Global Herbicide Market Size, Share, And Business Benefits By Type (Synthetic (Glyphosate, Atrazine, 2,4-Dichlorophenoxyacetic Acid, Acetochlor, Paraquat, Others), Bio-Herbicides), By Mode of Action (Selective, Non-selective), By Application (Fertigation, Foliar, Soil, Others), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155182

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

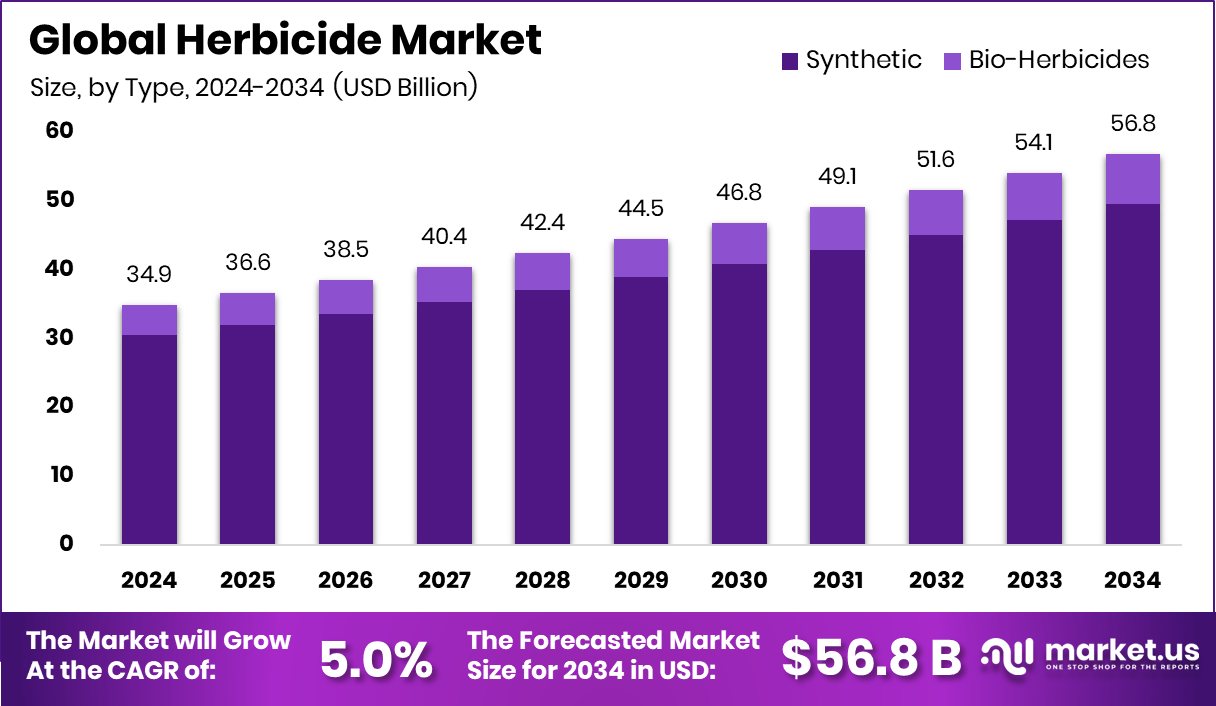

The Global Herbicide Market is expected to be worth around USD 56.8 billion by 2034, up from USD 34.9 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. USD 14.7 Bn, Asia-Pacific dominates with 42.3% share.

Herbicide is a type of chemical substance used to control or eliminate unwanted plants, commonly known as weeds. These weeds compete with crops for nutrients, water, and sunlight, reducing agricultural productivity. Herbicides are applied in farmlands, gardens, forests, and industrial areas to prevent weed growth, improve crop yields, and maintain land health. They can be selective, targeting specific weed species without harming crops, or non-selective, killing all vegetation in a treated area.

The herbicide market refers to the global trade and consumption of herbicide products across agriculture, landscaping, and industrial vegetation control sectors. It includes the production, formulation, distribution, and use of herbicides for various crop and non-crop applications.

The market is influenced by factors such as population growth, rising food demand, advancements in farming practices, and the adoption of precision agriculture. One major growth factor is the increasing need to boost crop productivity to meet the food requirements of a growing global population. Limited arable land and higher demand for efficient farming methods are pushing farmers to adopt herbicides for better yield management.

The demand for herbicides is also driven by changing climate patterns, which encourage the spread of invasive weeds and pests, increasing the need for effective and long-lasting weed control solutions. Recent funding developments in the sector highlight innovation potential—MSU-led research group secures $500K grant to tackle herbicide-resistant weeds in soybean crops, UK-based agritech company RootWave secures $15M to develop herbicide alternatives, Oxford herbicide startup Moa raises $40M in seed funding and later obtains $44M in Series B funding to introduce next-generation herbicides, while the Gates Foundation spearheads a $45M funding round for pesticide innovator Enko. Additionally, a Precision AI farming firm secures $20M to launch herbicide-spraying drone fleets.

Key Takeaways

- The Global Herbicide Market is expected to be worth around USD 56.8 billion by 2034, up from USD 34.9 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- In 2024, synthetic herbicides dominated the herbicide market, accounting for a significant 87.3% market share.

- Selective herbicides led the herbicide market by mode of action, holding a strong 67.8% share globally.

- Foliar application methods captured 51.6% of the herbicide market, driven by efficiency and targeted weed control.

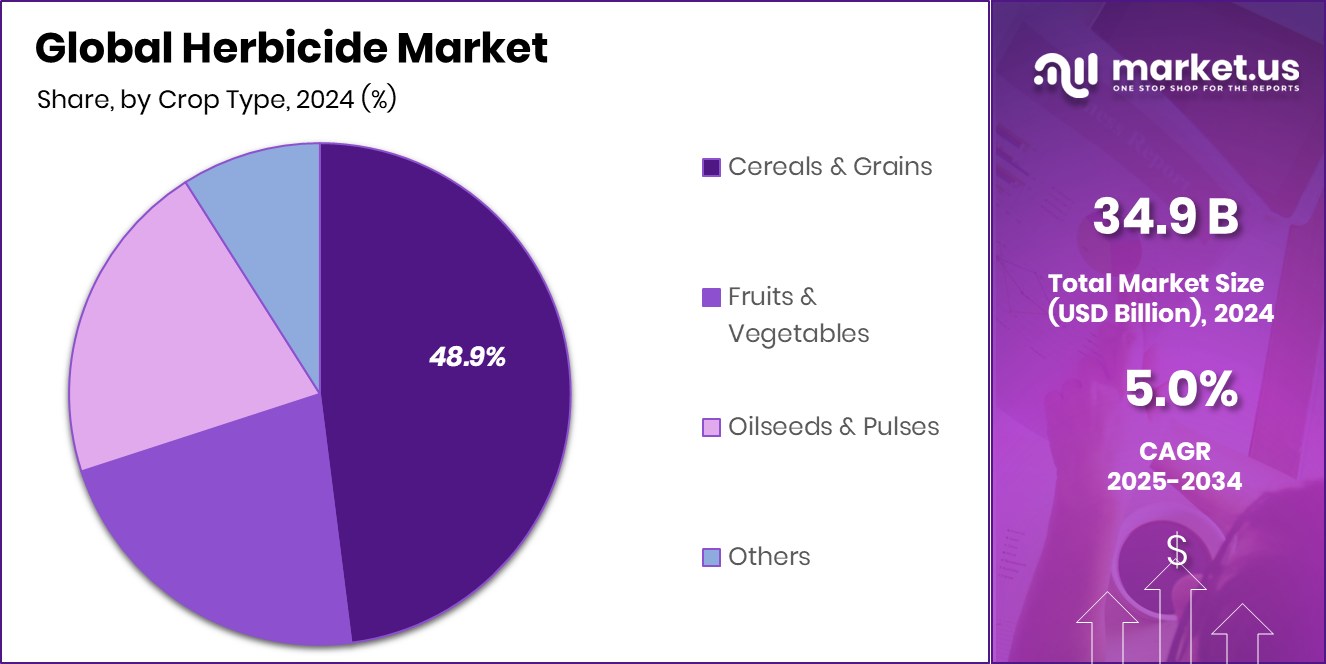

- Cereals and grains were the largest crop segment in the herbicide market, representing 48.9% market share.

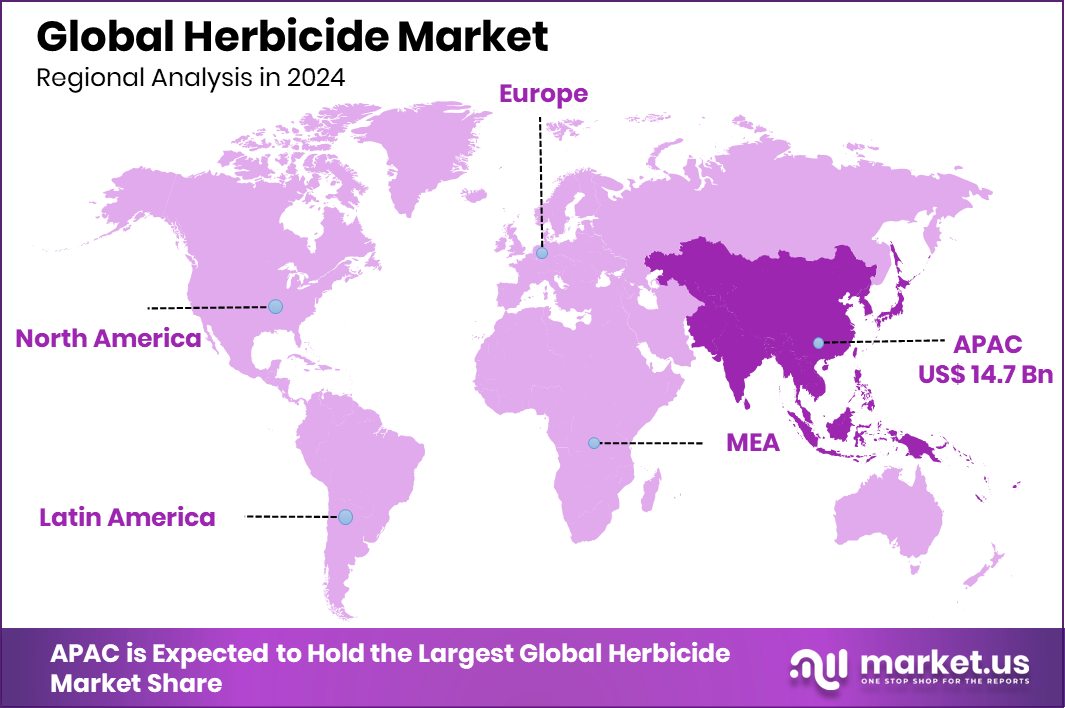

- Asia-Pacific, 42.3% share, USD 14.7 Bn, leads the global market.

By Type Analysis

Synthetic herbicides dominate the herbicide market, holding an 87.3% share.

In 2024, Synthetic held a dominant market position in the By Type segment of the herbicide market, with an 87.3% share, reflecting its widespread adoption in large-scale agricultural operations. Synthetic herbicides are preferred for their fast action, consistent performance, and ability to target a broad spectrum of weeds, making them a reliable choice for farmers aiming to protect crop yields.

Their chemical composition enables both selective and non-selective applications, catering to diverse crop types and weed control requirements. The high share also stems from their cost-effectiveness and compatibility with existing farming equipment, enabling efficient large-area coverage in shorter time frames.

The dominance of synthetic herbicides is further supported by the increasing global demand for high agricultural productivity amid limited arable land. As food demand rises due to population growth, farmers are increasingly relying on synthetic herbicides to manage weeds more effectively, reduce labor costs, and ensure higher crop yields.

Additionally, advancements in herbicide formulations have enhanced safety, application precision, and resistance management, maintaining their market leadership. While environmental concerns and regulatory pressures exist, synthetic herbicides continue to command the majority share, driven by their proven efficiency and vital role in meeting the agricultural sector’s productivity targets.

By Mode of Action Analysis

Selective herbicides lead by mode of action with a 67.8% share

In 2024, Selective held a dominant market position in the By Mode of Action segment of the Herbicide Market, with a 67.8% share, underscoring its critical role in modern agriculture. Selective herbicides are designed to target specific weed species while leaving the desired crops unharmed, making them highly valuable for protecting yield quality and quantity.

This precision targeting not only minimizes crop damage but also reduces the need for repeated applications, improving cost efficiency for farmers. Their effectiveness in managing a variety of broadleaf weeds and grasses across multiple crop types has contributed to their widespread adoption.

The strong market share of selective herbicides is also driven by the increasing focus on sustainable farming practices and the need to optimize input usage. Farmers prefer selective solutions to maintain soil health, minimize chemical residues on crops, and meet regulatory compliance for safe food production.

Additionally, advancements in selective herbicide formulations, including enhanced resistance management and compatibility with modern spraying equipment, have reinforced their appeal. With global food demand rising and arable land under pressure, selective herbicides continue to be a cornerstone in integrated weed management strategies, enabling farmers to achieve higher productivity while protecting crop integrity.

By Application Analysis

Foliar application accounts for 51.6% of the total herbicide market.

In 2024, Foliar held a dominant market position in the By Application segment of the Herbicide Market, with a 51.6% share, reflecting its effectiveness and popularity among farmers for rapid weed control. Foliar herbicides are applied directly to the leaves of unwanted plants, allowing for quick absorption and faster visible results compared to other methods.

This direct contact approach ensures that the active ingredients reach the plant’s vital systems swiftly, disrupting growth processes and leading to efficient weed elimination. Such efficiency is particularly valuable during critical crop growth stages when timely weed control is essential to protect yields.

The dominance of foliar application is also supported by its ability to be used in both selective and non-selective treatments, offering flexibility across various crop types and weed challenges. Modern spraying technologies have enhanced the precision and uniformity of foliar applications, reducing wastage and improving cost-effectiveness for large-scale farming.

Additionally, advancements in formulation have improved rainfastness and reduced the time needed for visible effects, increasing farmer confidence in this method. With agriculture increasingly focused on productivity and resource optimization, foliar herbicides remain a preferred choice for their speed, efficiency, and adaptability in addressing diverse weed control needs.

By Crop Type Analysis

Cereals and grains use herbicides the most, capturing a 48.9% share

In 2024, Cereals and Grains held a dominant market position in the By Crop Type segment of the Herbicide Market, with a 48.9% share, driven by their central role in global food security and agricultural production.

Crops such as wheat, rice, maize, and barley occupy a significant share of cultivated land worldwide, making effective weed management essential for maintaining high yields and quality. Herbicides used in cereals and grains help control a wide variety of broadleaf weeds and grasses that compete for nutrients, sunlight, and water, ensuring optimal crop growth.

The dominance of this segment is also linked to rising global demand for staple foods, particularly in developing regions where population growth and changing dietary patterns are accelerating consumption. Farmers in major producing countries increasingly rely on herbicides to minimize manual labor, reduce crop losses, and enhance harvest efficiency.

Technological advancements in herbicide formulations, including resistance management solutions and compatibility with precision agriculture systems, have further boosted their adoption in cereal and grain farming. With these crops forming the backbone of the food supply chain, the continued use of herbicides in this segment remains critical for meeting both domestic and international demand efficiently and sustainably.

Key Market Segments

By Type

- Synthetic

- Glyphosate

- Atrazine

- 2,4-Dichlorophenoxyacetic Acid

- Acetochlor

- Paraquat

- Others

- Bio-Herbicides

By Mode of Action

- Selective

- Non-selective

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

Driving Factors

Rising Global Food Demand Boosts Herbicide Usage

One of the main driving factors for the herbicide market is the growing global demand for food. As the world population continues to increase, farmers are under pressure to produce more crops on the same or even smaller areas of land. Weeds compete with crops for water, nutrients, and sunlight, reducing yield and quality.

Herbicides offer a fast, efficient, and cost-effective solution to manage these weeds, helping farmers maintain higher productivity. In large-scale agriculture, they save time and labor while ensuring consistent crop health. With dietary shifts, urbanization, and increasing grain consumption, the need for reliable weed control is only set to grow, making herbicides an essential tool in modern farming to secure the global food supply.

Restraining Factors

Stringent Environmental Regulations Limit Herbicide Expansion

A key restraining factor for the herbicide market is the presence of strict environmental regulations and safety standards. Many herbicides contain chemical compounds that can impact soil health, water quality, and biodiversity if not used properly. Governments across the world have implemented rules to limit or ban certain active ingredients due to their potential environmental and health risks.

Farmers are also facing increased pressure to adopt sustainable farming practices, which can reduce the use of synthetic herbicides. Compliance with these regulations often requires additional costs for safer products, training, and monitoring. While these rules aim to protect ecosystems and human health, they can slow market growth by restricting product availability and increasing operational challenges for producers and users.

Growth Opportunity

Rising Demand for Eco-Friendly Bio-Based Herbicides

A major growth opportunity in the herbicide market lies in the increasing demand for eco-friendly and bio-based herbicides. With growing awareness about environmental safety and health concerns, farmers and agricultural companies are shifting towards sustainable weed control solutions. Bio-based herbicides, made from natural plant extracts, essential oils, or microbial formulations, offer effective weed management without harming soil health, water resources, or beneficial organisms.

They also help meet stringent regulatory standards and appeal to consumers who prefer sustainably grown food. Technological advancements and research investments are making these products more efficient and affordable. As governments promote organic and eco-friendly farming, the adoption of bio-based herbicides is expected to rise, creating a strong growth pathway for the market in the coming years.

Latest Trends

Adoption of Precision Agriculture Enhances Herbicide Efficiency

One of the latest trends in the herbicide market is the growing adoption of precision agriculture technologies to improve application efficiency. Farmers are increasingly using GPS-guided equipment, drones, and smart sprayers to apply herbicides only where needed and in accurate amounts. This targeted approach reduces wastage, lowers costs, and minimizes environmental impact while ensuring effective weed control.

Data analytics and sensors help monitor weed growth patterns, allowing for timely and precise herbicide application. This trend also supports compliance with environmental regulations by reducing chemical runoff and residue. As technology becomes more accessible and affordable, precision agriculture is expected to play a major role in shaping the future of herbicide usage, making farming more productive and sustainable.

Regional Analysis

In 2024, the Asia-Pacific held 42.3%, USD 14.7 Bn.

In 2024, Asia-Pacific emerged as the dominant region in the global Herbicide Market, capturing a 42.3% share valued at USD 14.7 billion. The region’s leadership is driven by its vast agricultural base, high population density, and the increasing need to boost crop productivity to meet rising food demand. Major crop producers in countries such as China, India, and Australia are adopting herbicides at a large scale to control weeds efficiently and maximize yields.

Government initiatives promoting modern farming techniques, combined with the adoption of precision agriculture, have further accelerated herbicide usage in the region. Favorable climatic conditions for year-round farming and the expansion of commercial agriculture are also contributing factors.

While Asia-Pacific holds the lead, other regions such as North America, Europe, Latin America, and the Middle East & Africa are witnessing steady growth due to the rising adoption of sustainable weed management practices and technological advancements in herbicide formulations.

However, Asia-Pacific’s combination of large-scale cultivation, evolving farming practices, and growing demand for staple crops ensures its continued dominance in the market. This regional strength highlights the importance of herbicides in supporting agricultural productivity and food security in one of the world’s most critical farming hubs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to focus on sustainable herbicide formulations, integrating advanced chemistry to improve crop selectivity and reduce environmental impact. Its R&D efforts target herbicide resistance management, catering to global demand for efficient and eco-friendly weed control.

Bayer AG maintains a strong market footprint through its well-established herbicide portfolio, supported by innovation in seed-herbicide integration systems. The company is leveraging biotechnology and precision agriculture to improve application efficiency and farmer profitability.

Corteva Inc. stands out for its robust product pipeline, particularly in selective herbicides designed for cereals, grains, and specialty crops. Its focus on customer-driven innovation ensures solutions are tailored to regional farming needs, boosting adoption rates.

Drexel Chemical Co. Inc. emphasizes reliable, cost-effective herbicide solutions, catering to both large-scale agricultural enterprises and smaller farming operations. Its diversified product range supports flexibility across multiple crop types and climatic conditions.

Top Key Players in the Market

- BASF SE

- Bayer AG

- Corteva Inc.

- Drexel Chemical Co. Inc.

- DuPont

- FMC Corporation

- Heranba Industries Ltd.

- ICL Group

- Nissan Chemical Corporation

- Nufarm

- Nutrien

Recent Developments

- In March 2025, Bayer revealed Vyconic soybeans, a new soybean trait that tolerates five different herbicides—dicamba, glufosinate, mesotrione, 2,4‑D, and glyphosate—all in one seed. These soybeans give farmers more options for fighting weeds and help prevent resistance.

- In February 2024, BASF received U.S. EPA approval for Surtain®, a new corn herbicide offering early-season, residual control of tough weeds. This product supports farmers by providing long-lasting weed management during critical growth stages. It’s a readiness indicator for commercial launch, enhancing BASF’s herbicide portfolio.

Report Scope

Report Features Description Market Value (2024) USD 34.9 Billion Forecast Revenue (2034) USD 56.8 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic (Glyphosate, Atrazine, 2,4-Dichlorophenoxyacetic Acid, Acetochlor, Paraquat, Others), Bio-Herbicides), By Mode of Action (Selective, Non-selective), By Application (Fertigation, Foliar, Soil, Others), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Bayer AG, Corteva Inc., Drexel Chemical Co. Inc., DuPont, FMC Corporation, Heranba Industries Ltd., ICL Group, Nissan Chemical Corporation, Nufarm, Nutrien Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Bayer AG

- Corteva Inc.

- Drexel Chemical Co. Inc.

- DuPont

- FMC Corporation

- Heranba Industries Ltd.

- ICL Group

- Nissan Chemical Corporation

- Nufarm

- Nutrien