the seamless blending of physical and digital elements on set.

Furthermore, neural rendering approaches like Neural Radiance Fields (NeRF) have shown potential in generating complex 3D scenes with realistic lighting and texture fidelity. These methods can reduce reliance on traditional 3D modeling, making content creation more accessible and flexible.

Challenge

Workflow Standardization and Interoperability

A major challenge faced by the ICVFX industry is the lack of standardized production pipelines. Currently, workflows vary widely across studios due to differences in hardware, software, and technical know-how. This variability leads to interoperability issues when transitioning between pre-visualization, live shooting, and post-production stages. Without universal practices, scaling ICVFX across multiple projects or locations remains complex.

Moreover, inconsistent metadata handling and asset transfer protocols often cause delays and data mismatches during production. In some cases, valuable scene configurations may be lost or inaccurately replicated. Addressing this challenge will require collaboration across industry stakeholders to define best practices and develop unified systems that support efficient asset reuse and real-time communication between departments.

Key Player Analysis

Industrial Light & Magic (ILM) leads the in-camera visual effects market with advanced LED volume applications. ARRI supports the ecosystem with high-end cameras and lighting gear. ROE Visual provides LED panels widely used in virtual production stages for their clarity and durability.

Mo-Sys Engineering offers precise camera tracking systems essential for real-time scene alignment. Disguise and Pixotope supply rendering and XR software used in immersive sets. Absen continues to expand its footprint with LED displays optimized for film and live production.

Sony enhances production quality through high-resolution cinematic cameras. MRMC delivers robotic motion systems tailored for virtual sets. Vū Studios, Lux Machina, and PRG offer full-stack services, from LED stage builds to virtual set integration, supporting studios with end-to-end production solutions.

Top Key Players Covered

- Industrial Light & Magic (ILM)

- ARRI

- ROE Visual

- Mo-Sys Engineering

- Disguise

- Pixotope

- Absen

- Sony

- MRMC (Mark Roberts Motion Control)

- Vū Studios

- Lux Machina

- PRG (Production Resource Group)

- Others

Recent Developments

- In 2025, ROE Visual partnered with ARK Ventures, CJ Olive Networks, and YoungdoB&C to build the MunGyeong Virtual Studio (MVS) in South Korea. The studio integrates 1,024 Ruby RB2.6 and 320 Carbon CB5L MKII LED panels, creating a high-end virtual production environment. This collaboration highlights the growing demand for advanced visual effects infrastructure in Asia and positions MVS as a major player in regional content creation.

- Also in 2025, Fivefold Studios invested in ROE Visual LED technology to set up a new virtual production studio in Wales. ROE Visual is supporting the project with integrated hardware, R&D assistance, and training programs. The initiative is further strengthened through a partnership with Sunbelt Rentals UK & Ireland, enabling the studio to deliver next-generation broadcast and film production capabilities in the UK market.

Report Scope

Report Features Description Market Value (2024) USD 632.1 Mn Forecast Revenue (2034) USD 2,089.4 Mn CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (LED Volume Displays (Curved & Flat Walls), Camera Tracking Systems, Rendering Servers & GPUs, Cameras (Cinematic/Volumetric), Lighting & Sensors, Others), Software (Real-Time Engines, Camera Tracking & Calibration Software, Scene Management & Previs Tools, Virtual Set Design Software), Services (System Integration, Support & Consulting, Training))), By Application (Film & Television, Commercial Advertising, Live Broadcast & Events, Automotive Product Visualization, Architecture / Real Estate Walkthroughs, Others), By Technology (LED Volume Technology, Real-Time Rendering Engines, Camera Tracking Systems) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Industrial Light & Magic (ILM), ARRI, ROE Visual, Mo-Sys Engineering, Disguise, Pixotope, Absen, Sony, MRMC (Mark Roberts Motion Control), Vū Studios, Lux Machina, PRG (Production Resource Group), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In-Camera Visual Effects MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

In-Camera Visual Effects MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Industrial Light & Magic (ILM)

- ARRI

- ROE Visual

- Mo-Sys Engineering

- Disguise

- Pixotope

- Absen

- Sony

- MRMC (Mark Roberts Motion Control)

- Vū Studios

- Lux Machina

- PRG (Production Resource Group)

- Others