Global Heart Attack Diagnostics Market Analysis By Test (Electrocardiogram, Blood Test, Others), By End-use (Hospitals, Ambulatory Surgical Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150672

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

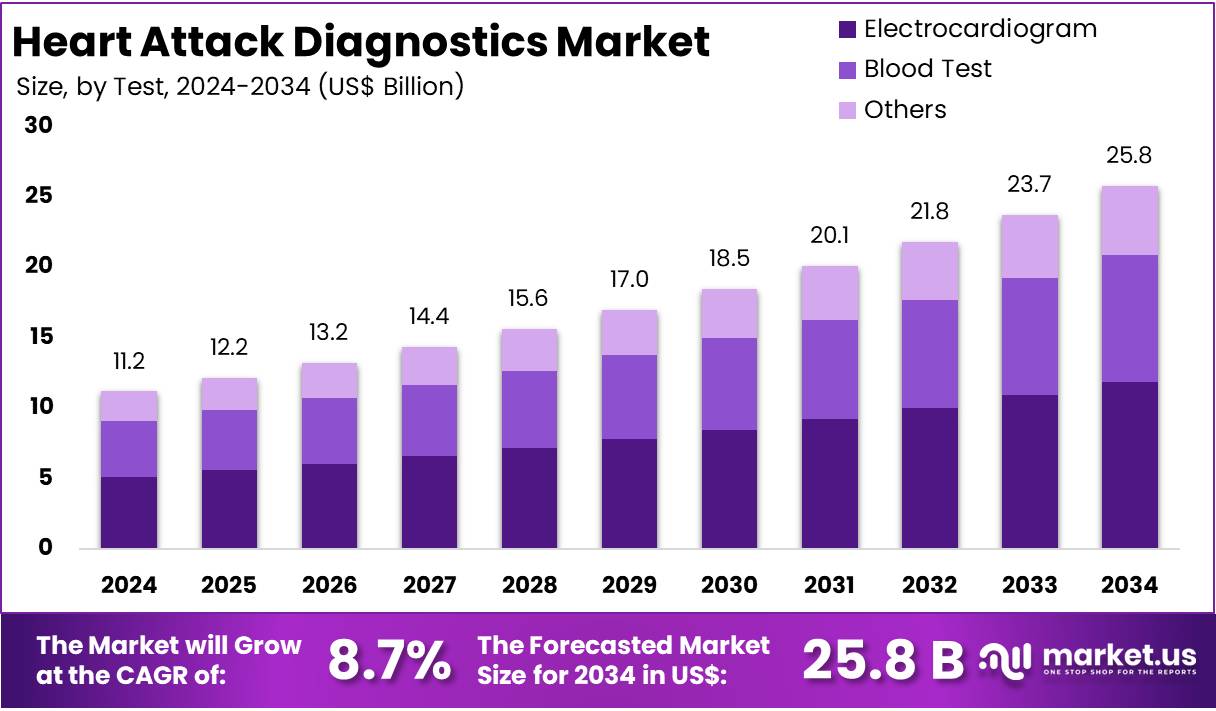

The Global Heart Attack Diagnostics Market Size is expected to be worth around US$ 25.8 Billion by 2034, from US$ 11.2 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43.4% share and holds US$ 11.2 billion market value for the year.

Heart Attack Diagnostics refers to medical tests and technologies used to detect or confirm myocardial infarction. These diagnostic tools are essential in identifying reduced blood flow to the heart and determining the extent of cardiac damage. Key methods include electrocardiograms (ECG), high-sensitivity cardiac troponin tests, echocardiography, chest X-rays, and coronary angiography. Early and accurate diagnosis allows healthcare professionals to initiate life-saving treatments promptly. This supports better survival outcomes and reduces the risk of complications associated with heart attacks.

The global burden of heart attacks is significant. According to the World Health Organization (WHO), cardiovascular diseases were responsible for 17.9 million deaths in 2019, accounting for 32% of all global deaths. Heart attacks form a major part of this statistic. The rise in risk factors such as high blood pressure, smoking, obesity, unhealthy diet, and diabetes continues to elevate the demand for efficient diagnostic tools. Rapid diagnostics are essential for early detection and better heart disease management in both acute and long-term settings.

High-sensitivity cardiac troponin tests have become the gold standard in heart attack diagnosis. These tests can detect even subtle damage to the heart muscle within hours of symptom onset. Studies indicate that troponin is detectable in 58% to 78% of the population, enabling timely and accurate diagnosis. Additional cardiac biomarkers, such as Heart-type Fatty Acid-Binding Protein (H-FABP), can detect damage in 1–3 hours, further improving sensitivity when used alongside troponin tests.

Government programs are actively supporting access to these diagnostics. For example, in June 2025, India’s Ernakulam Government Medical College began offering free Troponin I testing for low-income patients. Initiatives like this improve emergency care access and help reduce health disparities. According to the U.S. Centers for Disease Control and Prevention (CDC), the Division for Heart Disease and Stroke Prevention allocated over US$ 114 million in fiscal year 2023 to enhance state-level cardiovascular programs. This funding supports diagnostics, telehealth solutions, and early detection initiatives.

Artificial intelligence and smart algorithms are transforming the diagnostic landscape. For instance, CoDE-ACS—a machine learning model—uses troponin values and clinical inputs to provide highly accurate heart attack risk estimates. A study confirmed its diagnostic accuracy with an AUC of 0.953. These AI tools enhance clinical decision-making by integrating patient data and identifying high-risk individuals faster and more reliably than traditional methods.

Digital health platforms and remote monitoring also play a growing role. The CDC acknowledges telehealth as a valuable tool for managing chronic conditions like hypertension and diabetes, which are major contributors to heart attack risk. These technologies allow patients to track biomarker levels and receive alerts for timely medical intervention. As digital integration increases, heart attack diagnostics are expected to become more personalized, proactive, and accessible worldwide.

Key Takeaways

- The Global Heart Attack Diagnostics Market is projected to reach US$ 25.8 billion by 2034, up from US$ 11.2 billion in 2024, growing at 8.7% CAGR.

- In 2024, blood tests led the test segment, accounting for over 54.2% of the market due to their accuracy in detecting cardiac biomarkers.

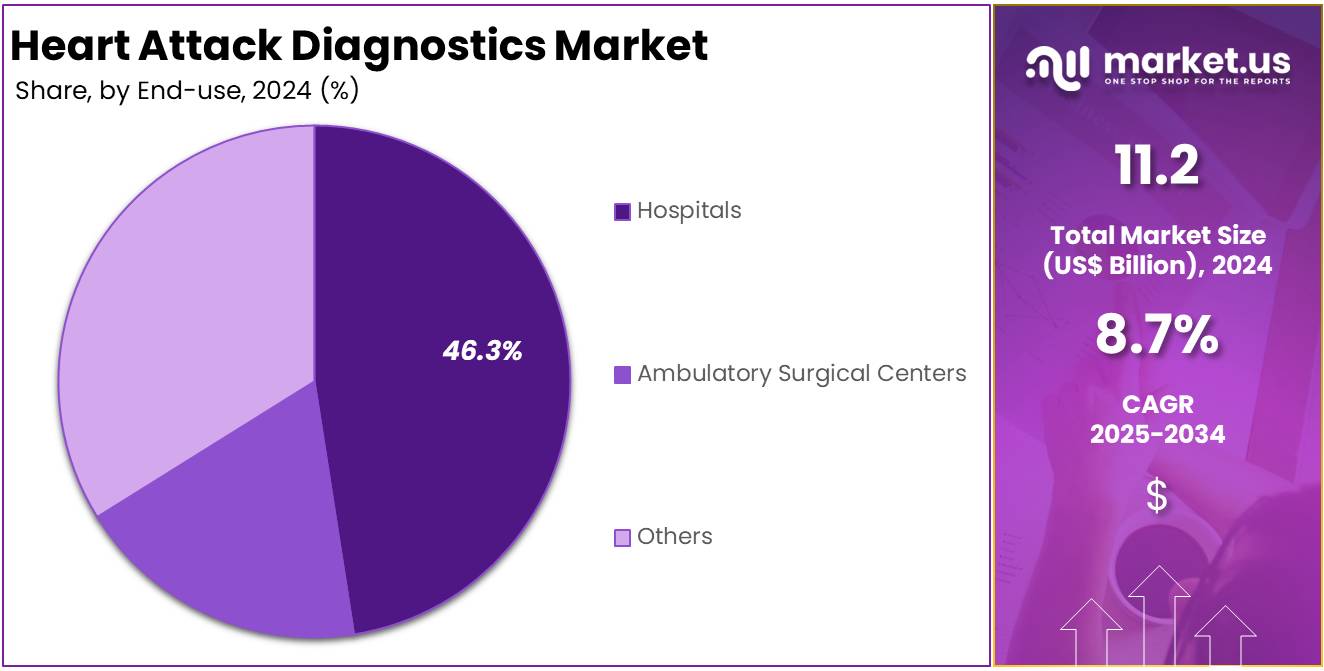

- Hospitals dominated the end-use segment in 2024, securing more than 46.3% market share, driven by higher patient inflow and availability of advanced diagnostic tools.

- North America held the leading regional position in 2024, contributing over 43.4% market share with a market value of US$ 11.2 billion.

Test Analysis

In 2024, the Blood Test segment held a dominant market position in the Test Segment of the Heart Attack Diagnostics Market, capturing more than a 54.2% share. This was largely due to its strong reliability in detecting cardiac biomarkers such as troponin. These markers are key indicators of heart muscle damage. Blood tests are widely used in emergency rooms. Their fast results help doctors make quicker decisions. This makes blood tests essential in early heart attack detection.

The Electrocardiogram (ECG) segment ranked second in the test category. ECGs are used to record the electrical activity of the heart. They help identify irregular heart rhythms and signs of a heart attack. While ECG may not detect early signs in all cases, it remains the first diagnostic tool used. It is fast, painless, and non-invasive. These features make it a valuable method for initial screening in both hospital and ambulance settings.

The Others category includes imaging tests such as echocardiograms and cardiac MRI. These methods are often used after the initial diagnosis. They help in assessing the extent of damage to the heart. Although not the first choice in emergencies, these tests provide detailed information. This supports accurate treatment planning. Each test method plays a different role in heart attack diagnosis. The focus remains on using fast, reliable, and cost-effective tools to save lives.

End-use Analysis

In 2024, the Hospitals section held a dominant market position in the End-use segment of the Heart Attack Diagnostics market and captured more than a 46.3% share. This leadership was driven by the availability of advanced diagnostic technologies and specialized cardiac care units in hospitals. These facilities offer critical tools like electrocardiograms (ECGs), blood biomarker tests, and imaging systems. Hospitals are also the first point of care during heart attack emergencies, making them central to rapid diagnosis and intervention.

The high rate of hospital admissions for acute cardiac events supports their large market share. According to the CDC, over 800,000 heart attacks occur in the United States each year. Most of these cases require urgent diagnostic procedures in hospital settings. The presence of trained personnel and 24/7 service availability further strengthens the hospital segment. These factors together explain why hospitals continue to lead in heart attack diagnostic services globally.

Ambulatory Surgical Centers (ASCs) and the Others category hold smaller shares. ASCs are used mostly for routine cardiac assessments and outpatient follow-ups. They are favored for shorter wait times and cost-effective care. The Others segment includes diagnostic labs and urgent care clinics. This group is growing, especially in urban regions. However, limited emergency capabilities keep their share lower compared to hospitals.

Key Market Segments

By Test

- Electrocardiogram

- Blood Test

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Technological Advancements in Early Biomarker Testing for Accurate MI Detection

High-sensitivity cardiac troponin (hs-cTn) assays are transforming heart attack diagnostics. These assays allow for the rapid and safe exclusion of myocardial infarction (MI) within 3–4 hours of emergency department arrival. The sensitivity and specificity of these tests consistently exceed 90%, reducing unnecessary admissions and improving clinical decision-making. According to the WHO-IFCC criteria, assays that detect troponin in over 50% of healthy individuals with ≤10% imprecision are considered high-sensitivity, ensuring both precision and reliability in acute settings.

In addition to hs-cTn, copeptin has emerged as an essential early biomarker for MI diagnosis. Released immediately after acute stress, copeptin complements troponin testing. When both are used together, the negative predictive value (NPV) for MI ranges between 95% and 100%. This dual-marker approach facilitates quicker patient triage, especially in borderline cases. The combination also reduces the diagnostic window and supports earlier discharge from emergency care, significantly lowering healthcare costs and patient burden.

Heart-type fatty acid-binding protein (H-FABP) further enhances diagnostic speed. Detectable in blood within 1–3 hours of myocardial injury, H-FABP is one of the earliest markers. Meta-analysis data shows its area under the curve (AUC) reaching 0.86, outperforming conventional cardiac troponin I in early-stage MI. When H-FABP is used with hs-cTn and copeptin, diagnostic accuracy is maximized. This multi-marker strategy is now seen as a critical advancement in early and reliable heart attack diagnosis.

Restraints

Limited Awareness and Diagnostic Delays in Developing and Underserved Regions

Heart attack diagnostics face significant restraint due to limited healthcare infrastructure and low awareness in low- and middle-income countries (LMICs). Cardiovascular diseases (CVDs), including heart attacks and strokes, accounted for nearly 19 million global deaths between 2021 and 2022, with 80% occurring in LMICs. A disproportionate number of premature deaths—approximately 82% of those under 70—also came from these regions. These figures highlight the urgent need for early diagnosis infrastructure, which remains inadequate and contributes to higher mortality rates and poor treatment outcomes.

Late diagnosis is a key challenge in developing regions, where healthcare systems often lack sufficient diagnostic tools and public education. As a result, heart attacks are frequently identified at an advanced stage, reducing the effectiveness of treatment. In the United States alone, heart attack incidence reaches 805,000 cases annually, with 20% being silent heart attacks that go unrecognized. Globally, poor symptom recognition—especially of atypical signs—results in delayed care and increased risk of complications or death, further limiting the success of diagnostic interventions.

Gender-based disparities also compound diagnostic challenges. Many adults cannot identify basic heart attack symptoms, and awareness of atypical signs remains below 40%. Women’s awareness of heart disease as the leading health threat fell from 65% in 2009 to 44% in 2019. Due to atypical presentations, women face higher misdiagnosis rates and treatment delays. These issues severely hinder timely diagnosis and limit the impact of current heart attack diagnostic systems.

Opportunities

Growing Role of Telecardiology and Wearable ECG Devices in Heart Attack Diagnostics

The increasing adoption of telecardiology and remote monitoring tools presents a promising opportunity in heart attack diagnostics. These technologies allow healthcare professionals to evaluate patients in real time without the need for in-person visits. Wearable ECG devices, including smartwatches with arrhythmia detection, are enabling early identification of cardiac abnormalities. This capability significantly improves diagnostic response times. The shift toward remote monitoring also supports early intervention, which is critical in preventing serious cardiac events such as myocardial infarction.

Remote diagnostic platforms are especially beneficial for patients in rural or underserved areas. Many regions face limited access to specialized cardiology services. By using wearable ECG monitors and digital health tools, clinicians can monitor cardiac health continuously. This leads to improved management of high-risk individuals and supports timely medical action. It also reduces the burden on hospitals and emergency services. In turn, this enhances the efficiency of healthcare delivery and expands diagnostic coverage to broader populations.

The expansion of telehealth platforms is being supported by favorable regulatory frameworks and digital infrastructure improvements. Government health agencies are increasingly promoting remote care models. Integration of ECG data with telemedicine portals ensures secure data sharing and better clinical decision-making. This convergence of wearable technology and telemedicine is poised to redefine how heart attack risk is assessed, particularly in remote and aging populations with rising cardiovascular disease burdens.

Trends

Rise of Personalized and Genetic-Based Heart Attack Diagnostics

The growing adoption of personalized medicine presents a major opportunity for heart attack diagnostics. Increasing focus on individual genetic risk factors, such as familial hypercholesterolemia, is changing how heart attack risk is identified. Genetic testing is enabling early detection of inherited conditions that contribute to cardiovascular disease. As a result, diagnostic solutions are being developed that focus on individual patient profiles rather than general population metrics. This shift supports more precise, timely, and proactive cardiovascular care through tailored diagnostic models.

Genetic risk profiling is helping physicians identify high-risk individuals even before symptoms appear. For example, mutations in genes like LDLR and APOB are associated with familial hypercholesterolemia and can elevate heart attack risk at a young age. Diagnostic labs and healthcare providers are investing in integrated testing platforms that combine traditional biomarkers with genetic panels. This innovation is expanding preventive care, encouraging early interventions, and supporting the transition from reactive to predictive cardiovascular diagnostics.

Moreover, government health agencies are recognizing the potential of precision diagnostics in reducing long-term healthcare costs. Initiatives such as population-level genomic screening are gaining traction in countries like the U.S. and the U.K. These programs aim to incorporate genetic testing into standard cardiac assessments. With increasing clinical adoption and regulatory support, genetic-based diagnostics are set to reshape the heart attack diagnostics market and create new opportunities for diagnostic companies worldwide.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 43.4% share and holds US$ 11.2 billion market value for the year. This strong performance was primarily supported by the high prevalence of cardiovascular diseases in the region. According to the U.S. Centers for Disease Control and Prevention (CDC), heart disease remains the leading cause of death, contributing to nearly 695,000 deaths in the United States in 2023 alone. This sustained burden drives the demand for early and precise diagnostic tools.

The region also benefits from advanced healthcare infrastructure. Hospitals and diagnostic centers in the U.S. and Canada have widespread access to high-sensitivity troponin tests, ECG monitoring, and cardiac imaging technologies. The presence of skilled healthcare professionals further supports the adoption of modern diagnostic procedures. Emergency response systems in major cities are well-equipped to provide timely care, which enhances the utility of rapid diagnostics.

Government health agencies across North America have also focused on public awareness and prevention programs. For example, initiatives by the American Heart Association promote routine screening, which boosts the uptake of diagnostic tools. Additionally, high health insurance coverage and increased per capita healthcare spending contribute to better access to heart attack diagnostics, further strengthening the region’s market leadership.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Heart Attack Diagnostics Market is moderately consolidated, with key global players focusing on innovation, diagnostic accuracy, and regional outreach. Companies are strengthening their portfolios through advanced technologies, AI integration, and strategic collaborations. GE Healthcare leads in cardiac diagnostics with its Vivid series and MAC ECG systems, widely adopted in hospitals and cardiac centers. The company focuses on AI-powered analytics for real-time diagnostics. Hitachi Corporation supports non-invasive cardiac imaging with advanced ultrasound and MRI-compatible systems, expanding its presence in emerging markets through service-driven models and integrated solutions.

Koninklijke Philips N.V. holds a strong position in the market through its cardiovascular informatics and imaging systems. The company offers integrated cardiac monitoring platforms and biomarker analyzers, enabling faster and more precise diagnoses. Philips’ ecosystem supports early detection and efficient clinical workflows. Midmark Corporation provides point-of-care ECG devices widely used in outpatient settings. Its focus lies in EMR-integrated diagnostics that enhance workflow efficiency. These tools offer accurate, user-friendly monitoring with seamless digital connectivity, making them suitable for both primary and specialty care providers.

F. Hoffmann-La Roche Ltd remains a dominant player in cardiac biomarker testing. Its Elecsys Troponin assays are globally used for rapid myocardial infarction detection. The company invests significantly in R&D to improve assay sensitivity and speed. Other major contributors include Siemens Healthineers, Abbott Laboratories, Nihon Kohden Corporation, and Beckman Coulter Inc. These firms offer innovative lab-based diagnostics and mobile health platforms. Overall, the market is shaped by rapid technological evolution, strategic partnerships, and growing demand for early and accurate heart attack detection.

Market Key Players

- GE Healthcare

- Hitachi Corporation

- Koninklijke Philips NV

- Midmark Corporation

- F Hoffmann-La Roche Ltd

- Schiller AG

- Siemens Healthineers

- Toshiba Corporation

- Welch Allyn Inc

- Astrazenca PLC

Recent Developments

- In September 2024: The U.S. Food and Drug Administration granted approval for GE HealthCare’s Flyrcado (flurpiridaz F‑18) injection, a PET radiotracer specifically designed for myocardial perfusion imaging. It is intended to enhance the detection of coronary artery disease—often the underlying cause of heart attacks—by delivering higher-resolution imaging and improved diagnostic accuracy, especially in patients with obesity or female physiology. This FDA clearance paved the way for a commercial rollout in early 2025.

- In June 2024: Launch of Philips Cardiac Workstation in EMEA: A new Cardiac Workstation platform has been released across Europe, Middle East, and Africa. This system was designed to accelerate clinical decision‑making by streamlining ECG data management and analysis through advanced algorithms, enabling clinicians to swiftly prioritize patients at risk. The platform integrates gesture-driven review tools, clinical decision support, and interoperability with existing EMR and IntelliSpace ECG systems.

Report Scope

Report Features Description Market Value (2024) US$ 11.2 Billion Forecast Revenue (2034) US$ 25.8 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test (Electrocardiogram, Blood Test, Others), By End-use (Hospitals, Ambulatory Surgical Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GE Healthcare, Hitachi Corporation, Koninklijke Philips NV, Midmark Corporation, F Hoffmann-La Roche Ltd, Schiller AG, Siemens Healthineers, Toshiba Corporation, Welch Allyn Inc, Astrazenca PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heart Attack Diagnostics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Heart Attack Diagnostics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Hitachi Corporation

- Koninklijke Philips NV

- Midmark Corporation

- F Hoffmann-La Roche Ltd

- Schiller AG

- Siemens Healthineers

- Toshiba Corporation

- Welch Allyn Inc

- Astrazenca PLC