Immunofluorescence Assay Market By Product (Consumables- Antibodies. Kits and Reagents, Accessories, Instruments), By Type (Direct Immunofluorescence, Indirect Immunofluorescence), By Application (Cancer, Infectious Diseases, Autoimmune Diseases, Cardiovascular Diseases, Others), By End-user (Pharmaceutical & Biopharmaceutical Companies, Hospital and Diagnostic Centers, CROs, Academic Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151014

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

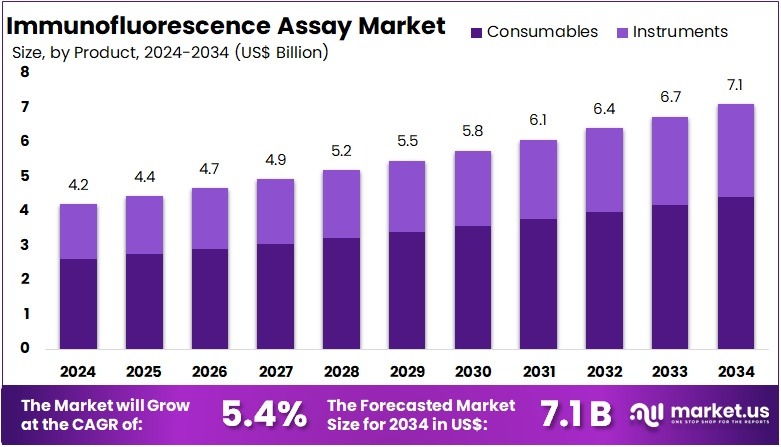

The Immunofluorescence Assay Market Size is expected to be worth around US$ 7.1 billion by 2034 from US$ 4.2 billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034.

The immunofluorescence assay (IFA) market is a vital segment within the diagnostic and research industries, particularly for its ability to provide detailed insights into cellular and molecular structures. This technique is widely used in clinical diagnostics, research, and drug discovery, owing to its high sensitivity and specificity in detecting a variety of biomarkers.

IFA plays a critical role in identifying diseases such as autoimmune disorders, infections, and cancers by using fluorescently-labeled antibodies that bind to specific antigens within a sample. This results in a fluorescent signal that can be detected and analyzed, providing a clear visual representation of molecular processes. The growing demand for precise and non-invasive diagnostic tools has significantly boosted the market, particularly in clinical settings where the ability to detect low-abundance biomarkers in early disease stages is essential for effective treatment.

Increasing prevalence of chronic diseases such as cancer, autoimmune conditions, and neurological disorders is one of the key drivers of growth in the market. For example, IFA is frequently used to diagnose conditions like systemic lupus erythematosus (SLE) and rheumatoid arthritis, where it helps to identify specific antibodies present in the patient’s serum. Additionally, the rise in research activities related to oncology and personalized medicine has further fueled the market’s growth, as IFA is an essential tool for biomarker validation in clinical trials.

The demand for IFA is also supported by the ongoing advancements in imaging technologies, such as super-resolution microscopy, which improves the resolution and accuracy of immunofluorescence detection. As new and innovative applications of IFA continue to emerge, particularly in the fields of drug discovery and molecular biology, the market is expected to expand, with a growing number of companies investing in the development of novel assay kits, reagents, and imaging systems to meet the evolving needs of both researchers and clinicians.

The regulation of cell states relies on signal cascades primarily initiated by receptor-ligand binding on the cell membrane and intercellular interactions. Multiplexed immunofluorescence (IF) allows for the study of membrane proteins by visualizing signal activation and offering a spatially detailed view of these proteins.

In this research, scientists from Kyushu University (Fukuoka, Japan) developed precise emission-canceling antibodies (PECAbs) featuring cleavable fluorescent labels. These PECAbs enable high-specificity sequential imaging with hundreds of antibodies, enhancing the capabilities of IF by adding temporal data alongside its spatial resolution. The researchers demonstrated that combining the spatiotemporal data of signaling pathways captured through PECAb-based IF with information gathered using seq-smFISH allowed them to classify cells and their states in human tissue, facilitating the analysis of complex cellular processes.

Key Takeaways

- In 2024, the market for immunofluorescence assay generated a revenue of US$ 4.2 billion, with a CAGR of 5.4%, and is expected to reach US$ 7.1 billion by the year 2034.

- Among the product segment, Consumables including Antibodies, Kits and Reagents, and Accessories dominated the market with 62.1% share in 2024.

- Based on type segment, Indirect Immunofluorescence held 66.7% share in 2024 and captured the dominant position.

- Infectious Diseases segment is the maximum revenue generating application holding 39.5% share in 2024.

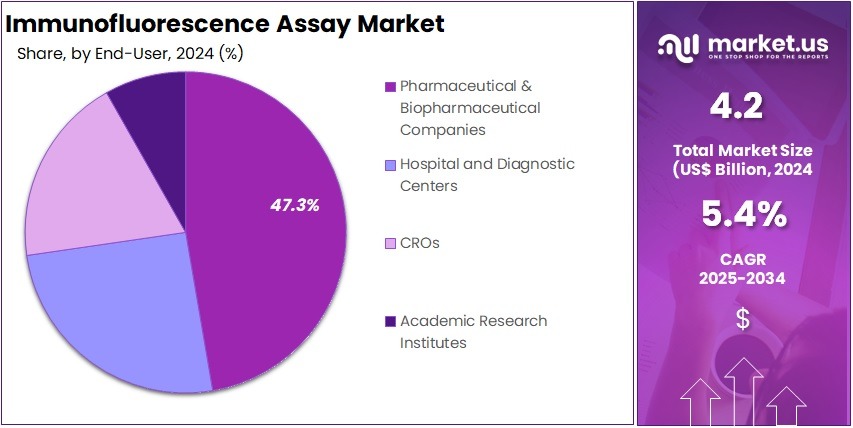

- Among the end-user segment, Pharmaceutical & Biopharmaceutical Companies was the largest segment accounting for 47.3% in 2024.

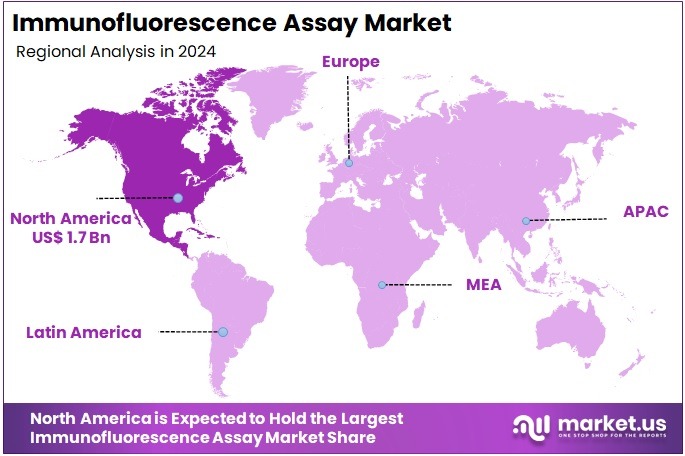

- North America held the largest share of 40.4% in 2024 in the global market.

Product Analysis

Consumables, encompassing reagents, antibodies, and kits, represent the largest and fastest-growing segment in the IFA market with 62.1% share in 2024. These products are essential for conducting immunofluorescence tests, providing the necessary components for sample preparation and analysis.

The demand for consumables is propelled by the increasing number of diagnostic tests performed globally, particularly in clinical laboratories and research institutions. For instance, the widespread adoption of IFA in diagnosing infectious diseases, autoimmune disorders, and cancer has led to a surge in the consumption of these materials.

Moreover, advancements in reagent formulations and the development of ready-to-use kits have further fueled market expansion by enhancing test efficiency and accuracy. For instance, Sino Biological provides over 2000 antibodies for immunofluorescence applications. Each antibody undergoes rigorous quality control processes and is thoroughly validated using various cell samples to confirm its specificity, ensuring reliable and reproducible results for your immunofluorescence research.

Type Analysis

Indirect immunofluorescence assays (IFA) dominate the market, accounting for 66.7% share in 2024 due to their enhanced sensitivity and versatility. This method involves the use of a secondary antibody conjugated to a fluorescent dye, which binds to the primary antibody that has attached to the target antigen. The amplification of the fluorescent signal through this secondary antibody step results in improved detection capabilities.

Indirect IFA is widely utilized in various applications, including the detection of autoantibodies in autoimmune diseases and the identification of specific antigens in infectious diseases. Its cost-effectiveness and ability to utilize a single labeled secondary antibody for multiple primary antibodies contribute to its prevalent use in both clinical diagnostics and research settings.

In June, 2023, Revvity, Inc. announced that its EUROIMMUN division has introduced the UNIQO 160 (CE-IVDR), an automated indirect immunofluorescence test (IIFT) system designed for autoimmune disease diagnostics. Available in countries that accept the CE mark, this comprehensive solution enhances the efficiency of the entire IIFT workflow, including sample preparation, incubation, washing, slide mounting, and image acquisition and analysis.

Application Analysis

Infectious diseases represent the largest application segment for immunofluorescence assays holding 39.5% share in 2024, driven by the need for rapid and accurate diagnostic methods. IFA is employed to detect pathogens such as bacteria, viruses, and parasites by identifying specific antigens present in patient samples. The technique’s high sensitivity and specificity make it invaluable in diagnosing conditions like tuberculosis, malaria, and various viral infections.

For instance, according to the WHO, globally in 2023, there were approximately 263 million cases of malaria and 597,000 deaths across 83 countries. The COVID-19 pandemic further underscored the importance of IFA in infectious disease diagnostics, leading to increased adoption and innovation in assay development. Additionally, the growing global burden of infectious diseases, coupled with advancements in assay technologies, continues to drive the demand for IFA in this application segment.

End-User Analysis

Pharmaceutical and biopharmaceutical companies constitute the largest end-user segment with 47.3% share in 2024 in the immunofluorescence assay market. These organizations utilize IFA in various stages of drug development, including target identification, biomarker discovery, and preclinical testing. IFA’s ability to provide detailed visualization of molecular interactions and cellular localization of drug targets makes it an essential tool in pharmaceutical research.

The increasing focus on personalized medicine and the need for precise therapeutic interventions have further amplified the role of IFA in the pharmaceutical industry. Moreover, collaborations between diagnostic companies and pharmaceutical firms are fostering innovation and expanding the application of IFA in drug development pipelines.

Key Market Segments

By Product

- Consumables

- Antibodies

- Kits and Reagents

- Accessories

- Instruments

By Type

- Direct Immunofluorescence

- Indirect Immunofluorescence

By Application

- Cancer

- Infectious Diseases

- Autoimmune Diseases

- Cardiovascular Diseases

- Others

By End-User

-

- Pharmaceutical & Biopharmaceutical Companies

- Hospital and Diagnostic Centers

- CROs

- Academic Research Institutes

Drivers

Rising Prevalence of Chronic and Infectious Diseases

The rising prevalence of chronic and infectious diseases is one of the key drivers fueling the growth of the immunofluorescence assay (IFA) market. Immunofluorescence assays are widely used in diagnostic laboratories to detect specific antigens or antibodies within a sample, playing a crucial role in the early detection and monitoring of various diseases. As the global burden of chronic conditions, such as cancer, autoimmune disorders, and infectious diseases like HIV, tuberculosis, and hepatitis, continues to increase, the demand for accurate and reliable diagnostic tools like IFA also rises.

For instance, in recent years, HIV testing has become more prevalent, with the increasing number of patients requiring regular monitoring to assess viral load and treatment efficacy. As per WHO, at the end of 2023, an estimated 39.9 million people (ranging from 36.1 to 44.6 million) were living with HIV, including 1.4 million children (ages 0–14 years) and 38.6 million adults (ages 15+ years). By 2025, the goal is for 95% of people living with HIV to know their HIV status, referred to as the first 95. In 2023, 86% (ranging from 69% to 98%) of individuals living with HIV were aware of their status. IFA plays an essential role in detecting such infections due to its high sensitivity and ability to identify specific biomarkers in complex samples.

Moreover, the growing number of autoimmune diseases, such as lupus and rheumatoid arthritis, has further expanded the need for immunodiagnostic techniques like IFA. This method provides the precision required to identify autoantibodies associated with these diseases. As healthcare systems around the world invest more in advanced diagnostic technologies to combat these rising health challenges, the immunofluorescence assay market is witnessing robust growth. The increasing recognition of IFA’s accuracy and its ability to provide timely results for a wide array of diseases makes it an indispensable tool in modern medical diagnostics.

Restraints

High Cost of Equipment and Reagents

Immunofluorescence assays, while offering accurate and sensitive diagnostic results, often require expensive equipment, such as fluorescent microscopes and immunofluorescence analyzers, which can be a significant financial burden for smaller diagnostic labs or healthcare facilities in low-resource settings. Additionally, the reagents required for conducting IFA tests, including antibodies, fluorescent dyes, and secondary reagents, can be costly, especially when considering the need for regular replenishment and high-quality materials to ensure reliable results.

For instance, the cost of new immunofluorescence antibodies usually varies between $100 and $1,000, depending on factors such as specificity, conjugate type, and application. Antibodies that are of higher quality and offer advanced features, like multi-label capabilities, tend to be priced at the upper end of this range. These high operational costs can limit the adoption of immunofluorescence assays, particularly in regions where healthcare budgets are constrained or where more affordable diagnostic alternatives are available.

The need for specialized training to handle the equipment and interpret the results also adds to the financial challenge. Many diagnostic facilities must invest in training staff, further increasing operational expenses. While IFA provides high specificity and sensitivity for diagnosing diseases like autoimmune disorders, infectious diseases, and cancer, the cost factor may discourage some healthcare providers from incorporating this technology into their regular diagnostic practices. As a result, the high cost of IFA equipment and reagents remains a significant barrier to widespread use, especially in developing regions where more cost-effective diagnostic methods may be prioritized.

Opportunities

Development of Multiplexed and High-Throughput Assays

The development of multiplexed and high-throughput assays presents a significant opportunity for growth in the immunofluorescence assay (IFA) market. Multiplexed assays allow for the simultaneous detection of multiple targets in a single sample, increasing efficiency and expanding the range of diseases that can be monitored at once. This capability is especially valuable in research and clinical settings, where quick and comprehensive analysis is crucial. For instance, multiplexed assays are increasingly being used in oncology, where multiple biomarkers need to be detected to evaluate cancer progression or response to therapy.

This innovation is pushing the boundaries of IFA technology, allowing clinicians and researchers to obtain a broader understanding of complex diseases without requiring multiple individual tests, which saves both time and resources. For instance, in January 2023, Agilent Technologies, Inc. announced a collaboration with Akoya Biosciences, Inc., known as The Spatial Biology Company®, to develop multiplex-immunohistochemistry diagnostic solutions for tissue analysis.

This partnership aims to commercialize workflow solutions for multiplex assays within the clinical research market. By integrating Agilent’s Dako Omnis (an autostaining instrument) with Akoya’s PhenoImager® HT (an imaging platform), the collaboration will offer a unified, end-to-end commercial workflow. This will encompass all aspects of the process, including reagents, staining, imaging, and analysis, for both multiplex chromogenic immunohistochemistry (mIHC) and immunofluorescent (mIF) assays.

In addition, the demand for high-throughput assays is growing, driven by the need for large-scale, rapid testing in both clinical diagnostics and drug development. High-throughput technologies enable the processing of hundreds or even thousands of samples in a shorter time frame, increasing productivity and enabling large-scale epidemiological studies.

The ability to handle large sample volumes with high accuracy and speed is essential in fields such as infectious disease diagnostics and autoimmune disorder testing, where early detection and monitoring are critical. As both multiplexed and high-throughput assays become more advanced, they offer substantial advantages in terms of diagnostic capacity, cost-efficiency, and patient care, making them a key opportunity in the IFA market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the IFA market by influencing both the demand and supply of diagnostic technologies. Economic conditions, such as recessions or inflation, can lead to reduced healthcare spending, particularly in emerging markets where healthcare budgets are often more constrained. This can limit the adoption of advanced diagnostic tools like IFA, which require substantial investment in equipment and reagents.

In contrast, periods of economic growth and stability can drive demand for innovative diagnostic solutions, as governments and private healthcare providers seek to improve healthcare outcomes and infrastructure. Geopolitical tensions, such as trade wars or conflicts, can disrupt the supply chain of critical components needed for immunofluorescence assays.

For example, restrictions on the import or export of raw materials or reagents can lead to shortages, increasing costs and slowing the pace of technological advancements. Additionally, geopolitical factors may affect research funding and the ability of companies to collaborate across borders, particularly in regions with strict regulatory environments. As a result, these macroeconomic and geopolitical factors play a crucial role in shaping the growth and accessibility of the IFA market.

Latest Trends

Adoption of Point-of-Care Testing

The adoption of point-of-care (POC) testing is a significant trend reshaping the IFA market, driven by the need for faster, more convenient diagnostic solutions. Point-of-care testing allows for immediate results at or near the patient’s location, reducing the need for sample transportation to centralized labs and minimizing waiting times. This trend is particularly important in settings like emergency rooms, outpatient clinics, and remote areas, where quick decision-making is crucial for patient care. By integrating immunofluorescence assays into point-of-care devices, healthcare providers can obtain rapid, accurate results, particularly for infectious diseases, autoimmune disorders, and cancer diagnostics.

The rise of portable and user-friendly IFA devices has made it possible for clinicians to perform these assays in diverse settings, from small clinics to field-based operations. In addition, technological advancements have led to the development of microfluidic platforms and compact fluorescence detectors, enabling high-performance testing with minimal equipment and expertise. The global health crisis brought on by COVID-19 accelerated the demand for point-of-care diagnostics, highlighting the value of rapid, on-site testing for controlling disease spread.

As a result, the IFA market is seeing greater investment in creating POC devices that not only meet the standards of accuracy and sensitivity but also align with the growing need for cost-effective and easily accessible healthcare solutions. For instance, the POCT Immunofluorescence Quantitative Analyzer is designed for use with specialized fluoroimmunoassay reagent strips and is suitable for conducting fluoroimmunoassays on human body samples. This product is applicable for both semi-quantitative and quantitative immunoassays in medical, epidemic prevention, and research institutions.

Regional Analysis

North America is leading the Immunofluorescence Assay Market

In 2024, North America held the largest share of the global IFA market with 40.4% share, driven by factors such as a high prevalence of chronic diseases, robust healthcare infrastructure, and substantial investments in medical research and development. The United States, in particular, accounted for a significant portion of this market share, supported by government initiatives and the presence of major industry players.

For instance, according to data from the National Cancer Institute, it is estimated that in 2025, there will be 2,041,910 new cancer diagnoses in the United States, with 618,120 deaths attributed to the disease. The cancer incidence rate is projected to be 445.8 cases per 100,000 men and women annually, based on data from 2018 to 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is projected to witness the highest growth rate in the coming years. Countries like China and India are investing heavily in healthcare infrastructure and research, leading to increased adoption of advanced diagnostic technologies, including IFAs. The rising burden of chronic and infectious diseases in these countries further propels the demand for efficient diagnostic tools.

The adoption of advanced diagnostic technologies, including IFAs, is accelerating in these countries to address the rising burden of chronic and infectious diseases. For instance, Asia, which accounts for 60% of the global population, carries a large portion of the world’s infectious disease burden. In India, approximately 10 million people die each year, with over 17%—about 1.7 million—of those deaths attributed to communicable diseases. Among these, respiratory infections such as influenza and pneumonia are the leading causes of death, particularly affecting the elderly.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The immunofluorescence assay market is characterized by a competitive landscape with several key players driving innovation and market share. Thermo Fisher Scientific, a U.S.-based company, is a prominent leader in the IFA market, offering a wide range of products and services that cater to various diagnostic needs. Bio-Rad Laboratories, also based in the U.S., has a strong presence in the market, providing comprehensive IFA solutions for research and clinical applications.

Abcam, a UK-based company, specializes in the development and supply of high-quality antibodies and reagents for immunofluorescence techniques. PerkinElmer, another U.S. company, offers advanced imaging systems and reagents that enhance the sensitivity and specificity of IFA. Werfen, a Spanish company, is recognized for its diagnostic instruments and reagents, contributing significantly to the IFA market.

These companies, among others, are continuously innovating and expanding their product portfolios to meet the growing demand for accurate and efficient diagnostic tools in the immunofluorescence assay market.

Top Key Players in the Immunofluorescence Assay Market

- Thermo Fisher Scientific, Inc.

- Inova Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- Abcam plc

- PerkinElmer Inc.

- Merck KGaA

- Cell Signaling Technology, Inc.

- Medipan GmbH

- Sino Biological, Inc.

- Danaher Corporation

- Agilent Technologies, Inc.

- EpigenTek Group Inc.

- MaxVision Biosciences Inc.

- Nikon Corporation

Recent Developments

- In February 2025, Bio-Rad Laboratories, Inc., a leading global provider of life science research and clinical diagnostics products, introduced its TrailBlazer Tag and TrailBlazer StarBright Dye Label Kits. These new kits are designed to simplify the process of labeling any antibody with one of Bio-Rad’s StarBright Dyes, suitable for use in flow cytometry or fluorescent western blot experiments.

- In March 2024, Bio-Rad Laboratories, Inc. unveiled its validated antibodies for rare cell and circulating tumor cell (CTC) enumeration. These antibodies, validated for use with Bio-Rad’s Celselect Slides Enumeration Stain Kits, target specific CTC surface markers, enabling the precise and sensitive identification of target cell populations. This innovation aids in the study of tumor heterogeneity and disease progression across various stages.

Report Scope

Report Features Description Market Value (2024) US$ 4.2 billion Forecast Revenue (2034) US$ 7.1 billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Consumables- Antibodies. Kits and Reagents, Accessories, Instruments), By Type (Direct Immunofluorescence, Indirect Immunofluorescence), By Application (Cancer, Infectious Diseases, Autoimmune Diseases, Cardiovascular Diseases, Others), By End-user (Pharmaceutical & Biopharmaceutical Companies, Hospital and Diagnostic Centers, CROs, Academic Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Inova Diagnostics, Inc., Bio-Rad Laboratories, Inc., Abcam plc, PerkinElmer Inc., Merck KGaA, Cell Signaling Technology, Inc., Medipan GmbH, Sino Biological, Inc., Danaher Corporation, Agilent Technologies, Inc., EpigenTek Group Inc. MaxVision Biosciences Inc., Nikon Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Immunofluorescence Assay MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Immunofluorescence Assay MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Inova Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- Abcam plc

- PerkinElmer Inc.

- Merck KGaA

- Cell Signaling Technology, Inc.

- Medipan GmbH

- Sino Biological, Inc.

- Danaher Corporation

- Agilent Technologies, Inc.

- EpigenTek Group Inc.

- MaxVision Biosciences Inc.

- Nikon Corporation