Global Human Resources Management Software Market Size, Share Analysis Report By Software Type (Core HR, Employee Collaboration & Engagement, Recruitment and, Applicant Tracking, Talent Management, Learning Management, Workforce Planning & Analytics, Others), By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs), By Industry (Education, Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, IT & Telecom, Manufacturing, Retail, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145255

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- U.S. Digital Robot Market Size

- Software Type Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Industry Type Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Latest Trends

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

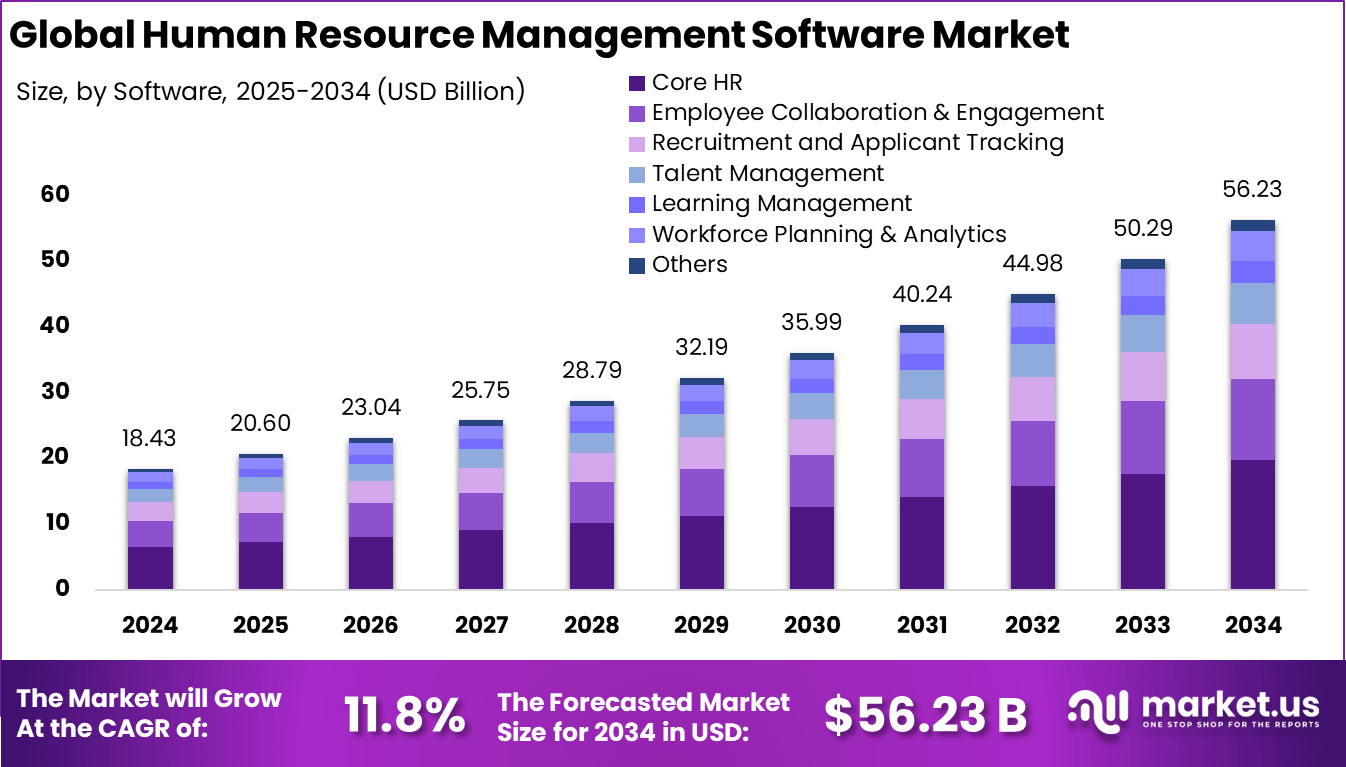

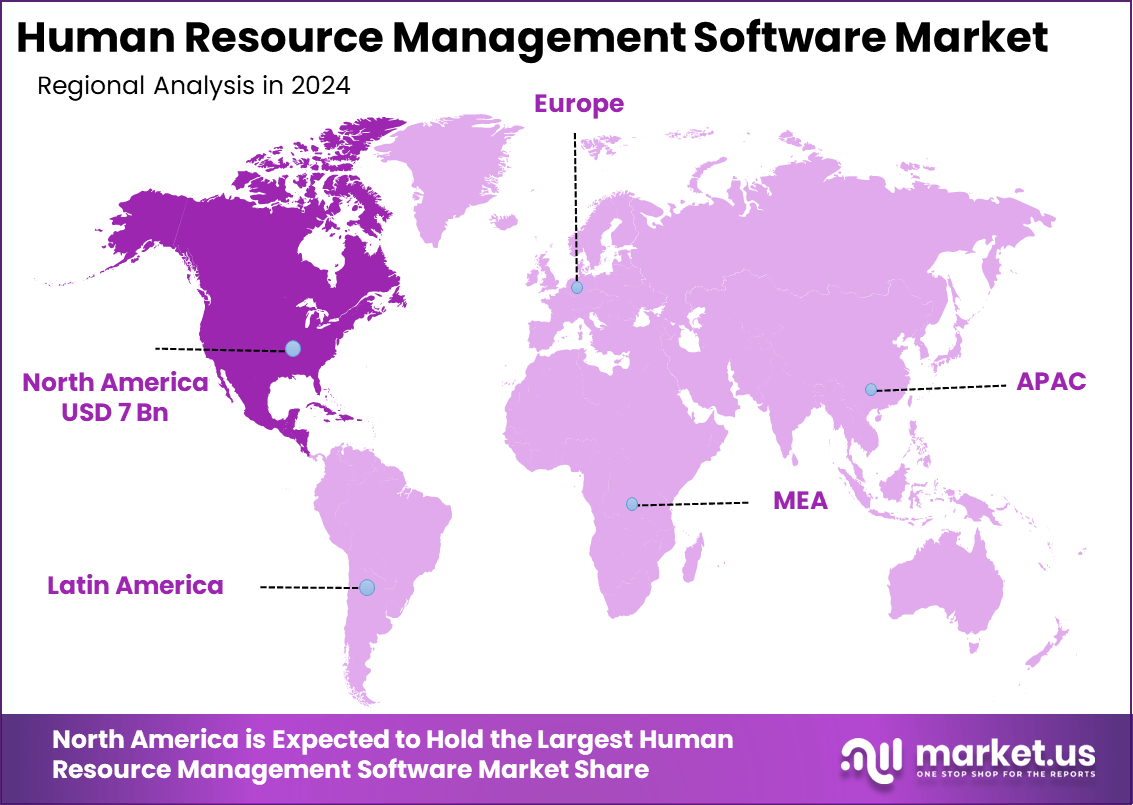

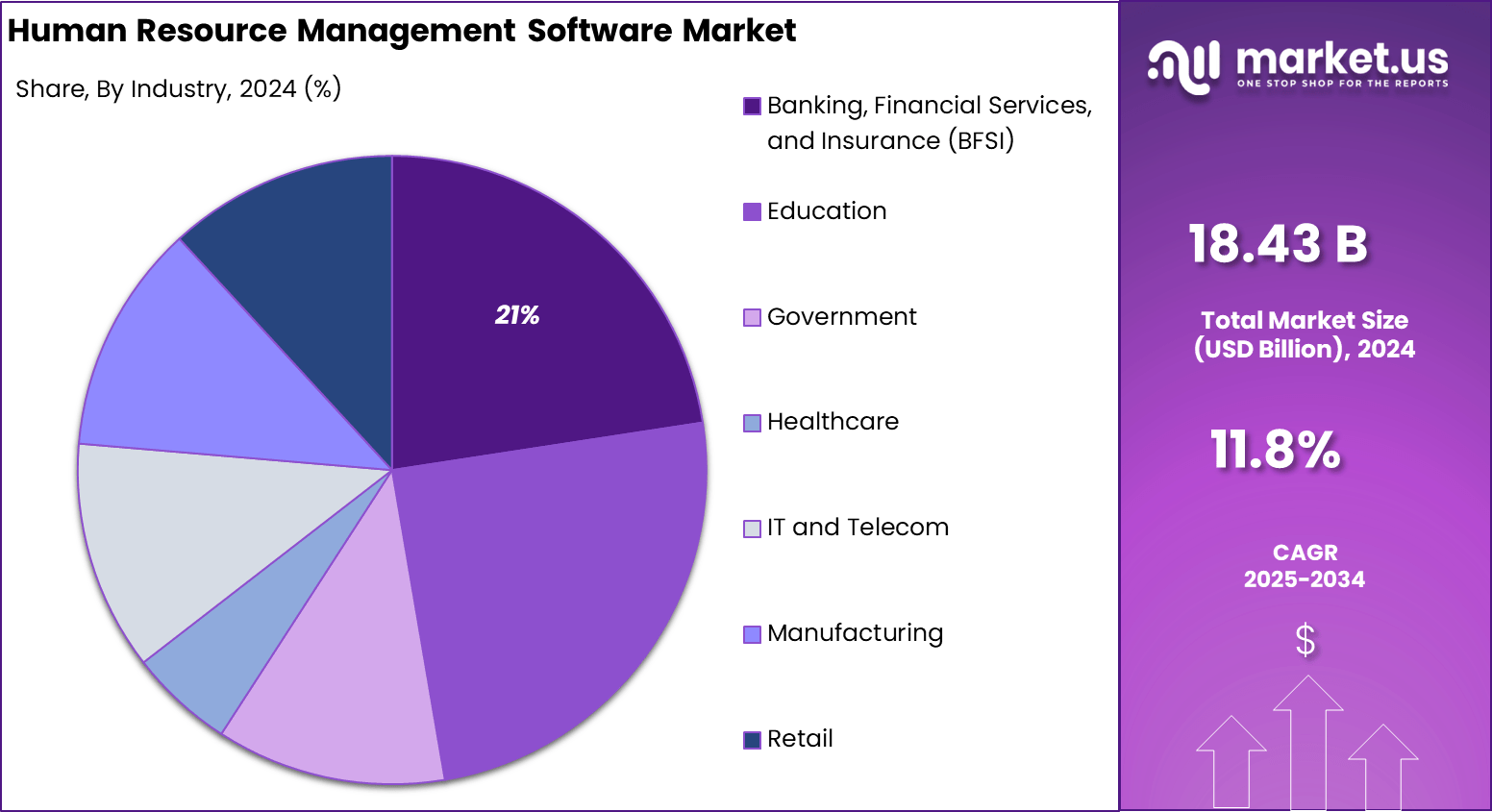

The Global Human Resources Management Software Market size is expected to be worth around USD 56.23 billion by 2034, from USD 18.43 billion in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.1% share, holding USD 7.0 Billion revenue.

The HRM software market is growing due to the acceptance of digital technologies by businesses aiming to enhance and automate HR functions. Rising demand for cloud-based HR solutions has emerged as one major growth driver for the market, with the ability to offer elasticity, remote access, and cost-effectiveness. This makes them more desirable for SMEs.

The increasing focus on employee engagement, talent acquisition, and workforce analytics has accelerated the entrance of AI and machine learning technologies into HRM software solutions. Organizations are rapidly considering data-driven decision-making in HR processes, which span the entire employee life cycle from recruitment and on-boarding to performance management and retention.

Also, in the face of the global transition to remote and hybrid work patterns, the HRM system must be capable of supporting the effective management of distributed teams. Other decisive factors for the acceptance of an advanced HRM software solution are regulatory compliance and effective record-keeping. With organizations attempting to increase productivity while accompanying a positive employee experience, the HRM software market will continue to expand steadily.

According to Forbes, the evolving landscape of human resources reveals critical shifts in workplace dynamics and talent management strategies. 1.4 HR staff per 100 employees is the recommended ratio to effectively support organizational needs. However, with 45% of employees reporting burnout due to constant organizational changes in 2023, it is evident that structural support is not keeping pace with transformation.

At the same time, 47% of HR leaders have made employee experience a key focus, recognizing its impact on retention and productivity. Yet, 44% of companies still lack compelling career paths, which continues to hinder employee growth and satisfaction. On the recruitment front, 46% of HR leaders have prioritized hiring efforts amid a competitive talent market.

Key Takeaway

- In 2024, the Core HR segment held a dominant market position, capturing a 35% share of the Global Human Resources Management Software Market.

- In 2024, the Cloud segment held a dominant market position, capturing a 74% share of the Global Human Resources Management Software Market.

- In 2024, the Large Enterprise Size segment held a dominant market position, capturing a 58.6% share of the Global Human Resources Management Software Market.

- In the global human resources management software market, the BFSI (Banking, Financial Services, and Insurance) sector holds a significant portion, accounting for 21% of the market share

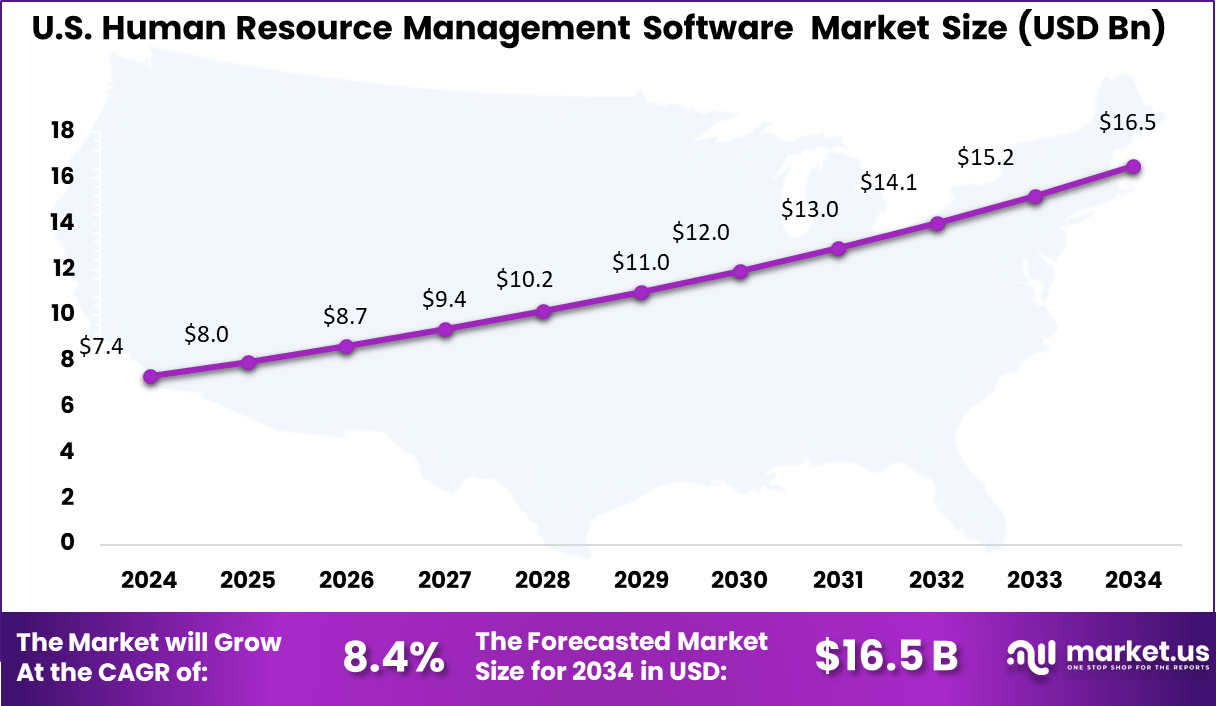

- The US Human Resources Management Software Market was valued at USD 7.37 billion in 2024, with a robust CAGR of 4%.

- In 2024, North America held a dominant market position in the Human Resources Management Software Market, capturing more than a 40% share.

Analysts’ Viewpoint

Current trends in the HRMS market include the rising adoption of cloud-based platforms, which offer scalability and accessibility advantages over traditional on-premise solutions. There is also a significant focus on mobile access capabilities, allowing employees and managers to perform HR tasks on the go.

Investment in HRMS is seen as strategically important for long-term business sustainability. It not only improves HR operational efficiency but also provides a platform for strategic HR management that can significantly influence organizational success.

The regulatory environment for HRMS is evolving, with increased emphasis on data security and privacy, driven by regulations such as GDPR in Europe and various national laws concerning employee data protection.

U.S. Digital Robot Market Size

The market for Human Resources Management Software within the U.S. is growing tremendously and is currently valued at USD 7.37 billion and the market has a projected CAGR of 8.4%. Human Resource Management (HRM) Software in the U.S. region is growing due to several key factors.

One major driving factor is the increased adoption of digital tools often linked to the streamlining of the whole HR function data on recruitment, payroll, performance management, and employee engagement. Also, remote working and hybrid working models are the next things that have opened the way for cloud-based solutions of HRM-accommodating real-time access while housing centralized data management.

Furthermore, business organizations are moving towards advanced technologies like AI and analytics that result in data-backed decision-making in workforce planning and talent acquisition. For instance, In May 2024 Aconso, the European leader in HR document management, announced its entrance into the U.S. market.

The company hopes to redefine the way HR document management is conducted in the U.S. by optimizing HR processes, ensuring compliance, and improving efficiency through digital document management. Aconso will be able to provide its expertise to American companies, that want to manage employee files, automate document workflows, and secure data, and continue offering promising solutions for the continually evolving needs of HR functions in the new market.

In 2024, North America held a dominant market position in the Human Resources Management Software Market, capturing more than a 40% share. North America is well-equipped in terms of technological infrastructure to promote the fast adoption and development of advanced HRMS solutions.

Many companies in North America also emphasize automating HR processes for greater efficiency, streamlining operations, and more informed decisions. The presence of major HR software providers, such as ADP, Oracle, and Workday, has encouraged the region’s market position. This is what makes North America a leader in the global HRMS market.

For instance, Workstream launched an HR management platform for the hourly workforce in North America, which started during the last quarter of 2023. The platform aims to ease the hiring, onboarding, and management of hourly employees. This unique population makes up a large part of the North American labor market.

The Core HR segment is the uniqueness where different needs would be necessary to solve the problem of uniqueness not only in workforce demographics but also in industries within specific geographic regions. Such solutions are modified with time frames by businesses as they aim at operational efficiency and cost reduction.

Software Type Analysis

In 2025, The Core HR segment held a dominant market position, capturing a 36% share of the Global Human Resources Management Software Market. Core HR systems have the significant responsibility of streamlining and automating the fundamental functions of human resource management, including payroll, employee records management, benefits administration, and legal compliance.

For instance, SAP SE is a cloud-based payroll management system, and the payroll processing function is critical. Core HR systems facilitate pay calculations with the deductions and tax requirements that must be met by law to permit payment to employees on time, thus enhancing employee satisfaction and compliance with existing labor laws.

Such software is required by businesses almost all the time since they are mostly operational efficiency-minded and cost-conscious. The people’s movement toward generic, simple, internet-usable systems that pull different HR-related functions together may have pushed them toward the Core HR system. The Core HRs provide even higher data security and compliance possibilities, both of which are a major concern in a regulatory sense these days.

Deployment Analysis

In 2025, the Cloud segment held a dominant market position, capturing a 74% share of the Global Human Resource Management Market. Various factors account for its growth, one being the rising demand for scalable, flexible, and cost-effective HR solutions that can be accessed anywhere. Enhanced collaboration, real-time data access, and easy integration with other enterprise tools make cloud HR systems attractive to organizations of all sizes.

Automation of critical HR processes, enhancement of compliance, and security of data act as other strong reasons powering the adoption of cloud-based HR solutions. The cloud segment continues to be one of the major driving factors in the HRM market as organizations migrate to digital transformation.

For instance, In April 2025, Ciphr launched its new cloud-based payroll solution with real-time calculations. The modern payroll software has been developed to ease and simplify the payroll processes for businesses. The key features include instant payroll calculations to reduce the time and effort put into the payroll, processing traditionally stated Ciphr.

Further, the platform has an intuitive user interface, enhanced automation to reduce errors, and API integration with other HR and finance systems. Ciphr cites that the software can be accessed anywhere, offers secure functionality, and ensures compliance with the latest regulations. The solution is intended to increase control and efficiency for the payroll operations of its users.

Enterprise Size Analysis

In 2025, the Large Enterprise segment held a dominant market position, capturing a 58.6% share of the Global Human Resource Management Software Market. The increase in HR operations complexity and scale in large organizations drives demand for robust, scalable software solutions to provide efficient workforce coverage.

These organizations are increasingly accepting end-to-end advanced HRMS to support their talent management cycle, manage the payroll, fulfill compliance requirements, and smoothen performance tracking. The other factors strengthen the adoption of an end-to-end HR solution to fit large organizations as the need for business data for decision-making, integration with other business-facing systems, and managing global workforces.

Large businesses are now ever-increasingly embracing the automated end-to-end process model because these types of systems will be very efficient in carrying out regular corporate functions at low operational costs. For instance, IBM and Microsoft, these powerful HRMS platforms are utilized for payroll, recruitment, and performance management processes across their multiple divisions or regions.

Besides, scalability and customization of the system greatly support large enterprise operations in processing voluminous data and integration with any other enterprise software. And so, with large organizations growing ever more globally and implementing their digital transformation strategies, there remains an ever-growing demand for comprehensive HR software solutions.

Industry Type Analysis

In 2025, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position, capturing a 21% share of the Global Human Resource Management Software Market. Growing demand for technology in managing the complex HR functions of the sector like recruitment, compliance, and talent management.

AI-driven HR software, for instance, is being used in banks and insurance companies to streamline regulatory compliance, assist with diverse workforces, and provide skills-based talent acquisition. These systems also include customized functions, such as secure payroll management and financial regulatory training, thereby representing the sector’s specialized requirements.

For Instance, In March 2025, ESAF Small Finance Bank’s major investment in AI-led HR technology for a future-ready workforce is the peg of the Fortune India article. The bank is using AI to automate and enhance various HR functions such as talent acquisition, performance management, and employee engagement.

It will increase productivity, customize employee development, and ensure that the right skills and talents are present that the bank would need to accomplish its future growth targets in the competitive financial services market of India. The increasing trend in the BFSI sector towards using technology in HR for strategic and impactful human capital decisions is what ESAF Bank does here by adopting AI in HR.

Key Market Segments

By Software Type

- Core HR

- Employee Collaboration & Engagement

- Recruitment and Applicant Tracking

- Talent Management

- Learning Management

- Workforce Planning & Analytics

- Others

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry

- Education

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Others

Drivers

Digital HR Transformation Driving Software Adoption

The increasing focus on digital transformation across various functions within organizations, including human resources, is creating a strong catalyst in driving the HRM software market. The need for the adoption of advanced HRM software has reached a crescendo as organizations transform their entire workplace into a more agile and data-driven environment.

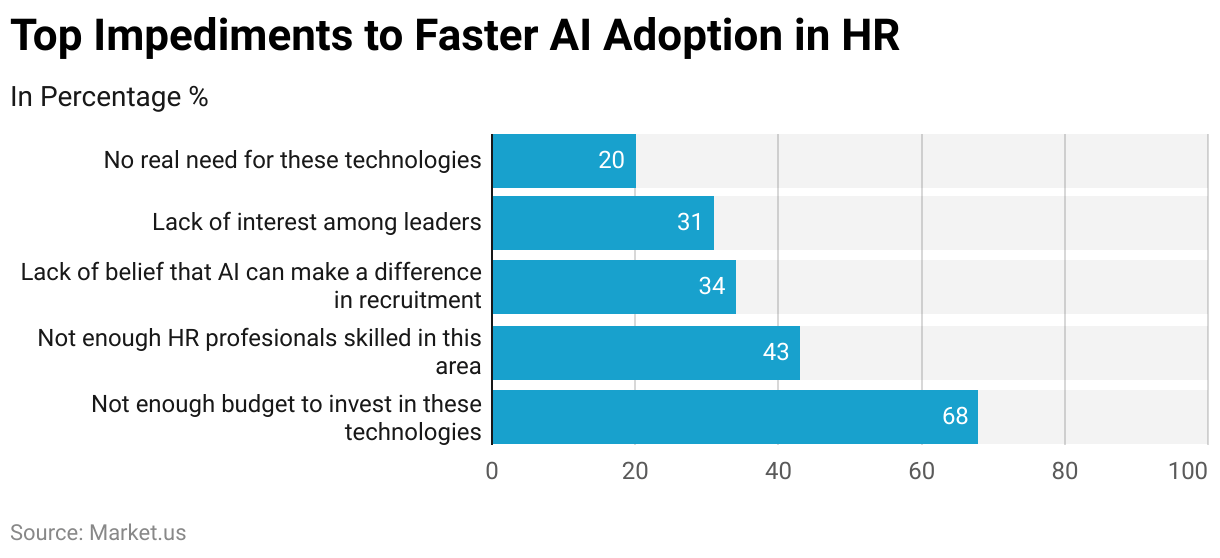

Such systems bring companies effective improvements in modernizing HR operations by automating routine processes, enhancing the efficiency of workflow, and consolidating employee information through centralization. For instance, the growing digital transformation in HR is reflected in the increasing adoption of AI tools.

A case in point is how major companies such as Unilever and IBM have installed artificial intelligence (AI) into their recruitment processes at work. Unilever had AI-driven platforms equipped with video interviews and gamified assessments that objectively examine candidates’ skills and potential and result in faster and more diverse hiring outcomes.

Coupled with this, IBM uses their Watson Recruitment AI to analyze resumes and candidate and job matches based on predicted performance and client-side identification and mitigation of possible biases in the job posting, which goes a step further in proving the real shift to using cutting-edge technologies to modernize talent acquisition.

Restraint

High Cost of Implementation

The initial huge investment for the HRM software is a major constraint for SMEs with tight budgets. Licensing costs, often necessary customization to fit business processes, challenges and costs of migrating data, and the need for overall employee training require considerable investment upfront and might fight against adoption because they can easily act as top deterrents by not showing the speed and size of return on investment.

Hence, organizations with limited budgets are reluctant to even look at promising HRM solutions because of that uncertainty. For instance, the initial investment for such systems may vary widely, with cloud-based HR systems typically costing up to $50 to $300 per user per month, depending on their specific features and services. High initial costs for on-premise HRM systems can range between $5,000 and $20,000 or more, exclusive of annual maintenance charges.

Heavy expenditures might be required for hybrid systems as well causing customization and integration with the company’s existing systems. Following that is the critical step of maintenance and support, which can have variable costs depending on the software’s complexity.

A small to medium-sized enterprise can spend anywhere from $1,000 to $5,000 annually on maintenance, while for larger enterprises, the expenditures can even be higher. These amounts can increase when training for the user employees would have to be catered for, along with customization of the system, and continuous support.

Opportunities

Adapting to the Evolving Workplace: HRM Solutions for Remote and Hybrid

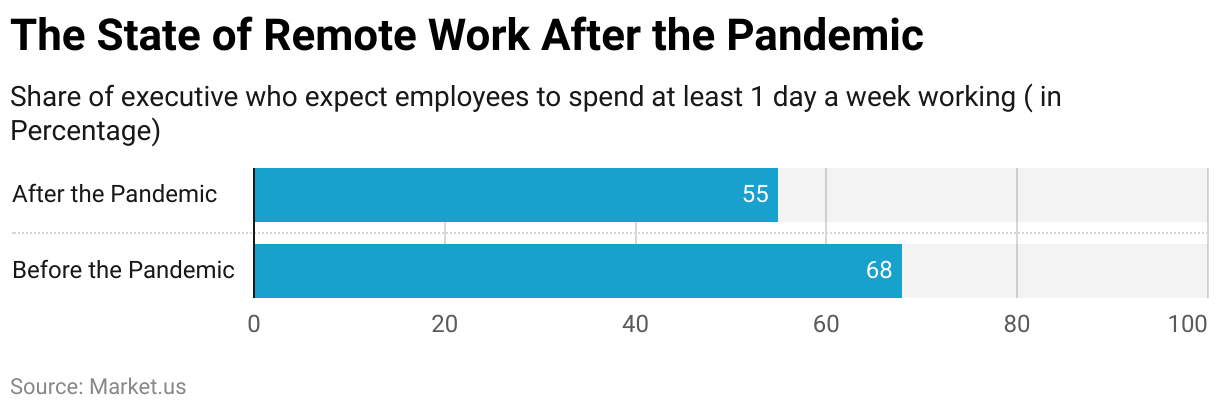

The COVID-19 pandemic propelled society toward more flexible work arrangements, and recent movements in human resource management indicate that hybrid work is now a permanent installation in the contemporary workplace. Companies are investing heavily in digital collaboration tools, redefining all workplace strictures, and developing performance management systems for remote teams.

All these tools usually ensure seamless communication, collaboration, and productivity regardless of one’s physical location, while employers test flexible work schedules for enhanced productivity and work-life balance.

As companies transition to hybrid models, it has become more crucial to create a culture of inclusion and engagement amongst remote employees to ensure that every team member feels connected, regardless of the work environment. This is one of many changes shaping the future of HR practices to develop flexible, dynamic, and supportive working environments.

For instance, the HR solutions provided by SAP SE through SAP Success Factors support hybrid workplaces by allowing employees to choose their work location and hours, thereby improving productivity and work-life balance. Tools for performance management, collaboration, and employee engagement, which are essential for effectively managing distributed teams, are included with these solutions.

Challenges

Data Security Concerns in HRM Software Growth

HRM software stores sensitive employee information, with personal data, payroll, performance records, and health information all constituting a significant challenge in assuring robust data security, because of the recent growth in remote work, employees are accessing HR systems these days from varied locations and devices and networks, thereby exposing the system ever more to threats of data breach, unauthorized access, and cyber-attack.

HRM software service providers must encrypt their communication using strong encryption methods, multi-factor authentication, and secure cloud storage to ensure the protection of confidential data. Furthermore, the divergence of the workforce can pose additional complications in implementing global data protection regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

For Instance, in December of 2021, the ransomware attack on Ultimate Kronos Group was a rude shock to the HRM software systems because of its vulnerabilities. This attack resulted in around 2000 U.S. companies being targeted by this cyberattack. The breach interrupted payroll and scheduling services for thousands of employers, including large companies, hospitals, and public agencies.

They had to rely on manual processes to ensure their employees were paid accurately and on time. This incident highlights the vital importance of robust data security and disaster recovery contingency plans for the protection of sensitive employee information, as well as the operational continuity against cyber disruptions.

Latest Trends

HR management trends highlight the role of AI and automation in simplifying hiring, screening, and even assessment, thus allowing HR professionals to concentrate on strategic initiatives. An equally prominent role is given to employee well-being, as organizations have discovered the direct correlation between productivity and retention with mental health programs, flexible benefits, and a positive work atmosphere.

Decision-making based on data has improved talent management through HR analytics. Also, Diversity, Equity, and Inclusion continue to be a priority, alongside plans to improve employee retention through personalized career development opportunities and a nurturing environment. The adoption of HR technology and cloud solutions remains a key trend, enabling organizations to use AI, automation, and integration capabilities in refining HR processes.

In January 2025, Pocket HRMS, an AI-first HR software company based in India, introduced their POSH (Prevention of Sexual Harassment) module. Designed to enhance workplace safety for female employees through Artificial Intelligence, this module integrates several innovative features. These include an AI-crafted POSH policy, digital management of the POSH committee, and predictive analytics to foresee policy breaches.

Additionally, it ensures the protection of victims’ identities, offers automated email updates on complaint status, and provides timelines for grievance resolution. The module, which also includes flexible complaint delegation and intelligent compliance reporting, is available in the standard plan for all Pocket HRMS customers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

November 2023, One of the leading players in the market, PwC India announced a strategic partnership with Darwinbox, a leading Software as a Service (SaaS) based human resource (HR) technology firm for the aim to enable organizations across India with truly revolutionary HR transformation solutions.

This integration will combine the powers of PwC India’s HR consulting and digital transformation skills with Darwinbox’s cutting-edge and nimble HCM platform. The partnership aims to assist organizations across India in transforming their HR functions and making a big business impact through technology-based solutions.

Top Key Players in the Market

- Accenture plc

- Cezanne HR Limited

- IBM Corporation

- NetSuite, Inc.

- Zellis Group

- PwC

- SAP SE

- Talentsoft

- UKG, Inc.

- Workday Inc.

- ADP, Inc.

- Cegid

- Ceridian HCM Holding, Inc.

- Mercer LLC

- Oracle

- Zoho

- BambooHR

- Other Key Players

Recent Developments

- In March 2025, Oracle announced the general availability of the OCI Generative AI Agents platform. This platform is introducing the next generation of AI in Oracle’s application suite-Oracle AI Agents. The deployment of these AI Agents is intended for automating even more complex business processes. Besides this, Oracle released AI Agent Studio around March 21, 2025, to provide tools for the development and management of these AI agents.

- In May 2024, Cezanne, a human resources information system (HRIS) specialist, announced the launch of a new payroll solution named Cezanne Payroll. This is a major expansion to their HRIS platform, now allowing for a fully integrated HR and payroll experience. Cezanne Payroll is intended to afford businesses a seamless, efficient way of managing their HR and payroll processes within one system.

Report Scope

Report Features Description Market Value (2024) USD 18.43 Bn Forecast Revenue (2034) USD 56.23 Bn CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Software Type (Core HR, Employee Collaboration & Engagement, Recruitment and, Applicant Tracking, Talent Management, Learning Management, Workforce Planning & Analytics, Others); By Deployment (Cloud, On-premise); By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs); By Industry (Education, Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, IT & Telecom, Manufacturing, Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, Cezanne HR Limited, IBM Corporation, NetSuite, Inc., Zellis Group, PwC, SAP SE, Talentsoft, UKG, Inc., Workday Inc., ADP, Inc., Cegid, Ceridian HCM Holding, Inc., Mercer LLC, Oracle, Zoho, BambooHR, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Human Resources Management Software MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Human Resources Management Software MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture plc

- Cezanne HR Limited

- IBM Corporation

- NetSuite, Inc.

- Zellis Group

- PwC

- SAP SE

- Talentsoft

- UKG, Inc.

- Workday Inc.

- ADP, Inc.

- Cegid

- Ceridian HCM Holding, Inc.

- Mercer LLC

- Oracle

- Zoho

- BambooHR

- Other Key Players