Global Home Biogas Systems Market Size, Share Analysis Report By Product Type (Fixed Dome, Floating Drum, Balloon Digester, Others), By Feedstock (Animal Manure, Food Waste, Agricultural Waste, Others), By Capacity (Up to 2 Cubic Meters, 2–6 Cubic Meters, Above 6 Cubic Meters), By Application (Energy Generation, Cooking Fuel, Fertilizer, Residential, Small Farms, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161035

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

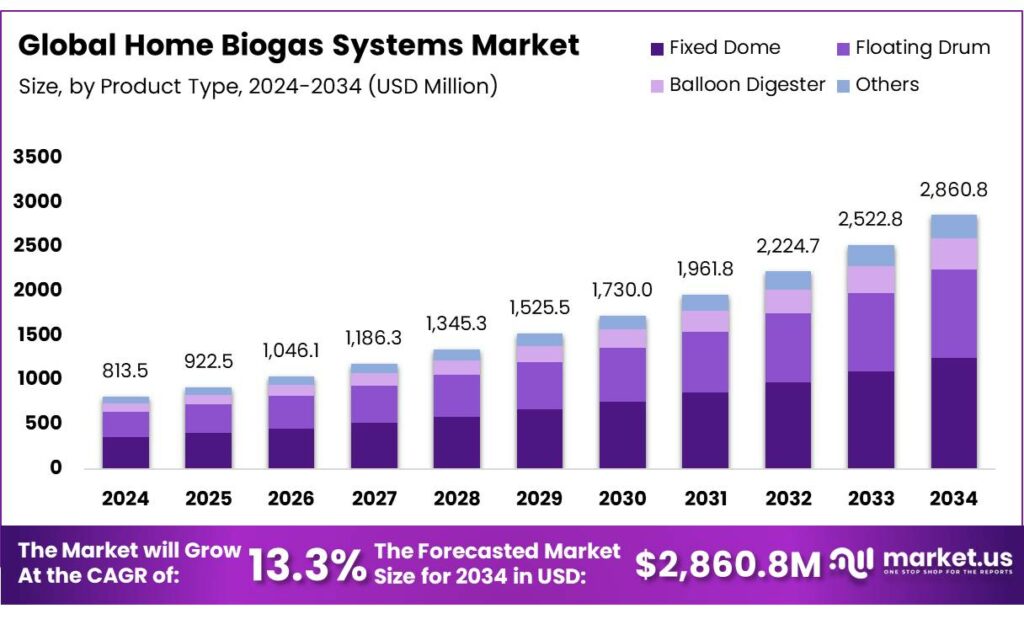

The Global Home Biogas Systems Market size is expected to be worth around USD 2860.8 Million by 2034, from USD 813.5 Million in 2024, growing at a CAGR of 13.3% during the forecast period from 2025 to 2034. Strong industrial growth and rising Energy production supported Asia-Pacific’s 43.8% leading regional market position.

Home biogas systems are compact anaerobic digestion units designed for households or small farms to convert organic waste into biogas and digestate. These systems offer a decentralized, circular waste-to-energy solution: they reduce organic waste volumes, generate on-site renewable energy, and produce biofertilizer, thereby closing loops at the household or community level.

The industrial / market scenario for home biogas systems remains fragmented, largely driven by local/regional players, NGOs, social enterprises, and specialized suppliers. Adoption is strongest in regions with high organic waste generation, limited access to clean cooking fuels, agricultural linkages, and supportive policy frameworks. China has historically been a leader: the Chinese rural household biogas program had installed nearly 42 million household digesters by 2015 under government support.

The Indian government has implemented several initiatives to promote biogas adoption. The Ministry of New and Renewable Energy (MNRE) launched the National Bioenergy Programme for the period 2021–2026 with an outlay of ₹858 crore to support biogas projects. Additionally, the MNRE approved a supplementary budget of ₹140 crore for the National Bioenergy Programme, with ₹50 crore allocated specifically for biogas projects.

In the broader biogas and biomethane sector, interest is rising. The International Energy Agency (IEA) estimates that sustainably usable feedstocks could yield the equivalent of nearly 1 trillion cubic metres of natural gas per year globally via biogas/biomethane production without competing with food systems. Also, the IEA forecasts strong growth for the biogas sector in coming years, emphasizing its role in energy security, decarbonisation, and circular economy goals.

In China, in particular, household biogas has a long history — estimates suggest in the order of 40 million household biogas digesters exist there, though many are traditional fixed dome units rather than modern modular home systems. Broadly, among reporting IEA Bioenergy Task 37 member countries, China leads in numbers of biogas plants, with over 100,000 large and medium plants reported. In terms of energy scale, Germany, for example, produces about 87 TWh per year of biogas; China about 81 TWh in reported segments. These large figures reflect the scale of biogas in energy systems, illustrating the potential backdrop against which home systems must compete and complement.

Key Takeaways

- Home Biogas Systems Market size is expected to be worth around USD 2860.8 Million by 2034, from USD 813.5 Million in 2024, growing at a CAGR of 13.3%.

- Fixed Dome held a dominant market position, capturing more than a 43.7% share of the home biogas systems market.

- Animal Manure held a dominant market position, capturing more than a 38.5% share of the home biogas systems market.

- 2–6 Cubic Meters held a dominant market position, capturing more than a 48.2% share of the home biogas systems market.

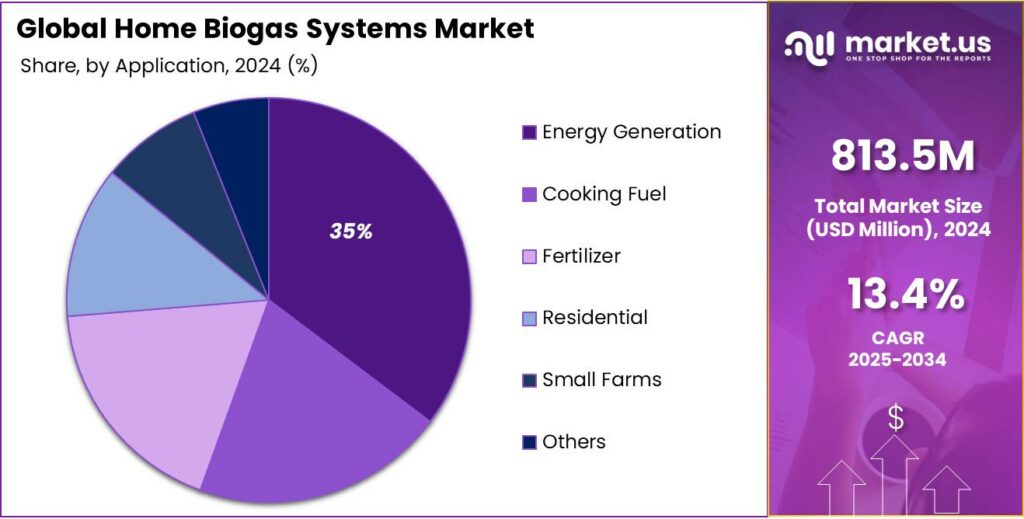

- Energy Generation held a dominant market position, capturing more than a 34.9% share of the home biogas systems market.

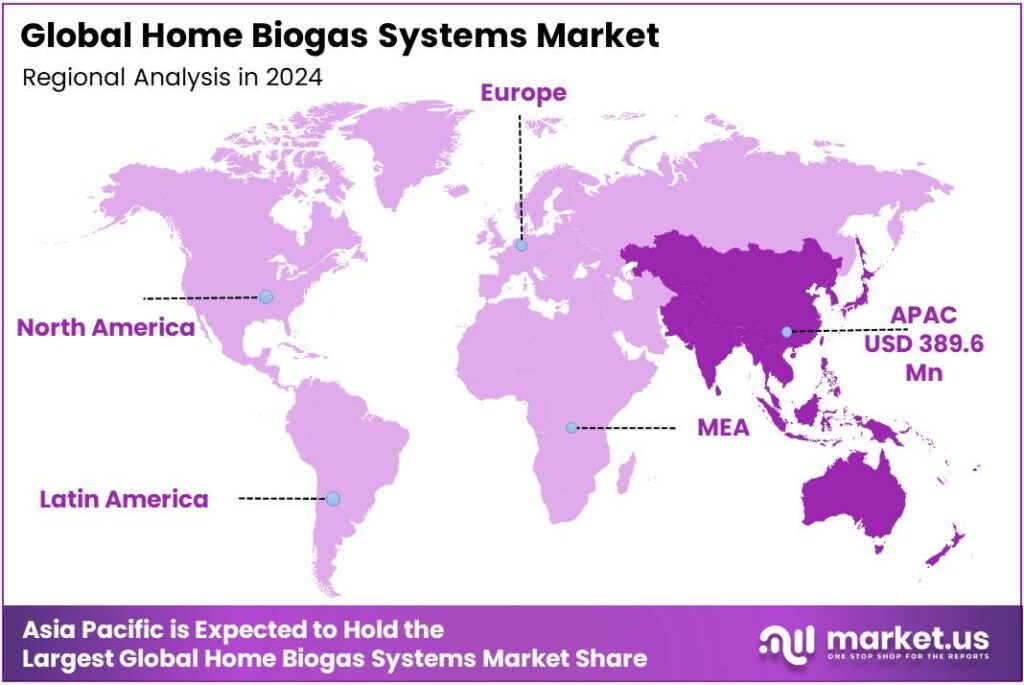

- Asia Pacific region held a dominant position in the home biogas systems market, capturing more than a 47.9% share, valued at approximately USD 389.6 million.

By Product Type Analysis

Fixed Dome dominates with 43.7% share in 2024 due to its reliability and long-term usage

In 2024, Fixed Dome held a dominant market position, capturing more than a 43.7% share of the home biogas systems market. This preference can be attributed to its durable construction, low maintenance requirements, and ability to efficiently handle organic waste for continuous biogas production. Fixed Dome systems are widely adopted in rural and semi-urban households, where long-term reliability is prioritized over mobility.

The steady adoption of these systems is also supported by government initiatives promoting sustainable energy solutions, particularly for clean cooking fuel and rural energy access. The design of Fixed Dome digesters allows for higher gas storage capacity and stability in performance, making them more suitable for households with consistent organic waste availability. Looking forward, the segment is expected to maintain its leadership position in 2025, driven by increasing awareness of clean energy, technological improvements in biogas storage, and policies incentivizing biogas adoption for rural development and energy security.

By Feedstock Analysis

Animal Manure leads with 38.5% share in 2024 due to its high availability and efficiency

In 2024, Animal Manure held a dominant market position, capturing more than a 38.5% share of the home biogas systems market. This trend is largely driven by the widespread availability of livestock waste in rural and semi-urban areas, making it a reliable and cost-effective feedstock for biogas production. Animal manure offers high biogas yield and consistent performance, which enhances its adoption among households and small farms seeking sustainable energy solutions.

The use of animal manure also aligns with government programs promoting organic waste utilization and renewable energy generation, contributing to cleaner cooking fuels and reduced dependency on conventional energy sources. Moving into 2025, the segment is expected to maintain its prominence as awareness grows around sustainable energy practices, and households increasingly integrate biogas solutions into their waste management and energy strategies.

By Capacity Analysis

2–6 Cubic Meters capacity leads with 48.2% share in 2024 due to its optimal size for household use

In 2024, 2–6 Cubic Meters held a dominant market position, capturing more than a 48.2% share of the home biogas systems market. This capacity range is particularly preferred by households and small farms as it provides an optimal balance between gas production and space requirements, making it suitable for daily cooking and energy needs. Systems within this capacity efficiently process organic waste, including animal manure and kitchen scraps, generating sufficient biogas for family use without requiring excessive investment or maintenance.

The adoption of 2–6 Cubic Meters units is further supported by government initiatives encouraging renewable energy at the household level and rural energy programs. In 2025, this segment is expected to continue its leading position, driven by increasing awareness of clean energy solutions, ease of installation, and consistent performance that meets the typical energy demands of small-scale users.

By Application Analysis

Energy Generation dominates with 34.9% share in 2024 due to its efficient and sustainable use

In 2024, Energy Generation held a dominant market position, capturing more than a 34.9% share of the home biogas systems market. This segment is driven by the growing demand for clean and reliable energy solutions at the household and small farm levels. Home biogas systems used for energy generation convert organic waste, such as animal manure and kitchen scraps, into biogas that can be utilized for cooking, heating, and small-scale electricity production.

The adoption of energy-focused biogas systems is supported by government programs promoting renewable energy and reducing dependency on conventional fuels. By 2025, the segment is expected to maintain its strong position as more households recognize the benefits of sustainable energy, including reduced energy costs, environmental protection, and the efficient use of organic waste for continuous energy supply.

Key Market Segments

By Product Type

- Fixed Dome

- Floating Drum

- Balloon Digester

- Others

By Feedstock

- Animal Manure

- Food Waste

- Agricultural Waste

- Others

By Capacity

- Up to 2 Cubic Meters

- 2–6 Cubic Meters

- Above 6 Cubic Meters

By Application

- Energy Generation

- Cooking Fuel

- Fertilizer

- Residential

- Small Farms

- Others

Emerging Trends

Smart And Modular Systems with IoT Monitoring

In the past, many household-scale biogas units were simple, static tanks. But now developers are making modular units so homeowners or small farms can scale up gradually. The Indian Biogas Programme explicitly mentions that designs are available from 1 m³ to 1000 m³ to suit family, farmer, community or institutional use. This modular approach means someone can start small, test the system, and expand later — lowering upfront risk and making adoption more flexible.

This trend is further pushed by government programs and initiatives that favor integration, data reporting, and efficiency tracking. In India, schemes like SATAT (Sustainable Alternative Towards Affordable Transportation) and GOBARdhan, which promote compressed biogas (CBG) and waste-to-energy value chains, also emphasize better feedstock aggregation, infrastructure, and performance tracking. When home biogas units can connect to broader networks — for example, feeding surplus biogas or data into community grids — the modular + smart combination becomes more powerful.

Organic waste and food waste continue to be major issues and opportunities. In 2022, about 1.05 billion tonnes of food waste were generated globally, of which 60% came from households. That’s a huge raw material opportunity — and smart systems help future users to better manage that waste stream. When households see waste turning into energy and fertilizer, and can watch real metrics (gas output, savings, faults), the idea becomes more concrete and trustworthy.

Another global trend is attention to food loss. The FAO estimates that 30–40% of total food production is lost before reaching market, with 40–50% losses in fruits and vegetables in some regions. These losses deepen the narrative: we are letting precious resources slip away. Smart biogas systems let households reclaim a small share of that loss — turning rotten or excess produce into value.

Drivers

Organic Waste Availability And Food Waste Realities

One of the most compelling and human-centric drivers behind home biogas systems is the vast and growing quantity of organic waste — especially food waste — that is generated globally and locally. This is more than just a number on paper: it’s the leftovers in households, the peelings in kitchens, the spoiled produce in markets, and the unsold food that quietly rots. Turning that waste into energy via home biogas systems addresses both a waste challenge and an energy need — it’s a dual benefit that resonates with communities.

To put it in perspective, the Food and Agriculture Organization (FAO) estimates that roughly one-third of all food produced globally is lost or wasted every year. Moreover, the FAO currently estimates that 13% of food is lost in the supply chain, and another 19% is wasted at the household, retail, and food service levels. When we imagine all of that wasted organic matter — much of it still rich in biodegradable carbon compounds — it becomes a large feedstock base for biogas systems.

In many cities and rural areas, municipal solid waste (MSW) shows a similar pattern: organic waste often makes up 50 % or more of the overall waste stream. For example, in Ukraine, up to 60 % of municipal solid waste is organic (food, yard, biodegradable). While that example is country-specific, similar proportions are common in many developing and middle-income regions. In India and South Asia broadly, organic and food waste segments form a particularly large share of the total waste stream — often cited informally as 40–60 %, though rigorous national figures vary.

Governments and institutions recognize this synergy, and many have created incentives and programs around it. In India, under the Biogas Programme run by the Ministry of New and Renewable Energy (MNRE), small biogas plants (1–25 m³/day) are eligible for Central Financial Assistance (CFA) ranging from ₹ 9,800 to ₹ 70,400 per plant, depending on size. Also, in India’s Phase I Biogas Programme (2021-22 to 2025-26), there’s an additional incentive of ₹ 10,000 for biogas-powered generator sets or biogas engine water pumping systems in the 10–25 m³ range.

Restraints

High Upfront Cost And Financial Barriers

One of the most persistent and human-felt constraints on the adoption of home biogas systems is the high initial cost and financing difficulty. For many households—especially in low-income or rural areas—paying for a biogas digester, installation, piping, and basic operation support is a burden that outweighs perceived long-term benefit. This barrier often means that even if people understand the advantages, they shy away because the investment feels too risky or too large in one go.

To illustrate the scale of food and organic waste (which is the feedstock) is large, yet converting it is costly: globally, about one-third of food produced is lost or wasted, amounting to 1.3 billion tonnes per year, according to the FAO. That means there is more than enough raw material around—but turning that raw material into biogas for individual homes requires hardware, engineering, and maintenance. In many cases, the cost of a household biogas unit (depending on volume and complexity) can run into hundreds or even thousands of dollars or equivalent local currency. For poorer households, that’s a steep barrier.

In many national programs, subsidies or financial supports exist, but they often don’t fully cover the expense or reach the people who need them. Further, subsidy schemes have sometimes been cut or inconsistent. In some regions, earlier government support for domestic digesters was phased out: for example, in one review, it was noted that “governmental support for domestic digester has been stopped since 2015” in certain jurisdictions, weakening uptake. That kind of rollback creates uncertainty: households hesitate to adopt solutions when subsidy continuity is not guaranteed.

Governments and trusted agencies can help address this restraint. For example, integrating output-based subsidies, asset financing, community biogas cooperatives, or public guarantees can lower risk. Ensuring long-term, stable subsidy or support policies can instill confidence. Technical assistance, warranty support, and local maintenance networks help reduce the perceived risk of breakdowns.

Opportunity

Circular Economy And Waste-to-Energy Integration

One of the most promising and human-touch growth opportunities for home biogas systems lies in embedding them as key nodes in a circular economy, particularly via waste-to-energy integration. This idea is simple: the food scraps, market leftovers, and organic kitchen waste we generate every day don’t have to be “trash.” Instead, they can become fuel, fertilizer, or income. For home biogas systems, this means scaling not just by selling more digesters, but by tying them closely with local waste streams and municipal programs.

Globally, the scale of organic and food waste is staggering. FAO estimates that about one-third of all food produced, or approximately 1.3 billion tonnes per year, is lost or wasted. In 2022 alone, around 1.05 billion tonnes of food waste were generated — with households contributing 60% of that amount. That means a huge feedstock pool exists right in our kitchens, markets, and neighborhoods. Home biogas units, if integrated smartly, can tap into that resource.

Imagine a housing complex, a rural block, or a municipality collecting organic waste centrally, pre-treating it modestly, and supplying digesters at individual households or cluster units. This kind of aggregation improves feedstock consistency, reduces per-unit cost, and allows economies of scale in maintenance or monitoring.

For example, in India, the government has launched the Biogas Programme, which supports both small (1–25 m³/day) and medium biogas plants via Central Financial Assistance (CFA). Also under India’s GOBARdhan scheme, 500 new “waste-to-wealth” plants are slated to be built in 2023–24, including 200 compressed biogas (CBG) plants and 300 community cluster biogas units.

India already illustrates scale potential more than 5 million small biogas plants reportedly exist in the country. These plants not only serve households but can create local circular loops of energy and soil health. Also, in recent years, the Indian government and industry are pushing compressed biogas (CBG) expansion: India plans to roll out 5,000 CBG plants to produce 15 million tonnes of bio-CNG annually, aiming to meet ~40% of current CNG demand. While that is at a larger scale than home systems, it shows the appetite for leveraging biogas in energy mix.

Regional Insights

Asia Pacific leads with 47.9% share in 2024, valued at USD 389.6 million, due to high adoption rates and supportive policies

In 2024, the Asia Pacific region held a dominant position in the home biogas systems market, capturing more than a 47.9% share, valued at approximately USD 389.6 million. This leadership is attributed to several factors, including high rural population density, prevalent small-scale farming practices, and increasing organic waste generation, which create a conducive environment for biogas adoption. Countries such as India, China, and Thailand are at the forefront, implementing supportive government policies and initiatives to promote renewable energy solutions and waste-to-energy technologies.

For instance, India’s Ministry of New and Renewable Energy (MNRE) launched the Biogas Programme to set up biogas plants for clean cooking fuel, lighting, and small power needs, aiming to reduce greenhouse gas emissions and improve sanitation. Additionally, the SATAT scheme encourages entrepreneurs to set up Compressed Bio Gas (CBG) plants, producing and supplying CBG to Oil Marketing Companies for sale. As of November 30, 2024, 80 CBG plants have been commissioned under this initiative. These efforts are expected to further stimulate the growth of the home biogas systems market in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

HomeBiogas Ltd, based in Beit Yanai, Israel, specializes in compact anaerobic digesters that convert organic waste into clean cooking gas and liquid fertilizer. Their product line includes the HomeBiogas 2, 4, and 7 systems, designed for residential and small-scale agricultural use. The company emphasizes ease of installation and user-friendly operation, catering to households and communities seeking sustainable waste management solutions. HomeBiogas Ltd has expanded its reach globally, offering solutions that promote environmental sustainability and renewable energy adoption.

Flexi Biogas, established in Kenya, offers portable biogas systems designed to convert organic waste into clean cooking gas. Their innovative design features a flexible, above-ground system made of durable PVC tarpaulin, making it cost-effective and suitable for rural households and small-scale farms. The company has installed over 1,500 units in Kenya and expanded its reach to other regions, providing an affordable and sustainable energy solution to communities lacking access to conventional energy sources.

Shenzhen Puxin Technology Co., Ltd., founded in 2001, is a Chinese company specializing in biogas technology and environmental protection solutions. They design and manufacture large and medium-sized biogas projects, including containerized anaerobic treatment systems and assembly biogas plants. Puxin’s products cater to various sectors, including agriculture and industrial applications, aiming to convert organic waste into renewable energy efficiently. The company has expanded its operations globally, providing sustainable energy solutions to diverse markets.

Top Key Players Outlook

- HomeBiogas Ltd.

- Sistema.bio

- Flexi Biogas

- Puxin Technology Co., Ltd.

- SEaB Energy Ltd.

- Green Elephant Engineering Pvt. Ltd.

- Acr Energy Ltd.

- Biotech Renewable Energy Pvt. Ltd.

- True Eco Tech

- Agama Biogas

- Kingdom Bioenergy Ltd.

Recent Industry Developments

In 2024, HomeBiogas Ltd reported a revenue of $2.63 million, a decline of approximately 45.56% from $4.83 million in 2023. Despite this decrease, the company continues to expand its global footprint, with installations in over 100 countries, including significant operations in Kenya, India, and parts of Latin America.

In 2024, Puxin Technology Co., Ltd. reported total revenue of CNY 878.32 million and net income of CNY 104.65 million, reflecting a strong market presence and financial performance.

Report Scope

Report Features Description Market Value (2024) USD 813.5 Mn Forecast Revenue (2034) USD 2860.8 Mn CAGR (2025-2034) 13.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed Dome, Floating Drum, Balloon Digester, Others), By Feedstock (Animal Manure, Food Waste, Agricultural Waste, Others), By Capacity (Up to 2 Cubic Meters, 2–6 Cubic Meters, Above 6 Cubic Meters), By Application (Energy Generation, Cooking Fuel, Fertilizer, Residential, Small Farms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HomeBiogas Ltd., Sistema.bio, Flexi Biogas, Puxin Technology Co., Ltd., SEaB Energy Ltd., Green Elephant Engineering Pvt. Ltd., Acr Energy Ltd., Biotech Renewable Energy Pvt. Ltd., True Eco Tech, Agama Biogas, Kingdom Bioenergy Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HomeBiogas Ltd.

- Sistema.bio

- Flexi Biogas

- Puxin Technology Co., Ltd.

- SEaB Energy Ltd.

- Green Elephant Engineering Pvt. Ltd.

- Acr Energy Ltd.

- Biotech Renewable Energy Pvt. Ltd.

- True Eco Tech

- Agama Biogas

- Kingdom Bioenergy Ltd.