Global Green Mining Market By Type(Surface Mining, Underground Mining), By Technology(Power Reduction, Emission Reduction, Water Reduction, Others), By Equipment(Electric Vehicles and Machinery, Energy-efficient Machinery, Water-saving Technologies), By Minerals Extracted(Precious Metals, Mineral Fuels, Industrial Metals, Ferro Alloys, Non-Ferrous Metals) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 126896

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

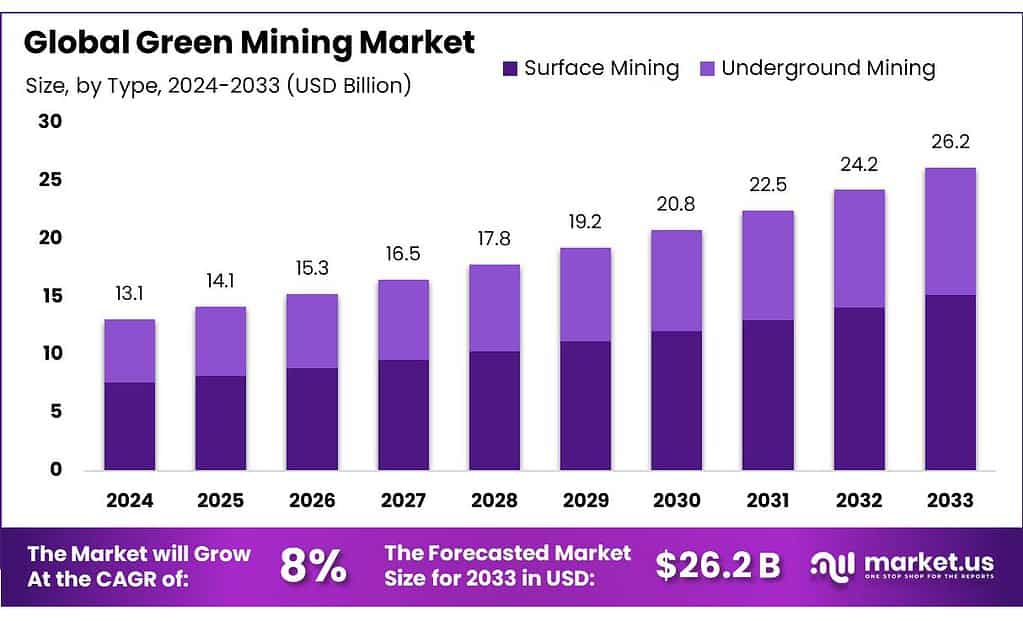

The global Green Mining Market size is expected to be worth around USD 26.2 billion by 2033, from USD 13.1 billion in 2023, growing at a CAGR of 8.0% during the forecast period from 2023 to 2033.

The Green Mining Market is a critical segment of the mining industry focused on reducing environmental impacts through sustainable practices. This market employs various advanced technologies and methodologies that aim to lower the ecological footprint of mining activities.

Key practices include the adoption of renewable energy sources, efficient waste management, recycling processes, and the utilization of eco-friendly mining technologies. These initiatives are driven by heightened global environmental concerns, rigorous regulatory frameworks, and a growing demand from consumers for sustainable practices.

In the realm of green mining, significant technological innovations play a pivotal role. For instance, the development of methods to mine from tailings helps reclaim valuable materials from waste, diminishing the need for new extraction activities and lessening environmental degradation.

Other notable technologies include dust suppression techniques and liquid membrane emulsion technology, which are crucial for minimizing pollution and enhancing the efficiency of mineral extraction and processing.

The push for green mining is further supported by substantial investments in research and development. These investments focus on refining processing techniques and boosting water and energy efficiency, aiming to enhance sustainability and reduce the environmental impact of mining operations. Such advancements are not only beneficial for the environment but also help in reducing operational costs and boosting the long-term viability of mining enterprises.

Governments and international bodies are actively fostering green mining through various initiatives. These include setting strict environmental standards and backing technological innovations that aim to minimize ecological disturbances and emissions associated with mining. The application of these standards and supports is crucial in promoting environmentally responsible mining practices globally.

Economically, green mining practices have shown significant value, with the U.S. mining sector alone producing an estimated $90.4 billion in mineral commodities in 2021. This sector supports a wide array of industries, including steel, aerospace, and electronics, making substantial contributions to the national economy.

The ongoing shift towards green mining is expected to continue growing, reflecting the adoption of more sustainable practices and technologies across the mining industry. This shift not only addresses environmental and regulatory demands but also aligns with the broader economic and social goals of reducing the mining sector’s impact on the planet.

Key Takeaways

- The Green Mining Market is set to grow from USD 13.1 billion in 2023 to USD 26.2 billion by 2033, at an 8.0% CAGR.

- Surface mining dominated in 2023 with a 58.6% market share, favored for its cost-effectiveness and efficiency in near-surface mineral extraction.

- Emission reduction technologies captured 39.5% of the market in 2023, focusing on minimizing air pollution and greenhouse gas emissions.

- Electric vehicles and machinery led the market with a 45.2% share in 2023, reducing emissions compared to traditional diesel-powered equipment.

- Precious metals extraction held a 38.2% market share in 2023, driven by high demand for gold, silver, and platinum in various industries.

- North America leads the green mining market with a 38.4% share, valued at approximately USD 5.0 billion.

By Type

In 2023, Surface Mining held a dominant market position in the Green Mining sector, capturing more than a 58.6% share. This method is favored for its cost-effectiveness and efficiency in extracting minerals from near the earth’s surface.

Surface mining techniques, such as open-pit mining, quarrying, and strip mining, are less expensive and safer than underground mining, making them more sustainable and aligned with green mining practices. These methods also allow for the use of large-scale machinery and automation, which can be adapted to reduce environmental impact through precision operations and better waste management.

Underground Mining, while occupying a smaller segment of the market, plays a crucial role in extracting minerals located deep beneath the earth’s surface. This type of mining is essential for accessing mineral deposits that cannot be reached by surface mining methods.

Despite its higher cost and complexity, underground mining has seen advancements in technologies that minimize surface disruption and reduce energy consumption, contributing to the goals of green mining. Innovations in underground mining include improved ventilation systems and electric vehicles, which help reduce greenhouse gas emissions and enhance the overall sustainability of mining operations.

By Technology

In 2023, Emission Reduction technology held a dominant market position in the Green Mining sector, capturing more than a 39.5% share. This segment focuses on reducing the environmental impact of mining operations by implementing technologies that minimize air pollution and greenhouse gas emissions. Such technologies include advanced filtration systems, the use of cleaner fuel alternatives, and energy-efficient machinery that complies with stringent environmental standards.

Power Reduction technologies also play a crucial role in the Green Mining market, focusing on decreasing the energy consumption of mining operations. This segment includes the integration of renewable energy sources such as solar and wind power into mining operations, as well as the adoption of energy-efficient machines and equipment that reduce overall power usage.

Water Reduction technologies are essential for minimizing the water footprint of mining activities. This segment involves the implementation of recycling systems that reuse water in mining processes, advanced treatment solutions that ensure water purity, and innovative mining techniques that require less water consumption.

By Equipment

In 2023, Electric Vehicles and Machinery held a dominant market position in the Green Mining sector, capturing more than a 45.2% share. This category includes battery-powered mining vehicles and electrically driven machinery that significantly reduce emissions compared to traditional diesel-powered equipment. The shift towards electric vehicles and machinery in mining not only helps in cutting down greenhouse gas emissions but also reduces ventilation needs in underground operations, contributing to considerable energy and cost savings.

Energy-efficient Machinery is another critical segment of the Green Mining market. This equipment is designed to require less energy to operate without compromising performance, encompassing advanced drive systems and optimized mechanical components. The adoption of energy-efficient machinery is driven by the dual benefits of lowering operational costs and reducing the environmental impact of mining operations.

Water-saving Technologies form an essential part of the green mining equipment landscape. This segment includes technologies that reduce water usage in mining processes through recycling and reusing water in mineral processing and dust control systems. Water-saving technologies are particularly crucial in regions where water scarcity is a significant concern, helping mines to operate more sustainably and with less dependency on local water resources.

By Minerals Extracted

In 2023, Precious Metals held a dominant market position in the Green Mining sector, capturing more than a 38.2% share. This segment includes the extraction of gold, silver, platinum, and other valuable metals, which are highly sought after for their use in jewelry, electronics, and investment. The green mining practices in this segment focus on reducing environmental impact through the use of non-toxic extraction methods and recycling of waste materials.

Mineral Fuels, comprising coal, oil, and natural gas, also play a significant role in the green mining market. Although these are traditionally associated with high environmental impacts, advancements in cleaner extraction and processing technologies are helping to minimize the footprint of these essential energy sources.

Industrial Metals, including iron, copper, and aluminum, are critical to various sectors of the global economy, from construction to electronics. Green mining practices in this segment aim to improve energy efficiency and reduce water and air pollution in the extraction and processing stages.

Ferro Alloys, used primarily to improve the strength and quality of steel and other metal products, include manganese, chromium, and silicon among others. The green mining of these materials focuses on enhancing the energy efficiency of production processes and reducing emissions.

Non-ferrous metals, such as zinc, lead, and nickel, are essential for many industrial applications, including batteries and metal plating. In the green mining context, the focus for these metals is on technologies that reduce toxic waste and improve the recyclability of by-products.

Key Market Segments

By Type

- Surface Mining

- Underground Mining

By Technology

- Power Reduction

- Emission Reduction

- Water Reduction

- Others

By Equipment

- Electric Vehicles and Machinery

- Energy-efficient Machinery

- Water-saving Technologies

By Minerals Extracted

- Precious Metals

- Mineral Fuels

- Industrial Metals

- Ferro Alloys

- Non-Ferrous Metals

Drivers

Increasing Demand for Critical Minerals

A pivotal driving factor for the green mining market is the surging global demand for critical minerals essential for renewable energy technologies and electric vehicles. This demand is accelerating due to the worldwide push towards decarbonization and energy transition. Critical minerals like lithium, cobalt, and nickel, crucial for battery production, are seeing increased demand.

As countries aim to secure stable and sustainable supplies of these minerals, there’s a significant emphasis on adopting green mining practices. These practices not only aim to minimize environmental impact but also align with growing regulatory and societal expectations for more sustainable and responsible mining operations.

Governments and international organizations are increasingly promoting green mining through various initiatives, setting stringent environmental standards, and supporting technological advancements that enable more efficient and less polluting mining operations.

For instance, innovations in processes that reduce water and energy use and decrease greenhouse gas emissions are becoming critical in meeting both environmental and economic goals. The market’s growth is further supported by investments in technologies that ensure cleaner extraction and processing methods, reflecting a broader commitment to environmental stewardship in the mining sector.

Restraints

Regulatory and Stakeholder Challenges

A significant restraining factor for the green mining sector is the complexity and stringency of environmental regulations, coupled with the challenges of stakeholder engagement. The mining industry, while pivotal for supplying critical minerals necessary for the green energy transition, faces considerable hurdles due to its energy-intensive nature and the environmental impacts associated with mining activities.

Regulatory challenges are a major bottleneck. The stringent environmental standards designed to ensure sustainable mining practices require significant investment and time to comply with, which can delay project timelines and increase costs. For example, the permitting process is often prolonged by regulatory reviews and stakeholder opposition, particularly when potential environmental impacts are significant. Stakeholders, including local communities and environmental groups, demand high standards for environmental and social governance (ESG), which can lead to additional project delays if not managed effectively from the outset.

Furthermore, the mining sector contends with a lack of public trust, which can exacerbate opposition and delay projects. Effective stakeholder engagement and transparent communication are essential to overcome skepticism and build support for mining projects. This includes demonstrating a clear commitment to environmental protection and community benefits, which are increasingly scrutinized by the public and regulatory bodies.

Opportunity

Demand for Critical Minerals in Clean Energy Technologies

A significant growth opportunity in the green mining sector is the escalating demand for critical minerals, fueled by the global transition towards clean energy technologies. This demand is driven by the increasing adoption of technologies that rely on minerals such as lithium, cobalt, and rare earth elements, essential for manufacturing batteries, wind turbines, and other renewable energy infrastructure.

The push for these critical minerals is bolstered by government initiatives and international cooperation aiming to secure stable, sustainable supplies. For instance, substantial investments are being made to develop mining projects that adhere to stringent environmental standards, emphasizing the reduction of greenhouse gas emissions and enhancing biodiversity protection. The World Bank, for example, has set up a $1 billion fund to support green mining projects in developing countries, focusing on projects that align with these goals.

Moreover, advancements in mining technologies are facilitating more efficient and environmentally friendly extraction and processing methods. Companies are increasingly deploying technologies such as autonomous mining equipment, real-time monitoring systems, and sophisticated mine planning software to improve efficiency and reduce environmental impacts.

The market outlook for green mining is very positive, with projections suggesting substantial growth in market size over the next decade. This is further supported by a rising regulatory and consumer push towards sustainable and responsible mining practices globally. The integration of green mining practices not only helps in reducing the ecological footprint of mining activities but also aligns with the broader goals of economic sustainability and corporate social responsibility.

Trends

Integration of Renewable Energy and Advanced Technologies

A significant trend in the green mining industry is the increased integration of renewable energy sources and the adoption of advanced technologies to enhance mining operations’ sustainability. This shift is driven by the need to reduce the environmental impact of mining activities and comply with stringent global regulations aimed at curbing emissions and conserving resources.

Mining operations are increasingly utilizing renewable energy, such as solar and wind power, to meet their energy needs. For instance, a notable trend is the procurement of large amounts of renewable energy to power operations, as seen with a mining project that secured 1.5 million megawatt hours of renewable energy certificates primarily from wind power. This approach not only reduces greenhouse gas emissions but also aligns with corporate social responsibility goals by showcasing a commitment to sustainable practices.

Furthermore, the adoption of advanced technologies such as the oxidizing utilization of ventilation air methane (VAM) is gaining traction. This technology captures and utilizes methane—a potent greenhouse gas—released during mining operations, turning it into a viable energy source. This not only helps in reducing emissions but also provides a financial incentive through the generation of carbon credits or offsets.

The integration of these renewable energy sources and advanced technologies is transforming the green mining sector, making it more sustainable and economically viable. This trend is supported by investments and innovations that optimize resource use and reduce the environmental footprint of mining activities, thus contributing to the broader goals of the global energy transition and sustainable development.

Regional Analysis

North America stands as the leading region in the Green Mining sector, commanding a substantial 38.4% market share, with a market value of approximately USD 5.0 billion. This dominance is primarily attributed to stringent environmental regulations and significant investments in sustainable mining technologies. The United States and Canada are at the forefront, driven by their proactive stance on reducing environmental impacts and promoting innovative green technologies.

Europe follows closely, benefiting from its robust environmental policies and commitment to sustainable practices. The European market is characterized by high adoption rates of green mining technologies, such as waste management and energy-efficient mining equipment. Countries like Germany, Sweden, and the United Kingdom are leading the charge, with substantial investments aimed at minimizing ecological footprints and enhancing resource efficiency.

Asia Pacific is experiencing rapid growth, largely due to the region’s burgeoning mining activities and increasing focus on environmental sustainability. China and Australia are key players, with significant advancements in green mining practices to address the environmental challenges associated with their extensive mining operations. The region’s growth is supported by government initiatives and international collaborations aimed at reducing the environmental impact of mining.

In the Middle East & Africa, the green mining market is gradually expanding, driven by rising awareness and regulatory measures aimed at sustainable resource extraction. Countries such as South Africa and Saudi Arabia are making strides in implementing green mining practices to mitigate environmental impacts.

Latin America is also witnessing growth in green mining, spurred by increasing environmental regulations and investment in sustainable mining technologies. Countries like Brazil and Chile are focusing on improving environmental management and reducing the ecological impacts of their mining activities.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Frequently Asked Questions (FAQ)

What is the Size of Green Mining Market?Green Mining Market size is expected to be worth around USD 26.2 billion by 2033, from USD 13.1 billion in 2023

What is the CAGR for the Green Mining Market ?The Green Mining Market is expected to grow at a CAGR of 8.0% during 2023-2032.List the key industry players of the Global Green Mining Market?Anglo American, Antofagasta PLC, ArcelorMittal, BHP, BHP Billiton, CODELCO, Doosan Infracore, Dundee Precious Metals, Freeport-McMoRan, Inc., Glencore Plc, Jiangxi Copper Corporation Limited, Liebherr, Rio Tinto, Sany, Saudi Arabian Mining Corporation, Shandong Gold Mining Co. Ltd, Tata Steel, Vale S.A., Zijin Mining Group Co., Ltd.

-

-

- Anglo American

- Antofagasta PLC

- ArcelorMittal

- BHP

- BHP Billiton

- CODELCO

- Doosan Infracore

- Dundee Precious Metals

- Freeport-McMoRan, Inc.

- Glencore Plc

- Jiangxi Copper Corporation Limited

- Liebherr

- Rio Tinto

- Sany

- Saudi Arabian Mining Corporation

- Shandong Gold Mining Co. Ltd

- Tata Steel

- Vale S.A.

- Zijin Mining Group Co., Ltd.