Global GPON Technology Market By Technology(2.5G PON, XG-PON), By Component(Optical Network Terminal, Optical Line Terminal), By Application(FTTH, Other FTTx), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 126754

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

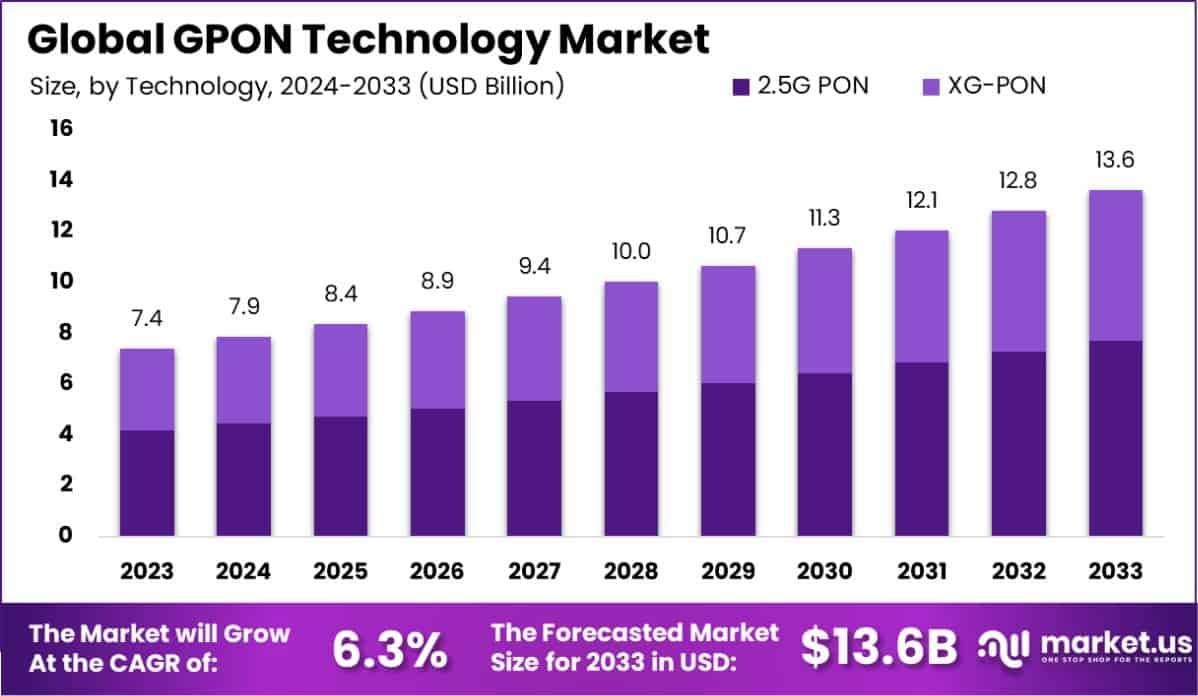

The Global GPON Technology Market size is expected to be worth around USD 13.6 Billion By 2033, from USD 7.4 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

GPON (Gigabit Passive Optical Network) technology is a point-to-multipoint access mechanism. It utilizes passive splitters in the fiber distribution network, enabling one single feeding fiber from the provider’s central office to serve multiple homes and small businesses.

GPON is widely recognized for its ability to transmit Ethernet, TDM (Time Division Multiplexing), and ATM (Asynchronous Transfer Mode) traffic, its high bandwidth, the long distances it covers, and its efficiency in terms of fiber network utilization.

The GPON technology market is experiencing robust growth driven by the surging demand for high-speed broadband services and the expansion of fiber optic infrastructure globally. Key opportunities in this market lie in developing regions where fiber optic infrastructure is rapidly expanding and in the integration of GPON with emerging technologies such as 5G, IoT, and smart city projects.

Additionally, the ongoing upgrades from older technologies to GPON in developed countries provide substantial growth avenues, making GPON a critical component in modern telecommunication frameworks.

The GPON (Gigabit Passive Optical Network) technology market stands at the cusp of transformative growth, underpinned by its robust capability to deliver high-speed internet services. This is primarily due to the technology’s support for a maximum downstream data rate of 2.5 Gbps and an upstream data rate of 1.25 Gbps, as reported by Ascentoptics. Such speeds are quintessential for the burgeoning demand for high-bandwidth internet services and the seamless operation of data-intensive applications.

Moreover, GPON’s architecture allows for significant network extension, with the capability to cover distances up to 20 kilometers between the Optical Line Terminal (OLT) and Optical Network Terminals (ONTs). This feature, detailed by Planet, is pivotal in ensuring comprehensive coverage, particularly in under-served and developing regions, thereby enhancing the scope of digital inclusivity.

The scalability of GPON is further exemplified by its high split ratio of 1:128, indicating that a single OLT can efficiently serve up to 128 ONTs. This scalability makes GPON a highly cost-effective solution for widespread broadband deployment. Additionally, the capacity to support up to 1024 Optical Network Units (ONUs) per deployment facilitates extensive connectivity for both residential and business applications, marking a significant advancement in network management and service delivery.

Notably, the energy efficiency of GPON deployments, such as the GPL-8000 OLT which consumes approximately 60 watts, underscores the sustainable nature of this technology in delivering high performance while maintaining lower energy consumption.

Key Takeaways

- The Global GPON Technology Market size is expected to be worth around USD 13.6 Billion By 2033, from USD 7.4 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

- In 2023, 2.5G PON held a dominant market position in the By Technology segment of the GPON Technology Market, capturing more than a 56.7% share.

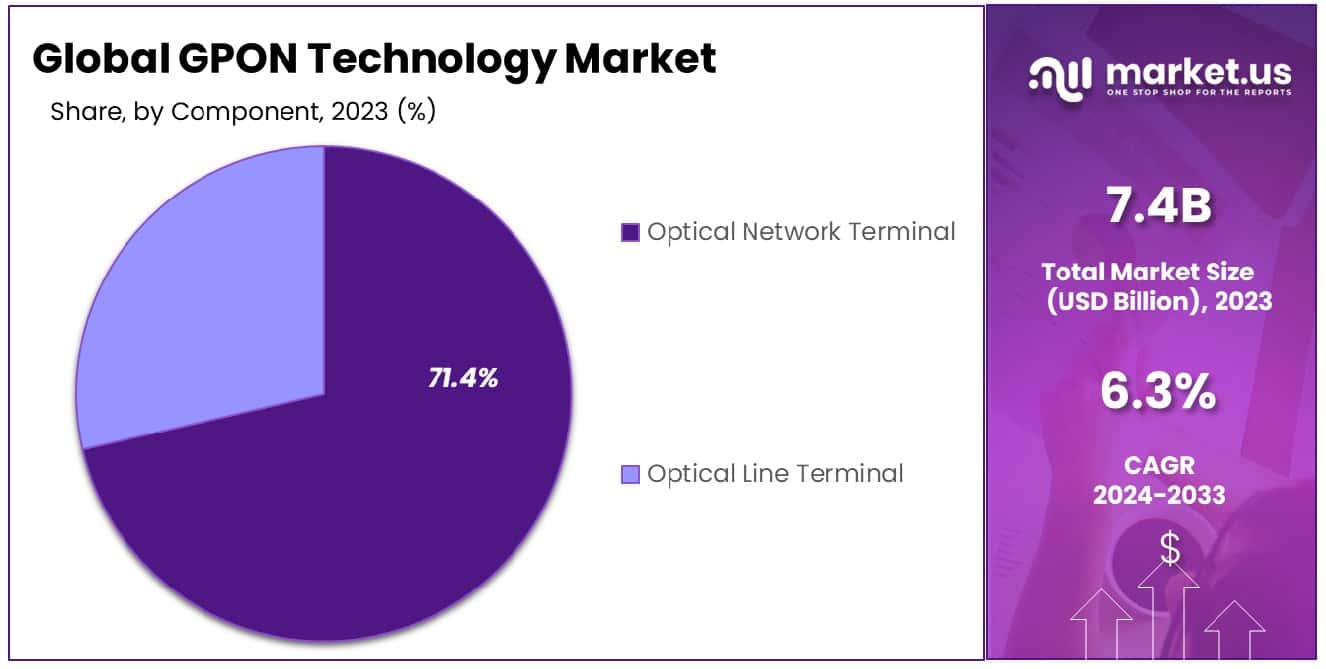

- In 2023, Optical Network Terminal held a dominant market position in the By Component segment of the GPON Technology Market, capturing more than a 71.4% share.

- In 2023, FTTH held a dominant market position in the By Application segment of the GPON Technology Market, capturing more than a 64.8% share.

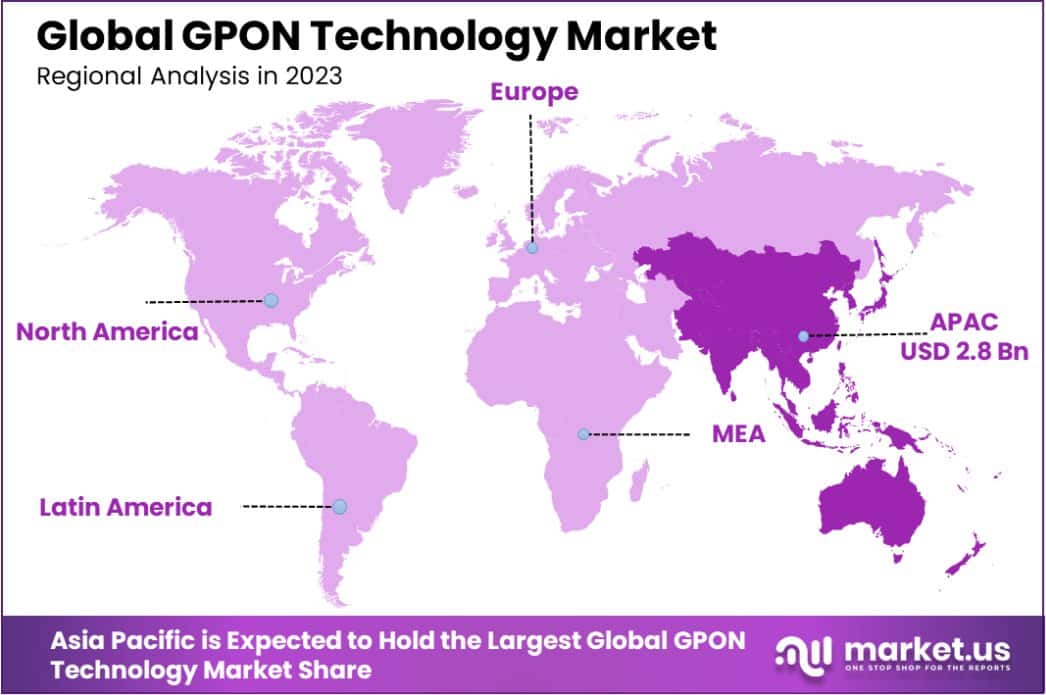

- Asia Pacific dominated a 38.5% market share in 2023 and held USD 2.8 Billion revenue of the GPON Technology Market.

By Technology Analysis

In 2023, 2.5G PON held a dominant market position in the By Technology segment of the GPON Technology Market, capturing more than a 56.7% share. This significant market presence underscores the widespread adoption of 2.5G PON in various telecommunication applications due to its cost-effectiveness and reliable performance in delivering high-speed broadband services.

Meanwhile, XG-PON, although possessing advanced capabilities for higher bandwidth, represented a smaller portion of the market. The preference for 2.5G PON can be attributed to its established infrastructure and compatibility with existing network frameworks, making it a practical choice for many service providers.

The market dynamics suggest a continuing robust demand for 2.5G PON, driven by the ongoing expansion of broadband networks and the increasing need for cost-effective solutions that can accommodate the escalating data traffic. As network demands evolve, the market anticipates gradual shifts towards more advanced technologies like XG-PON, which are expected to gain traction as the need for higher data rates becomes more pronounced in various regions.

By Component Analysis

In 2023, Optical Network Terminal (ONT) held a dominant market position in the By Component segment of the GPON Technology Market, capturing more than a 71.4% share. This substantial market penetration is largely due to the critical role that ONT plays in fiber-to-the-home (FTTH) deployments, where it acts as the endpoint of the GPON network, converting optical signals into electrical signals for residential and business use.

The demand for ONTs has been driven by the extensive roll-out of FTTH services globally, aiming to meet the soaring demand for high-speed internet and advanced telecommunications services.

In contrast, the Optical Line Terminal (OLT), which coordinates the fiber optic signals on the provider side, accounted for a smaller share of the market. The higher share of ONTs in the market can be attributed to their deployment at multiple endpoints within the network, whereas typically fewer OLTs are required.

As broadband services expand and the push towards more efficient and higher-capacity networks grows, the importance of ONTs within the GPON ecosystem is expected to remain strong, supported by continuous innovations and upgrades in network technology.

By Application Analysis

In 2023, FTTH (Fiber to the Home) held a dominant market position in the By Application segment of the GPON Technology Market, capturing more than a 64.8% share. This significant market presence is primarily driven by the global surge in demand for higher bandwidth and faster internet services directly delivered to residential units. The superior network performance and reliability of FTTH, which offers end-users unprecedented download and upload speeds, greatly contributed to its widespread adoption.

On the other hand, Other FTTx applications, which include Fiber to the Premises (FTTP), Fiber to the Building (FTTB), and Fiber to the Curb (FTTC), collectively held a smaller portion of the market. These technologies, while important, typically cater to less dense or commercial environments and do not offer the direct-to-home connectivity that FTTH provides.

As urbanization continues and the demand for connected devices and smart home applications escalates, FTTH is expected to maintain its dominance. This is supported by governmental initiatives and investments in infrastructure upgrades, aiming to ensure vast and reliable high-speed internet access.

Key Market Segments

By Technology

- 2.5G PON

- XG-PON

By Component

- Optical Network Terminal

- Optical Line Terminal

By Application

- FTTH

- Other FTTx

Drivers

Drivers of GPON Technology Growth

The GPON (Gigabit Passive Optical Network) technology market is expanding primarily due to the escalating demand for high-speed broadband services globally. This growth is spurred by increasing internet penetration and the surge in data traffic due to digital transformation in various sectors such as education, healthcare, and entertainment.

Additionally, the deployment of GPON helps reduce the capital and operational expenses for network providers by allowing multiple users to share the same connection without degrading the quality of service. Governments are also promoting the adoption of fiber-optic networks, further boosting market growth.

Moreover, the shift towards smart homes and cities, which rely heavily on stable and fast internet connectivity, is pushing the demand for advanced GPON solutions, making it a crucial technology in today’s digital age.

Restraint

Barriers to GPON Market Expansion

Despite the rapid growth of the GPON technology market, several challenges hinder its broader adoption. The primary restraint is the high initial cost of deploying fiber-optic infrastructure, particularly in rural and undeveloped regions where the return on investment is uncertain and slow.

Additionally, the existing network infrastructure in many areas is based on older technologies like copper lines, making the transition to fiber optics both costly and complex. Technological limitations and compatibility issues with existing systems also pose significant barriers, requiring substantial upgrades and investments.

Furthermore, the competitive pressure from alternative technologies, such as 5G wireless networks, which offer high-speed internet without the need for extensive cabling, continues to challenge the dominance of GPON solutions in the broadband market.

Opportunities

Expanding Opportunities in the GPON Market

The GPON technology market is poised for substantial growth, driven by several emerging opportunities. One significant opportunity lies in the ongoing global push for smart city projects, where GPON can provide the backbone for ultra-fast and reliable internet services essential for smart infrastructure.

Additionally, the increasing consumer demand for high-definition content and real-time streaming services necessitates robust broadband solutions that GPON technology can offer. Another growth area is the integration of GPON with emerging technologies like the Internet of Things (IoT), which requires high-speed data transfer rates to function efficiently.

The expansion of telecommunication infrastructure in developing countries also presents a vast opportunity for GPON deployment, as these regions seek to improve internet accessibility and network reliability, fostering greater market penetration and adoption.

Challenges

Challenges Facing GPON Technology

The GPON technology market faces significant challenges that could impede its growth. A major hurdle is the complexity of upgrading from existing network infrastructures to advanced fiber optics, which can be both time-consuming and expensive, particularly for established service providers with extensive legacy systems.

Additionally, the skilled workforce required to deploy and maintain these advanced networks is often scarce, leading to delays and increased costs. Regulatory hurdles and compliance issues in different regions also pose challenges, as they can restrict the deployment of new infrastructure or complicate the operational processes.

Moreover, the rise of competing technologies such as 5G, which offers comparable speeds without the need for extensive cabling, threatens GPON’s market share, challenging providers to innovate and differentiate their offerings to stay competitive.

Growth Factors

- Surging Demand for High-Speed Internet: The increasing need for faster internet speeds due to video streaming, online gaming, and high data consumption is driving demand for GPON technology.

- Government Initiatives: Various government policies promoting digital infrastructure, including investments in broadband networks and mandates for high-speed internet availability, are accelerating GPON deployment.

- Cost-Effective Network Solutions: GPON offers cost-efficiency in both deployment and maintenance compared to traditional network solutions, appealing to service providers aiming to reduce operational costs.

- Fiber to the Home (FTTH) Expansion: The expansion of FTTH connections driven by consumer demand for high-speed home internet is boosting the installation of GPON systems.

- Technological Advancements: Continuous improvements in optical network technologies that increase bandwidth and enhance connectivity reliability are propelling the adoption of GPON.

- Growing Telecommunication Infrastructure: As emerging markets develop their telecommunication infrastructure, there is increased adoption of GPON to support the expansion and modernization of network capabilities.

Emerging Trends

- Increased Fiber Rollouts: Governments and private companies are accelerating fiber optic rollouts to improve internet speeds and connectivity, promoting broader adoption of GPON technologies in new and underserved markets.

- Integration with Smart Home Devices: GPON is increasingly integrated with smart home systems, providing the high-speed backbone necessary for the seamless operation of smart devices, and enhancing home automation and energy management.

- Advancements in Fiber Technology: New developments in fiber optic technology are increasing the capacity and efficiency of GPON networks, allowing for faster speeds and more reliable connections over longer distances.

- Rise of 5G Integration: As 5G networks expand, GPON is being used to backhaul 5G traffic, ensuring robust and high-capacity links between 5G cells and core networks, facilitating faster rollout and enhanced service quality.

- Green Energy Solutions: There’s a growing trend to couple GPON deployments with green energy practices, utilizing renewable energy sources to power network equipment and reduce the carbon footprint of telecommunications infrastructure.

- Enhanced Security Features: Security enhancements in GPON equipment are becoming critical as reliance on digital communications increases. Providers are improving encryption and adding advanced security features to protect data integrity and privacy.

Regional Analysis

The GPON technology market exhibits varied levels of penetration and growth dynamics across different global regions. In North America, the market is characterized by advanced telecommunications infrastructure and high consumer demand for broadband services, contributing to steady growth. Europe follows a similar trajectory, with extensive government support for digital infrastructure driving the adoption of GPON technologies.

Asia Pacific stands out as the dominating region in the GPON market, holding a significant market share of 38.5% and generating revenues of USD 2.8 billion. This robust growth is fueled by rapid urbanization, the digital transformation of economies, and large-scale deployments of fiber optic networks to meet the increasing demand for high-speed internet in both urban and rural areas.

Meanwhile, the Middle East & Africa region is witnessing growing investments in network infrastructure by governments aiming to enhance digital connectivity, which is propelling the adoption of GPON technologies. Latin America, although slower in adoption due to economic constraints, shows potential for growth with ongoing projects to improve internet accessibility and network reliability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global GPON technology market continues to be dominated by key players such as Huawei, Cisco, ZTE, and Nokia, each playing a pivotal role in shaping the industry landscape.

Huawei remains a leader in the GPON market, known for its robust product offerings and extensive geographical reach. Despite facing regulatory challenges in various markets, Huawei’s continuous innovation in GPON technology and strong relationships with large network operators worldwide sustain its competitive edge.

Cisco, with its focus on North America and Europe, leverages its broad portfolio of networking equipment to integrate GPON technologies within its existing systems. Cisco’s strategy emphasizes security and high-end performance, catering to premium market segments that demand reliability and advanced features in their network infrastructures.

ZTE, another significant player, focuses on cost-effective solutions that appeal to developing regions looking to upgrade their digital infrastructure. ZTE’s aggressive pricing strategy and flexible solutions make it a preferred choice in Asia and Africa, driving its expansion in these rapidly growing markets.

Nokia capitalizes on its reputation for quality and reliability, continuously innovating in the space to offer state-of-the-art GPON solutions. Nokia’s commitment to research and development positions it as a go-to provider for advanced network technologies, particularly in European and North American markets where technological leadership is crucial.

Top Key Players in the Market

- Huawei

- Cisco

- ZTE

- Nokia

- DASAM Zhone Solutions

- FiberHome

- Broadcom, Inc.

- Allied Telesis, Inc.

- Iskratel

- NXP Semiconductors N.V.

- Verizon Communications, Inc

Recent Developments

- In September 2023, Allied Telesis, Inc. secured funding to develop advanced GPON solutions, aiming to improve connectivity in underserved areas. This initiative highlights their commitment to expanding global access to high-speed internet.

- In August 2023, Broadcom, Inc. announced a strategic partnership with a major telecom operator to supply next-generation GPON chips. This deal is expected to generate significant revenues and expand their market presence.

- In July 2023, FiberHome launched a new series of GPON products aimed at enhancing network efficiency. These solutions are designed to support the growing demand for faster and more reliable internet services.

Report Scope

Report Features Description Market Value (2023) USD 7.4 Billion Forecast Revenue (2033) USD 13.6 Billion CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology(2.5G PON, XG-PON), By Component(Optical Network Terminal, Optical Line Terminal), By Application(FTTH, Other FTTx) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huawei, Cisco, ZTE, Nokia, DASAM Zhone Solutions, FiberHome, Broadcom, Inc., Allied Telesis, Inc., Iskratel, NXP Semiconductors N.V., Verizon Communications, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is GPON Technology?GPON (Gigabit Passive Optical Network) technology is a point-to-multipoint access mechanism. It utilizes passive splitters in the fiber distribution network, enabling one single feeding fiber from the provider's central office to serve multiple homes and small businesses.

How big is GPON Technology Market?The Global GPON Technology Market size is expected to be worth around USD 13.6 Billion By 2033, from USD 7.4 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the GPON Technology Market?The GPON technology market is thriving due to increasing demand for high-speed broadband globally, driven by digital transformation, cost efficiency for network providers, government support, and the shift towards smart homes and cities.

What are the emerging trends and advancements in the GPON Technology Market?The GPON market is growing due to accelerated fiber rollouts, integration with smart homes, technological advancements in fiber, 5G integration, green energy solutions, and enhanced security features to support digital communication.

What are the major challenges and opportunities in the GPON Technology Market?The GPON market's growth is driven by smart city initiatives, increasing demand for streaming, and IoT integration, but faces challenges from infrastructure upgrades, skilled labor shortages, regulatory hurdles, and competition from 5G technologies.

Who are the leading players in the GPON Technology Market?Huawei, Cisco, ZTE, Nokia, DASAM Zhone Solutions, FiberHome, Broadcom, Inc., Allied Telesis, Inc., Iskratel, NXP Semiconductors N.V., Verizon Communications, Inc.

-

-

- Huawei

- Cisco

- ZTE

- Nokia

- DASAM Zhone Solutions

- FiberHome

- Broadcom, Inc.

- Allied Telesis, Inc.

- Iskratel

- NXP Semiconductors N.V.

- Verizon Communications, Inc