Global Home Healthcare Software Market Analysis By Software Type (Clinical Management Systems, Agency Management Solutions, Other Software), By Service (Skilled Nursing, Infusion Therapy, Other Services), By Mode of Delivery (Cloud-Based Solutions, On-Premises Solutions, Hybrid Solutions), By End User (Home Health Agencies, Hospice Agency, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160248

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

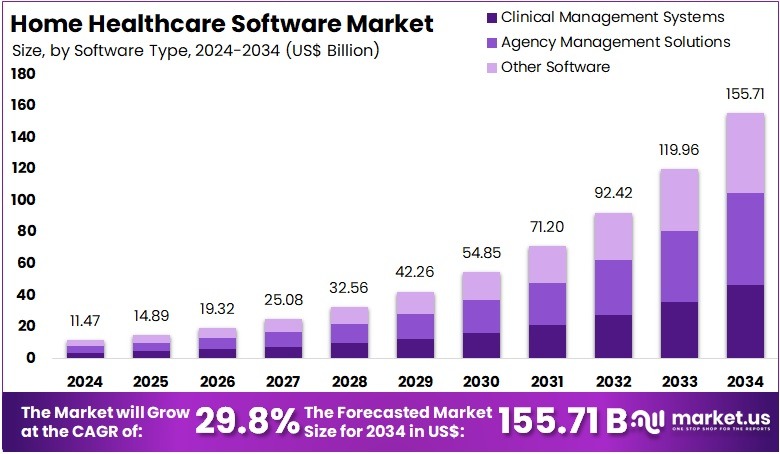

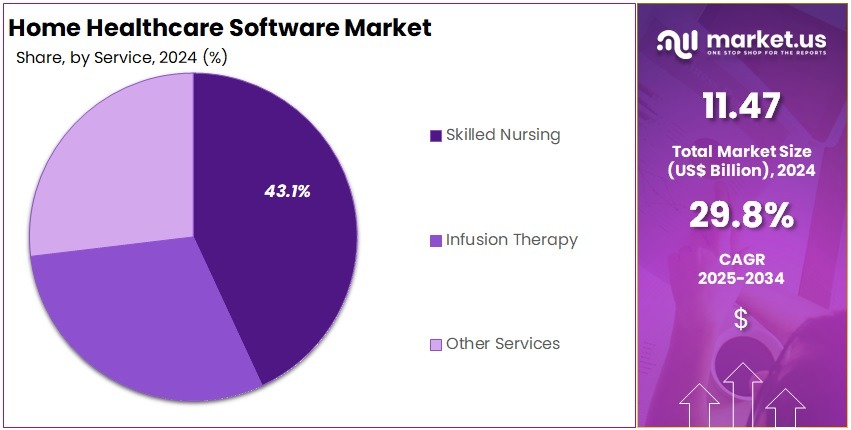

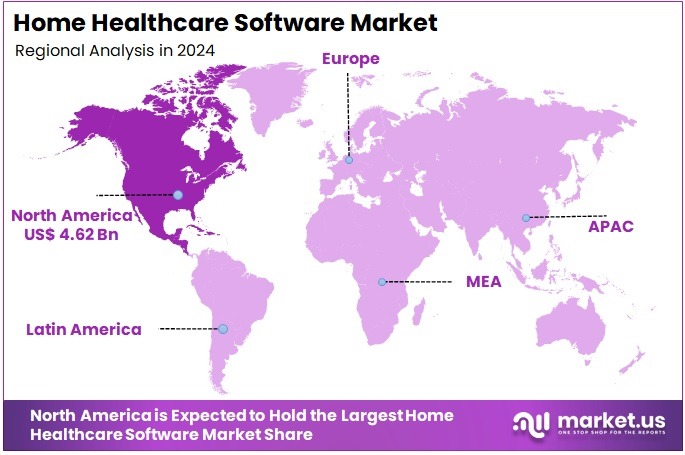

The Global Home Healthcare Software Market size is expected to be worth around US$ 155.71 Billion by 2034, from US$ 11.47 Billion in 2024, growing at a CAGR of 29.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.3% share and reaching a market value of US$4.62 billion.

Home healthcare software supports the delivery of medical and personal care services in patients’ homes. It includes solutions for clinical documentation, billing, scheduling, telehealth, and electronic health records (EHR). These platforms enhance coordination among providers, caregivers, and patients while maintaining compliance with healthcare regulations. By enabling real-time data access, they improve care quality and operational efficiency. For example, cloud-based systems now allow physicians to monitor patient health status remotely and adjust care plans promptly.

The growth of this market is driven by demographic change. According to the World Health Organization (WHO), one in six people will be aged 60 years or older by 2030. In addition, the number of people aged 80 years or older is expected to triple between 2020 and 2050. This ageing population increases demand for home-based services and creates opportunities for software that supports safe and efficient chronic care management at home.

Chronic disease prevalence adds further momentum. WHO reports that non-communicable diseases account for about three-quarters of global deaths, mainly cardiovascular disease, cancer, diabetes, and chronic respiratory illness. Because these conditions require regular monitoring, digital platforms for symptom tracking, medication adherence, and remote data sharing are being adopted to avoid hospital readmissions. For instance, remote patient monitoring software reduces unnecessary emergency visits by alerting clinicians to early deterioration.

Rising health expenditures reinforce this trend. In the United States, national health spending reached USD 4.9 trillion in 2023, reflecting a 7.5% increase from the previous year. Medicare spending alone grew 8.1% to USD 1,029.8 billion, representing 21% of total expenditure. Meanwhile, private health insurance costs rose 11.5% to USD 1,464.6 billion, or 30% of total spending. These rising costs are encouraging payers and providers to seek cost-effective alternatives. Home-based care supported by digital platforms offers a viable model to reduce financial pressure on the healthcare system.

Policy support is also central to adoption. In the U.S., Medicare telehealth flexibilities now extend through September 2025. According to CMS guidance, home health agencies can use new billing codes for telehealth visits and remote monitoring, making digital workflows financially sustainable. Similarly, international guidelines by WHO and ITU promote inclusive telehealth design with features such as captioning and simple user flows, which accelerates adoption in both developed and developing markets.

Technology, Regulation, and Adoption Trends

Interoperability requirements are shaping market dynamics. In the United States, the ONC’s Cures Act Final Rule and the Information Blocking framework require secure access to electronic health information. This pushes vendors to adopt open APIs and exchange data with hospitals, pharmacies, and primary care networks. The CMS Interoperability and Patient Access Rule further extends these requirements to Medicare and Medicaid programs. In the European Union, the new European Health Data Space regulation introduces certification obligations and interoperability criteria, raising the baseline for EHR and home care software.

Cybersecurity expectations are tightening in parallel. The U.S. Department of Health and Human Services has proposed updates to the HIPAA Security Rule, reflecting a surge in cyberattacks on healthcare systems. Providers adopting home healthcare solutions must therefore ensure advanced encryption, multifactor authentication, and audit trails. For example, agencies caring for patients with complex needs require robust safeguards for electronic protected health information (ePHI) to maintain compliance and trust.

Technology readiness has made home healthcare software more practical. The World Bank notes that global fixed broadband penetration reached about 20 subscriptions per 100 people in 2024. The International Telecommunication Union also reports growth in mobile and broadband traffic, improving reliability for video consultations and data uploads. With stronger connectivity, telehealth and cloud-based documentation can now function seamlessly in both urban and rural areas, strengthening adoption worldwide.

Workforce shortages are another driver of digital solutions. According to the OECD, health and long-term care employ about one in ten workers across member countries. However, many roles are part-time, and staff shortages are acute. Software for task scheduling, caseload optimization, and triage alerts helps agencies manage limited staff more effectively. For instance, decision-support tools enable nurses to focus on higher-priority patients while routine checks are managed digitally.

The pandemic further accelerated adoption. A CDC study shows that telemedicine claims in the U.S. rose from 0.2% in 2019 to 15.4% in 2020. Moreover, 80.5% of U.S. office-based physicians used telemedicine in 2021, compared to 16% in 2019. Globally, only 13.8% of countries have advanced telehealth systems, with higher shares in developed markets. A survey by Doximity in 2023 found that 88% of physicians believe telemedicine improves patient access. These statistics highlight a shift toward normalized virtual care, supporting sustainable growth in home healthcare software.

Key Takeaways

- By 2034, the global Home Healthcare Software Market is forecasted to reach US$ 155.71 billion, rising significantly from US$11.47 billion in 2024.

- The Clinical Management Systems segment dominated software types in 2024, accounting for over 37.5% market share in the Home Healthcare Software landscape.

- Skilled Nursing services secured the leading position in 2024, representing more than 43.1% share of the Home Healthcare Software service market.

- Cloud-Based Solutions emerged as the preferred mode of delivery in 2024, capturing more than 58.1% share within the Home Healthcare Software segment.

- Home Health Agencies led the end-user segment in 2024, holding a dominant share of over 61.0% in the Home Healthcare Software Market.

- North America maintained regional leadership in 2024, with a market share exceeding 40.3% and generating US$4.62 billion in value.

Software Type Analysis

In 2024, the Clinical Management Systems Section held a dominant market position in the Software Type Segment of the Home Healthcare Software Market, and captured more than a 37.5% share. This segment’s growth was supported by the increasing shift toward digital patient records and the rising need for accurate treatment tracking. These systems were recognized for improving diagnostic efficiency and minimizing manual errors. Their contribution to faster decision-making and enhanced care quality strengthened their demand across multiple care settings.

The Agency Management Solutions segment emerged as the second-largest contributor within the market. Its growth was mainly linked to the rising requirement for automated billing, scheduling, and workforce coordination. The segment benefited from the expansion of home healthcare service providers and their need for operational efficiency. These solutions were acknowledged for reducing administrative burdens and improving resource utilization. Their role in supporting smooth agency operations created steady adoption across both established and emerging healthcare organizations.

The Other Software segment, which covers telehealth platforms, remote patient monitoring tools, and specialized care applications, also gained notable traction. Demand for these solutions was shaped by the rising acceptance of digital health and the integration of cloud-based technologies. These software systems were observed to strengthen remote care, personalized health delivery, and communication between providers and patients. With the increase in mobile accessibility and connected care services, this category was identified as a vital enabler of long-term growth in the home healthcare software market.

Service Analysis

In 2024, the Skilled Nursing section held a dominant market position in the Service Segment of the Home Healthcare Software Market, and captured more than a 43.1% share. This segment maintained leadership due to rising demand for continuous patient supervision and efficient management of chronic illnesses. Industry experts noted that software solutions improved workflow efficiency for skilled nurses, reduced manual errors, and enabled seamless communication with doctors and caregivers. Such benefits supported the expansion of this segment.

The Infusion Therapy segment also accounted for a notable share of the market. Analysts observed that demand was supported by home-based administration of treatments such as chemotherapy, antibiotics, and nutritional therapy. The integration of infusion therapy with digital platforms increased treatment accuracy and ensured better compliance with prescribed dosages. In addition, it reduced the risk of hospital readmissions. These factors encouraged steady adoption of infusion therapy services supported by healthcare software in home settings.

Other Services, which include physical therapy, occupational therapy, and speech therapy, demonstrated moderate adoption during the period. Observers highlighted that digital platforms helped caregivers improve scheduling, track patient progress, and prepare accurate reports. The use of home healthcare software in these services enhanced patient engagement and therapy outcomes. While this segment held a smaller market share compared to skilled nursing and infusion therapy, it is projected to grow steadily. Rising focus on multidisciplinary home care is expected to support future demand.

Mode of Delivery Analysis

In 2024, the Cloud-Based Solutions section held a dominant market position in the mode of delivery segment of the Home Healthcare Software Market, and captured more than a 58.1% share. This position was supported by the rising adoption of digital healthcare platforms. Cloud models offered low upfront costs, simple scalability, and quick access to patient records. Improved internet penetration and a focus on operational efficiency further strengthened adoption. Many healthcare providers preferred cloud deployment for reducing administrative burdens and improving care delivery.

The On-Premises Solutions section maintained a smaller but notable share within the market. This deployment model was often selected by providers requiring greater control of their patient information. It also appealed to organizations operating under strict compliance obligations. However, higher costs related to installation, upgrades, and long-term maintenance created challenges. Limited flexibility when compared to cloud systems also restricted growth. Despite these factors, this model continued to serve users in highly regulated healthcare environments.

The Hybrid Solutions section showed steady momentum in recent years. This model combined the flexibility of cloud systems with the data security advantages of on-premises software. Its balanced approach supported healthcare providers aiming to meet regulatory requirements while still optimizing operations. Large organizations adopted hybrid platforms to integrate data from different sources more effectively. The increasing need for secure, yet adaptable, systems supported the rise of this segment. Hybrid deployment was expected to gain wider preference in future home healthcare applications.

End User Analysis

In 2024, the Home Health Agencies Section held a dominant market position in the End User Segment of Home Healthcare Software Market, and captured more than a 61.0% share. This dominance was linked to a rising demand for efficient patient data management and compliance support. According to industry observations, home health agencies benefited from digital tools that simplified scheduling, billing, and reporting. The use of such solutions helped reduce paperwork and enhanced the overall productivity of care teams.

Hospice Agencies represented another key end-user group. Their adoption of home healthcare software was reported to be growing steadily. Analysts noted that hospice providers relied on digital platforms to manage care plans, medication records, and communication with families. The focus on palliative care required accurate documentation and better coordination. As a result, software platforms offered measurable support for service quality. Industry insights suggested that the hospice segment would continue to expand in the coming years.

The Others category included private caregivers, rehabilitation centers, and smaller care providers. This segment accounted for a relatively smaller share in 2024. However, experts highlighted that steady growth was underway, driven by rising awareness of digital healthcare benefits. The demand for home-based care among patients with chronic conditions supported this trend. Reports indicated that smaller providers were adopting cost-effective solutions to streamline operations. These improvements were expected to enhance efficiency while encouraging broader use of healthcare software across non-traditional care settings.

Key Market Segments

By Software Type

- Clinical Management Systems

- Agency Management Solutions

- Other Software

By Service

- Skilled Nursing

- Infusion Therapy

- Other Services

By Mode of Delivery

- Cloud-Based Solutions

- On-Premises Solutions

- Hybrid Solutions

By End User

- Home Health Agencies

- Hospice Agency

- Others

Drivers

Shift to Value-Based Care Models

The global healthcare system is moving from fee-for-service to value-based care. Governments and insurers are offering incentives to organizations that deliver cost-efficient, outcome-focused home care. This shift creates demand for software solutions that can track patient outcomes, monitor performance, and generate reports. Providers are increasingly dependent on such platforms to meet compliance standards, demonstrate quality, and secure reimbursements. As a result, value-based care models are acting as a major driver for the home healthcare software market.

Home healthcare software plays a critical role in supporting this transition. It enables providers to capture accurate patient data, measure health improvements, and ensure transparency in reporting. With growing emphasis on accountability, software solutions that integrate clinical, financial, and operational data are gaining importance. These tools not only streamline processes but also help in proving efficiency gains to payers. The adoption of these platforms is expected to expand rapidly as value-based care becomes a global standard.

Labor Shortages in Healthcare

Healthcare systems worldwide are facing severe workforce shortages. This is particularly critical in home healthcare, where rising patient demand cannot be met with limited staff. Providers are turning to automation tools within home healthcare software to optimize resources. Features such as digital scheduling, automated workflows, and telehealth capabilities are helping organizations handle larger patient volumes. These solutions ensure that limited human resources are used more efficiently, thus reducing operational strain.

The role of software in addressing labor shortages is becoming increasingly prominent. By using intelligent scheduling, documentation automation, and predictive staffing tools, providers can minimize staff burnout while improving patient care. The technology also reduces administrative burdens, allowing professionals to focus more on clinical responsibilities. As workforce shortages continue to challenge the sector, the reliance on home healthcare software is expected to strengthen further, making it a key growth driver.

Increased Use of Wearables and IoT Devices

The rise of digital health tools such as wearables and IoT devices is transforming home healthcare. These devices generate real-time patient data on vital signs, activity levels, and other health indicators. The continuous flow of information creates the need for software that can collect, analyze, and interpret this data. Home healthcare software platforms are being developed with capabilities to integrate wearable technology, enabling more personalized and preventive care approaches.

Real-time data integration provides providers with actionable insights. It allows early detection of health risks, reduces hospital readmissions, and supports remote monitoring. Patients benefit from proactive interventions, while providers gain efficiency and accuracy in care delivery. The growing adoption of wearables and IoT devices is, therefore, fueling the demand for advanced software systems that support connected care ecosystems. This trend is set to accelerate as digital health becomes central to modern home care.

Restraints

Interoperability with Legacy Systems

The absence of standardization in healthcare IT has created challenges for the integration of home healthcare software with hospital EHRs, laboratories, and pharmacies. Existing legacy systems often run on outdated protocols, making smooth data exchange difficult. This lack of interoperability results in fragmented patient records and communication barriers. As a result, care coordination becomes inefficient and error-prone, which directly impacts the reliability of home healthcare solutions and reduces provider confidence in adopting such systems.

Additionally, system incompatibility increases the time and cost required for customization and integration. Providers are compelled to invest in middleware or manual processes to bridge gaps between different systems. This not only delays implementation but also reduces overall efficiency. Hospitals and clinics may hesitate to adopt home healthcare software if seamless integration with their existing infrastructure cannot be guaranteed. Thus, interoperability challenges act as a major restraint to the broader acceptance of digital home healthcare solutions.

High Implementation and Training Costs

The adoption of home healthcare software demands significant upfront investment in software licensing, infrastructure, and customization. Smaller providers face the greatest strain, as limited budgets restrict their ability to absorb such costs. In addition, the training of staff to adapt to new platforms increases financial and operational pressures. This often discourages small and mid-sized players from adopting such technologies despite the potential for long-term efficiency gains.

Moreover, return on investment is not always immediate, creating hesitation among providers. The need to allocate funds for ongoing maintenance and technical support adds to the total cost of ownership. In many cases, providers choose to continue with manual systems rather than invest in costly digital solutions. This cost barrier slows down the penetration of home healthcare software, particularly in developing regions and among independent care facilities.

Digital Literacy Gap Among Elderly Patients

A significant proportion of home healthcare users are elderly patients who often face challenges with digital tools. Low digital literacy makes it difficult for them to navigate mobile applications and software interfaces. This reduces the effectiveness of home healthcare solutions, as patients may fail to engage fully with digital platforms for monitoring, communication, or scheduling. Consequently, software adoption rates decline in populations that form the core demand base for such services.

Furthermore, the usability gap increases dependence on caregivers or family members for system operation. This dependence undermines the independence that home healthcare software aims to provide. In some cases, patients may abandon digital platforms altogether, leading to reduced treatment adherence and lower efficiency of home-based care models. Hence, the digital literacy divide continues to act as a structural restraint on the widespread adoption of home healthcare solutions.

Opportunities

Behavioral and Mental Health Expansion

The home healthcare software market has significant opportunities in behavioral and mental health support. Rising awareness of mental health has created demand for accessible therapy options. Home-based therapy modules and virtual counseling sessions can be integrated into platforms. This allows patients to receive professional care without travel barriers. Additionally, software-enabled medication adherence tracking can support treatment consistency. Providers can monitor patients in real time and intervene when needed. Such features address a growing healthcare segment and create strong adoption potential among patients and caregivers.

The integration of behavioral health solutions into home healthcare software also creates value for providers. Personalized therapy schedules and progress tracking improve patient engagement. Secure digital platforms reduce stigma by enabling private consultations. Moreover, remote monitoring lowers the risk of relapse or missed treatments. As healthcare systems focus on preventive and holistic care, these features strengthen competitiveness. The combination of convenience, compliance, and patient-centered design positions mental health expansion as a long-term growth driver for the industry.

Integration with Smart Home Ecosystems

The adoption of smart home devices is creating new opportunities for healthcare software providers. Partnerships with Amazon Alexa, Google Home, or Apple Health enable seamless integration of care. Patients can use voice commands to schedule appointments or access medication reminders. Smart home sensors can also track health metrics such as sleep or physical activity. This ecosystem approach simplifies patient engagement. It also enhances accessibility for elderly users who may struggle with complex digital interfaces.

For providers, integration with smart home systems ensures continuous patient monitoring. Real-time data streams can improve early detection of health issues. Automated alerts can notify caregivers of irregularities in patient behavior. Such technology reduces hospitalization risks and lowers costs for healthcare systems. By aligning with household devices already in use, adoption barriers are minimized. This creates a scalable growth pathway. The synergy between connected homes and digital health is likely to transform care delivery over the next decade.

Data-Driven Personalized Care Plans

Predictive analytics represents a high-value opportunity for home healthcare software. By analyzing patient history, lifestyle, and clinical data, software can generate individualized care plans. These plans adjust dynamically based on progress or setbacks. Personalized care pathways improve treatment outcomes and reduce unnecessary interventions. Data-driven recommendations also empower patients to take active roles in managing their health. Such personalization increases satisfaction and trust in digital healthcare platforms.

For healthcare providers, predictive analytics enhances operational efficiency. Clinicians can prioritize high-risk patients through AI-powered alerts. Resource allocation becomes more efficient, reducing system strain. Providers also gain insights into population-level health patterns. These insights support preventive care strategies and improve long-term outcomes. Moreover, integration with electronic health records ensures continuity of care. The ability to transform raw data into actionable intelligence makes predictive analytics a central pillar of future home healthcare software growth.

Trends

Voice-Enabled and Ambient Interfaces

The use of voice-enabled and ambient interfaces is emerging as a major trend in home healthcare software. Voice assistants allow caregivers to document patient data without manual input, thereby reducing administrative workload. Patients also benefit from hands-free access to their health information and treatment reminders. This creates higher usability, especially for elderly and disabled users. The integration of such interfaces is improving patient engagement, while also enabling more efficient workflows for healthcare providers in home settings.

Adoption of voice-enabled technologies is being accelerated by the growing demand for convenience and efficiency in home care delivery. These systems allow seamless communication between patients, families, and caregivers, reducing errors caused by manual documentation. They also improve compliance with treatment plans through automated reminders. As a result, healthcare outcomes can be enhanced while also lowering operational costs. The trend reflects a shift toward patient-centered design and demonstrates how intuitive technology supports accessibility in healthcare.

Blockchain for Data Security

Blockchain technology is being increasingly explored in home healthcare software to strengthen data protection. Patient records managed within home care environments face risks of tampering and unauthorized access. Blockchain ensures immutability, meaning once records are entered, they cannot be altered without authorization. This helps improve trust in digital systems and guarantees a transparent audit trail. Security and integrity of sensitive health data remain a key driver for adopting blockchain frameworks in this domain.

The implementation of blockchain addresses compliance with healthcare data privacy regulations such as HIPAA and GDPR. It provides decentralized storage and enables secure sharing of patient information among multiple stakeholders. This minimizes risks of breaches and fosters accountability across the ecosystem. The capability to ensure auditability is especially vital in home healthcare, where multiple caregivers and service providers handle sensitive information. As a result, blockchain is positioning itself as a critical enabler of digital trust in healthcare technology.

Microservices-Based Platforms

The home healthcare software market is shifting from monolithic systems toward microservices-based platforms. A modular, API-driven architecture allows software to be developed, deployed, and scaled with greater flexibility. Unlike traditional systems, microservices enable independent updates of specific modules without disrupting the entire system. This improves integration with medical devices, third-party applications, and electronic health record systems. Scalability and adaptability are becoming key advantages for software vendors in this competitive space.

This architectural shift supports faster innovation cycles and reduced time to market. Healthcare providers can adopt new features or services without replacing their entire software system. The interoperability of microservices enhances collaboration among diverse healthcare systems, enabling smooth information exchange. Furthermore, the architecture is well-suited for handling increasing data volumes generated by remote monitoring devices and digital health tools. As demand for integrated and efficient home care software grows, microservices platforms are gaining significant traction.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 40.3% share and reaching a market value of US$ 4.62 billion. According to data, the United States remains the largest healthcare spender globally, with total health expenditure of about US$4.9 trillion in 2023. Within this, home health agency services accounted for US$147.8 billion, marking a 10.8% increase. This high level of investment has encouraged significant adoption of home healthcare software, supporting scheduling, billing, remote monitoring, and clinical documentation systems.

The region’s strong provider base has also reinforced this leadership. For instance, in 2021, the U.S. recorded 11,474 Medicare-certified home health agencies. Around 3 million Medicare beneficiaries used home healthcare services that year. Large-scale service delivery requires advanced digital platforms to manage care plans, ensure compliance with quality reporting, and streamline reimbursement. As a result, the demand for efficient home healthcare software continues to grow alongside the expansion of provider capacity.

Demographic changes further drive market adoption. According to the World Health Organization, the share of older populations is rising globally, and North America is no exception. For example, Canada reported that seniors accounted for nearly 19% of its total population, with projections indicating continued growth. An aging population increases the reliance on home-based services, which in turn accelerates the need for digital tools to coordinate care delivery effectively and securely.

Policy support has also played a critical role. In the U.S., federal interoperability rules under the 21st Century Cures Act have reduced barriers to data access and restricted information blocking. In Canada, the Connected Care for Canadians Act and the Pan-Canadian Interoperability Roadmap have been introduced to facilitate secure patient data sharing. These initiatives promote innovation in electronic records, digital coordination, and remote health services, strengthening the market base for home healthcare software.

Sustained healthcare funding continues to support long-term growth. Canada’s health expenditure is expected to reach C$372 billion in 2024, equal to roughly C$9,054 per person. Strong public funding, combined with demographic and policy drivers, has established favorable conditions for digital adoption. Therefore, the combination of rising expenditure, aging demographics, and interoperability rules ensures that North America will maintain its leadership in the global home healthcare software market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The home healthcare software market is shaped by leading companies such as WellSky Corporation, Cerner Corporation (Oracle Health), McKesson Corporation, Epic Systems, and Allscripts Healthcare Solutions. WellSky holds strong expertise in post-acute care, offering advanced solutions for home health and hospice services. Cerner (Oracle Health) provides integrated home care modules within its enterprise EHR framework, ensuring hospital-to-home continuity. McKesson leverages its scale and supply chain strength to support home-based care. Epic Systems and Allscripts enable providers with comprehensive EHR-integrated home care solutions.

Specialized providers enhance the landscape by focusing on home health and senior care operations. PointClickCare Technologies has established a strong reputation in long-term and post-acute settings, with effective data exchange and referral capabilities. Netsmart Technologies offers its myUnity platform, combining home health, hospice, and behavioral health solutions. MatrixCare, part of ResMed, delivers integrated software with notable strengths in compliance and documentation. These vendors provide advanced capabilities to support agencies in clinical documentation, scheduling, compliance, and revenue cycle management.

Cloud-native and mobile-first platforms are driving innovation in home healthcare. Axxess Technology Solutions emphasizes user-friendly interfaces, rapid deployment, and electronic visit verification (EVV). AlayaCare provides API-driven platforms with strong caregiver engagement and scheduling optimization tools. Birdie focuses on care planning and outcomes for European markets, while Axle Health strengthens in-home workforce logistics and visit coordination. These companies enhance care efficiency by addressing workforce shortages, compliance needs, and operational performance through modern, scalable, and user-centric technologies.

Additional players contribute through payer integration and digital-first approaches. HealthHero delivers virtual-first care coordination across Europe, extending clinical reach into home settings. HealthEdge focuses on payer-side platforms, supporting value-based models and enabling data integration with providers. These solutions highlight the industry’s shift toward interoperability, population health management, and patient outcomes. The market is therefore characterized by a mix of enterprise EHR vendors, post-acute care specialists, and innovative digital platforms, all working to support a growing demand for home-based healthcare solutions.

Market Key Players

- WellSky Corporation

- Cerner Corporation (Oracle Health)

- McKesson Corporation

- Epic Systems Corporation

- Allscripts Healthcare Solutions

- PointClickCare Technologies

- Netsmart Technologies

- MatrixCare (by ResMed)

- Axxess Technology Solutions

- AlayaCare Inc.

- Birdie

- Axle Health

- HealthHero

- HealthEdge

- Others

Recent Developments

- In October 2024: WellSky announced the acquisition of Bonafide, a software provider serving durable medical equipment (DME) and home medical equipment (HME) providers. This acquisition was aimed at strengthening WellSky’s home care ecosystem and expanding its market reach. By integrating DME/HME workflows, WellSky is positioned to optimize care delivery in home settings and broaden its addressable market in the home-based care sector.

- In March 2024: Veradigm, formerly known as Allscripts, completed the acquisition of ScienceIO, an AI platform provider. The deal, valued at approximately $140 million, was intended to accelerate the development of AI-enabled capabilities across Veradigm’s healthcare technology portfolio.

- In January 2024: Vanderbilt Home Care officially went live with Epic’s Dorothy home care module on January 6, 2024. This implementation integrated home health operations into the broader Epic patient record platform. Clinicians gained seamless access to home care documentation within the patient’s complete record, improving continuity of care. The transition also required specific customizations, including segregating financial metrics and enabling electronic visit verification, in order to align with regulatory and operational needs in home health.

- In June 2023: At the AHIP 2023 conference, PointClickCare introduced its expanded real-time analytics capabilities designed for health plans. These tools enable payers to improve care coordination, close care gaps, and enhance quality management within value-based care models. With this initiative, PointClickCare extended its role beyond provider-focused systems to payer and integrated care workflows.

Report Scope

Report Features Description Market Value (2024) US$ 11.47 Billion Forecast Revenue (2034) US$ 155.71 Billion CAGR (2025-2034) 29.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Software Type (Clinical Management Systems, Agency Management Solutions, Other Software), By Service (Skilled Nursing, Infusion Therapy, Other Services), By Mode of Delivery (Cloud-Based Solutions, On-Premises Solutions, Hybrid Solutions), By End User (Home Health Agencies, Hospice Agency, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape WellSky Corporation, Cerner Corporation (Oracle Health), McKesson Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, PointClickCare Technologies, Netsmart Technologies, MatrixCare (by ResMed), Axxess Technology Solutions, AlayaCare Inc., Birdie, Axle Health, HealthHero, HealthEdge, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Healthcare Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Home Healthcare Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WellSky Corporation

- Cerner Corporation (Oracle Health)

- McKesson Corporation

- Epic Systems Corporation

- Allscripts Healthcare Solutions

- PointClickCare Technologies

- Netsmart Technologies

- MatrixCare (by ResMed)

- Axxess Technology Solutions

- AlayaCare Inc.

- Birdie

- Axle Health

- HealthHero

- HealthEdge

- Others