Global Learning Management System Market By Component (Solution, Services), Deployment Type (Cloud-based, On-premises), Pricing Model (Subscription-based, Pay-per-use, One-time License), By End-User (K-12 Education, Higher Education, Corporate/Enterprise, Government, Healthcare, Other End-Users), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 12428

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

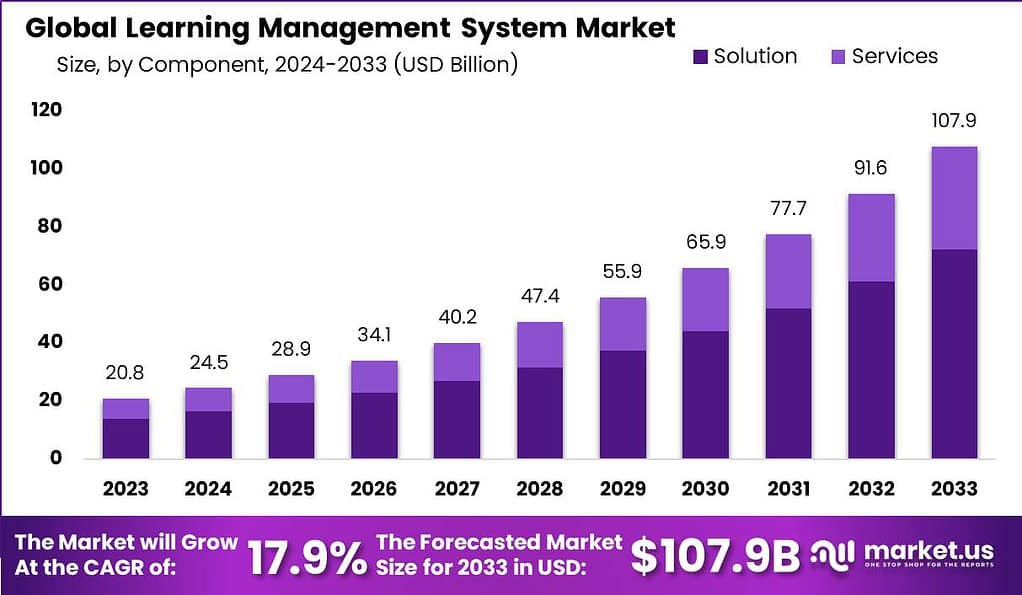

The Global Learning Management System Market is likely to jump from USD 24.5 Billion in 2024 to USD 107.9 Billion by 2033. This projected expansion is anticipated to result from an average 17.9% CAGR in the demand for the Learning Management System (LMS) over the upcoming decade.

A Learning Management System (LMS) is a software application or platform that enables the management, delivery, and tracking of educational and training content. It provides a centralized system for organizations to create, distribute, and assess learning materials and courses, as well as track learner progress and performance. LMSs are widely used in educational institutions, corporations, and other organizations for e-learning and training purposes.

The Learning Management System market refers to the industry that develops and provides LMS software solutions and services. The market encompasses software vendors, service providers, and related technologies that support the implementation and use of LMS platforms.

Analyst Viewpoint

The Learning Management System (LMS) market is witnessing a significant upsurge, primarily fueled by the increasing adoption of digital learning solutions in educational institutions and corporate sectors. This growth can be attributed to several factors, including the burgeoning demand for cost-effective training solutions and the escalating need for remote learning, especially in the wake of global disruptions such as the COVID-19 pandemic.

The major driving factors propelling the market revenue growth include technological advancements in e-learning platforms, the integration of artificial intelligence and machine learning algorithms for personalized learning experiences, and the rising penetration of internet and mobile devices.

However, the market faces certain restraints that could potentially impede its growth trajectory. These include high implementation costs of advanced LMS solutions, which may be prohibitive for small and medium-sized enterprises.

The advantages of E-Learning and LMS are substantiated by a survey conducted by the American Society for Training and Development. According to the findings, companies implementing a comprehensive training program reported a remarkable 218% increase in revenue and a notable 24% rise in profit margins. This underscores the substantial impact that E-Learning, coupled with an efficient LMS, can have on organizational success and financial performance.

Key Takeaways

- The Global Learning Management System Market is projected to grow from USD 24.5 Billion in 2024 to a staggering USD 107.9 Billion by 2033, indicating a substantial CAGR of 17.9% over the next decade.

- In 2023, the Solution segment dominated the LMS market, accounting for over 67% share. These solutions provide flexible, accessible, and personalized learning experiences.

- Cloud-based LMS held a dominant position in 2023, with over 70% share due to flexibility and scalability.

- Subscription-based pricing held over 75% market share in 2023, offering cost-effectiveness and access to the latest features.

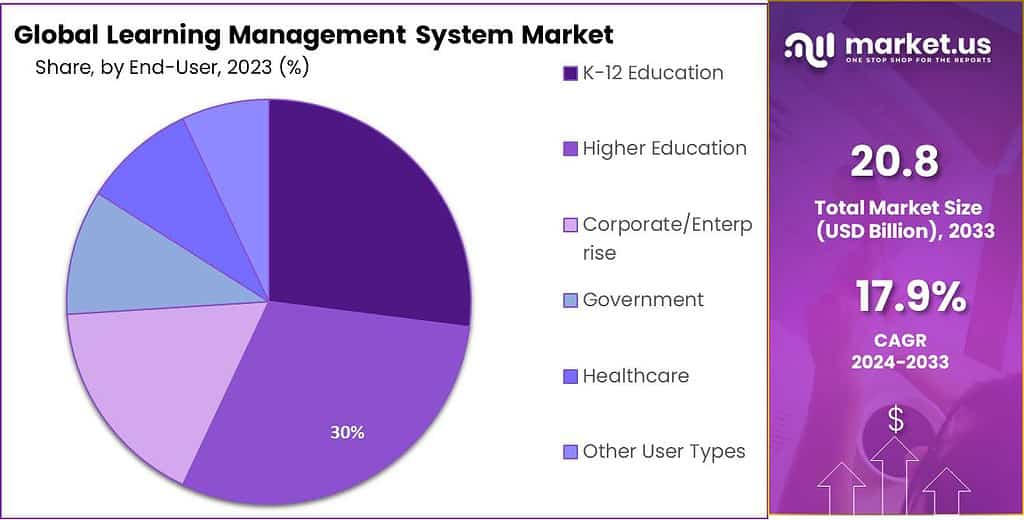

- Higher Education was the dominant segment in 2023, with over 30% share, driven by the demand for digital learning tools and advanced technologies.

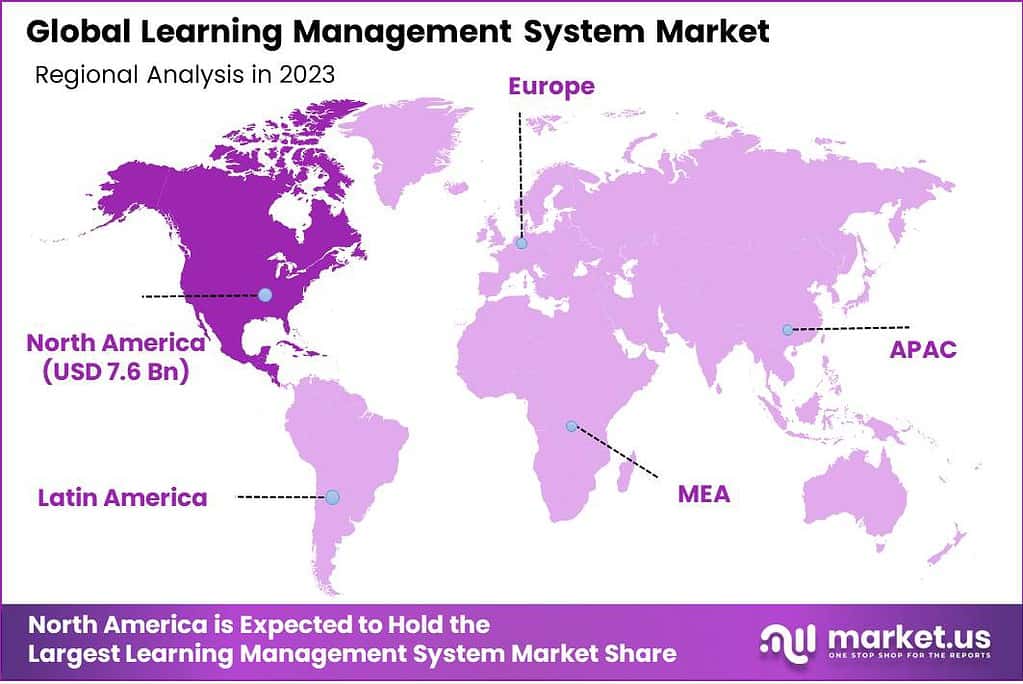

- In 2023, North America dominated the LMS market, with over 37% share, thanks to its technological infrastructure, high internet penetration, and investments in education technology

Component Analysis

In 2023, the Solution segment held a dominant market position in the Learning Management System (LMS) market, capturing more than a 67% share. This dominance is largely attributable to the increasing demand for scalable and efficient e-learning platforms in educational and corporate settings.

Solutions in the LMS market primarily encompass a range of software platforms designed to create, manage, and deliver educational courses, training programs, or learning and development programs. The high adoption rate of these solutions is driven by their ability to provide flexible, accessible, and personalized learning experiences.

Furthermore, the growing emphasis on digital transformation in education and corporate training has significantly contributed to the expansion of the Solution segment. With the integration of advanced technologies such as AI, ML, and cloud computing, LMS solutions are becoming more sophisticated, offering enhanced functionalities like automated course recommendations, progress tracking, and data analytics. These features not only facilitate a more engaging learning experience but also enable institutions and organizations to monitor learner progress and efficacy of the training programs.

The increasing investment in R&D by key market players to innovate and improve LMS solutions further bolsters the segment’s growth. For instance, the integration of gamification and interactive content has made learning more engaging and effective, leading to higher adoption rates. Given these factors, the Solution segment’s significant market share reflects its crucial role in meeting the evolving demands of the digital learning landscape.

Deployment Type Analysis

In 2023, the Cloud-based segment in the Learning Management System (LMS) market held a dominant market position, capturing more than a 70% share. This significant market share is primarily due to the numerous advantages that cloud-based LMS solutions offer over traditional on-premises systems.

Key among these advantages is the flexibility and scalability that cloud-based solutions provide. They enable users to access learning materials from anywhere at any time, which is particularly valuable in today’s increasingly remote and mobile world.

Additionally, cloud-based LMS platforms are continually updated and upgraded by the providers, ensuring that users have access to the latest functionalities and security features without additional investment. This aspect of continuous improvement and hassle-free management further enhances their appeal.

The increasing adoption of cloud computing across various sectors, coupled with the growing emphasis on collaborative and interactive learning, has also played a crucial role in the cloud-based segment’s market dominance.

Pricing Model Analysis

In 2023, the Subscription-based segment held a dominant market position in the Learning Management System (LMS) market, capturing more than a 75% share. This leadership can be primarily attributed to the segment’s alignment with the evolving preferences of both educational institutions and corporate entities. Subscription-based models offer a level of flexibility and scalability that is highly valued in the rapidly changing educational and training landscapes.

The subscription model’s popularity is underpinned by its cost-effectiveness, especially for organizations seeking to minimize capital expenditure. Instead of a large upfront investment, as is typically required in a one-time license model, subscription-based LMS allows for a more manageable, ongoing operational expense. This approach is particularly appealing to small and medium-sized enterprises and educational institutions with limited budgets.

Moreover, the subscription-based model ensures that users always have access to the latest features and updates without additional costs. This continuous access to updated technology is crucial in an environment where educational methods and corporate training requirements are constantly evolving. It allows organizations to stay current with the latest educational technology trends without needing to invest in new software every few years.

Another key factor driving the dominance of the Subscription-based segment is the predictability in budgeting it offers. Organizations can plan their finances more effectively, knowing their LMS costs upfront. This predictability is particularly important for long-term strategic planning and resource allocation in education and training departments.

End-User Outlook

In 2023, the Higher Education segment held a dominant market position in the Learning Management System (LMS) market, capturing more than a 30% share. This leadership can be attributed to several key factors that align with the unique needs and evolving dynamics of higher education institutions.

Primarily, the increasing demand for digital learning tools in universities and colleges is a significant driver. Higher education institutions are rapidly adopting LMS to facilitate a seamless transition to blended and online learning models. This shift is in response to the growing preference for flexible learning options among students, as well as the need for institutions to expand their reach to a global student base.

Another factor contributing to the dominance of the Higher Education segment is the integration of advanced technologies in LMS platforms. These technologies, such as AI and analytics, are particularly beneficial for higher education institutions in terms of personalizing the learning experience and providing data-driven insights into student performance and engagement. This capability is crucial for educators in enhancing teaching methods and improving student outcomes.

Furthermore, the pressure on higher education institutions to improve operational efficiency while maintaining educational quality has led to a greater reliance on LMS solutions. These platforms streamline various administrative and academic processes, from enrollment and course management to assessment and certification, thereby reducing costs and increasing efficiency.

Additionally, the rise in research and collaborative projects in higher education necessitates robust platforms for knowledge sharing and management. LMS platforms facilitate this need by providing tools for collaboration, resource sharing, and communication, both within and between institutions.

Key Market Segments

Component

- Solution

- Services

Deployment Type

- Cloud-based

- On-premises

Pricing Model

- Subscription-based

- Pay-per-use

- One-time License

End-User

- K-12 Education

- Higher Education

- Corporate/Enterprise

- Government

- Healthcare

- Other End-Users

Driving Factors

Enterprises focusing more on human capital development

A prominent driver is the increasing focus of enterprises on human capital development. Organizations are recognizing the strategic importance of investing in their workforce’s skills and knowledge as a key competitive advantage. This shift is evident in the rising expenditures on employee training and development programs.

For instance, a report by Training Magazine in year 2019, the overall U.S. training expenditures, inclusive of payroll and investments in external products and services, contracted by 5.3% to $83 billion. Spending on external products and services reduced from $11 billion to $7.5 billion, and other training-related expenses, encompassing travel, facilities, and equipment, dropped to $23.8 billion from $29.6 billion. Concurrently, training payroll demonstrated a 10% surge, reaching $51.7 billion.

The increasing emphasis on employee development is further supported by government initiatives and policies. For instance, several countries have implemented workforce development programs, incentivizing businesses to invest in employee training. The European Union, for instance, through its European Social Fund, has allocated significant funds towards improving employment and promoting social inclusion, which includes funding for vocational training and lifelong learning.

Restraining Factors

Reluctance of enterprises to convert existing training content into micro-content

Many organizations have comprehensive training and development programs with extensive content, which presents a challenge when considering conversion into microcontent. Globally, there is a noticeable reluctance to invest heavily in this transformation, primarily due to the tedious and costly nature of the process. Converting detailed, traditional training material into shorter, focused microcontent is not only time-consuming but also complex, often requiring a significant restructuring of the existing content.

This complexity can lead to situations where it’s more feasible for organizations to create new training content from scratch to suit microlearning formats, rather than attempting to adapt what they already have. However, developing new content entails considerable expenses, not just in terms of financial outlay but also in resource allocation and time. The need for specialized skills to create effective microcontent adds another layer of challenge.

Therefore, while microlearning offers notable advantages in terms of learner engagement and retention, the practical difficulties and costs associated with transitioning to this format act as a substantial deterrent for many organizations. This hesitancy to embrace microlearning, despite its potential benefits, is a significant restraint in the broader adoption of Learning Management Systems in the market.

Moreover, many organizations face budgetary constraints, making the investment in content conversion seem less feasible, especially for small and medium-sized enterprises. According to a survey by Brandon Hall Group, 70% of companies cite limited budgets as a barrier to advancing their learning and development programs.

Opportunities

Incorporation of advanced technologies for a better training environment

The incorporation of advanced technologies in LMS offers significant opportunities for market growth. Technologies like Artificial Intelligence (AI), Machine Learning (ML), and Augmented Reality (AR) are revolutionizing the training environment, making it more interactive, engaging and personalized. The market is poised to benefit from these technological advancements, as evidenced by the projected growth in the AI in education market.

Government support for digital transformation in education also presents an opportunity for LMS providers. For example, the U.S. government’s Digital Literacy initiative aims to increase access to digital learning resources, thereby creating a favorable environment for LMS adoption. Similarly, the European Commission’s Digital Education Action Plan emphasizes the integration of technology in education, further supporting the market.

Challenges

Lack of LMS solutions with multi-language support

One of the key challenges in the LMS market is the lack of solutions with robust multi-language support. This limitation is particularly acute in the context of globalization, where enterprises often have a diverse, multilingual workforce. The need for multi-language support is not just a matter of convenience but also inclusivity, ensuring that all learners have access to training in their preferred language.

According to a survey conducted by Training Magazine, only 35% of training programs offered by multinational corporations are available in languages other than English. This gap highlights a significant area for improvement in LMS offerings. Government initiatives like the European Union’s multilingualism policy, which promotes language diversity, underscore the importance of this feature in educational and training tools.

Regional Analysis

In 2023, North America held a dominant market position in the Learning Management System (LMS) market, capturing more than a 37% share. This importance can be attributed to several key factors. Firstly, the region’s robust technological infrastructure and high internet penetration rates facilitate widespread adoption of digital learning platforms. The demand for Learning Management System in North America reached US$ 7.6 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

Additionally, North America’s substantial investment in education technology, particularly in the United States and Canada, has spurred the growth of LMS solutions. The presence of leading LMS providers in this region, who are continually innovating and expanding their offerings, also contributes significantly to market dominance.

Furthermore, the increasing demand for flexible, scalable, and personalized learning solutions in corporate and academic sectors drives the market’s expansion. North America’s corporate sector, in particular, shows a high adoption rate of LMS for employee training and development, a trend accelerated by the shift towards remote working environments. The region’s educational institutions, from K-12 to higher education, are integrating LMS to enhance the learning experience, offering a blend of synchronous and asynchronous learning.

Statistically, the market’s growth in this region is impressive. The compound annual growth rate (CAGR) is projected to maintain a robust trajectory over the next few years, underpinned by continuous technological advancements and the integration of emerging technologies like AI and cloud computing into LMS platforms. This growth is also supported by government initiatives promoting digital learning and the private sector’s increasing investment in employee skill development.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In response to evolving market demands, players in the Learning Management System (LMS) sector are increasingly focusing on the development of cloud-based learning content and the enhancement of cloud learning solutions. A key trend observed is the active integration of advanced technologies such as artificial intelligence, analytics and machine learning into existing LMS platforms, underscoring a shift towards more intelligent and adaptive learning environments.

A notable example of this trend is the strategic move by Docebo in January 2022. The company acquired Skillslive, an educational consulting agency renowned for combining professional services with cutting-edge learning technologies. This acquisition is a strategic step for Docebo, aimed at expanding its footprint in the Asia Pacific region, particularly in Australia.

It also aligns with the company’s objective to enhance its service offerings in these markets by leveraging direct customer feedback. This move underscores the broader industry trend where LMS providers are not only expanding geographically but also enriching their technology stack to meet the dynamic needs of global learners.

Some key players in the global learning management system market include,

- Adobe Inc.

- Blackboard Inc.

- Moodle Pty Ltd.

- Cornerstone OnDemand Inc.

- D2L Corporation

- SAP SE

- Instructure Inc. (Canvas)

- IBM Corporation

- Oracle Corporation

- Schoology (a subsidiary of PowerSchool)

- SumTotal Systems LLC (Skillsoft)

- Talentsoft Group

- Other Key Players

Recent Developments

- In February 2023, GSoft a software company announced its acquisition of Didacte, a Quebec City-based company. Didacte specializes in offering a corporate learning management system that efficiently facilitates and enhances professional development initiatives. This strategic acquisition is in harmony with GSoft’s overarching mission to create innovative products that streamline processes, foster kindness, and expedite work, reinforcing their standing as an industry leader.

- In November 2022, The D2L Brightspace Creator+ package was launched by D2L Corporation. Offering integrated workflows within Brightspace, this package enables users to efficiently create engaging digital course content, resulting in substantial time, effort, and cost savings for course creators.

Investments

- Docebo raised $115 million in an IPO on the Nasdaq stock exchange. This move gave the company increased financial flexibility and boosted its visibility in the LMS market.

Innovations

- Several LMS providers like SAP Litmos and Absorb LMS focused on developing AI-powered personalization features to tailor learning experiences to individual learners’ needs and preferences.

- The trend of microlearning (short, focused learning modules) and gamification continued to gain traction, with LMS providers like Totara Learn and iSpring integrating these features into their platforms.

Acquisitions and Mergers

- Thoma Bravo completed its acquisition of Coupa Software for $8.0 billion. This move brought together a leading cloud-based business spend management platform with an established LMS provider.

- Skillsoft acquired SumTotal Systems for $583 million, forming a leading provider of comprehensive learning and talent management solutions for enterprises.

- Blackboard Inc. acquired EdX for an undisclosed amount, expanding its reach into the higher education market with EdX’s open-source LMS platform.

Report Scope

Report Features Description Market Value (2023) US$ 20.8 Bn Forecast Revenue (2033) US$ 107.9 Bn CAGR (2024-2033) 17.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), Deployment Type (Cloud-based, On-premises), Pricing Model (Subscription-based, Pay-per-use, One-time License), By End-User (K-12 Education, Higher Education, Corporate/Enterprise, Government, Healthcare, Other End-Users), Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adobe Inc., Blackboard Inc., Moodle Pty Ltd., Cornerstone OnDemand Inc., D2L Corporation, SAP SE, Instructure Inc. (Canvas), IBM Corporation, Oracle Corporation, Schoology (a subsidiary of PowerSchool), SumTotal Systems LLC (Skillsoft), Talentsoft Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Learning Management System (LMS)?An LMS is a software application designed to manage, deliver, and track educational content and training programs.

How big is the learning management system market?The Global Learning Management System Market is likely to jump from USD 24.5 Billion in 2024 to USD 107.9 Billion by 2033. This projected expansion is anticipated to result from an average 17.9% CAGR in the demand for the Learning Management System (LMS) over the upcoming decade.

Which region accounted for the highest share in the learning management system market?North America dominated the learning management system market with a share of 37% in 2023.

Who are the key players in learning management system market?Some key players operating in the learning management system market include Adobe Inc., Blackboard Inc., Moodle Pty Ltd., Cornerstone OnDemand Inc., D2L Corporation, SAP SE, Instructure Inc. (Canvas), IBM Corporation, Oracle Corporation, Schoology (a subsidiary of PowerSchool), SumTotal Systems LLC (Skillsoft), Talentsoft Group, Other Key Players

What are the key features of a Learning Management System?Common features include course management, user management, content creation, tracking and reporting, and collaboration tools.

Learning Management System MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Learning Management System MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Blackboard Inc.

- Moodle Pty Ltd.

- Cornerstone OnDemand Inc.

- D2L Corporation

- SAP SE

- Instructure Inc. (Canvas)

- IBM Corporation

- Oracle Corporation

- Schoology (a subsidiary of PowerSchool)

- SumTotal Systems LLC (Skillsoft)

- Talentsoft Group

- Other Key Players