Global Hyperscale Computing Market By Component (Solutions and Services), By Application (Cloud Computing, Big Data, IoT, Other Applications), By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 105494

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

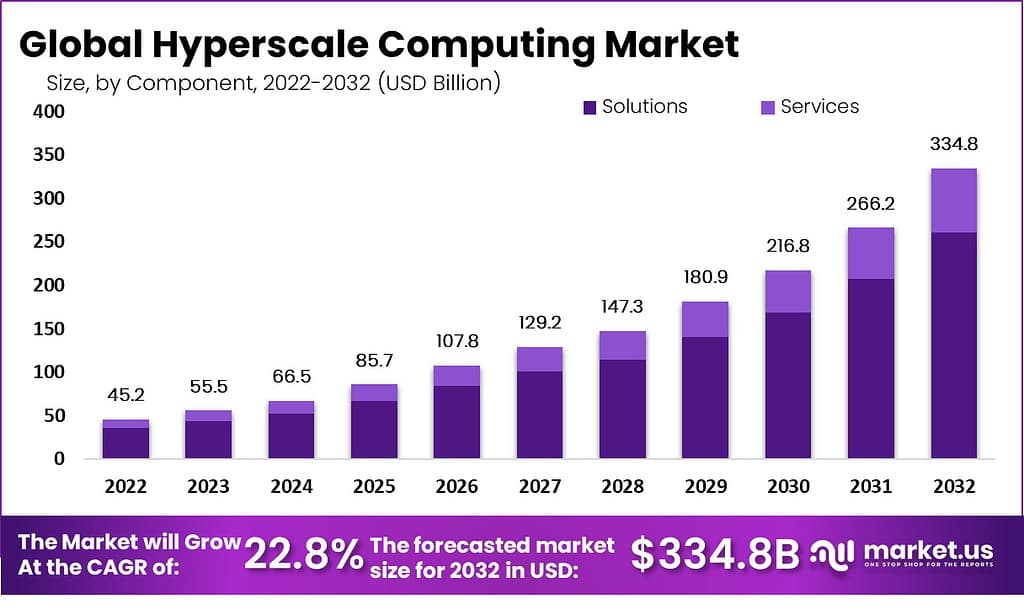

The Global Hyperscale Computing Market Size accounted for USD 55.5 Billion in 2023 and is estimated to garner a market size of USD 334.8 Billion by 2032; rising at a CAGR of 22.8% from 2023 to 2032. The growth of the market is being driven by the increasing adoption of cloud computing, big data analytics, and artificial intelligence.

The hyperscale computing market has emerged as a significant influencer in shaping the tech landscape by transforming how enterprises and individuals engage with digital services and information. Hyperscale computing supports the architectural approach of creating and operating data centers that can dynamically expand to accommodate extensive workloads and vast data volumes.

The continuously growing demand for digital data, cloud computing, artificial intelligence, and other applications related to the Internet of Things has supported the growth of the hyperscale computing market. Businesses operating in several industries are adopting hyperscale infrastructure to provide uninterrupted, prompt user experiences, streamline data processing, and facilitate sophisticated data analysis.

Note- The figures presented here are subject to change in the final report.

Cloud computing adoption continues to drive market expansion. Furthermore, artificial intelligence, big data analysis, machine learning and IoT present significant growth potential. Major companies in the Market have solidified their positions in the hyperscale computing sector by rendering on-demand computing resources and services to enterprises of all scales. With security, scalability, and performance remaining focal points, the Market is continually observing investments in pioneering technologies like advanced cooling methods, enhancements in energy efficiency, and reinforcement of security protocols.

Data scientists led the effort against pandemic influenza by employing AI and machine learning solutions from across a wide spectrum of AI/ML providers; they frequently relied on cloud computing since complex algorithms often required significant amounts of processing power to operate effectively. Many hyperscale providers recognized this need and assisted global initiatives with free tools, services, financial commitments or financial guarantees during times of crisis – Rescale Inc. in collaboration with Microsoft Azure and Google Cloud announced a program offering free high-performance computing (HPC) resources to teams working to develop COVID-19 test kits/vaccines/test kits/vaccines etc.

Key Takeaways

- Market Growth Projection: The global Hyperscale Computing Market is projected to reach a significant size of USD 334.8 Billion by 2032, with a substantial Compound Annual Growth Rate (CAGR) of 22.8% from 2023 to 2032.

- Factors Driving Market Growth: The market’s growth is primarily fueled by the increasing adoption of cloud computing, big data analytics, and artificial intelligence. Businesses are increasingly relying on hyperscale infrastructure to accommodate extensive workloads and manage large data volumes effectively.

- Components Analysis: Solutions dominate the component segment of the market, accounting for 77.8% of the revenue share. This dominance can be attributed to the rising adoption of hyperscale computing solutions to meet high-performance application requirements.

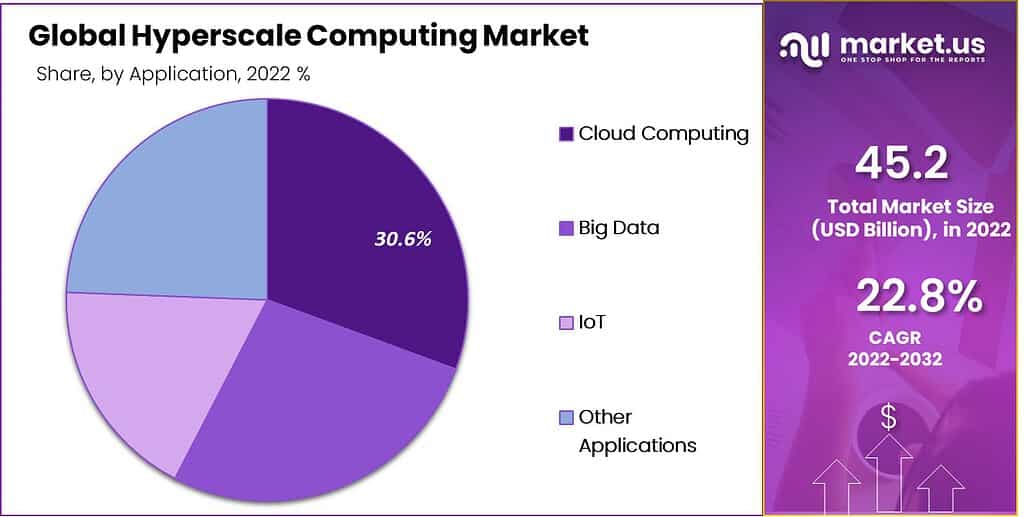

- Application Landscape: Cloud computing holds a major revenue share in the application segment of the market, covering 30.6% of the market share. This can be attributed to the increasing adoption of cloud computing solutions across various industries worldwide.

- End-Use Industry Analysis: The IT & telecommunication industry leads the end-use industry segment, securing a major revenue share of 22.9%. The advantages that hyperscale computing provides to the telecommunication industry, including increased operational efficiency and scalability, are driving its adoption.

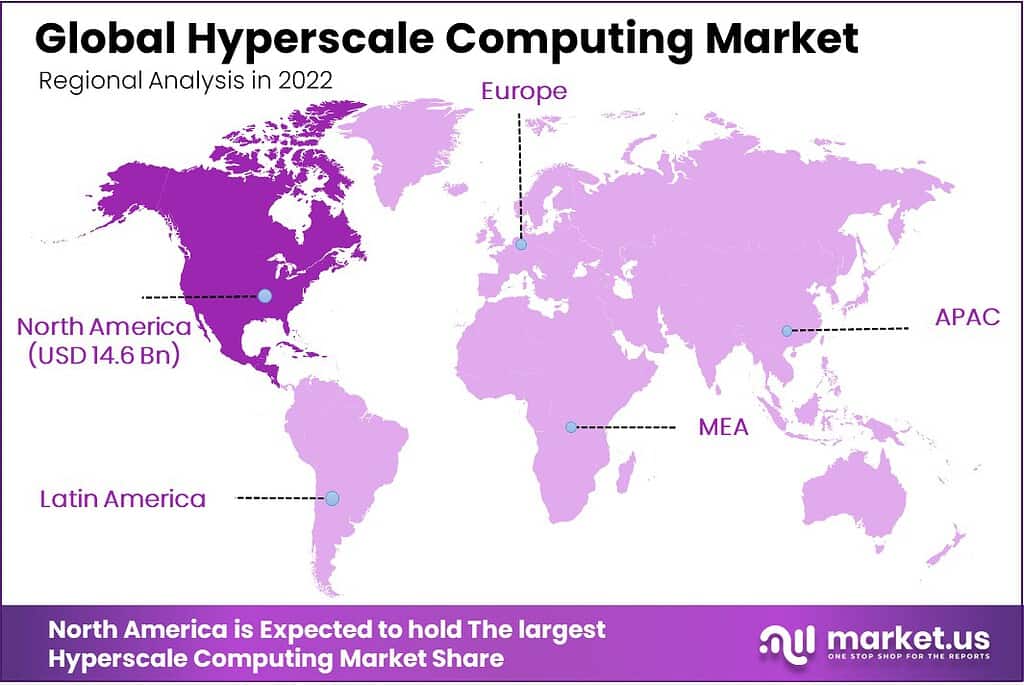

- Regional Analysis: North America is leading the global hyperscale computing market, holding a substantial revenue share of 32.4%. This growth can be attributed to the established IT services market, the presence of major cloud service providers, and high investments in research and development.

- Key Market Players: Major players in the market, including Amazon Web Services Inc., Hewlett Packard Enterprise Development LP, Intel Corporation, Microsoft, Google, Oracle, Dell Inc., IBM, Tencent, and Huawei, are adopting various strategies like mergers, acquisitions, partnerships, and collaborations to strengthen their position in the market.

- Latest Trends: The increasing need for large-scale data centers is expected to further boost the growth of the global hyperscale computing market in the coming years, as more companies adopt advanced technologies like hyperscale computing to fulfill their increasing data processing needs.

- Growth Opportunities: The wide usage of hyperscale computing across various industries is expected to create lucrative opportunities in the market during the forecast period. As companies increasingly rely on heavy data applications, the demand for scalable and high-performance computing infrastructure has significantly increased.

Driving Factor

The Rise in Creation and Utilization of Data Across Various Sectors is Driving the Growth of the Global Hyperscale Computing Market.

The rapid expansion of the hyperscale computing market worldwide is being propelled by the support of various factors that are profoundly influencing the digital world. The significant surge in the creation and utilization of data across several sectors, such as online commerce, cloud-based services, social networking, and the Internet of Things (IoT), is fueling the demand for hyperscale solutions. Organizations are actively looking for ways to handle and swiftly organize huge data volumes in real time, thus increasing the requirement for adaptable and efficient infrastructure. This is driving the growth of the global hyperscale computing market.

Restraining Factor

High Initial Investment and Negative Impact on the Environment are Anticipated to Restrict the Growth of Global Hyperscale Computing Market.

The Market for hyperscale computing is known for its vast data centers and cloud setups. The environmental impact and energy use due to the massive scale of operations are leading to high environmental carbon emissions. Therefore, it is expected to obstruct the growth of the global hyperscale computing market in the upcoming period. Moreover, the high initial investment needed to establish and maintain hyperscale infrastructure can restrict many small and medium businesses or organizations with tight budgets from adopting hyperscale computing solutions.

Component Analysis

Solutions Lead the Component Segment in the Global Hyperscale Computing Market by Securing the Major Revenue Share in Account.

Based on components, the global hyperscale computing market is divided into solutions and services. From these components, solutions lead the segment in the global hyperscale computing market by holding a major revenue share of 77.8%. This growth of solutions in the component segment is due to the increasing adoption of hyperscale computing solutions to meet the rising need for high-performance application requirements. Many companies are adopting scalable computing architecture to process heavy operations through the system. This is boosting the growth of solutions in the component segment of the global hyperscale computing market.

Application Analysis

Cloud Computing Leads the Application Segment in the Global Hyperscale Computing Market by Holding a Major Revenue Share Account.

Based on application, the global hyperscale computing market is classified into cloud computing, big data, IoT, and other applications. From these applications, cloud computing dominates the segment in the global hyperscale computing market by covering a major revenue share of 30.6%. This growth of cloud computing is due to the rising adoption of cloud computing solutions for building advanced infrastructure systems to meet companies’ growing cloud computing requirements worldwide. This is driving the growth of cloud computing in the application segment of the global hyperscale computing market.

Note- The figures presented here are subject to change in the final report.

End-Use Industry Analysis

IT & Telecommunication Industry Leads the End-Use Industry Segment in Global Hyperscale Computing Market by Securing Major Revenue Share in Account.

Based on the end-use industry, the global hyperscale computing market is classified into BFSI, IT & telecommunication, media & entertainment, retail & e-commerce, healthcare, and other end-use industries. Among these end-use industries, the IT & telecommunication industry holds a major revenue share of 22.9%, accounting for dominating the segment in the global hyperscale computing market. This growth of the IT & telecommunication industry is attributed to the advantages that hyperscale computing provides to the telecommunication industry, such as less downtime, increased operational efficiency, scalability, simpler data backups, and simplified management. This is encouraging more companies in the IT & telecommunication industry to adopt hyperscale computing in their operations. This is propelling the growth of the IT & telecommunication industry in the global hyperscale computing market.

Key Market Segments

Component

- Solutions

- Services

Application

- Cloud Computing

- Big Data

- IoT

- Other Applications

End-Use Industry

- BFSI

- IT & Telecommunication

- Media & Entertainment

- Retail & E-commerce

- Healthcare

- Other End-Use Industries

Growth Opportunity

Wide Usage of Hyperscale Computing Across Various Industries is Expected to Create Many Lucrative Opportunities in the Market Over the Forecast Period.

Companies increasingly depend on heavy data applications like artificial intelligence, machine learning, and big data analysis. Therefore, the Market’s scalable and high-performance computing infrastructure requirement has grown significantly. Many companies are adopting advanced technologies like hyperscale computing to fulfill their needs. Moreover, hyperscale computing is used by many industries worldwide, such as BFSI, IT & telecommunication, media & entertainment, retail & e-commerce, healthcare, and many others. This growing use of hyperscale computing is expected to create many lucrative opportunities in the global hyperscale computing market during the forecast period.

Latest Trends

Growing Need for Large Scale Data Centers is Expected to Boost the Growth of Global Hyperscale Computing Market in the Upcoming Years.

The continuously increasing need for cloud services across various industries with extensive data processing and applications related to artificial intelligence has boosted the growth of large-scale data centers in the Market. Major companies in the Market have adopted this expansion by making significant investments in constructing advanced data center complexes spread across various worldwide locations. This is expected to propel the global hyper-scale computing market growth in the upcoming years.

Regional Analysis

North America leads the Global Hyperscale Computing Market by Holding the Major Revenue Share in Account.

North America leads the global hyper-scale computing market by holding a major revenue share of 32.4% in the account. This massive growth of the North American region is attributed to the established IT services market, the presence of major cloud service providers, and high investment in research & development. Moreover, the developed technology infrastructure is also supporting the growth of the North American region in the global hyperscale computing market. After North America, Asia Pacific is expected to grow at a significant CAGR throughout the forecast period. Increasing investments in technological infrastructure in developing countries across the Asia Pacific region are expected to drive the growth of the Asia Pacific region in the upcoming years.

Note- The figures presented here are subject to change in the final report.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Player Analysis

The global hyperscale computing market is fragmented into many companies offering solutions and services in the Market. However, major key players in the Market are adopting various strategies like mergers, acquisitions, partnerships, and collaboration to expand the business across various regions and strengthen the position in the Market. Some of the key players in the global hyperscale computing market are Amazon Web Services Inc., Hewlett Packard Enterprise Development LP, Intel Corporation, Microsoft, Google, Oracle, Dell Inc., IBM, Tencent, Huawei, and Other Key Players.

Top Key Players in the Hyperscale Computing Market:

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Development LP

- Intel Corporation

- Microsoft

- Oracle

- Dell Inc.

- IBM

- Tencent

- Huawei

- Other Key Players

Recent Developments

- In February 2023, Microsoft launched a new wave of Azure for Operators solutions and services that allows the secure development of ubiquitous computing that spans from cloud to edge.

- In May 2023, IBM collaborated with chip and system design software development company Cadence. According to this collaboration, Cadence is leveraging high-performance computing (HPC) with IBM Cloud HPC to help develop its software faster.

Report Scope

Report Features Description Market Value (2023) US$ 55.5 Bn Forecast Revenue (2032) US$ 334.8 Bn CAGR (2023-2032) 20.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component – Solutions and Services; By Application – Cloud Computing, Big Data, IoT, Other Applications; By End-Use Industry – BFSI, IT & Telecommunication, Media & Entertainment, Retail & E-commerce, Healthcare, Other End-Use Industries Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Amazon Web Services Inc., Hewlett Packard Enterprise Development LP, Intel Corporation, Microsoft, Google, Oracle, Dell Inc., IBM, Tencent, Huawei, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is hyperscale computing?Hyperscale computing is a type of computing infrastructure that is designed to scale rapidly and efficiently to meet the demands of large-scale applications. It is typically used by cloud computing providers, social media companies, and other organizations that need to process and store large amounts of data.

How big is the hyperscale cloud market?The Global Hyperscale Computing Market Size accounted for USD 45.2 Billion in 2022 and is estimated to garner a market size of USD 334.8 Billion by 2032; rising at a CAGR of 22.8% from 2023 to 2032

What is an example of hyperscale computing?here are some examples of hyperscale computing:

- The data centers of cloud computing providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- The data centers of social media companies, such as Facebook, Twitter, and Instagram.

- The data centers of e-commerce companies, such as Amazon, eBay, and Alibaba.

- The data centers of content delivery networks (CDNs), such as Akamai and Cloudflare.

- The data centers of gaming companies, such as Microsoft and Sony.

- The data centers of research institutions, such as CERN and NASA.

What are the top three hyperscalers?- Amazon Web Services (AWS) : AWS is the leading hyperscaler, with a market share of 33%. It offers a wide range of cloud computing services, including compute, storage, networking, databases, analytics, machine learning, and artificial intelligence.

- Microsoft Azure : Azure is the second-largest hyperscaler, with a market share of 20%. It offers a similar range of cloud computing services as AWS.

- Google Cloud Platform (GCP) : GCP is the third-largest hyperscaler, with a market share of 9%. It offers a more focused set of cloud computing services than AWS and Azure, but it is growing rapidly.

These three hyperscalers are responsible for the vast majority of the cloud computing market. They are constantly innovating and expanding their services, and they are investing heavily in research and development. This is driving the growth of the cloud computing market, and it is making hyperscale computing an increasingly important part of the global economy.

What are the key trends in the hyperscale computing market?The key trends in the hyperscale computing market include:

- The growth of cloud computing: Cloud computing is the major driver of the hyperscale computing market, as it requires large-scale computing infrastructures to store and process data.

- The rise of artificial intelligence: Artificial intelligence is another major driver of the hyperscale computing market, as it requires large-scale computing infrastructures to train and deploy AI models.

- The increasing adoption of edge computing: Edge computing is a new trend that is gaining traction in the hyperscale computing market. Edge computing refers to the deployment of computing resources closer to the end-user, which can help to improve performance and reduce latency.

- The development of new technologies: The development of new technologies, such as quantum computing and 5G, is also expected to drive the growth of the hyperscale computing market.

Hyperscale Computing MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Hyperscale Computing MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Development LP

- Intel Corporation

- Microsoft

- Oracle

- Dell Inc.

- IBM

- Tencent

- Huawei

- Other Key Players