Global Handheld Point of Sale (POS) Market Size, Share, Industry Analysis Report By Component (Hardware, Software, and Services), By End-User Industry (Retail, Hospitality, Entertainment & Events, Healthcare, Transportation & Logistics, and Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 160133

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- U.S. Handheld POS Market

- By Component Analysis

- By End-User Industry Analysis

- Emerging trends

- Growth factors

- POS Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Challenge Analysis

- Key Player Analysis

- Top Key Players

- Recent Developments

- Report Scope

Report Overview

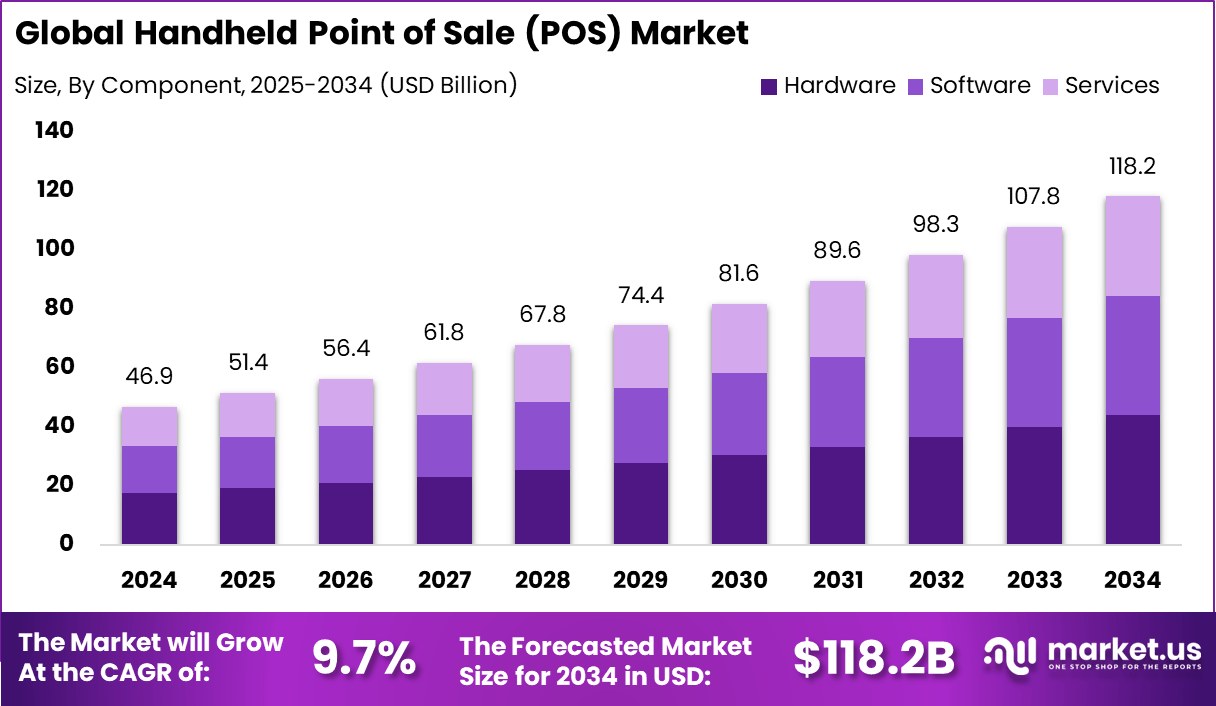

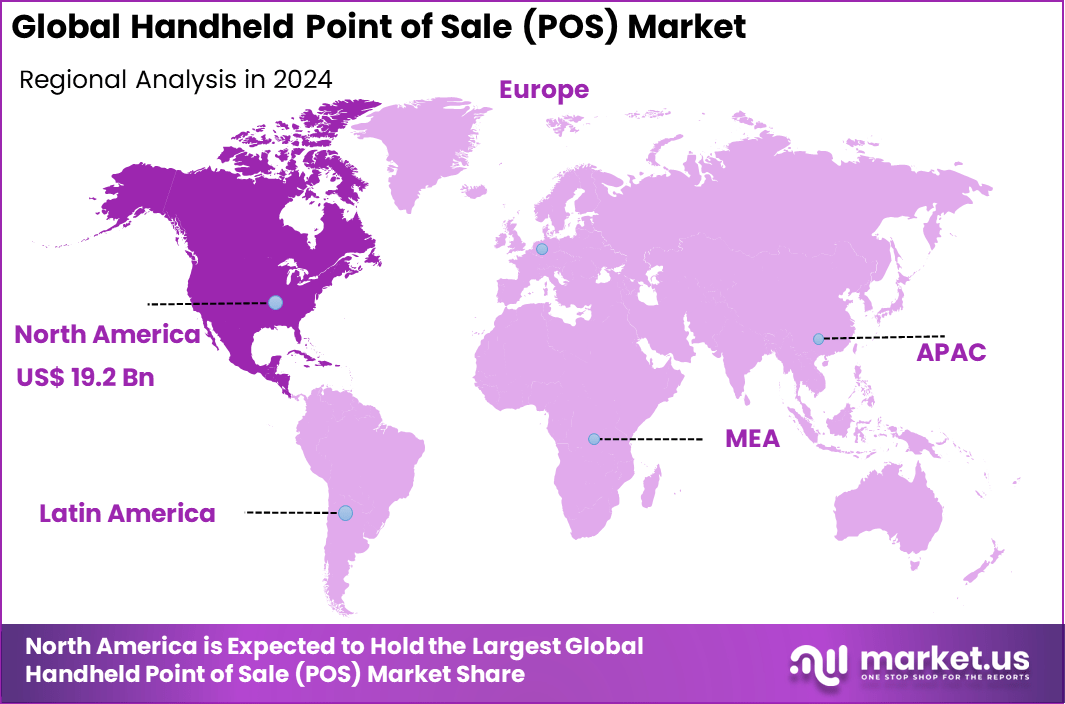

The Global Handheld Point of Sale (POS) Market size is expected to be worth around USD 118.2 billion by 2034, from USD 46.85 billion in 2024, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41% share, holding USD 19.2 billion in revenue.

The Handheld POS Market encompasses mobile, compact devices used to process sales transactions in retail, hospitality, field services, and other settings. These devices integrate card readers (magstripe, EMV, NFC), barcode scanners, printers, and network connectivity (WiFi, cellular). They allow merchants to accept payments anywhere in a store or on the go, improving customer experience and operational flexibility.

The adoption rate of handheld Point of Sale (POS) systems in 2025 is driven by increasing demand for mobility, contactless payments, and seamless customer service across retail and hospitality sectors. Wireless handheld POS devices are leading adoption with a 50% market share, enabling payments anywhere on-site like tableside or curbside, which enhances transaction speed and convenience.

Key factors supporting growth include the rise of mobile commerce and the demand for flexible checkout experiences. Consumers expect fast, on-the-spot service, which handheld POS enables. Retailers seek to reduce queues and improve floor engagement by bringing checkout to customers. The growth of small and micro merchants, food trucks, pop-up stores, and delivery services expands demand for portable payment devices.

According to coinlaw.io, more than 68% of small and medium-sized businesses used mobile POS in 2025, reflecting strong sales adoption. The tablet POS market was valued at $5.16 billion in 2024 and is expected to keep growing in 2025. Soft-POS transactions reached $23.9 billion in 2025, driven by mobile-first users. Around 30% of all POS sales in 2024 came from e-commerce, and this share is rising further in 2025.

For instance, In June 2024, Posiflex Technology Inc. introduced the Opera MT-6200 Series, a new line of slim mobile POS tablets. These devices come in both x86 and RISC versions and run on either Android 13 or Windows 11 IoT, offering flexibility for different business environments.

Advances in wireless connectivity, secure payment technology (EMV, tokenization), and compact, durable hardware make handheld POS more viable. Finally, plug-and-play integration with cloud POS systems, software as a service, and managed services reduce complexity for merchants. Demand analysis shows a strong preference for handheld POS in retail, hospitality, and field service sectors where mobility and fast checkout improve customer satisfaction and operational efficiency.

Key Takeaways

- Hardware components account for 37.2%, reflecting strong demand for terminals, scanners, and mobile POS devices.

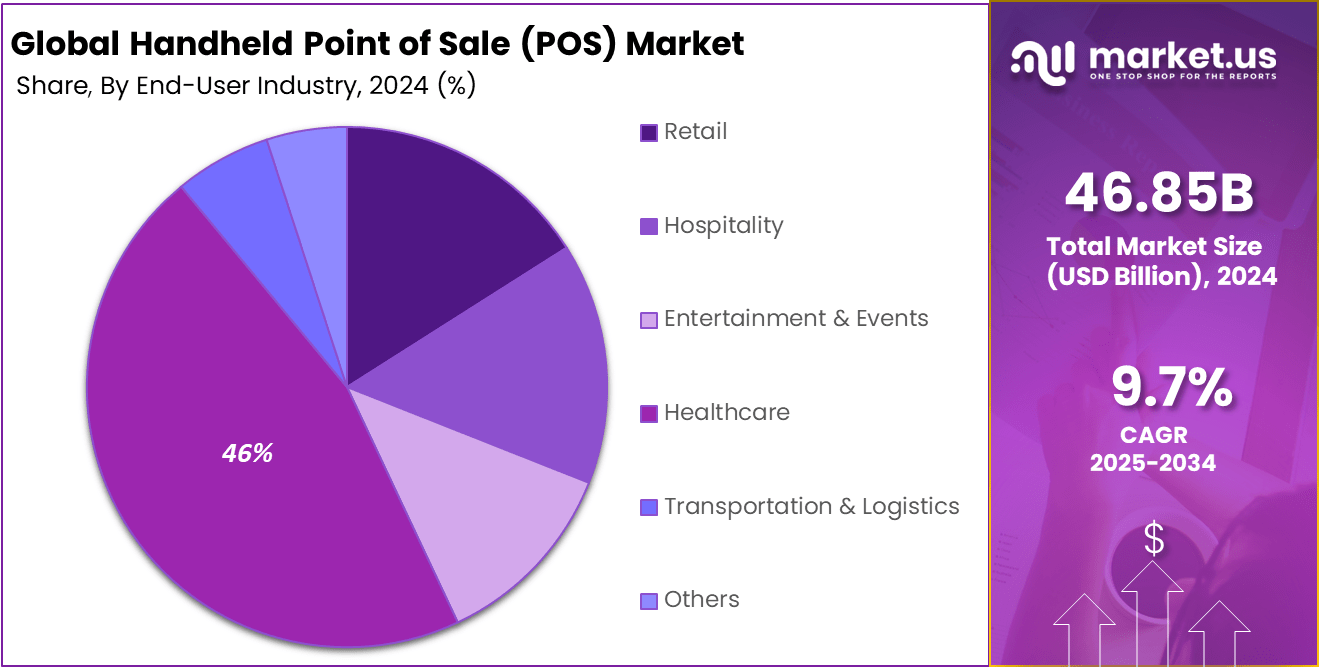

- Hospitality industry leads with 46%, as restaurants, hotels, and travel services prioritize mobile payment solutions.

- North America holds 41%, supported by advanced payment infrastructure and consumer preference for cashless transactions.

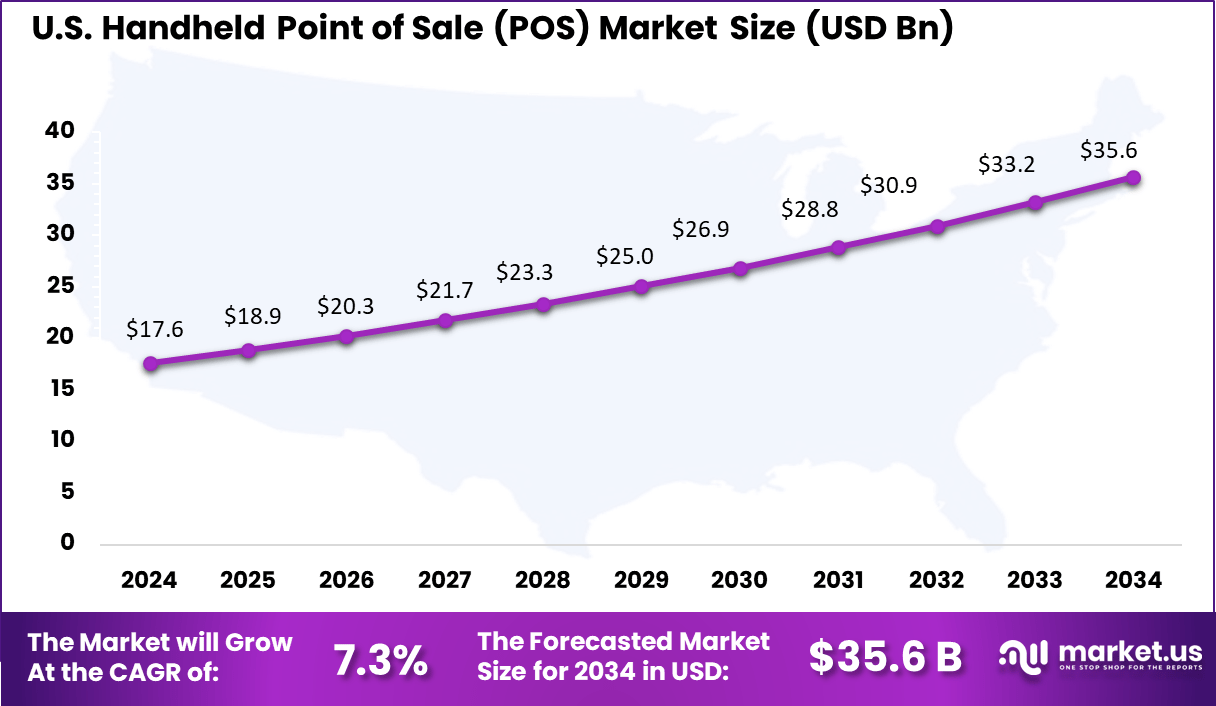

- The US market reached USD 17.6 billion and is growing at a CAGR of 7.3%, driven by digital payment adoption and rapid expansion in retail and hospitality sectors.

Analysts’ Viewpoint

Handheld POS devices increasingly integrate with cloud-based backend systems for inventory, analytics, customer management, and loyalty. They adopt contactless payment protocols (NFC, QR) to support mobile wallet payments. Advanced security features like hardware encryption, secure elements, and PCI compliance modules are standard.

Some newer devices use Android or Linux operating systems, enabling richer apps and extensibility. Battery and power management improvements allow longer use per charge. Multi-function designs add barcode scanning, label printing, or biometric authentication for staff access. Merchants adopt handheld POS to improve flexibility, reduce wait times, and increase conversion.

It allows staff to complete sales directly on the floor, improving service efficiency. For small merchants, handheld POS delivers payment capabilities without needing fixed POS terminals or heavy infrastructure. It supports omnichannel strategies by connecting offline and online systems. For mobility-focused businesses (delivery, taxis, events), handheld POS is essential.

Role of Generative AI

The handheld Point of Sale (POS) market is being significantly reshaped by generative AI, which is transforming transaction processing and customer interactions. Generative AI enables personalized shopping experiences by creating tailored product recommendations and automating marketing communications.

Data shows that around 73% of retailers using generative AI in POS systems have reported faster decision-making and improved automation in daily operations. This technology also helps prevent fraud by analyzing suspicious activities, enhancing trust in digital payments.

Investment and Business Benefits

Investment opportunities in handheld POS are strong, especially in markets seeing surges in digital payment adoption and SME growth. Regions like Asia-Pacific present attractive opportunities owing to their expanding retail sectors and smartphone penetration.

Investments focused on developing advanced wireless, AI-powered POS devices with seamless backend integration are attractive to businesses prioritizing operational efficiency and customer experience. Cloud-based POS platforms and secure payment ecosystems also offer promising returns. Companies offering customizable solutions for varied industry needs stand to benefit the most.

Business benefits of handheld POS include faster checkout times, enhanced customer satisfaction, and improved staff productivity due to system mobility. Businesses gain deeper insights into sales trends and inventory management from real-time data analytics, enabling them to optimize stock and marketing strategies.

Enhanced security features reduce fraud risk, build consumer trust, and ensure compliance with payment standards. Smaller and medium-sized enterprises appreciate the relatively lower upfront costs and scalability. The integration of loyalty programs and CRM further helps in customer retention and personalized marketing.

U.S. Handheld POS Market

The U.S. handheld Point of Sale (POS) market is a leading segment within the global POS landscape, valued at USD 17.6 billion in 2024 and expected to grow steadily at a CAGR of 7.3%. The market is primarily driven by the widespread adoption of mobile and contactless payment solutions, increasing demand for cloud-based POS software, and the growing preference for portable, flexible transaction systems across retail, hospitality, and service sectors.

In 2024, North America held 41% of the market. Strong card payment adoption, coupled with rapid digitization in retail and hospitality, has made handheld POS systems a natural fit in the region. Widespread consumer dependence on secure and flexible payment methods ensures steady demand for such devices.

By Component Analysis

The component segment comprises hardware, software, and services, each catering to different merchant needs. Hardware dominates with a 37.2% share in 2024, including smartphones, tablets, dedicated handheld terminals, and card reader accessories.

Smartphones and tablets, such as iPads and Samsung Galaxy tablets, are increasingly used in retail and hospitality due to their portability, multifunctionality, and lower cost compared to traditional POS terminals. Dedicated handheld terminals, like Clover Flex and Ingenico Move/5000, are preferred in high-volume environments for durability and reliability.

Software forms the backbone of POS operations, split between on-premise solutions, ideal for large enterprises requiring custom integrations, and cloud-based solutions, offering SMEs and startups flexibility, scalability, and real-time analytics. Cloud-based software from providers such as Square, Toast, and Lightspeed allows seamless updates, inventory management, and sales tracking without heavy IT infrastructure.

By End-User Industry Analysis

The end-user industry segment plays a pivotal role in shaping the global handheld POS market, with hospitality leading at 46% share in 2024. In hospitality, restaurants, cafés, quick-service restaurants (QSRs), food trucks, and hotels increasingly deploy handheld POS devices to enable tableside ordering, mobile payments, and streamlined service, improving customer experience and operational efficiency.

For example, chains like Starbucks, Chipotle, and Shake Shack utilize tablets and handheld terminals to reduce wait times and optimize order management. The retail sector, including specialty stores, supermarkets, hypermarkets, and convenience stores, leverages handheld POS systems to manage inventory, loyalty programs, and on-the-go checkout, with brands such as Walmart and Best Buy implementing mobile checkout solutions for faster service.

In entertainment and events, handheld POS devices facilitate ticketing, merchandise sales, and concession payments at stadiums, museums, theaters, and pop-up events, enhancing convenience for large crowds. Emerging adoption is also seen in healthcare, where clinics and pharmacies use portable POS for patient payments, and in transportation and logistics, enabling mobile ticketing, fare collection, and fleet management.

Emerging trends

Emerging trends in handheld POS include the integration of AI-driven features such as dynamic upselling, real-time inventory alerts, and advanced sales analytics. Mobility and wireless connectivity continue to drive demand, with wireless POS devices accounting for 50% of the market in 2025.

Android-based systems are leading, capturing about 60% of the market share due to their flexibility and compatibility with various applications. The restaurant sector is a notable adopter, representing 18% of handheld POS applications, using mobile ordering and contactless payment functions to improve customer experience and operational speed.

Growth factors

Growth factors for handheld POS revolve around the rising need for mobility, contactless transactions, and cloud-based integration. Innovations in hardware, such as devices with long battery life, NFC support, and multi-layered security, are helping businesses streamline payment processes.

Increased smartphone penetration and card usage in regions like Asia-Pacific, growing at around 12% CAGR, also boost market expansion. The adoption of AI for personalized interactions and predictive analytics further fuels growth, improving operational efficiency and customer satisfaction.

POS Market Segments

By Component

- Hardware

- Smartphones & Tablets

- Dedicated Handheld Terminals

- Card Reader Accessories

- Software

- On-Premise

- Cloud-Based

- Services

- Payment Processing Services

- Subscription & Support Services

End-User Industry

- Retail

- Specialty Stores (Apparel, Electronics)

- Supermarkets/Hypermarkets

- Convenience Stores

- Hospitality

- Restaurants & Cafés

- Food Trucks & Quick-Service Restaurants (QSR)

- Hotels & Resorts

- Entertainment & Events

- Stadiums & Arenas

- Museums & Theaters

- Festivals & Pop-up Events

- Healthcare

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Driving Factor

Increasing Adoption of Cashless Transactions

The widespread shift towards cashless transactions has become a major driver for the handheld point of sale (POS) market. More consumers now prefer digital payments such as mobile wallets, contactless cards, and QR code payments for convenience and hygiene reasons. This trend pushes businesses across retail, hospitality, and field service sectors to adopt portable POS devices that support these payment methods, making transactions faster and more secure.

For instance, the rise in contactless payments during the pandemic has led to an accelerated demand for handheld POS systems that facilitate touch-free purchases, enhancing customer experience and operational efficiency. Additionally, governments in various regions are promoting digital payments through policies and initiatives that encourage cashless economies.

This institutional support further drives market growth, especially in emerging economies where mobile payment adoption is rapidly rising. Markets like Asia Pacific dominate with large revenue shares due to quick government-backed digital infrastructure development. The result is a growing need for handheld POS devices that are wireless, mobile-ready, and integrated with emerging payment technologies, fueling the market’s expansion.

Restraining Factor

Data Security and Integration Challenges

One significant restraint to handheld POS market growth is the complexity and cost associated with data security and system integration. Handheld POS devices must comply with stringent security standards (like PCI-DSS) and use encryption to protect sensitive customer payment information. Meeting these requirements adds costs and operational complexity, which can deter smaller or budget-constrained businesses from upgrading or adopting new handheld POS solutions.

For example, smaller retailers or startups in emerging markets may struggle with the expenses and technical requirements of implementing robust, secure payment processing systems. Moreover, integration with existing legacy systems remains a major hurdle. Many retailers and hospitality businesses still rely on fragmented or outdated back-end systems that are not easily compatible with modern POS technologies.

This makes deploying new handheld POS devices time-consuming, technically challenging, and resource-intensive. The need to sync real-time analytics, inventory management, and customer data across platforms creates implementation barriers that slow market penetration and increase costs for operators.

Growth Opportunity

Growing Demand for Mobility in Retail and Hospitality

A major opportunity for handheld POS systems lies in the increasing demand for mobility and flexibility in transaction processing within retail and hospitality settings. Businesses want to offer seamless payment experiences anywhere in-store, at pop-up events, or on-the-go, boosting customer convenience and satisfaction.

For instance, handheld POS devices enable servers in restaurants to take orders and process payments from the table, reducing wait times and improving service flow. Similarly, retailers use these mobile devices for faster checkout lines and personalized customer engagement. This mobility factor is driving innovation in handheld POS hardware and software, including cloud-based solutions, real-time inventory updates, and integrated customer analytics.

The rise of omnichannel retailing and smaller businesses adopting digital payment tools also contributes to expanding handheld POS adoption. Companies that invest in user-friendly, scalable handheld POS systems can capture these growing segments. The opportunity is particularly strong in regions with increasing smartphone and mobile internet penetration, supporting portable payment technologies.

Challenge Analysis

High Hardware and Operation Costs

A key challenge facing the handheld POS market is the high initial cost of hardware and ongoing expenses for software updates and cloud services. Handheld POS devices require sophisticated technology, including barcode scanners, card readers, wireless connectivity, and secure payment capabilities, which can be costly to produce and purchase.

For many small and medium businesses, these upfront investments can be a significant barrier to adoption, especially in cost-sensitive emerging markets. Apart from hardware expenses, operators must budget for continuous software maintenance, security patching, and cloud subscription fees to keep devices functional and compliant.

These recurring costs add to the total cost of ownership and can limit market growth among budget-conscious businesses. For example, businesses in developing countries might delay upgrading to the latest handheld POS technology due to the cumulative cost load.

Key Player Analysis

The global handheld POS market is highly competitive, with key players focusing on hardware innovation, cloud-based software, and service integration to expand their customer base. Leading vendors such as Square (Block, Inc.), Toast, Lightspeed Commerce, Clover (Fiserv), Ingenico, Verifone, and PAX Technology dominate the landscape.

In 2024, Square leads with an estimated 15% market share, driven by its strong presence in the U.S. SME segment and mobile-first POS ecosystem. Toast holds around 10%, specializing in handheld POS solutions tailored for restaurants and QSRs. Ingenico and Verifone together account for nearly 18%, leveraging their long-standing expertise in secure payment terminals.

PAX Technology is expanding rapidly in Asia-Pacific, capturing about 7% of the market with cost-efficient solutions. Meanwhile, Lightspeed Commerce holds around 6%, with strengths in cloud-based POS and retail analytics. These players compete through partnerships with fintech firms, PaaS subscription models, and AI-driven payment analytics, shaping a dynamic and innovation-focused market.

Top Key Players

- Ingenico SA (Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc. (Block)

- Fiserv Inc. (Clover)

- Lightspeed Commerce Inc.

- Shopify Inc. (Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation (MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- Other Key Players

Recent Developments

- January 2025, Verifone Systems Inc. unveiled the Victa series, integrating large displays, Qualcomm processors, and biometric fingerprint authentication to enhance security and user experience. An updated Tap SoftPOS software solution was launched, enabling faster, scalable payments in retail and hospitality environments with enhanced battery life and NFC support.

- April 2024, PAX Technology Ltd. introduced the world’s first 5G and WiFi 6 connectivity upgrade for their flagship SmartPOS devices, including the A920 MAX and A6650 models. This enhanced connectivity supports faster, more reliable, and secure payment processing, emphasizing PAX’s commitment to future-proofed payment innovations.

Report Scope

Report Features Description Market Value (2024) USD 46.9 Bn Forecast Revenue (2034) USD 118.2 Bn CAGR(2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, and Services), By End-User Industry (Retail, Hospitality, Entertainment & Events, Healthcare, Transportation & Logistics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ingenico SA (Worldline), VeriFone Systems Inc., PAX Technology Ltd., NCR Corporation, Diebold Nixdorf Inc., Toshiba Global Commerce Solutions, HP Inc., Panasonic Corporation, Fujitsu Ltd., Samsung Electronics Co. Ltd., Newland Payment Technology, BBPOS Ltd., Square Inc. (Block), Fiserv Inc. (Clover), Lightspeed Commerce Inc., Shopify Inc. (Shopify POS), Toast Inc., Revel Systems Inc., Oracle Corporation (MICROS), Agilysys Inc., Aptos Inc., GK Software SE, NEC Corporation, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Handheld Point of Sale (POS) MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Handheld Point of Sale (POS) MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ingenico SA (Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc. (Block)

- Fiserv Inc. (Clover)

- Lightspeed Commerce Inc.

- Shopify Inc. (Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation (MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- Other Key Players