Global Hybrid Solar Wind Systems Market Size, Share, And Business Benefits By Component (Solar Photovoltaic (PV) Panels, Wind Turbines, Inverters, Batteries / Energy Storage, Others), By Connectivity (On-Grid System, Stand-Alone System), By End Use (Commercial, Residential, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154886

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

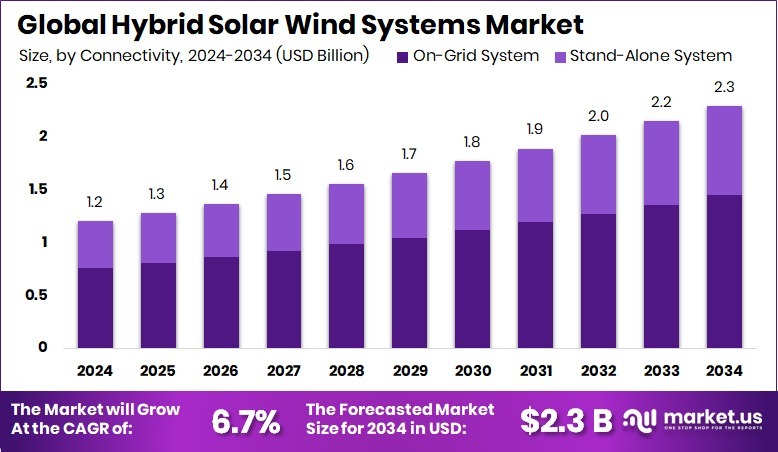

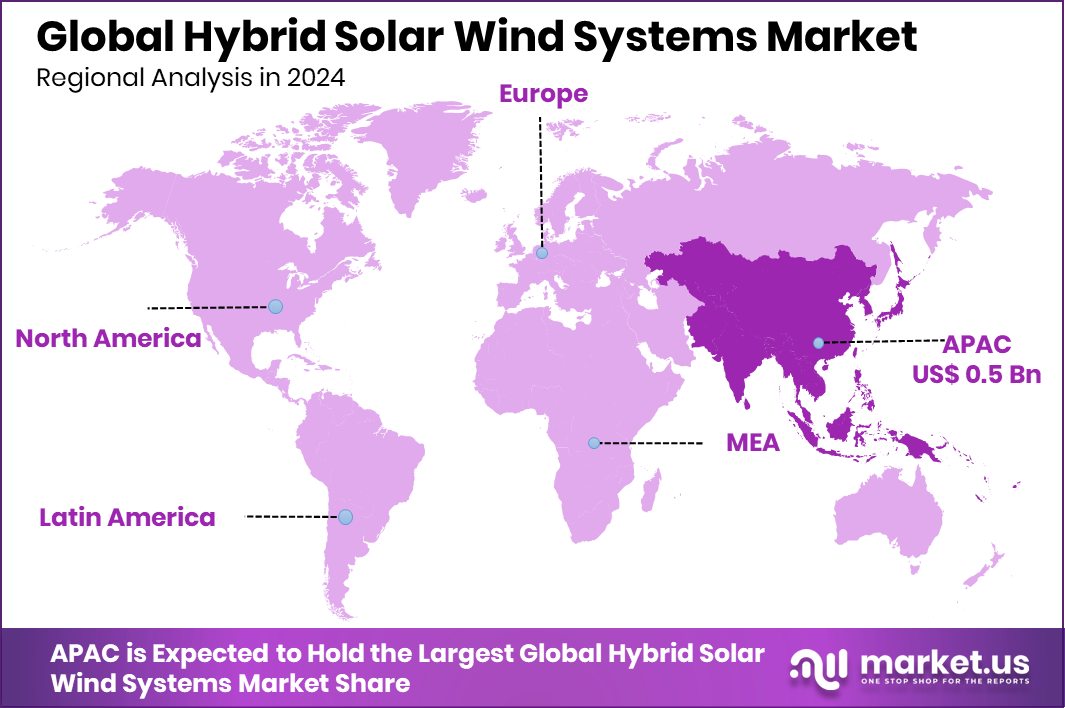

The Global Hybrid Solar Wind Systems Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. Asia Pacific dominated the market with a 43.8% share, totaling USD 0.5 billion.

Hybrid Solar Wind Systems refer to integrated renewable energy solutions that combine both solar photovoltaic (PV) panels and wind turbines to generate electricity. These systems are designed to offer a stable and continuous power supply by taking advantage of the complementary nature of solar and wind resources—solar power is generally available during daytime hours, while wind power often peaks at night or under overcast conditions. This hybrid configuration leads to more efficient and balanced energy production, reducing dependence on diesel generators or grid electricity, particularly in off-grid and remote regions.

The Hybrid Solar Wind Systems Market is witnessing steady expansion, driven by the global shift toward decentralized and sustainable energy infrastructure. Rising electricity demand in rural areas, where grid extension is technically challenging and economically unfeasible, has significantly increased the attractiveness of hybrid systems. Additionally, governments and energy institutions across both emerging and developed economies are actively promoting hybrid systems through supportive policies and clean energy targets.

In this context, major funding has further accelerated market activity—Adani Green Energy has obtained $1.06 billion in long-term refinancing for its solar-wind hybrid project, reflecting robust investor confidence in the sector. Similarly, KPI Green Energy has received a loan of INR 272 crore to support the development of a 50 MW wind-solar hybrid project in Gujarat, India.

A key driver behind market growth is the demand for reliable, uninterrupted electricity in locations lacking grid connectivity. Hybrid systems provide energy stability by offsetting the intermittency of individual sources, which is crucial for critical facilities such as rural schools, telecom towers, and healthcare centers.

The economic feasibility of such systems has also improved with the declining costs of key components like solar panels, wind turbines, and battery storage units. In support of this trend, ACME Solar has secured financing for a 300 MW solar-wind hybrid project and has also won a 300 MW PV project, further strengthening its presence in the hybrid energy sector.

Environmental regulations and climate change mitigation policies are contributing additional momentum. With nations advancing their commitments to reduce carbon emissions and transition away from fossil fuel-based energy, hybrid renewable systems have emerged as an important solution. Their ability to utilize local wind and solar resources effectively makes them ideal for rural electrification, microgrids, and disaster-resilient infrastructure.

Backing this development, Tata Power has raised $4.25 billion from the Asian Development Bank for clean energy initiatives, including hybrid systems. Furthermore, ACME Renewtech has finalized financing worth ₹19.88 billion to implement a 300 MW wind-solar hybrid project, underscoring the growing investor and policy support behind hybrid energy deployment.

Key Takeaways

- The Global Hybrid Solar Wind Systems Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- Solar Photovoltaic (PV) Panels held a 38.4% share in the Hybrid Solar Wind Systems Market.

- On-Grid Systems dominated the Hybrid Solar Wind Systems Market with a 63.1% market share in 2024.

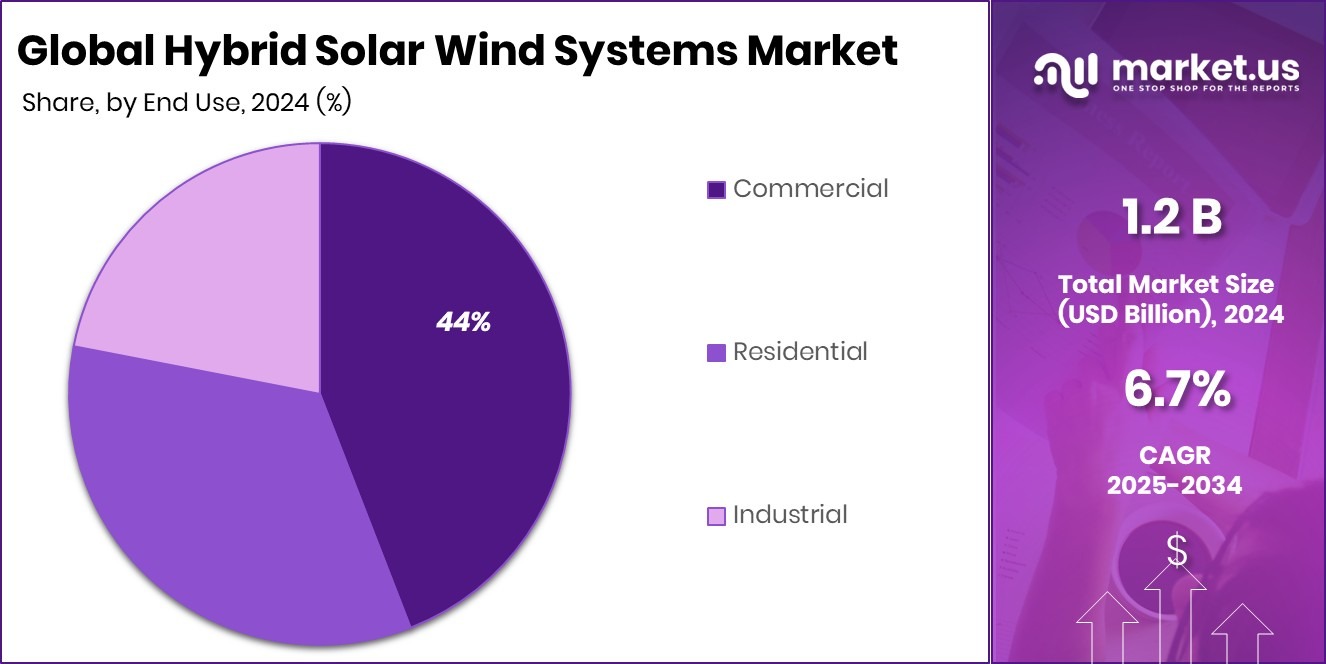

- The Commercial segment led the Hybrid Solar Wind Systems Market, capturing 44.2% of total demand.

- Strong renewable energy initiatives in the Asia Pacific supported a USD 0.5 billion market value.

By Component Analysis

Solar Photovoltaic (PV) Panels hold 38.4% of the hybrid systems market.

In 2024, Solar Photovoltaic (PV) Panels held a dominant market position in the By Component segment of the Hybrid Solar Wind Systems Market, with a 38.4% share. This dominance can be attributed to the increasing deployment of solar PV modules in hybrid setups due to their high efficiency, declining installation costs, and ease of integration with wind turbines and storage units.

Solar PV panels continue to be favored in regions with strong solar irradiance, allowing consistent daytime power generation that complements variable wind conditions. Their modular nature enables flexible design, making them suitable for both small-scale residential systems and larger off-grid commercial applications.

The 38.4% share reflects the strategic importance of PV technology in enhancing overall system performance and energy reliability. With governments and utilities prioritizing the development of hybrid microgrids for remote electrification, solar PV has emerged as a key technology in achieving a round-the-clock renewable energy supply.

Additionally, improved durability, lower maintenance requirements, and rapid technological advancements in PV cell efficiency have further supported the segment’s leading market position. As hybrid systems become more critical in transitioning toward sustainable energy infrastructure, solar PV panels are expected to maintain their prominent role in the component mix.

By Connectivity Analysis

On-grid systems dominate with 63.1% connectivity in global share.

In 2024, the On-Grid System held a dominant market position in the By Connectivity segment of the Hybrid Solar Wind Systems Market, with a 63.1% share. This dominance is primarily driven by the increasing preference for grid-connected hybrid installations in urban and semi-urban areas, where reliable grid infrastructure is available.

On-grid hybrid systems enable users to utilize both renewable sources and grid electricity, optimizing power usage while allowing excess energy to be fed back into the grid. This grid integration helps reduce electricity bills and ensures an uninterrupted power supply during peak demand hours or weather-related fluctuations in renewable generation.

The 63.1% market share of the on-grid segment highlights its wide acceptance among commercial, industrial, and residential users who benefit from net metering policies and government incentives. These systems are also cost-effective, as they eliminate the need for large-scale battery storage while ensuring system stability through grid support.

Furthermore, increasing installation of on-grid hybrid systems across industrial parks, institutional campuses, and smart cities is reinforcing their position in the market. As countries continue to modernize their energy infrastructure and promote cleaner grid-based power systems, on-grid hybrid models are expected to remain the preferred choice within the connectivity segment.

By End Use Analysis

The commercial sector leads with 44.2% end-use in hybrid installations.

In 2024, Commercial held a dominant market position in the By End Use segment of the Hybrid Solar Wind Systems Market, with a 44.2% share. This leading position was largely supported by the growing adoption of hybrid energy systems by commercial establishments such as office buildings, retail chains, hospitals, educational institutions, and data centers.

These facilities require a stable and uninterrupted power supply to support daily operations, and hybrid solar wind systems provide a reliable and cost-effective solution by combining two renewable sources with varying generation patterns.

The 44.2% market share signifies the commercial sector’s increasing commitment to energy efficiency, sustainability goals, and long-term cost savings. Rising electricity prices and pressure to reduce carbon emissions have further encouraged businesses to invest in hybrid installations. Additionally, the availability of rooftop and open spaces in commercial properties has enabled the smooth deployment of such systems without significant infrastructural changes.

Many commercial users are also benefiting from government support, tax benefits, and favorable policies that promote on-site renewable energy generation. As more commercial facilities integrate hybrid power solutions to enhance energy resilience and environmental compliance, the segment is expected to retain its strong foothold in the overall market landscape.

Key Market Segments

By Component

- Solar Photovoltaic (PV) Panels

- Wind Turbines

- Inverters

- Batteries / Energy Storage

- Others

By Connectivity

- On-Grid System

- Stand-Alone System

By End Use

- Commercial

- Residential

- Industrial

Driving Factors

Rising Demand for Reliable Clean Power Supply

One of the main driving factors for the Hybrid Solar Wind Systems Market is the increasing need for reliable and clean electricity. Many areas across the world, especially in developing regions, face regular power cuts and unstable grid supply. Hybrid systems, which use both solar and wind energy, help solve this issue by providing a stable power source throughout the day and night.

When sunlight is not available, wind energy can still generate electricity, and vice versa. This dual-source setup ensures continuous power, which is important for homes, schools, hospitals, and businesses. As more people and companies aim to reduce their use of polluting energy sources, hybrid systems are becoming a popular and practical solution for cleaner and more reliable energy.

Restraining Factors

High Initial Installation Cost Limits Adoption

A major restraining factor in the Hybrid Solar Wind Systems Market is the high upfront cost required to install the system. Setting up both solar panels and wind turbines together, along with storage batteries and control units, demands a large initial investment. For many small businesses, rural users, or households, this cost can be too high, even if the system offers long-term savings.

Additionally, the cost of transportation and installation in remote areas further increases the total expense. Without strong government subsidies or financial support, many potential users hesitate to adopt hybrid systems. This financial barrier slows down market growth, especially in regions where income levels are low or access to credit and loans is limited.

Growth Opportunity

Expanding Rural Electrification in Developing Countries

A key growth opportunity for the Hybrid Solar Wind Systems Market lies in the increasing push for rural electrification in developing countries. Many remote villages and islands still lack access to reliable electricity due to the absence of grid infrastructure. Extending power lines to such regions is expensive and time-consuming. Hybrid solar wind systems offer a practical solution, as they can generate power locally using natural resources.

These systems can be easily installed in off-grid areas to provide clean, stable, and low-cost electricity. Governments and international agencies are also supporting such efforts through funding and renewable energy programs. This growing focus on powering rural communities is expected to create strong demand for hybrid systems in the coming years.

Latest Trends

Integration of Smart Energy Management System Technologies

One of the latest trends in the Hybrid Solar Wind Systems Market is the growing use of smart energy management systems. These advanced technologies help control and balance the energy coming from both solar and wind sources in real time. They automatically adjust power usage, store extra energy in batteries, and even send unused electricity back to the grid when needed.

This makes the whole system more efficient and reliable. Users can also monitor their energy generation and consumption through mobile apps or smart dashboards. As technology becomes more user-friendly and affordable, more hybrid systems are being equipped with these intelligent controls, helping to reduce waste, lower costs, and make renewable energy easier to manage for homes and businesses.

Regional Analysis

In 2024, the Asia Pacific held a 43.8% market share, reaching USD 0.5 billion.

In 2024, Asia Pacific held a dominant position in the Hybrid Solar Wind Systems Market, capturing 43.8% of the global share with a market value of USD 0.5 billion. The strong market presence in this region can be attributed to favorable government initiatives, rural electrification programs, and the growing need for decentralized energy in countries such as India, China, and Southeast Asian nations. The region’s diverse climatic conditions, which support both solar and wind resources, have further encouraged large-scale deployment of hybrid systems in off-grid and semi-urban areas.

In comparison, North America and Europe showed steady progress in hybrid system adoption, driven by sustainability goals and investments in clean energy infrastructure. However, their combined market share remained below that of Asia Pacific, reflecting the relatively higher penetration and maturity of single-source renewable systems in these regions.

Meanwhile, the Middle East & Africa and Latin America represented emerging markets, with increasing interest in hybrid energy solutions for remote and underserved regions. These areas are expected to gradually expand their market presence through pilot projects and international development support. Overall, Asia Pacific remained the clear leader in regional adoption of hybrid solar wind systems in 2024, both in terms of percentage share and market value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alpha Devraj Renewable Energy LLP distinguished itself through its localized service model, with a deep understanding of regional energy needs and infrastructure conditions. Its approach focused on customizing hybrid systems for off-grid and rural deployments. By emphasizing durable design and low-maintenance operation, Alpha Devraj achieved notable presence among rural electrification projects and small industrial users. The company’s emphasis on adaptivity and resilience rendered it a trusted partner in regions with challenging climatic and logistical constraints.

Gamesa leveraged its technical expertise in wind energy integration, delivering hybrid systems that balanced high-efficiency wind turbines with solar arrays. Central to their strategy was system robustness and performance optimization across diverse geographies. This enabled them to serve mid-sized to large-scale industrial and institutional clients, where energy reliability and scalability were paramount. Gamesa’s strength in integrating turbine engineering with solar functionality positioned it favorably in projects demanding continuous power and grid compatibility.

UNITRON Energy System Pvt. Ltd. emphasized innovation in modular hybrid designs, incorporating advanced control systems and energy storage options. The company targeted both commercial and residential users by offering flexible, scalable solutions that could be tailored to site-specific requirements. UNITRON’s modularity enabled gradual expansion and minimized upfront investment, appealing to a broader customer base seeking adaptable and cost-effective hybrid systems.

Top Key Players in the Market

- Alpha Devraj Renewable Energy LLP.

- Gamesa

- UNITRON Energy System Pvt. Ltd.

- Polar Power, Inc.

- Windstream Energy Technologies

- ONIX Renewable

- Deepa Solar Systems

- Iysert Energy

- Eagle Science & Technology (H K) Co., Ltd

Recent Developments

- In April 2025, ONIX Renewable revealed a strategic plan to invest ₹25,000 crore over three years to develop 7 GW of renewable energy capacity, including enhancements in solar manufacturing. The company aims to build a 2,400 MW module plant and a 1,200 MW cell facility in Gujarat.

- In April 2024, WindStream Energy Technologies entered into a memorandum of understanding with the Philippine National Oil Company (PNOC) to deploy its SolarMill® hybrid wind‑solar systems across remote, off‑grid islands in the Philippines.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solar Photovoltaic (PV) Panels, Wind Turbines, Inverters, Batteries / Energy Storage, Others), By Connectivity (On-Grid System, Stand-Alone System), By End Use (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpha Devraj Renewable Energy LLP., Gamesa, UNITRON Energy System Pvt. Ltd., Polar Power, Inc., Windstream Energy Technologies, ONIX Renewable, Deepa Solar Systems, Iysert Energy, Eagle Science & Technology (H K) Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hybrid Solar Wind Systems MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Hybrid Solar Wind Systems MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpha Devraj Renewable Energy LLP.

- Gamesa

- UNITRON Energy System Pvt. Ltd.

- Polar Power, Inc.

- Windstream Energy Technologies

- ONIX Renewable

- Deepa Solar Systems

- Iysert Energy

- Eagle Science & Technology (H K) Co., Ltd