Global Immunotherapy Drugs Market By Type (Antibody Drugs, Inhibitor Drugs, Interferons and Interleukins, Cancer Vaccines Other Types) By Application(Cancer, Autoimmune and Inflammatory Diseases, Hematology, Osteology, Neurology, Other Applications), Route of Administration (Intravenous, Subcutaneous, Other Routes of Administration), By End User (Hospitals, Long-Term Care Facilities, Other End Users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 125774

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

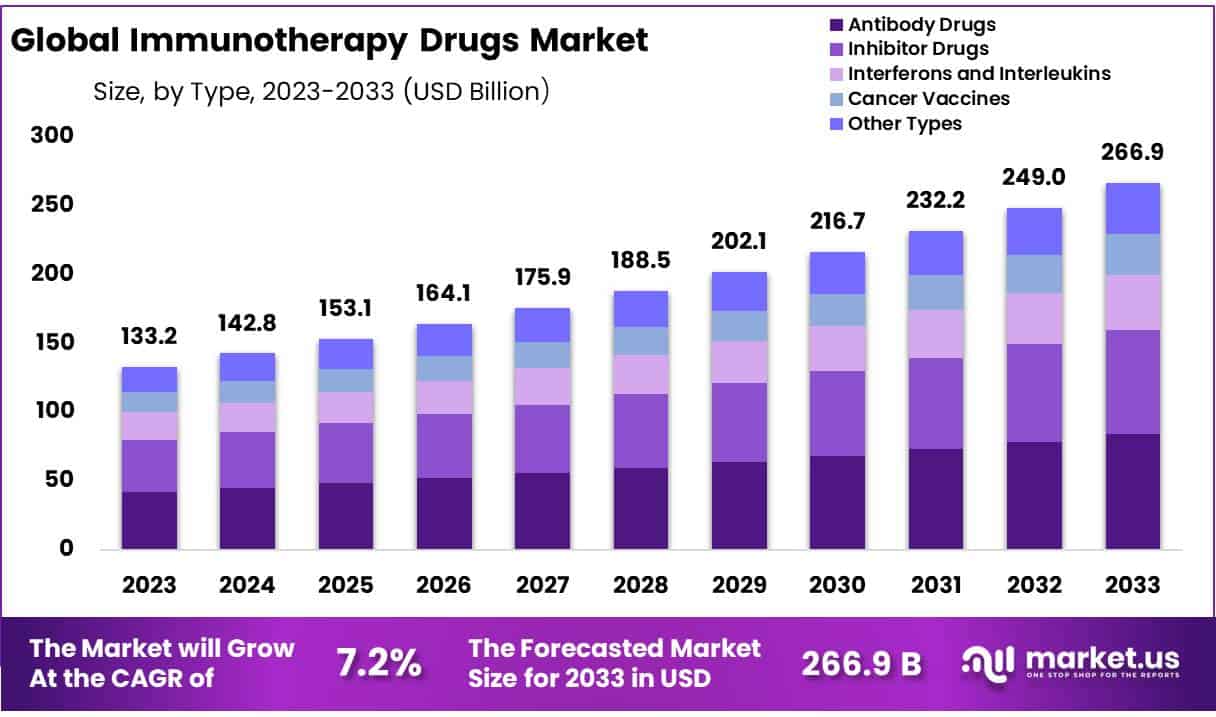

The Global Immunotherapy Drug Market is witnessing significant growth over the forecast period 2024-2033 owing to rising provenance of cancer worldwide. The market was sized at USD 133.2 Billion in 2023 and is expected to reach USD 263.1 Billion growing at the compound annual growth rate (CAGR) of 7.2% from 2024 to 2033.

- According to the World Health Organization, in 2022, there were approximately 20 million new cancer cases and 9.7 million deaths due to cancer.

- About 1 in 5 people develop cancer in their lifetime, approximately 1 in 9 men and 1 in 12 women die from the disease.

Furthermore, the rising prevalence of other chronic diseases such as autoimmune disorders, and infectious diseases is promoting the need for innovative immunotherapy treatments.

- According to the International Diabetes Federation, an estimated 537 million people aged 20 to 79 had diabetes in 2021. This number is projected to increase to 783 million by 2045.

- Furthermore, as per the reports by the Institute of Health Metrics and Evaluation, more than half a billion of the population was living with diabetes in 2023.

Advances in biotechnology and a deeper understanding of immune mechanisms have led to the development of novel immunotherapies, enhancing market growth. Increased investment in research and development by pharmaceutical companies and favorable government policies supporting drug approvals further propel the market.

Additionally, the growing adoption of personalized medicine, which tailor’s treatments to individual genetic profiles, boosts the demand for targeted immunotherapies. Public awareness of immunotherapy’s benefits and its potential to offer long-term remission and fewer side effects compared to traditional therapies also contribute to market expansion. Finally, the rising geriatric population, more susceptible to chronic diseases, underscores the increasing need for effective immunotherapeutic solutions.

- The United Nations has stated that the age distribution is the US is witnessing a shift. Nearly 58 million adults aged 65 and older lived in the U.S. in 2022, accounting for 17.3% of the nation’s population.

Key Takeaways

- Market Size: The Immunotherapy Drugs Market generated a revenue of USD 133.2 billion and is predicted to reach USD 263.1 billion.

- Market Growth: The market growing at a CAGR of 7.2% during the forecast period from 2024 to 2032.

- Type Analysis: Based on the type, the antibody drugs segment generated the most revenue for the market with a market share of 31.6%.

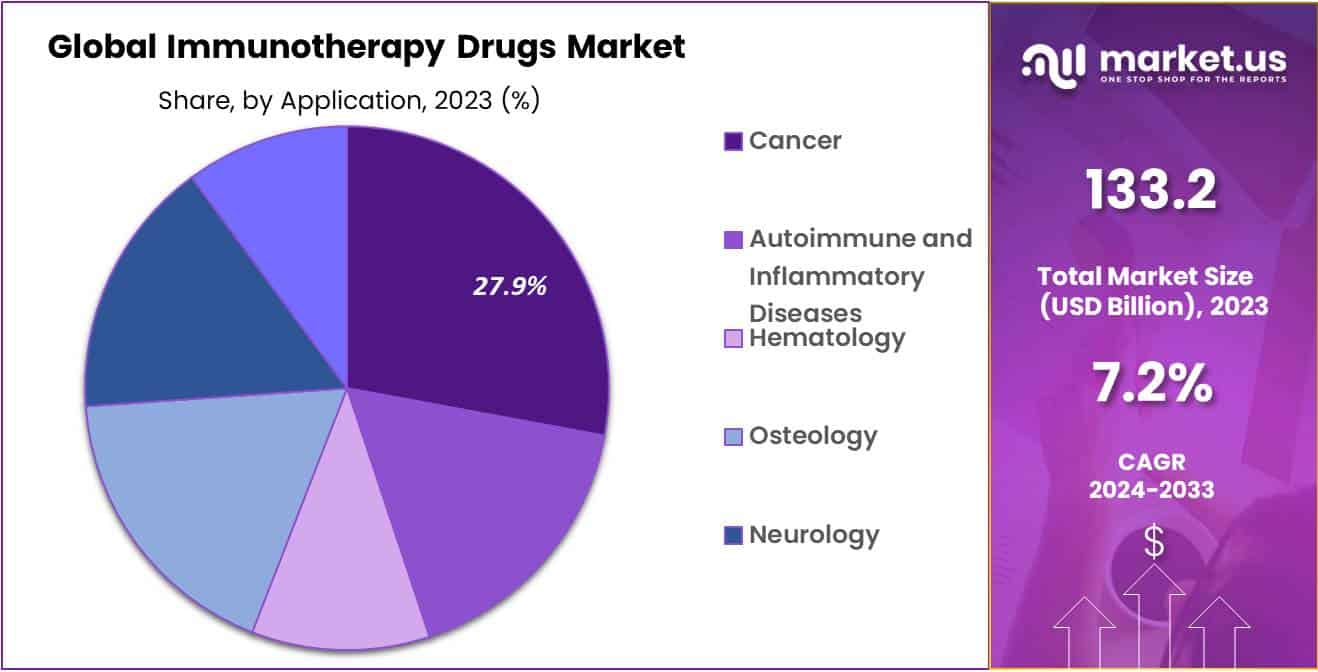

- Application Analysis: By application, the cancer segment contributed the most to the market and secured a market share of 27.9%.

- End-Use Analysis: In terms of end-users, the hospitals led the market in 2023, with a market share of 46.2%.

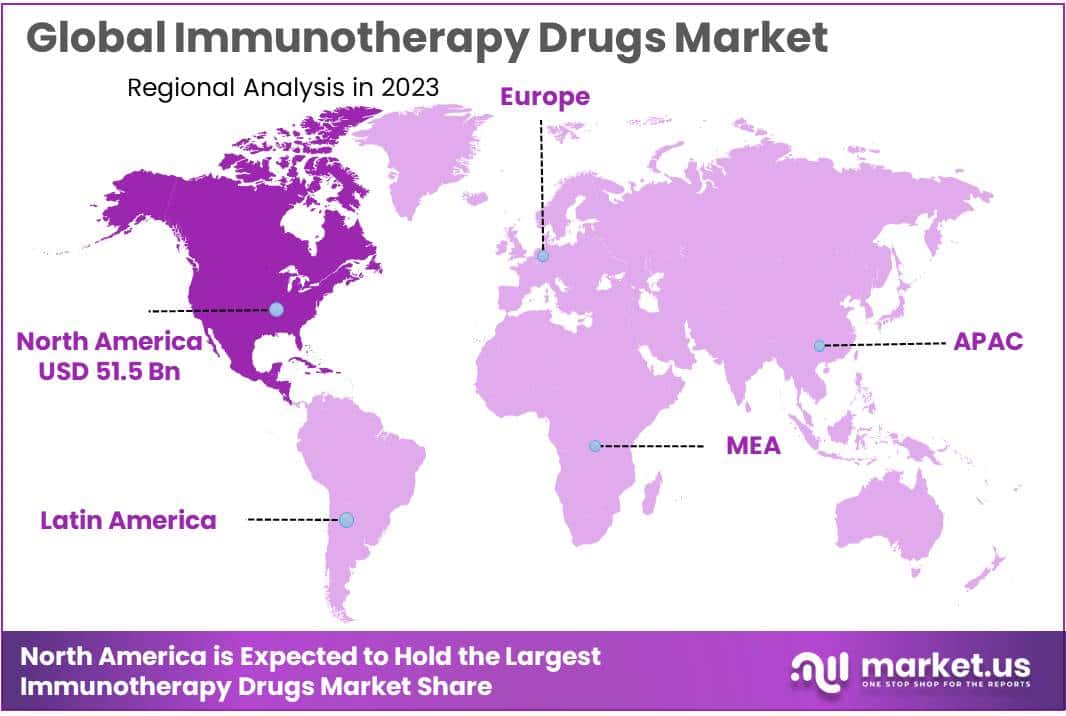

- Regional Analysis: Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 38.7%.

- Cancer Treatment Focus: Immunotherapy drugs are increasingly used in oncology, offering targeted treatment options that enhance the immune system’s ability to fight cancer cells.

- Innovative Therapies: The market is witnessing the development of innovative therapies, including checkpoint inhibitors, CAR T-cell therapy, and monoclonal antibodies.

By Type Analysis

Based on the type, the market is further segmented into antibody drugs, inhibitor drugs, interferons and interleukins, cancer vaccines other types. The antibody drugs led the global immunotherapy drugs market and attained a market share of 31.6% in 2023. Antibody drugs lead the immunotherapy drugs market due to their specificity and efficacy in targeting cancer cells and other diseases. These drugs can precisely identify and bind to specific antigens on the surface of diseased cells, minimizing damage to healthy cells and reducing side effects.

Advances in monoclonal antibody technology have improved their effectiveness and expanded their therapeutic applications. Additionally, antibody drugs can be engineered to enhance immune system responses, making them highly effective in treating various cancers and autoimmune disorders, further driving their dominance in the immunotherapy market.

By Application Analysis

Immunotherapy drugs have applications in cancer, autoimmune and inflammatory diseases, hematology, osteology, neurology, and other applications. Immunotherapy in cancer is dominating the application segment and has attained 27.9% of the global market share in 2023. Immunotherapy has shown remarkable efficacy in treating various types of cancers by harnessing the body’s immune system to specifically target and destroy cancer cells.

Innovations such as immune checkpoint inhibitors, CAR T-cell therapies, and monoclonal antibodies have significantly improved patient outcomes. The rising global incidence of cancer, combined with the limitations of traditional treatments like chemotherapy and radiation, has driven demand for more effective and targeted therapies.

Additionally, substantial investments in cancer research and development, along with regulatory approvals and support, have further propelled the dominance of the cancer segment in the immunotherapy market.

- According to the John Hopkins Medicine Organization, immunotherapy has the response rates of about 15% to 20%.

By Route of Administration Analysis

The intravenous route of administration dominated the global immunotherapy drugs market due to its ability to deliver drugs directly into the bloodstream, ensuring rapid and efficient distribution. This method is particularly effective for treatments requiring precise dosages and immediate action, making it ideal for immunotherapies.

By End-User Analysis

The immunotherapy drugs market is broadly segmented by end users into hospitals, long-term care facilities, and other end users (such as specialty care centers). In 2023, the hospitals segment held the largest market share. Hospitals extensively use monoclonal antibodies (mAbs) for their targeted therapy, rapid diagnostic applications, and effectiveness in treating various conditions, including cancer, autoimmune disorders, and infectious diseases.

Key Market Segments

By Type

- Antibody Drugs

- Inhibitor Drugs

- Interferons and Interleukins

- Cancer Vaccines

- Other Types

By Application

- Cancer

- Autoimmune and Inflammatory Diseases

- Hematology

- Osteology

- Neurology

- Other Applications

By Route of Administration

- Intravenous

- Subcutaneous

- Other Routes of Administration

By End User

- Hospitals

- Long-Term Care Facilities

- Other End Users

Drivers

Rising Prevalence of Chronic Diseases Globally, Driving the Immunotherapy Drugs Market

Rising prevalence of chronic diseases globally is significantly propelling the immunotherapy drugs market. The increasing prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders is propelling the growth of the immunotherapy drugs market. Immunotherapy leverages the body’s immune system to combat diseases, offering effective treatment with fewer side effects compared to traditional methods.

Technological advancements in biotechnology, along with heightened research investments, are further fuelling market expansion. As chronic disease rates continue to rise globally, the demand for innovative immunotherapy treatments is expected to grow, providing new avenues for medical breakthroughs and improved patient outcomes.

- Diabetes prevalence increased to 11.5% of the adult population, impacting nearly 31.9 million adults.

- Chronic Obstructive Pulmonary Disease was 7.1 times higher among American Indian/Alaska Native adults than Asian adults.

Restrains

High Treatment Costs Associated with Immunotherapy Drugs is Restraining the Market

The high treatment costs associated with immunotherapy drugs are a significant market restraint. These therapies, while effective, are often expensive due to the complex manufacturing processes and advanced technologies involved. High costs can limit patient access and place financial strain on healthcare systems, particularly in low- and middle-income countries. Insurance coverage variability and out-of-pocket expenses further hinder widespread adoption.

Consequently, despite their clinical benefits, the steep price of immunotherapy drugs restricts market growth and accessibility, highlighting the need for cost-effective solutions and broader financial support mechanisms to make these treatments more widely available.

Opportunities

Strategic Alliances between Pharmaceutical Companies and Research Institutions is Presenting Growth Opportunities

Strategic alliances between pharmaceutical companies and research institutions are creating significant growth opportunities in the immunotherapy drugs market. These collaborations combine the expertise, resources, and innovation capabilities of both sectors, accelerating the development of advanced therapies. Partnerships facilitate knowledge sharing, enhance clinical trial efficiency, and drive breakthroughs in personalized medicine.

Additionally, joint ventures can leverage funding and infrastructure to overcome research and development challenges. By working together, companies and institutions can bring new immunotherapy treatments to market more quickly and effectively, meeting the rising demand for innovative solutions to combat chronic diseases.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the immunotherapy drugs market. Economic growth drives higher healthcare spending and boosts investment in drug research and development. Conversely, economic downturns can limit funding and impact drug affordability.

Exchange rate fluctuations affect the cost of drug imports and exports, influencing market prices. Geopolitical factors such as regulatory differences can create barriers to market entry, impacting drug approval processes and launch schedules. Trade policies and international relations also play a role, with trade restrictions or tariffs affecting global distribution and pricing. Additionally, geopolitical stability can influence investment flows and collaborations within the biopharmaceutical sector.

Latest Trends

The global immunotherapy drugs market is experiencing several key trends. There is a growing focus on personalized and targeted therapies, driven by advancements in genomics and biotechnology. Combination therapies, integrating immunotherapy with traditional treatments or other novel agents, are gaining traction for enhanced efficacy. Increased investment in research is accelerating the development of innovative therapies, including next-generation CAR T-cell therapies and immune checkpoint inhibitors.

Additionally, expanding indications beyond oncology, such as autoimmune diseases and infectious diseases, is broadening the market. Enhanced understanding of immune mechanisms and emerging biomarkers are also shaping the future of immunotherapy.

Regional Analysis

North America Dominates the Global Immunotherapy Drugs Market

North America dominates the global immunotherapy drugs market due to its advanced healthcare infrastructure, significant investment in research and development, and strong presence of major pharmaceutical companies. The region held the market share of 38.7% in 2023. High healthcare spending and well-established reimbursement policies further support the adoption of immunotherapy treatments.

Additionally, North America has a high prevalence of cancer and other diseases treated by immunotherapy, driving demand. The presence of leading research institutions and clinical trial centers also contributes to the region’s market leadership.

The growth of the region is expected to be supported by the launch and regulatory approval of new immunotherapy drugs and favorable reimbursement policies. For example, Merck’s anti-PD-1 therapy, Keytruda, received FDA approval in October 2021 for use in combination with chemotherapy for treating cervical cancer. Additionally, in August 2021, Bristol Myers Squibb Co.’s Opdivo (nivolumab) was granted FDA approval for the treatment of urothelial carcinoma.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global immunotherapy drugs market is highly competitive, featuring key players such as Bristol-Myers Squibb, Merck & Co., Roche, and Pfizer. These companies lead in developing and commercializing innovative therapies, including checkpoint inhibitors, CAR-T cell therapies, and monoclonal antibodies. Market dynamics are driven by ongoing research, collaborations, and acquisitions aimed at expanding drug portfolios and enhancing treatment efficacy.

Emerging biotech firms and generics also contribute to the competitive landscape, focusing on novel approaches and cost-effective solutions. The market is characterized by rapid technological advancements, regulatory challenges, and high R&D investments.

Top Key Players

- Amgen, Inc.

- Novartis AG

- AbbVie, Inc.

- Pfizer, Inc.

- Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- AstraZeneca

- GSK

- Sanofi

- Bayer AG

Recent Developments

- In January 2021, Sanofi entered an agreement to acquire Kymab for an upfront payment of approximately USD 1.1 billion, adding the monoclonal antibody KY1005 to its pipeline.

- In May 2024, Merck acquired EyeBio (UK), a privately held biotechnology company specializing in ophthalmology. Through this acquisition, Merck gained rights to EyeBio’s pipeline candidate, Restoret (EYE103), an investigational tri-specific antibody that functions as an agonist of the WNT signaling pathway.

- In December 2023, F. Hoffmann-La Roche acquired Telavant Holdings, Inc., which was owned by Roivant Sciences Ltd. and Pfizer Inc., to advance therapies targeting gastrointestinal health.

- In May 2023, Janssen Global Services, LLC, a subsidiary of Johnson & Johnson, partnered with Cellular Biomedicine Group Inc. (CBMG) to develop and commercialize advanced chimeric antigen receptor (CAR) T-cell therapies for treating B-cell malignancies.

Report Scope

Report Features Description Market Value (2023) USD 133.2 Billion Forecast Revenue (2033) USD 263.1 Billion CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type – Antibody Drugs, Inhibitor Drugs, Interferons and Interleukins, Cancer Vaccines Other Types, By Application-Cancer, Autoimmune and Inflammatory Diseases, Hematology, Osteology, Neurology, Other Applications, Route of Administration-Intravenous, Subcutaneous, Other Routes of Administration, By End User -Hospitals, Long-Term Care Facilities, Other End Users. Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Amgen, Inc., Novartis AG, AbbVie, Inc., Pfizer, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson Services, Inc., AstraZeneca, GSK, Sanofi, Bayer AG, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amgen, Inc.

- Novartis AG

- AbbVie, Inc.

- Pfizer, Inc.

- Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- AstraZeneca

- GSK

- Sanofi

- Bayer AG