Global Healthcare Content Management System Market Analysis By Solution (Document Management, Web Content Management, Data Records, Others), By End-user (Hospitals and Clinics, Ambulatory Surgical Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151277

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

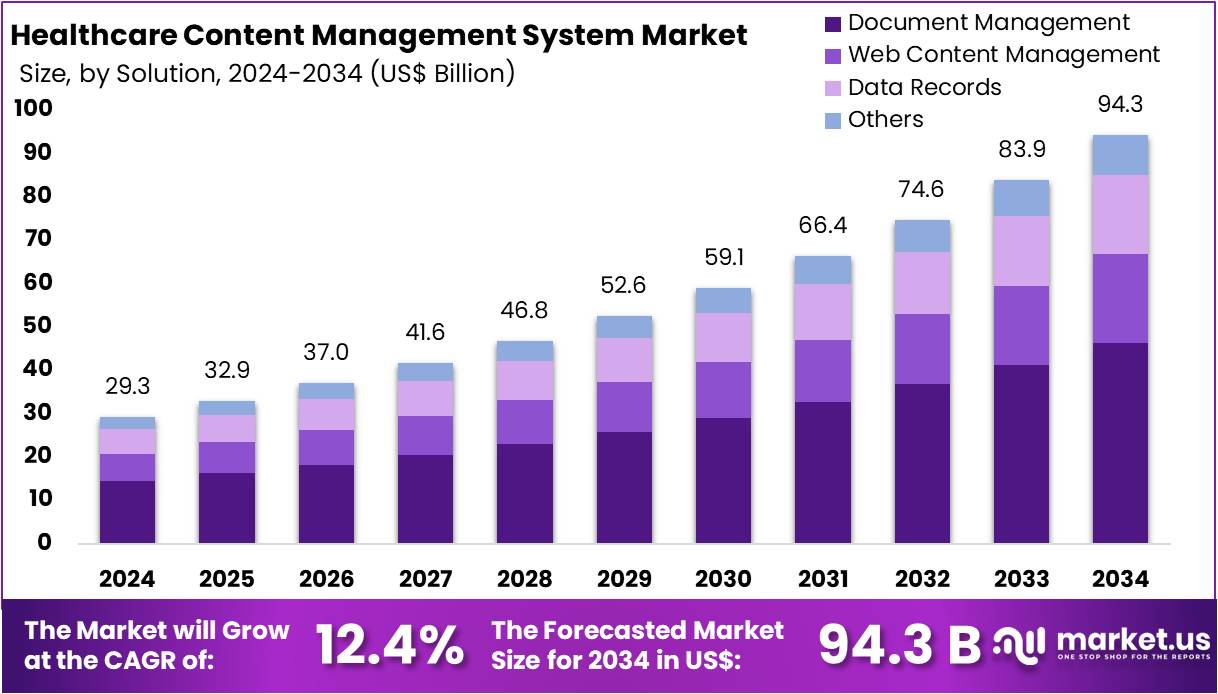

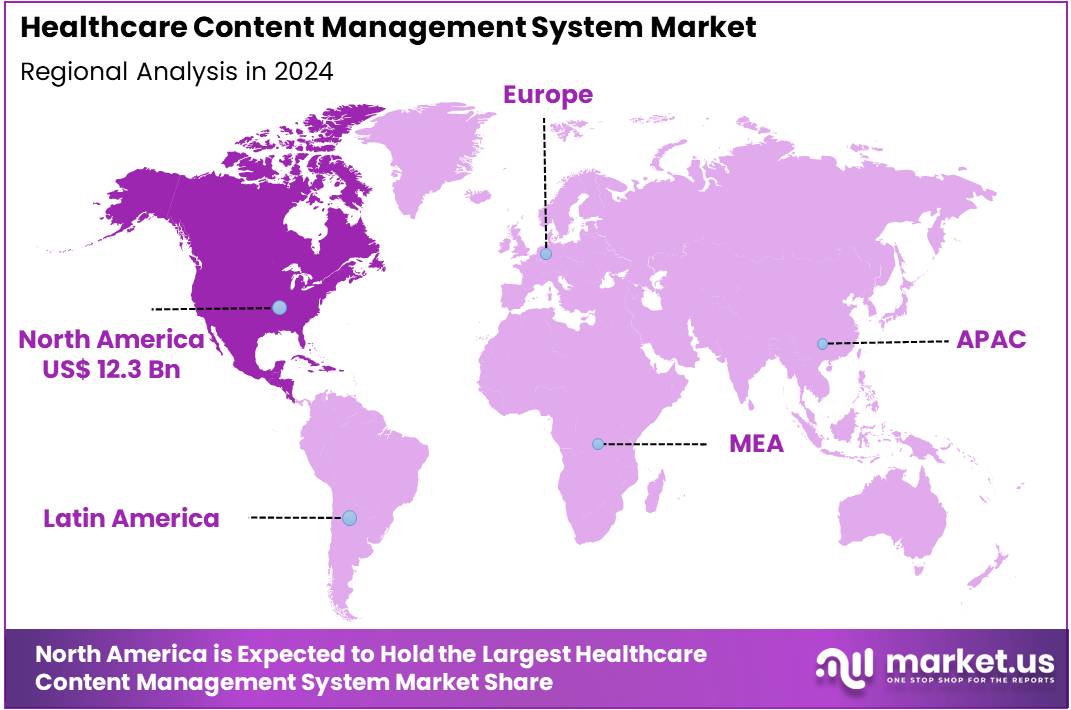

The Global Healthcare Content Management System Market Size is expected to be worth around US$ 94.3 Billion by 2034, from US$ 29.3 Billion in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.2% share and holds US$ 12.3 Billion market value for the year.

A Healthcare Content Management System (HCMS) is a specialized digital platform used to manage healthcare content such as electronic health records (EHRs), medical images, billing documents, and administrative files. These systems are designed to store, organize, retrieve, and distribute structured and unstructured medical data across healthcare settings. For instance, hospitals and clinics use HCMS to enhance workflows by automating document processes and ensuring HIPAA-compliant data security. The integration with EHRs, PACS, and CRMs enables centralized access and improved clinical decision-making.

According to the U.S. National Center for Health Statistics, by 2021, 88.2% of office-based physicians had adopted EHR systems, and 77.8% of them used certified platforms. These systems are core components of HCMS. Similarly, the CDC’s National Healthcare Safety Network (NHSN) collects healthcare-associated infection data from over 37,000 U.S. facilities, including 6,000 hospitals and nearly 15,400 CMS-certified nursing homes. These volumes highlight the critical need for content systems that can manage extensive medical datasets and support operational efficiency.

Governments and international organizations are actively promoting digital healthcare infrastructure. For example, the NHS in the UK has prioritized transforming online health content to improve clinical accuracy and navigation under initiatives like ‘Pharmacy First’. Likewise, the U.S. CMS explores secure health data sharing with certified vendors to support personal health records (PHRs). The World Health Organization (WHO) also supports these efforts through the Global Strategy on Digital Health (2020–2025), now extended through 2027, which encourages over 129 countries to adopt interoperable digital health systems.

Regulatory bodies are setting quality benchmarks that impact HCMS development. The FDASIA Health IT Report calls for standardized frameworks and quality management principles in health IT. The European Medicines Agency’s 2028 strategy highlights the need for AI integration and digital analytics, which requires HCMS platforms to manage big data while ensuring interoperability and safety. These regulatory pushes create new growth avenues by demanding advanced, compliant systems in clinical and administrative workflows.

A shift towards AI and patient-centered content is shaping the future of HCMS. For example, NHS.uk emphasizes AI-driven personalization and mobile-first strategies to simplify user experiences. The WHO and ITU jointly estimate that digital interventions like telemedicine and mHealth could prevent over 2 million noncommunicable disease deaths in 10 years with just a $0.24 investment per patient annually. This growing reliance on digital tools reinforces the importance of HCMS in managing clinical notes, patient communication, and diagnostic content securely and efficiently.

Global initiatives continue to build digital capacity in healthcare systems. The WHO’s Global Initiative on Digital Health (GIDH), launched in 2023, supports country-specific digital transformation and standardization. WHO reports training over 1,600 officials and 25,000 healthcare workers in digital tools since 2020, including HCMS-related technologies. These efforts not only ensure smoother adoption but also enhance awareness of secure, interoperable, and patient-focused content systems critical for modern healthcare delivery.

Key Takeaways

- By 2034, the Global Healthcare Content Management System Market is projected to reach approximately US$ 94.3 Billion, rising from US$ 29.3 Billion in 2024.

- The market is set to grow at a compound annual growth rate (CAGR) of 12.4% during the forecast period from 2025 to 2034.

- In 2024, document management solutions led the healthcare CMS market, accounting for more than 38.2% of the solution segment’s total share.

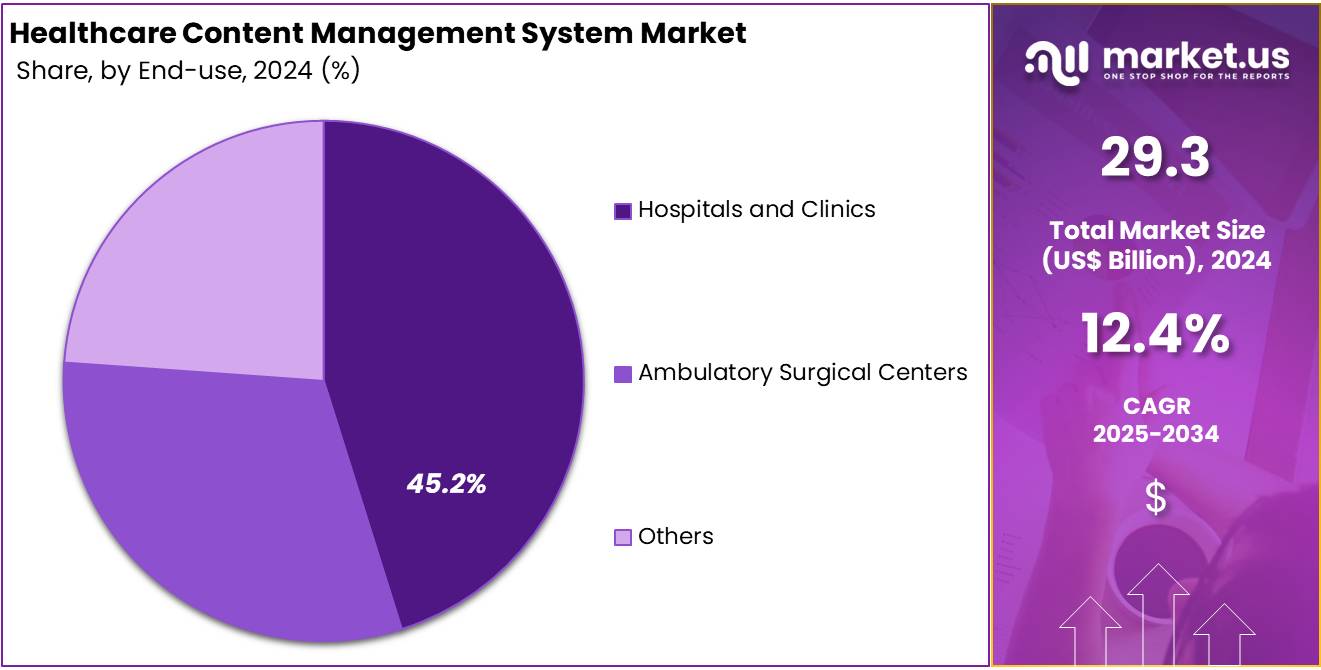

- Hospitals and clinics emerged as the leading end-users in 2024, capturing over 45.2% of the total healthcare CMS market segment.

- North America dominated regional performance in 2024, representing a 42.2% market share and contributing approximately US$ 12.3 Billion in revenue.

Solution Analysis

In 2024, the Document Management section held a dominant market position in the solution segment of the healthcare content management system market and captured more than a 38.2% share. This leadership can be linked to the rising demand for digital recordkeeping in hospitals and clinics. Healthcare facilities are increasingly shifting from paper-based to electronic documents. This change helps improve data access, maintain compliance, and enhance patient safety. Faster document retrieval also supports efficient medical workflows and timely clinical decisions.

Web Content Management emerged as the second-leading segment in this market. The growth of this segment is tied to the demand for digital patient engagement platforms. Healthcare providers are using websites and portals to offer telehealth services and health education. Mobile-friendly interfaces and secure access to personal health information are now essential features. These systems are helping institutions improve communication with patients, especially in rural and underserved regions, where digital care delivery is gaining momentum.

Data Records management showed steady growth across healthcare organizations. This is largely due to the need for storing patient histories, lab reports, and diagnostic images. These systems support clinical accuracy by ensuring real-time data access. Other solution types—such as workflow automation and digital asset management—also showed promise. These tools are widely used in non-clinical operations like billing, compliance tracking, and legal documentation. Overall, content management systems are improving efficiency and meeting regulatory needs across the healthcare sector.

End-user Analysis

In 2024, the Hospitals and Clinics section held a dominant market position in the end-user segment of the Healthcare Content Management System (CMS) market, and captured more than a 45.2% share. This dominance is largely due to the heavy reliance on digital systems for managing patient information. Hospitals and clinics generate vast amounts of clinical, administrative, and diagnostic data. Content management solutions help these facilities store, access, and organize records securely. They also enable faster decision-making and enhance overall operational efficiency.

Hospitals and clinics also face strict regulatory obligations. Systems that ensure compliance with privacy laws like HIPAA and GDPR are increasingly in demand. CMS tools provide real-time access to records and ensure accurate documentation across departments. As these institutions continue to invest in digital health infrastructure, the role of CMS becomes more critical. Third-party analysts have observed that integrated CMS platforms reduce manual errors and improve patient care coordination significantly.

Ambulatory Surgical Centers (ASCs) formed the second-largest end-user group in this market. These centers are adopting CMS to support outpatient procedures and optimize billing operations. Meanwhile, the Others category includes diagnostic labs and long-term care centers. Though their share is smaller, adoption is slowly increasing. Experts believe the need for secure archiving and streamlined data sharing in these facilities will drive future CMS implementation. Growth is expected to remain steady across all segments.

Key Market Segments

By Solution

- Document Management

- Web Content Management

- Data Records

- Others

By End-user

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Rising Volume of Healthcare Data Necessitating Secure Content Management

The exponential growth of healthcare data is a major driver for the adoption of Healthcare Content Management Systems (HCMS). In the United States, a surge in patient data breaches has intensified the urgency for secure and efficient digital storage. By 2023, over 133 million healthcare records were compromised, and by May 2024, an additional 277 million records had been exposed—averaging 758,000 records daily. This highlights an urgent need for HCMS platforms that can ensure data protection, compliance, and accessibility across health institutions.

Globally, nations are digitizing their healthcare systems, leading to a growing need for scalable content platforms. India’s Ayushman Bharat Digital Mission (ABDM), launched in 2023, illustrates this shift. Initially linking 12 million electronic health records (EHRs), it now supports the creation of over 77,000 EHRs per day. This increase demands robust systems capable of managing structured and unstructured health data securely. HCMS solutions serve this purpose by offering storage, retrieval, indexing, and access control mechanisms to support national digital health strategies.

The United Kingdom presents another significant case. The NHS, in its push for digital transformation, plans to replace fragmented paper records with unified electronic systems, including a “patient passport” integrated into the NHS App. These efforts aim to eliminate data silos and promote standardized governance. HCMS platforms directly support these objectives by enabling centralized, interoperable, and compliant digital document management.

Restraints

Rising Data Security and Privacy Breaches in Healthcare CMS

The centralization of patient information in Healthcare Content Management Systems (CMS) has intensified the risks associated with data security. Sensitive medical records, once fragmented across departments, are now stored in unified repositories, making them lucrative targets for cybercriminals. The Change Healthcare ransomware attack in 2023 alone affected approximately 100 million individuals. By 2024, the cumulative impact reached over 276 million compromised records. These breaches not only expose patients to identity theft but also place substantial legal and operational burdens on healthcare providers relying on CMS platforms.

The financial consequences of data breaches in healthcare continue to rise. In 2024, the average cost per breach reached USD 9.77 million, underscoring the sector’s position as the most expensive for data security incidents for the 14th consecutive year. Although there was a slight 10.6% reduction in average costs from the previous year, the overall financial burden remains high. Around 14 million U.S. patients were directly affected in 2024 alone. These recurring costs strain budgets, discourage CMS adoption, and increase scrutiny over IT investments—particularly in mid-sized healthcare institutions with limited cybersecurity infrastructure.

By December 2024, 677 major breaches were reported, affecting over 182 million individuals, with nearly 550 events attributed to hacking and IT vulnerabilities. This growing trend highlights a major restraint in scaling Healthcare CMS adoption. Ensuring HIPAA and international compliance requires continuous upgrades, skilled personnel, and advanced threat detection mechanisms. The long-term sustainability of CMS implementations is thus constrained by high-risk exposure, regulatory obligations, and potential reputational damage from privacy lapses.

Opportunities

Integration of Cloud and AI Enhancing Healthcare CMS Adoption

The healthcare content management system (CMS) market is experiencing a strong opportunity due to the growing adoption of cloud-based deployment models. Multi-tenant cloud platforms are being embraced by hospitals and healthcare providers for their scalability, cost-effectiveness, and ease of access. These platforms allow centralized storage of structured and unstructured data, improving operational efficiency. Cloud deployment also supports compliance with data privacy regulations such as HIPAA by offering secure, managed environments. As a result, demand for healthcare CMS solutions is rising steadily across both developed and emerging healthcare markets.

The integration of artificial intelligence (AI) and machine learning (ML) further strengthens this opportunity. Healthcare CMS platforms are increasingly incorporating AI tools for automated data extraction, classification, and intelligent search. These functions streamline document handling, reduce administrative workload, and enable faster access to patient records. Predictive insights generated through AI enhance clinical decision-making and improve care coordination. The convergence of CMS with AI transforms passive content repositories into active decision-support systems, accelerating adoption among providers.

Workflow automation is another key benefit driving growth in healthcare CMS systems. AI-enabled CMS platforms automate document routing, approvals, and notifications. This reduces manual errors and enhances the speed of administrative operations. With rising patient data volumes and staffing shortages, automated workflows improve productivity and ensure timely access to critical information. Combined with cloud infrastructure, these capabilities allow healthcare systems to scale efficiently while maintaining accuracy and compliance. This synergy positions cloud-AI integration as a long-term growth enabler for the healthcare CMS market.

Trends

Seamless Integration with EHR and Interoperable Healthcare Systems

The healthcare content management system (HCMS) market is experiencing a major shift toward integration with core clinical systems. HCMS platforms are increasingly being designed to work in sync with electronic health records (EHR), picture archiving and communication systems (PACS), laboratory information systems (LIS), and customer relationship management (CRM) platforms. This integration ensures that healthcare providers have centralized access to patient data. It also minimizes administrative redundancies, boosts data accuracy, and supports more informed clinical decisions in real time.

Interoperability has become a key feature of modern HCMS platforms. These systems are now built with open architecture to enable smooth data exchange between multiple departments. By supporting standardized data formats and communication protocols, HCMS platforms are promoting system-wide visibility. This enhances clinical coordination, especially in multi-site healthcare networks. It also supports compliance with national digital health initiatives aimed at secure and efficient information exchange across providers.

As HCMS platforms evolve, the focus is shifting from basic document management to comprehensive workflow integration. The aim is to streamline administrative processes while supporting continuity of care. This transformation ensures that patient information flows effortlessly across various digital systems. It also reduces the risk of data silos and ensures consistent documentation throughout the care continuum. Overall, this trend is reshaping how healthcare facilities manage content and deliver patient-centered services.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.2% share and holds US$ 12.3 Billion market value for the year. This dominance is supported by the widespread adoption of digital health infrastructure across the region. Hospitals and clinics in the United States and Canada are increasingly implementing healthcare content management systems (CMS) to streamline data handling and improve administrative workflows. The presence of advanced healthcare IT policies and supportive regulatory frameworks further boosts the adoption rate of such platforms.

The Health Insurance Portability and Accountability Act (HIPAA) in the United States has played a key role in driving the demand for secure content management tools. These systems help ensure the safe storage and retrieval of electronic health records (EHRs), discharge summaries, billing data, and consent forms. Additionally, the U.S. Centers for Medicare & Medicaid Services (CMS) promotes digital transformation through incentives, which has encouraged healthcare providers to invest in automated content solutions.

High healthcare spending levels and a strong network of healthcare institutions have contributed to this regional lead. Leading academic medical centers and multispecialty hospitals in North America use CMS solutions for document standardization, version control, and compliance tracking. Furthermore, the growing need for patient engagement and integrated care delivery is expected to sustain North America’s leadership in the global healthcare content management system market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Healthcare Content Management System (CMS) market is driven by global technology firms that offer interoperable, secure, and scalable solutions. These providers support healthcare organizations in centralizing data, enhancing compliance, and improving operational efficiency. Capgemini SE plays a critical role by integrating AI and cloud capabilities into its CMS platforms. It focuses on HIPAA-compliant, automated document workflows and hybrid cloud infrastructure. Xerox Corporation also stands out for its expertise in digitizing patient records and document workflow automation, enabling hospitals and clinics to boost administrative productivity and maintain content traceability.

OpenText Corporation remains a key contributor to the CMS market through its enterprise information management platforms. It offers tailored CMS tools for healthcare providers that integrate easily with electronic health records (EHRs). The company supports clinical decision-making by enabling seamless information retrieval and robust data governance. IBM Corporation strengthens the market with its Watson Health and FileNet offerings, delivering AI-powered analytics and secure content collaboration. IBM’s CMS tools align with global standards such as HL7 and FHIR, helping healthcare systems ensure interoperability and efficient clinical workflows.

Microsoft Corporation delivers cloud-based CMS solutions through its Azure and SharePoint platforms. Its tools facilitate secure document sharing, automated indexing, and HIS integration. Microsoft enhances CMS adoption through its advanced cybersecurity framework and Microsoft 365 compatibility. Oracle Corporation supports the CMS market via Oracle Content Management and Health Sciences. These platforms offer centralized access to patient data, including clinical records and consent forms. Oracle’s strengths in AI and data analytics contribute to better content utilization and patient outcome improvements across healthcare environments.

Other key participants include regional vendors and niche technology firms that address specific healthcare settings such as ambulatory care, diagnostics, and elder care facilities. These companies offer tailored CMS tools designed to meet local regulatory requirements and operational needs. Their role is essential in enabling digital transformation in smaller healthcare networks. Collectively, these key players shape the competitive landscape through their focus on innovation, regulatory alignment, and integration with healthcare IT systems. Their combined efforts are expected to accelerate global adoption of healthcare CMS platforms in the coming years.

Market Key Players

- Capgemini SE

- Xerox Corporation

- OpenText Corporation

- IBM

- Microsoft

- Oracle

- Dell Inc

- Hyland Software Inc.

- IQVIA

- SAP

- Constant Contact

- RWE

- Health Catalyst

- Informa

Recent Developments

- In April 2025: Health Catalyst introduced Ignite Spark™, a next-generation data and analytics platform tailored for community, regional, and specialty health systems—particularly those with lean IT resources. This solution offers self-service analytics, AI-driven decision support, and seamless integration with existing data systems, aiming to reduce operational complexity while enabling enterprise-grade insights.

- In October 2024: Xerox disclosed its agreement to acquire ITsavvy, a provider of integrated IT infrastructure and services, in a $400 million deal comprising $180 million in cash and $220 million in promissory notes. While the acquisition spans multiple sectors, it significantly enhances Xerox’s IT services portfolio, particularly in content management, cloud integration, and managed services. The move aligns with Xerox’s strategy to deliver comprehensive digital transformation solutions, including support for healthcare workflows, clinical systems, electronic health records (EHR) integration, and hybrid workplace environments.

- In April 2024: OpenText introduced the Extended ECM Cloud Edition 24.2, bringing forward key advancements in content management tailored for healthcare settings. The update featured precise document linking through deep-link URLs, enabling direct navigation to specific document sections, which enhances clinical collaboration, record auditing, and coordinated care delivery. Additionally, improvements in team integration and notifications allow automated team structure imports, Microsoft Teams synchronization, and real-time alerts. These features collectively support streamlined workflows and better communication among multidisciplinary healthcare teams.

Report Scope

Report Features Description Market Value (2024) US$ 29.3 Billion Forecast Revenue (2034) US$ 94.3 Billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Document Management, Web Content Management, Data Records, Others), By End-user (Hospitals and Clinics, Ambulatory Surgical Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Capgemini SE, Xerox Corporation, OpenText Corporation, IBM, Microsoft, Oracle, Dell Inc, Hyland Software Inc., IQVIA, SAP, Constant Contact, RWE, Health Catalyst, Informa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Content Management System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Content Management System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Capgemini SE

- Xerox Corporation

- OpenText Corporation

- IBM

- Microsoft

- Oracle

- Dell Inc

- Hyland Software Inc.

- IQVIA

- SAP

- Constant Contact

- RWE

- Health Catalyst

- Informa