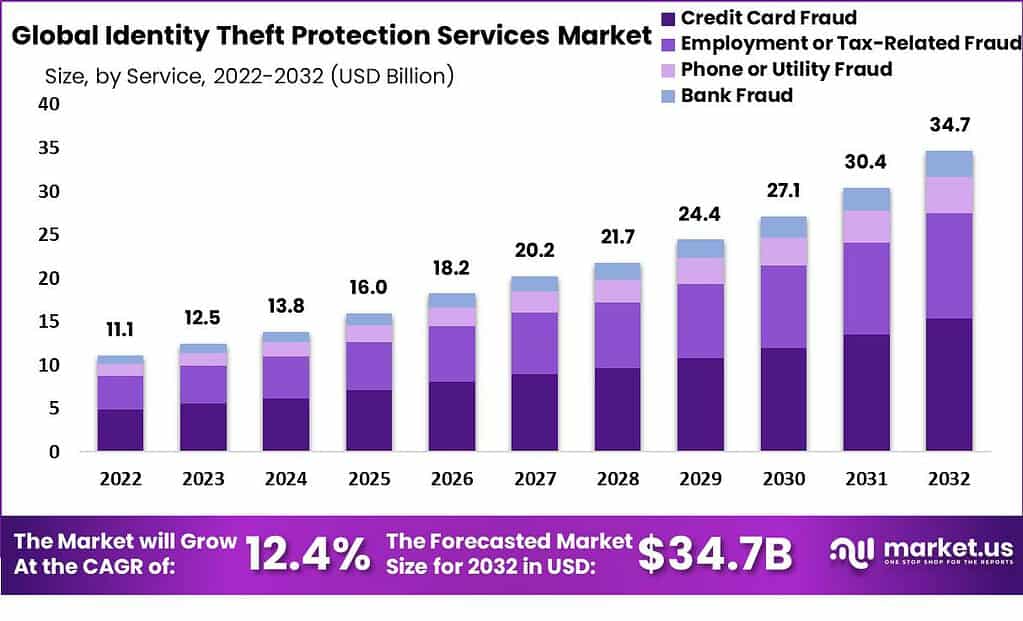

Global Identity Theft Protection Services Market By Type (Credit Card Fraud, Employment, Tax-Related Fraud, Phone or Utility Fraud, and Bank Fraud), By Application (Consumer and Enterprise), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Jan. 2024

- Report ID: 12695

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Identity Theft Protection Services Market size is expected to be worth around USD 34.7 Billion by 2032, from USD 12.5 Billion in 2023, growing at a CAGR of 12.4% during the forecast period from 2024 to 2033.

Identity Theft Protection Services are specialized programs designed to monitor and protect individuals’ personal and financial information from unauthorized access and fraudulent activities. These services offer a range of features, including credit monitoring, social security number tracking, public records monitoring, and financial account surveillance. Some advanced services even provide insurance coverage and dedicated recovery teams to assist in reclaiming one’s identity, mitigating financial losses, and rectifying credit reports. These services safeguard against the growing risk of identity theft, which can have severe repercussions, ranging from financial loss to legal complications.

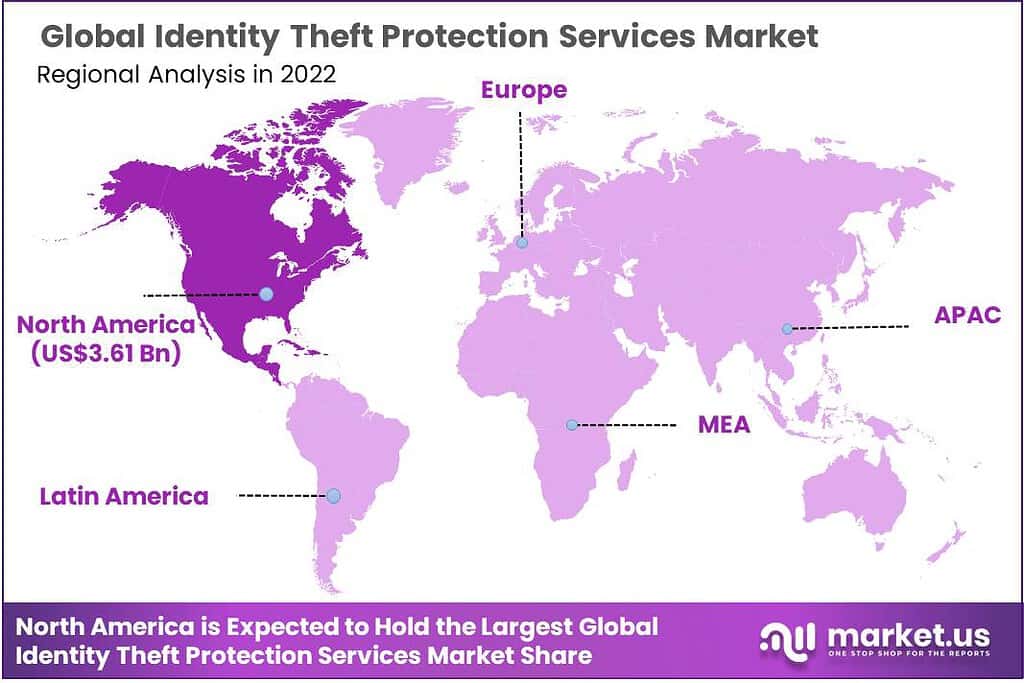

The global market of Identity Theft Protection Services has been experiencing robust growth, fueled by the surge in online transactions, increased use of social media, and the proliferation of digital devices. The demand for these services has surged across regions, including North America, Europe, and Asia-Pacific. With its high internet penetration rate and awareness regarding the importance of cybersecurity, North America holds a significant market share. However, emerging economies also contribute to market expansion as awareness grows and they undergo digital transformations that expose them to similar risks of identity theft.

Key Takeaways

- In 2022, the Global Identity Theft Protection Services Market was valued at US$ 11.1 Billion.

- The Market is estimated to register the highest CAGR of 12.4% between 2023 and 2032.

- Rising Incidents of Identity Theft Drives the Market Growth.

- Cost of Services and Limited Awareness are expected to impact the market negatively.

- Based on type, the Credit Card Fraud segment dominates the market with a massive revenue share of 3%.

- Based on application Consumer segment grow at 3 % in 2022.

- Rising cybercrime rates are expected to create many lucrative opportunities over the forecast period.

- AI and machine learning integration are the latest trends in the market.

- Based on Region, North America dominates the market with a major revenue share of 32.5%.

- Some of the key players in the market are Symantec Corporation, Experian plc, Equifax Inc., TransUnion, McAfee Corp., Identity Guard, and Others.

By Type Analysis

Credit card fraud segment dominated the market in 2022

In 2022, the Credit card fraud segment led the market with a major revenue share of 44.3%. Credit card fraud is a growing concern as more consumers embrace credit cards. Bank fraud, driven by the demand for swift online transactions, is expected to grow rapidly. Fraudsters exploit rising utility costs to access personal and financial data.

Additionally, employment and tax-related fraud are rising due to identity theft linked to loyalty schemes and retirement accounts. Bank fraud currently represents 26.1% of the market and is projected to grow at a 5.3% CAGR between 2022 and 2030. This growth is fueled by consumers’ preference for online banking and utility bill payments, emphasizing the need for robust security measures.

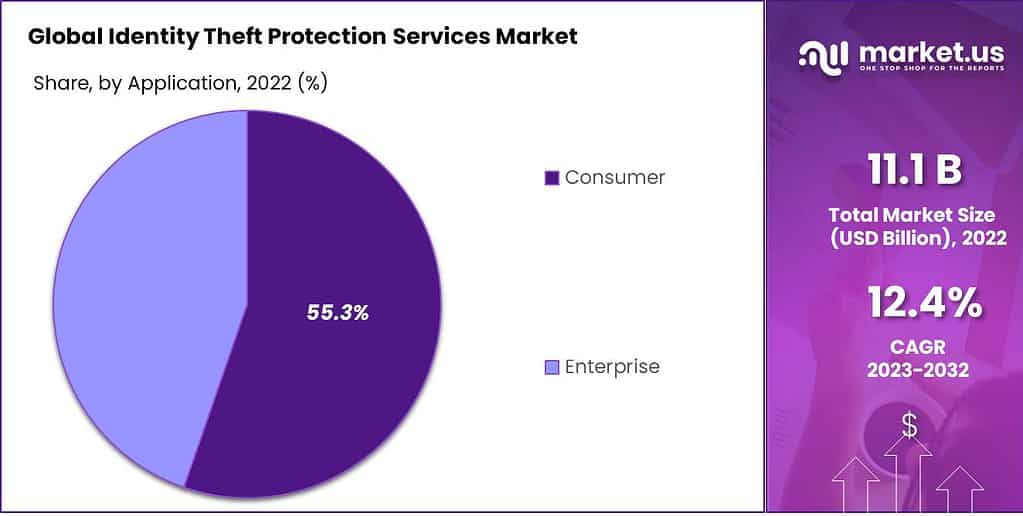

By Application Analysis

Consumer Segment Leads the Market with a Major Revenue Share of 55.3%.

The market can be divided into two main segments: consumers and enterprises. The consumer segment is leading the market with 55.3% revenue share. This is primarily due to the increasing number of individuals creating online shopping accounts, engaging in social media platforms, and using online banking services. As a result, the consumer segment is experiencing robust growth.

However, looking ahead, the enterprise segment is expected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. The rising occurrences of data breaches, frauds, and thefts across various industries influence this projection. Enterprises recognize the need to bolster their cybersecurity measures, which will likely drive growth in this segment over time.

Market Segmentation

Based on Type

- Credit Card Fraud

- Employment or Tax-Related Fraud

- Phone or Utility Fraud

- Bank Fraud

Based on Application

- Consumer

- Enterprise

Driver

Growing Cybersecurity Concerns

The Identity Theft Protection Services Market is driven by the growing concerns surrounding cybersecurity. With the increasing frequency and sophistication of cyberattacks, individuals and organizations are becoming more aware of the risks associated with identity theft. High-profile data breaches and the constant threat of hackers targeting personal information have created a strong demand for comprehensive protection services. The need to safeguard sensitive data and prevent identity theft incidents drives the adoption of identity theft protection services.

As individuals and businesses recognize the potential financial and reputational damage that can result from identity theft, they are increasingly seeking proactive measures to mitigate these risks. This driver fuels the growth of the identity theft protection services market as consumers and organizations prioritize the security of their personal and financial information.

Restraint

Cost of Services

One of the significant restraints for the Identity Theft Protection Services Market is the cost of services. Premium identity theft protection services often come with a subscription-based fee, which can be a deterrent for some individuals and businesses. The cost of ongoing monitoring, credit reports, and identity theft insurance can quickly add up, making it challenging for budget-conscious consumers to justify the expense.

Additionally, with various providers in the market offering different pricing models and service packages, it can be overwhelming for consumers to navigate and make informed decisions. Providers in the identity theft protection services market need to offer competitive pricing that aligns with the value provided and flexible plans that cater to different customer segments. By addressing the cost factor and providing transparent pricing structures, providers can overcome this restraint and reach a broader market.

Opportunity

Expansion of Online Transactions

The expansion of online transactions presents a significant opportunity for the Identity Theft Protection Services Market. As more individuals and businesses conduct financial transactions, share personal information, and engage in online activities, the risk of identity theft increases. This growth in online transactions necessitates robust protection measures to safeguard sensitive data. The increasing popularity of e-commerce, digital banking, and social media platforms creates a vast amount of personal information susceptible to breaches and identity theft.

Identity theft protection services can capitalize on this opportunity by offering comprehensive solutions that monitor and protect personal information across various online platforms. By providing real-time monitoring, alerts, and resolution assistance, these services address the growing need for proactive protection in the digital age. The expansion of online transactions serves as a catalyst for the growth of the identity theft protection services market, as individuals and businesses seek reliable solutions to mitigate the risks associated with online activities.

Challenge

Lack of Awareness

One of the key challenges for the Identity Theft Protection Services Market is the lack of awareness among individuals and businesses. Many people are not fully aware of the risks associated with identity theft or the available protection services. There may be a misconception that identity theft only happens to others or that their personal information is not valuable to cybercriminals. Additionally, some individuals and businesses may underestimate the potential financial and reputational damage that can result from identity theft incidents. This lack of awareness poses a challenge for providers in terms of reaching potential customers and conveying the importance of proactive protection.

Overcoming this challenge requires effective marketing and education campaigns to highlight the potential consequences of identity theft and the benefits of proactive protection. Providers need to invest in raising awareness about the risks, best practices for protecting personal information, and the value of identity theft protection services. By increasing awareness, providers can expand the market and drive adoption of their services, ultimately helping individuals and businesses safeguard their identities and sensitive information.

Latest Trends

AI and Machine Learning Integration

Identity theft protection services have embraced the power of artificial intelligence (AI) and machine learning algorithms to enhance their ability to detect unusual behavioral patterns effectively. By harnessing these advanced technologies, these services can swiftly and accurately identify potential threats, enabling users to respond swiftly. This integration of AI and machine learning not only bolsters the efficiency of identity theft protection but also underscores the growing significance of technology in safeguarding individuals’ personal information and financial security.

Geopolitics and Recession Impact Analysis

- Regulatory Environment: Geopolitical tensions impact data flow across borders, affecting identity theft protection providers. Adapting to changing data access regulations is crucial. Providers must understand global data laws, invest in encryption and security measures, and stay agile to maintain data protection and trust in a shifting geopolitical landscape.

- Cybersecurity Collaboration: Geopolitical alliances impact cybersecurity cooperation, leading to threat intelligence sharing that benefits identity theft protection. Conversely, cyberattacks from geopolitical adversaries boost demand for protection services, highlighting the link between politics and the identity theft market.

- Corporate Budget Constraints: During economic downturns, businesses may reduce cybersecurity budgets, impacting service providers relying on corporate clients. This cost-cutting approach, though understandable, can leave both companies vulnerable to cyber threats, emphasizing the need for a balanced approach that maintains robust security measures despite financial constraints.

- Unemployment: High unemployment rates can drive financially distressed individuals to engage in identity theft, increasing demand for protection services like identity theft prevention and credit monitoring. This underscores the importance of safeguarding personal information during times of economic instability.

Regional Analysis

North America Dominates the Market with a Major Revenue Share of 32.5%.

In 2022, North America asserted its dominance in the global market, accounting for a significant revenue share of over 32.5%. The region’s supremacy can be attributed to the robust presence of key market players and the emergence of innovative companies offering digital transaction management solutions. Furthermore, North America has earned a reputation for its early embrace of cutting-edge digital solutions in transaction management, further solidifying its substantial contribution to the global market.

Furthermore, Asia Pacific is poised to emerge as the fastest-growing regional market during the forecast period. This accelerated growth can be primarily attributed to the increasing adoption of digital transaction management solutions in developing countries like India and China.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The global identity theft protection services market is growing steadily due to increasing data security and privacy concerns. Key players such as LifeLock, Experian, Equifax, and TransUnion offer services like credit monitoring, identity theft insurance, and dark web monitoring. This market is highly competitive, with a focus on innovation. North America leads due to high awareness of identity theft risks, while the Asia-Pacific region shows potential for future growth due to digitalization and connectivity trends.

Market Key Players

- Symantec Corporation

- Experian plc

- Equifax Inc

- TransUnion

- RELX PLC

- PrivacyGuard

- Identity Guard

- McAfee Corp.

- AllClear ID Inc.

- F-Secure Corporation

- IdentityForce, Inc.

- IDShield

- Other Key Players

Recent Developments

- In January 2023, McAfee Corp. unveiled its latest offering, the McAfee+ Family plan. This comprehensive plan is designed to safeguard the online security and well-being of families, encompassing privacy, identity protection, and device security all under one convenient package. Currently accessible exclusively within the United States, this plan extends its protective umbrella to cover up to six members within a family unit.

Report Scope

Report Features Description Market Value (2023) US$ 12.5 Bn Forecast Revenue (2032) US$ 34.7 Bn CAGR (2023-2032) 12.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Credit Card Fraud, Employment, Tax-Related Fraud, Phone or Utility Fraud, and Bank Fraud), By Application (Consumer and Enterprise) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Symantec Corporation, Experian plc, Equifax Inc, TransUnion, RELX PLC, PrivacyGuard, Identity Guard, McAfee Corp., AllClear ID Inc., F-Secure Corporation, IdentityForce, Inc., IDShield, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is identity theft protection service?Identity theft protection services provide individuals with subscription-based services designed to safeguard their personal and financial data against being stolen and used fraudulently. Such services often provide credit monitoring, identity monitoring and recovery assistance services.

How big is the identity theft protection services market?The Global Identity Theft Protection Services Market is predicted to thrive at 12.4% CAGR during the assessment period. Total sales revenue will increase from USD 11.1 Billion in 2023 to USD 34.7 billion by 2032.

Who is the biggest target of identity theft?Identity theft can affect anyone, but certain groups of people are more at risk than others. These include:

- Seniors

- People with disabilities

- People with low incomes

- People who have been victims of other crimes, such as burglary or theft

- People who have recently moved or changed jobs

- People who have applied for credit or a loan recently

How does identity theft protection work?These services typically monitor various data sources for signs of identity theft, such as changes in credit reports or the dark web. If suspicious activity is detected, they notify the subscriber and offer guidance on how to address the issue.

Which region has the largest share in Global Identity Theft Protection Services Market?North America region held the highest share in 2022.

Who are the key players in Global Identity Theft Protection Services Market?The top key players in the Global Identity Theft Protection Services Market are Symantec Corporation, Experian plc, Equifax Inc, TransUnion, RELX PLC, PrivacyGuard, Identity Guard, McAfee Corp., AllClear ID Inc., F-Secure Corporation, IdentityForce, Inc., IDShield, Other Key Players

Identity Theft Protection Services MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Identity Theft Protection Services MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Symantec Corporation

- Experian plc

- Equifax Inc

- TransUnion

- RELX PLC

- PrivacyGuard

- Identity Guard

- McAfee Corp.

- AllClear ID Inc.

- F-Secure Corporation

- IdentityForce, Inc.

- IDShield

- Other Key Players