Global Gold Plating Chemicals Market Size, Share, And Industry Analysis Report By Type (Electrolyte Solutions, Additives Acids, Pre-Treaters, Cleaning Chemicals), By Chemicals (Potassium Gold Cyanide, EDTA, Succinic Acid, Sodium Succinate, Palladium Acetate), By Application (Electronics, Gold Plating Products, Infrared, Reflectors and Radars, Jewelry, Connectors, Printed Circuit Board), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173480

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

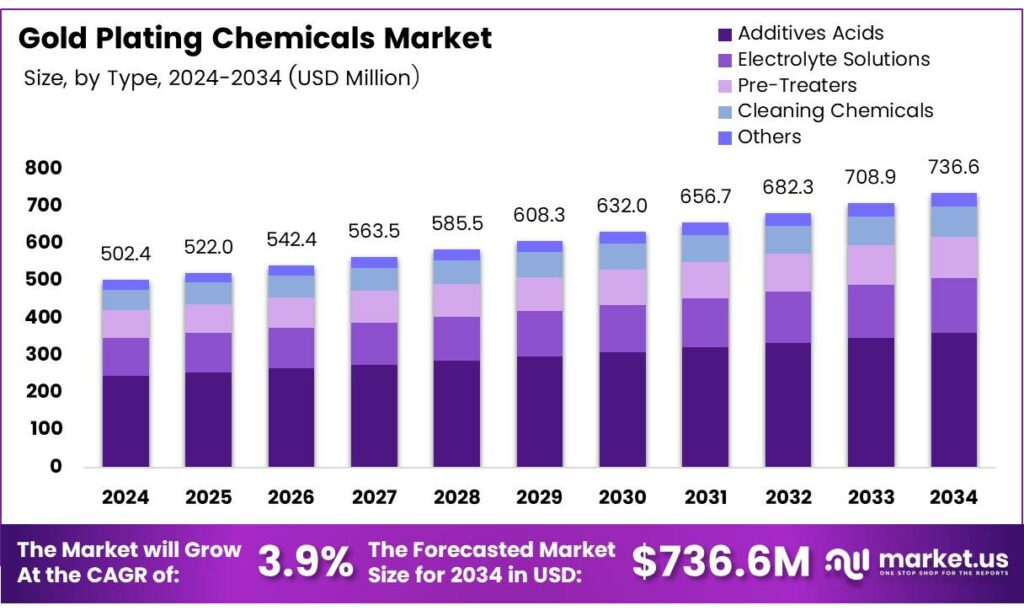

The Global Gold Plating Chemicals Market size is expected to be worth around USD 736.6 million by 2034, from USD 502.4 million in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

The Gold Plating Chemicals Market represents the specialized chemical ecosystem supporting surface finishing for electronics, industrial coatings, and decorative applications. Broadly, it includes gold salts, electrolytes, complexing agents, brighteners, and process additives. These chemicals enable controlled deposition, corrosion resistance, and electrical conductivity across high-value manufacturing segments.

Gold plating chemicals are strategically important because gold offers stable conductivity and oxidation resistance. Consequently, electronics manufacturing relies on these formulations for reliable signal transmission and long service life. Moreover, controlled chemistry allows consistent deposition quality, which is critical for high-precision industrial coatings and microelectronic components.

- The high price of gold remains a structural constraint. Applications prioritize performance-critical uses rather than mass adoption. Decorative plating typically uses thin layers of 0.05–0.1 μm, while industrial applications require thicker coatings in the 0.5–10 μm range, according to the ASM International Surface Finishing Guidelines, balancing cost and durability.

Electrochemical systems influence broader plating chemistry development. Silver electroplating commonly uses a 99.9% silver anode with an electrolyte based on [Ag(CN)₂]⁻, as documented by the International Electroplaters and Finishers Society. Importantly, silver must not directly contact steel, since severe corrosion can occur.

Electronics miniaturization and semiconductor packaging. Therefore, demand rises as electronic contacts and semiconductor devices increasingly use gold–silicon low-temperature eutectic bonding. This eutectic behavior enables efficient joining at reduced thermal stress, supporting advanced industrial coatings and microelectronics manufacturing. Innovation opportunities also extend into nanotechnology-enabled coatings.

Key Takeaways

- The Global Gold Plating Chemicals Market is projected to grow from USD 502.4 million in 2024 to USD 736.6 million by 2034, registering a CAGR of 3.9%.

- Electrolyte Solutions dominated the By Type segment with a market share of 49.7%, driven by stable performance and wide industrial acceptance.

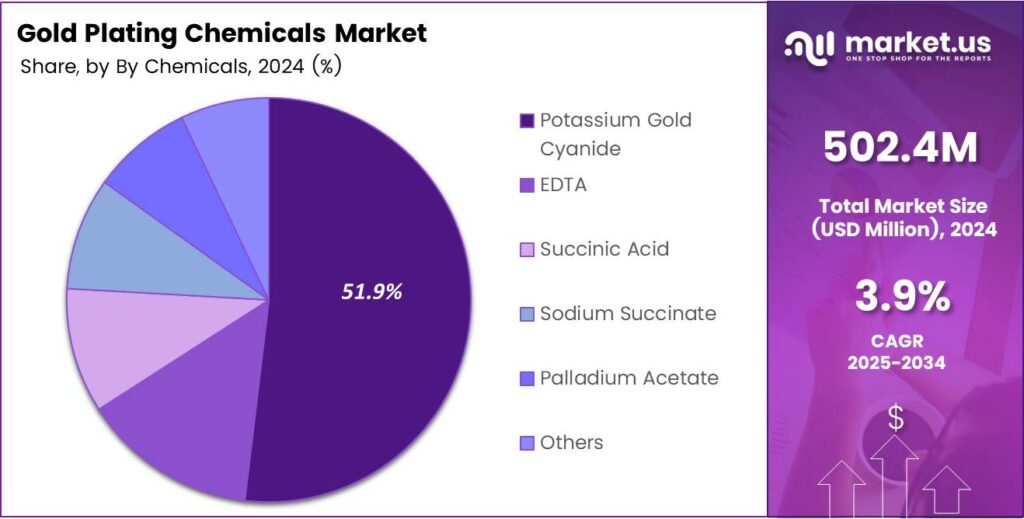

- Potassium Gold Cyanide led the By Chemicals segment, accounting for a dominant share of 51.9% due to high purity and plating efficiency.

- Electronics emerged as the largest application segment, holding a market share of 44.8%, supported by rising demand for reliable conductive coatings.

- Decorative gold plating applications typically use thin layers of 0.05–0.1 μm, while industrial applications require thicker coatings ranging from 0.5–10 μm.

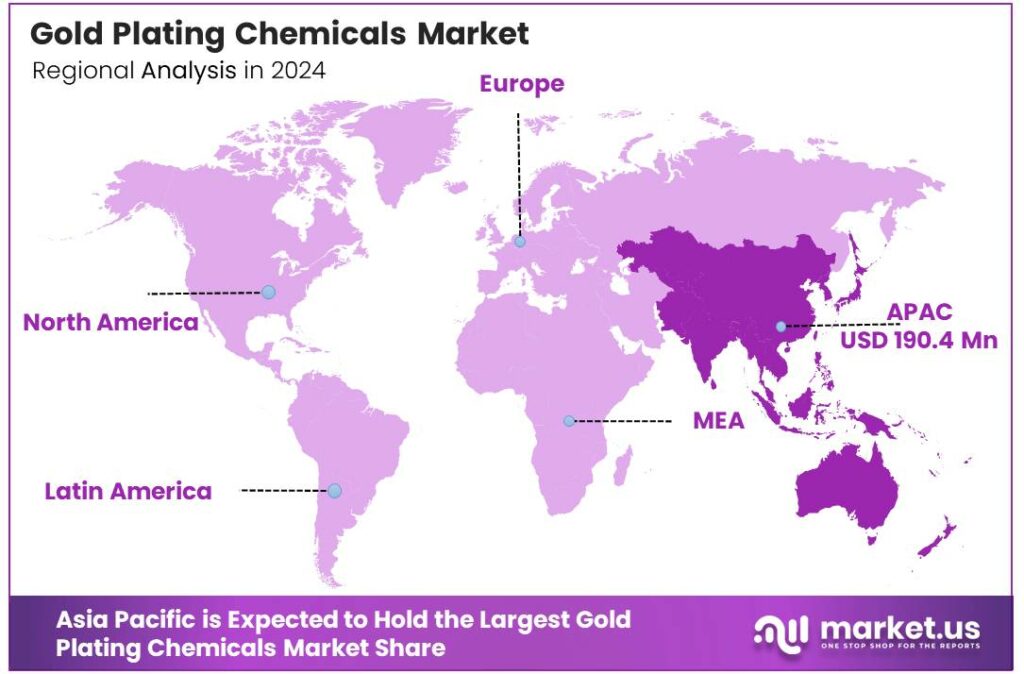

- Asia Pacific was the leading regional market, capturing a share of 37.9% and valued at USD 190.4 million in 2024.

By Type Analysis

Electrolyte Solutions dominates with 49.7% due to its stable performance and wide industrial acceptance.

In 2024, Electrolyte Solutions held a dominant market position in the By Type Analysis segment of the Gold Plating Chemicals Market, with a 49.7% share. This dominance is supported by consistent plating quality, reliable conductivity control, and smoother gold deposition across electronics and decorative applications.

Additives Acids play a supporting yet essential role by improving bath stability and surface finish. They help control grain structure and brightness, allowing manufacturers to fine-tune coating properties for precision electronics and high-value decorative gold plating needs.

Pre-Treaters are increasingly used to prepare metal surfaces before plating. They enhance adhesion by removing oxides and contaminants, thereby reducing defects. As quality standards rise, their role becomes more important in high-reliability industrial plating operations.

Cleaning Chemicals ensure contamination-free substrates before gold application. Their demand remains steady as manufacturers prioritize defect reduction and consistent layer thickness, especially in electronics and connector-based applications where surface purity is critical.

By Chemical Analysis

Potassium Gold Cyanide dominates with 51.9% due to its high purity and plating efficiency.

In 2024, Potassium Gold Cyanide held a dominant market position in the By Chemicals Analysis segment of the Gold Plating Chemicals Market, with a 51.9% share. Its dominance comes from superior conductivity, consistent gold deposition, and strong acceptance in electronics and precision plating applications.

EDTA functions as a chelating agent that stabilizes plating baths. It helps control metal ion activity, improving bath life and operational efficiency, especially in complex industrial plating systems requiring consistent chemical balance. Succinic Acid supports buffering and pH control within plating formulations.

Its usage improves bath stability and surface smoothness, making it suitable for applications where controlled deposition and finish uniformity are required. Sodium Succinate is commonly used to enhance solution stability and improve coating consistency. It assists in achieving uniform thickness, especially in sensitive components used across electronics and connector manufacturing.

By Application Analysis

Electronics dominates with 44.8% driven by rising demand for reliable conductive coatings.

In 2024, Electronics held a dominant market position in the By Application Analysis segment of the Gold Plating Chemicals Market, with a 44.8% share. Growth is supported by increasing use of gold plating in semiconductors, connectors, and high-reliability electronic components.

Gold Plating Products include decorative and functional coatings used across consumer and industrial goods. These applications rely on gold’s corrosion resistance and aesthetic appeal, supporting steady demand across multiple end-use industries.

Infrared reflectors and Radars benefit from gold’s reflective and conductive properties. These applications require precise coatings, making gold plating chemicals critical for performance-sensitive optical and defense-related systems. Jewelry remains a consistent application, driven by visual appeal and tarnish resistance.

Although thickness levels are lower, chemical quality remains important to achieve a uniform finish and durability. Connectors, Printed Circuit Board, and Others rely on gold plating for conductivity and longevity. These segments support long-term demand through industrial electronics and infrastructure applications.

Key Market Segments

By Type

- Electrolyte Solutions

- Additives Acids

- Pre-Treaters

- Cleaning Chemicals

- Others

By Chemicals

- Potassium Gold Cyanide

- EDTA

- Succinic Acid

- Sodium Succinate

- Palladium Acetate

- Others

By Application

- Electronics

- Gold Plating Products

- Infrared

- Reflectors and Radars

- Jewelry

- Connectors

- Printed Circuit Board

- Others

Emerging Trends

Shift Toward Sustainable and Precision Plating Shapes Market Trends

One major trend in the gold plating chemicals market is the focus on sustainability. Manufacturers are developing low-toxicity and recyclable chemical systems to reduce environmental impact. This helps plating companies comply with stricter regulations while maintaining production efficiency.

- The Government of India’s Electronics Component Manufacturing Scheme recently approved projects worth about $4.64 billion aimed at strengthening domestic electronics production, including mobile device components that rely on gold-plated connectors and subassemblies.

Precision plating is another growing trend. Industries are moving toward thinner and more controlled gold layers to reduce material waste. Advanced bath chemistry and automation support consistent coating thickness, especially in electronics and micro-components. Digital monitoring of plating baths is gaining popularity. Sensors and software help track chemical balance in real time, reducing defects and downtime.

Drivers

Rising Electronics Manufacturing Drives Gold Plating Chemicals Demand

The gold plating chemicals market is strongly driven by growing electronics manufacturing across consumer, industrial, and automotive segments. Gold plating is widely used in connectors, switches, and printed circuit boards because it offers stable conductivity and strong corrosion resistance. As devices become smaller and more complex, reliable surface finishes are becoming more important.

- The expansion of semiconductor fabrication has increased the need for controlled and high-purity plating chemicals. Gold is often used in bonding wires and contact points where performance cannot be compromised. A big trigger is Europe’s proposed restriction covering around 10,000 PFAS substances, which has pushed many formulators to replace PFAS-based mist suppressants and wetting agents used in electroplating tanks.

Even thin gold layers improve product life, which makes the process cost-effective despite higher material prices. Demand from decorative and luxury applications. Jewelry, watches, and premium accessories continue to use gold plating for visual appeal and surface protection.

Restraints

High Gold Prices Limit Wider Adoption of Plating Chemicals

The biggest restraint for the gold plating chemicals market is the high and volatile price of gold. Since gold is the core raw material, fluctuations directly affect production costs. Many small manufacturers hesitate to adopt gold plating due to tight margins, especially in price-sensitive industries.

Environmental and safety regulations also restrict market growth. Gold plating processes often involve hazardous chemicals such as cyanide-based compounds. Handling, storage, and waste treatment increase compliance costs for plating facilities. Smaller workshops struggle to meet these standards, limiting expansion.

Alternative surface treatments are gaining attention. Palladium, nickel, and other alloy coatings are sometimes used as substitutes where full gold performance is not essential. These alternatives reduce dependency on gold-based chemicals in certain applications.

Growth Factors

Advanced Electronics Creates New Opportunities for Gold Plating Chemicals

Growth opportunities in the gold plating chemicals market are closely linked to advanced electronics and digital infrastructure. Rising investment in data centers, 5G equipment, and high-speed communication devices is increasing demand for reliable electrical contacts. Gold plating remains a preferred choice in these systems.

Medical electronics also present strong opportunities. Implantable devices, diagnostic sensors, and surgical tools use gold-plated components due to their biocompatibility and corrosion resistance. As healthcare technology adoption rises, chemical suppliers can benefit from specialized formulations.

Another opportunity lies in process optimization and chemical innovation. Low-gold-content baths and improved additives help reduce overall gold consumption without affecting quality. These solutions attract cost-conscious manufacturers and improve market accessibility.

Regional Analysis

Asia Pacific Dominates the Gold Plating Chemicals Market with a Market Share of 37.9%, Valued at USD 190.4 Million

Asia Pacific leads the Gold Plating Chemicals Market, holding a dominant share of 37.9%, with the market valued at USD 190.4 million. This dominance is supported by strong electronics manufacturing, rising semiconductor fabrication, and increasing use of gold plating in connectors and printed circuit boards. Rapid industrialization and export-oriented manufacturing further sustain regional demand.

North America shows stable growth driven by advanced electronics, aerospace components, and high-reliability industrial coatings. Demand remains consistent due to strict quality standards and technological upgrades in surface finishing processes. The region also benefits from ongoing investments in semiconductor manufacturing and defense electronics.

Europe’s market is supported by precision engineering, automotive electronics, and luxury decorative applications. Strong environmental regulations influence the adoption of safer and optimized gold plating formulations. The region emphasizes sustainable chemical usage while maintaining high plating performance. Growth remains steady due to innovation-driven manufacturing and demand for long-lasting corrosion-resistant coatings.

The Middle East and Africa market is gradually expanding with increasing industrial activity and infrastructure development. Gold plating chemicals find applications in electronics imports, jewelry manufacturing, and specialized industrial components. Growing awareness of advanced surface treatment technologies supports market adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Umicor is well-positioned in gold plating chemicals because it understands how electronics and industrial users balance performance with metal cost. Its strength is in offering process consistency and technical support that help customers reduce rejects, stabilize bath life, and maintain tight thickness control in high-value applications.

Technic stands out for its practical, application-led approach to plating chemistry, especially for electronics and connector finishing. The company’s edge comes from helping manufacturers run reliable, repeatable lines through tailored bath formulations, additive control strategies, and on-site troubleshooting that improve throughput without compromising deposit quality.

SAXONIA Edelmetalle GmbH benefits from its precious-metal focus, which fits naturally with gold chemistry supply and closed-loop value recovery. It is typically viewed as a steady partner for customers who want secure sourcing, strong quality discipline, and support in managing precious-metal inventories alongside chemical performance targets.

METALOR remains relevant as customers push for both premium surface results and tighter control of precious-metal consumption. Its market positioning is supported by its ability to align plating solutions with customer cost goals, including guidance on bath maintenance and metal management to keep decorative and functional plating outcomes stable over long production runs.

Top Key Players in the Market

- Umicor

- Technic

- SAXONIA Edelmetalle GmbH

- METALOR

- Matsuda Sangyo

- LEGOR GROUP S.p.A.

- Johnson Matthey

- Japan Pure Chemical Co.

- Heimerle Meule

- American Elements

Recent Developments

- In 2025, Umicore introduced several innovations in gold plating electrolytes focused on sustainability and performance. They launched AURUNA 3408, a nearly pure hard gold electrolyte free of hazardous substances, enabling responsible gold plating. The company developed AURUNA gold-iron alloys, providing cobalt- and nickel-free hard gold plating for high-quality finishes.

- In 2025, Technic has advanced its gold plating solutions, particularly for semiconductor and decorative applications. The company offers Elevate Gold 7990, a cyanide-free sulfite gold process for semiconductor wafer plating. They also provide cyanide-based options like Elevate Gold 7934 for functional performance in wire bonding.

Report Scope

Report Features Description Market Value (2024) USD 502.4 million Forecast Revenue (2034) USD 736.6 million CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electrolyte Solutions, Additives, Acids, Pre-Treaters, Cleaning Chemicals, Others), By Chemicals (Potassium Gold Cyanide, EDTA, Succinic Acid, Sodium Succinate, Palladium Acetate, Others), By Application (Electronics, Gold Plating Products, Infrared, Reflectors and Radars, Jewelry, Connectors, Printed Circuit Board, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Umicor, Technic, SAXONIA Edelmetalle GmbH, METALOR, Matsuda Sangyo, LEGOR GROUP S.p.A., Johnson Matthey, Japan Pure Chemical Co., Heimerle Meule, American Elements Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Gold Plating Chemicals MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Gold Plating Chemicals MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Umicor

- Technic

- SAXONIA Edelmetalle GmbH

- METALOR

- Matsuda Sangyo

- LEGOR GROUP S.p.A.

- Johnson Matthey

- Japan Pure Chemical Co.

- Heimerle Meule

- American Elements