Healthcare Software As A Service Market By Solution Type (EHR Systems, Telehealth, Healthcare Data Analytics Tools, Laboratory Information Systems (LIS), Medical Practice Management Systems, Inventory and Material Management, Supply Chain and Logistics Management, Medical Billing, HR & Workforce Management, ePrescribing, Others), By Deployment Model (Private Cloud, Public Cloud, Hybrid Cloud), By End-User (Healthcare Providers- Hospitals & Clinics, Diagnostic Centers, Pharmacies, Ambulatory Care Centers, Others; Healthcare Payers- Private Payers, Public Payers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153114

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

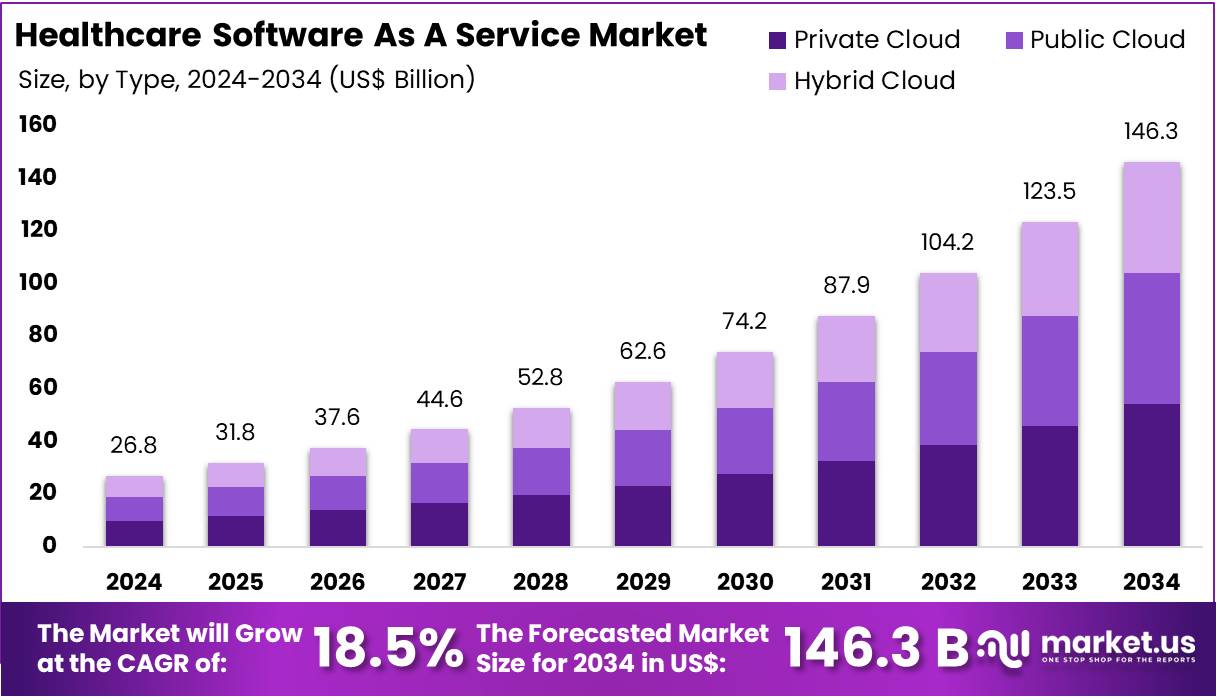

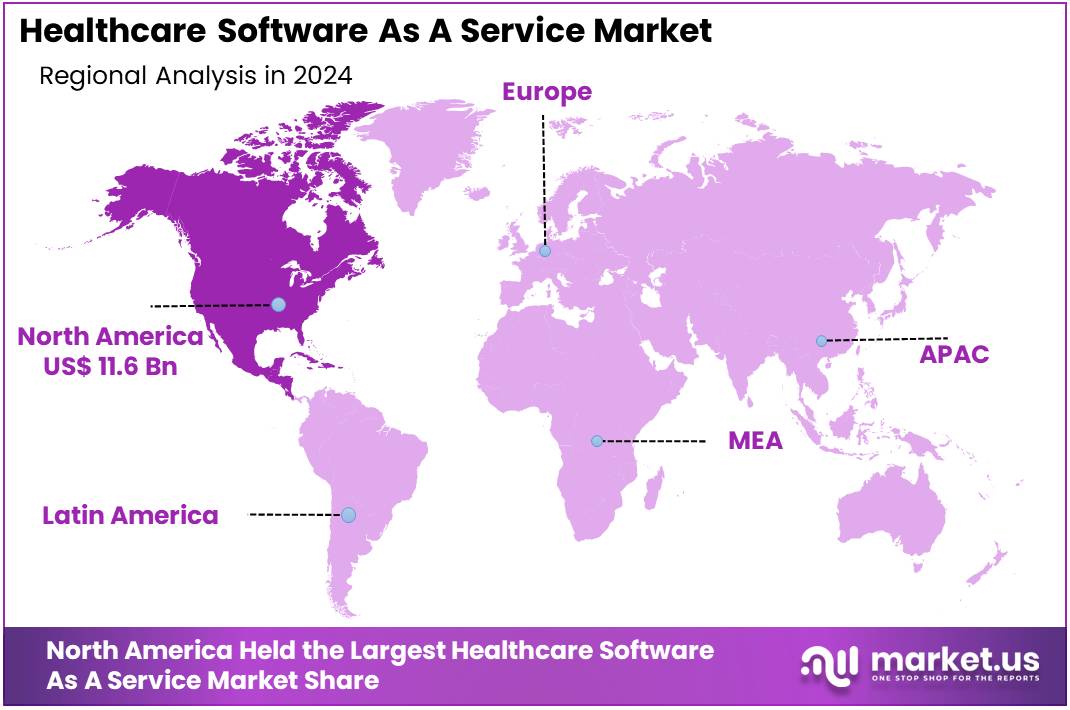

The Global Healthcare Software As A Service Market Size is expected to be worth around US$ 146.3 Billion by 2034, from US$ 26.8 Billion in 2024, growing at a CAGR of 18.5% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.4% share and holds US$ 11.6 Billion market value for the year.

The Healthcare Software as a Service (SaaS) market is experiencing substantial growth as healthcare providers increasingly adopt digital solutions to improve patient care and operational efficiency. This growth is driven by several factors, including technological advancements, regulatory mandates, and the evolving needs of healthcare organizations. Cloud-based platforms are at the forefront of this transformation, offering healthcare providers scalable, cost-effective, and flexible solutions. These platforms enable healthcare providers to manage patient data, administrative tasks, billing, and other critical functions more efficiently, reducing the reliance on legacy systems and on-premise infrastructure.

A significant driver behind the adoption of SaaS solutions is the regulatory push for interoperability and patient access to healthcare data. For example, the 21st Century Cures Act in the United States mandates healthcare organizations to make patient data more accessible and exchangeable across different systems. This regulatory requirement compels healthcare providers to integrate SaaS solutions that facilitate seamless data sharing and empower patients to access their health records. Such initiatives are crucial in enhancing the transparency of healthcare delivery and improving patient outcomes.

The healthcare sector is also seeing a shift toward more specialized, AI-driven SaaS solutions. These solutions cater to niche clinical pathways, such as oncology, cardiology, and neurology, where AI algorithms are used to enhance diagnostic accuracy, personalize treatment plans, and streamline clinical workflows.

AI-powered vertical SaaS platforms are particularly beneficial in specialties that require precise, data-driven decision-making. These platforms not only improve the quality of care but also increase operational efficiency, ultimately benefiting both healthcare providers and patients. On the other hand, traditional on-premise healthcare software requires significant investment in infrastructure and maintenance, while SaaS platforms offer more affordable alternatives with lower upfront costs. These cloud-based solutions provide healthcare organizations with the flexibility to scale services quickly and adapt to changing needs without the burden of managing physical hardware.

In addition, the COVID-19 pandemic accelerated the adoption of telehealth and remote monitoring solutions. The need for virtual care and the ability to monitor patients remotely prompted healthcare providers to seek SaaS solutions that can support telemedicine services, allowing for real-time consultations and continuous patient monitoring. This shift has not only expanded access to healthcare but also reduced the strain on physical healthcare facilities.

The healthcare technology sector is witnessing continued investment as startups grow their operations. For instance, Personal Health Tech revealed in July 2025 that it had secured funding from the corporate venture fund NTT DOCOMO Ventures to expand its “Kensapo” business, which aids corporate health management through SaaS and BPO services.

Some of the funding initiatives undertaken by the healthcare SaaS companies in 2024-2025

Date Company Funding Amount Reason to Use Funds May 2025 CERTIFY Health Series A funding To improve its technology platform, expand market presence, grow the team, and enhance the patient journey from intake to payment. March 2025 ModMed® Majority growth investment (financial terms not disclosed) To support company growth, though specific uses for the funding were not disclosed. December 2024 PBR Life Sciences $1 million (pre-seed funding) To upgrade its AI infrastructure and expand operations into Ghana and Kenya. May 2024 RFX Solutions $9 million (Series A funding) To advance healthcare compliance processes and fuel growth, supported by Arthur Ventures’ expertise in scaling B2B SaaS businesses. Key Takeaways

- In 2024, the market for healthcare software as a service generated a revenue of US$ 26.8 billion, with a CAGR of 18.5%, and is expected to reach US$ 146.3 billion by the year 2034.

- By Solution Type, EHR Systems segment dominated the market with 16.5% share in 2024.

- Based on the deployment model segment, Private Cloud held the largest revenue share of 37.1% in 2024.

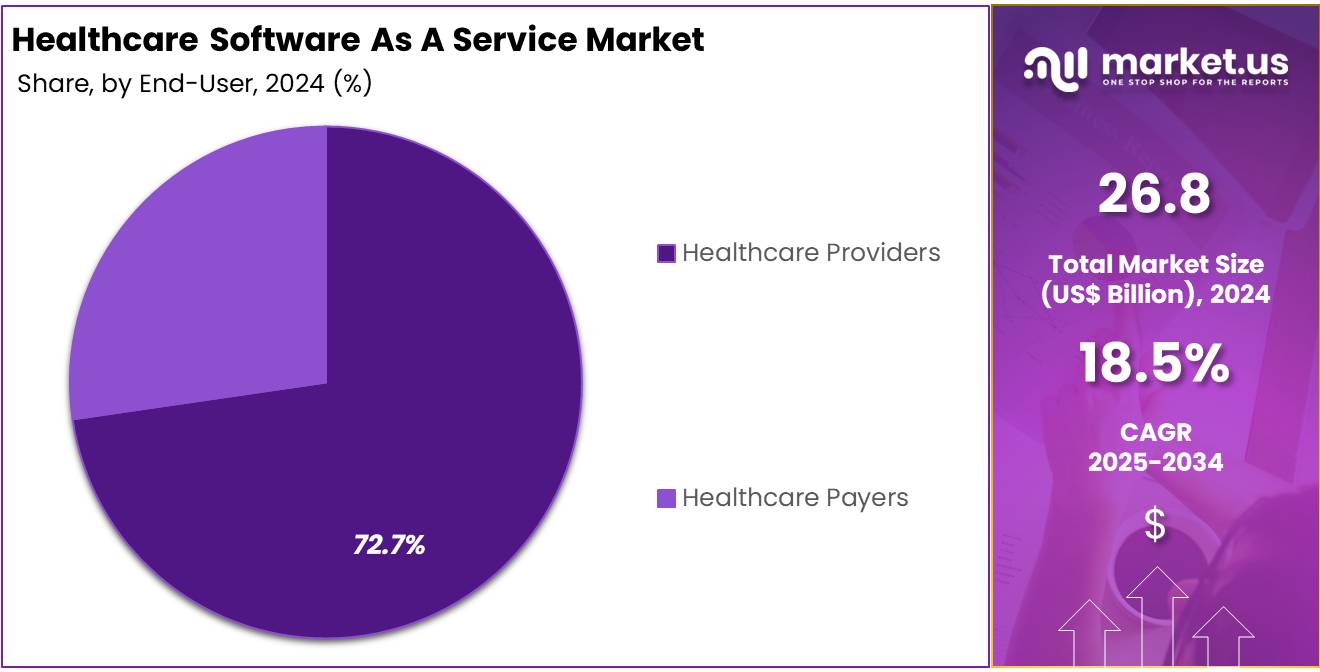

- By end-user, Healthcare Providers displayed the highest revenue generation in 2024 with a share of 72.7%.

- North America remains the largest region accounting for 43.4% share.

Type Analysis

The Electronic Health Records (EHR) systems segment stands as the largest within the Healthcare Software as a Service (SaaS) market with 16.5% share in 2024, reflecting a significant shift towards digitalization in healthcare. EHR systems centralize patient data, encompassing medical histories, diagnoses, treatments, and medications, thereby enhancing care coordination and clinical decision-making. This transformation is particularly evident in the United States, where nearly 88% of office-based physicians have adopted EHR systems, and 77.8% utilize certified EHRs.

The rapid adoption of cloud-based EHR solutions has been a pivotal factor in this growth. In 2022, 82% of healthcare organizations had either adopted or planned to adopt cloud-based EHR systems. These cloud-based platforms offer scalability, cost-effectiveness, and remote accessibility, making them particularly appealing to small and medium-sized healthcare providers.

For instance, Epic Systems introduced “Garden Plot,” a SaaS solution tailored for independent medical groups, providing them access to Epic’s core EHR functionalities without the need for extensive IT infrastructure. Furthermore, companies like Oracle Health are incorporating AI capabilities into their EHR platforms, aiming to automate administrative tasks, enhance clinical decision-making, and improve patient outcomes.

Deployment Model Analysis

In 2024, the private cloud deployment model has emerged as significant segment within the Healthcare SaaS market with 37.1% share. This growth can be attributed to the increasing need for enhanced data security, regulatory compliance, and more control over IT infrastructure, all of which are crucial in healthcare settings where sensitive patient information is handled daily.

Unlike public clouds, which rely on shared infrastructure, private clouds provide a dedicated environment for healthcare organizations, allowing them to tailor security protocols, performance, and storage solutions to meet their specific requirements. One of the key reasons for the rise of private cloud solutions in healthcare is the growing concern around data privacy. With stringent regulations such as HIPAA in the U.S. and GDPR in Europe, healthcare providers are under pressure to safeguard patient data against breaches or unauthorized access.

Private cloud systems allow healthcare organizations to implement robust security measures, including encrypted data storage, secure access protocols, and customized firewalls. These solutions offer greater control over how and where data is stored, reducing the risk of data exposure compared to public cloud environments, where data is often stored in shared facilities. Moreover, the private cloud is increasingly favored for its ability to integrate seamlessly with other healthcare technologies.

In November 2024, Rackspace Technology, a prominent provider of hybrid, multicloud, and AI technology services, has announced the implementation of an Epic EHR system for AdventHealth on its Healthcare Cloud platform. This deployment stands as one of the largest Epic installations for a U.S. healthcare system, supporting more than 38,000 concurrent users. Rackspace Technology is responsible for fully hosting and managing the Epic environment, along with nine other key applications in the AdventHealth IT portfolio, all within a secure private cloud infrastructure.

End-User Analysis

The healthcare providers segment stands as the largest end-user category within the Healthcare SaaS market holding 72.7% share in 2024, reflecting the sector’s substantial investment in digital transformation to enhance patient care and operational efficiency. Healthcare providers, encompassing hospitals, clinics, and independent medical practices, are increasingly adopting SaaS solutions to streamline operations, improve patient outcomes, and ensure compliance with regulatory standards.

A significant driver of this adoption is the need for scalable and cost-effective solutions. SaaS platforms offer healthcare providers the flexibility to scale their operations without the substantial upfront costs associated with traditional on-premise software. For instance, cloud-based Electronic Health Record (EHR) systems enable providers to manage patient data securely and accessibly, facilitating improved care coordination and decision-making. This shift is particularly beneficial for smaller practices that may lack the resources to maintain extensive IT infrastructure.

Moreover, SaaS solutions enhance interoperability among various healthcare systems. Through standardized data formats and cloud-based integration, providers can share patient information seamlessly across different platforms, reducing the risk of errors and improving the continuity of care. This capability is crucial as healthcare systems strive to deliver patient-centered care that is both efficient and effective.

In April 2025, RapidClaims, an AI-driven SaaS startup, secured US$ 8 million (INR 68 crore) in a Series A funding round, with venture capital firm Accel leading the investment. Together Fund also participated in the round. The company caters to a wide range of clients, including Federally Qualified Health Centers (FQHCs), physician groups, outpatient facilities, and ambulatory surgery centers.

Key Market Segments

By Solution Type

- EHR Systems

- Telehealth

- Healthcare Data Analytics Tools

- Laboratory Information Systems (LIS)

- Medical Practice Management Systems

- Inventory and Material Management

- Supply Chain and Logistics Management

- Medical Billing

- HR & Workforce Management

- ePrescribing

- Others

By Deployment Model

- Private Cloud

- Public Cloud

- Hybrid Cloud

By End-User

- Healthcare Providers

- Hospitals & Clinics

- Diagnostic Centers

- Pharmacies

- Ambulatory Care Centers

- Others

- Healthcare Payers

- Private Payers

- Public Payers

Drivers

Cloud Adoption and Scalability

The rapid adoption of cloud computing is primarily due to its scalability and flexibility. Healthcare organizations are increasingly transitioning from traditional on-premises infrastructure to cloud-based solutions to meet the growing demands of patient care, data management, and regulatory compliance. This shift is not only enhancing operational efficiency but also enabling healthcare providers to deliver more personalized and timely care.

One of the most significant advantages of cloud computing in healthcare is its scalability. Healthcare institutions often experience fluctuating demands, such as seasonal increases in patient volume or the need to rapidly expand services during public health emergencies. Cloud platforms allow organizations to adjust their computing resources dynamically, scaling up during peak times and scaling down during quieter periods, without the need for substantial upfront investments in physical infrastructure. This elasticity ensures that healthcare providers can maintain optimal performance and cost-efficiency at all times.

The flexibility offered by cloud computing extends to the deployment of various healthcare applications. For instance, EHR systems, telemedicine platforms, and patient management tools can be integrated into a unified cloud environment, facilitating seamless data sharing and collaboration across departments and locations. This interconnectedness enhances care coordination and enables healthcare professionals to access real-time patient information, leading to more informed decision-making and improved patient outcomes.

The transition to cloud computing also addresses the challenges associated with data management and storage. Healthcare organizations generate vast amounts of data daily, including patient records, imaging files, and diagnostic results. Cloud platforms offer scalable storage solutions that can accommodate this growing data volume, ensuring that information is securely stored and easily accessible. Additionally, cloud services often include built-in data backup and disaster recovery features, safeguarding against data loss and ensuring business continuity.

In November 2024, Simplify Healthcare, a prominent provider of SaaS solutions for the health insurance industry through its Simplify Health Cloud™, announced the launch of SimplifyX, a new subsidiary focused on delivering innovative software products across a wider range of industries. It is projected that by 2026, approximately 70% of health systems will have adopted a cloud-based approach to supply chain management.

Restraints

Data Security and Privacy Concerns

Healthcare organizations often face obstacles related to data security, regulatory compliance, and the complexity of cloud integration. Data security remains a primary concern. The centralization of sensitive health information in cloud environments increases the risk of cyberattacks. In 2022, healthcare experienced a surge in security issues with SaaS applications, reporting 19% of such incidents compared to 10% in other industries. Moreover, healthcare organizations were responsible for 86% of data thefts, highlighting vulnerabilities in cloud-based systems.

Regulatory compliance adds another layer of complexity. Healthcare providers must adhere to stringent regulations such as HIPAA in the U.S., which mandates the protection of electronic Protected Health Information (ePHI). Ensuring that cloud service providers comply with these regulations requires meticulous oversight and can be resource-intensive. Furthermore, the integration of cloud solutions into existing healthcare infrastructures can be technically challenging. Healthcare organizations often operate legacy systems that may not be compatible with modern cloud technologies. Migrating to cloud-based platforms necessitates significant investment in time and resources to ensure interoperability and minimize disruptions to patient care.

Episource, a U.S.-based healthcare services company offering risk adjustment, medical coding, data analytics, and technology solutions to health plans and providers, has reported a data breach after hackers stole health information of over 5 million individuals in a January 2025 cyberattack. According to a data breach notification on its website, Episource detected unusual activity on its systems on February 6, 2025. An investigation revealed that hackers had accessed and exfiltrated sensitive data stored on these systems between January 27 and the discovery date. A report filed with the U.S. Department of Health and Human Services Office for Civil Rights’ breach portal indicates that the cyberattack affected 5,418,866 people.

Opportunities

AI-Driven Vertical SaaS Solutions for Specialized Clinical Pathways

The integration of artificial intelligence (AI) into vertical SaaS platforms is revolutionizing specialized clinical pathways in healthcare. These AI-driven solutions are tailored to specific medical disciplines, enhancing diagnostic accuracy, streamlining workflows, and personalizing patient care. By embedding AI into specialized SaaS applications, healthcare providers can address the unique challenges of various clinical pathways, from oncology to cardiology, with greater precision and efficiency.

A notable example is Aidoc, an AI company specializing in medical imaging. Its algorithms assist radiologists in identifying critical conditions such as strokes and pulmonary embolisms in real-time, thereby accelerating diagnosis and treatment. This capability is particularly beneficial in emergency settings, where timely intervention is crucial. The integration of AI into imaging workflows exemplifies how vertical SaaS solutions can enhance specific clinical pathways by providing specialized tools that cater to the nuances of particular medical fields.

Ellipsis Health has developed an AI-powered platform called Sage, designed to assist patients between medical appointments. The company secured a substantial US$45 million in a Series A funding round, according to June 2025 news reports. Sage autonomously engages with patients to help them understand discharge instructions, track medication adherence, and arrange transportation. Its “empathy engine,” trained on millions of clinical calls, allows it to detect emotions and tailor its responses, offering a more human-like interaction. This AI-driven solution is tailored to meet the specific needs of post-discharge care, highlighting the potential of vertical SaaS platforms to enhance specialized clinical pathways.

Impact of Macroeconomic / Geopolitical Factors

The global COVID-19 pandemic significantly accelerated the adoption of cloud-based healthcare solutions. However, the economic slowdown and strain on healthcare budgets during the pandemic posed challenges for healthcare providers in both developed and developing nations. Governments around the world had to reallocate funds to support immediate health needs, which delayed the planned implementation of more advanced SaaS solutions. In the U.S., while healthcare institutions pushed forward with digital transformation initiatives, many smaller practices had to postpone cloud adoption due to financial constraints as they faced dwindling patient volumes and increased operational costs.

In April 2025, President Trump announced a 145% reciprocal tariff on Chinese goods, including critical components like semiconductors and GPUs essential for AI-driven healthcare applications. This move was a response to China’s trade practices and aimed to bolster domestic manufacturing. However, it led to increased costs for U.S. healthcare providers and SaaS vendors reliant on Chinese technology, potentially delaying the deployment of advanced digital health solutions.

Subsequently, in May 2025, the U.S. reduced the tariff to 30% following a trade agreement with China, which included commitments to resume exports of rare earth elements vital for semiconductor production. Despite this reduction, the initial high tariffs had already disrupted supply chains and escalated costs for healthcare technology providers. These developments underscore the complex interplay between trade policies and the healthcare SaaS market, highlighting the need for strategic planning to navigate such geopolitical uncertainties.

Additionally, the implementation of stringent data privacy regulations, such as the European Union’s General Data Protection Regulation (GDPR), has affected SaaS providers offering services across multiple jurisdictions. For example, healthcare organizations in the U.K. and EU had to make significant adjustments to ensure compliance with GDPR, leading to delays in the rollout of new SaaS applications and increased operational costs. This regulatory burden has often slowed the pace at which SaaS solutions are adopted, as healthcare providers struggle to meet the necessary data protection standards.

Latest Trends

Increasing adoption of Hybrid Cloud Deployments

The healthcare industry is increasingly adopting hybrid cloud deployments to enhance data management, ensure compliance, and support advanced technologies. Hybrid cloud solutions, which combine private and public cloud infrastructures, offer healthcare organizations the flexibility to store sensitive data on-premises while leveraging the scalability and innovation of public clouds for less critical workloads. For instance, Sharp HealthCare is implementing a multi-phase hybrid cloud strategy that integrates AWS infrastructure, a private cloud, and hundreds of applications, including an electronic medical record system migration. This approach allows Sharp HealthCare to maintain control over sensitive patient data while benefiting from the scalability and efficiency of cloud technologies.

Genetec, a global provider of enterprise physical security software, has highlighted a growing trend towards hybrid and cloud adoption in the healthcare sector’s physical security infrastructure, as revealed in its 2025 State of the Physical Security Report. The report, based on insights from over 5,600 physical security professionals worldwide, includes data from those working in or with the healthcare industry, offering a thorough analysis of emerging trends in physical security operations. Hybrid and cloud models are gaining momentum, with 48.3% of organizations using some form of hybrid-cloud solutions, and 8.7% having fully transitioned to cloud-based security.

Furthermore, the integration of AI and edge computing with hybrid cloud architectures is enabling real-time data processing at the point of care. For instance, AI applications running on edge devices, such as ultrasounds and MRI machines, can provide immediate insights to clinicians, enhancing decision-making and patient outcomes. This edge-to-cloud approach balances the need for rapid data processing with the benefits of centralized data storage and analysis.

Regional Analysis

North America is leading the Healthcare Software As A Service Market

North America remains the largest region accounting for 43.4% share in the global Healthcare SaaS market in 2024. This dominance is primarily driven by the advanced healthcare infrastructure, high levels of digital health adoption, and robust regulatory frameworks, especially in the United States and Canada. The U.S. leads in the implementation of cloud-based healthcare solutions, driven by a substantial shift towards EHRs, telemedicine, and patient management tools.

The government’s incentives for adopting health IT and the growing pressure to improve patient outcomes while reducing costs have encouraged widespread SaaS adoption among healthcare providers. Major U.S. healthcare systems leverage SaaS platforms to streamline operations, enhance data security, and improve patient engagement. For instance, the increasing integration of AI within SaaS platforms is enabling healthcare providers to offer predictive analytics and personalized care, which are transforming patient management and clinical decision-making.

In January 2025, Innovaccer, a healthcare AI company based in San Francisco, CA, secured $275 million in a Series F funding round. The investment will support the company’s expansion, strengthen its AI and cloud capabilities, and scale its developer ecosystem. Innovaccer plans to introduce new solutions, including utilization management, clinical decision support, and care management.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the Healthcare SaaS market, owing to rapid digital transformation and government initiatives aimed at improving healthcare infrastructure. Countries like India, China, and Japan are making significant strides in adopting digital healthcare solutions, with governments pushing for nationwide adoption of Electronic Medical Records (EMRs) and telehealth services.

In particular, the rise of cloud computing in countries like India is making it easier for smaller healthcare providers to adopt SaaS solutions without the need for heavy upfront infrastructure investments. The adoption of SaaS platforms is also being driven by the increasing need to manage a rapidly growing and aging population, which has placed greater demands on healthcare systems. As a result, more healthcare providers are turning to cloud-based solutions to improve efficiency and deliver high-quality care. This trend is further bolstered by a growing private sector investment in digital healthcare technologies, which is contributing to the region’s fast-paced growth in the healthcare SaaS market.

In April 2025, HealthMetrics introduced HealthMetrics Indonesia, rebranding Across Asia Assist Indonesia (AAA) following its acquisition of the company in 2022. This merger integrates HealthMetrics’ digital infrastructure with AAA’s local expertise, establishing a digital Third-party Administrator (TPA) in Indonesia’s healthcare sector. AAA, with over a decade of experience, has provided services to insurers such as Allianz and AXA, as well as local corporations. Operating under the HealthMetrics brand, the company aims to improve healthcare administration through digital solutions like the HealthMetrics Cloud Platform, Global Member App, and International Assistance Hub.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Healthcare SaaS market is shaped by a mix of established healthcare IT providers and new entrants leveraging cutting-edge technologies. Epic Systems Corporation is one of the dominant players, known for its extensive EHR solutions that are widely adopted by large healthcare systems, particularly in the U.S. Epic’s platform integrates clinical, administrative, and financial functions, providing seamless data flow and improving patient care.

Cerner, now part of Oracle, is another major competitor, offering EHR solutions that focus on improving care coordination and reducing healthcare costs. Cerner’s recent integration with Oracle’s cloud infrastructure positions it strongly to compete with other tech giants in the AI and cloud healthcare space.

Recent Developments

- In March 2025, GE HealthCare introduced its new Genesis solutions, a suite of cloud-based enterprise imaging software-as-a-service offerings. When commercially launched, the solutions will include four key features: edge, storage, vendor-neutral archive, and data migration. These cloud solutions are designed to improve efficiency and accuracy in healthcare organizations, streamline workflows, and optimize the use of capital and IT resources.

- In October 2024, Oracle launched the general availability of Oracle Health Clinical Data Exchange, a cloud-based solution designed to simplify medical claims processing by enabling secure, automated data exchange between healthcare providers and payers.

- In January 2024, CareCloud, Inc. unveiled a strategic partnership with Kovo HealthTech Corporation, a leader in healthcare technology and Billing-as-a-Service. This collaboration is set to provide Kovo clients with an advanced suite of electronic health record (EHR) solutions, cutting-edge practice management software, comprehensive credentialing support, and an integrated clearinghouse.

Top Key Players in the Healthcare Software As A Service Market

- Microsoft

- Salesforce, Inc.

- Oracle

- Cisco Systems, Inc.

- Adobe

- SAP

- IBM

- ServiceNow

- Workday, Inc.

- CareCloud, Inc.

- Suki AI, Inc.

- Epic Systems

- Veradigm

- McKesson

- Change Healthcare

- GE HealthCare

Report Scope

Report Features Description Market Value (2024) US$ 26.8 billion Forecast Revenue (2034) US$ 146.3 billion CAGR (2025-2034) 18.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution Type (EHR Systems, Telehealth, Healthcare Data Analytics Tools, Laboratory Information Systems (LIS), Medical Practice Management Systems, Inventory and Material Management, Supply Chain and Logistics Management, Medical Billing, HR & Workforce Management, ePrescribing, Others), By Deployment Model (Private Cloud, Public Cloud, Hybrid Cloud), By End-User (Healthcare Providers- Hospitals & Clinics, Diagnostic Centers, Pharmacies, Ambulatory Care Centers, Others; Healthcare Payers- Private Payers, Public Payers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Salesforce, Inc., Google, Oracle, Cisco Systems, Inc., Adobe, SAP, IBM, ServiceNow, Workday, Inc., CareCloud, Inc., Suki AI, Inc., Epic Systems, Veradigm, McKesson, Change Healthcare, GE HealthCare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Software As A Service MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Software As A Service MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- Salesforce, Inc.

- Oracle

- Cisco Systems, Inc.

- Adobe

- SAP

- IBM

- ServiceNow

- Workday, Inc.

- CareCloud, Inc.

- Suki AI, Inc.

- Epic Systems

- Veradigm

- McKesson

- Change Healthcare

- GE HealthCare