Global High-performance Computing (HPC) Market Size, Share, Growth Analysis Report By Component (Hardware, Software, Services), By Deployment (On-premises, Cloud-based, Hybrid), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Simulation & Modeling, Data Analytics & Artificial Intelligence, Research & Development, Engineering & Design, Weather & Climate Forecasting, Others), By End-User Industry (Government & Defense, Academic & Research, Manufacturing, Banking, Financial Services, and Insurance, Healthcare & Life Sciences, Media & Entertainment, Energy & Utilities, Others) – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2035

- Published date: Jan. 2026

- Report ID: 173385

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment

- By Organization Size

- By Application

- By End-User Industry

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Competitive Capability Matrix

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

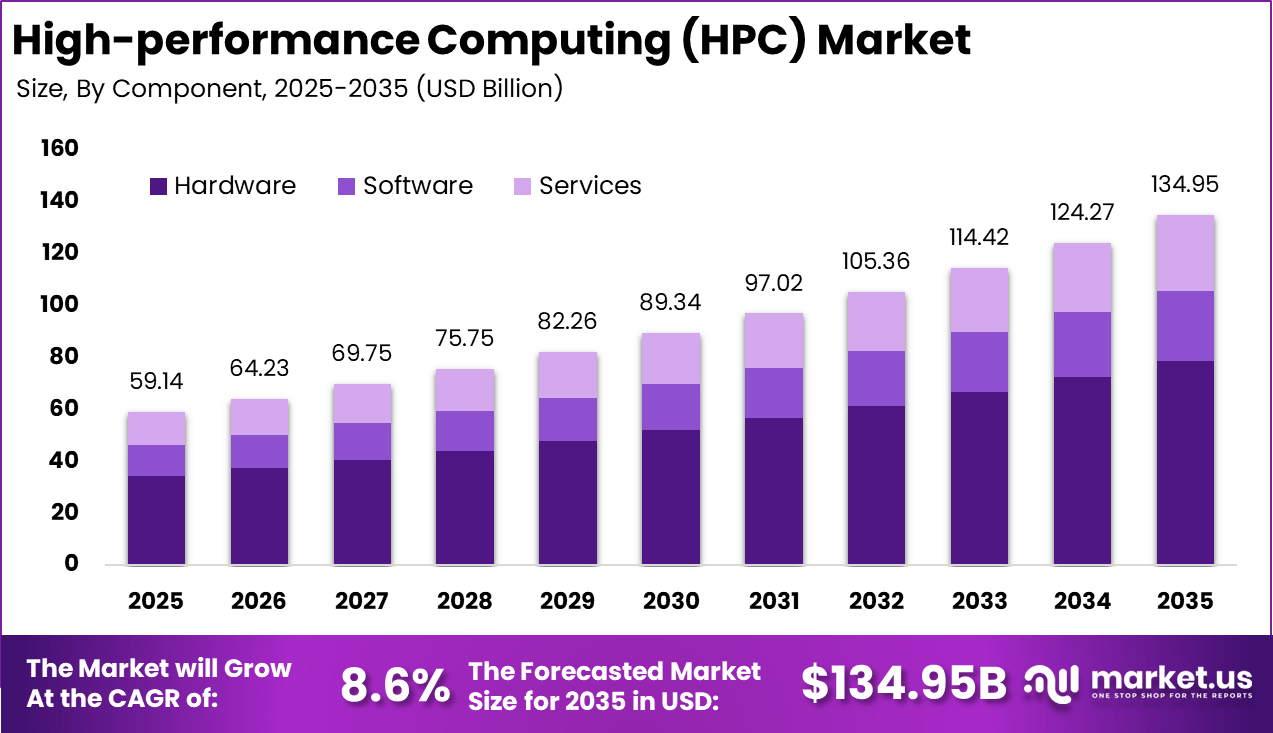

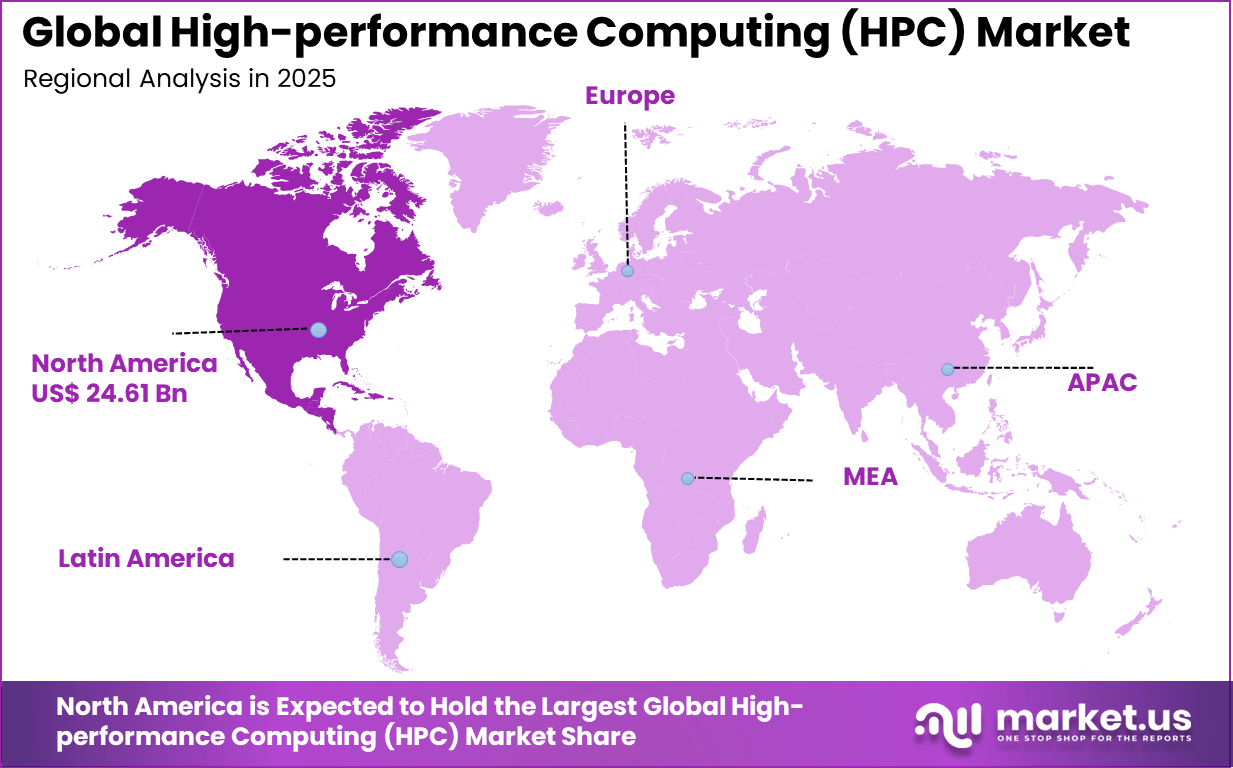

The Global High-performance Computing (HPC) Market size is expected to be worth around USD 134.95 Billion by 2035, from USD 59.14 Billion in 2025, growing at a CAGR of 8.6% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 41.62% share, holding USD 24.61 billion in revenue.

The high Performance Computing market refers to advanced computing systems and solutions that deliver exceptional processing power to solve complex scientific, engineering, and data-intensive problems. HPC systems utilize tightly coupled processors, scalable architectures, and parallel processing frameworks to perform calculations at speeds far beyond conventional computing platforms. These solutions are employed in domains such as weather modeling, life sciences, financial analysis, aerospace design, and artificial intelligence research.

The market encompasses hardware components, middleware, software suites, and integration services that support HPC deployments. Growth in the HPC market has been propelled by the exponential increase in data volumes and the need for accelerated computing performance. Organizations across public and private sectors increasingly recognize that traditional computing cannot sustain emerging workloads. Advances in processor technologies, interconnect systems, and storage architectures have expanded HPC capabilities.

For instance, in April 2025, Fujitsu continued to commercialize technologies from its Fugaku supercomputer by rolling out cloud‑based HPC services tailored to climate modeling and pharmaceutical simulation. This strategy lets enterprises tap into Fugaku‑class capabilities without owning national‑lab‑scale infrastructure, extending Fujitsu’s HPC footprint beyond Japan.

Key Takeaway

- In 2025, the Hardware segment emerged as the core foundation of the High-performance Computing market, accounting for a dominant 58.4% share. This reflects continued reliance on advanced processors, accelerators, and system architectures to meet intensive computational needs.

- The On-premises deployment model retained leadership with a 52.7% share in 2025, indicating that performance control, data security, and latency management remain critical priorities for HPC users.

- Large enterprises represented the strongest user base, capturing 82.6% of total adoption in 2025. This dominance highlights the role of scale, capital strength, and long-term digital infrastructure strategies in HPC investments.

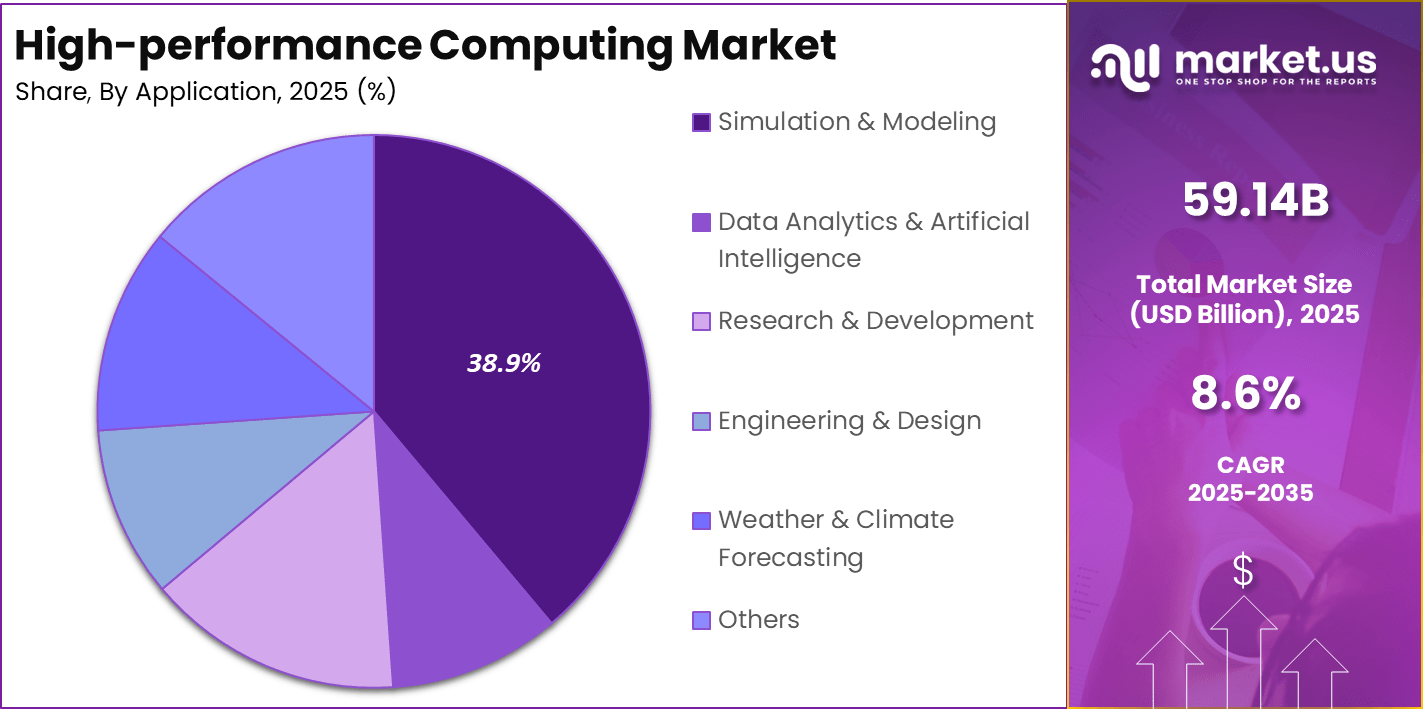

- The Simulation and Modeling application segment held a leading 38.9% share in 2025, driven by its essential role in scientific research, engineering design, and complex system analysis.

- The Government and Defense sector accounted for a substantial 31.8% share in 2025, underlining the strategic importance of HPC in national security, research laboratories, and mission-critical analytics.

- North America maintained regional leadership in 2025 with more than a 41.62% share, supported by strong research ecosystems, early technology adoption, and sustained investment in advanced computing infrastructure.

Key Statistics

Key Enterprise and Technology Insights

- During 2025-2026, enterprise adoption of cloud-based computing became nearly universal, with 90%-94% of large organizations using cloud services. A growing share of these enterprises integrated HPC capabilities to support data-heavy analytics and AI workloads.

- AI adoption accelerated sharply, as 78% of organizations reported active AI usage by late 2024, compared with 55% a year earlier. This shift directly increased demand for HPC systems that can handle large-scale model training and inference tasks.

- Industry 4.0 adoption strengthened HPC relevance in manufacturing, where 75% of companies migrated to cloud systems by 2026. These environments enabled real-time operations, predictive maintenance, and scalable production analytics.

- Early-stage next-generation computing adoption was observed, with 28% of newly installed HPC systems in 2024 supporting quantum simulation frameworks. This indicates cautious but steady preparation for future computational models.

HPC Usage Patterns by Industry

- Manufacturing emerged as the largest HPC user, accounting for 40% of global usage. HPC platforms were widely applied for digital twins, crash testing, and supply chain optimization.

- Government and defense remained a strategic HPC user group, contributing about 24.6% of global revenue and 18% of total capacity during 2023–2024. These deployments focused on national research, security simulations, and advanced analytics.

- Life sciences and healthcare showed rapid expansion, supported by a projected 12.9% growth rate through 2030. Genomic sequencing workloads alone processed nearly 12 billion reads per week, increasing dependence on high-throughput computing.

- Financial services demonstrated sustained HPC usage, with over 6,700 firms running approximately 7.4 billion computation cycles each month. Risk modeling, fraud detection, and algorithmic trading remained key drivers.

Deployment and Operational Trends

- Cloud-based HPC led new deployments in 2024, capturing 59% of demand, while on-premises systems continued to represent about 41% of installed capacity. This reflects a transition phase rather than a full replacement cycle.

- Hybrid and multi-cloud architectures became standard by 2026, with more than 90% of large enterprises relying on multiple cloud environments to balance performance, resilience, and compliance needs.

- Global HPC workloads processed over 2.3 zettabytes of data in 2024, highlighting the rapid growth in simulation, AI, and data-intensive research tasks.

- Power efficiency gained importance, as leading supercomputing facilities averaged 23 MW in energy use. Adoption of liquid cooling improved thermal efficiency by up to 31%, supporting sustainability and long-term cost control.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of data intensive workloads Increasing simulation, modeling, and analytics demand ~2.4% North America, Europe Short to Mid Term AI and machine learning adoption HPC systems supporting large scale AI training ~2.1% Global Short Term Scientific research expansion Rising investment in climate, genomics, and physics research ~1.7% North America, Europe Mid Term Cloud based HPC availability Flexible access to compute resources ~1.4% Global Mid Term National supercomputing initiatives Government funded HPC infrastructure programs ~1.0% Asia Pacific, Europe Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High capital expenditure Significant upfront investment for HPC infrastructure ~2.2% Emerging Markets Short Term Energy consumption concerns Rising power and cooling costs ~1.8% Global Mid Term Skilled workforce shortage Limited availability of HPC specialists ~1.5% Global Mid Term Technology obsolescence Rapid evolution of processors and architectures ~1.2% Global Long Term Supply chain constraints Dependence on advanced semiconductor nodes ~0.9% Global Short Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High deployment cost Budget limitations restrict adoption ~2.6% Emerging Markets Short to Mid Term Complex system integration Difficulty integrating HPC with legacy IT ~2.0% Global Mid Term Cooling and space requirements Infrastructure limitations ~1.6% Global Long Term Limited ROI visibility Challenges in quantifying benefits ~1.3% Global Mid Term Vendor lock in risk Dependence on proprietary architectures ~1.1% Global Long Term By Component

In 2025, Hardware accounts for 58.4%, showing its central role in high-performance computing systems. HPC environments rely on powerful processors, memory, and networking components to handle complex workloads. Hardware performance directly affects computing speed and accuracy. Organizations invest in robust hardware to support intensive calculations. Reliable infrastructure remains essential for HPC operations.

The dominance of hardware is driven by increasing demand for processing capacity. Advanced simulations and analytics require specialized computing equipment. Hardware upgrades improve system efficiency and scalability. Organizations prioritize performance and reliability when selecting components. This sustains strong investment in HPC hardware.

For Instance, in November 2025, HPE launched next-generation Cray supercomputing blades like GX440n and GX350a, packed with high-density compute for hardware-intensive workloads. These liquid-cooled options boost performance density, targeting AI and HPC hardware needs directly.

By Deployment

In 2025, On-premises deployment holds 52.7%, reflecting preference for localized control over computing resources. Many organizations require direct access to sensitive data and systems. On-premises setups provide greater control over security and performance. They also support customized configurations. This deployment model suits mission-critical workloads.

Adoption of on-premises HPC is driven by regulatory and operational needs. Organizations handling classified or sensitive data prefer internal infrastructure. On-premises systems reduce dependency on external networks. They also offer predictable performance. This supports continued use of on-site deployments.

For instance, in December 2025, AWS rolled out on-premises AI Factories powered by NVIDIA GPUs for secure, local high-performance deployments. Enterprises gain cloud-like power in their data centers without giving up control.

By Organization Size

In 2025, Large enterprises represent 82.6%, highlighting their dominant role in HPC adoption. These organizations manage complex projects that require massive computing power. HPC supports advanced research, design, and analytics tasks. Large enterprises have resources to invest in high-end systems. Scale increases the need for computing efficiency.

Adoption among large enterprises is driven by innovation and competitiveness. HPC enables faster problem solving and product development. Enterprises use HPC to analyze large datasets. Centralized computing supports collaboration across teams. This sustains high adoption rates.

For Instance, in May 2025, at Dell Technologies World, Dell unveiled PowerEdge servers for dense AI and HPC racks aimed at large-scale enterprise needs. These handle up to 256 GPUs per rack for big operations.

By Application

In 2025, Simulation and modeling account for 38.9%, making them the leading application area. HPC enables accurate modeling of complex systems and scenarios. Industries use simulations to test designs and predict outcomes. High computing power improves precision and speed. This reduces development time.

Growth in this application is driven by need for risk assessment and optimization. Simulations support decision-making in engineering and science. Modeling helps reduce physical testing costs. HPC platforms allow continuous refinement of models. This supports sustained demand.

For Instance, in January 2024, International Business Machines Corporation debuted the Power10 processor tailored for HPC simulations, offering 50% better performance per watt. It speeds up modeling in research and engineering.

By End-User Industry

In 2025, Government and defense account for 31.8%, making them a key end-user segment. These organizations use HPC for research, security, and strategic planning. High computing capacity supports data analysis and simulations. Reliability and performance are critical requirements. HPC systems support national priorities.

Adoption in this sector is driven by security and research needs. Government agencies rely on HPC for complex calculations. Defense applications require real-time processing capabilities. Controlled environments ensure data protection. This keeps demand steady.

For Instance, in November 2025, Atos SE continues strong ties in government HPC, building on past supercomputer deals. Recent focuses include exascale and AI systems for national research missions worldwide.

By Region

In 2025, North America accounts for 41.62%, supported by strong technological infrastructure. The region has high adoption of advanced computing systems. Research institutions and enterprises invest in HPC. Digital innovation supports continued growth. The region remains a major contributor.

For instance, in October 2025, Google Cloud introduced H4D VMs and Parallelstore for next-gen HPC, alongside A3 Ultra with NVIDIA H200 GPUs. These advancements enhance AI/ML workload optimization, cementing U.S. leadership in scalable high-performance infrastructure.

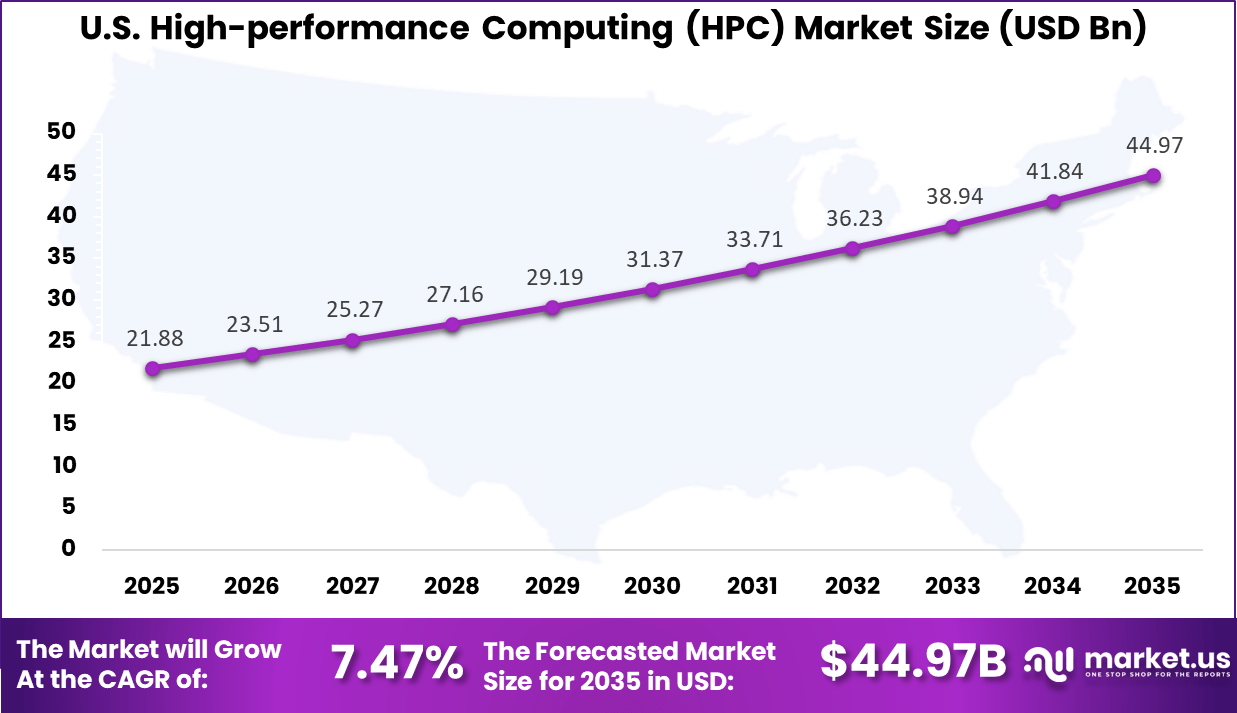

The United States reached USD 21.88 Billion with a CAGR of 7.47%, reflecting stable market expansion. Growth is driven by research and defense investments. Enterprises continue to adopt advanced computing systems. Demand for data-intensive processing remains strong. Market growth continues at a steady pace.

For instance, in November 2025, HPE launched its next-generation Cray Supercomputing portfolio featuring industry-leading compute density and unified AI/HPC architecture. This platform, built for research institutions and sovereign AI initiatives, powers breakthrough systems like El Capitan, the world’s fastest exascale supercomputer, solidifying U.S. leadership in high-performance computing innovation.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Government and research bodies Very High ~35% National research competitiveness Long term funding Large enterprises High ~29% Advanced analytics and simulation Capital intensive investment Cloud service providers High ~18% On demand HPC services Platform expansion Universities Moderate ~12% Academic research needs Grant based spending SMEs Low to Moderate ~6% Selective workload acceleration Usage based adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Multi core CPUs Core computational processing ~2.6% Mature GPU accelerators Parallel processing for AI and simulations ~2.2% Growing High speed interconnects Low latency node communication ~1.7% Mature Cloud HPC platforms Elastic compute access ~1.3% Growing Advanced cooling solutions Energy efficiency and reliability ~0.8% Developing Competitive Capability Matrix

Capability Area Market Leaders Strong Contenders Emerging Players Importance Compute performance Very High High Moderate Critical System scalability Very High High Moderate Critical Energy efficiency High High Moderate High Software ecosystem High High Moderate High Cost optimization Moderate High High Medium Deployment flexibility High Moderate Moderate High Global support presence High Moderate Moderate High Emerging Trends

In the high-performance computing (HPC) market, a noticeable trend is the integration of heterogeneous architectures combining traditional CPUs with specialized accelerators such as GPUs and tensor processors. These configurations enhance computation throughput for tasks like scientific modelling, artificial intelligence training, and large-scale simulation, enabling organisations to tackle more complex workloads with greater efficiency.

Another emerging trend is the adoption of HPC capabilities via hybrid cloud models. Organisations that once relied solely on on-premises supercomputers are increasingly linking local HPC clusters with public cloud resources to handle peak demand or specialised tasks. This blended model supports flexible scaling, while allowing core workloads to reside within an organisation’s controlled environment.

Growth Factors

A primary growth factor in the HPC market is the expanding demand for advanced computational power across research and industrial sectors. Fields such as climate science, life sciences, aerospace, and automotive engineering require intense simulation and data processing to drive innovation. HPC systems that deliver high throughput and low latency enable these disciplines to accelerate discovery and improve product performance.

Another growth factor is the rise of data-intensive applications that depend on rapid processing and real-time analytics. Large datasets generated by genomics research, remote sensing, and sensor networks require sophisticated computing infrastructures to extract insight efficiently. HPC platforms provide the capability to analyse, model, and simulate these data volumes at speeds far beyond traditional systems.

Key Market Segments

By Component

- Hardware

- Servers

- Storage

- Networking Equipment

- Cooling Systems

- Others

- Software

- Operating Systems & Middleware

- Application Software

- Cluster Management Software

- Performance Optimization Tools

- Others

- Services

- Deployment & Integration

- Managed Services

- Support & Maintenance

- Others

By Deployment

- On-premises

- Cloud-based

- Hybrid

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Simulation & Modeling

- Data Analytics & Artificial Intelligence

- Research & Development

- Engineering & Design

- Weather & Climate Forecasting

- Others

By End-User Industry

- Government & Defense

- Academic & Research

- Manufacturing

- Banking, Financial Services, and Insurance

- Healthcare & Life Sciences

- Media & Entertainment

- Energy & Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Hewlett Packard Enterprise Company, Dell Technologies, Inc., and International Business Machines Corporation hold a strong position in the high-performance computing market. Their offerings include supercomputers, high-density servers, advanced storage, and optimized software stacks. Focus is placed on scalability, reliability, and energy efficiency. These companies mainly serve government labs, research institutions, and large enterprises.

Lenovo Group Limited, Fujitsu Limited, NEC Corporation, and Atos SE focus on tailored HPC systems for scientific and industrial workloads. Their strengths lie in system integration and co-design with end users. Close collaboration with universities and public research bodies supports steady demand. Emphasis is placed on power efficiency and sustainability. Regional expertise improves deployment success.

Sugon Information Industry Co., Ltd. and Inspur Electronic Information Industry Co., Ltd. expand HPC adoption through cost-effective platforms in Asia. Technology leadership is driven by NVIDIA Corporation, Advanced Micro Devices, Inc., and Intel Corporation through advanced processors. Cloud providers such as Microsoft Corporation, Amazon Web Services, Inc., and Google LLC support flexible HPC access. Other players address niche and emerging workloads.

Top Key Players in the Market

- Hewlett Packard Enterprise Company

- Dell Technologies, Inc.

- International Business Machines Corporation

- Lenovo Group Limited

- Fujitsu Limited

- NEC Corporation

- Atos SE

- Sugon Information Industry Co., Ltd.

- Inspur Electronic Information Industry Co., Ltd.

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Others

Recent Developments

- In November 2025, NEC Corporation launched research infrastructure solutions at SC25 for open science, featuring SCUP-HPC provenance management to track supercomputer workflows. Universities like Osaka are already adopting it for next-gen AI and big data.

- In October 2025, Fujitsu deepened its NVIDIA partnership to build full-stack AI infrastructure, including the FUJITSU-MONAKA CPU series fused with NVIDIA GPUs via NVLink. They’re targeting zetascale performance for industrial AI breakthroughs.

- In August 2025, IBM unveiled a new quantum computing system designed to work seamlessly with its existing high performance computing infrastructure. The system was developed to support advanced computational tasks alongside traditional computing environments. This approach reflected IBM’s focus on making quantum technology more practical and accessible.

Report Scope

Report Features Description Market Value (2025) USD 59.1 Bn Forecast Revenue (2035) USD 134.9 Bn CAGR(2026-2035) 8.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment (On-premises, Cloud-based, Hybrid), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Simulation & Modeling, Data Analytics & Artificial Intelligence, Research & Development, Engineering & Design, Weather & Climate Forecasting, Others), By End-User Industry (Government & Defense, Academic & Research, Manufacturing, Banking, Financial Services, and Insurance, Healthcare & Life Sciences, Media & Entertainment, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hewlett Packard Enterprise Company, Dell Technologies, Inc., International Business Machines Corporation, Lenovo Group Limited, Fujitsu Limited, NEC Corporation, Atos SE, Sugon Information Industry Co., Ltd., Inspur Electronic Information Industry Co., Ltd., NVIDIA Corporation, Advanced Micro Devices, Inc., Intel Corporation, Microsoft Corporation, Amazon Web Services, Inc., Google LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High-performance Computing (HPC) MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

High-performance Computing (HPC) MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hewlett Packard Enterprise Company

- Dell Technologies, Inc.

- International Business Machines Corporation

- Lenovo Group Limited

- Fujitsu Limited

- NEC Corporation

- Atos SE

- Sugon Information Industry Co., Ltd.

- Inspur Electronic Information Industry Co., Ltd.

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Others