Global Waterborne UV Coating Systems Market Size, Share, And Enhanced Productivity By Product Type (Acrylic-based Coatings, Urethane-based Coatings, Polyester-based Coatings, Epoxy-based Coatings), By Technology (UV Radiation Curing, Electron Beam Curing, Hybrid Curing), By Application (Wood Coatings, Metal Coatings, Plastic Coatings, Glass Coatings), By End-use (Automotive, Furniture, Consumer Goods, Electronics, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177120

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

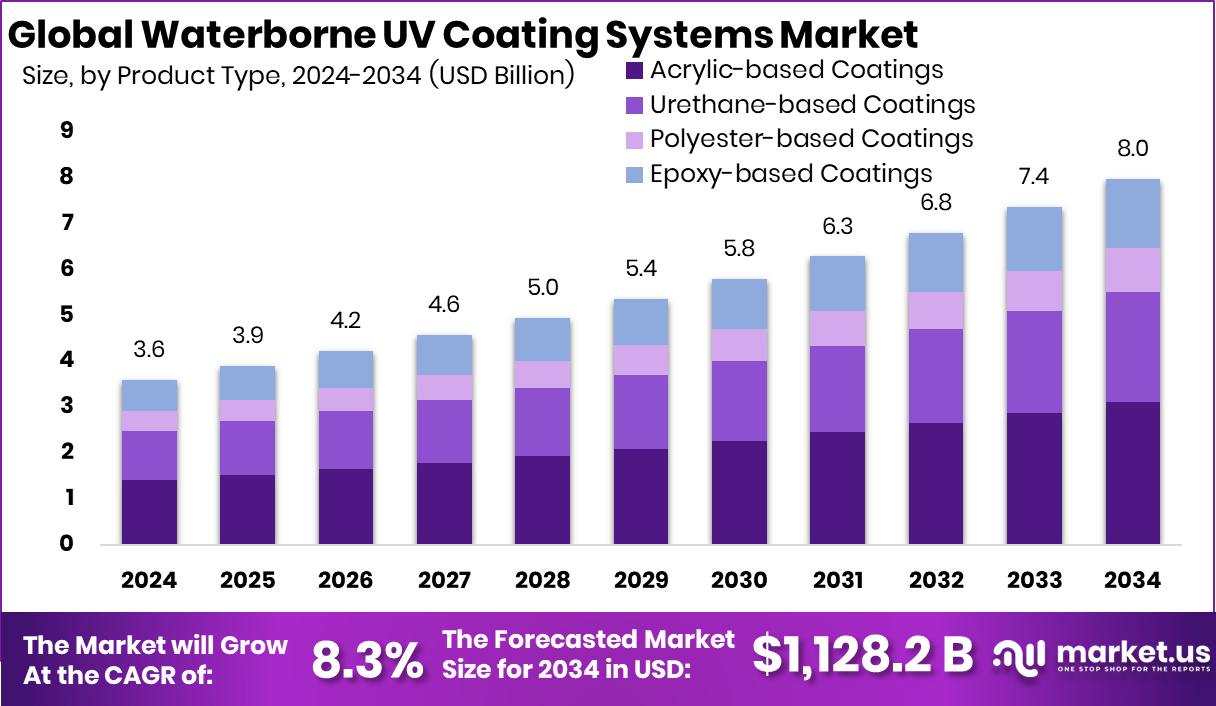

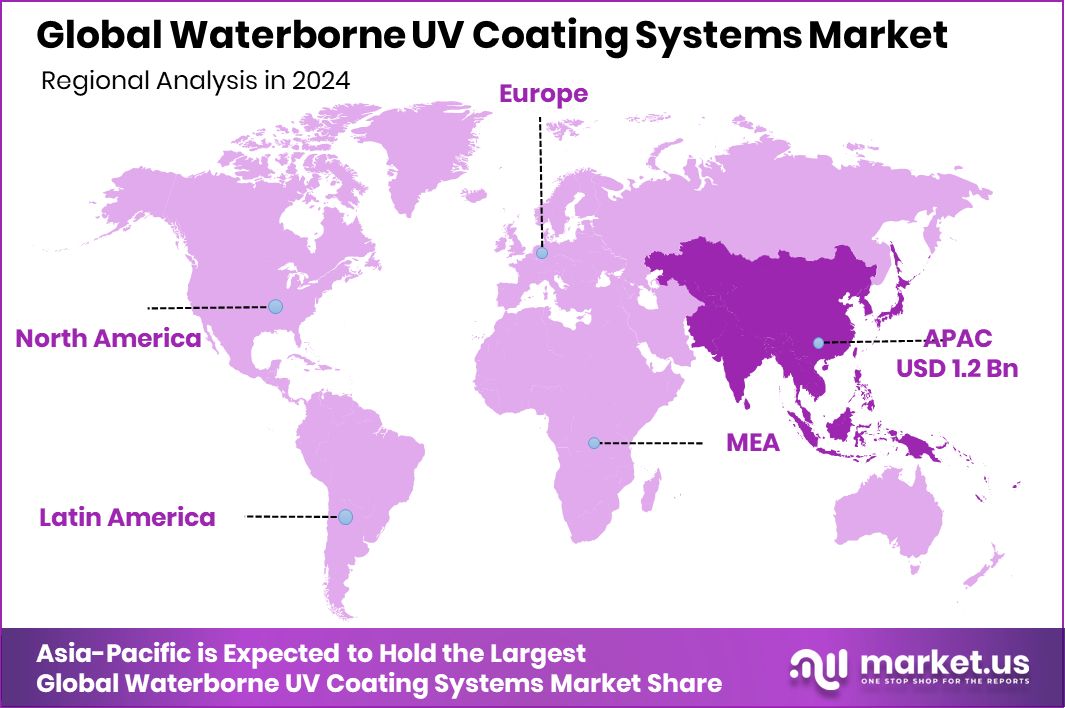

The Global Waterborne UV Coating Systems Market is expected to be worth around USD billion by 2034, up from USD 3.6 billion in 2024, and is projected to grow at a CAGR of 8.3% from 2025 to 2034. Waterborne UV coating systems thrive in the Asia Pacific with 34.8% and USD 1.2 billion.

Waterborne UV coating systems are fast-curing, low-emission coatings that combine water-based formulations with ultraviolet light to create durable finishes on wood, metal, plastics, glass, and consumer goods. These coatings offer strong surface protection, quick processing times, and reduced environmental impact, making them suitable for industries prioritizing clean production and high-quality finishes.

The Waterborne UV Coating Systems Market represents the global demand for these technologies across product types such as acrylic, urethane, polyester, and epoxy coatings, used through UV radiation curing, electron beam curing, and hybrid curing methods in applications that include automotive components, furniture, electronics, packaging, and everyday consumer goods.

Market growth is supported by technological progress and increasing interest in cleaner coating solutions. Recent funding activities, such as Ecoat securing €21 million to reinvent future paint technologies and Earthodic raising $6 million for bio-based coating breakthroughs, highlight expanding investment in sustainable coating materials. Demand continues to rise as industries adopt faster, more efficient curing systems to reduce emissions and improve production efficiency.

Additional opportunities emerge as climate initiatives gain attention, illustrated by Saie’s push toward $100 million in sales while launching its environmental program. Broader investment trends, such as Bessemer Venture Partners committing $1 billion to innovation, and localized support like a $500K grant for restoring the historic DeLand building, contribute to a landscape where cleaner, faster-curing coatings become increasingly valuable across global manufacturing and finishing operations.

Key Takeaways

- The Global Waterborne UV Coating Systems Market is expected to be worth around USD billion by 2034, up from USD 3.6 billion in 2024, and is projected to grow at a CAGR of 8.3% from 2025 to 2034.

- Waterborne UV Coating Systems Market sees acrylic-based coatings leading with a strong 39.1% global share.

- Waterborne UV Coating Systems Market growth accelerates as UV radiation curing dominates with an impressive 78.2% share.

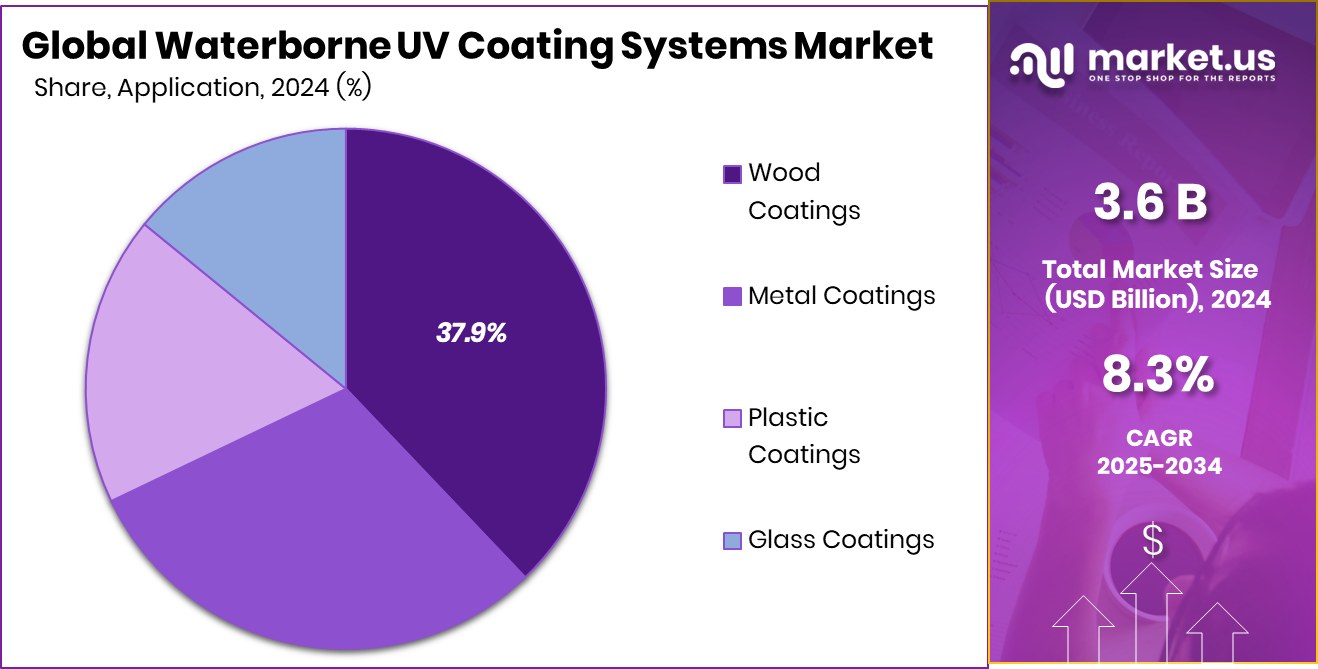

- Waterborne UV Coating Systems Market expands steadily, supported by wood coatings segment holding a notable 37.9% share.

- Waterborne UV Coating Systems Market benefits from rising furniture demand, driven by its influential 29.7% end-use share.

- In the Asia Pacific, market share hits 34.8%, supported by USD 1.2 billion in demand today.

By Product Type Analysis

Acrylic-based coatings held 39.1% within the Waterborne UV Coating Systems Market growth today.

In 2024, the Waterborne UV Coating Systems Market was strongly shaped by the dominance of acrylic-based coatings, which held a 39.1% share, reflecting their wide acceptance in surface finishing, industrial coatings, and consumer applications. These formulations gained traction for their clarity, durability, and compatibility with waterborne UV systems, especially as industries moved toward low-VOC and fast-curing solutions.

Manufacturers continued to adopt acrylic-based systems to meet performance needs in printing, packaging, flooring, and wood finishing, supporting consistent growth across regions. The rising shift toward sustainable formulations and the need for coatings that balance quality with regulatory compliance further strengthened the position of acrylic-based coatings, helping this category remain a central growth engine within the global market.

By Technology Analysis

UV radiation curing dominated 78.2% in the Waterborne UV Coating Systems Market performance.

In 2024, the Waterborne UV Coating Systems Market was heavily influenced by the dominance of UV radiation curing technology, accounting for a commanding 78.2% share. This technology continued to gain industry-wide preference due to ultra-fast curing, reduced energy use, and improved surface quality, offering manufacturers shorter production cycles and higher throughput. UV curing advanced rapidly as companies adopted automated coating lines for electronics, packaging, and wood finishing.

Its compatibility with low-emission waterborne formulations added further value as regulations tightened worldwide. The efficiency, durability, and environmental advantages of UV-curable systems positioned this segment as a cornerstone of technological progress, making it the most influential driver of performance and innovation within the global coating ecosystem.

By Application Analysis

Wood coatings captured 37.9%, supporting the Waterborne UV Coating Systems Market expansion recently.

In 2024, the Waterborne UV Coating Systems Market saw wood coatings maintain a strong foothold with a 37.9% share, driven by rising demand for high-performance finishes in furniture, flooring, cabinetry, and architectural interiors. Wood product manufacturers embraced waterborne UV coatings because they deliver excellent clarity, scratch resistance, and faster curing without compromising environmental standards. These systems also support consistent surface quality, making them suitable for decorative and protective functions across both residential and commercial wood applications.

With growing interest in premium wooden interiors and sustainable finishing materials, the wood coatings segment continued to expand, benefiting from construction activity, renovation trends, and the increasing preference for low-odor, durable, and energy-efficient coating solutions.

By End-use Analysis

Furniture applications reached 29.7%, driving the Waterborne UV Coating Systems Market demand forward.

In 2024, the Waterborne UV Coating Systems Market was reinforced by the strength of the furniture end-use segment, which held 29.7% of the market, reflecting the shift toward safer and environmentally conscious finishing materials. Furniture producers relied on waterborne UV coatings for their fast curing, reduced emissions, and ability to produce smooth, long-lasting finishes on wood and composite surfaces.

Growth in ready-to-assemble furniture, modular interior designs, and residential upgrades contributed to higher use of these coatings across global manufacturing hubs. As consumers increasingly favored sustainable home products, demand for coatings supporting low-VOC production and enhanced durability strengthened this end-use segment’s role, making it a significant contributor to overall market expansion across major regions.

Key Market Segments

By Product Type

- Acrylic-based Coatings

- Urethane-based Coatings

- Polyester-based Coatings

- Epoxy-based Coatings

By Technology

- UV Radiation Curing

- Electron Beam Curing

- Hybrid Curing

By Application

- Wood Coatings

- Metal Coatings

- Plastic Coatings

- Glass Coatings

By End-use

- Automotive

- Furniture

- Consumer Goods

- Electronics

- Packaging

- Others

Driving Factors

Rising demand for fast-curing, sustainable coatings

Rising demand for fast-curing sustainable coatings continues to strengthen the Waterborne UV Coating Systems Market as manufacturers and end-users prioritize cleaner, low-emission finishing materials. The need for shorter curing cycles and reduced energy use supports wider adoption in furniture, packaging, electronics, and automotive components. This momentum aligns with broader advances in coating technologies, highlighted by Anaphite raising £1.4 million to push dry-coating innovation into mass-market EV batteries, signaling increased investment in next-generation surface technologies. These developments indirectly reinforce the shift toward UV-curable waterborne systems, as industries look for reliable solutions that blend sustainability with production efficiency. Together, these factors create a strong outlook for fast-curing and environmentally responsible coatings.

Restraining Factors

High equipment costs slow technology adoption

High equipment costs remain a significant restraint for Waterborne UV Coating Systems, particularly for smaller manufacturers that require specialized curing units and controlled production lines. This financial barrier limits adoption speed, especially in regions where industrial upgrading happens gradually. Broader R&D funding trends also influence where investment flows, as shown when the U.S. Department of Energy announced $52 million for small business research grants, including $3.4 million for hydrogen and fuel-cell projects.

While these initiatives support innovation, they also highlight that national funding priorities often shift toward clean energy and advanced technologies rather than coating system upgrades. As a result, some industries delay transitioning to UV-curable waterborne solutions due to upfront financial demands.

Growth Opportunity

Growing interest in eco-friendly coating innovations

Growing interest in eco-friendly coating innovations creates strong opportunities for Waterborne UV Coating Systems, particularly as global industries emphasize reduced VOCs, cleaner curing methods, and improved workplace safety. This opportunity is supported by continued investment in material science, reflected in initiatives such as the DOE granting $28 million for R&D on ultra-high-temperature materials, which encourages advancements that may influence next-generation coating performance.

Additional momentum comes from startups pushing new surface technologies, as seen with Slips Technologies raising $9 million for coatings tech, demonstrating market enthusiasm for functional, sustainable coating solutions. These investments shape an environment where manufacturers increasingly explore UV-curable waterborne systems as a modern, efficient alternative to solvent-based coatings.

Latest Trends

Shift toward low-VOC waterborne UV systems

A clear trend in the Waterborne UV Coating Systems Market is the shift toward low-VOC coating technologies, driven by environmental regulations and pressure for safer manufacturing environments. Waterborne UV systems align well with this shift by offering quick curing, low odor, and reduced emissions while maintaining durable finishes. This movement is supported by scientific and academic advancements, highlighted by pioneering chemistry research at Queen’s University receiving a $24 million boost, which strengthens long-term innovation in material science and coating chemistry.

As sustainability and cleaner production standards become central to manufacturing practices, industries increasingly integrate waterborne UV systems into wood, metal, plastic, and consumer goods finishing processes, shaping a trend toward greener and higher-performance coatings.

Regional Analysis

Asia Pacific leads with 34.8%, reaching USD 1.2 billion in the waterborne UV coatings market.

The Asia Pacific region dominated the Waterborne UV Coating Systems Market, holding a 34.8% share valued at USD 1.2 billion, supported by strong manufacturing activity, rising furniture production, and expanding use of eco-friendly coating technologies across major economies. Demand for waterborne UV systems continued to grow as regional industries focused on faster curing, low-emission coatings for wood, packaging, and surface protection applications.

North America showed steady adoption driven by increased use of durable UV-curable finishes in advanced manufacturing and higher reliance on sustainable coatings across industrial segments. Europe maintained consistent growth through strict environmental regulations and the widespread shift toward low-VOC, high-performance coating technologies.

Meanwhile, the Middle East & Africa region experienced gradual progress due to overall construction activity and the rising need for efficient surface finishing solutions. Latin America continued to develop its market presence, supported by the growing adoption of waterborne technologies in furniture, interior applications, and packaging industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bayer MaterialScience continued to influence the market through its strong expertise in polymer technologies and high-performance materials. The company’s focus on developing durable, environmentally conscious coating ingredients supported the rising demand for waterborne UV systems in furniture, interiors, and industrial applications. Its emphasis on clean chemistry and surface-protection technologies positioned it as a contributor to next-generation coating performance.

Axalta Coating Systems reinforced its market presence through its established footprint in advanced coating solutions. With a deep background in protective and decorative coatings, the company continued aligning its waterborne UV offerings with growing industry requirements for faster curing, reduced emissions, and improved surface durability. Its ongoing commitment to high-efficiency manufacturing and consistent product quality supported adoption across wood finishing and industrial sectors.

Nanovere Technologies brought a specialized edge to the market with its work in nanotechnology-enhanced coating systems. Its focus on ultra-durable, scratch-resistant, and environmentally friendly coatings contributed to the development of premium waterborne UV solutions. Collectively, these companies helped accelerate market progress through material innovation, improved performance standards, and a clear shift toward sustainable coating technologies.

Top Key Players in the Market

- Bayers MaterialScience

- Axalta Coating Systems

- Nanovere Technologies

- Becker Coatings

- Sirca SpA

- Others

Recent Developments

- In February 2024, Nanovere Technologies introduced its Nano Clear Coatings, an advanced transparent coating designed to greatly extend surface life by improving durability, UV resistance, and scratch protection for painted materials across many applications. These coatings help protect surfaces such as wood, metal, and composites from weathering and wear.

- In January 2024, Bayer introduced a “Dynamic Shared Ownership” operating model to make the company more agile, simplify processes, and speed up innovation across divisions, including materials and chemicals that support coating technologies.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 8.0 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Acrylic-based Coatings, Urethane-based Coatings, Polyester-based Coatings, Epoxy-based Coatings), By Technology (UV Radiation Curing, Electron Beam Curing, Hybrid Curing), By Application (Wood Coatings, Metal Coatings, Plastic Coatings, Glass Coatings), By End-use (Automotive, Furniture, Consumer Goods, Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer MaterialScience, Axalta Coating Systems, Nanovere Technologies, Becker Coatings, Sirca SpA, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Waterborne UV Coating Systems MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Waterborne UV Coating Systems MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayers MaterialScience

- Axalta Coating Systems

- Nanovere Technologies

- Becker Coatings

- Sirca SpA

- Others