Healthcare Cloud Infrastructure Market By Component (Service (Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS)) and Hardware (Network, Server, and Storage)), By End Use (Healthcare Providers (Ambulatory Centers, Diagnostic & Imaging Centers, and Hospitals) and Healthcare Payers (Private Payers and Public Payers)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 125087

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

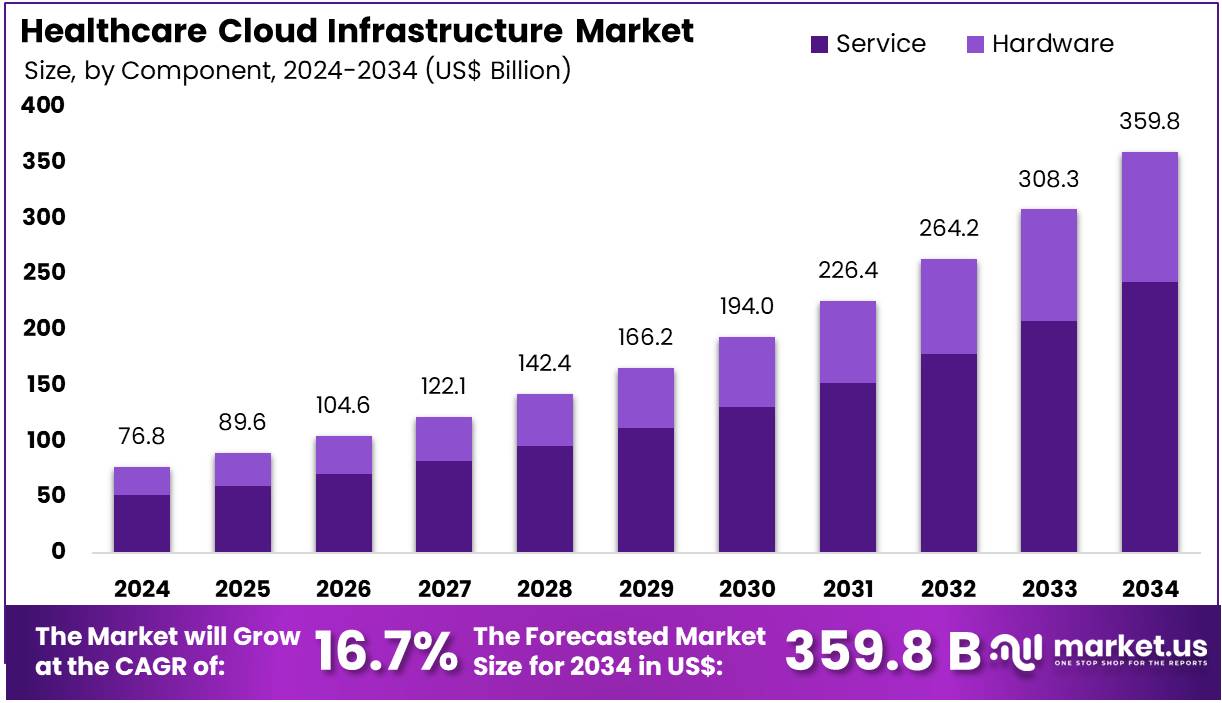

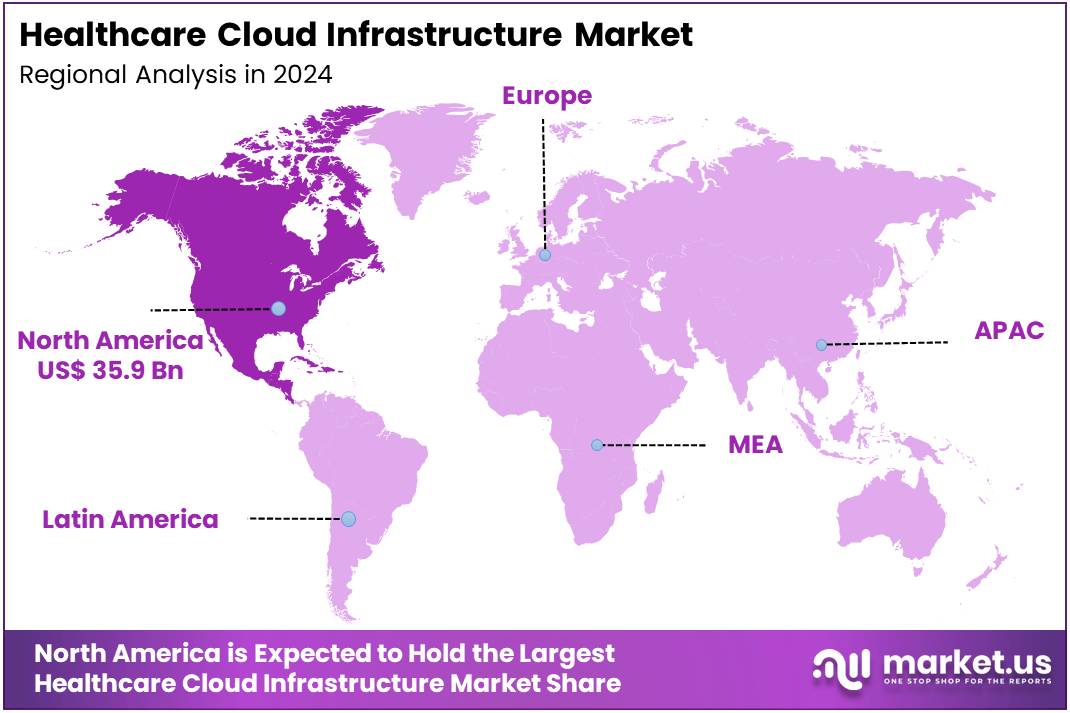

The Healthcare Cloud Infrastructure Market Size is expected to be worth around US$ 359.8 billion by 2034 from US$ 76.8 billion in 2024, growing at a CAGR of 16.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 46.7% share and holds US$ 35.9 Billion market value for the year.

The healthcare cloud infrastructure market is witnessing significant growth due to the increasing demand for scalable, secure, and efficient data management solutions. Healthcare providers are generating vast volumes of data from various sources such as electronic health records (EHRs), telemedicine platforms, and wearable devices. According to industry studies, this data surge requires advanced systems for storage, management, and analytics. Cloud infrastructure enables healthcare professionals to access patient records in real-time, improve collaboration, and enhance overall care delivery and operational efficiency.

The adoption of cloud-based technologies is being accelerated by digital healthcare trends. For instance, EHR systems and telemedicine tools are producing large datasets that demand reliable cloud-based storage and processing capabilities. Moreover, wearable health devices continuously transmit data, adding to the volume and velocity of healthcare information. As a result, providers are turning to the cloud to manage this influx. The flexibility and accessibility offered by cloud platforms are helping both large hospitals and smaller clinics adapt to growing digital demands.

Artificial intelligence (AI) and machine learning (ML) are also transforming the healthcare sector. These technologies are increasingly used for predictive analytics, patient monitoring, and clinical decision support. For example, AI-driven tools require robust cloud infrastructure for seamless data processing and secure storage. In response, the healthcare market is prioritizing HIPAA-compliant cloud services to safeguard sensitive information. A study by the Healthcare Information and Management Systems Society (HIMSS) suggests that data security is a top concern when selecting cloud partners.

In January 2022, a notable development occurred when Francisco Partners, a private equity firm, acquired multiple data and analytics assets from IBM’s Watson Health division. This included Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software. This acquisition expanded Francisco Partners’ footprint in healthcare cloud technologies and reflected the growing interest in health data management solutions. As digital transformation becomes a central priority for healthcare institutions, cloud infrastructure is expected to play a crucial role in supporting clinical workflows, administrative functions, and innovation in patient care.

Key Takeaways

- In 2024, the market for healthcare cloud infrastructure generated a revenue of US$ 76.8 billion, with a CAGR of 16.7%, and is expected to reach US$ 359.8 billion by the year 2034.

- The component segment is divided into service and hardware, with service taking the lead in 2024 with a market share of 67.5%.

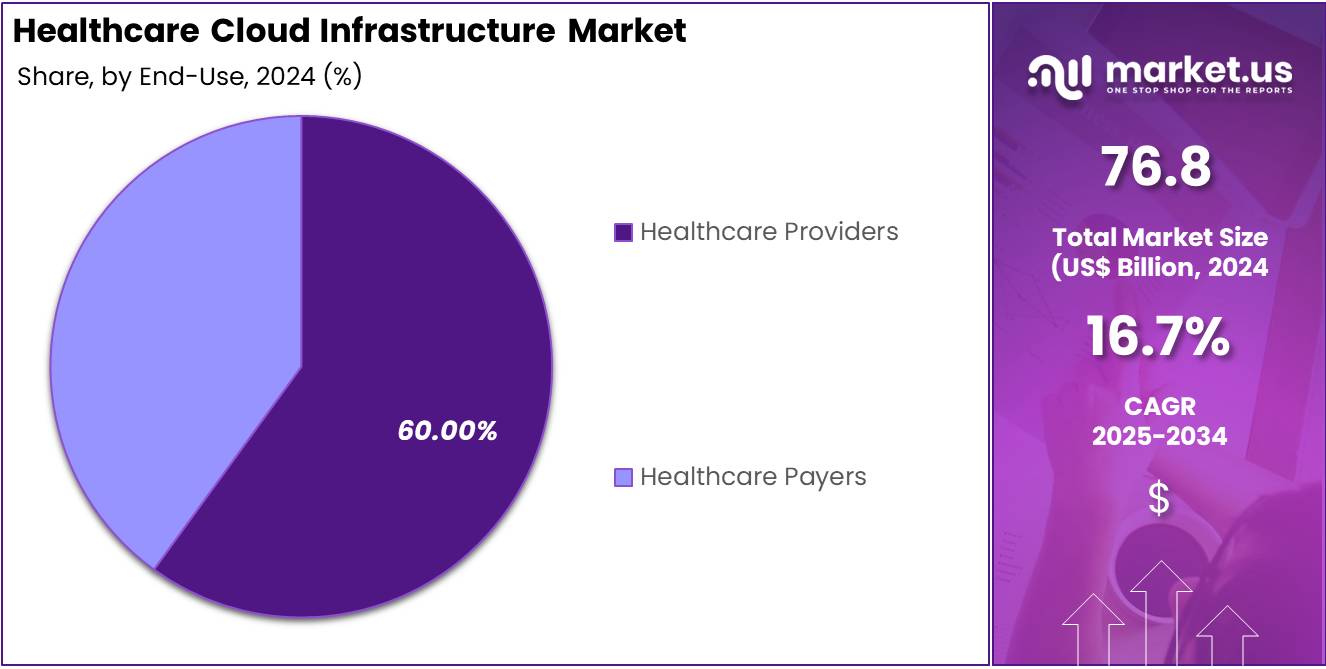

- Considering end use, the market is divided into healthcare providers and healthcare payers. Among these, healthcare providers held a significant share of 60.0%.

- North America led the market by securing a market share of 46.7% in 2024.

Component Analysis

The service segment is projected to hold 67.5% of the healthcare cloud infrastructure market share. The growing demand for cloud-based solutions is anticipated to be the key driver of this segment’s dominance. Healthcare organizations are increasingly opting for cloud services due to their scalability, cost-effectiveness, and ability to support a wide range of applications, including electronic health records (EHR), patient management systems, and data analytics platforms.

Cloud services allow healthcare providers to store and access large volumes of patient data securely, ensuring compliance with regulatory standards such as HIPAA. Additionally, the flexibility offered by cloud services enables healthcare organizations to improve collaboration, streamline workflows, and enhance data accessibility for better patient care. The increasing need for real-time data processing and analysis is expected to continue fueling the demand for cloud services in healthcare.

End-Use Analysis

Healthcare providers are expected to capture 60.0% of the market share in the healthcare cloud infrastructure sector. Healthcare providers, including hospitals, clinics, and diagnostic centers, are increasingly adopting cloud infrastructure to enhance operational efficiency and improve patient care. The growing volume of patient data and the need for secure storage and easy access are key factors contributing to this trend. Cloud infrastructure enables healthcare providers to maintain and manage large amounts of data while ensuring that it is available for timely decision-making.

Healthcare providers are also leveraging cloud-based solutions to streamline administrative processes, reduce operational costs, and improve patient engagement. Furthermore, the integration of cloud-based telemedicine and remote patient monitoring solutions is expected to drive significant growth in this segment. As healthcare organizations continue to shift toward digitalization, the adoption of cloud infrastructure is anticipated to remain strong in the coming years.

Key Market Segments

By Component

- Service

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Software-as-a-Service (SaaS)

- Hardware

- Network

- Server

- Storage

By End Use

- Healthcare Providers

- Ambulatory Centers

- Diagnostic & Imaging Centers

- Hospitals

- Healthcare Payers

- Private Payers

- Public Payers

Drivers

Increasing Adoption of Digital Health Technologies is Driving the Market

The increasing adoption of digital health technologies is a significant driver for the rapid expansion of the healthcare cloud infrastructure market. Healthcare organizations are strategically transitioning from conventional, on-premise IT systems to cloud-based solutions to securely and efficiently manage and store vast amounts of patient data. This pivotal transition is propelled by the widespread implementation of electronic health records (EHRs), the significant growth of telehealth services, and the increasing reliance on remote patient monitoring devices.

Cloud infrastructure inherently provides the necessary scalability, flexibility, and accessibility to comprehensively support these digital initiatives, allowing healthcare providers to effectively manage ever-increasing data volumes without requiring substantial upfront hardware investments. The shift towards digital health is also strongly encouraged by various government initiatives and regulatory frameworks that actively promote the utilization of health information technology to enhance patient outcomes and improve operational efficiency across the healthcare continuum.

For instance, the Office of the National Coordinator for Health Information Technology (ONC), under the U.S. Department of Health and Human Services (HHS), reported that in 2021, 96% of non-federal acute care hospitals in the U.S. had adopted certified EHR technology, with 88% of office-based physicians adopting some form of EHR by 2021. While the most recent comprehensive adoption statistics are from 2021, the continued focus on digital transformation by organizations like the ONC, coupled with the inherent benefits of cloud computing in terms of cost-effectiveness and data accessibility, solidifies its indispensable role as a foundational element for modern healthcare delivery, driving continuous demand.

Restraints

Data Security and Regulatory Compliance Concerns are Restraining the Market

Despite its compelling benefits, significant concerns regarding robust data security and stringent regulatory compliance are currently restraining the rapid expansion of the healthcare cloud infrastructure market. Healthcare data, which includes highly sensitive patient information, remains a prime target for cyber threats, making data breaches a paramount concern for both healthcare providers and patients. The pervasive fear of unauthorized access, potential data loss, and debilitating cyberattacks compels healthcare organizations to exercise extreme caution and undertake extensive due diligence when migrating their sensitive data and applications to cloud environments.

Furthermore, the healthcare sector operates under a complex and evolving web of regulations, most notably the Health Insurance Portability and Accountability Act (HIPAA) in the US, which imposes strict rules regarding data protection, patient privacy, and breach notification. Compliance with these intricate regulations necessitates the implementation of robust security measures, regular and thorough audits, and comprehensive data governance policies, all of which can significantly add layers of complexity and cost to cloud adoption.

As reported by The HIPAA Journal on March 19, 2025, there were 734 large healthcare data breaches reported to the HHS Office for Civil Rights (OCR) in 2024 (as of that date), affecting over 276 million individuals, making 2024 the worst year on record for breached healthcare records. This dramatic increase in breaches, predominantly due to hacking incidents, underscores the critical and ongoing security challenges that serve as a major restraint on cloud adoption in the healthcare sector, as organizations prioritize safeguarding patient data above all else.

Opportunities

The Emergence of Hybrid Cloud Models and Interoperability Needs are Creating Growth Opportunities

The emergence of sophisticated hybrid cloud models and the increasing, undeniable need for seamless interoperability are creating significant growth opportunities in the healthcare cloud infrastructure market. Hybrid cloud deployments, which strategically combine private cloud infrastructure with public cloud services, offer healthcare organizations the best of both worlds: the heightened security and granular control of a private environment for highly sensitive data, coupled with the remarkable scalability, flexibility, and cost-effectiveness of public cloud for less critical workloads and fluctuating demands. This inherent flexibility allows providers to gradually transition to the cloud, optimize their IT infrastructure based on specific needs, and rigorously adhere to stringent compliance requirements.

Furthermore, the imperative for seamless and secure data exchange across disparate healthcare systems and providers is driving an accelerated demand for cloud solutions that inherently facilitate interoperability. The U.S. Department of Health and Human Services (HHS) and its Office of the National Coordinator for Health Information Technology (ONC) consistently champion interoperability initiatives, such as those spurred by the 21st Century Cures Act, which specifically mandates provisions to prevent information blocking and ensure robust data accessibility.

Cloud-based platforms are uniquely positioned to address these complex interoperability challenges by providing centralized, accessible, and standardized data repositories that can be easily integrated with a wide array of healthcare applications and systems. This fosters significantly improved care coordination, demonstrably enhances patient outcomes, and streamlines complex administrative processes, thereby creating compelling opportunities for cloud infrastructure providers that can deliver robust, interoperable, and inherently secure hybrid solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the healthcare cloud infrastructure market, shaping both its challenges and its trajectory. Economic conditions, such as persistent inflation and fluctuations in interest rates, directly impact healthcare organizations’ investment capacities in new technologies. During periods of high inflation, the cost of cloud services, essential hardware components, and specialized IT labor can increase, potentially slowing down the rate of cloud adoption or expansion for some providers.

For example, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for all urban consumers, U.S. city average, increased 3.1% over the 12 months ended January 2024, indicating persistent inflationary pressures that affect technology costs across sectors, including healthcare IT. However, in times of economic uncertainty, the operational expenditure model of cloud computing, which replaces large upfront capital investments with a more flexible pay-as-you-go approach, becomes increasingly appealing for cost-conscious organizations seeking to optimize their budgets.

Simultaneously, geopolitical tensions, including international trade disputes and regional conflicts, can disrupt global supply chains for crucial cloud hardware and software components, potentially leading to price volatility and delays in service provisioning. Despite these challenges, such global events can also accelerate the adoption of resilient, geographically distributed cloud infrastructures, as organizations seek to diversify their IT footprints and reduce dependency on single regions, ultimately bolstering the long-term strategic value and inherent resilience of cloud solutions in healthcare.

Current US tariffs impose both direct and indirect impacts on the healthcare cloud infrastructure market. Tariffs on imported hardware components, such as servers, storage devices, and networking equipment, directly increase the cost for cloud service providers and, consequently, for healthcare organizations consuming these cloud resources.

These higher input costs can translate into increased service fees for healthcare clients or reduced profit margins for cloud providers, potentially slowing down the rate of infrastructure expansion or modernization within the US. For example, if tariffs target specific advanced microchips or specialized data center equipment manufactured abroad, the cost of building and maintaining hyperscale cloud data centers used by healthcare entities could rise, influencing service pricing.

Indirectly, these tariffs can lead to heightened trade uncertainties, potentially discouraging foreign investment in US-based cloud infrastructure and possibly limiting the diversity of cutting-edge technological offerings available to the US healthcare sector. However, such tariff policies can also serve as a strong incentive for domestic manufacturing and innovation within the US, encouraging cloud providers and hardware manufacturers to invest more heavily in US-based production and research and development capabilities.

This domestic focus can lead to job creation and foster a more secure and independent supply chain for crucial components of cloud infrastructure, ultimately strengthening the resilience and self-sufficiency of the US healthcare cloud ecosystem and ensuring continued, reliable access to vital, secure computing resources for patient care.

Latest Trends

Increased Focus on Artificial Intelligence (AI) and Machine Learning (ML) Integration is a Recent Trend

A prominent recent trend profoundly shaping the healthcare cloud infrastructure market, particularly observable throughout 2024 and continuing strongly into 2025, is the significantly increased focus on integrating advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities. Healthcare organizations are extensively leveraging the cloud’s vast computational power, immense storage capacity, and specialized services to deploy and scale sophisticated AI/ML applications, which are fundamentally transforming various facets of healthcare delivery.

These applications include powerful AI-powered diagnostic tools that analyze complex medical images with enhanced accuracy, advanced predictive analytics for identifying at-risk patients and optimizing personalized treatment pathways, and natural language processing (NLP) solutions for extracting valuable insights from large volumes of unstructured clinical notes.

Cloud providers are actively developing and offering specialized AI/ML services meticulously tailored for the healthcare sector, acknowledging its unique data requirements, stringent ethical considerations, and complex regulatory landscape. For instance, the National Center for Biotechnology Information (NCBI) Bookshelf’s “2025 Watch List: Artificial Intelligence in Health Care” highlights AI for disease detection and diagnosis and AI for disease treatment as key emerging AI technologies for 2025, underscoring the escalating importance of AI in clinical practice, which heavily relies on scalable and high-performance cloud infrastructure.

This trend signifies a profound shift beyond basic data storage in the cloud, moving towards leveraging the cloud as a dynamic platform for advanced analytics, intelligent automation, and clinical decision support, ultimately aiming to improve patient care, enhance operational efficiency, and drive personalized medicine initiatives.

Regional Analysis

North America is leading the Healthcare Cloud Infrastructure Market

North America dominated the market with the highest revenue share of 46.7% owing to the accelerating digital transformation within healthcare organizations, the increasing demand for scalable and secure data management solutions, and supportive regulatory frameworks. The shift towards value-based care models and the proliferation of electronic health records (EHRs) have necessitated robust cloud platforms for data storage, analytics, and interoperability.

For instance, a survey conducted by Global Healthcare Exchange (GHX) in September 2023 indicated that nearly 70% of U.S. health systems and hospitals plan to implement cloud-based solutions for supply chain management by 2026, highlighting a strong commitment to cloud adoption. Major technology providers are actively expanding their offerings in this sector; Microsoft’s Intelligent Cloud segment, which includes Azure, reported revenue of US$28.5 billion for the fourth quarter of fiscal year 2024, an increase of 19% from the prior year period, reflecting broad cloud adoption across industries, including healthcare.

Amazon Web Services (AWS) also demonstrated robust growth, with its revenue increasing by 18.9% year-over-year to US$28.8 billion in Q4 2024, indicating continued migration of workloads to the cloud by various sectors, including healthcare. These developments underscore the strong momentum in North America, as healthcare entities increasingly leverage cloud solutions to enhance operational efficiency, improve patient care, and ensure compliance with stringent data protection regulations like HIPAA.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing government investments in digital health initiatives, a growing emphasis on health data utilization, and the rising demand for accessible and cost-effective healthcare IT solutions. Governments across the region are actively promoting the modernization of healthcare systems through digital transformation. For example, India’s National Digital Health Mission is likely to drive significant adoption of cloud-based solutions for managing electronic health records and facilitating health information exchange.

China’s National Health Commission is anticipated to continue supporting cloud computing for its vast healthcare network to improve efficiency and data sharing. Furthermore, countries like Singapore are estimated to further integrate cloud infrastructure into their national electronic health record systems to enhance data accessibility and analytics capabilities.

Leading cloud service providers are expanding their presence and offerings to cater to this growing demand. Microsoft, for instance, is likely to continue its collaborations to advance life sciences and healthcare through enhanced cloud capabilities and AI technology in the region. These strategic investments and initiatives by governments, coupled with the increasing need for scalable and secure data management solutions to support burgeoning patient populations and evolving healthcare models, mean that the adoption of cloud-based platforms in healthcare will accelerate significantly across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the healthcare cloud infrastructure market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting healthcare applications. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for healthcare solutions.

Dell Technologies is a prominent player in the healthcare cloud infrastructure market. Headquartered in Round Rock, Texas, Dell Technologies offers a comprehensive portfolio of cloud solutions, including hybrid and multi-cloud platforms, designed to meet the specific needs of healthcare organizations. The company’s infrastructure solutions support the secure storage, management, and analysis of healthcare data, enabling providers to enhance patient care and streamline operations.

Dell Technologies collaborates with various healthcare providers and technology partners to deliver scalable and compliant cloud solutions that align with industry standards and regulations. Through continuous innovation and a customer-centric approach, Dell Technologies plays a significant role in advancing digital transformation in the healthcare sector.

Top Key Players in the Healthcare Cloud Infrastructure Market

- Amazon

- CloudWave

- Cognizant

- Eviden

- Fujitsu

- IBM

- Microsoft

- Oracle

Recent Developments

- In May 2025, Oracle Health, G42, and the Cleveland Clinic formed a strategic alliance to jointly develop an advanced healthcare platform driven by AI. This collaboration is focused on enhancing patient care and optimizing public health management by leveraging artificial intelligence, large-scale data analytics, and intelligent clinical solutions. The ultimate goal is to create scalable, secure, and accessible models of care that lead to improved health outcomes and longer life spans.

- In March 2023, Fujitsu unveiled a new cloud-based platform in Japan designed to accelerate personalized healthcare and drug development within the industry. This platform aims to advance the efficiency and precision of healthcare services while supporting faster innovation in drug development processes.

Report Scope

Report Features Description Market Value (2024) US$ 76.8 billion Forecast Revenue (2034) US$ 359.8 billion CAGR (2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Service (Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS)) and Hardware (Network, Server, and Storage)), By End Use (Healthcare Providers (Ambulatory Centers, Diagnostic & Imaging Centers, and Hospitals) and Healthcare Payers (Private Payers and Public Payers)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon, CloudWave, Cognizant, Eviden, Fujitsu, IBM, Microsoft, Oracle. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Cloud Infrastructure MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Cloud Infrastructure MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon

- CloudWave

- Cognizant

- Eviden

- Fujitsu

- IBM

- Microsoft

- Oracle