Global Hysteroscope Market Analysis By Product (Rigid Hysteroscopes, Flexible Hysteroscopes), By Application (Polypectomy, Myomectomy, Endometrial Ablation, Others), By End User (Hospitals, Ambulatory Surgical Services, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 66016

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

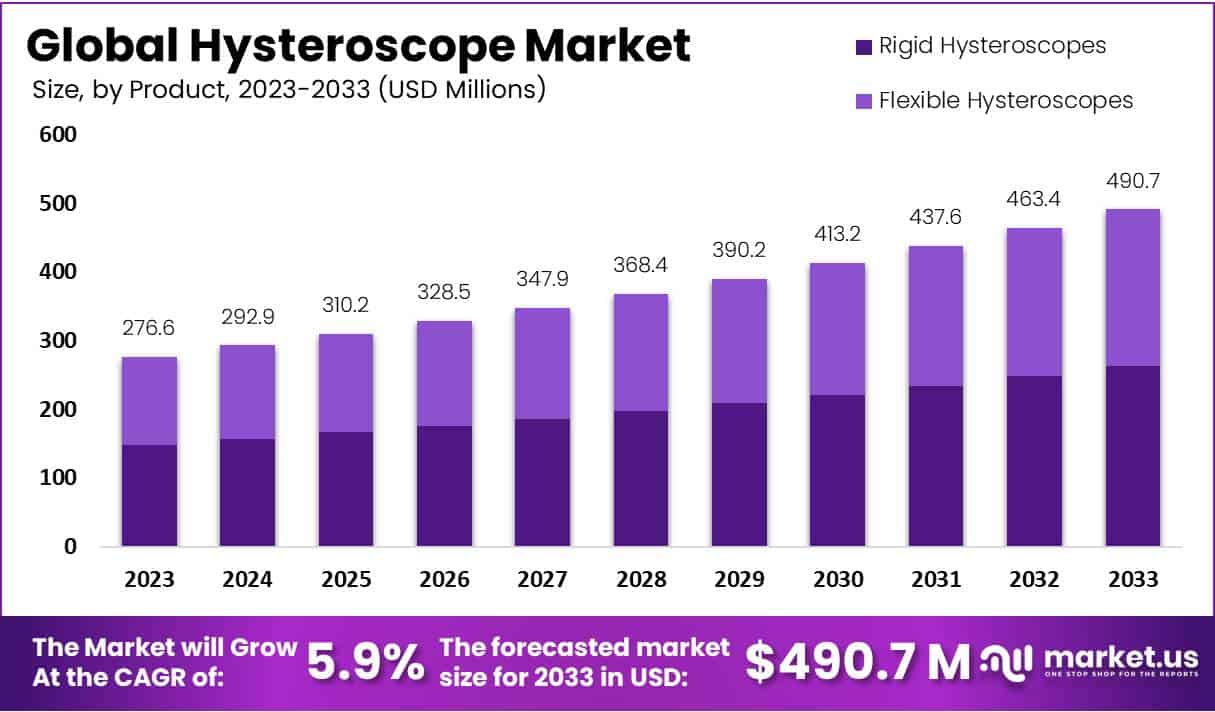

The Hysteroscope Market Size is anticipated to reach approximately USD 490.7 Million by 2033, witnessing a significant growth compared to USD 276.6 Million in 2023. This growth is projected at a Compound Annual Growth Rate (CAGR) of 5.9% from 2024 to 2033.

A hysteroscope is a thin device that doctors use to look inside a woman’s uterus. It is a tiny telescope with a light and camera at the end. The doctor inserts the hysteroscope through the vagina and cervix and into the uterus. This allows the doctor to see inside the uterus on a monitor. They may use the hysteroscope to find problems in the uterus or to do minor surgery inside it.

Having a hysteroscope inserted is usually quick and causes only mild discomfort for a woman. Doctors often do the procedure in their office without any major medicine. Using this little scope, doctors can diagnose and treat some common conditions so women do not always need surgery.

The hysteroscope market includes various types of hysteroscopes, such as rigid and flexible hysteroscopes, along with related accessories and instruments. These devices are used for diagnostic and operative procedures in gynecology, allowing healthcare professionals to visualize and treat various conditions affecting the uterus.

Key factors influencing the hysteroscope market include advancements in technology, increasing prevalence of gynecological disorders, and a growing demand for minimally invasive surgical procedures. The market is also shaped by factors such as healthcare infrastructure development, awareness about women’s health, and the overall trend toward less invasive medical interventions.

This report presents the latest information on the hysteroscope market, encompassing market trends, key players, and recent developments. The content is derived from diverse industry reports, market research publications, and news sources, ensuring a comprehensive overview. These sources contribute up-to-date insights into market dynamics, competitive landscapes, and emerging opportunities within the medical device industry. Furthermore, consultation with healthcare professionals, industry experts, and regulatory bodies enhances the report’s credibility, providing valuable perspectives on the current state of the hysteroscope market.

Key Takeaways

- Market Growth Projection: Anticipated market size of USD 490.7 Mn by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

- Dominant Product Segment: Rigid Hysteroscopes led in 2023 with 53.6% market share.

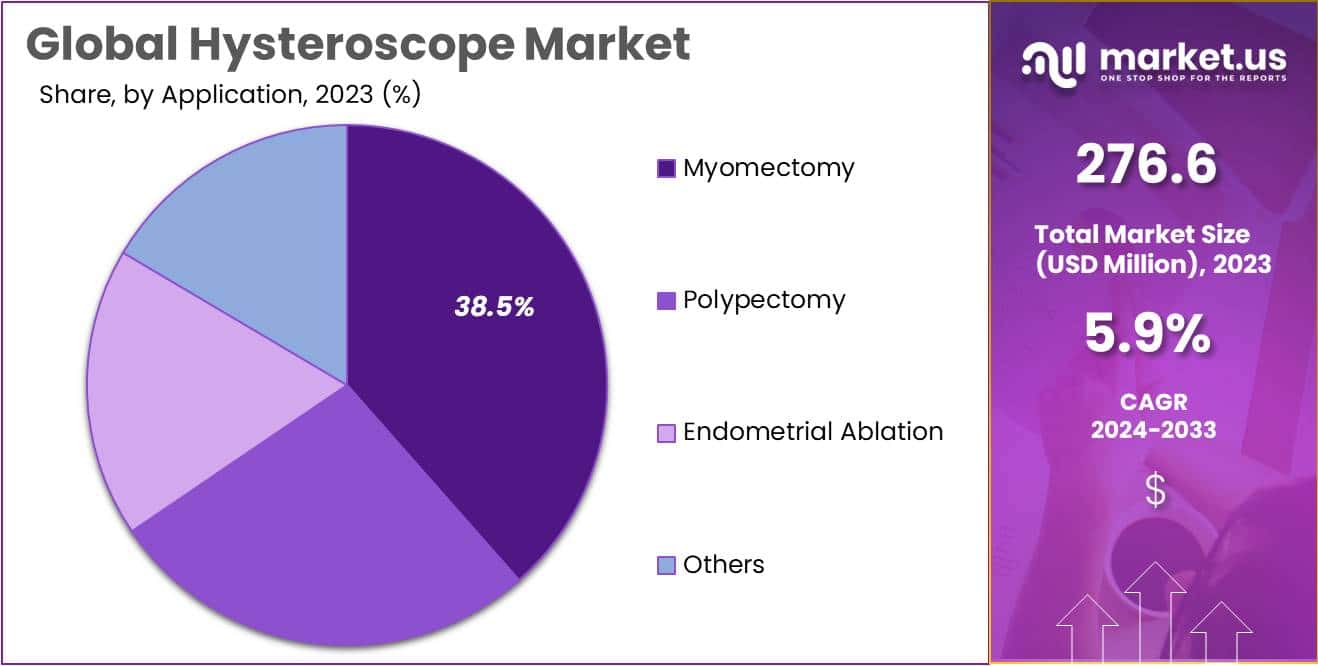

- Application Leadership: Myomectomy claimed a prominent 38.5% market share in 2023, addressing prevalent uterine fibroids.

- Primary End User: Hospitals dominated with 52.6% market share in 2023, showcasing their pivotal role in hysteroscope demand.

- Market Drivers: Increasing gynecological disorders drive demand, with global healthcare expenditure supporting adoption of advanced technologies.

- Challenges in Adoption: High cost and limited skilled professionals pose barriers, while infection control remains a significant concern.

- Lucrative Opportunities: Expansion into emerging markets and development of disposable hysteroscopes offer growth prospects.

- Innovative Trends: Shift towards minimally invasive procedures, integration of AI, and customization of devices signify evolving market dynamics.

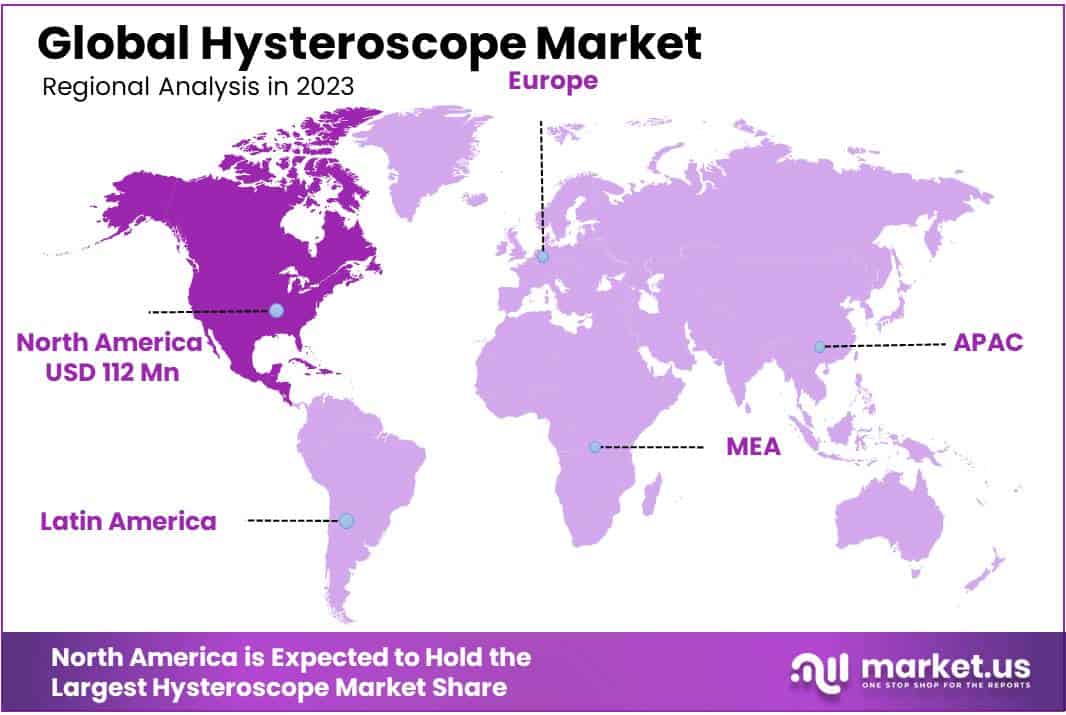

- Regional Dominance: North America led in 2023 with a 40.6% market share and USD 112 Mn value, driven by advanced healthcare infrastructure.

- Collaboration Impact: Partnerships foster innovation, propelling the integration of hysteroscopic procedures with telemedicine for expanded patient reach.

Product Analysis

In 2023, the Rigid Hysteroscopes segment emerged as a frontrunner in the market, securing a robust 53.6% share. These instruments, known for their sturdy construction, played a pivotal role in maintaining their dominant position.

Rigid Hysteroscopes, characterized by their inflexible design, showcased a substantial market presence due to their reliability and precise diagnostic capabilities. Healthcare professionals favored these instruments for their durability and consistent performance in various medical settings.

On the other hand, Flexible Hysteroscopes also made notable strides, capturing a significant market share. Their flexible nature provided a distinct advantage in navigating intricate anatomical structures, offering a more versatile solution for diagnostic and therapeutic procedures.

As the healthcare landscape evolves, the competition between Rigid and Flexible Hysteroscopes continues to shape the market dynamics. With advancements in technology and a growing emphasis on patient comfort, both segments are expected to witness further innovations, ensuring a dynamic and competitive market in the coming years.

Application Analysis

In 2023, the Hysteroscope market witnessed a noteworthy trend as the Myomectomy segment emerged as the frontrunner, securing a dominant market position by capturing over 38.5% share. This signifies a substantial preference among healthcare practitioners and patients for hysteroscopic procedures specifically aimed at addressing uterine fibroids.

Myomectomy, a surgical intervention targeting the removal of uterine fibroids, demonstrated significant market traction due to its effectiveness in treating this prevalent condition. The procedure’s prominence can be attributed to its ability to alleviate symptoms like heavy menstrual bleeding and pelvic pain, contributing to its widespread adoption in the medical community.

The Polypectomy segment also marked a considerable presence in the Hysteroscope market, indicating a notable share. Addressing the removal of uterine polyps, this application garnered attention due to its role in resolving issues related to abnormal bleeding and fertility concerns. As healthcare professionals increasingly recognize the diagnostic and therapeutic benefits of hysteroscopic polypectomy, its market share continues to reflect its importance in gynecological interventions.

Furthermore, the Endometrial Ablation segment exhibited substantial growth, underlining the rising adoption of hysteroscopic procedures for treating conditions like excessive menstrual bleeding. This application’s market share is indicative of its effectiveness in providing a minimally invasive alternative to traditional surgical methods, resonating positively with both healthcare providers and patients.

The Others category, encompassing various hysteroscopic applications beyond the prominent ones mentioned, contributed to the overall market landscape. This diverse segment reflects the evolving nature of hysteroscopy, as medical professionals explore and incorporate innovative applications for improved patient outcomes.

End User Analysis

In 2023, the Hysteroscope market showcased a noteworthy presence, with the Hospitals segment emerging as the frontrunner, securing a robust market position by commanding over 52.6% share. Hospitals, as key end-users, played a pivotal role in driving the demand for hysteroscopes, underlining their significance in the medical landscape.

Hospitals, being the primary hub for comprehensive healthcare services, exhibited a strong affinity for hysteroscopes due to their indispensable role in gynecological procedures. The preference for these devices within hospital settings was attributed to their effectiveness in diagnosing and treating various uterine conditions, contributing to the segment’s commanding market share.

Ambulatory Surgical Services also contributed significantly to the hysteroscope market, with a notable share in the overall landscape. These outpatient facilities, designed for surgical procedures that do not require overnight stays, found hysteroscopes to be valuable tools in ensuring minimally invasive yet highly efficient interventions for gynecological issues.

Furthermore, other end-user segments, comprising clinics, diagnostic centers, and specialized healthcare institutions, collectively added to the market’s vibrancy. Their diverse application of hysteroscopes in addressing specific patient needs contributed to a well-rounded market growth.

As the healthcare landscape continues to evolve, the Hysteroscope market is anticipated to witness further segmentation and dynamic shifts among end-user preferences. The dominance of hospitals, the notable presence of ambulatory surgical services, and the diverse contributions from other segments collectively paint a picture of a robust and adaptable market in 2023.

Key Market Segments

Product

- Rigid Hysteroscopes

- Flexible Hysteroscopes

Application

- Polypectomy

- Myomectomy

- Endometrial Ablation

- Others

End User

- Hospitals

- Ambulatory Surgical Services

- Others

Drivers

Increasing Incidence of Gynecological Disorders

The growing occurrence of gynecological issues like abnormal uterine bleeding and polycystic ovary syndrome (PCOS) is fueling the need for hysteroscopes, which serve as both diagnostic and therapeutic tools.

Advancements in Technology

Continuous technological advancements, including the integration of high-definition imaging and minimally invasive techniques, contribute to the growth of the hysteroscope market, improving diagnostic accuracy and patient outcomes.

Growing Awareness and Acceptance of Hysteroscopy

As awareness about the benefits of hysteroscopy increases among both healthcare professionals and patients, there is a growing acceptance of this minimally invasive procedure, boosting the demand for hysteroscopes.

Rising Healthcare Expenditure

The globally increasing healthcare expenditure, particularly in emerging economies, supports the adoption of advanced medical devices, including hysteroscopes, thereby fueling market growth.

Restraints

High Cost of Hysteroscopic Procedures

The high initial cost and maintenance expenses associated with hysteroscopic equipment can limit market growth, especially in regions with budget constraints and lower healthcare spending.

Limited Access to Skilled Healthcare Professionals

The successful implementation of hysteroscopy relies on the availability of skilled healthcare professionals. Limited access to training and education may hinder the widespread adoption of hysteroscopic procedures.

Concerns Regarding Infection Control

Infection control remains a significant concern in hysteroscopy, and the need for stringent sterilization processes may pose challenges, particularly in resource-limited healthcare settings.

Alternative Diagnostic Methods

The availability of alternative diagnostic methods, such as ultrasound and magnetic resonance imaging (MRI), may act as a restraining factor for the hysteroscope market, especially in cases where these alternatives are deemed sufficient.

Opportunities

Expansion in Emerging Markets

Opportunities for market growth lie in expanding into emerging markets where there is a growing demand for advanced medical technologies, coupled with improving healthcare infrastructure.

Introduction of Disposable Hysteroscopes

The development and introduction of disposable hysteroscopes provide a lucrative growth opportunity, addressing concerns related to infection control and reducing the overall cost of hysteroscopic procedures.

Telemedicine and Remote Consultations

The integration of hysteroscopic procedures with telemedicine and remote consultations opens up new avenues for growth, allowing healthcare professionals to reach a broader patient base and provide specialized care.

Collaborations and Partnerships

Collaborations between medical device manufacturers and healthcare institutions, as well as partnerships with research organizations, can foster innovation and drive the development of advanced hysteroscopic technologies.

Trends

Shift Towards Minimally Invasive Procedures

There is a noticeable trend towards minimally invasive procedures in gynecology, and hysteroscopy aligns with this shift, offering reduced recovery times and lower complication rates.

Integration of Artificial Intelligence (AI)

The incorporation of artificial intelligence in hysteroscopic imaging and analysis is a growing trend, enhancing diagnostic accuracy and assisting healthcare professionals in making informed decisions.

Focus on Patient-Centric Approaches

Market players are increasingly adopting patient-centric approaches, developing hysteroscopic technologies that prioritize patient comfort, safety, and overall experience during procedures.

Customization and Personalization of Hysteroscopic Devices

The trend towards customizable and personalized hysteroscopic devices allows healthcare providers to tailor solutions to individual patient needs, contributing to improved outcomes and satisfaction.

Regional Analysis

In 2023, North America emerged as the frontrunner in the global Hysteroscope market, establishing a dominant market position by capturing more than a 40.6% share. The region’s robust performance was underscored by a substantial market value, reaching USD 112 million for the year. Several key factors contributed to North America’s commanding presence in the Hysteroscope market, reflecting a dynamic landscape shaped by a combination of technological advancements, rising healthcare awareness, and strategic initiatives.

The advanced healthcare infrastructure in North America played a pivotal role in fostering the adoption of Hysteroscopes. The region’s well-established healthcare facilities, coupled with a high prevalence of gynecological disorders, fueled the demand for cutting-edge diagnostic and therapeutic solutions. Additionally, a proactive approach to women’s health and increasing investments in research and development further propelled the market forward.

Furthermore, the presence of key market players and their continuous efforts in product innovation and development contributed significantly to North America’s market dominance. Collaborations between healthcare institutions and manufacturers facilitated the seamless integration of Hysteroscopes into clinical practices, enhancing diagnostic accuracy and patient outcomes.

Government initiatives aimed at promoting women’s health and creating awareness about gynecological disorders also played a pivotal role in boosting the Hysteroscope market in North America. Public health campaigns and screening programs contributed to early detection and treatment, driving the adoption of advanced medical devices like Hysteroscopes.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Hysteroscope Market, B. Braun SE emerges as a key player, contributing significantly to the industry’s growth. With its innovative medical solutions, B. Braun SE has established a strong presence, offering hysteroscopes that adhere to high-quality standards. The company’s commitment to advancing healthcare technology places it at the forefront of market competitiveness.

CooperSurgical Inc. stands as another pivotal player in the Hysteroscope Market, playing a crucial role in shaping the industry’s trajectory. Known for its diverse portfolio of medical devices, CooperSurgical Inc. brings forth hysteroscopes that integrate cutting-edge technology. The company’s strategic initiatives and emphasis on research and development underscore its dedication to meeting evolving healthcare demands.

Hologic Inc. commands attention in the Hysteroscope Market with its innovative solutions designed to enhance diagnostic and therapeutic procedures. The company’s focus on women’s health amplifies its significance in the market, providing hysteroscopic tools that cater to a range of medical applications. Hologic Inc.’s forward-thinking approach positions it as a formidable player driving market advancements.

Karl Storz SE & Co. KG contributes substantially to the Hysteroscope Market, offering a comprehensive range of hysteroscopic instruments. Renowned for its precision and reliability, Karl Storz SE & Co. KG plays a vital role in meeting the evolving needs of healthcare professionals. The company’s global presence and commitment to technological excellence position it as a key influencer in the market.

Among the Other Key Players, there are notable contributors that add diversity and innovation to the Hysteroscope Market. These players, though diverse in their approaches, collectively contribute to the market’s growth and development. Their unique strengths and strategies create a competitive landscape that fosters continuous advancements in hysteroscopic technology.

Market Key Players

- B. Braun SE

- CooperSurgical Inc.

- Hologic Inc.

- Karl Storz SE & Co. KG

- MedGyn Products

- Medtronic

- Olympus Corporation

- Richard Wolf GmbH

Recent Developments

- In October 2023, Stryker Corporation, a medical device manufacturer, revealed its acquisition of EnFocus Medical, a company known for its innovative hysteroscopic devices. The undisclosed deal aims to broaden Stryker’s hysteroscopy portfolio, reinforcing its global standing in gynecological surgery. Among EnFocus Medical’s notable products is the EnFocus One Hysteroscopic Tissue Removal System, designed for minimally invasive removal of uterine fibroids and polyps.

- In September 2023, Boston Scientific, a leading medical technology company, introduced its latest generation of hysteroscopic scissors named TruClear II Scissors. These scissors boast a revamped blade design and improved tissue grasp, promising enhanced performance and precision in hysteroscopic procedures. Available in various sizes, the TruClear II Scissors cater to diverse surgical needs.

- In July 2023, German medical technology firm Richard Wolf GmbH disclosed its acquisition of Karl Storz Endoscopy-America, Inc., the U.S. subsidiary of global endoscopy leader Karl Storz SE & Co. KG. This strategic move expands Richard Wolf’s footprint in the U.S. market and solidifies its position in the realm of minimally invasive surgery. Karl Storz Endoscopy-America is renowned for providing top-notch endoscopy equipment and supplies in the United States.

- In June 2023, Medtronic, a prominent medical device company, launched its latest hysteroscopy system, the SonarH3D System. This advanced system offers high-resolution, 3D hysteroscopy, granting surgeons improved visualization during procedures. The SonarH3D System’s sophisticated imaging capabilities enable better identification and diagnosis of uterine conditions, ultimately leading to enhanced patient care.

Report Scope

Report Features Description Market Value (2023) USD 276.6 Mn Forecast Revenue (2033) USD 490.7 Bn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Rigid Hysteroscopes, Flexible Hysteroscopes), By Application (Polypectomy, Myomectomy, Endometrial Ablation, Others), By End User (Hospitals, Ambulatory Surgical Services, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape B. Braun SE, CooperSurgical Inc., Hologic Inc., Karl Storz SE & Co. KG, MedGyn Products, Medtronic, Olympus Corporation, Richard Wolf GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the hysteroscope market in 2023?The hysteroscope market size is USD 276.6 million in 2023.

What is the projected CAGR at which the hysteroscope market is expected to grow at?The hysteroscope market is expected to grow at a CAGR of 5.9% (2024-2033).

List the segments encompassed in this report on the hysteroscope market?Market.US has segmented the hysteroscope market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Rigid Hysteroscopes, Flexible Hysteroscopes. By Application the market has been segmented into Polypectomy, Myomectomy, Endometrial Ablation, Others. By End User the market has been segmented into Hospitals, Ambulatory Surgical Services, Others.

List the key industry players of the hysteroscope market?B. Braun SE, CooperSurgical Inc., Hologic Inc., Karl Storz SE & Co. KG, MedGyn Products, Medtronic, Olympus Corporation, Richard Wolf GmbH, Other Key Players

Which region is more appealing for vendors employed in the hysteroscope market?North America is expected to account for the highest revenue share of 40.6% and boasting an impressive market value of USD 112 million. Therefore, the hysteroscope industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for hysteroscope?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the hysteroscope Market.

-

-

- B. Braun SE

- CooperSurgical Inc.

- Hologic Inc.

- Karl Storz SE & Co. KG

- MedGyn Products

- Medtronic

- Olympus Corporation

- Richard Wolf GmbH