Global High Voltage Battery Market By Battery Capacity(75 kWh–150 kWh, 151 kWh–225 kWh, 226 kWh–300 kWh, >300 kWh), By Battery Type(Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Lithium Nickel Cobalt Aluminium Oxide, Others), By Voltage(400–600V, >600V, By Driving Range, 100–250 miles, 251–400 miles, 401–550 miles, >550 miles), By Applications(Passenger cars, Bus, Trucks, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 73442

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

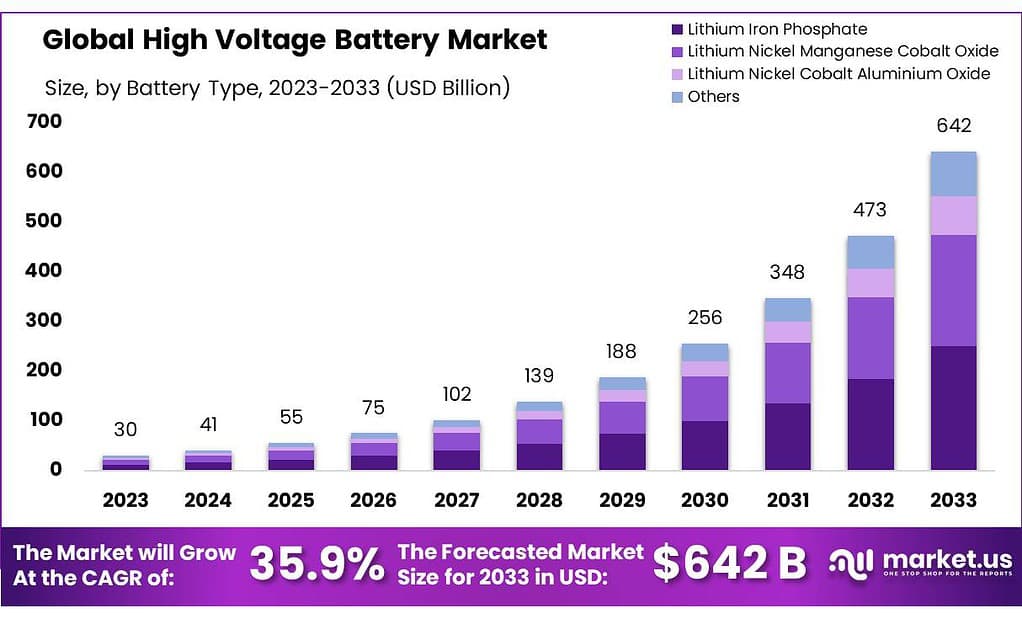

The global High Voltage Battery Market size is expected to be worth around USD 642 Billion by 2033, from USD 30 Billion in 2023, growing at a CAGR of 35.9% during the forecast period from 2023 to 2033.

The High Voltage Battery Market refers to the segment of the battery industry that specializes in the development, production, and sale of batteries capable of operating at higher voltages compared to standard battery systems. These batteries are predominantly utilized in applications requiring significant power output, such as electric vehicles (EVs), industrial machinery, renewable energy storage systems, and other high-power applications.

High-voltage batteries are characterized by their ability to store and deliver energy at voltages typically above 60 volts, with many applications in the automotive sector utilizing systems that operate in the range of 400 volts to 800 volts or more. This high voltage capability is essential for achieving the desired performance characteristics in terms of power output, efficiency, and energy density, which are critical for the operational requirements of electric vehicles and other high-demand applications.

The growth of the High Voltage Battery Market can be attributed to several factors, including the global shift towards electrification in the automotive industry, the increasing demand for renewable energy storage solutions, and advancements in battery technology that have improved the performance and reduced the costs of high voltage battery systems. The market encompasses a range of products, including lithium-ion batteries, solid-state batteries, and other emerging battery technologies that offer high-voltage capabilities.

The High Voltage Battery Market is a dynamic and rapidly evolving sector, driven by technological innovations, regulatory policies promoting clean energy, and the growing demand for electric mobility and efficient energy storage solutions. Market participants include battery manufacturers, automotive companies, energy storage system providers, and technology firms, all contributing to the development of advanced high-voltage battery solutions that meet the needs of various high-power applications.

Key Takeaways

- Market Growth: High Voltage Battery Market set to reach USD 642 Billion by 2033, with a CAGR of 35.9% from 2023.

- Lithium-Ion Dominance: Lithium Iron Phosphate (LFP) batteries hold over 39.6% market share due to safety and longevity.

- Voltage Preference: 400–600V batteries capture 65.6% market share, favored for performance and cost balance in EVs.

- Driving Range Dynamics: 100–250 miles range dominates with 32.2% market share, catering to urban driving needs.

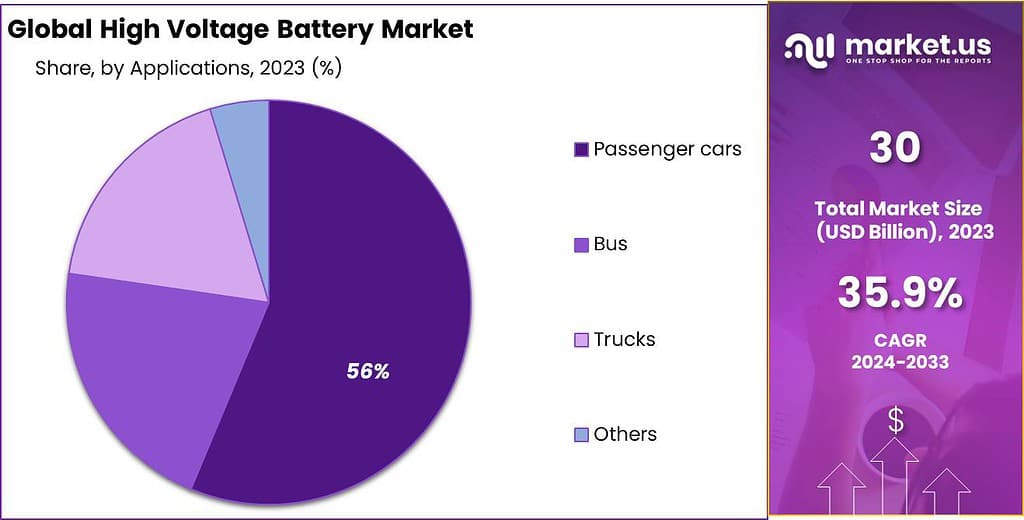

- Application Leadership: Passenger cars lead with 56.3% market share, followed by buses and trucks.

- North America’s Dominance: Secures 46% market share, driven by strong EV adoption and government support.

- The voltage range for high voltage batteries is typically between 300V and 800V.

- By 2024, the average energy density of lithium-ion batteries is expected to reach 300 Wh/kg, enabling longer driving ranges for EVs.

By Battery Capacity

In 2023, the 75 kWh–150 kWh segment held a dominant market position, capturing more than a 45.6% share of the High Voltage Battery Market. This segment’s popularity is primarily due to its widespread application in electric vehicles (EVs), which require batteries with high energy density and efficiency to provide acceptable range and performance at competitive costs. The versatility of batteries within this capacity range makes them suitable for a broad spectrum of EVs, from sedans to smaller SUVs, aligning with the growing consumer demand for electric mobility solutions that balance range, cost, and charging speed.

Moving up the scale, the 151 kWh–225 kWh segment represents a niche but growing portion of the market, tailored mainly for premium electric vehicles and commercial applications like electric buses and trucks. Although this segment accounted for a smaller market share compared to the 75 kWh–150 kWh category, it is crucial for applications requiring extended range and durability. The demand in this segment is driven by the logistics and transportation sectors’ need for reliable, long-range electric vehicles to reduce carbon emissions and operating costs.

The 226 kWh–300 kWh battery capacity range is emerging as a critical segment for heavy-duty applications, including large commercial vehicles and industrial energy storage systems. This segment addresses the need for high power output and energy storage capacity, essential for supporting the electrification of heavy transportation and the integration of renewable energy sources into the grid. Although its market share is currently smaller, its importance is expected to grow significantly as industries push for more sustainable and efficient energy solutions.

Lastly, the >300 kWh segment caters to highly specialized applications that require extremely high energy capacities, such as electrified maritime vessels, grid-scale energy storage systems, and certain types of large commercial vehicles. While this segment represents the smallest market share, its growth potential is substantial, driven by the global transition towards greener energy and the electrification of sectors traditionally reliant on fossil fuels.

The development in this segment is indicative of the market’s direction towards higher capacity and more efficient battery solutions, capable of meeting the demands of a wide range of high-power applications.

By Battery Type

In 2023, Lithium Iron Phosphate (LFP) held a dominant market position, capturing more than a 39.6% share of the High Voltage Battery Market. LFP’s lead is due to its exceptional safety profile and long life cycle, making it a preferred choice for electric vehicles (EVs) and energy storage systems. Its resistance to high temperatures and cost-effectiveness further bolster its appeal in markets prioritizing safety and value.

Following closely, Lithium Nickel Manganese Cobalt Oxide (NMC) batteries have carved out a significant niche, prized for their balanced performance. NMC batteries offer a good mix of energy density, power, and longevity, suiting a wide range of applications from consumer electronics to electric vehicles. This versatility has positioned NMC as a key player in the market, especially in sectors seeking a compromise between cost and performance.

Lithium Nickel Cobalt Aluminium Oxide (NCA) batteries are notable for their high energy density, which translates into longer ranges for EVs and greater storage capacity for portable electronics. Though they hold a smaller share compared to LFP and NMC, the demand for NCA is on the rise, especially in high-end electric vehicles and aerospace applications where maximum energy density is paramount.

By Voltage

In 2023, the 400–600V segment held a dominant market position, capturing more than a 65.6% share of the High Voltage Battery Market. This voltage range is particularly popular in the electric vehicle (EV) industry, offering an optimal balance between performance, safety, and cost.

Batteries within this voltage range are widely used in passenger EVs, providing sufficient power for most consumer needs while ensuring compatibility with existing charging infrastructure. Their widespread adoption is driven by the segment’s ability to meet the majority of market demands for efficiency, range, and charging speed, making it a staple in the electric mobility sector.

The >600V segment, while smaller, targets high-performance and commercial applications requiring greater power output and efficiency. This higher voltage range is key for electric buses, trucks, and performance-oriented passenger vehicles, where it enables longer ranges and faster charging times. Although it represents a smaller portion of the market, the >600V segment is critical for advancing electric transportation in sectors that demand more from their battery systems. The growth in this segment reflects the industry’s push towards more robust and efficient electric vehicles, catering to a niche yet essential market need.

Together, these voltage segments highlight the evolving landscape of the High Voltage Battery Market, showing a clear preference for 400–600V solutions in mainstream applications, while also acknowledging the growing role of >600V batteries in pushing the boundaries of what electric powertrains can achieve.

By Driving Range

In 2023, the High Voltage Battery Market, the 100–250 miles segment held a dominant market position, capturing more than a 32.2% share. This range is especially popular among entry-level electric vehicles (EVs) and hybrids, offering an accessible entry point for consumers new to electric mobility. The appeal of this segment lies in its ability to meet daily commuting needs without the premium price tag of longer-range models. It’s an ideal choice for city driving and short trips, making it a practical option for a significant portion of the market.

The 251–400 miles range segment follows, catering to consumers seeking EVs with longer driving ranges without venturing into the highest price brackets. This segment combines practicality with advanced battery technology, providing enough range to eliminate most range anxiety concerns for users. It’s particularly appealing for those who regularly undertake longer journeys and represents a growing preference for versatility and reliability in electric mobility.

Moving up, the 401–550 miles segment targets a niche yet growing market of consumers demanding even greater driving ranges. Vehicles in this category are often equipped with cutting-edge battery technology, offering extended ranges that rival and sometimes surpass traditional internal combustion engines. This segment is increasingly relevant as infrastructure and charging technology continue to evolve, catering to the needs of long-distance drivers and enthusiasts of cutting-edge EV technology.

Lastly, the >550 miles segment, though currently the smallest, showcases the pinnacle of high voltage battery technology and innovation. This segment is for ultra-long-range EVs, often in the luxury or specialized market niches, pushing the boundaries of what’s currently possible in the electric vehicle range. While it represents a smaller market share, its growth signals a future where electric vehicles can compete directly with the longest-range internal combustion vehicles, offering exciting prospects for advancements in battery technology and EV capabilities.

By Applications

In 2023, passenger cars held a dominant market position in the High Voltage Battery Market, capturing more than a 56.3% share. This segment benefits from the surge in consumer demand for electric vehicles (EVs), as more people seek sustainable and efficient transportation options.

Passenger cars with high voltage batteries offer enhanced performance and longer driving ranges, making them an attractive choice for everyday use. The broad appeal of EVs in this category underscores the shift towards cleaner, electric-powered personal mobility solutions.

Buses come next, embodying the push for electrification in public transportation. High voltage batteries are key to this segment, providing the necessary power and endurance for buses to operate efficiently on their routes throughout the day. This application is critical for cities aiming to reduce carbon emissions and improve air quality, representing a growing market as more municipalities invest in electric public transport solutions.

Trucks equipped with high voltage batteries mark another important segment, addressing the demand for cleaner, more efficient commercial vehicles. This category includes light, medium, and heavy-duty trucks, all benefiting from the high power and extended range that high voltage batteries provide. As logistics and delivery companies look to decrease their environmental footprint and operating costs, the adoption of electric trucks is on the rise, signaling a significant shift in the commercial vehicle market.

Key Market Segments

By Battery Capacity

- 75 kWh–150 kWh

- 151 kWh–225 kWh

- 226 kWh–300 kWh

- >300 kWh

By Battery Type

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt Oxide

- Lithium Nickel Cobalt Aluminium Oxide

- Others

By Voltage

- 400–600V

- >600V

By Driving Range

- 100–250 miles

- 251–400 miles

- 401–550 miles

- >550 miles

By Applications

- Passenger cars

- Bus

- Trucks

- Others

Drivers

Electrification of the Automotive Sector: A Catalyst for High Voltage Battery Market Growth

A pivotal driver propelling the High Voltage Battery Market forward is the comprehensive electrification of the automotive sector. This transformative shift is fueled by a global consensus on reducing carbon emissions, the implementation of stringent environmental regulations by governments worldwide, and a collective move towards sustainable transportation solutions.

Electric vehicles (EVs), as the cornerstone of this transition, rely heavily on high voltage batteries to meet the increasing demands for longer driving ranges, faster charging times, and improved overall performance. These batteries, characterized by their ability to operate at higher voltages than traditional battery systems, are instrumental in optimizing the efficiency and capabilities of electric powertrains.

The push for automotive electrification is not just a response to environmental concerns but also reflects changing consumer preferences. Buyers are increasingly favoring vehicles that offer lower operating costs, reduced noise levels, and zero tailpipe emissions, all of which are achievable with EVs powered by high voltage batteries.

Furthermore, technological advancements in battery chemistry and management systems have significantly reduced the cost of high voltage batteries while enhancing their energy density and longevity. This evolution has made electric vehicles more accessible and appealing to a broader audience, thereby stimulating the demand for high voltage batteries.

In addition, government incentives such as tax rebates, grants, and subsidies for EV purchasers, coupled with investments in charging infrastructure, have made electric vehicles more attractive to consumers and businesses alike. This supportive regulatory environment is crucial for the continued expansion of the high voltage battery market, as it helps to lower the barriers to EV adoption.

The automotive industry’s commitment to electrification is evidenced by the substantial investments from established automakers and new entrants in developing electric models across various segments, from passenger cars to commercial vehicles. This diversification of the EV market ensures a steady demand for high voltage batteries, positioning them as a key component in the future of transportation.

Restraints

High Initial Costs and Infrastructure Challenges: Key Restraints in the High Voltage Battery Market

One significant restraint facing the High Voltage Battery Market is the high initial costs associated with developing and manufacturing these advanced energy storage solutions, coupled with the challenges of establishing a comprehensive charging infrastructure.

High voltage batteries, particularly those used in electric vehicles (EVs) and renewable energy storage systems, incorporate sophisticated technology and materials that elevate production costs. These expenses, in turn, contribute to higher retail prices for end-users, potentially hindering market growth by making EVs and other applications less accessible to a broader audience.

The manufacturing of high voltage batteries involves complex processes and high-quality materials to ensure safety, efficiency, and longevity. The need for these high standards stems from the batteries’ operation at significantly higher voltages than traditional battery systems, which introduces additional technical and safety challenges.

Consequently, research and development (R&D) in this area are both time-intensive and costly, with the expenses often passed on to consumers in the form of higher-priced products. While technological advancements and economies of scale are gradually reducing these costs, they remain a considerable barrier to widespread adoption.

Furthermore, the deployment of high voltage battery technology on a large scale necessitates a robust and accessible charging infrastructure, particularly for EVs. The current infrastructure in many regions is insufficient to support the growing number of electric vehicles, leading to range anxiety among potential buyers.

The challenge is not just the quantity of charging stations but also their distribution, reliability, and the speed at which they can recharge high voltage batteries. Developing this infrastructure requires significant investment from both public and private sectors and is a slow process that can lag behind the pace of EV adoption, further restraining the market.

These challenges are compounded in regions with limited access to reliable electricity or where the grid may not support rapid growth in demand from EVs and other high voltage battery-dependent technologies.

In such areas, the feasibility of transitioning to electric mobility or adopting high voltage energy storage solutions faces additional hurdles, not just in terms of infrastructure but also in ensuring the stability and sustainability of energy supplies.

Opportunities

Expansion into Emerging Markets: A Golden Opportunity for the High Voltage Battery Market

The High Voltage Battery Market stands on the brink of a significant opportunity through its expansion into emerging markets. As countries around the globe intensify their focus on sustainable development and green energy solutions, the demand for high voltage batteries, especially within the electric vehicle (EV) and renewable energy storage sectors, is set to skyrocket.

Emerging economies, in particular, represent untapped potential due to their rapid urbanization, increasing environmental awareness, and growing acceptance of new technologies. These markets are witnessing a substantial shift towards electrification in transportation and a push for renewable energy sources, which are intrinsically linked to the adoption of high voltage battery systems.

Emerging markets offer a fertile ground for the growth of the High Voltage Battery Market for several reasons. Firstly, the rising middle class in these regions is showing a keen interest in adopting EVs, driven by the desire for cleaner, more efficient modes of transportation and supported by improving economic conditions. As consumer purchasing power increases, the appetite for technologically advanced, sustainable products, including electric vehicles equipped with high voltage batteries, is expanding.

Secondly, many governments in emerging economies are implementing policies and incentives to promote the adoption of electric vehicles and the development of renewable energy projects. These initiatives often include subsidies for EV purchases, investments in charging infrastructure, and targets for renewable energy adoption, creating a conducive environment for the growth of the High Voltage Battery Market. The regulatory push towards reducing carbon emissions and mitigating climate change effects further amplifies this opportunity.

Moreover, the energy sector in these regions is undergoing a transformation, with a growing emphasis on energy security and the integration of renewable sources into the grid. High voltage batteries play a crucial role in this transition, offering solutions for energy storage that enable the stabilization of renewable energy supply and enhance grid reliability.

The potential for high voltage battery applications in utility-scale energy storage, microgrids, and off-grid systems is particularly significant in emerging markets, where the energy infrastructure may be less developed or in need of modernization.

Lastly, the increasing technological collaboration and investment flow into emerging markets are facilitating the transfer of high voltage battery technology and expertise. This not only aids in building local capacities but also in adapting these technologies to meet the unique needs and challenges of each region, thereby maximizing market penetration and impact.

Trends

The Rise of Solid-State Batteries: A Transformative Trend in the High Voltage Battery Market

A significant trend shaping the future of the High Voltage Battery Market is the emergence and anticipated commercialization of solid-state batteries. This new battery technology is poised to revolutionize the market with its superior energy density, enhanced safety features, and longer lifespan compared to traditional lithium-ion batteries.

Solid-state batteries replace the liquid or gel electrolytes found in conventional batteries with a solid electrolyte, which not only improves the battery’s thermal stability but also reduces the risk of leakage and combustion. This advancement addresses some of the primary concerns surrounding battery safety, particularly in electric vehicles (EVs) and high-power applications, making solid-state batteries a highly anticipated development in the industry.

The transition towards solid-state technology represents a leap forward in battery performance and efficiency. With the ability to store more energy in a smaller and lighter package, solid-state batteries offer the potential to significantly increase the driving range of electric vehicles, a critical factor in accelerating EV adoption globally. This enhanced energy density also opens up new possibilities for the miniaturization of power sources in portable electronics and the development of more compact, efficient energy storage solutions for renewable energy systems.

Another key advantage of solid-state batteries is their potential for faster charging times. The improved ionic conductivity of the solid electrolytes can facilitate quicker energy transfer, allowing for rapid charging of EVs and reducing downtime for consumers and businesses alike. This capability could dramatically enhance the convenience and appeal of electric vehicles, further propelling the High Voltage Battery Market forward.

The trend towards solid-state batteries is also being fueled by significant investments in research and development from both established industry players and innovative startups. As these entities strive to overcome the technical challenges associated with scaling up production and reducing costs, the progress made in this area is encouraging. Breakthroughs in materials science and manufacturing processes are gradually bringing solid-state batteries closer to commercial viability, with several companies announcing plans to begin production within the next few years.

Regional Analysis

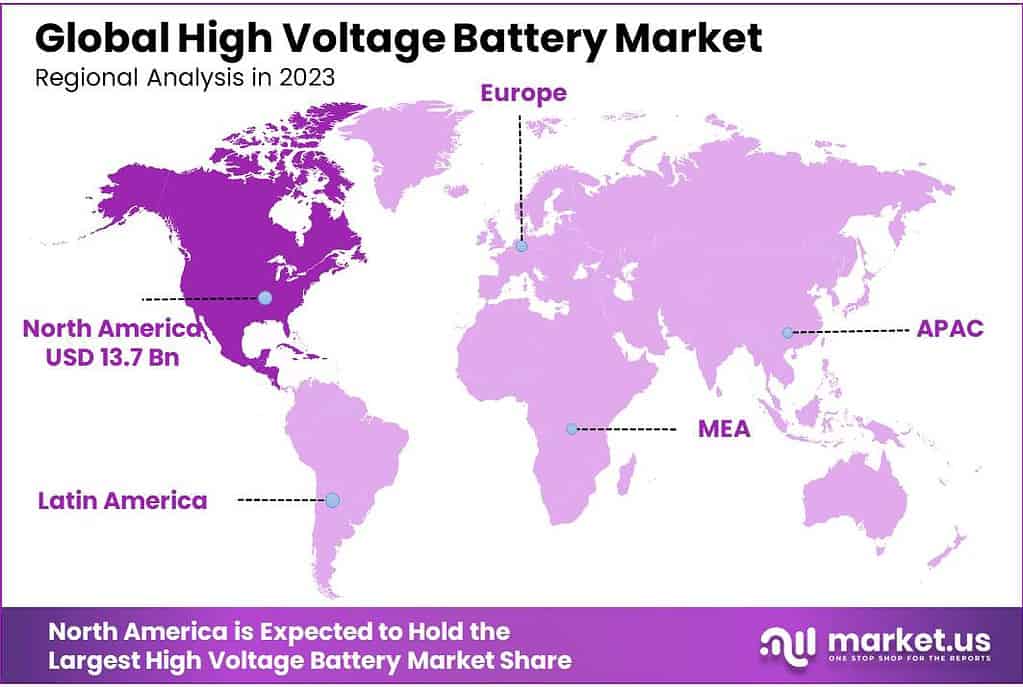

North America is projected to be the most lucrative region in the Global High Voltage Battery Market.

In 2023, North America secured the largest market share, holding 46% in the high voltage battery sector. The region, particularly the United States and Canada, boasts a robust adoption rate of electric vehicles (EVs) and renewable energy systems, underpinned by a strong cultural and economic embrace of technological innovation and sustainability. This has fostered significant consumer demand and established a solid foundation for market expansion.

The high voltage battery market in North America is distinguished by its commitment to innovation and a wide array of product offerings. Manufacturers are continuously advancing battery technology, exploring new chemistries, and enhancing energy density and charging speeds to meet the dynamic needs of consumers and industries. This drive for innovation is supported by substantial investments in research and development, aimed at pushing the boundaries of what high voltage battery technology can achieve.

Marketing strategies and government policies also play pivotal roles in bolstering the high voltage battery market in North America. Initiatives include incentives for EV purchases, investments in charging infrastructure, and campaigns promoting the adoption of renewable energy, all of which have contributed to maintaining and increasing the region’s market share.

Moreover, while the demand for high voltage batteries in applications like electric vehicles and large-scale energy storage systems remains strong, there is an observable shift towards more sustainable and efficient energy solutions. Manufacturers are responding to this trend by offering products that cater to this demand, including batteries with lower environmental impacts and higher efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market share analysis of the High Voltage Battery Market reveals a dynamic and competitive landscape, shaped by a variety of factors including technological advancements, consumer preferences, regulatory policies, and the strategic initiatives of key market players. This analysis aims to provide insights into how different companies and regions are positioned within the market, reflecting their strengths, innovations, and market penetration.

Key Market Players

- Tesla

- BYD Company Ltd.

- Panasonic Corporation

- LG Chem

- Continental AG

- SAMSUNG SDI CO.LTD.

- XALT Energy LLC

- ABB

- Contemporary Amperex Technology Co. Limited

- Siemens AG

- PROTERRA

- Robert Bosch GmbH

- Delphi Technologies

- Mitsubishi Electric Corporation

- Nissan

- Johnson Controls

- ChargePoint Inc.

- Magna International Inc.

Recent Developments

As of 2024, Tesla continues to dominate the high voltage battery sector, maintaining its position as a pioneering force in electric vehicle (EV) technology.

As of 2024, Panasonic Corporation remains a significant player in the high-voltage battery sector, particularly through its partnership with Tesla in supplying batteries for electric vehicles (EVs).

Report Scope

Report Features Description Market Value (2023) USD 30 Bn Forecast Revenue (2033) USD 642 Bn CAGR (2024-2033) 35.9% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Battery Capacity(75 kWh–150 kWh, 151 kWh–225 kWh, 226 kWh–300 kWh, >300 kWh), By Battery Type(Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Lithium Nickel Cobalt Aluminium Oxide, Others), By Voltage(400–600V, >600V, By Driving Range, 100–250 miles, 251–400 miles, 401–550 miles, >550 miles), By Applications(Passenger cars, Bus, Trucks, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Tesla, BYD Company Ltd., Panasonic Corporation, LG Chem, Continental AG, SAMSUNG SDI CO.LTD., XALT Energy LLC, ABB, Contemporary Amperex Technology Co. Limited, Siemens AG, PROTERRA, Robert Bosch GmbH, Delphi Technologies, Mitsubishi Electric Corporation, Nissan, Johnson Controls, ChargePoint Inc., Magna International Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of High Voltage Battery Market?High Voltage Battery Market size is expected to be worth around USD 642 Billion by 2033, from USD 30 Billion in 2023

What CAGR is projected for the High Voltage Battery Market?The High Voltage Battery Market is expected to grow at 35.9% CAGR (2024-2033).Name the major industry players in the High Voltage Battery Market?Tesla, BYD Company Ltd., Panasonic Corporation, LG Chem, Continental AG, SAMSUNG SDI CO.LTD., XALT Energy LLC, ABB, Contemporary Amperex Technology Co. Limited, Siemens AG, PROTERRA, Robert Bosch GmbH, Delphi Technologies, Mitsubishi Electric Corporation, Nissan, Johnson Controls, ChargePoint Inc., Magna International Inc.

High Voltage Battery MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

High Voltage Battery MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla

- BYD Company Ltd.

- Panasonic Corporation

- LG Chem

- Continental AG

- SAMSUNG SDI CO.LTD.

- XALT Energy LLC

- ABB

- Contemporary Amperex Technology Co. Limited

- Siemens AG

- PROTERRA

- Robert Bosch GmbH

- Delphi Technologies

- Mitsubishi Electric Corporation

- Nissan

- Johnson Controls

- ChargePoint Inc.

- Magna International Inc.