Global High Pressure Washer Market Size, Share, Growth Analysis By Product Type (Portable, Stationary), By Pressure Range (Below 2,000 psi, 2,000-2,500 psi, Above 2,500 psi), By Temperature Type (Hot, Cold), By Power Source (Electric, Gas, Others), By End-use (Residential, Commercial, Industrial, Construction, Mining, Agriculture, Oil & Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 152204

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

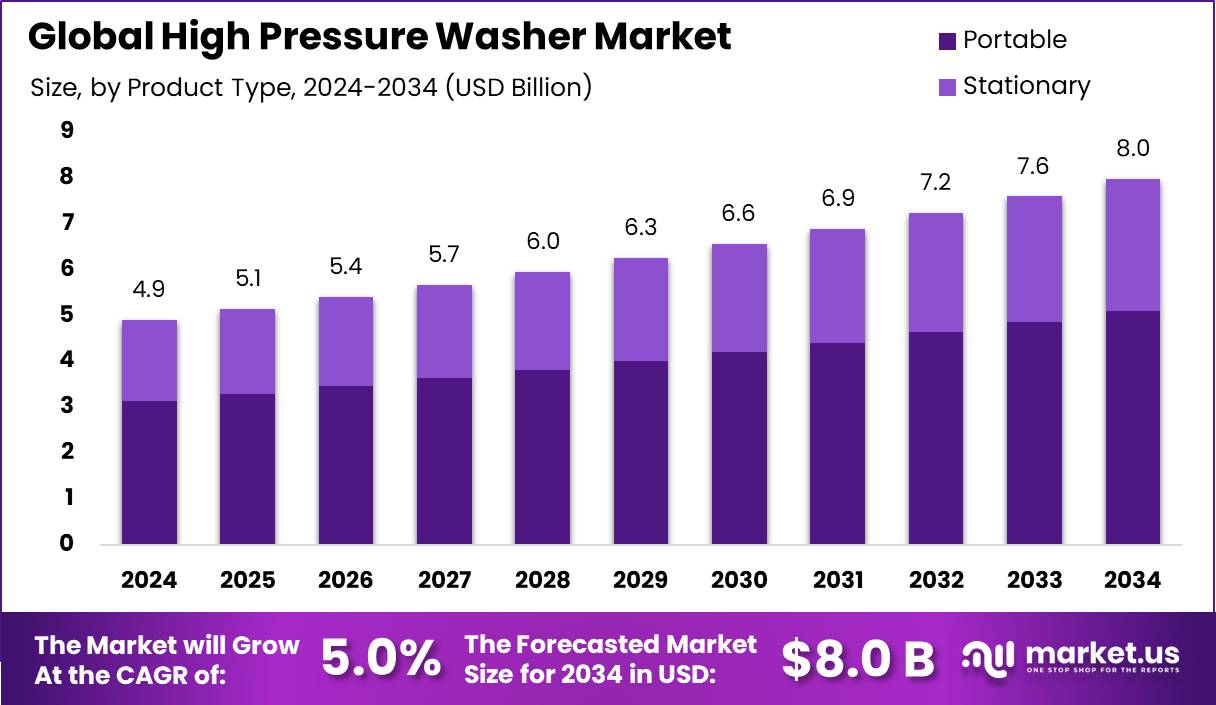

The Global High Pressure Washer Market size is expected to be worth around USD 8.0 Billion by 2034, from USD 4.9 Billion in 2024, growing at a CAGR of 5% during the forecast period from 2025 to 2034.

The High Pressure Washer Market includes machines that spray water at high pressure to clean surfaces. These washers are used in homes, businesses, factories, and construction sites. They help remove dirt, grease, and grime quickly and with less water. With growing demand for better cleaning, this market is expanding across many industries.

High pressure washers are available in different strengths. According to Surfacemaxx, most electric models sold in stores offer 1,500 to 3,000 PSI and 1.5 to 2.5 GPM, which are ideal for household and light industrial use. These are popular for cleaning driveways, walls, and small business spaces.

For tougher jobs, Jennychem says washers with 4,000 to 5,000 PSI (or 275 to 345 bar) are used in construction and manufacturing. They are strong enough to strip paint and clean heavy equipment or large warehouses. Demand for such machines is rising in large-scale industries and infrastructure projects.

Mid-range machines are also widely used. According to Hotsyab, models with 2,000 to 3,000 PSI work well for most industrial cleaning jobs. These are preferred by commercial users for their power and value. Many small factories and service providers use them for regular cleaning tasks.

Lighter washers are in demand for basic cleaning. Activeproducts reports that 1,000 to 2,000 PSI washers are perfect for washing cars, bikes, patio furniture, and small decks. These are popular among homeowners and small cleaning businesses. They are also easy to use and affordable.

Governments in many countries are encouraging cleaner and greener cleaning methods. Investments and incentives for eco-friendly machines are growing. Regulations are also pushing companies to use less water and fewer chemicals. This helps the market shift towards efficient and sustainable products.

In urban areas, rising interest in car washing services, home cleaning, and facility management is boosting sales. At the same time, new technology is improving washer design—cordless, battery-powered, and smart control models are gaining attention.

The rental model is also expanding. Many small businesses prefer renting pressure washers for short-term use, reducing cost and boosting market reach. As urbanization grows and awareness about hygiene increases, especially in Asia and Africa, the high pressure washer market is expected to see strong growth in the coming years.

Key Takeaways

- The Global High Pressure Washer Market is projected to reach USD 8 Billion by 2034, growing from USD 4.9 Billion in 2024 at a CAGR of 5% from 2025 to 2034.

- In 2024, Portable high pressure washers led the By Product Type segment with a 64.4% market share, driven by their flexibility and ease of use.

- The Below 2,000 psi category dominated the By Pressure Range segment in 2024 with a 46.7% share, favored for its safety and effectiveness for casual users.

- Hot water pressure washers captured a 73.4% share of the By Temperature Type segment in 2024, ideal for cleaning grease and industrial grime.

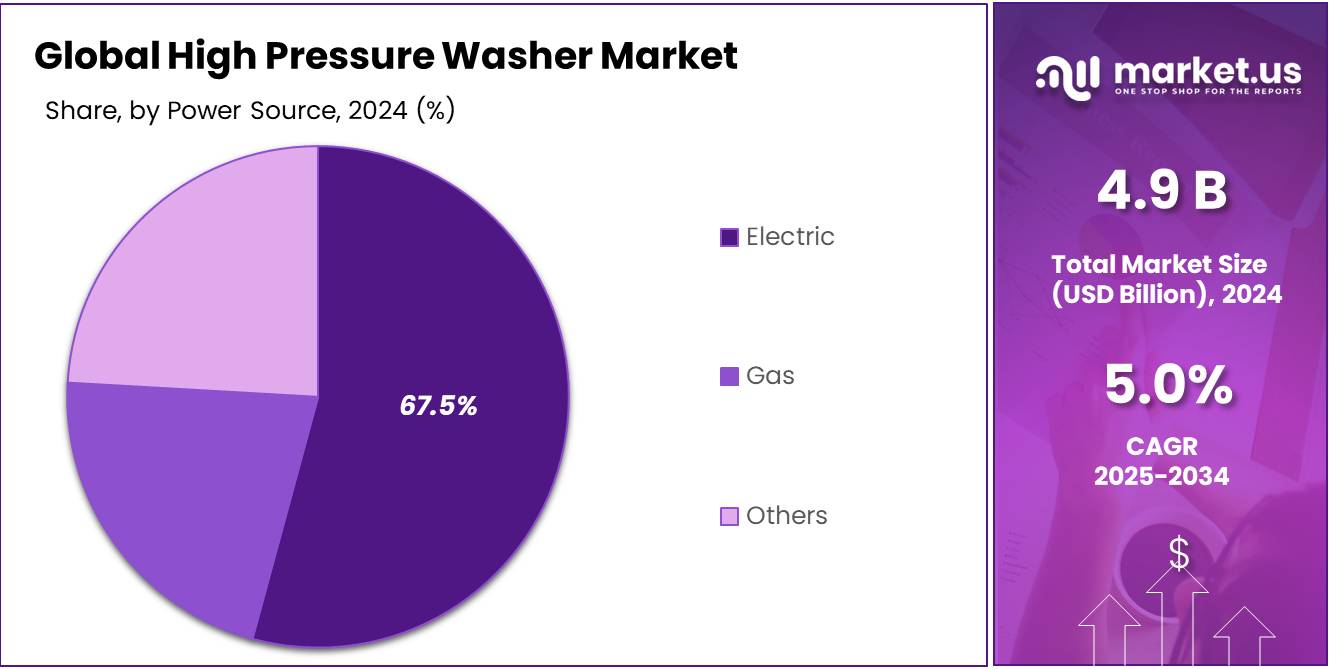

- In the By Power Source segment, Electric models held a leading 67.5% market share in 2024 due to low maintenance and indoor suitability.

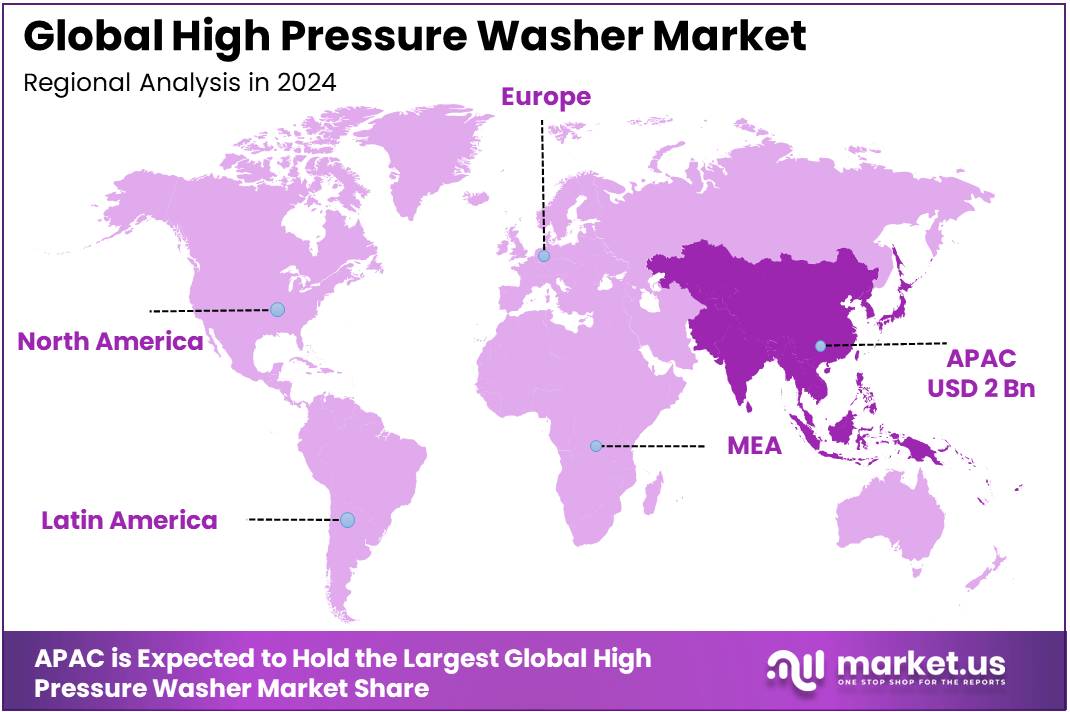

- Asia Pacific was the top regional market in 2024, accounting for 42.4% of the global share and valued at USD 2 Billion, driven by industrial growth and urbanization.

Product Type Analysis

Portable high pressure washers lead the market with 64.4% share owing to their mobility and user convenience.

In 2024, Portable held a dominant market position in By Product Type Analysis segment of the High Pressure Washer Market, with a 64.4% share. The strong preference for portable models stems from their flexibility in usage across both residential and commercial settings. Users benefit from easy handling and transportation, making these devices ideal for dynamic cleaning environments.

Stationary high pressure washers, while reliable and powerful, cater to fixed-location tasks and thus represent a smaller portion of the market. They are typically chosen for industrial or heavy-duty cleaning where mobility is not essential.

The growing trend toward do-it-yourself cleaning, especially in the automotive and homecare sectors, has further propelled demand for portable units. Additionally, compact storage requirements and cost-effectiveness have made them attractive for small businesses and individual users alike.

Pressure Range Analysis

Below 2,000 psi dominates with 46.7% due to suitability for residential and light-duty tasks.

In 2024, Below 2,000 psi held a dominant market position in By Pressure Range Analysis segment of the High Pressure Washer Market, with a 46.7% share. This range is particularly favored for its balance of effectiveness and safety, making it the go-to choice for homeowners and casual users.

High pressure washers in this category are ideal for cleaning vehicles, patios, and outdoor furniture, where overly high pressure might cause damage. Their accessibility, coupled with affordability, further enhances their appeal across non-industrial segments.

The 2,000–2,500 psi segment is often utilized for medium-duty cleaning, while Above 2,500 psi models are typically reserved for professional or industrial applications. However, their adoption remains limited due to higher operational risks and costs.

Temperature Type Analysis

Hot pressure washers dominate with 73.4% market share driven by superior grease and oil removal performance.

In 2024, Hot held a dominant market position in By Temperature Type Analysis segment of the High Pressure Washer Market, with a 73.4% share. Hot water washers excel at breaking down stubborn grime, grease, and oil, which makes them particularly valuable in automotive, construction, and industrial sectors.

The high efficiency of hot models results in faster cleaning cycles and reduced need for detergents, contributing to operational cost savings in the long term. These advantages make them the preferred choice in demanding work environments.

Cold water washers, while more economical and simpler in design, are primarily limited to general-purpose or low-demand cleaning tasks. Their inability to tackle heavy-duty dirt limits their scope of application in commercial and industrial settings.

Power Source Analysis

Electric high pressure washers lead with 67.5% due to low emissions and ease of use in residential areas.

In 2024, Electric held a dominant market position in By Power Source Analysis segment of the High Pressure Washer Market, with a 67.5% share. Electric models are widely used due to their low maintenance requirements, quieter operation, and suitability for indoor and residential environments.

The absence of fuel-related emissions makes them more eco-friendly and compliant with environmental regulations, adding to their popularity across urban users and eco-conscious buyers.

Gas-powered washers, though powerful, are preferred mainly in outdoor and industrial applications where electricity access is limited. The Others category—which may include battery-powered or hybrid models—remains a niche segment, with emerging interest but limited market share at this stage.

Key Market Segments

By Product Type

- Portable

- Stationary

By Pressure Range

- Below 2,000 psi

- 2,000-2,500 psi

- Above 2,500 psi

By Temperature Type

- Hot

- Cold

By Power Source

- Electric

- Gas

- Others

By End-use

- Residential

- Commercial

- Industrial

- Construction

- Mining

- Agriculture

- Oil & Gas

- Others

Drivers

Increasing Demand for Efficient Industrial Cleaning Solutions Drives Market Growth

The high pressure washer market is expanding due to the growing need for faster and more effective cleaning methods in industrial settings. Factories, warehouses, and manufacturing units prefer high pressure washers to reduce labor time and ensure high cleaning standards. These machines help remove tough stains, grease, and dirt without the need for harmful chemicals, improving overall productivity.

The rise in car wash and vehicle maintenance services also supports market growth. High pressure washers are essential in these businesses because they save water, reduce manual effort, and deliver better cleaning results. As more people seek professional car cleaning services, especially in urban areas, demand for high pressure washers is increasing.

Another contributing factor is the growth in commercial construction and infrastructure development. After construction, cleaning heavy equipment and surfaces like concrete and steel requires powerful cleaning tools. High pressure washers offer quick and deep cleaning, making them ideal for post-construction cleanup and ongoing maintenance.

In agriculture, farmers and agribusinesses are now using high pressure washers to clean farming tools, vehicles, and animal facilities. Clean environments help prevent disease and extend the life of equipment. With modern farms becoming more mechanized, the need for efficient cleaning tools like pressure washers is also rising.

Restraints

Limited Accessibility in Remote and Rural Areas Restrains Market Growth

One of the major challenges in the high pressure washer market is poor accessibility in rural and remote areas. These regions often lack the infrastructure needed to support equipment use, such as electricity and water supply, limiting the adoption of pressure washers in farming or household applications.

Noise pollution is another concern, especially in residential or urban settings. High pressure washers often produce loud noise during operation, which can disturb nearby people or animals. This factor discourages use in areas where quiet environments are necessary, such as hospitals, schools, or neighborhoods.

Environmental concerns also act as a restraint. High water usage and improper disposal of contaminated runoff can harm the environment. Some governments and environmental groups are calling for stricter regulations on water use, which may limit the use of traditional pressure washers.

In many developing economies, a lack of awareness and limited marketing prevents consumers from understanding the benefits of high pressure washers. People in these regions often rely on manual cleaning due to affordability issues or lack of exposure, slowing market penetration.

Growth Factors

Integration of IoT and Smart Monitoring Features Opens New Market Opportunities

Technology is creating new growth paths in the high pressure washer market, especially through IoT and smart monitoring features. These innovations allow users to track performance, water usage, and machine health remotely. Businesses can manage cleaning operations more efficiently, reducing maintenance costs and downtime.

There is also a rising demand for portable and battery-powered models. These versions are lighter, easier to carry, and ideal for locations without a direct power supply. Consumers and small businesses prefer them for quick cleaning tasks around homes, gardens, and construction sites. The mobility and convenience of these machines are boosting their popularity.

Strategic collaborations between high pressure washer manufacturers and cleaning service companies are further expanding the market. These partnerships allow brands to reach more customers by integrating washers into service packages. Cleaning firms benefit from modern, effective equipment, while manufacturers gain steady product demand.

These opportunities are helping the market to evolve beyond traditional industries and appeal to a broader audience, including residential users and emerging economies.

Emerging Trends

Shift Toward Eco-Friendly and Water-Efficient Technologies Shapes Market Trends

The trend toward eco-friendly solutions is transforming the high pressure washer market. Consumers and businesses now prefer machines that use less water and reduce harmful emissions. Manufacturers are responding by developing models that clean efficiently while conserving natural resources, aligning with environmental regulations and customer values.

Another emerging trend is the adoption of subscription-based models for cleaning equipment. Instead of purchasing machines, many businesses now rent or subscribe to cleaning equipment services. This reduces upfront costs and ensures regular maintenance, making high pressure washers more accessible to smaller firms or temporary projects.

The food processing industry is also using high pressure washers more frequently to maintain hygiene standards. These machines help clean machinery, floors, and surfaces quickly, reducing the risk of contamination. As food safety regulations tighten globally, demand for efficient and reliable cleaning tools in this industry is rising steadily.

Together, these trends reflect a broader shift toward sustainable, flexible, and industry-specific cleaning solutions, driving innovation and influencing buyer preferences in the high pressure washer market.

Regional Analysis

Asia Pacific Dominates the High Pressure Washer Market with a Market Share of 42.4%, Valued at USD 2 Billion

Asia Pacific leads the global high pressure washer market, accounting for the largest share of 42.4% and valued at USD 2 Billion. The region’s dominance is attributed to rapid industrialization, growing urban infrastructure, and rising demand for commercial and residential cleaning equipment in countries like China, India, and Southeast Asia. Increasing construction activities and awareness around hygiene and maintenance are also fueling market expansion in the region.

North America High Pressure Washer Market Trends

North America holds a significant position in the global market, driven by the widespread use of pressure washers in industrial cleaning, vehicle maintenance, and residential applications. Technological advancements and increased adoption of eco-friendly and electric-powered pressure washers are influencing demand. The U.S. remains a key contributor due to its developed infrastructure and strong emphasis on cleanliness standards.

Europe High Pressure Washer Market Trends

Europe exhibits steady growth in the high pressure washer market, supported by stringent environmental regulations and high adoption of sustainable cleaning technologies. The demand is particularly strong in countries with a focus on industrial hygiene, automotive maintenance, and efficient water use. The region’s strong manufacturing base also contributes to consistent product demand across commercial and industrial sectors.

Middle East and Africa High Pressure Washer Market Trends

The Middle East and Africa market is expanding gradually, primarily due to increasing urban development and infrastructure projects. Growing construction activities and efforts to improve sanitation in public and industrial areas are supporting demand. However, overall market penetration remains moderate due to economic variability across the region.

Latin America High Pressure Washer Market Trends

Latin America shows a developing market landscape, with growth spurred by rising awareness of hygiene and cleaning equipment efficiency. Urbanization and infrastructural upgrades in countries like Brazil and Mexico are positively influencing the market. However, economic challenges and limited industrialization in some parts of the region could impact broader adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key High Pressure Washer Company Insights

The global High Pressure Washer Market in 2024 remains competitive and innovation-driven, with several key players strengthening their foothold through product development, distribution expansion, and brand recognition. Alfred Karcher SE & Co. KG continues to lead the market with its wide-ranging product portfolio catering to both residential and industrial applications. The company’s strong global presence and focus on eco-friendly technologies bolster its dominance.

Annovi Reverberi S.p.A. stands out with its deep-rooted engineering expertise and robust distribution networks across Europe and North America. The company maintains steady growth by offering a diverse array of high-pressure pumps and washers known for durability and performance.

AR North America, a subsidiary of Annovi Reverberi, leverages its parent company’s R&D capabilities while targeting the North American market with tailored solutions. Its emphasis on compact, consumer-grade models makes it a preferred choice for DIY users.

Bosch holds a strategic position in the market due to its reputation for engineering excellence and product reliability. Its pressure washers are often integrated with smart technology features, aligning with growing consumer demand for convenience and innovation.

These players are shaping the trajectory of the high pressure washer market through targeted innovations and regional expansion. Their continued investment in product differentiation and customer service will be crucial in navigating the increasingly fragmented competitive landscape.

Top Key Players in the Market

- Alfred Karcher SE & Co. KG

- Annovi Reverberi S.p.A.

- AR North America

- Bosch

- Briggs & Stratton Corporation

- Comet Spa

- Craftsman

- Dewalt

- FNA Group

- Husqvarna Group

- Karcher

- Nilfisk Group

- Ryobi

- Simpson

Recent Developments

- In date July 2024, Annovi Reverberi (AR) Group announces the acquisition of 100% of the capital of Alberti International Srl, strengthening its presence in the industrial cleaning sector. This strategic move enhances AR’s technological capabilities and global market position.

- In date July 2024, ExpressClean360, a premier provider of pressure washing services, proudly acquires St. Augustine Powerwashing LLC, a reputable company based in St. Augustine, FL. The acquisition expands ExpressClean360’s footprint in the Southeastern U.S. and boosts its residential and commercial offerings.

- In date February 2025, RF announces the acquisition of S&K Building Services, reinforcing its portfolio in the essential services sector. This acquisition enhances RF’s operational capacity and national reach across the facilities maintenance industry.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Billion Forecast Revenue (2034) USD 8 Billion CAGR (2025-2034) 5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Portable, Stationary), By Pressure Range (Below 2,000 psi, 2,000-2,500 psi, Above 2,500 psi), By Temperature Type (Hot, Cold), By Power Source (Electric, Gas, Others), By End-use (Residential, Commercial, Industrial, Construction, Mining, Agriculture, Oil & Gas, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alfred Karcher SE & Co. KG, Annovi Reverberi S.p.A., AR North America, Bosch, Briggs & Stratton Corporation, Comet Spa, Craftsman, Dewalt, FNA Group, Husqvarna Group, Karcher, Nilfisk Group, Ryobi, Simpson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Pressure Washer MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

High Pressure Washer MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfred Karcher SE & Co. KG

- Annovi Reverberi S.p.A.

- AR North America

- Bosch

- Briggs & Stratton Corporation

- Comet Spa

- Craftsman

- Dewalt

- FNA Group

- Husqvarna Group

- Karcher

- Nilfisk Group

- Ryobi

- Simpson