Global Home Infusion Therapy Market By Product Type (Infusion Pumps, Intravenous Sets, IV Cannulas, Needleless Connectors), By Application (Anti-Infective, Endocrinology, Hydration Therapy, Chemotherapy, Enteral Nutrition, Parenteral Nutrition, Specialty Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116600

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

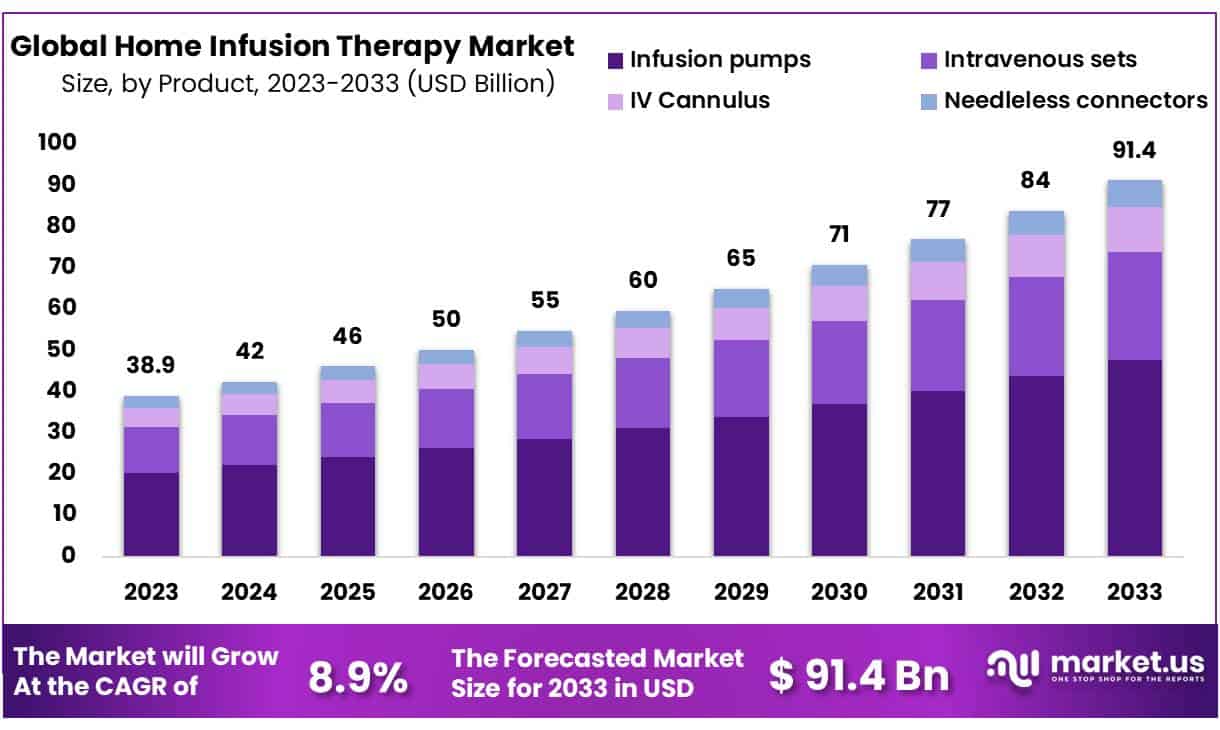

The global Home Infusion Therapy Market was valued at the USD 38.9 Billion in 2023 and is projected to reach substantial growth of the USD 91.4 Billion by 2033, with a 8.9% CAGR.

A specialized treatment involving administration of medications such as antivirals or immunological globin, fluids, or nutrients intravenously to patients at the comfort of their homes aided by various equipments such as pumps, catheters, and vials is known as home infusion therapy market. The patients dealing with infections, malignancies, or chronic illnesses such as rheumatoid arthritis and multiple scherosis is advised with home infusion therapy for its long term effect. The therapy is mostly employed to treat oncological problems, gastrointestinal issues and diabetes as is it effective in chemotherapy and hydration, pain management and is anti-infective.

The market for home infusion therapy is majorly thriven by rising incidences of chronic diseases such as autoimmune disorders, infectious diseases, and cancer requiring long-term drug treatment. The rising cases of these diseases demands for home infusion therapies, being more efficient and accessible for patients and healthcare providers, with the advances in technology such as electronic health records and creation of portable infusion pumps.

- According to Canadian Cancer Society, approximately 226,700 new cancer cases diagnosed in 2022, with an estimated 84,100 cancer fatalities in Canada.

Key Takeaways

- Based in product, infusion pumps segment acquired a remarkable market share of 52.3% in the year 2023.

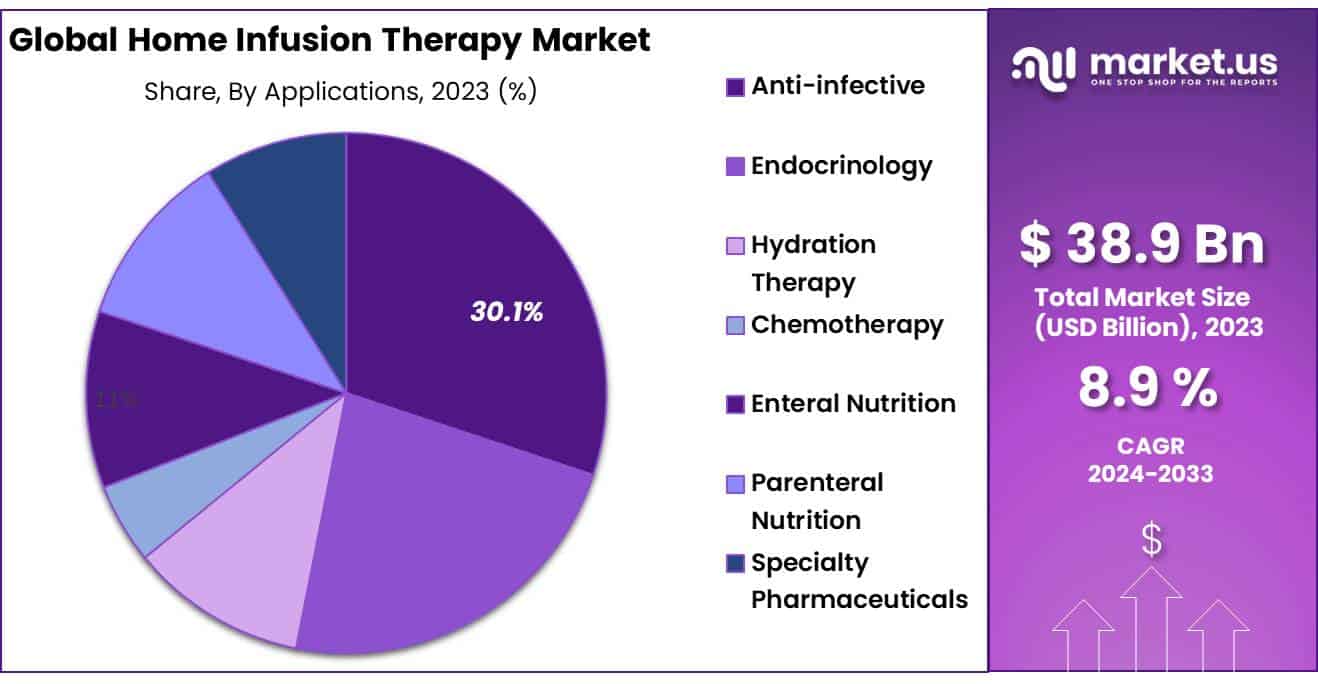

- A prominent market revenue share of 30.1% is withheld by anti-infective segment

- Based on Application, owing to considerable number of procedures performed for administration of antifungal and antibiotic drugs, anti-infective segment accounted a major market portion of home infusion therapy market.

- Rising prevalence of chronic illness such as cancer, diabetes and osteoarthritis thrives the market for home infusion therapy market.

- Limited availability of skilled healthcare professional limits tha market growth.

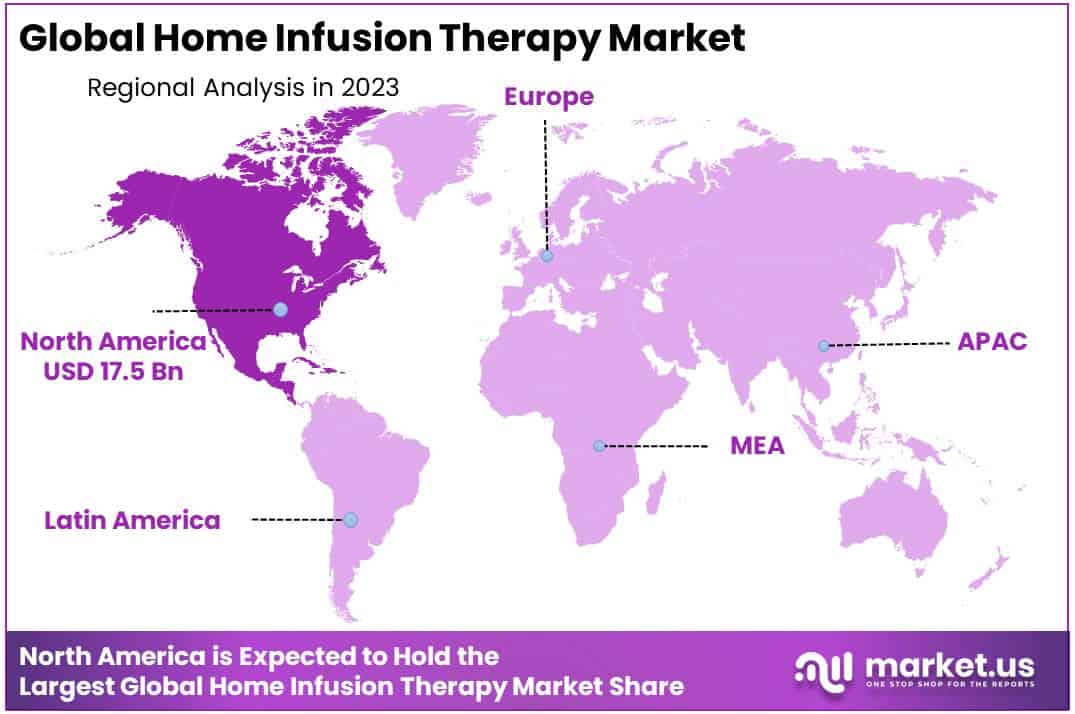

- North America dominates 45.2% market share the global home infusion therapy market in the year 2023.

By Product Analysis

Infusion pumps are widely utilized across the globe

Based on product, the market is broadly categorized into Infusion Pumps, Intravenous Sets, IV Cannulas and Needleless Connectors segments. Infusion pump segment accounted an impressive market share of 52.3%, dominating the global home infusion therapy market in the year 2023. Being exclusively used in healthcare facilities, infusion pumps are now widely adopted for outpatient settings owing to the design of pumps controlling delivery of fluids, nutrients and medications. The infusion pumps results in preciseness, thereby reducing medication errors, for instance, smart pumps comprising barcode technology, enhances patient identity verification, thus minimizing administration errors.

In addition to the aforementioned benefits, the pumps also provide alerts to healthcare professionals regarding inappropriate dosage selection. The market for home infusion therapy is expected to robustly amplify with the advent of advanced infusion pumps, such as CADD-Solis ambulatory infusion pumps by Smiths Medical.

On the flip side, highest CAGR is expected by needle connectors segment during the prophecy period owing to its small sized devices used in intravenous systems to minimize needle stick injuries. This prevents contamination caused by bacterias combined with safety improvisation.

By Application Analysis

Anti-infective segment is a major leader in 2023

With repsect to applications, the market is bifurcated into Anti-Infective, Endocrinology, Hydration Therapy, Chemotherapy, Enteral Nutrition, Parenteral Nutrition, Specialty Pharmaceuticals and other segments. A prominent market revenue share of 30.1% is withheld by anti-infective segment. The segment being highly preferred is ascribed to the considerable number of procedures perfomed for the administration of antifungal and antibiotic drugs. In addition to this, anti-infective segment also minimize exposure to patients with other hospital-acquired infections.

- According to World Health Organization data in Global Tuberculosis report 2021, majority of tuberculosis cases were discovered in the WHO region of South-East Asia(43%), Africa(25%), and the Western Pacific(18%).

- According to WHO data published in 2021, approximately 95% of all malaria infections occurring in Sub-Saharan Africa is likely to continue to experience a heavy burden from the disease.

On the other hand, owing to the accelerating cases of cancer, chemotherapy segment is anticipated to be the fastest growing segment during the prophecy period. The infusion pumps used for chemotherapies at home are compact with no battery usage, administering medications at appropriate infusion speed and in accurate quantities.

Key Market Segments

By Product

- Infusion Pumps

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

By Applications

- Anti-Infective

- Endocrinology

- Hydration Therapy

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Other

Market Drivers

Rising prevalence of chronic illnesses

The rising pervasiveness of chronic illnesses is the major factor thriving the market growth in recent years. The chronic illnesses such as osteoarthritis, Human Immunodeficiency Virus(HIV), diabetes and cancer are forming the drivers of global home infusion pump market. Simultaneously, the growing elderly population more prone to such life-threatening disorders necessitates regular medical attention such as infusion therapy, which is optimistically bolstering the market reach.

Infusion therapy, comprising significant components like IV therapy and IV hydration therapy plays a crucial role in addressing critical conditions such as congestive heart failure, immune deficiencies and cancer. The integration of IV therapy and IV hydration therapy drives the market, enabling enhanced accessesibility to effective and personalized medical solutions at comfort of their homes.

Cost effective treatments and enhanced outcomes observed in patients boost the market expansion. An ultimatum for home infusion therapy up scale with increasing demographic of baby boomers struggling with curtailing mobility due to conditions such as osteoarthritis and paralysis. In addition to this, the emergence of continuous subcutaneous apomorphine infusion acts as an exceptional effective treatment for Parkinson’s Disease. The demand for subcutaneous infusion therapy escalates with the mounting burden of Parkinsons’ Disease.

- According to Parkinson’s Foundation’s 2022 data update, an estimated 90,000 people receive a PD diagnosis annually in United States. Furthermore, in U.S. an expected number of people living with PD is projected to elevate to nearly 1.2 million by 2030.

Restraints

Limited recognition and education

The market for home infusion therapy encounters vital barriers constraining the market growth. One of the primary factor comprise of limited recognition and education regarding home infusion therapies and its related benefits. In order to up scale awareness and acceptance of home based services, education campaigns and outreach efforts are required to bolster the market back to a good reach.

Regulatory Hurdles

The healthcare professionals providing home infusion services are impeded by stringent regulations and licensing requirements creating barriers towards market expansion. Complying with strict regulatory frameworks further enhances the operational costs, as the products are recalled several times while inspection through regulatory agencies. This slows down the procedure resulting in late launch of products in the market, thereby restricting the entry of new entrants into the market climate.

Infrastructure Limitations

The home infusion therapy market is constrained with poor healthcare infrastructures in rural areas. Improved healthcare infrastructure is required for proper setup of desired facilities and resources to support home infusion therapy programs. In addition to this, the market encompass dearth of skilled healthcare professionals, inadequate telecommunications infrastructure and challenges in transportation, which further limits the market to adopt advanced home infusion therapies for effective treatments.

Opportunities

Technological advancements offers wealthy opportunities for the market growth

The increasing pervasiveness of hospital acquired infections due to prolonged exposure to contaminated equipment, bed linens, and air droplets is fostering the market growth. In addition, creative advancements in technology such as developing portable, light-weight and simple to use infusion pumps outfitted with advanced drip systems provides precise and real time monitoring of IV treatments. This creates lucrative opportunities for industry players operating in creation of such advanced technologies, resulting into enhanced market growth.

- According to World Health Organization, out of every 100 patients in acute-care hospitals, 7-8 patients in high income countries and 16 patients in low and middle income countries will acquire at least one health care associated infection during their hospital stays. On an average, 1 in every 10 affected patients will die from hospital acquired infections.

Collaborational efforts leads to market expansion

Strategic collaborations among pharmaceutical companies, technology firms and healthcare providers contributes to the market expansion, ensuring an evolving approach to home-based infusion therapy. Mergers and acquisitions undertaken by major industry players also enhances the market reach. These efforts are incorporated to scale focus on increasing company’s products and services portfolio coupled with rising strategic importance of home infusion therapy.

- In March 2021, a company specializing in remote patient monitoring software and mobile apps, Terumo and Glooko, announced a technological integration to jointly provide new diabetes data solutions globally. This effort enabled the integration of data from Terumo’s diabetes care devices into Glooko’s diasend diabetes data management platform.

Impact of Macroeconomic factors

The market for home infusion therapy is greatly influenced by outbreak of pandemic or widespread health crises leading to short term and long term effects, which in turn, leads to changes in healthcare delivery models and escalated ultimatum for home-based care. Factors such as currency exchange rates, global economic conditions and international trade policies indirectly impact the home infusion market by affecting expense of equipment, pharmaceuticals and medical supplies.

In addition, fluctuations in interest rates impact both consumers and healthcare providers. The cost of financing for providers increases with the higher interest rates, potentially resulting into higher prices for home infusion therapy services. This in turn, reduce consumer spending on healthcare services.

Latest Trends

Anti-infective Treatment/Therapy: It is a type of home infusion therapy to stop periodontal infection by removing infectious biofilms and biofilm-retentive calculus using mechanical instrumentation to create a favourable ecology by eliminating deep pockets.

Short Peripheral IV: This is the most common IV access device that can be used up to three days. It is less than 3 inches in length and often is inserted into a superficial vein of the hand or forearm.

Regional Analysis

North America dominates the market

North America is at the forefront of global home infusion pump market in the year 2023. The region grabs a remarkable market share of 45.2%, owing to existence of factors such as increasing prevalence of chronic illnesses, advancing technologies, product launches and treatment costs. Various types of cancer such as bladder cancer, colorectal cancer, skin cancer and breast cancer are the most prevailing malignancies in the United States. The regions’ success is further highlighted due to minimal costs and ameliorated patient mobility leading to growing migration from acute care to home care settings.

- According to American Cancer Society update in 2021, approximately 1.9 million new cancer cases were held by United States alone.

Asia-Pacific is projected to register fastest CAGR during the prophecy period. The regions’ underscored significance owes to rising patient recognition regarding the benefits of home infusion therapy over in-hospital procedures coupled with rising pervasiveness of diabetes in the region. Furthermore, the escalating elderly population and rise in chronic illnesses in the region is anticipated to propel the market growth.

- According to Times of India, approximately 76.1 million people above 60 years are dealing with some chronic diseases in India, resulting into the adoption of home care services in the country.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Investments and mergers & acquisitions by key players are driving the global home infusion therapy market

The market is characterized by a highly competitive environment, with a selected few players holding a significant portion of the revenue. Companies are adopting stratergies like the introduction of new products and technological progress to maintain the competitive edge, and improved market penetration. are some of the market leaders in the global home infusion pump market. These companies are focusing on mergers and acquisitions, as well as investing in the development and distribution of portable infusion pumps.

Market Key Players

- Baxter International Inc.

- Contec Medical Systems, Co, Ltd

- Amsino International Inc.

- Lepu Medical Technology

- Terumo Corporation

- ICU Medical Inc

- Moog Inc.

- Option Care Health

- Smiths Medical

- JMC Co, ltd.

- Fresenius Kabi

Recent Development

- In June 2023: An American Healthcare business, Baxter International introduces Progressa+ Next Gen ICU bed to fulfil patients’ essential needs at home.

- In May 2023: An independent platform for home healthcare service is launched by Option Care Health(healthcare service provider) and Amedisys Inc.(renowned provider of home health services.

- In April 2023: Advanced ultrasound technology, is launched by Care Fusion, an American medical technology company, to provide clinicians with optimal IV insertions. This contributes towards the growth of home infusion therapy as 90-92% hospitalized patients receive IV therapy.

Report Scope

Report Features Description Market Value (2023) USD 38.9 Billion Forecast Revenue (2033) USD 91.4 Billion CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Infusion Pumps, Intravenous Sets, IV Cannulas, Needleless Connectors) By Applications (Anti-Infective, Endocrinology, Hydration Therapy, Chemotherapy, Enteral Nutrition, Parenteral Nutrition, Specialty Pharmaceuticals, Other) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Baxter International Inc., Contec Medical Systems, Co, Ltd, Amsino International Inc., Lepu Medical Technology, Terumo Corporation, ICU Medical Inc, Moog Inc., Option Care Health, Smiths Medical, JMC Co, ltd., Fresenius Kabi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is home infusion therapy?Home infusion therapy involves the administration of medication through a needle or catheter, typically when oral therapy is not effective. This type of therapy is provided in the patient's home and includes treatments such as antibiotics, antifungals, nutrition, pain management, and therapies for chronic diseases.

How big is the Home Infusion Therapy Market?The global Home Infusion Therapy Market size was estimated at USD 38.9 Billion in 2023 and is expected to reach USD 91.4 Billion in 2033.

What is the Home Infusion Therapy Market growth?The global Home Infusion Therapy Market is expected to grow at a compound annual growth rate of 8.9%. From 2024 To 2033

Who are the key companies/players in the Home Infusion Therapy Market?Some of the key players in the Home Infusion Therapy Markets are Baxter International Inc., Contec Medical Systems, Co, Ltd, Amsino International Inc., Lepu Medical Technology, Terumo Corporation, ICU Medical Inc, Moog Inc., Option Care Health, Smiths Medical, JMC Co, ltd., Fresenius Kabi.

What are the benefits of home infusion therapy?The key benefits include greater convenience, reduced hospital stays, potential cost savings, and the comfort of receiving treatment in a familiar home environment. It also allows patients to maintain their normal daily activities and offers a personalized care approach.

Which patients are suitable for home infusion therapy?Patients with chronic diseases, infections resistant to oral antibiotics, nutritional disorders, or those requiring long-term pain management can be suitable for home infusion therapy. Suitability often depends on the patient's condition, the type of therapy needed, and their overall home environment.

Home Infusion Therapy MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Home Infusion Therapy MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Baxter International Inc.

- Contec Medical Systems, Co, Ltd

- Amsino International Inc.

- Lepu Medical Technology

- Terumo Corporation

- ICU Medical Inc

- Moog Inc.

- Option Care Health

- Smiths Medical

- JMC Co, ltd.

- Fresenius Kabi