Global Glycol Market By Product (Ethylene Glycol and Propylene Glycol), By Application (Automotive, HVAC, Textiles, Airlines, Medical, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 42737

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

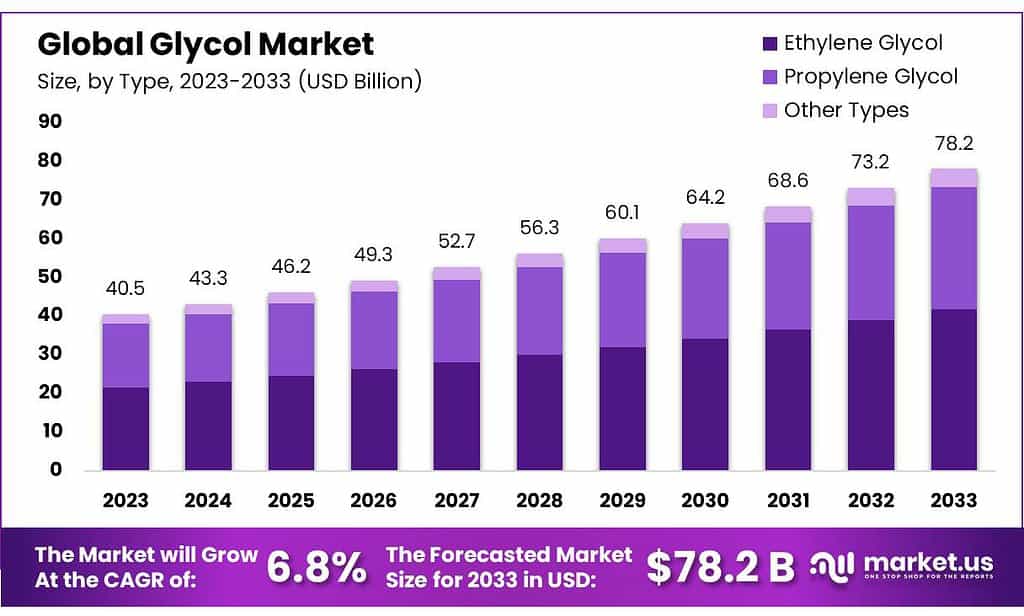

The Glycol Market size is expected to be worth around USD 78.2 billion by 2033, from USD 40.5 Bn in 2023, growing at a CAGR of 6.8% during the forecast period from 2023 to 2033.

There are many uses for glycol derivatives in the following sectors: transportation & automotive; heating; food and beverage processing; ventilation, and air conditioning; and polyester fibers. Due to recovering manufacturing activities, the market has seen a recent rebound in its economic outlook. This has had a positive influence on its growth.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth Projection: The Glycol Market is expected to reach approximately USD 78.2 billion by 2033, showing a substantial growth projection from USD 40.5 billion in 2023, with a CAGR of 6.8% during the forecast period.

- Dominant Glycol Types: Ethylene Glycol held a dominant market share of over 53.4% in 2023 due to its versatile use in crucial industries like textiles and packaging, notably in producing polyester fibers and PET resins.

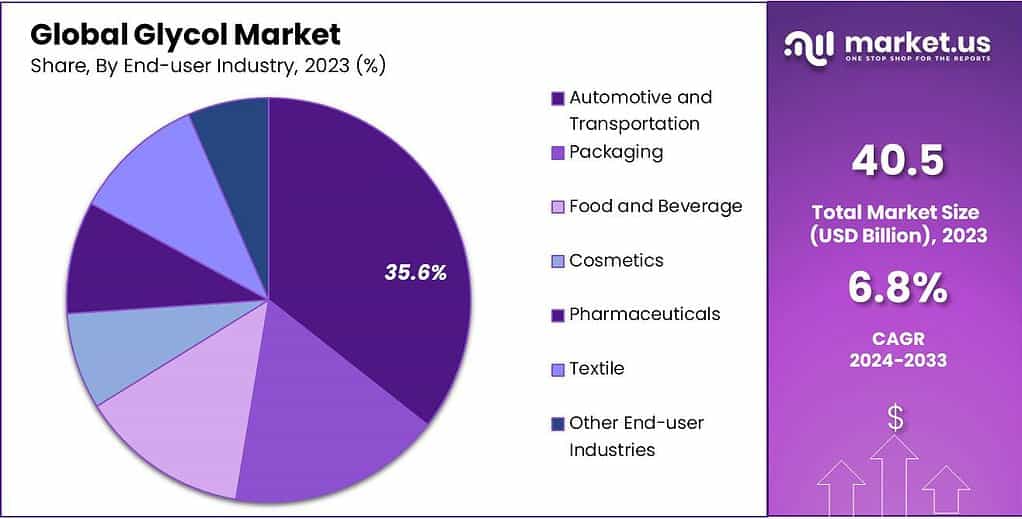

- Applications Across Industries: Glycols, especially Ethylene Glycol, are extensively used in automotive sectors (35.6% market share in 2023) primarily as antifreeze agents to ensure optimal engine performance.

- Factors Driving Market Growth: The resurgence of manufacturing activities post-pandemic and the textile industry’s reliance on glycols, particularly Ethylene Glycol, have been pivotal growth drivers.

- Challenges Faced: Health concerns linked to glycol consumption pose challenges; regulatory limitations exist due to potential health risks. Raw material price fluctuations, environmental regulations, and sector-specific dependencies also impact market stability.

- Opportunities: The automotive industry’s escalating reliance on glycols, especially Ethylene Glycol, presents a significant growth opportunity due to its indispensable properties in engine optimization and temperature management.

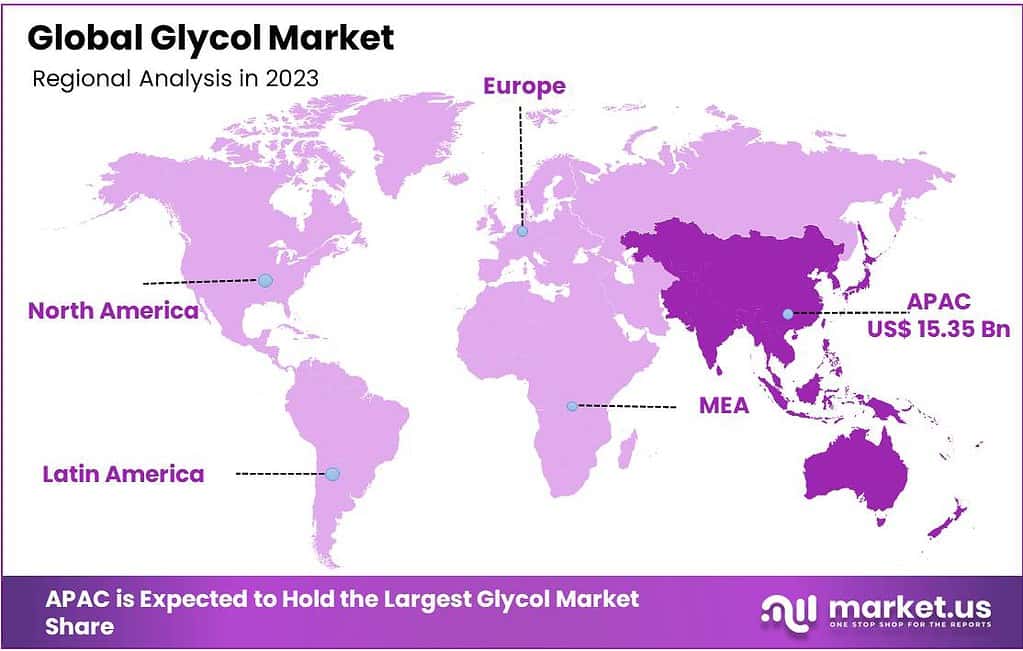

- Regional Market Dynamics: Asia Pacific (APAC) led in revenue share (over 37.9% in 2023), with India and China being dominant consumers and production hubs, showcasing significant growth potential.

- Competitive Landscape: Key players include DowDuPont, Shell PLC, BASF, Sinopec, among others, investing in research to enhance product specifications and competitiveness.

Type Analysis

In 2023, the glycol market was largely influenced by Ethylene Glycol, securing a dominant position with a share exceeding 53.4%. This type of glycol held sway due to its multi-faceted utility across industries.

Ethylene Glycol’s prevalence was notably attributed to its widespread use in various applications, particularly as an essential component in the production of polyester fibers and polyethylene terephthalate (PET) resins, pivotal materials in the textile and packaging industries.

According to the product, the market segments were propylene (1.2-propanediol) and ethylene (1.2-ethanediol). These products are used in a wide range of industries. The production of polyester compounds is dominated by propanediol.

Propylene glycol, which is low in toxicity, has been accepted by antifreeze agents. 1,2-propanediol is used in the antifreeze business. It is also used in the pharmaceutical, chemical, and food industries. It can also be used as a replacement for ethylene glycol. It can also be used to replace ethylene glycol in a 40-60:1 ratio with water.

Ethylene glycol is used extensively as an antifreeze. It also serves as a coolant and heat-transferring agent. It can lower fluid’s freezing point but also act as a reagent in producing polyesters and alkyd resins. Ethylene-based glycols can also be used as an additive in printing inks.

End-User Industry

In 2023, the Automotive and Transportation sector took the lead in the glycol market, holding a substantial share of over 35.6%. This industry segment drove the demand for glycols, particularly Ethylene Glycol, primarily for its use as an antifreeze agent in automotive coolants.

The need for glycols to prevent freezing and ensure optimal engine performance propelled this sector’s dominance within the glycol market.

The global GDP increased, as industrial activities improved in developed countries, while they also grew significantly in the developing world. Glycol manufacturers are optimistic about the future because of this development in the global economy.

Automotive will continue to grow at the fastest rate during the prediction period. Worldwide automotive production increased, and some European countries such as the Netherlands, Finland, and Portugal saw double-digit increases. Europe still holds a dominant position in glycol requests. As such, optimistic macro indicators should be used to optimize the industry’s growth estimate.

Actual Numbers Might Vary in the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Ethylene Glycol

- Monoethylene Glycol (MEG)

- Diethylene Glycol (DEG)

- Triethylene Glycol (TEG)

- Propylene Glycol

End-user Industry

- Automotive

- Auto Retail

- Auto Traditional

- Heavy-duty

- Specialty Applications

- HVAC

- Textiles

- Airlines

- Medical

- Pipeline Maintenance

- Polyester Fibers & Resins

- Food & Beverage

- Other Applications

Drivers

The textile industry’s growing reliance on glycols has been a significant driver in the glycol market. Glycols, especially ethylene glycol, are pivotal in producing essential textile materials like polyester fibers, cellophane, and leather.

Despite the setbacks faced during the COVID-19 pandemic, the textile sector witnessed a remarkable resurgence in 2021, buoyed by the global economic recovery. Countries like China, the European Union, and India emerged as key players, collectively accounting for a substantial market share, showcasing notable growth in textile production and exports.

India, in particular, showcased robust growth in its textile industry, witnessing a surge in exports and substantial investments post the pandemic outbreak. The government’s initiatives, such as proposing mega textile parks, aimed at boosting employment and enhancing India’s competitiveness in the global textile market, further spurred growth.

The textile and apparel sector in India showed substantial promise, contributing significantly to the country’s economy.

Government strategies like the Buy America Act waiver procedure designed to increase procurement transparency and support domestic textile production have given an additional boost to market growth.

This measure offers clearer business prospects for textile companies, creating an environment conducive to developing locally produced goods. When combined, these factors are predicted to spur substantial expansion in the glycol market as a result of the textile industry’s increasing demands and supportive government initiatives.

Restraints

The glycol market faces a notable impediment linked to health concerns arising from its usage. Excessive intake of glycol poses potential health risks, influencing the market’s growth rate negatively. Regulatory bodies like the WHO have established guidelines limiting daily glycol consumption as a food additive to ensure safety, setting the threshold at 25 mg/kg of body weight. These health-related challenges loom as significant restraints, potentially slowing down the market’s growth trajectory.

Mitigating these concerns and ensuring safe usage of glycols are pivotal for sustaining market momentum. Efforts toward educating consumers, adherence to established safety guidelines, and advancements in safer formulations could address these health-related apprehensions, potentially alleviating the restraints impeding the glycol market’s growth.

Finding a balance between meeting market demands and ensuring consumer safety remains a critical challenge for glycol manufacturers, necessitating a concerted focus on regulatory compliance and consumer well-being to navigate these constraints effectively.

Opportunities

The automotive industry’s escalating reliance on glycol, particularly ethylene glycol, presents a substantial opportunity for the global glycol market’s expansion. Ethylene glycol’s unique properties, including its lower freezing point compared to water, render it indispensable in automotive applications.

It acts as a safeguard for engines during winter, preventing freezing and ensuring optimal functionality. Moreover, as a coolant, ethylene glycol plays a pivotal role in averting overheating in summer, contributing to the engine’s efficient performance across diverse climates.

The utilization of ethylene glycol in automobiles to absorb combustion heat stands as a key factor driving the anticipated growth in the global glycol market. Its function in efficiently managing engine temperatures and preventing both freezing and overheating underscores its significance within the automotive sector. As automotive technology advances, the demand for glycols, particularly ethylene glycol, is expected to witness a substantial surge, further bolstering the glycol market’s expansion.

This growing demand in the automotive industry not only signifies the critical role of glycols in ensuring engine efficiency and performance but also presents a lucrative avenue for the glycol market’s substantial growth. As vehicles evolve and demand for high-performing engines rises, the necessity and usage of glycols, especially in automotive cooling systems, is poised to drive significant opportunities for market expansion and technological innovation within the glycol industry.

Challenges

Challenges within the glycol market encompass various facets that influence its trajectory. One significant hurdle revolves around health concerns associated with glycol consumption. Excessive intake poses potential health risks, leading to regulatory limitations on its usage as a food additive. These health-related apprehensions could impact consumer confidence and market acceptance, posing a challenge for manufacturers to address safety concerns effectively.

Raw material prices – which are vital in glycol production – remain an ever-present challenge. Fluctuations in crude oil prices have a direct effect on glycol production costs and can put pressure on market stability and profitability for manufacturers. Due to this price sensitivity, manufacturers need adaptive strategies in place to manage cost fluctuations while remaining competitive within their markets.

Environmental regulations and sustainability demands can present another difficulty for glycol manufacturers. Meeting those demands necessitating eco-friendly alternatives or lessening environmental impact requires investments in greener technologies and compliance measures that help ensure market viability while meeting environmental regulations and sustainability demands.

Also, glycol demand’s dependence on specific end-use industries like automotive and textile makes the market vulnerable to sector-specific fluctuations; economic downturns or shifts could significantly alter demand in these sectors – further underscoring its vulnerability to external forces.

Addressing these challenges demands a multifaceted approach involving innovation in production processes, adherence to stringent regulatory standards, investment in sustainable technologies, and diversification of market applications. Overcoming these hurdles effectively will be crucial for the sustained growth and resilience of the glycol market amidst evolving market dynamics and demands.

Geopolitical and Recession Impact Analysis

Geopolitical Impact on the Glycol Market

When countries have tensions or disagreements, they might put taxes or limits on the imports and exports of glycol. This can make it hard to get glycol, cost more, and mess up how it’s made and sent to places.

Changes in rules about how glycol should be made or labeled can happen when countries have big changes in their politics. This might mean companies have to change how they make glycol and follow new rules, which can be tricky.

If places, where glycol is needed, have problems like fights or issues, it can make it tough for companies to grow there. Also, if there are arguments about where to get the stuff needed to make glycol, it can cause problems in making it and being eco-friendly.

Recession Impact Analysis

When money gets tight during tough times, people might buy less glycol. Even though glycol is pretty important, folks might try to save money by using less of it. Because everyone’s trying to save money, they’ll pay more attention to how much glycol costs. Companies might need to rethink how much they charge to stay competitive.

When the economy isn’t doing well, it can mess up how things are made and sent out. If the companies that make glycol or send it to stores have money problems, it could slow down making and getting glycol. Also, when times are tough, people might care more about the environment. They might want glycol that’s good for the planet and makes less waste.

Regional Analysis

Europe and North America have always been the leaders in manufacturing technologies, and innovative approaches to building an industry ecosystem. But, the market has witnessed a major shift towards Asian markets. China has established itself as a regional but also a global manufacturing hub. Asia Pacific (APAC) had the largest revenue share at over 37.9% in 2023

India, China & Taiwan dominated the region’s production. India & China accounted for 85.0% of each of the region’s consumption. Their large consumer base & export-oriented production are characteristics that make them a strong contender.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

A surge in demand across many industries for glycols has created a high-level competition among players. Many glycol recovery firms have emerged in North America due to the high potential for growth in developing nations. Global markets are product-driven. Market players invest heavily in research and development to commercialize products with improved specifications.

Маrkеt Кеу Рlауеrѕ

- DowDuPont

- Shell PLC

- MEGlobal International FZE

- Indorama Ventures Public Company Limited

- Reliance Industries Limited

- PETRONAS Chemicals Group

- BASF

- Sinopec

- Royal Dutch Shell

- Lotte Chemical

- Ashland

- Cargill

- Univar

- AkzoNobel

- SABIC

- Huntsman

- Others

Recent Developments

In October 2022, Reliance Industries Limited’s Hazira Manufacturing Complex expansion and debottlenecking plan of INR 100 billion was recently approved by the Ministry of Environment, Forests, and Climate Change panel. RIL under Mukesh Ambani established HMD back in 1991-92 to manufacture MonoEthylene Glycol (MEG) and vinyl Chloride Monomer (VCM), among other chemicals plus utilities services.

Report Scope

Report Features Description Market Value (2023) USD 40.5 Bn Forecast Revenue (2033) USD 78.2 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Ethylene Glycol, Monoethylene Glycol (MEG), Diethylene Glycol (DEG), Triethylene Glycol (TEG), Propylene Glycol), End-user Industry(Automotive, Auto Retail, Auto Traditional, Heavy-duty, Specialty Applications, HVAC, Textiles, Airlines, Medical, Pipeline Maintenance, Polyester Fibers & Resins, Food & Beverage, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Shell PLC, MEGlobal International FZE, Indorama Ventures Public Company Limited, Reliance Industries Limited, PETRONAS Chemicals Group, DowDuPont, BASF, Sinopec, Royal Dutch Shell, Lotte Chemical, Ashland, Cargill, Univar, AkzoNobel, SABIC, Huntsman, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Glycols?Glycols are organic compounds characterized by their alcohol-like properties and the presence of hydroxyl groups. Common types include ethylene glycol (EG), propylene glycol (PG), and others used in various industries.=

What are the Key Uses of Glycols?Glycols have diverse applications. Ethylene glycol is primarily used in antifreeze solutions, polyester production, and as a coolant in various industries. Propylene glycol is utilized in food, pharmaceuticals, cosmetics, and as a coolant.

How are Glycols Produced?Glycols are typically produced through the hydration of corresponding epoxides or via chemical reactions involving different raw materials. Ethylene glycol is usually derived from ethylene, while propylene glycol is derived from propylene oxide.

-

-

- DowDuPont

- Shell PLC

- MEGlobal International FZE

- Indorama Ventures Public Company Limited

- Reliance Industries Limited

- PETRONAS Chemicals Group

- BASF

- Sinopec

- Royal Dutch Shell

- Lotte Chemical

- Ashland

- Cargill

- Univar

- AkzoNobel

- SABIC

- Huntsman

- Others