Healthcare Natural Language Processing Market By Product Type (Software, Platforms, and Services), By Technology (Cloud-Based, and On-Premises), By Application (Clinical Documentation, Data Mining, and Patient Interaction), By End-user (Hospitals & Clinics, and Pharmaceutical Companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159868

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

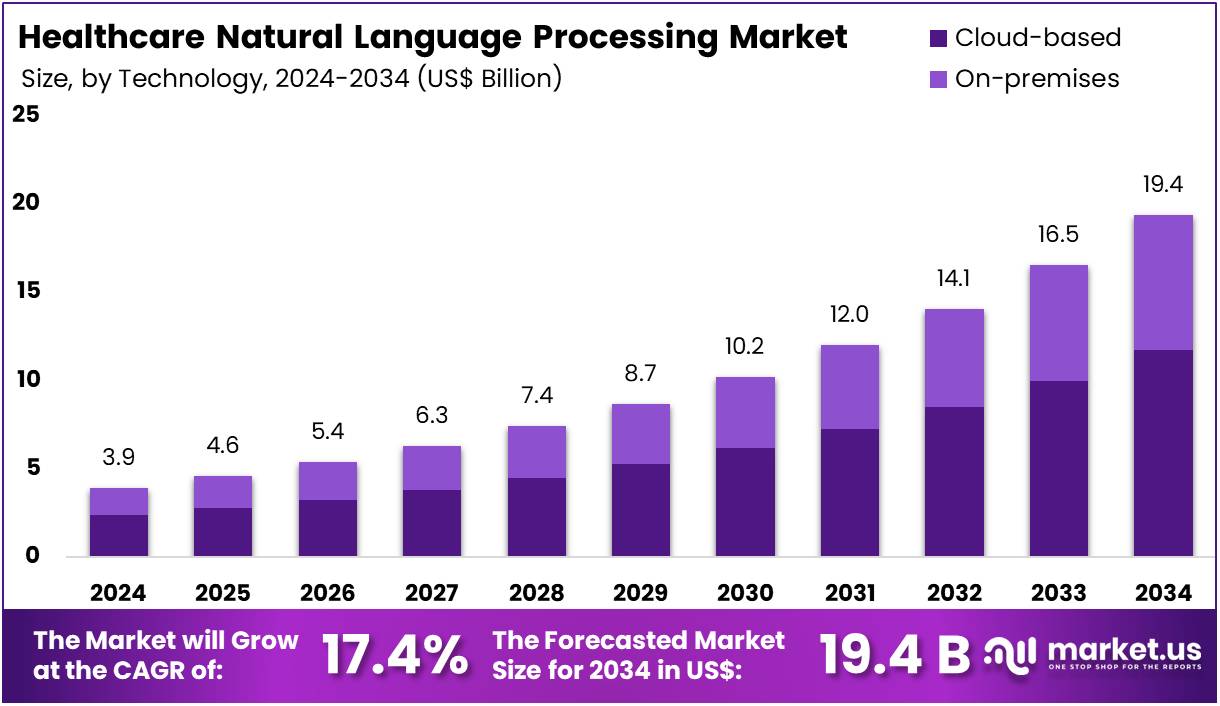

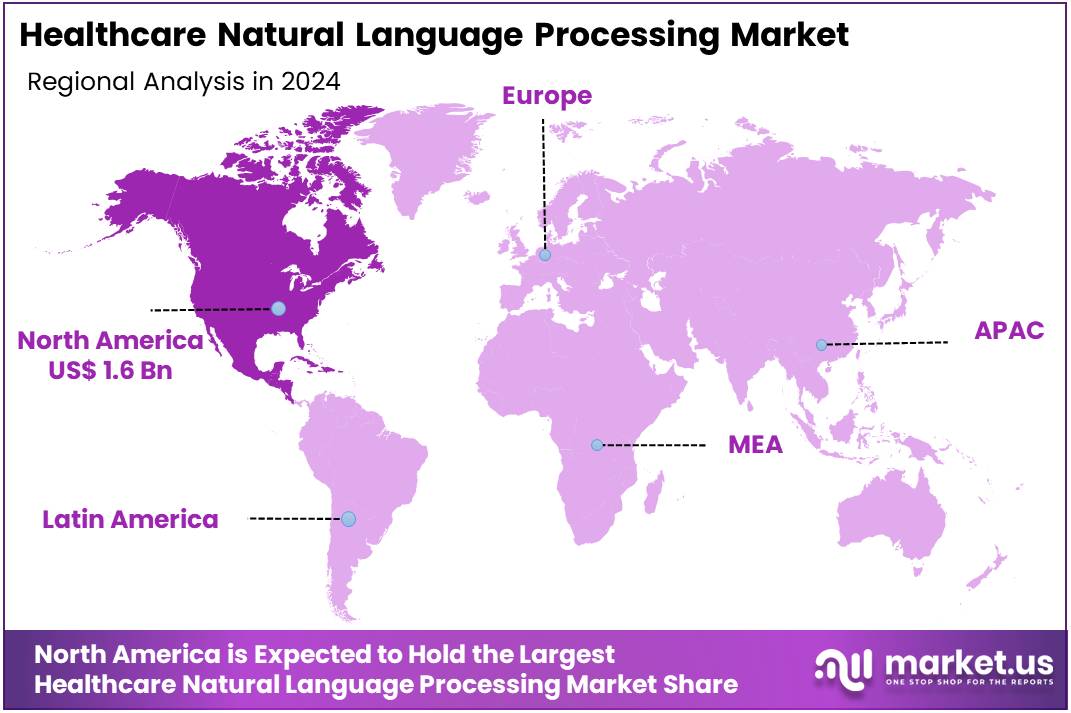

The Healthcare Natural Language Processing Market Size is expected to be worth around US$ 19.4 billion by 2034 from US$ 3.9 billion in 2024, growing at a CAGR of 17.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.8% share and holds US$ 1.6 Billion market value for the year.

The increasing volume of unstructured clinical data is a key driver of the healthcare natural language processing (NLP) market. With unstructured data such as physician notes, lab results, and patient feedback accounting for approximately 80% of all medical data, healthcare organizations face significant challenges in extracting actionable insights.

NLP solutions address these challenges by automatically extracting, classifying, and summarizing vital information, thereby enhancing clinical documentation and decision-making. The widespread adoption of Electronic Health Records (EHRs), with 96% of US hospitals now using EHR systems, provides a growing repository of data that NLP can transform into actionable insights, improving patient care and operational efficiency.

The integration of generative AI and large language models (LLMs) into healthcare workflows presents emerging opportunities in the NLP market. These advanced models are capable of performing tasks such as automated clinical trial matching, where they analyze patient records to identify eligible participants, and facilitating patient support through conversational AI.

A recent survey found that 75% of leading healthcare organizations are either experimenting with or planning to scale up the use of generative AI. This trend was highlighted at the HIMSS 2025 conference, where Google demonstrated how generative AI search and agents could improve patient care by enabling clinicians to efficiently access and summarize data within EHR systems.

Recent developments in the healthcare NLP market show a shift toward specialized, domain-specific models and multimodal NLP approaches. Unlike general-purpose models, domain-specific models, trained on large medical datasets, offer superior accuracy in interpreting complex clinical text. Furthermore, multimodal NLP, which integrates text with visual data from medical images and scans, provides a more comprehensive view of patient information.

For example, the Delphi-2M AI tool, trained on data from over 2 million patients, can predict the risk of more than 1,000 diseases, including cancer and diabetes, demonstrating how integrated data analysis can accurately forecast future health outcomes. These advancements highlight the growing focus on developing more reliable, context-aware AI solutions for the healthcare sector.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.9 billion, with a CAGR of 17.4%, and is expected to reach US$ 19.4 billion by the year 2034.

- The product type segment is divided into software, platforms, and services, with software taking the lead in 2024 with a market share of 40.5%.

- Considering technology, the market is divided into cloud-based and on-premises. Among these, cloud-based held a significant share of 60.5%.

- Furthermore, concerning the application segment, the market is segregated into clinical documentation, data mining, and patient interaction. The clinical documentation sector stands out as the dominant player, holding the largest revenue share of 45.5% in the market.

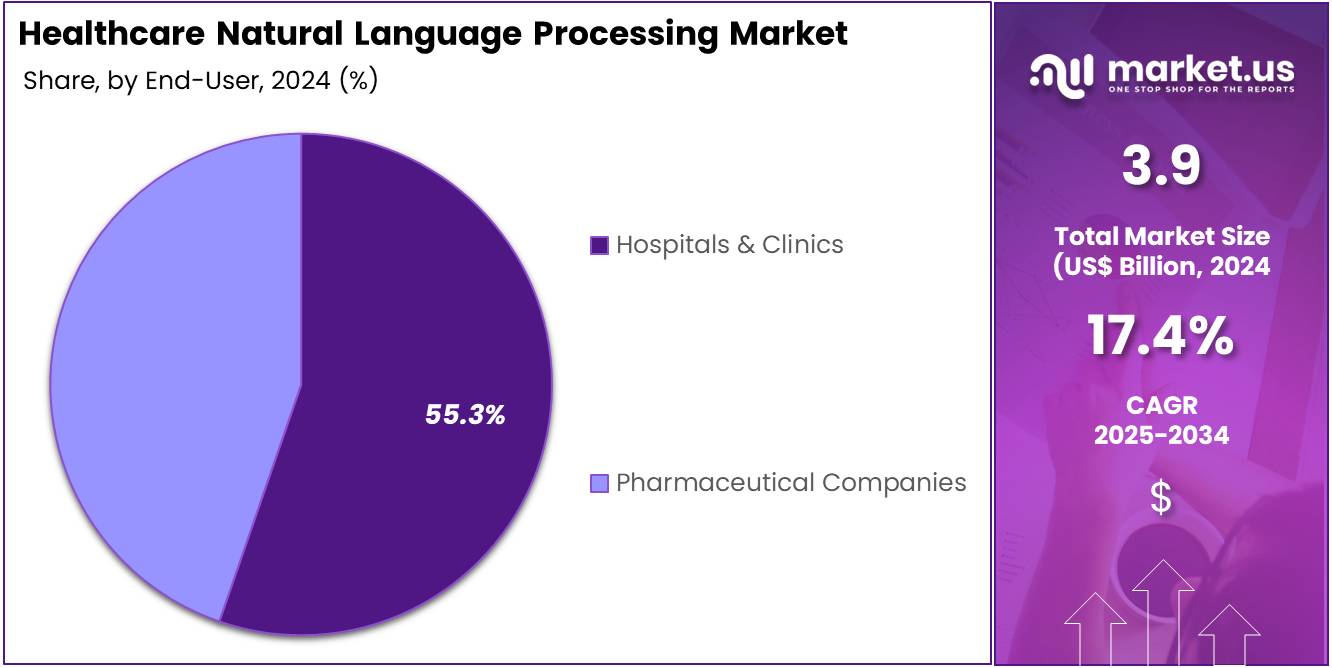

- The end-user segment is segregated into hospitals & clinics and pharmaceutical companies, with the hospitals & clinics segment leading the market, holding a revenue share of 55.3%.

- North America led the market by securing a market share of 41.8% in 2024.

Product Type Analysis

Software leads the product type segment in the healthcare Natural Language Processing (NLP) market with 40.5%. The growing need for efficient data processing in healthcare has accelerated the adoption of NLP software. These solutions allow healthcare providers to extract valuable insights from unstructured clinical data, such as doctors’ notes, lab reports, and medical literature, which significantly enhances decision-making processes.

NLP software is increasingly being integrated with electronic health records (EHR) systems, improving the accessibility and accuracy of patient data. The rise of artificial intelligence and machine learning in NLP applications is also expected to drive growth by enhancing the software’s ability to understand and process complex medical language. As healthcare organizations continue to invest in technology for improving patient outcomes, the demand for NLP software is anticipated to rise, further driving the market.

Technology Analysis

Cloud-based technology dominates the healthcare NLP market with 60.5%. The flexibility and scalability of cloud-based solutions make them highly attractive for healthcare organizations that need to process and store large volumes of data. Cloud computing reduces the need for on-premises hardware, which can be costly and difficult to maintain.

With the growing volume of healthcare data, the cloud allows for more efficient processing, real-time updates, and better data sharing across healthcare providers. As the healthcare sector increasingly adopts cloud technologies to improve collaboration and streamline workflows, cloud-based NLP platforms are expected to continue driving the market’s growth. Furthermore, the rise in telemedicine and remote patient monitoring will likely contribute to further demand for cloud-based solutions in healthcare.

Application Analysis

Clinical documentation leads the application segment with 45.5%. Healthcare providers are increasingly using NLP solutions to extract, analyze, and structure clinical data from unstructured text, such as physicians’ notes, lab results, and discharge summaries. This helps to automate time-consuming processes, improving workflow efficiency and accuracy. Clinical documentation is essential for accurate billing, regulatory compliance, and effective care delivery.

The need to streamline documentation processes and reduce human error is driving the demand for NLP in clinical documentation. As healthcare providers shift towards electronic health records and value-based care models, clinical documentation solutions are expected to become even more critical, accelerating the adoption of NLP technologies in the healthcare sector.

End-User Analysis

Hospitals & clinics dominate the end-user segment with 55.3%. These healthcare providers are increasingly adopting NLP solutions to improve clinical workflows, enhance decision-making, and optimize patient care. By integrating NLP technologies into EHRs and clinical systems, hospitals and clinics can automate data entry, retrieve structured data from unstructured sources, and ensure better patient management.

The increasing focus on reducing operational costs and improving patient outcomes is anticipated to drive the growth of NLP applications in hospitals & clinics. Furthermore, with the rise of digital health solutions and a growing emphasis on improving care quality, the healthcare industry’s shift toward advanced technologies, including NLP, is expected to continue driving demand in this segment.

Key Market Segments

By Product Type

- Software

- Platforms

- Services

By Technology

- Cloud-Based

- On-Premises

By Application

- Clinical Documentation

- Data Mining

- Patient Interaction

By End-user

- Hospitals & Clinics

- Pharmaceutical Companies

Drivers

The increasing volume of unstructured clinical data is driving the market

The rapid and exponential growth of unstructured clinical data is a key driver for the healthcare Natural Language Processing (NLP) market. Healthcare organizations generate massive amounts of data daily from various sources, including electronic health records (EHRs), clinical notes, and medical reports. A significant portion of this data is unstructured and therefore not easily searchable or analyzable by traditional methods. This ‘trapped’ data contains invaluable insights into patient conditions, treatment effectiveness, and disease patterns.

NLP is the key to unlocking this information by converting free-text data into a structured format that can be analyzed to improve patient care, streamline operations, and support clinical research. As the adoption of EHRs has become widespread, with 96% of non-federal acute care hospitals in the US having a certified EHR by 2021, the volume of this unstructured data has surged. The rise of new data sources, such as genomic sequencing and wearable devices, further amplifies this trend, creating a continuous and growing demand for sophisticated NLP solutions to manage and derive value from this information.

Restraints

Data privacy and security concerns are restraining the market

Despite the significant benefits of healthcare NLP, widespread adoption is restrained by persistent concerns over data privacy and security. Healthcare data is highly sensitive and is subject to stringent regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the US The use of NLP, which often involves the processing and analysis of vast amounts of protected health information (PHI), raises the risk of data breaches and unauthorized disclosures. The number of large healthcare data breaches has been escalating.

According to the US Department of Health and Human Services (HHS), there were 720 data breaches of 500 or more records in 2022, and this number rose to 725 in 2023. These breaches can result in significant financial and reputational damage. The cost of a healthcare data breach is the highest of any industry, with an average cost of US$10.93 million per incident in 2023. These risks, coupled with the complexity and cost of implementing robust cybersecurity measures, make many healthcare providers hesitant to fully embrace NLP technologies.

Opportunities

The rise of artificial intelligence is creating growth opportunities

The rise of artificial intelligence (AI) and machine learning (ML) is creating significant growth opportunities for the healthcare NLP market. NLP is a foundational component of many AI-driven healthcare applications, allowing machines to understand and process human language from clinical notes, research papers, and patient records. This integration enables the development of powerful tools that can automate administrative tasks, enhance clinical decision-making, and accelerate research.

For example, AI-powered systems can use NLP to automatically extract key information from patient charts for medical coding and billing, reducing the administrative burden on clinicians. A study published by the American Medical Association in 2024 found that 66% of physicians surveyed reported using AI in their practice, which was a 78% increase from 2023. In drug discovery, NLP can rapidly analyze large volumes of scientific literature and patents to identify potential drug targets, reducing the time and cost associated with research and development. The US Food and Drug Administration’s (FDA) Sentinel Initiative has also utilized NLP to analyze healthcare records for post-market drug safety monitoring.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors profoundly influence the healthcare natural language processing (NLP) market, presenting both challenges and opportunities for innovation. Persistent global inflation strains healthcare budgets, which may lead providers to delay the adoption of advanced AI text analytics platforms for clinical note extraction and decision support. Economic volatility in certain regions can also limit investments in research and development for scalable machine learning models.

Geopolitical tensions, such as trade conflicts and supply chain disruptions, can increase the cost of essential components like processors and cloud infrastructure. These challenges may also heighten cybersecurity risks and regulatory hurdles, complicating the implementation of new technology. However, the rising global need for personalized medicine and government support for AI initiatives are propelling demand.

The US CHIPS and Science Act, for example, is a notable government effort to strengthen domestic semiconductor manufacturing and research, which can help mitigate supply chain vulnerabilities for crucial hardware. By adapting to these shifts through diversified sourcing and technological advancements, the industry is poised to continue its growth.

Additionally, tariffs and other trade measures reshape the market by elevating costs while incentivizing domestic resilience. These policies can increase the cost of hardware vital to AI-driven algorithms, which may cause providers to postpone upgrades to their NLP platforms. However, such measures can also spur domestic manufacturing expansions, allowing firms to leverage government subsidies and create new technology roles. Strategic alliances with domestic suppliers can lead to the development of more resilient, duty-exempt solutions that prioritize data security. By pursuing these strategies, the industry can transform challenges into opportunities for sustained innovation and expansion.

Latest Trends

Integration of NLP with EHRs and clinical workflows is a recent trend

A significant trend in the healthcare NLP market is the deeper and more seamless integration of NLP tools directly into existing electronic health record (EHR) systems and clinical workflows. Historically, many NLP applications functioned as standalone tools, which created a disconnect and required clinicians to switch between multiple platforms, hindering efficiency. The new trend focuses on embedding NLP capabilities at the point of care, making the technology an invisible yet powerful assistant.

For instance, NLP-powered virtual scribes can listen to a doctor-patient conversation, transcribe it in real-time, and automatically populate the patient’s EHR with a comprehensive clinical note. This integration also facilitates better interoperability, allowing NLP to work with various systems, including billing and coding software. This move towards native integration not only improves workflow but also enhances the accuracy and timeliness of data capture, ultimately leading to better patient care.

Regional Analysis

North America is leading the Healthcare Natural Language Processing Market

In 2024, North America captured 41.8% of the global Healthcare Natural Language Processing (NLP) market, driven by the increasing integration of advanced text analytics into electronic health records to improve clinical decision support and patient outcomes. The region’s leadership is reinforced by regulatory advancements from the US FDA, which have fostered confidence in AI-enabled NLP applications for real-time diagnostics and workflow automation.

Furthermore, government support has been a significant catalyst, with the National Institutes of Health (NIH) allocating substantial funding to AI initiatives, rising from US$860.4 million in fiscal year 2022 to US$ 925.7 million in fiscal year 2024. This investment underscores the region’s focus on leveraging NLP platforms for enhanced population health management and predictive risk modeling.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific Healthcare NLP market to flourish during the 2024-2030 forecast period, as regional governments increasingly adopt strategic digital health reforms to address a rising burden of chronic diseases. This growth is fueled by initiatives that include the digitization of electronic medical records and the development of text mining capabilities to manage multilingual datasets.

Governments are committing significant resources to these efforts, exemplified by the Australian Government’s US$ 107.2 million investment in digital health programs and innovations in 2022-23. The region’s momentum is built on harnessing linguistic technologies to enhance access to care, with local innovators customizing semantic parsing engines and creating hybrid models that fuse local dialects with standard terminologies for more equitable healthcare delivery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the healthcare NLP sector propel growth by developing AI-driven platforms that enhance clinical documentation and decision-making for providers. They pursue strategic acquisitions to incorporate advanced language models, strengthening their technological offerings. Companies forge alliances with healthcare systems and tech innovators to create tailored, interoperable solutions, boosting market penetration.

Leaders allocate significant resources to R&D, integrating large language models for improved data extraction and patient interaction analysis. They expand into emerging markets like Asia and Latin America, adapting tools to meet local compliance and language needs. Additionally, firms provide subscription-based analytics services to foster client retention and ensure consistent revenue growth.

Nuance Communications, based in Burlington, Massachusetts, and part of Microsoft since 2022, delivers AI-powered speech and language solutions to streamline clinical workflows. Its Dragon Medical platform enhances documentation accuracy, enabling physicians to focus on patient care. Nuance invests heavily in AI innovation, prioritizing voice recognition and ambient intelligence for healthcare settings.

CEO Mark Benjamin leads a global team dedicated to advancing clinical efficiency through technology. The company collaborates with major health systems to deploy scalable NLP tools. Nuance maintains a competitive edge by blending deep industry expertise with Microsoft’s cloud infrastructure.

Top Key Players in the Healthcare Natural Language Processing Market

- Philips

- Optum

- Microsoft

- Mayo Clinic

- IBM

- HealthAPIx

- Computable General Equilibrium

- Amazon

- 3M

Recent Developments

- In July 2025: Philips shared insights from its Future Health Index 2025, revealing that a significant 76% of Indian healthcare professionals are optimistic about AI’s potential to improve patient outcomes. The report emphasizes the growing belief that AI can enhance care delivery, with 80% recognizing its ability to automate repetitive tasks. This underlines Philips’ focus on AI integration, including NLP-driven solutions, to reduce administrative workloads and increase clinician-patient interaction. The findings indicate a clear demand for AI tools tailored to daily clinical needs, driving Philips to develop more practical, integrated solutions.

- In May 2025: Microsoft introduced new AI features for Teams, aimed at enhancing enterprise task management through smarter, collaborative agents. These tools, revealed at Microsoft Build 2025, enable developers to build agents that automate tasks such as patient chart preparation and care gap identification. This innovation is part of Microsoft’s broader strategy, leveraging AI and NLP technologies, particularly through its Nuance Communications acquisition, to automate clinical documentation and support decision-making in healthcare settings.

Report Scope

Report Features Description Market Value (2024) US$ 3.9 billion Forecast Revenue (2034) US$ 19.4 billion CAGR (2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software, Platforms, and Services), By Technology (Cloud-Based, and On-Premises), By Application (Clinical Documentation, Data Mining, and Patient Interaction), By End-user (Hospitals & Clinics, and Pharmaceutical Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips, Optum, Microsoft, Mayo Clinic, IBM, HealthAPIx, Google, Computable General Equilibrium, Amazon, 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Natural Language Processing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Natural Language Processing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Philips

- Optum

- Microsoft

- Mayo Clinic

- IBM

- HealthAPIx

- Computable General Equilibrium

- Amazon

- 3M