Healthcare Cybersecurity Market By Product Type (Biocides & Disinfectants, Personal Protective Equipment (PPE), Detection & Monitoring Equipment, Decontamination Systems, and Others), by Application (Agriculture, Healthcare, Food Industry, Defense & Military, and Others), By End-User (Government & Regulatory Bodies, Healthcare Institutions, Agricultural Sector, Research & Academia, and Private & Commercial Sectors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 102715

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Solution Type Analysis

- Threat Analysis

- Security Analysis

- Deployment Mode Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

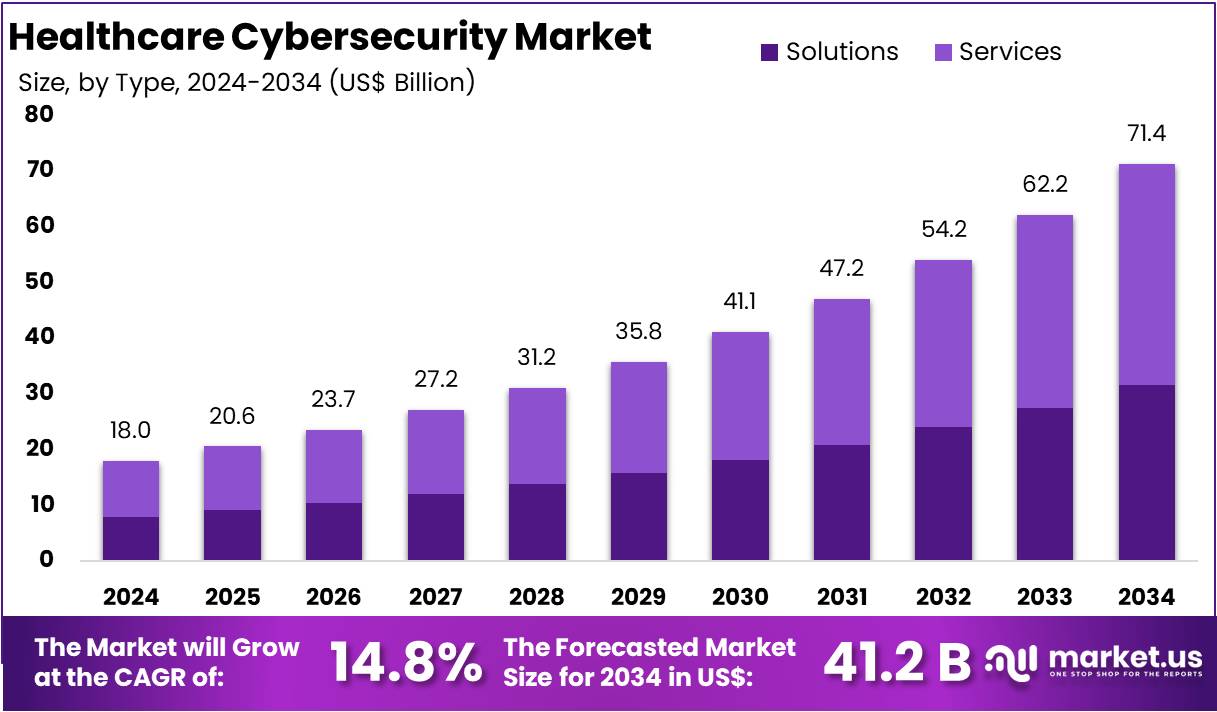

The Healthcare Cybersecurity Market size is expected to be worth around US$ 71.36 billion by 2034 from US$ 17.95 billion in 2024, growing at a CAGR of 14.8% during the forecast period 2025 to 2034.

The healthcare cybersecurity market refers to the sector that provides cybersecurity solutions to protect the sensitive information and data of the healthcare industry from cyber threats. This market is growing rapidly due to the increasing number of cyber-attacks on healthcare organizations and the growing adoption of digital healthcare technologies.

The healthcare sector has long been a prime target for cyberattacks. As of January 7, 2022, the U.S. Department of Health and Human Services’ Office for Civil Rights (HHS) was investigating 860 data breaches that had occurred over the previous 24 months, each involving the exposure of protected health information (PHI) for 500 or more individuals. Of these breaches, 119 (13.8%) involved “Business Associates,” such as vendors and other third parties with access to sensitive patient data, with the largest breach impacting 3.25 million individuals. According to the 2021 Cost of a Data Breach Report by IBM and the Ponemon Institute, the average cost of a healthcare breach was $9.23 million, more than double the US$ 4.24 million average across all industries.

The report cites factors such as the increasing frequency of healthcare data breaches, the rising adoption of healthcare IT solutions, and the growing demand for cloud-based security solutions as key drivers of the market’s growth. The healthcare cybersecurity market includes various solutions such as network security, endpoint security, application security, and cloud security. These solutions are offered by a range of vendors, including established cybersecurity companies, healthcare IT providers, and specialized healthcare cybersecurity firms. Overall, the healthcare cybersecurity market is expected to continue its strong growth trajectory as healthcare organizations increasingly prioritize cybersecurity in their IT investments and as the threat landscape continues to evolve.

Key Takeaways

- In 2024, the market for Healthcare Cybersecurity generated a revenue of US$ 95 billion, with a CAGR of 14.8%, and is expected to reach US$ 71.36 billion by the year 2034.

- The Type segment is divided into Solutions and Services with Services taking the lead in 2024 with a market share of 55.6%.

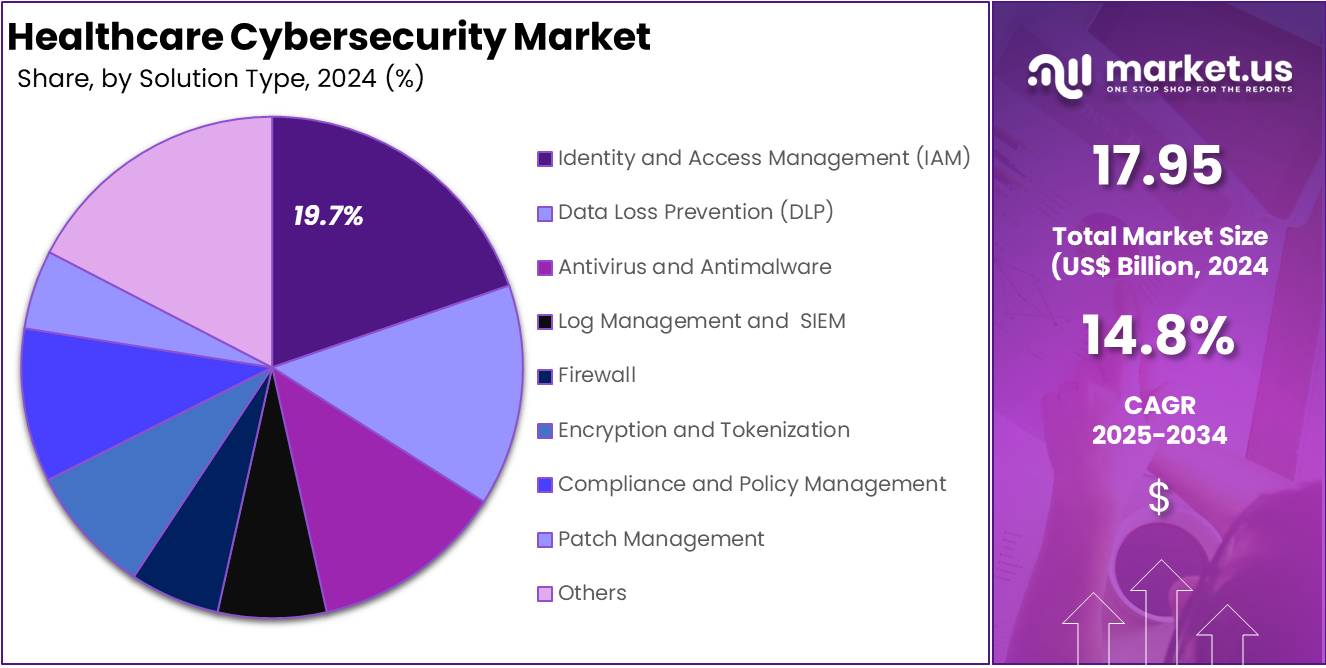

- In terms of Solution Type, the market is divided into Identity and Access Management (IAM), Data Loss Prevention (DLP), Antivirus and Antimalware, Log Management and, SIEM, Firewall, Encryption and Tokenization, Compliance and Policy Management, Patch Management, and Others, with Identity and Access Management (IAM) dominating the market with 19.7% market share.

- By Threat, the market is bifurcated into Malware, Advanced Persistent Threats (APT), Distributed Denial of Service (DDoS), Spyware, Phishing, Ransomware, and Others, with Malware leading the market with 25.9% of market share.

- Considering, the Security segment, the market is bifurcated into Network Security, Endpoint Security, Cloud Security, and Application Security, with Network Security taking the lead in 2024 with a market share of 30.5%.

- By Deployment Mode, the market is bifurcated into On-Premises and Cloud-Based, with On-Premises taking the lead in 2024 with a market share of 56.8%.

- Furthermore, concerning the End-User segment, the Hospitals sector stands out as the dominant segment, holding the largest revenue share of 40.2% in the Healthcare Cybersecurity market.

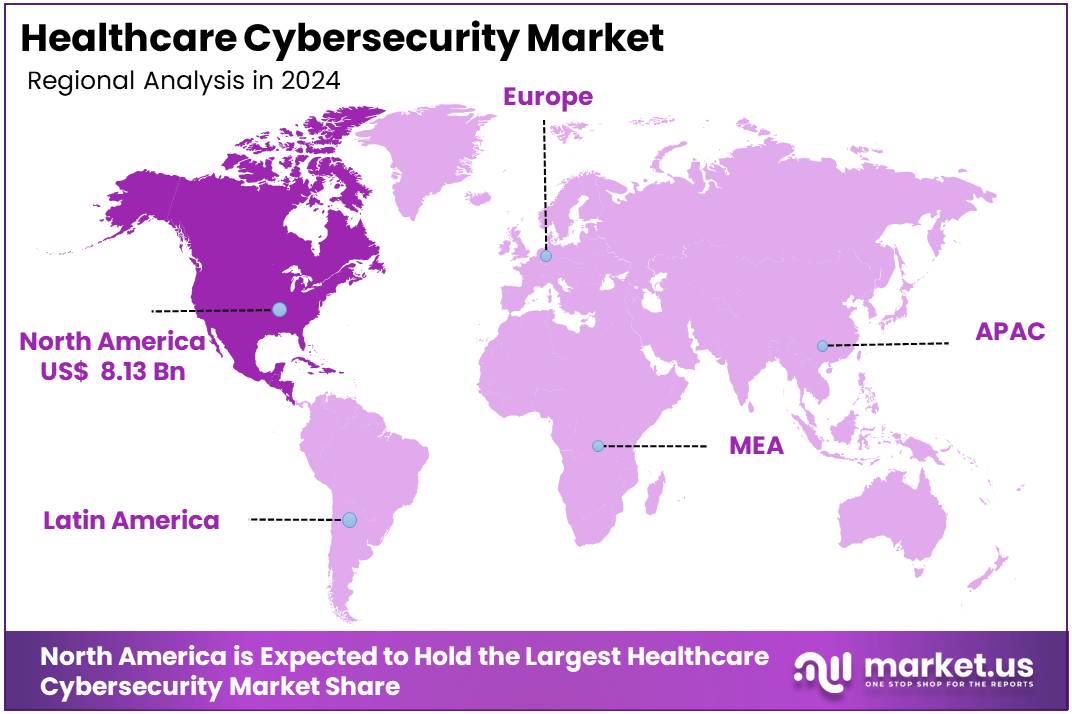

- North America led the market by securing a market share of 30% in 2023.

Type Analysis

In the Healthcare Cybersecurity Market, the Services segment dominated in 2024 with a market share of 55.6%. This is due to the increasing demand for managed security services, which help healthcare organizations safeguard sensitive patient data and comply with regulations. Healthcare providers are increasingly outsourcing their cybersecurity needs to specialized firms that offer 24/7 monitoring, threat intelligence, incident response, and security audits.

Services, particularly those based on security-as-a-service (SECaaS) models, are essential for healthcare organizations that lack in-house expertise to protect their systems effectively. Additionally, the complexity and evolving nature of cyber threats have made these services an essential part of the cybersecurity strategy in healthcare.

Solution Type Analysis

Among the solution types, Identity and Access Management (IAM) holds the largest market share of 19.7% in 2024. IAM is critical in healthcare because it ensures that only authorized personnel can access sensitive patient data, such as medical records.

Given the increasing concerns about unauthorized access and compliance with regulations like HIPAA, IAM is vital for ensuring data privacy and security. With the growing adoption of electronic health records (EHRs) and the shift to digital healthcare platforms, the need for robust IAM solutions that enforce policies around authentication, role-based access control, and user monitoring has surged.

Threat Analysis

Malware is the dominant threat in the healthcare cybersecurity market which held 25.9% market share in 2024. Healthcare organizations are prime targets for ransomware due to the critical nature of their operations. Attackers often exploit the urgency in healthcare settings, knowing that disruptions in services can have serious consequences.

Ransomware attacks lock access to vital systems and data, making healthcare providers more likely to pay ransoms to resume operations. As healthcare systems continue to digitize, the threat from ransomware is expected to rise, making it a primary focus for cybersecurity solutions.

Security Analysis

Network Security is the leading segment in healthcare cybersecurity which held 30.5% market share in 2024. As healthcare organizations increasingly rely on interconnected networks for data exchange, ensuring the integrity and security of their networks has become paramount.

Network security solutions, including firewalls, intrusion detection/prevention systems (IDS/IPS), and Virtual Private Networks (VPNs), are designed to protect against unauthorized access and attacks on the internal network. Given the growing number of connected medical devices and electronic health records, the need for strong network defenses is critical in preventing data breaches and attacks.

Deployment Mode Analysis

Cloud-Based deployment dominates in the healthcare cybersecurity market which held 56.8% market share in 2024. The healthcare industry’s shift toward cloud computing, driven by the need for scalable and cost-efficient solutions, has fueled the growth of cloud-based security services.

Cloud-based deployment models offer flexibility, scalability, and ease of access, making it easier for healthcare organizations to protect their data without heavy upfront investments in hardware. Additionally, cloud providers offer built-in security features, such as data encryption and multi-factor authentication, to enhance the security of patient data stored in the cloud.

End-User Analysis

In the healthcare cybersecurity market, Hospitals represent the dominant end-user segment which held 40.2% market share in 2024. Hospitals are major targets for cyberattacks due to their vast repositories of sensitive patient data and the critical services they provide.

As a result, hospitals require comprehensive cybersecurity solutions to protect their networks, devices, and data from a wide range of cyber threats. With the increasing adoption of electronic health records (EHRs), the need for robust cybersecurity systems in hospitals is more critical than ever to ensure data privacy and maintain patient trust.

Key Market Segments

By Type

- Solutions

- Services

By Solution Type

- Identity and Access Management (IAM)

- Data Loss Prevention (DLP)

- Antivirus and Antimalware

- Log Management and SIEM

- Firewall

- Encryption and Tokenization

- Compliance and Policy Management

- Patch Management

- Others

By Threat

- Malware

- Advanced Persistent Threats (APT)

- Distributed Denial of Service (DDoS)

- Spyware

- Phishing

- Ransomware

- Others

By Security

- Network Security

- Endpoint Security

- Cloud Security

- Application Security

By Deployment Mode

- On-Premises

- Cloud-Based

By End-User

- Hospitals

- Pharmaceutical Companies

- Health Insurance Providers

- Clinical Laboratories

- Government Healthcare Agencies

- Research Institutions

- Telehealth and Digital Health Providers

Drivers

Growing demand for cyber security in the healthcare industry

Cyberattacks and data breaches are rapidly reshaping the cybersecurity landscape in healthcare. In 2023 alone, over 93 million healthcare records were compromised from business associates, far exceeding the 34.9 million affected at provider level, according to HIPAA data. The Office for Civil Rights (OCR) reported a 239% rise in hacking-related breaches from January 2018 to September 2023. Ransomware attacks also surged by 278% during the same period. The share of hacking in total breaches grew from 49% in 2019 to 79.7% in 2023, highlighting a sharp and persistent upward trend.

The growing rate of cybercrime is a major force driving demand for robust cybersecurity in healthcare. Hospitals, clinics, and pharmaceutical firms are key targets for data theft, making protection a top priority. Increased spending on healthcare infrastructure and digital services has widened the attack surface. Consequently, safeguarding patient data has become essential. Organizations now require advanced security solutions to prevent unauthorized access and ensure regulatory compliance across all digital operations.

International governments are enacting strong regulations to secure personal and medical information. Data protection laws such as GDPR in Europe and HIPAA in the U.S. are promoting the adoption of cybersecurity technologies. These regulatory frameworks are creating substantial growth opportunities for vendors. By enforcing security best practices, the healthcare sector can improve resilience against evolving threats. Regulatory support, combined with rising risk, is accelerating market expansion.

The rising use of internet-connected devices in healthcare is also contributing to market growth. The COVID-19 pandemic increased reliance on remote access technologies and telehealth systems. These digital tools, while convenient, pose additional risks without proper safeguards. As healthcare systems continue to modernize, there is a growing need for endpoint security, network protection, and secure data storage. This digital shift is expected to further boost the demand for healthcare cybersecurity solutions.

Restraints

Lack of awareness

The healthcare cybersecurity market is projected to witness steady growth during the forecast period. However, some limitations are expected to slow the pace of expansion. One key issue is the lack of cybersecurity awareness among healthcare workers. Many employees do not understand the importance of cybersecurity or the role of protective software. This low awareness increases vulnerability to data breaches. Cybersecurity education and training remain critical. Without basic security practices in place, healthcare institutions are exposed to high levels of operational and financial risk.

Medical records have become both a vital resource and a serious liability for healthcare companies. These records contain sensitive data, including social security numbers and financial details. Criminals on the black market seek out this information to commit fraud or identity theft. As threats continue to evolve, healthcare providers must adopt advanced cybersecurity measures. It is essential to stay informed about these risks and respond quickly to technological changes. Continuous system upgrades and compliance enforcement are key to protecting patient data.

Opportunities

Rising phishing incidents in the healthcare industry

The rise in phishing incidents during the pandemic has contributed to significant market growth in cybersecurity. According to the 2022 IBM X-Force Threat Intelligence Index, phishing became the leading infection vector in cyberattacks. In 2021, 40% of cyberattacks started with phishing, showing a 33% increase from the previous year. As industries, including healthcare, expand their digital presence, the risk of cyber threats has grown. This rise in threats is directly driving the need for stronger, more responsive cybersecurity measures across multiple sectors.

In the healthcare sector, cybersecurity is becoming a top priority due to the growing number of data breaches. Increased use of digital platforms in hospitals and clinics has raised concerns over data protection. In response, governments and healthcare providers are investing more in advanced cybersecurity systems. The availability of cutting-edge solutions, such as AI-based monitoring and threat detection, is expected to support this market’s expansion. As threats evolve, demand for healthcare cybersecurity continues to grow steadily.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic Factors: Economic conditions, such as inflation and economic slowdowns, can lead healthcare organizations to limit their budgets, affecting their investment in cybersecurity solutions. In times of economic uncertainty, healthcare providers may prioritize immediate operational needs over long-term cybersecurity enhancements. Additionally, the rising costs of cybersecurity solutions due to inflation and supply chain disruptions in tech components could deter smaller healthcare institutions from adopting advanced security systems. However, a strong economy can increase healthcare spending, driving demand for enhanced cybersecurity measures as digital transformation accelerates.

Geopolitical Factors: Geopolitical tensions and cyber warfare have become more prominent, with state-sponsored cyber-attacks targeting critical infrastructure, including healthcare systems. Countries facing political instability may experience an increased risk of cyberattacks from adversaries seeking to disrupt healthcare operations or steal sensitive data. Furthermore, changing regulations across different regions, especially in the European Union (GDPR) and North America (HIPAA), drive healthcare providers to adopt stricter cybersecurity measures to comply with these laws. Trade disputes and tariffs can also affect the flow of cybersecurity technologies and services across borders, impacting global healthcare cybersecurity solutions and supply chains.

Latest Trends

Increasing frequency and sophistication of cyber-attacks

The healthcare cybersecurity market is experiencing a significant trend characterized by the increasing frequency and sophistication of cyberattacks. In 2024, the healthcare sector reported over 725 data breaches, compromising more than 133 million records, marking a substantial rise from previous years. These breaches often involve advanced persistent threats (APTs), ransomware, and phishing attacks targeting critical healthcare infrastructure.

The surge in cyberattacks is driven by several factors, including the growing digitization of healthcare services, the proliferation of connected medical devices, and the adoption of electronic health records (EHRs). These developments have expanded the attack surface, providing cybercriminals with more entry points to exploit. Additionally, the sensitive nature of healthcare data makes it a lucrative target for cybercriminals, leading to increased incidents of data theft and extortion.

Healthcare organizations are responding by investing in advanced cybersecurity solutions, such as artificial intelligence (AI)-powered threat detection systems, multi-factor authentication, and comprehensive data encryption strategies. However, challenges remain, including a shortage of skilled cybersecurity professionals and the complexity of securing diverse healthcare systems. As cyber threats continue to evolve, the healthcare industry must remain vigilant and proactive in enhancing its cybersecurity posture to protect patient data and maintain trust.

Regional Analysis

North America is leading the Healthcare Cybersecurity Market

The North American healthcare cybersecurity market is experiencing significant growth, driven by escalating cyber threats, stringent regulatory requirements, and the rapid digitalization of healthcare services. Key drivers include the rising frequency of cyberattacks, such as ransomware and data breaches, which have heightened the need for robust cybersecurity solutions to protect sensitive patient data.

Additionally, strict regulations like HIPAA mandate healthcare organizations to implement comprehensive cybersecurity measures, driving market demand. The digital transformation in healthcare, including the adoption of electronic health records (EHRs), telemedicine, and connected devices, has expanded the attack surface, increasing the demand for advanced cybersecurity strategies.

Key trends in the market include the shift towards cloud-based security solutions, artificial intelligence and machine learning for enhanced threat detection, and the adoption of Zero Trust architecture to mitigate internal and external threats. Overall, North America’s healthcare cybersecurity market is poised for substantial growth as organizations continue to prioritize data protection and compliance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Healthcare Cybersecurity market includes Symantec, Kaspersky, Northrop Grumman, Palo Alto Networks, Fortinet, McAfee, Cisco Systems, Check Point Software Technologies, IBM, Trend Micro, CrowdStrike, FireEye, NortonLifeLock, Barracuda Networks, Proofpoint, Sophos, Cloudflare, Microsoft, and Other Prominent Players.

Symantec, now part of Broadcom, offers comprehensive cybersecurity solutions for the healthcare sector, focusing on data protection, threat detection, and compliance with healthcare regulations. Its products include endpoint security, cloud security, and advanced threat protection, helping healthcare organizations safeguard sensitive patient data and ensure uninterrupted care.

Kaspersky provides robust cybersecurity solutions tailored to the healthcare industry, including antivirus, endpoint protection, and advanced threat detection. Its products protect healthcare networks, medical devices, and sensitive patient data against cyberattacks, ensuring compliance with regulations like HIPAA while enabling secure digital transformation within healthcare organizations.

Northrop Grumman offers cybersecurity solutions for the healthcare sector, focusing on advanced threat intelligence, data encryption, and secure infrastructure management. Their solutions help healthcare providers protect critical systems, maintain patient privacy, and comply with stringent regulatory requirements, supporting the safe integration of technology across healthcare services.

Top Key Players in the Healthcare Cybersecurity Market

- Symantec

- Kaspersky

- Northrop Grumman

- Palo Alto Networks

- Fortinet

- McAfee

- Cisco Systems

- Check Point Software Technologies

- IBM

- Trend Micro

- CrowdStrike

- FireEye

- NortonLifeLock

- Barracuda Networks

- Proofpoint

- Sophos

- Cloudflare

- Microsoft

- Other Prominent Players

Recent Developments

- In August 2024: IBM launched a new generative AI-powered cybersecurity assistant as part of its Threat Detection and Response Services. This assistant, built on IBM’s watsonx platform, aims to accelerate and improve the identification and response to security threats. Notably, it has reduced alert investigation times by 48% for clients and can automatically handle up to 85% of security alerts, significantly enhancing the efficiency of cybersecurity operations.

- In November 2023: McAfee was acquired by an investor group led by Advent International and Permira for approximately $14 billion. This acquisition highlights McAfee’s strategic shift towards enhancing its consumer cybersecurity offerings, including healthcare cybersecurity. The deal is expected to bolster McAfee’s ability to provide advanced cybersecurity solutions tailored for the healthcare sector, particularly in protecting patient data and connected medical devices.

- In March 2023: Symantec identified a resurgence of the Emotet malware, particularly targeting the healthcare sector. Emotet’s advanced techniques, including phishing emails and binary padding, led to a significant rise in healthcare cyber threats. Symantec’s report highlighted that these attacks compromised over 70% of healthcare organizations using cloud services, emphasizing the need for stronger cloud security measures.

Report Scope

Report Features Description Market Value (2024) US$ 17.95 billion Forecast Revenue (2034) US$ 71.36 billion CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Solutions and Services), By Solution Type (Identity and Access Management (IAM), Data Loss Prevention (DLP), Antivirus and Antimalware, Log Management and, SIEM, Firewall, Encryption and Tokenization, Compliance and Policy Management, Patch Management, Others), By Threat (Malware, Advanced Persistent Threats (APT), Distributed Denial of Service (DDoS), Spyware, Phishing, Ransomware and Others), By Security (Network Security, Endpoint Security and Cloud Security and Application Security), By Deployment Mode (On-Premises and Cloud-Based), By End-User (Hospitals, Pharmaceutical Companies, Health Insurance Providers, Clinical Laboratories, Government Healthcare Agencies, Research Institutions, and Telehealth & Digital Health Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Symantec, Kaspersky, Northrop Grumman, Palo Alto Networks, Fortinet, McAfee, Cisco Systems, Check Point Software Technologies, IBM, Trend Micro, CrowdStrike, FireEye, NortonLifeLock, Barracuda Networks, Proofpoint, Sophos, Cloudflare, Microsoft, and Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Cybersecurity MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Cybersecurity MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Symantec

- Kaspersky

- Northrop Grumman

- Palo Alto Networks

- Fortinet

- McAfee

- Cisco Systems

- Check Point Software Technologies

- IBM

- Trend Micro

- CrowdStrike

- FireEye

- NortonLifeLock

- Barracuda Networks

- Proofpoint

- Sophos

- Cloudflare

- Microsoft

- Other Prominent Players