Global Horse Riding Equipment Market By Type (Helmets, Vests, Stirrup, Saddle, Halters, Other Types), By Material Type (Wooden, Metal, Plastic, Leather, Other Material Types), By Equipment Type (Equine Equipment, Rider Equipment), By Consumer Orientation (Male, Female, Kids), By Sales Channel (Sports Retail Chain, Hypermarket and Supermarket, Independent Sports, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2024

- Report ID: 24307

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factors

- Restraining Factors

- By Type Analysis

- By Material Type Analysis

- By Equipment Type Analysis

- By Consumer Orientation Analysis

- By Sales Channel Analysis

- Key Market Segments

- Growth Opportunities

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

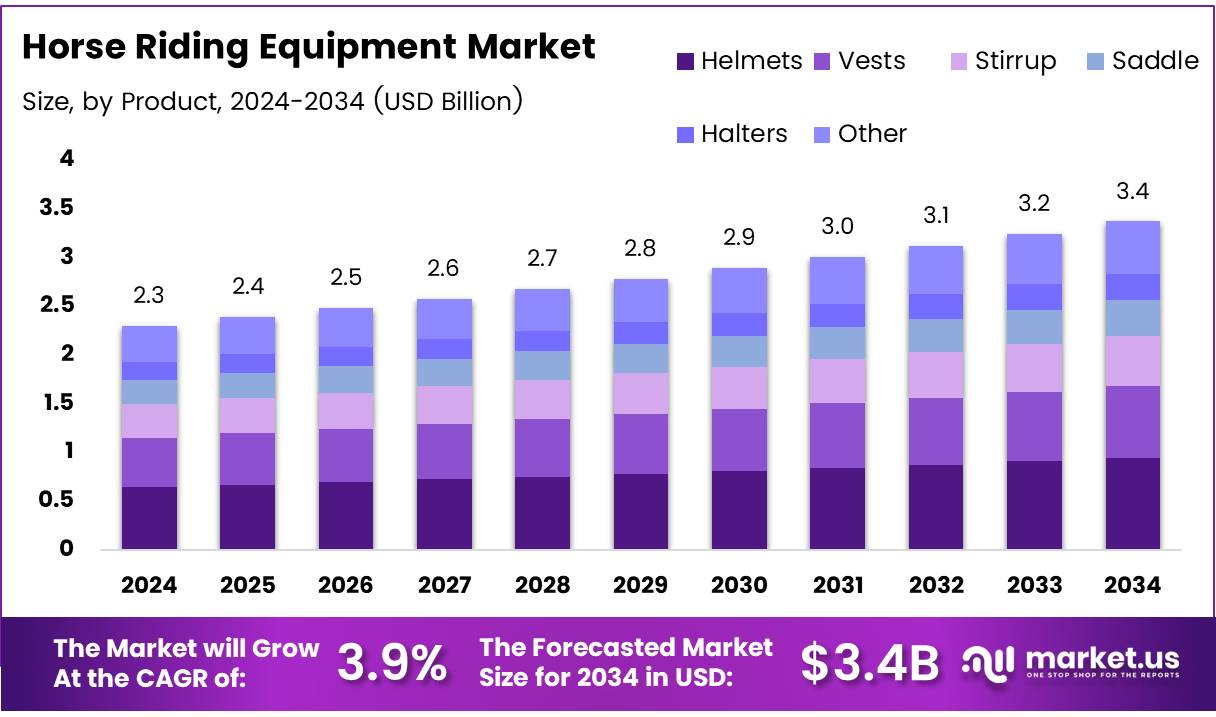

The Global Horse Riding Equipment Market size is expected to be worth around USD 3.4 Billion by 2034, From USD 2.3 Billion by 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

The Horse Riding Equipment Market encompasses a comprehensive range of products designed to cater to the various needs of equestrian sports and recreational riding. This market segment is characterized by the production and distribution of saddles, bridles, riding apparel, protective gear, and grooming supplies, among other essential items. Key stakeholders, including manufacturers, distributors, and retailers, play pivotal roles in the market’s dynamics, influencing trends, innovation, and product quality.

The growth of this market can be attributed to rising interest in equestrian activities, increasing disposable incomes, and the emphasis on safety and comfort for both riders and horses. Executives and product managers within this industry focus on leveraging technological advancements, understanding consumer preferences, and navigating regulatory landscapes to sustain growth and meet the evolving demands of the equestrian community.

The horse riding equipment market is experiencing a notable phase of evolution, marked by consumer preferences shifting towards more sophisticated and technologically advanced products. The segment of equestrian gloves, in particular, highlights this trend, having secured a substantial share of the market in 2022. This segment alone accounted for more than 26.9% of the market, a figure that underscores its significance within the broader industry landscape.

The increase in traction for equestrian gloves can be attributed to several factors, primarily the advancements in materials and design that significantly enhance the functionality and comfort of these products.

These technological enhancements not only cater to the increasing demands for quality and performance from consumers but also reflect the industry’s response to the growing emphasis on safety and durability in horse riding equipment.

The market’s trajectory suggests a continued focus on innovation, with manufacturers investing in research and development to introduce products that meet the evolving needs of riders. This dynamic is expected to drive further growth in the horse-riding equipment market, as consumers seek products that offer superior performance, safety, and comfort.

Key Takeaways

- Horse Riding Equipment Market size is expected to be worth around USD 3.2 Billion by 2034, From USD 2.2 Billion by 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

- The horse riding equipment market sees Europe leading with a 39% share in regional analysis.

- Helmets dominate with a 26% market share in the protective gear segment.

- Leather materials command a 30% market share in equipment production materials.

- Rider equipment leads the market, holding a significant 52% equipment share.

- Male consumers represent the largest segment, with a 54% market share.

- Sports retail chains are the leading sales channel, securing a 36% share.

Driving Factors

Increasing Popularity of Equestrian Sports and Recreational Activities

The growth of the horse riding equipment market is significantly driven by the increasing popularity of equestrian sports and recreational activities. This surge in interest can be attributed to the global recognition of horse riding as a prestigious and elite virtual sport, alongside its inclusion in numerous international competitions and events such as the Olympics.

The expanding base of equestrian enthusiasts, ranging from amateurs to professional athletes, necessitates a wide array of riding equipment, thus bolstering market expansion. Additionally, horse riding is increasingly perceived as a beneficial recreational activity, promoting physical health and psychological well-being, which further amplifies consumer demand for riding gear and accessories.

Advancements in Technology Leading to Improved Product Functionality and Safety

Technological advancements play a pivotal role in enhancing the functionality and safety of horse-riding equipment, thereby fueling market growth. Innovations in materials and design have led to the development of lighter, more durable, and comfortable equipment, improving the riding experience and performance.

Safety gear such as helmets, protective vests, and boots has seen significant improvements, incorporating materials that offer better shock absorption and protection against falls, which is crucial for both riders and their families.

Smart technologies, including wearable devices for horses that monitor health and performance, also contribute to this trend. These advancements not only cater to the demand for high-quality equipment but also elevate safety standards within the sport, encouraging wider participation and investment in horse riding activities.

Restraining Factors

High Cost of Premium Horse Riding Equipment

The premium segment of horse riding equipment is characterized by high-quality materials, superior craftsmanship, and advanced features, which in turn reflect in their pricing. This high cost can significantly limit the market’s growth by restricting the consumer base primarily to affluent individuals and professional riders.

The economic barrier created by premium pricing strategies not only narrows the potential customer base but also influences the overall perception of horse riding as an excessively expensive sport, potentially deterring new entrants to the market.

In regions where disposable income is lower, the impact is more pronounced, leading to reduced sales volume and slower market growth. Without specific statistics, it’s clear that the affordability factor plays a critical role in the consumer decision-making process, affecting market expansion and brand accessibility.

Limited Accessibility and Availability of Advanced Products in Emerging Markets

Emerging markets often face challenges related to the distribution and availability of advanced horse-riding equipment. This is partly due to the limited presence of established retail networks and a lack of awareness among potential consumers.

Furthermore, the import restrictions, high tariffs, and logistical challenges prevalent in these markets exacerbate the situation, making it difficult for manufacturers and suppliers to efficiently penetrate these regions.

This limited accessibility results in a significant untapped market, where demand exists but cannot be effectively met. The combined effect of these factors is a substantial restraint on the growth of the global horse-riding equipment market, as it hinders the ability of brands to expand their reach and limits potential revenue streams from rapidly growing economies.

By Type Analysis

Helmets hold a 26% market share, indicating a significant demand within the protective gear sector.

In 2023, the Horse Riding Equipment Market witnessed a significant hierarchy in the By Type segment, with Helmets leading the forefront. Helmets secured a dominant market position, capturing more than a 26% share. This prominence can be attributed to the increasing awareness regarding safety measures among equestrians and stringent regulations mandating the use of helmets.

Following Helmets, the segments of Vests, Stirrups, Saddles, Halters, and Other Types contributed to the market composition, each playing a vital role in addressing the diverse needs of horse riders.

Vests, designed to offer protection and comfort, have gained traction due to rising concerns over rider safety, particularly in eventing and cross-country disciplines. Stirrups, essential for maintaining balance and control, have evolved with technology to enhance safety and performance.

Saddles, integral for rider-horse communication, have seen innovations aimed at improving comfort and fit, thus influencing their market share. Halters, crucial for handling and training, remain indispensable, reflecting steady demand.

The Other Types category encapsulates a variety of equipment including bridles, reins, and grooming tools, underscoring the comprehensive nature of horse riding as a discipline. This segment caters to the nuanced needs of the equestrian community, highlighting the market’s adaptability and expansion potential.

By Material Type Analysis

Leather materials command a 30% market share, showcasing their enduring appeal in manufacturing quality equipment.

In 2023, the Horse Riding Equipment Market was segmented by material type into five key categories: Wooden, Metal, Plastic, Leather, and Other Material Types. Among these, Leather held a dominant market position, capturing more than a 30% share. This prominence can be attributed to leather’s durability, comfort, and traditional appeal, making it a preferred choice for high-quality saddles, bridles, and other riding accessories.

The metal segment, known for its strength and durability, also played a significant role in the market, particularly in the construction of bits, stirrups, and spurs. Plastic, valued for its affordability and versatility, catered primarily to the entry-level market, offering a wide range of products from grooming tools to riding equipment. Wooden materials, though less prevalent, found their niche in the manufacturing of brushes, training aids, and decorative items.

Other Material Types, encompassing a variety of innovative and alternative materials, showed a growing trend. This segment benefits from the increasing demand for sustainable and animal-friendly products, highlighting a shift towards ethical consumerism within the equestrian community.

By Equipment Type Analysis

Rider Equipment, with a 52% market share, dominates the segment, reflecting its critical importance for safety.

In 2023, within the Horse Riding Equipment Market, the segmentation by equipment type revealed significant disparities in market share and growth dynamics, with Rider Equipment and Equine Equipment emerging as primary categories.

Rider Equipment held a dominant market position in the By Equipment Type segment, capturing more than a 52% share. This considerable proportion underscores the segment’s pivotal role in the overall market landscape, highlighting consumer preferences and purchasing trends that prioritize rider safety, comfort, and performance.

Equine Equipment, while essential for the well-being and performance of the horse, accounted for the remainder of the market share. The difference in market share distribution between the Equine and Rider Equipment segments can be attributed to several factors, including the higher unit costs associated with Rider Equipment due to the incorporation of advanced materials and technologies designed to enhance rider safety and comfort.

Additionally, the growing awareness and emphasis on rider safety, coupled with regulatory and standardization measures, have further propelled the demand for high-quality Rider Equipment.

The robust position of Rider Equipment within the market is also reflective of evolving consumer behaviors and preferences, with riders increasingly seeking gear that combines functionality with aesthetic appeal. This trend has prompted manufacturers to innovate and diversify their product offerings, incorporating new materials, designs, and technologies that cater to the sophisticated demands of modern equestrians.

By Consumer Orientation Analysis

Male consumers represent 54% of the market, highlighting a predominant orientation towards male-specific equipment needs.

In 2023, the Horse Riding Equipment Market was characterized by a distinct segmentation based on Consumer Orientation, with the following market shares: Male, Female, and Kids.

Male consumers held a dominant market position, capturing more than a 54% share. This significant portion underscores the prevailing demand and preference trends within the market, particularly amongst male riders. The substantial market share held by males can be attributed to various factors, including higher participation rates in equestrian sports and a strong inclination towards professional riding.

On the other hand, the Female segment also represented a considerable portion of the market, reflecting the growing engagement of women in horse riding activities, both at amateur and professional levels. This segment’s growth is propelled by increasing recognition of the sport’s inclusivity and the expanding availability of tailored equipment catering to female riders.

The Kids segment, while smaller in comparison, is notable for its growth potential. It highlights the burgeoning interest among younger demographics in horse riding as a sport and recreational activity. The development of specialized equipment designed for children is anticipated to drive the segment’s expansion, fostering a new generation of equestrians.

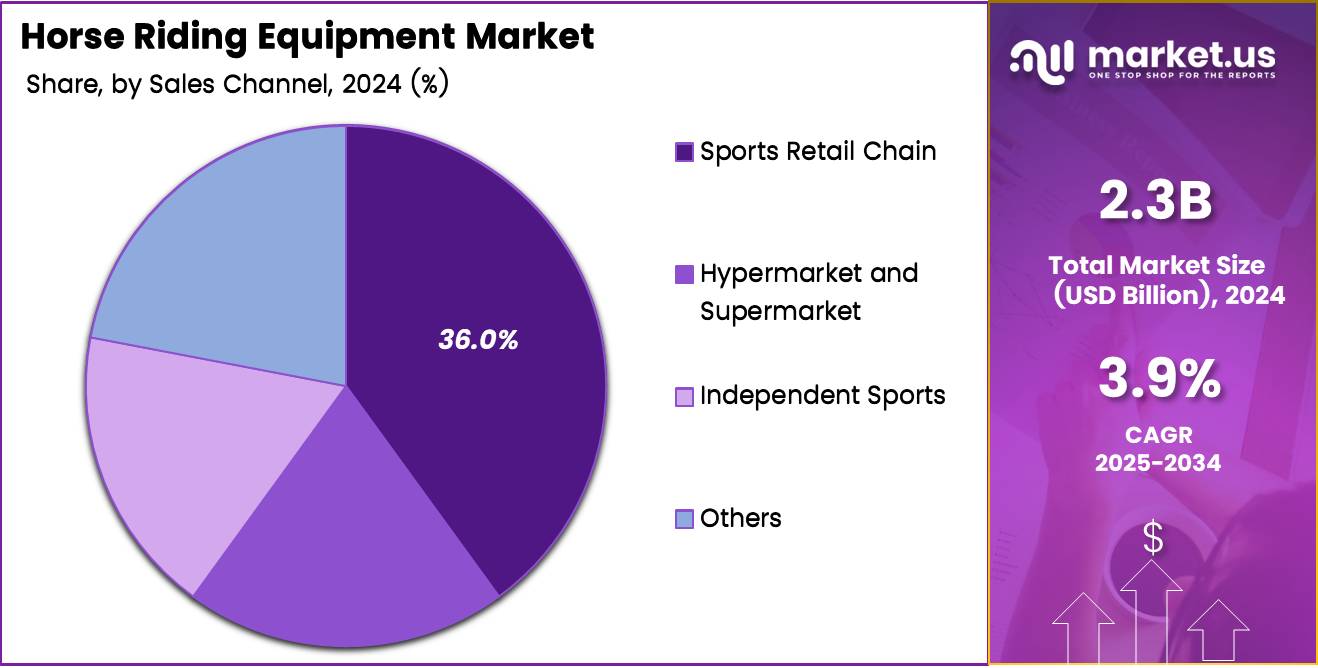

By Sales Channel Analysis

Sports Retail Chains, with a 36% market share, are pivotal in distributing equipment to the consumer base.

In 2023, the Horse Riding Equipment Market witnessed a notable distribution of market shares across various sales channels. Among them, Sports Retail emerged as the predominant force within the By by-sales channel segment, securing an impressive share of over 36%.

This segment outperformed other channels such as Hypermarkets and Supermarkets, Independent Sports Outlets, and Other sales channels, highlighting the consumer preference for specialized retail experiences that offer tailored product ranges and expert advice.

The Hypermarket and Supermarket channel, known for its convenience and accessibility, also played a significant role in the distribution landscape, albeit with a smaller market share. This channel benefits from high foot traffic and the ability to offer horse-riding equipment alongside a broad range of consumer goods.

Independent Sports Outlets, characterized by their localized service and niche market expertise, catered to a dedicated segment of equestrian enthusiasts. Their market presence underscores the value placed on personalized customer service and specialized product knowledge.

Sports Retail Chains, with their extensive network and brand recognition, have capitalized on consumer trust and the convenience of multiple locations. This channel’s significant market share is indicative of its successful strategy in offering a wide array of horse riding equipment and apparel, catering to both amateur and professional riders.

Lastly, the ‘Others’ category, encompassing online retailers and direct manufacturer sales, has also contributed to the market dynamics, offering alternative purchasing channels that emphasize convenience and competitive pricing.

Key Market Segments

By Type

- Helmets

- Vests

- Stirrup

- Saddle

- Halters

- Other Types

By Material Type

- Wooden

- Metal

- Plastic

- Leather

- Other Material Types

By Equipment Type

- Equine Equipment

- Rider Equipment

By Consumer Orientation

- Male

- Female

- Kids

By Sales Channel

- Sports Retail Chain

- Hypermarket and Supermarket

- Independent Sports

- Others

Growth Opportunities

E-commerce and Digitalization

The digital transformation has significantly impacted consumer behavior, leading to increased online shopping for convenience and variety. The global horse-riding equipment market can leverage this shift by expanding its presence on e-commerce platforms.

Enhanced online visibility and digital marketing strategies can attract a broader customer base, including novice riders and equestrian enthusiasts from regions with underdeveloped retail sectors.

Implementing virtual reality (VR) and augmented reality (AR) tools to offer virtual try-ons and equipment simulations could further enhance the customer experience, driving engagement and sales.

Sustainability and Ethical Practices

Growing awareness and concern for environmental sustainability and animal welfare have influenced consumer preferences across industries. In the horse riding equipment market, there is a rising demand for products made from sustainable materials and those certified for ethical production practices.

Manufacturers and retailers that prioritize eco-friendly materials, ethical sourcing, and transparency in their supply chain can distinguish themselves in the market. Additionally, products designed for durability and reparability cater to the increasing consumer preference for sustainable and ethical consumption, potentially commanding higher price points and customer loyalty.

Latest Trends

Sustainable and Ethically Sourced Materials

The global horse riding equipment market has witnessed a significant shift towards sustainability and ethical sourcing of materials. The growing awareness and concern over environmental impact and animal welfare have driven manufacturers to adopt eco-friendly and cruelty-free materials in their products. This trend not only aligns with the global movement toward sustainability but also caters to the increasing demand from consumers who prioritize ethical considerations in their purchasing decisions.

Technological Integration in Riding Equipment

Another prominent trend is the integration of technology into horse riding equipment. Advanced technologies such as GPS tracking, biometric sensors, and smart textiles are being incorporated to enhance the safety, performance, and comfort of both riders and horses. These innovations offer real-time data and insights, allowing for a more informed and responsive riding experience. The adoption of such technologies reflects the market’s shift towards data-driven and performance-oriented products.

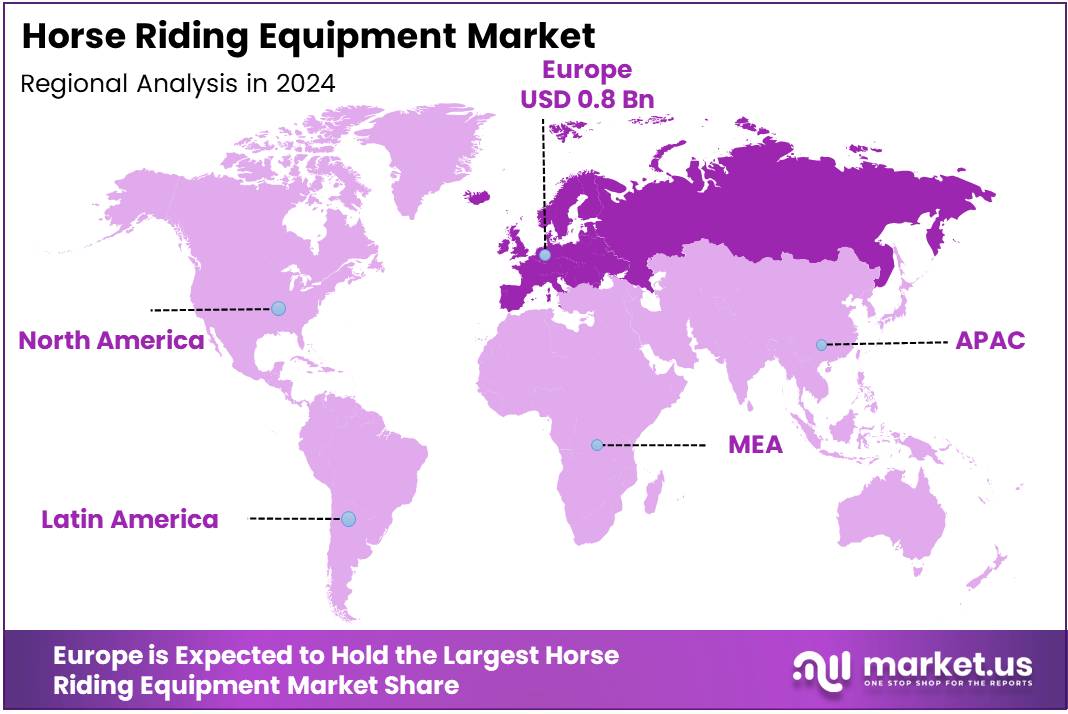

Regional Analysis

Europe dominates the horse riding equipment market with a 39% share.

Europe emerges as the dominating region, accounting for approximately 39% of the global market share. This prominence can be attributed to the rich equestrian history and the strong presence of leading horse-riding equipment manufacturers.

Countries like the United Kingdom, Germany, and France are pivotal, with their longstanding equestrian traditions fostering a sizable demand for advanced riding apparel and accessories. The European market is also supported by active equestrian communities and a high level of participation in professional sports.

In North America, the market benefits from a robust equestrian culture, with the United States leading in terms of consumer spending and innovation in horse riding gear. This region’s market is bolstered by the widespread participation in horse racing, show jumping, and other equestrian events, driving demand for high-quality equipment.

The Asia Pacific region is witnessing rapid growth, driven by increasing interest in equestrian sports and rising disposable incomes. Countries such as China and Australia are experiencing a surge in demand for horse riding equipment, facilitated by the growing middle class and the expansion of equestrian clubs and facilities.

The Middle East & Africa, though smaller in comparison, show growth potential, particularly in the Gulf countries, where horse racing and endurance riding have a significant following. Latin America, with countries like Brazil and Argentina, also contributes to the market, leveraging their strong horse culture and participation in rodeos and traditional horseback activities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global Horse Riding Equipment market in 2023, a dynamic array of key companies has significantly influenced the industry’s landscape, each bringing unique contributions to meet the diverse demands of equestrians worldwide.

Colonial Saddlery, with its rich heritage in crafting bespoke saddlery, has continued to cater to the premium segment, emphasizing quality and customization. The company’s adherence to traditional craftsmanship, combined with innovative design, has solidified its position as a preferred choice among discerning riders.

Dainese, primarily recognized for its prowess in safety and protective gear, has extended its innovative approach to equestrian apparel, offering products that blend safety, comfort, and style. This strategic focus on rider safety has positioned Dainese as a go-to brand for riders prioritizing protection without compromising on aesthetic appeal.

Georg Kieffer Sattlerwarenfabrik GmbH stands out for its commitment to precision and ergonomic design in saddle manufacturing. The company’s dedication to enhancing rider and horse comfort through scientific research has earned it accolades in the competitive dressage and show jumping circuits.

Decathlon, known for its broad reach in sports equipment, has made significant inroads into the equestrian market by offering affordable, quality horse riding gear. Its ability to democratize access to horse riding equipment has expanded the market, attracting new entrants to the sport.

Cavallo GmbH and Antares Sellier have both sustained their reputations through high-quality footwear and saddlery, respectively. Their focus on innovation and ergonomic design continues to set industry standards for comfort and performance.

Fabtron Inc. and Mountain Horse have carved niches in the Western riding and outdoor equestrian apparel segments. Their products resonate with riders seeking durability and weather resilience, underlining the importance of specialized equipment in enhancing the riding experience.

HKM Sports Equipment, Charlie1Horse, and Resistol have each contributed to the market’s diversity with their distinct product ranges, from technical gear to fashionable riding wear and hats, addressing the varied stylistic and functional requirements of the equestrian community.

Market Key Players

- Colonial Saddlery

- Dainese

- Georg Kieffer Sattlerwarenfabrik GmbH

- Decathlon

- Cavallo GmbH

- Antares Sellier

- Fabtron Inc.

- Mountain Horse

- HKM Sports Equipment

- Charlie1Horse

- Resistol

Recent Development

- In March 2024, Evoke, an equestrian brand, launched innovative helmets and a replacement scheme after a £3m investment, aiming to enhance rider safety and style with technology-driven designs.

- In December 2023, Scotland’s Rural College (SRUC) introduced RoboCob, a £100,000 robotic horse developed with Racewood Equestrian Simulators, enhancing equestrian education by simulating advanced riding techniques and providing dynamic feedback.

- In October 2023, Swish Equestrian pioneers sustainability and tech integration in equestrian gear. Their latest offerings focus on eco-friendly products, smart saddles, and personalized gear, reflecting modern trends while honoring tradition.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 3.2 Billion CAGR (2025-2034) 3.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Helmets, Vests, Stirrup, Saddle, Halters, Other Types), By Material Type(Wooden, Metal, Plastic, Leather, Other Material Types), By Equipment Type(Equine Equipment, Rider Equipment), By Consumer Orientation(Male, Female, Kids), By Sales Channel(Hypermarket and Supermarket, Independent Sports, Sports Retail Chain, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Colonial Saddlery, Dainese, Georg Kieffer Sattlerwarenfabrik GmbH, Decathlon, Cavallo GmbH, Antares Sellier, Fabtron Inc., Mountain Horse, HKM Sports Equipment, Charlie1Horse, Resistol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Horse Riding Equipment Market in 2023?The Horse Riding Equipment Market size is USD 2.2 Billion in 2023.

What is the projected CAGR at which the Horse Riding Equipment Market is expected to grow at?The Horse Riding Equipment Market is expected to grow at a CAGR of 3.80% (2024-2033).

List the segments encompassed in this report on the Horse Riding Equipment Market?Market.US has segmented the Horse Riding Equipment Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Helmets, Vests, Stirrup, Saddle, Halters, Other Types), By Material Type(Wooden, Metal, Plastic, Leather, Other Material Types), By Equipment Type(Equine Equipment, Rider Equipment), By Consumer Orientation(Male, Female, Kids), By Sales Channel(Sports Retail Chain, Hypermarket and Supermarket, Independent Sports, Others)

List the key industry players of the Horse Riding Equipment Market?Colonial Saddlery, Dainese, Georg Kieffer Sattlerwarenfabrik GmbH, Decathlon, Cavallo GmbH, Antares Sellier, Fabtron Inc., Mountain Horse, HKM Sports Equipment, Charlie1Horse, Resistol

Name the key areas of business for Horse Riding Equipment Market?The Germany, France, The UK, Spain, Italy, Rest of Western Europe, Russia, Poland, Rest of Eastern Europe are leading key areas of operation for Horse Riding Equipment Market. Horse Riding Equipment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Horse Riding Equipment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Colonial Saddlery

- Dainese

- Georg Kieffer Sattlerwarenfabrik GmbH

- Decathlon

- Cavallo GmbH

- Antares Sellier

- Fabtron Inc.

- Mountain Horse

- HKM Sports Equipment

- Charlie1Horse

- Resistol