Global Image Recognition in CPG Market By Component (Hardware, Solution, Services), By Application (Inventory Analysis, Product and Shelf Monitoring Analysis, Auditing Product Placement, Product Placement Trend Analysis, Assessing Compliance and Competition, Category Analysis, Gauging Emotions), By Deployment Type (Cloud, On-Premise), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec. 2023

- Report ID: 74679

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

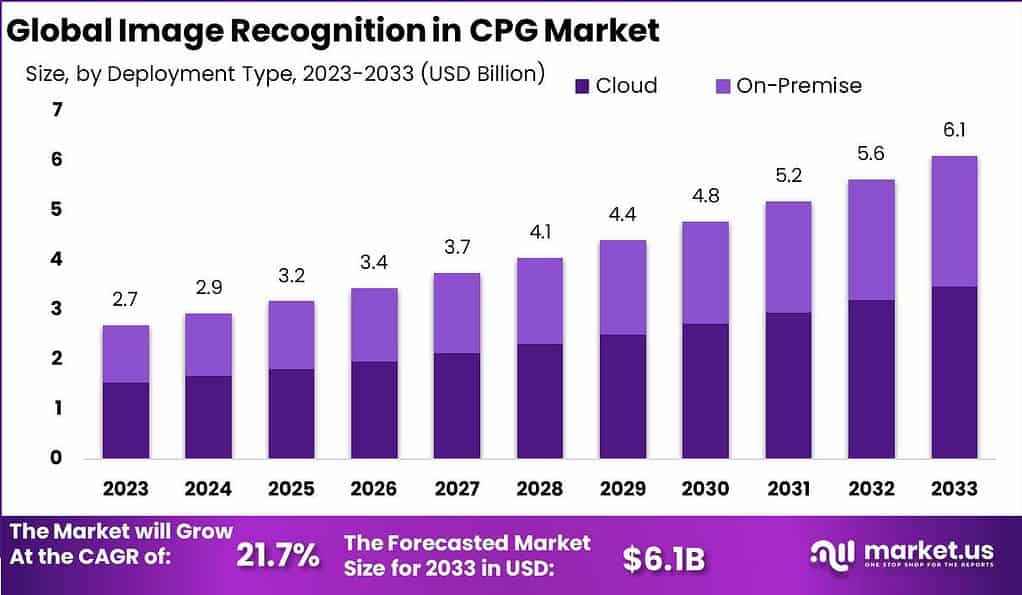

The global Image Recognition in CPG Market is anticipated to be USD 6.1 billion by 2033. It is estimated to record a steady CAGR of 21.7% in the Forecast period 2023 to 2033. It is likely to total USD 2.7 billion in 2023.

Image recognition in CPG (Consumer Packaged Goods) refers to the technology that uses computer vision algorithms and artificial intelligence to analyze and interpret visual content, particularly images and videos, related to consumer packaged goods. It involves the ability of software or systems to identify and understand objects, logos, brands, packaging, and other visual elements within images to extract valuable insights and enable various applications in the CPG industry.

The Image Recognition in CPG market represents the industry of technology providers and solution vendors that offer image recognition software, platforms, and services specifically tailored for the CPG industry. This market is driven by the increasing need for efficient and accurate analysis of visual data, as well as the growing adoption of artificial intelligence and computer vision technologies in the consumer goods sector.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Size and Expansion: Anticipated to achieve USD 6.1 billion by 2033, the Image Recognition in Consumer Packaged Goods (CPG) Market is poised for a consistent compound annual growth rate (CAGR) of 21.7%. Its estimated value in 2023 is projected to be USD 2.7 billion.

- Component Analysis: In 2023, the Solution Segment holds a dominant market position due to the demand for comprehensive image recognition solutions. These solutions offer product recognition, brand monitoring, and visual search, enhancing marketing strategies and supply chain management.

- Application Analysis: In 2023, Inventory Analysis segment holds a dominant market position, allowing real-time visibility into stock levels and optimizing inventory management.

- Deployment Type Analysis: In 2023, cloud-based deployment dominates the market due to scalability, accessibility, and reduced infrastructure costs. It enables real-time data analysis and processing.

- Driving Factors: Rising demand for automation and Enhanced customer engagement.

- Restraining Factors: High implementation costs and Data security concerns.

- Growth Opportunities: Exploring new applications and Market penetration in emerging economies.

- Challenges: Data privacy compliance.

- Key Market Trends: AI-powered image recognition.

- Regional Analysis: Coverage of North America, Europe, APAC, Latin America, and the Middle East & Africa.

- Key Players: Top players in the Image Recognition in CPG market include IBM, Google, Qualcomm, Microsoft, AWS, Trax, Catchoom, Slyce, and more.

Based on Component

In 2023, the Solution Segment held a dominant market position, capturing a significant share in the Image Recognition in CPG (Consumer Packaged Goods) Market. This segment’s prominence can be attributed to the growing demand for comprehensive and efficient image recognition solutions by CPG companies. Image recognition solutions offer advanced capabilities, including product recognition, brand monitoring, and visual search, which are crucial for enhancing marketing strategies, supply chain management, and consumer engagement within the CPG sector. These solutions leverage AI and machine learning algorithms to analyze images and provide actionable insights, making them indispensable tools for brands seeking a competitive edge in the market.

Hardware components also play a pivotal role in the Image Recognition in CPG Market. They encompass the physical infrastructure required for image capture and processing, such as cameras, sensors, and servers. While the Solution Segment leads in market share, hardware components remain essential for enabling image recognition capabilities. The quality and performance of hardware directly impact the accuracy and speed of image analysis, making them integral to the overall effectiveness of image recognition systems.

Additionally, services segment, including consulting, implementation, and support services, contribute significantly to the adoption and success of image recognition solutions in the CPG industry. These services assist organizations in deploying and optimizing image recognition systems, ensuring seamless integration with existing processes, and providing ongoing technical support. As CPG companies increasingly recognize the strategic value of image recognition, the services segment is expected to witness continued growth.

Overall, the Image Recognition in CPG Market is characterized by a symbiotic relationship between its key segments, with the Solution Segment taking the lead in providing cutting-edge image recognition capabilities that are complemented by the hardware’s infrastructure and supported by a range of services. This holistic approach enables CPG companies to leverage image recognition technology effectively, driving improved product visibility, consumer engagement, and operational efficiency in an increasingly competitive market landscape.

Based on Application

In 2023, the Inventory Analysis Segment held a dominant market position, capturing a substantial share in the Image Recognition in CPG (Consumer Packaged Goods) Market. This segment’s significance stems from its pivotal role in optimizing inventory management within the CPG industry. Image recognition technology has revolutionized inventory analysis by providing real-time visibility into stock levels, allowing companies to minimize overstock and understock situations. With the ability to accurately track product quantities on store shelves, in warehouses, and throughout the supply chain, CPG companies can streamline their operations, reduce carrying costs, and ensure product availability, ultimately enhancing customer satisfaction.

Product and Shelf Monitoring Analysis is another critical application segment within the Image Recognition in CPG Market. It enables brands to monitor product placement and shelf presentation in retail environments accurately. By analyzing images and data collected from various retail locations, CPG companies can ensure that their products are positioned optimally, enhancing their visibility and appeal to consumers. This application also aids in identifying instances of out-of-stock or misplaced items, allowing for quick corrective actions to improve overall sales performance.

Auditing Product Placement is a crucial application within the Image Recognition in CPG Market, ensuring that products are displayed according to contractual agreements and promotional strategies. Image recognition technology automates the auditing process by comparing in-store product placement with predefined standards and contractual obligations. This application not only helps in maintaining brand consistency but also assists in optimizing marketing investments and compliance with retail partners.

Furthermore, Product Placement Trend Analysis plays a significant role in helping CPG companies stay ahead of market trends. By leveraging image recognition, brands can track the placement and performance of their products over time, identifying trends and patterns that inform marketing and product development strategies. This data-driven approach enables CPG companies to make informed decisions and adapt to changing consumer preferences swiftly.

Assessing Compliance and Competition is another vital application segment. It allows CPG companies to monitor the presence and positioning of competitor products on store shelves, providing valuable insights into competitive dynamics. This information helps brands adjust their strategies and maintain a competitive edge in the market.

Category Analysis is essential for CPG companies to understand how their products fit within specific product categories. Image recognition technology facilitates the classification and analysis of products, ensuring that they are placed in the correct category within a retail environment. This accuracy is crucial for marketing, inventory management, and compliance purposes.

Lastly, Gauging Emotions is an emerging application segment that utilizes image recognition to analyze customer emotions and reactions when interacting with products. This valuable data can inform product design, packaging, and marketing strategies to create more emotionally resonant brand experiences.

Based on Deployment Type

In 2023, the Cloud Segment held a dominant market position, capturing a significant share in the Image Recognition in CPG (Consumer Packaged Goods) Market based on Deployment Type. This prominence of cloud-based deployment is a testament to the industry’s inclination toward scalable and flexible solutions. Cloud-based image recognition offers CPG companies several advantages, including seamless scalability, accessibility from anywhere, and reduced infrastructure costs. Enabling swift decision-making and improving overall operational efficiency, it facilitates real-time data analysis and image processing.

The surge in cloud deployment adoption within the Consumer Packaged Goods (CPG) sector stems from the demand for efficient storage, processing, and analysis of data. Given the growing quantity of images and data generated by image recognition systems, cloud-based solutions offer the essential infrastructure to effectively manage and analyze this information. Moreover, cloud-based deployments offer CPG companies the ability to integrate image recognition seamlessly into their existing IT ecosystems, facilitating data sharing and collaboration across various departments.

On the other hand, On-Premise deployment remains a relevant choice for some CPG companies, particularly those with specific security and compliance requirements. This deployment type allows for greater control over data and infrastructure, ensuring that sensitive information is kept within the organization’s premises. While on-premise solutions offer enhanced data security, they may require more substantial initial investments in hardware and maintenance.

Driving Factors

- Rising Demand for Automation: The increasing demand for automation in the CPG industry to streamline processes such as inventory management and product placement is driving the adoption of image recognition solutions.

- Enhanced Customer Engagement: Image recognition technology enables CPG companies to personalize marketing and promotions, enhancing customer engagement and brand loyalty through targeted advertising.

- Improved Data Analytics: Image recognition provides valuable insights by analyzing consumer behavior and preferences, allowing CPG companies to make data-driven decisions for product development and marketing strategies.

- Efficient Supply Chain Management: Image recognition aids in optimizing supply chain operations by tracking inventory levels, reducing errors, and ensuring accurate product placement, ultimately leading to cost savings.

Restraining Factors

- High Implementation Costs: The initial costs associated with implementing image recognition technology can be significant, posing a barrier to adoption for smaller CPG companies.

- Data Security Concerns: Storing and processing large volumes of visual data can raise data security and privacy concerns, especially with the increasing focus on data protection regulations.

- Integration Challenges: Integrating image recognition systems with existing IT infrastructure can be complex and time-consuming, leading to potential disruptions in operations.

- Limited Technical Expertise: The shortage of skilled professionals with expertise in image recognition technology can hinder its successful implementation and utilization in the CPG sector.

Growth Opportunities

- Expanding Application Areas: The CPG industry can explore new applications for image recognition, such as assessing product placement trends, gauging consumer emotions, and category analysis, to gain a competitive edge.

- Market Penetration in Emerging Markets: CPG companies can capitalize on the growing consumer market in emerging economies by implementing image recognition solutions to meet evolving consumer demands.

- Advanced AI and Machine Learning: Continued advancements in AI and machine learning algorithms can enhance the accuracy and capabilities of image recognition systems, opening doors to innovative use cases.

- Collaborative Partnerships: Collaborations between CPG companies and image recognition solution providers can lead to tailored, industry-specific solutions that address unique challenges and opportunities.

Challenges

- Data Privacy Compliance: Adhering to stringent data privacy regulations, such as GDPR and CCPA, can be challenging when handling consumer visual data, leading to compliance risks.

- Adoption Hurdles: Convincing traditional CPG companies to embrace image recognition technology may be challenging, as they may be resistant to change and new technology.

- Data Quality and Variability: Ensuring the quality and consistency of visual data across different environments and conditions can be a persistent challenge in image recognition.

- Competition and Innovation: Keeping pace with rapid technological advancements and staying ahead of competitors in adopting cutting-edge image recognition solutions is an ongoing challenge.

Key Market Trends

- AI-Powered Image Recognition: The integration of artificial intelligence (AI) and deep learning algorithms is a prevailing trend, enhancing the accuracy and precision of image recognition in CPG.

- Mobile Image Recognition Apps: The development of mobile apps with image recognition capabilities is gaining momentum, allowing consumers to interact with products in innovative ways.

- Augmented Reality (AR) Integration: AR applications, merging real-world visuals with digital information, are becoming increasingly popular, creating immersive shopping experiences.

- Sustainability and Eco-Friendly Packaging: Image recognition is being used to identify eco-friendly and sustainable packaging, aligning with the growing consumer preference for environmentally conscious products.

Key Market Segments

Global Image Recognition in CPG Market is segmented based on Component, Application, Deployment Type, and Region. Represented below is a detailed segmental description:

Based on Component

- Hardware

- Solution

- Services

Based on Application

- Inventory Analysis

- Product and Shelf Monitoring Analysis

- Auditing Product Placement

- Product Placement Trend Analysis

- Assessing Compliance and Competition

- Category Analysis

- Gauging Emotions

Based on Deployment Type

- Cloud

- On-Premise

Regional Analysis

In 2023, North America held a dominant market position, capturing more share in the Image Recognition in CPG (Consumer Packaged Goods) Market. This region’s supremacy can be attributed to several key factors. Firstly, North America boasts a mature and technologically advanced CPG sector, which readily embraces innovative solutions like image recognition to enhance operational efficiency and consumer engagement. Additionally, the region has significantly invested in advancing artificial intelligence (AI) and machine learning technologies, contributing to the accelerated expansion of image recognition applications.

Furthermore, the prevalence of major Consumer Packaged Goods (CPG) companies in North America has stimulated the widespread adoption of image recognition for diverse purposes, ranging from inventory management and product placement analysis to enhancing customer interaction. Additionally, the robust infrastructure for data analytics and cloud services in North America has further facilitated the implementation of image recognition solutions, offering real-time insights and improving decision-making processes for CPG businesses. As a result, North America continues to lead the Image Recognition in CPG Market, with a promising outlook for further expansion and innovation in the coming years.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Image Recognition in CPG market comprises several key players who provide image recognition software, platforms, and services tailored specifically for the CPG industry. These companies leverage computer vision algorithms, deep learning models, and artificial intelligence to offer accurate and efficient image recognition solutions

Top Key Players

- IBM

- Qualcomm

- Microsoft

- AWS

- Trax

- Catchoom

- Slyce

- LTU Tech

- Imagga

- Vispera

- Blippar

- Ricoh innovations

- Clarifai

- Deepomatic

- Wikitude

- Huawei

- Honeywell

- Toshiba

- Oracle

- Others

Recent Development

- In January 2023, Kroger collaborated with 3DLOOK to introduce a virtual try-on experience for its private label apparel brand, Top Stitch.

- In February 2023, PepsiCo has completed its acquisition of Orca AI, a company that specializes in artificial intelligence-powered image detection software designed for beverage and food industry.

- In March 2023, Nestle revealed a revolutionary app that makes use of images to aid consumers in tracking and identifying their intake of food.

- In April 2023, Unilever joined forces with IBM to create an innovative image recognition system designed for identifying and tracking the movement of products throughout the supply chain.

Report Scope

Report Features Description Market Value (2023) USD 2.7 billion Forecast Revenue (2033) USD 6.1 Billion CAGR (2023-2032) 21.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Solution, Services), By Application (Inventory Analysis, Product and Shelf Monitoring Analysis, Auditing Product Placement, Product Placement Trend Analysis, Assessing Compliance and Competition, Category Analysis, Gauging Emotions), By Deployment Type (Cloud, On-Premise) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM, Google, Qualcomm, Microsoft, AWS, Trax, Catchoom, Slyce, LTU Tech, Imagga, Vispera, Blippar, Ricoh innovations, Clarifai, Deepomatic, Wikitude, Huawei, Honeywell, Toshiba, Oracle, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Image Recognition in the CPG market?Image Recognition in the CPG market refers to the use of technology to identify and analyze images or visuals, providing valuable insights and aiding decision-making processes within the Consumer Packaged Goods sector.

How does Image Recognition benefit the CPG industry?Image Recognition offers benefits such as improved product identification, enhanced customer experiences through virtual try-on experiences, efficient supply chain tracking, and streamlined processes for food intake monitoring.

How big is Image Recognition in CPG Market?The global Image Recognition in CPG Market is anticipated to be USD 6.1 billion by 2033. It is estimated to record a steady CAGR of 21.7% in the Forecast period 2023 to 2033. It is likely to total USD 2.7 billion in 2023.

Which companies have recently adopted Image Recognition in the CPG market?Recent adoptions include Kroger partnering with 3DLOOK for a virtual try-on experience, PepsiCo acquiring Orca AI for AI-powered image recognition, Nestlé launching an app for food intake tracking, and Unilever collaborating with IBM for product movement tracking.

What applications does Image Recognition have in the CPG sector?Image Recognition applications in the CPG sector include virtual try-on experiences for apparel, AI-powered image recognition for the food and beverage industry, apps for identifying and tracking food intake, and systems for monitoring product movement in the supply chain.

Image Recognition in CPG MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Image Recognition in CPG MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Qualcomm

- Microsoft

- AWS

- Trax

- Catchoom

- Slyce

- LTU Tech

- Imagga

- Vispera

- Blippar

- Ricoh innovations

- Clarifai

- Deepomatic

- Wikitude

- Huawei

- Honeywell

- Toshiba

- Oracle

- Others