Global High-Performance Fibers Market, By Product (Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, and Other Products), By Application (Electronics & Telecommunication, and Other), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec 2024

- Report ID: 32821

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

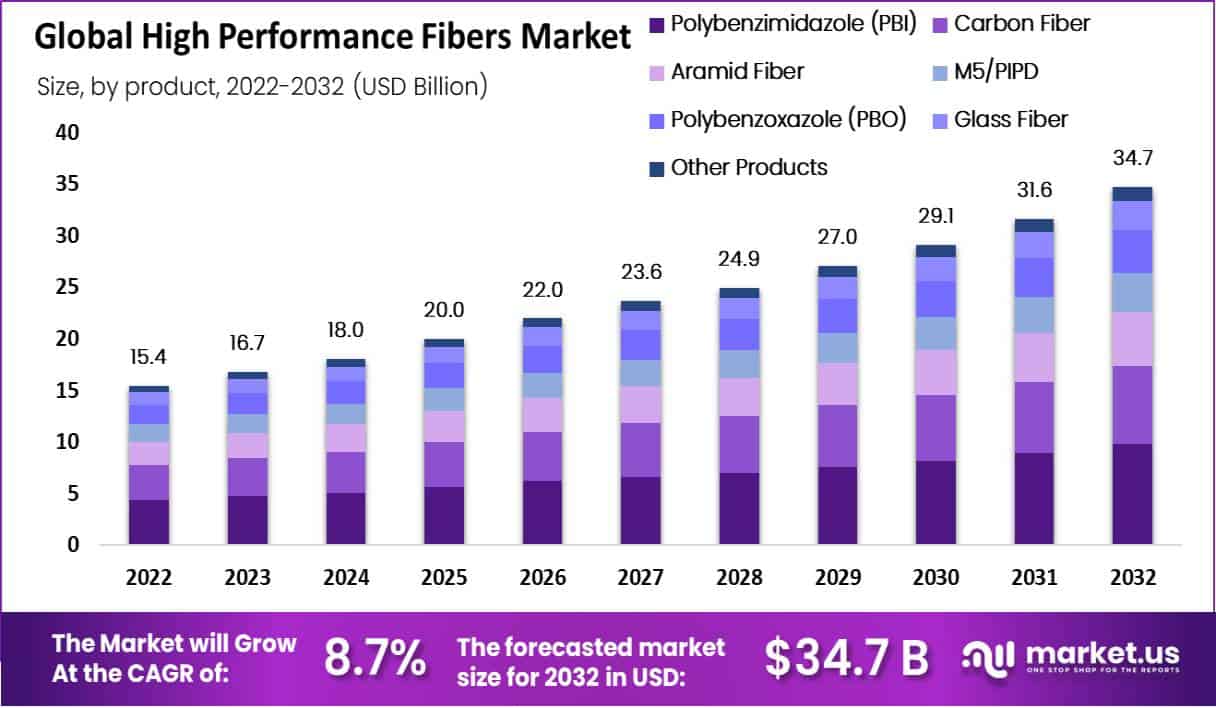

In 2022, the Global High-Performance Fiber Market size accounted for USD 15.4 billion and is expected to reach USD 34.7 billion in 2032. This market is estimated to register a CAGR of 8.7% between 2023 and 2032.

High-performance fibers (HPF) will increasingly be used to reinforce composite materials for use in aircraft, military vehicles, electronics, and sports goods. High-performance fibers are a preferred option in these industries because they provide greater mechanical qualities to more conventional materials such as metals and plastics.

Some of the top features of high-performance fibers are strong abrasion resistance, non-conductivity, and good fabric structure at high temperatures. The product is also particularly beneficial for aircraft applications due to its high rigidity and exceptional strength-to-weight ratio.

Production of materials with high tensile strength and higher heat resistance for many industries, including the automotive and aerospace industries, is being driven by the growing demand for innovative organic high-performance fibers.

Key Takeaways

- Market Trends: The high-performance fiber market is projected to experience compound annual compound growth of 8.7% between 2023-2032.

- High-Performance Fiber Overview: High-performance fibers have long been valued for their unparalleled strength, durability, and unique qualities in industrial settings. Their applications extend far beyond fiber optic cables.

- Product Analysis: Polybenzimidazole (PBI) held the highest market revenue share among high-performance fibers in 2022.

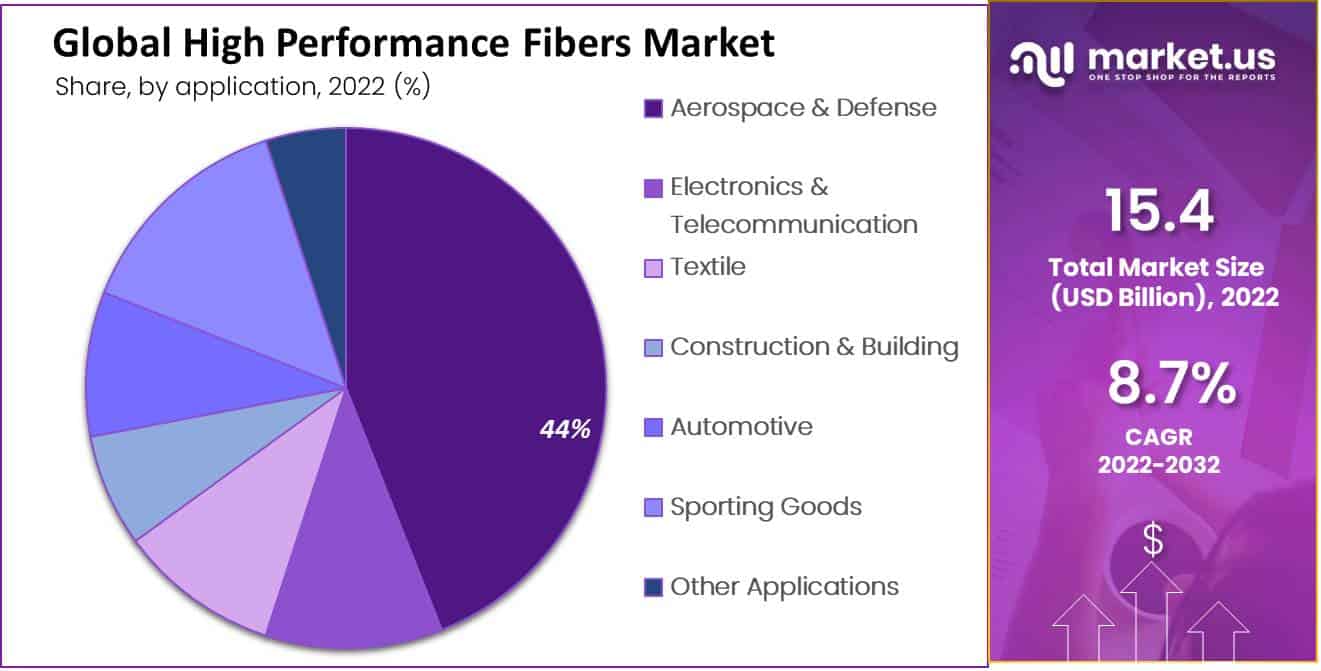

- Application Analysis: As of 2022, aerospace and defense applications held over 44% of global revenue share.

- End User Analysis: In 2022, personal use held the highest revenue share within the high-performance fibers market.

- Drivers: End-user industries’ expansion, technological developments, and demand for lightweight yet high-strength materials drive development in the high-performance fibers market. Manufacturing process improvements also significantly contribute to market expansion.

- Restraints: High-performance fiber manufacturers face many hurdles to their growth in production costs and raw material availability, along with competition from advanced materials.

- Recent Trends: Trends within the global high-performance fiber market include an increasing need for lightweight yet high-strength materials, advancements in fiber technologies, and an emphasis on sustainable and eco-friendly production of high-performance fiber.

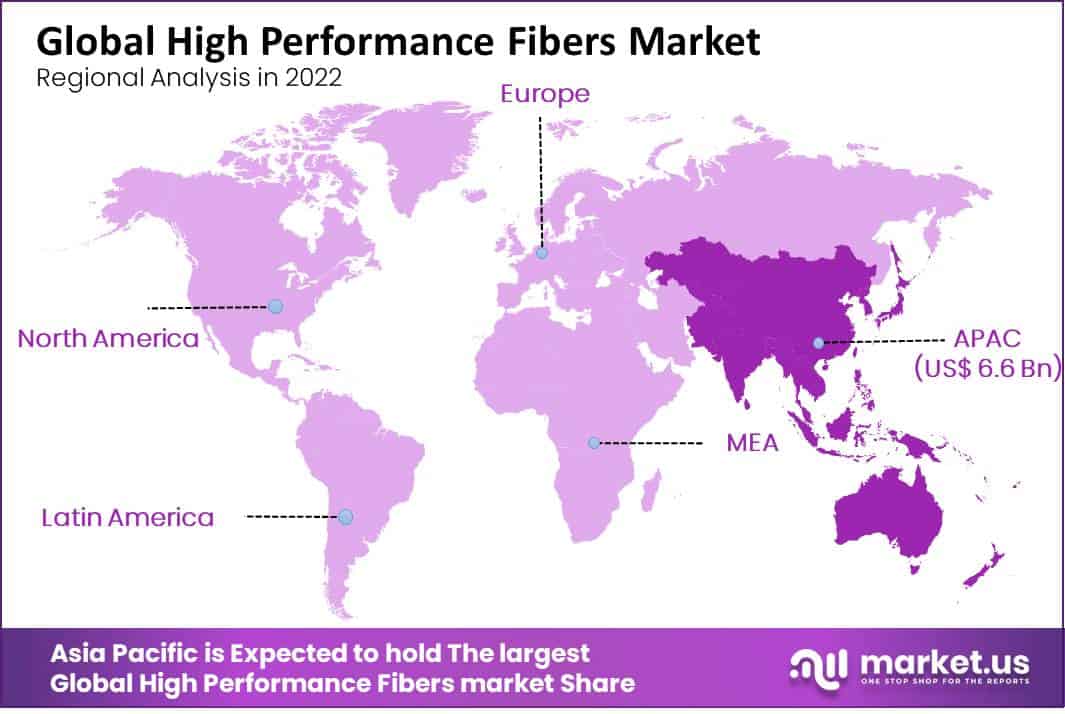

- Regional Analysis: Asia Pacific led global revenue sharing at 43.20% by contributing 43.40% of total revenues worldwide in 2022.

- Key Players in the High-Performance Fiber Market: Major players in the high-performance fiber industry include established manufacturers, research organizations, and technology innovators. These key players rely heavily on collaborations, innovation, and strategic expansions in order to stay competitive within this fast-growing sector of industry.

Driving Factors

Development of new manufacturing technologies:

With the development of new advanced technologies such as 3D printing and nanotechnology, it is now possible to manufacture high-performance fibers that have improved properties at lower costs. In the future, this is expected to raise the demand for high-performance fibers.

Increasing demand for electric vehicles:

Electric vehicles are expected to increase in popularity, which will lead to a rise in demand for high-performance fibers. These fibers reduce weight and improve the fuel efficiency of electric vehicles by using them.

Growing demand from emerging economies:

The demand from developing nations has grown. Countries like China and India are rapidly industrializing and urbanizing. This has enhanced the need for high-performance fibers. These nations make significant infrastructure investments, which fuels the market for high-performance fibers. The market for high-performance fibers is anticipated to expand in the upcoming years as a result of technical improvements, rising sustainability awareness, and growing demand from emerging economies.

Restraining Factors

The availability of substitute materials:

In some circumstances, substitute materials may provide high-performance fibers with equivalent performance qualities at a less expensive price. For instance, carbon fibers are frequently replaced by steel and aluminum in automobile applications.

Although high-performance fibers are stronger and lighter than conventional materials, for certain producers the cost reductions of alternative materials may be more attractive.

High cost of production:

High-performance fiber manufacture is a difficult, expensive process that requires specialized tools and expertise. High-performance fibers are made from expensive raw materials including aramid, carbon fiber, and glass fiber.

These elements raise the cost of manufacture relative to conventional fibers, which might prevent some businesses from adopting them. The failure of manufacturers to scale up results due to the high cost of production may hinder market expansion.

By Product Analysis

The Polybenzimidazole (PBI) Segment Accounted for the Largest Revenue Share in High-Performance Fibers Market in 2022

Polybenzimidazole fibers (PBI) are expected to have the highest CAGR, at more than 14.00%, due to the superior properties of the product. These include a high glass transition, no melting temperature, and an extremely high temperature for heat deflection.

PBI fibers find applications in a variety of products, including safety and heat garments such as firefighter’s uniforms and gloves.

PBI fibers can be used in a variety of applications, including high-performance fibers such as Kevlar. PBI fibers are flexible and have low moisture gain, low tenacity, and a superior strength-to-weight ratio.

They also do not burn or melt. These fibers are used for plastic reinforcements and heat and chemical-resistant filters. They can also be found in civil engineering applications.

The Carbon Fibers Segment is the Fastest Growing Type Segment in the High Performance Fibers Market.

Due to its numerous uses in the aerospace sector, including rockets, aircraft, missiles, and satellites, carbon fiber was the second-largest product.

Additionally, the demand is anticipated to be fueled by the rising use of CFRCs in aircraft components because of their lightweight and stiffness characteristics. The weight of carbon fiber structures is around one-third that of aluminum and half of steel.

By Application Analysis

The Aerospace and Defense Segment Accounted for the Largest Revenue Share in High-Performance Fibers Market in 2022

In 2022, the aerospace and defense application sector dominated the market and accounted for over 44% of the global revenue share.

Since the sector is going towards lightweight materials in an effort to increase the cost-efficiency and environmental performance of the aircraft, it is anticipated to achieve a consistent CAGR from 2022 to 2030.

Therefore, the production of aircraft depends on lightweight, high-strength, and fiber-reinforced composite materials. Lightweight materials and structures have a great advantage in aircraft applications because they provide strength and stiffness with reduced weight.

This reduces fuel consumption significantly. These materials allow aircraft, especially military aircraft, to carry more fuel and payload, extending their missions and reducing downtime.

By End-User Analysis

The Personal Segment Accounted for the Largest Revenue Share in High Performance Fibers Market in 2022

Based on end-user, the market is segmented into Personal, Public, and Other End-User. Among these types, the personal segment is expected to be the most lucrative in the global high performance fiber market, with the largest revenue share during the forecast period.

High-performance fibers used in personal protection equipment are often referred to as the personal segment of the high-performance fibers market.

Key Market Segments

Based on Product

- Carbon Fiber

- Polybenzimidazole (PBI)

- Aramid Fiber

- M5/PIPD

- Polybenzoxazole (PBO)

- Glass Fiber

- High Strength Polyethylene

- Other Products

Based on Application

- Electronics & Telecommunication

- Textile

- Aerospace & Defense

- Construction & Building

- Automotive

- Sporting Goods

- Other Applications

Based on End-User

- Personal

- Public

- Other End-User

Growth Opportunity

Product development and innovation:

The creation of new and better high-performance fibers with increased qualities, such as strength, durability, and heat resistance, can contribute to the industry’s growth. High-performance fiber performance research and development initiatives might result in new applications and a rise in demand.

High performance fibers customers often have very specific fiber requirements. Fibers can be tailored to meet the needs of customers, either by modifying fiber properties or creating a new fiber.

Latest Trends

Technological advancements in carbon fiber:

Carbon fiber is one of the most often used high-performance fibers, and in recent years, there have been major advances in carbon fiber technology. Considering these advancements have boosted carbon fiber’s strength, stiffness, and fatigue resistance, it is now an appealing material for a wider range of applications.

Increasing demand in the aerospace industry:

The use of high-performance fibers in the production of aircraft is rising. The aerospace industry is one of the largest users of high-performance fibers. The demand for lightweight materials can increase fuel efficiency and reduce carbon emissions.

Regional Analysis

Asia Pacific Accounted the Largest Revenue Share in High Performance Fiber Market in 2022

The Asia Pacific region dominated the market and generated more than 43.00% of the global revenue share in 2022. An increase in demand for fiber-reinforced composite materials in the construction, electronics, and automotive industries is expected to make it the market with the faster CAGR during the projection period.

The market is also anticipated to be driven by product advancements, the availability of raw materials at reasonable rates, and the establishment of production facilities by industry players.

The increasing need for security and protection measures across a range of end-use sectors, including mining, oil & gas, manufacturing, healthcare/medical, and building & construction, and, the military is driving product consumption in developed nations like China and India.

The rising use of high-performance fibers in place of asbestos and steel is anticipated to fuel market expansion. Additionally, North America represented a sizeable portion of the market in 2022 due to the region’s significant impact on product demand brought on by the existence of important aircraft manufacturers.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the market’s significant concentration of both global and regional players, manufacturers face intense competition from one another. Suppliers of raw materials are important players in the value chain since they provide the vital raw materials required to begin the production process of various fibers.

The profitability and expansion of the market throughout the world are being hampered by the high cost of producing M5/PIPD, PBI, aramid fibers, and PBO. In addition to high production costs, initial capital expenditure and monomer supply are expected to make it difficult for the capacity of the aforementioned fiber to increase throughout the projection period.

Market Key Players

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- Toyobo Co. Ltd

- DSM

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp.

- I. du Pont de Nemours and Company

- Zoltek Companies Inc.

- Kamenny Vek

- Koninklijke Ten Cate NV

- Other Key Players

Recent Developments

- The development of carbon fibers has advanced significantly in 2021, and new production techniques are being developed to lower their price and enhance their availability. For instance, scientists at the National Institute for Materials Science in Japan have created a brand-new method that enables the production of high-quality carbon fibers from a readily available, inexpensive precursor material.

- The aramid fiber industry launching new products that offer increased performance in areas like heat resistance and durability. For instance, Teijin unveiled the Twaron Black aramid fiber, a novel material with enhanced heat resistance and the ability to tolerate temperatures of up to 260 degrees Celsius.

Report Scope

Report Features Description Market Value (2022) USD 15.4 Bn Forecast Revenue (2032) USD 34.7 Bn CAGR (2023-2032) 8.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, Polybenzoxazole (PBO), Glass Fiber, High Strength Polyethylene, and Other Products), By Application (Electronics & Telecommunication, Textile, Aerospace & Defense, Construction & Building, Automotive, Sporting Goods and Other Applications), By End-User (Personal, Public and Other End-User) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Toray Industries, Inc., Dupont, Teijin Limited, Toyobo Co. Ltd, DSM, Kermel S.A., Kolon Industries, Inc., Huvis Corp., E.I. du Pont de Nemours and Company, Zoltek Companies Inc., Kamenny Vek, Koninklijke Ten Cate NV, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for High Performance Fibers Market in 2032?In 2032, the High Performance Fibers Market will reach USD 34.7 billion.

What CAGR is projected for the High Performance Fibers Market?The High Performance Fibers Market is expected to grow at 8.7% CAGR (2023-2032).

List the segments encompassed in this report on the High Performance Fibers Market?Market.US has segmented the High Performance Fibers Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product, market has been segmented into Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, Polybenzoxazole (PBO), Glass Fiber, High Strength, Polyethylene and Other Products. By Application, the market has been further divided into Electronics & Telecommunication, Textile, Aerospace & Defense, Construction & Building, Automotive, Sporting Goods and Other Applications.

Which segment accounts for the greatest market share in the High Performance Fibers industry?With respect to the High Performance Fibers industry, vendors can expect to leverage greater prospective business opportunities through the Carbon Fiber segment, as this area of interest accounts for the largest market share.

Name the major industry players in the High Performance Fibers Market.Toray Industries, Inc., Dupont, Teijin Limited, Toyobo Co. Ltd, DSM, Kermel S.A., Kolon Industries, Inc. Huvis Corp. and Other Key Players are the main vendors in this market.

High Performance Fiber MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

High Performance Fiber MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- Toyobo Co. Ltd

- DSM

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp.

- I. du Pont de Nemours and Company

- Zoltek Companies Inc.

- Kamenny Vek

- Koninklijke Ten Cate NV

- Other Key Players