Global Heat Therapy Units Market By Product Type (Moist Heat Therapy Units, Dry Electric Heating Pad Units, Infrared Heat Therapy Units, Paraffin Wax Bath Units, Diathermy machines, Others) By Application (Musculoskeletal and Joint Disorders, Chronic Back and Neck Pain, Sports Injuries and Soft-Tissue Strain, Post-operative and Trauma Rehabilitation, Neuropathic and Chronic Pain Conditions, Others) By Type (Stationary, Portable) By End-User (Hospitals & Clinics, Physiotherapy and Rehabilitation Centers, Homecare Settings, Others) By Distribution Channel (Retail Pharmacies and Mass Retail Stores, E-commerce Platforms, Direct Sales) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167031

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

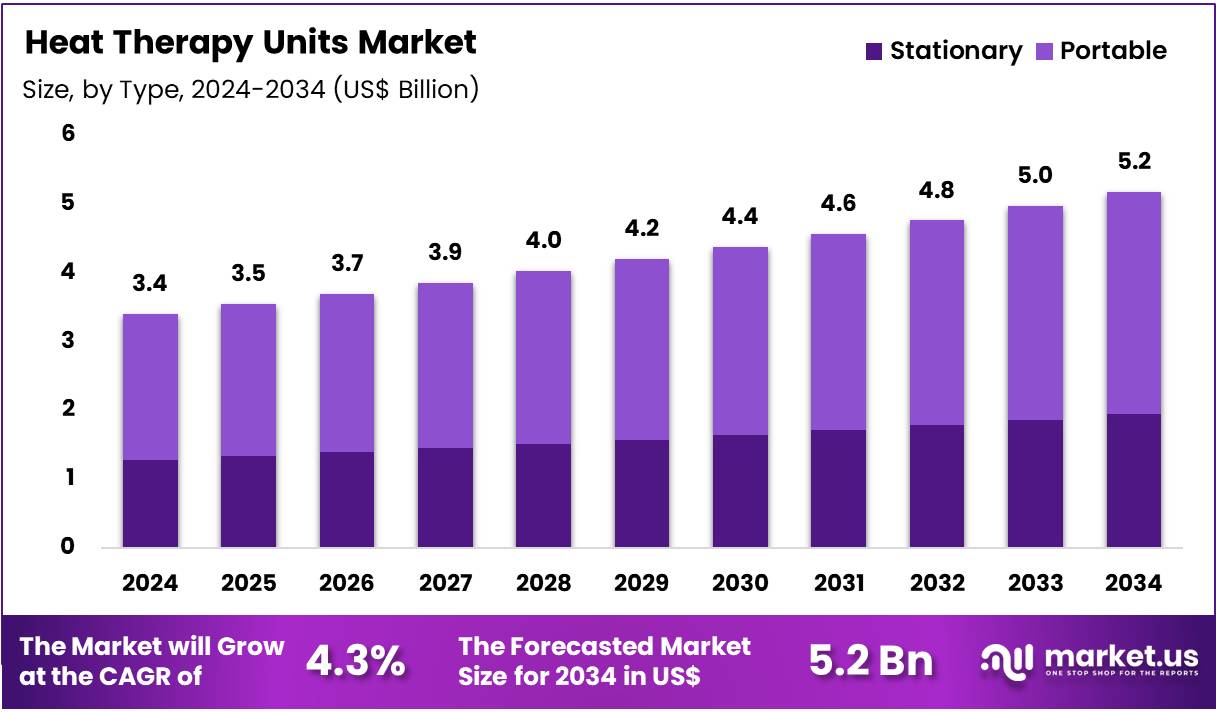

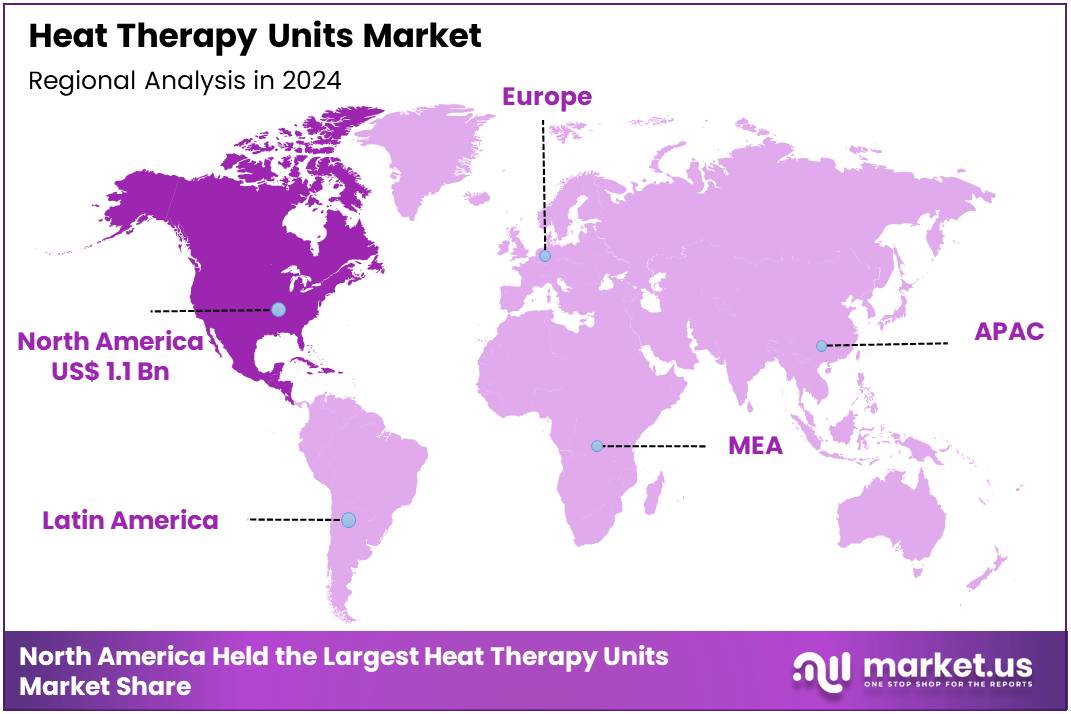

Global Heat Therapy Units Market size is expected to be worth around US$ 5.2 Billion by 2034 from US$ 3.4 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 32.4% share with a revenue of US$ 1.1 Billion.

An expansion of the heat therapy units market has been supported by a substantial and rising burden of musculoskeletal disorders worldwide. The World Health Organization has reported that approximately 1.71 billion people are affected by these conditions, while recent global burden studies estimate the figure at around 1.7 billion, representing nearly one-fifth of the global population. These disorders typically involve persistent pain, stiffness and functional limitations, which drive repeated demand for physiotherapy.

As a result, hospitals, rehabilitation centers and physiotherapy clinics are increasing their investments in heat therapy systems designed to improve blood flow, relax muscles and enhance recovery outcomes.

The prevalence of low back pain remains a central contributor to market expansion. It has been identified by WHO as the leading cause of disability worldwide. In 2020, about 619 million individuals were living with low back pain, and projections indicate an increase to roughly 843 million by 2050. WHO guidelines released in 2023 emphasize non-pharmacological management including heat application, exercise and education which is accelerating the adoption of non-invasive heat therapy across physiotherapy departments, pain clinics and primary care settings.

Population ageing adds strong momentum. WHO data show that 528 million people were living with osteoarthritis in 2019, more than double the number reported in 1990, and about 73% of affected individuals are older than 55. Age-related joint pain and reduced mobility have increased reliance on supportive interventions such as heat therapy units, thereby expanding the addressable patient pool.

A rising burden of chronic pain further strengthens market demand. According to the CDC, in 2023, 24.3% of U.S. adults experienced chronic pain, while 8.5% faced high-impact chronic pain. As health systems shift toward multimodal, non-opioid pain management, heat therapy units are gaining preference due to their safety, non-drug approach and compatibility with exercise-based rehabilitation.

Policy support for rehabilitation, growth in outpatient and home-based care and technological advancements such as improved ergonomics, precision temperature control and user-friendly interfaces are also contributing to adoption. Collectively, these factors are expected to sustain an annual market growth rate exceeding 8% over the coming decade.

Key Takeaways

- Market Size: Global Heat Therapy Units Market size is expected to be worth around US$ 5.2 Billion by 2034 from US$ 3.4 Billion in 2024.

- Market Growth: The market growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

- Product Type Analysis: Moist Heat Therapy Units accounted for the dominant position, representing 33.1% of the market share in 2024.

- Application Analysis: Musculoskeletal and Joint Disorders accounted for the largest share, representing 38.6% of the market in 2024.

- Type Anaysis: Portable heat therapy units accounted for 62.5% of the market share in 2024, establishing their dominance within the segment.

- End-Use Analysis: Physiotherapy and Rehabilitation Centers accounted for the largest share, representing 42.0% of the market in 2024.

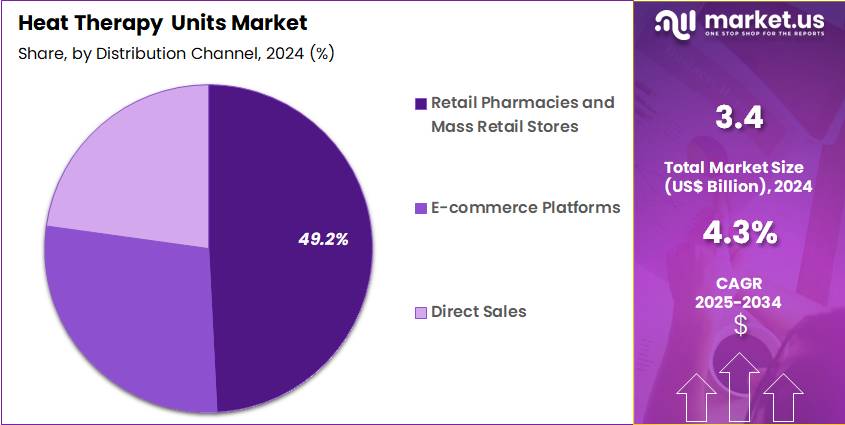

- Distribution Channel Analysis: Retail Pharmacies and Mass Retail Stores represented the dominant channel, accounting for 49.2% of the market share in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 32.4% share with a revenue of US$ 1.1 Billion.

Product Type Analysis

The market has been segmented based on product type, and a diversified portfolio of heat-based therapeutic devices has been observed across clinical and home-care settings. Moist Heat Therapy Units accounted for the dominant position, representing 33.1% of the market share in 2024. Their strong uptake can be attributed to the higher therapeutic efficacy associated with moist heat, which enables deeper tissue penetration and enhanced pain relief outcomes. Adoption has also been driven by increasing use in physiotherapy centers and outpatient rehabilitation facilities.

Dry Electric Heating Pad Units formed another significant segment. Their growth has been supported by widespread use in home-care applications due to ease of operation, temperature control features, and improved product affordability. Infrared Heat Therapy Units exhibited sustained progress as demand for targeted deep-tissue heating technologies increased, particularly in sports rehabilitation environments.

Paraffin Wax Bath Units have been utilized extensively for managing chronic stiffness, and their application in hand therapy clinics contributed to consistent demand. Diathermy machines remained relevant in professional medical settings where high-frequency energy is required for musculoskeletal treatments. The Others category captured emerging technologies and hybrid modalities, reflecting ongoing product innovation and gradual expansion into specialized therapeutic procedures.

Application Analysis

The market has been segmented based on application, and demand has been strongly concentrated in therapeutic areas where heat therapy supports pain management and mobility improvement. Musculoskeletal and Joint Disorders accounted for the largest share, representing 38.6% of the market in 2024. Increasing prevalence of arthritis, age-related degeneration, and chronic mobility impairments has supported the dominance of this segment. The therapeutic benefits of heat in reducing joint stiffness, improving circulation, and enhancing tissue elasticity have reinforced sustained adoption across clinical and home-care settings.

Chronic Back and Neck Pain formed another major application area, driven by rising incidences of sedentary lifestyles, poor posture, and occupational strain. The segment continued to benefit from the clinical preference for non-invasive pain management modalities. Sports Injuries and Soft-Tissue Strain exhibited steady growth due to expanding sports participation and greater reliance on localized heat therapy for faster muscle recovery.

Post-operative and Trauma Rehabilitation witnessed consistent utilization, as controlled heat has been widely applied to support healing and reduce post-surgical discomfort. Neuropathic and Chronic Pain Conditions showed increasing demand, supported by broader acceptance of heat-based therapies for long-term symptom management. The Others category reflected niche therapeutic areas, highlighting diversified usage across emerging clinical applications.

Type Anaysis

The market has been segmented by type, and a clear preference for compact and user-friendly devices has been observed across both clinical and home-care environments. Portable heat therapy units accounted for 62.5% of the market share in 2024, establishing their dominance within the segment. Their strong position can be attributed to increasing demand for flexible pain-management solutions, rising home-based care trends, and advancements in lightweight, battery-operated, and ergonomically designed devices. Growth of telehealth-supported rehabilitation and patient inclination toward self-administered therapies further contributed to the expanding use of portable systems.

The portability of these units has enabled broader accessibility for patients requiring frequent heat therapy, particularly those managing chronic pain, musculoskeletal stiffness, or long-term mobility constraints. Enhanced temperature control settings, safety features, and compact form factors have also supported strong adoption in outpatient clinics and physiotherapy centers.

Stationary heat therapy units captured the remaining share of the segment, maintaining relevance primarily in professional healthcare facilities. Their adoption has been concentrated in settings where higher intensity, consistent heat delivery, or specialized treatment protocols are required. These systems are commonly utilized in rehabilitation centers, sports medicine clinics, and hospital departments where structured therapeutic sessions are conducted. Although stationary units exhibited stable demand, their growth remained moderate due to increasing preference for portable alternatives across broader patient groups.

End-user Analysis

The market has been segmented based on end users, and demand has been shaped by rising utilization of heat therapy for pain management, rehabilitation, and mobility enhancement. Physiotherapy and Rehabilitation Centers accounted for the largest share, representing 42.0% of the market in 2024. This dominant position can be attributed to the extensive use of heat therapy in structured treatment programs targeting musculoskeletal disorders, injury recovery, and chronic pain conditions. Increased patient inflow, expanding outpatient rehabilitation services, and the integration of advanced therapeutic units supported the strong presence of this segment.

Hospitals and Clinics formed the next significant end-user group, driven by the need for medically supervised therapeutic interventions. These settings relied on heat therapy to support post-operative recovery, acute injury management, and long-term orthopedic care. Standardized treatment protocols and growing emphasis on non-invasive pain relief reinforced consistent usage.

Homecare Settings exhibited notable growth, supported by rising adoption of portable heat therapy devices and a shift toward self-managed treatment for chronic pain. Aging populations and increasing preference for home-based rehabilitation positively influenced this segment. The Others category included wellness centers, sports facilities, and specialty therapy providers, reflecting diversified applications and expanding acceptance of heat-based therapeutic modalities across broader care environments.

Distribution Channel Analysis

The heat Therapy units market has been segmented based on distribution channels, and accessibility to therapeutic devices has strongly influenced purchasing behavior across consumer and clinical groups. Retail Pharmacies and Mass Retail Stores represented the dominant channel, accounting for 49.2% of the market share in 2024.

Their leadership can be attributed to wide product availability, strong consumer confidence in pharmacy-based recommendations, and the convenience of immediate, in-store purchase options. The growing presence of specialty therapeutic devices in large retail chains and pharmacy-backed promotional programs further supported this channel’s expansion.

Hospitals and Clinics formed an important distribution pathway, particularly for advanced or clinically prescribed heat therapy units. Procurement in these settings has been driven by institutional purchasing standards, bulk ordering practices, and the requirement for certified therapeutic equipment used in rehabilitation and orthopedic departments. This channel remained essential for distributing high-performance or clinically regulated systems.

Homecare Settings exhibited rising demand due to the increasing adoption of portable and user-friendly devices. Direct-to-consumer distribution through homecare suppliers supported this trend, particularly among elderly patients and individuals managing long-term musculoskeletal conditions. The Others category included online specialty stores, sports therapy outlets, and wellness suppliers, indicating broader market penetration across diversified retail environments.

Key Market Segments

By Product Type

- Moist Heat Therapy Units

- Dry Electric Heating Pad Units

- Infrared Heat Therapy Units

- Paraffin Wax Bath Units

- Diathermy machines

- Others

By Application

- Musculoskeletal and Joint Disorders

- Chronic Back and Neck Pain

- Sports Injuries and Soft-Tissue Strain

- Post-operative and Trauma Rehabilitation

- Neuropathic and Chronic Pain Conditions

- Others

By Type

- Stationary

- Portable

By End-User

- Hospitals & Clinics

- Physiotherapy and Rehabilitation Centers

- Homecare Settings

- Others

By Distribution Channel

- Retail Pharmacies and Mass Retail Stores

- E-commerce Platforms

- Direct Sales

Driving Factors

The growth of the heat therapy units market is significantly driven by the rising global burden of musculoskeletal (MSK) disorders and chronic pain conditions. According to official health-guidance from the Centers for Disease Control and Prevention (CDC), non-opioid, non-pharmacologic therapies such as heat and ice are recommended for many types of acute and chronic pain. The increased prevalence of conditions such as low back pain, arthritis, and soft-tissue injuries has elevated the need for safe, effective alternatives to pharmacologic treatments.

Moreover, reviews published in peer-reviewed sources illustrate that superficial heat therapy can provide pain relief, improve muscle flexibility and circulation, and support tissue repair. The integration of heat therapy into multimodal care pathways for MSK pain further reinforces demand for specialised devices (units) capable of delivering controlled heat.

As awareness among patients and clinicians grows for non-drug pain management, opportunities for home-use and clinic-based heat therapy devices expand. The driver is thus rooted in the convergence of high disease prevalence, clinical guideline support for non-pharmacologic modalities, and patient preference shifts toward non-invasive solutions.

Trending Factors

A prominent trend within the heat therapy units market is the shift towards advanced, user-friendly technologies enabling home-based care and remote monitoring. Wearable and smart heat therapy units are emerging, aligning with the broader digital health movement where connected devices support therapy, rehabilitation, and chronic condition management. For example, literature on digital health indicates that wearable devices assist in rehabilitation and physical therapy including thermal modalities.

In parallel, clinical guidance emphasises the importance of integrating thermotherapy into a broader therapy regime for MSK pain; a recent narrative review notes that superficial heat represents a therapeutic option in the management of knee and sports-related pain, with a focus on improving function and supporting return to activity. These factors indicate an industry trend where device manufacturers increasingly focus on portability, connectivity, adjustable heat delivery profiles, and ease of home application. The trend is underpinned by growing interest in self-care, rehabilitation at home, and non-invasive therapies.

Restraining Factors

Despite positive growth drivers and trends, the heat therapy units market faces certain restraints. One major constraint is the limited high-quality clinical evidence specific to device-based heat units across diverse patient sub-populations. As one review concludes: although heat-therapy shows promise, “the quality of randomised clinical trials is generally low” and guidance is limited regarding optimal application, dosage and patient selection.

Additionally, while the CDC supports nonpharmacologic therapies for pain, it notes that access and cost barriers remain significant especially when therapies are not fully covered by insurance, or when patients live in rural or low-income settings. Hence, cost of advanced heat-therapy units, reimbursement challenges, and limited standardisation of device use protocols may inhibit wider adoption. Moreover, alternative therapies (cold therapy, electrotherapy, manual therapy) compete for the same therapeutic segment, which may restrict growth of the heat units segment.

Opportunity

An important opportunity within the heat therapy units market lies in expanding home-care and remote rehabilitation applications, particularly in ageing populations and emerging markets. Given the global increase in MSK conditions and the emphasis on non-invasive pain management, there is scope for device innovation tailored to senior users, chronic pain patients, and those managing rehabilitation outside clinic settings. For example, guidelines encourage using heat (and other nonpharmacologic modalities) for pain management rather than immediately opting for opioids.

Device manufacturers can capitalise on this by developing affordable, safe heat therapy units with guided interfaces, mobile app connectivity, and telemedicine integration. Additionally, in health systems where cost-pressure and home-care models are increasing, heat therapy units may serve as a cost-effective extension of physiotherapy and pain-management services. The accumulation of guideline support for non-pharmacologic therapies, combined with demographic shifts and rising home-healthcare demand, marks a sustainable opportunity for growth and diversification in the heat therapy unit market.

Regional Analysis

The growth of the market in North America can be attributed to a strong preference for advanced therapeutic devices. Chronic pain conditions remain widely prevalent. This has increased the adoption of heat therapy units in clinical and home-care settings. The region also benefits from well-established distribution networks. These channels ensured consistent product availability across retail and online platforms.

Investment in personal wellness has continued to rise. Consumers increasingly adopt heat therapy devices for muscle relaxation, injury recovery, and routine pain management. The expansion of sports and fitness activities further supported the uptake of portable units. Hospitals and physiotherapy centers also incorporate these systems in treatment plans. This enhanced institutional demand and strengthened the regional outlook.

Technological improvements have accelerated market penetration. The availability of digital, wearable, and adjustable-temperature units improved user convenience. High disposable income levels allowed for rapid acceptance of premium devices. This combination of factors secured North America’s strong position in the global landscape.

North America maintained its lead due to faster device replacement cycles and early adoption of innovative household therapeutic products. Other regions demonstrated steady growth, but expansion has progressed at a slower pace. Market maturity, strong purchasing power, and a shift toward home-based care reinforced North America’s advantage.

Overall, the region is expected to continue benefiting from shifting consumer preferences toward non-pharmaceutical pain-relief methods. This trend is anticipated to sustain North America’s dominant role in the heat therapy units market over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the heat therapy units market focus on continuous product innovation and broader distribution reach. Their strategies emphasize compact designs, digital controls, and improved safety features. Strong investment in R&D has resulted in devices with faster heating cycles and enhanced temperature precision. Leading manufacturers strengthened their market position through targeted partnerships with healthcare facilities and sports rehabilitation centers.

Many companies expanded their online sales channels, which increased consumer accessibility and supported steady revenue growth. Premium product portfolios help differentiate offerings in a competitive environment. Customer engagement through educational campaigns and wellness-focused promotions has improved brand visibility.

Key players also focus on regulatory compliance and quality certifications to build trust. These combined strategic efforts have reinforced their influence and sustained their competitive edge in the global heat therapy units market.

Market Key Players

- Zimmer MedizinSysteme GmbH

- Chattanooga

- Performance Health

- HMS Medical Systems

- NC Medical Systems

- Physio International

- Globus Corp.

- Cnergy Healthcare

- Capenergy Medical

- ASTAR Medical

- Easytech S.r.l.

- Fisioline

- DJO Global

- Hill Laboratories

- Accelerated Care Plus Corporation

- Fisioline

- Medline Industries, Inc.

- Breg, Inc.

- BTL International

Recent Developments

- Zimmer MedizinSysteme GmbH Feb 2025: Launched the Thermo TK diathermy-system which delivers deep heat via high-frequency electrotherapy and is aimed at acute and chronic musculoskeletal conditions.

- Chattanooga (Rehabilitation Equipment brand) Ongoing 2025: Reinforced global leadership in heat therapy units (via the brand) as part of the parent’s offering of rehabilitation equipment used in over 80 countries.

- HMS Medical Systems Aug 2025: Announced an upgraded and expanded range of TENS machines for physiotherapy clinics; while not strictly a heat-therapy unit, it signals equipment expansion in rehabilitation context

Report Scope

Report Features Description Market Value (2024) US$ 3.4 Billion Forecast Revenue (2034) US$ 5.2 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Moist Heat Therapy Units, Dry Electric Heating Pad Units, Infrared Heat Therapy Units, Paraffin Wax Bath Units, Diathermy machines, Others) By Application (Musculoskeletal and Joint Disorders, Chronic Back and Neck Pain, Sports Injuries and Soft-Tissue Strain, Post-operative and Trauma Rehabilitation, Neuropathic and Chronic Pain Conditions, Others) By Type (Stationary, Portable) By End-User (Hospitals & Clinics, Physiotherapy and Rehabilitation Centers, Homecare Settings, Others) By Distribution Channel (Retail Pharmacies and Mass Retail Stores, E-commerce Platforms, Direct Sales) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Zimmer MedizinSysteme GmbH, Chattanooga, Performance Health, HMS Medical Systems, NC Medical Systems, Physio International, Globus Corp., Cnergy Healthcare, Capenergy Medical, ASTAR Medical, Easytech S.r.l., Fisioline, DJO Global, Hill Laboratories, Accelerated Care Plus Corporation, Fisioline, Medline Industries, Inc., Breg, Inc., BTL International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zimmer MedizinSysteme GmbH

- Chattanooga

- Performance Health

- HMS Medical Systems

- NC Medical Systems

- Physio International

- Globus Corp.

- Cnergy Healthcare

- Capenergy Medical

- ASTAR Medical

- Easytech S.r.l.

- Fisioline

- DJO Global

- Hill Laboratories

- Accelerated Care Plus Corporation

- Fisioline

- Medline Industries, Inc.

- Breg, Inc.

- BTL International