Global Waste Gas Treatment Market Size, Share, And Industry Analysis Report By Type (Combustion, Absorption Equipment, Adsorption Equipment, Catalytic Equipment, Others), By Applications (Power Industry, Steel Industry, Chemical Industry, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173573

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

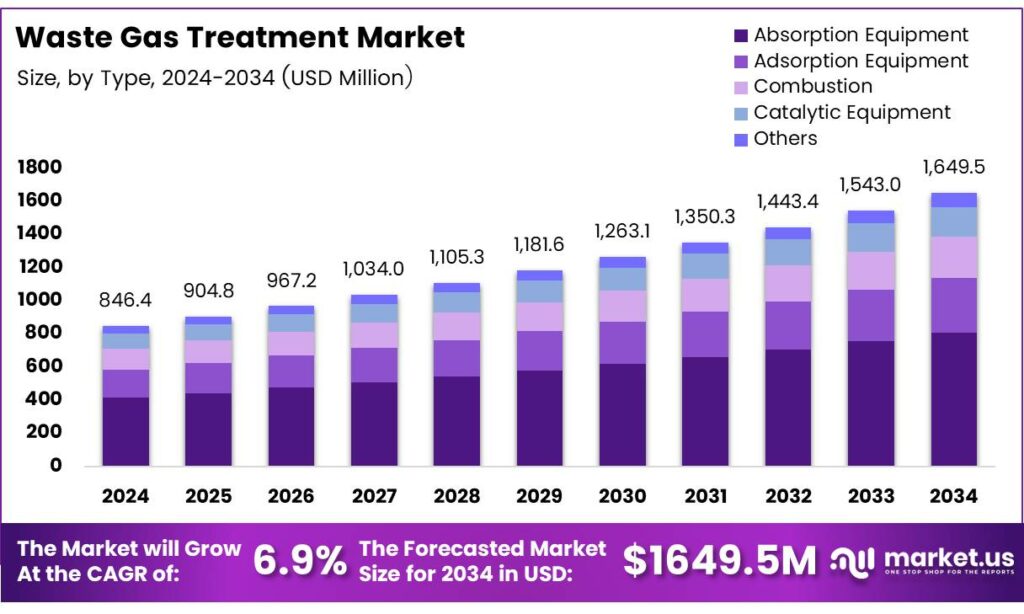

The Global Waste Gas Treatment Market size is expected to be worth around USD 1649.5 million by 2034, from USD 846.4 million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The Waste Gas Treatment Market refers to technologies and systems designed to capture, neutralize, or destroy harmful gaseous emissions from industrial processes. These solutions support cleaner production by reducing pollutants such as VOCs, acid gases, and particulates. Consequently, industries adopt waste gas treatment to meet environmental compliance and protect surrounding communities.

Waste gas treatment demand continues to expand as industrialization accelerates across emerging economies. Moreover, stricter emission thresholds are reshaping investment decisions in manufacturing, power generation, chemicals, and metals. Treatment systems increasingly shift from optional upgrades toward essential infrastructure supporting sustainable industrial operations.

The Brunauer–Emmett–Teller method is the globally accepted approach for determining specific surface area in adsorption materials. The method applies multilayer adsorption theory within a relative pressure range of 0.05–0.30, excluding type I isotherms, ensuring consistency in industrial gas treatment evaluations.

- Based on ISO 9277 and ASTM D6556, the BET surface area is calculated using monolayer adsorption capacity, adsorbate cross-sectional area, such as 0.162 nm² for nitrogen, Avogadro’s number, and ideal gas constants. Both single-point and multi-point BET analyses support compliance-driven waste gas treatment material qualification.

Furthermore, adsorbate gas selection directly influences pore accessibility and sensitivity in gas treatment media testing. According to IUPAC guidelines, nitrogen at 77 K supports mesopore analysis, argon at 87 K improves micropore accuracy, krypton at 77 K measures surfaces below 1 m²/g, and carbon dioxide analyzes pores smaller than 0.7 nm, enhancing waste gas treatment performance optimization.

Key Takeaways

- The Global Waste Gas Treatment Market is projected to grow from USD 846.4 million in 2024 to USD 1649.5 million by 2034, expanding at a CAGR of 6.9% during 2025–2034.

- Combustion technology leads the market by type, holding a dominant share of 44.7% in 2024.

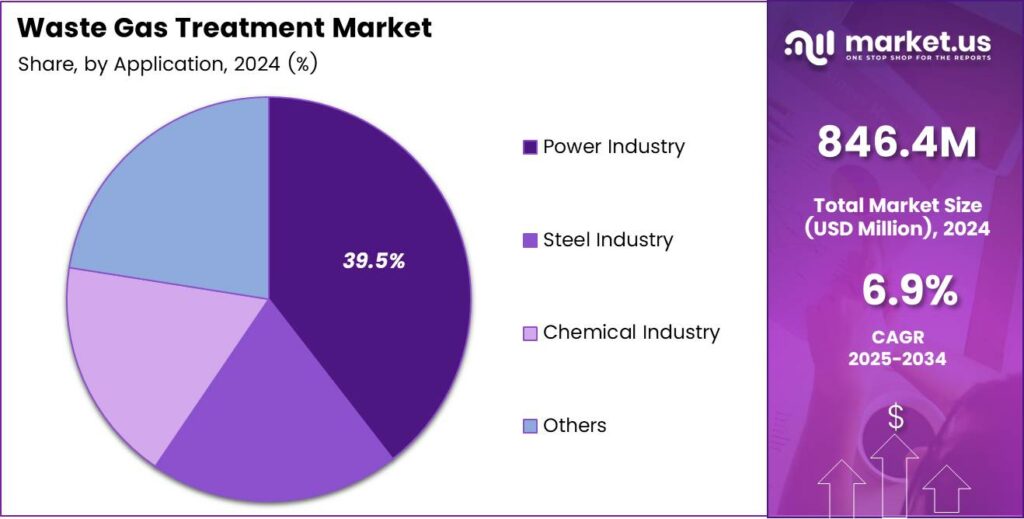

- The Power Industry is the largest application segment, accounting for a market share of 39.5% in 2024.

- Asia Pacific dominates the global market with a share of 39.7%, generating revenues of approximately USD 336.0 million.

By Type Analysis

Combustion dominates the By Type segment with a 44.7% share due to its proven efficiency in high-volume industrial emission control.

In 2024, Combustion held a dominant market position in the By Type analysis segment of the Waste Gas Treatment Market, with a 44.7% share. This dominance is driven by its ability to thermally destroy hazardous gases and volatile compounds. Moreover, industries prefer combustion systems for continuous operations and regulatory compliance.

Absorption Equipment follows as an important solution, especially where soluble pollutants must be removed from exhaust streams. It is widely applied in the chemical and process industries. Gradually, its demand grows due to stable performance, lower operational risk, and compatibility with existing industrial infrastructure.

Adsorption Equipment plays a supporting role, particularly for low-concentration pollutants. It is valued for flexibility and ease of installation. Consequently, adsorption systems are adopted where recovery of gases is required, although capacity limitations restrict dominance compared to combustion-based systems.

Catalytic Equipment gains attention for energy-efficient gas treatment. It enables oxidation at lower temperatures, reducing fuel usage. However, catalyst sensitivity and maintenance needs moderate its adoption, positioning it as a selective but technically important sub-segment.

By Applications Analysis

Power Industry dominates the By Applications segment with a 39.5% share, driven by strict emission norms and large-scale fuel combustion.

In 2024, the Power Industry held a dominant market position in the By Applications analysis segment of the Waste Gas Treatment Market, with a 39.5% share. This leadership is supported by coal- and gas-based power plants requiring continuous flue gas treatment to meet environmental standards.

The Steel Industry represents a major application area due to high emissions from furnaces and coke ovens. Gradually, steel producers invest in waste gas treatment to reduce particulate matter and toxic gases, ensuring safer operations and improved environmental performance.

The Chemical Industry relies on waste gas treatment systems to manage hazardous and corrosive emissions. As production scales, treatment solutions become essential for regulatory compliance. Therefore, consistent demand emerges from diversified chemical manufacturing processes.

Others include cement, food processing, and manufacturing sectors with moderate emission levels. Although individually smaller, their collective demand supports steady market participation, especially as environmental awareness and compliance requirements expand.

Key Market Segments

By Type

- Combustion

- Absorption Equipment

- Adsorption Equipment

- Catalytic Equipment

- Others

By Applications

- Power Industry

- Steel Industry

- Chemical Industry

- Others

Emerging Trends

Integration of Smart Monitoring and Automation Is Trending

Digital monitoring and automation are emerging as key trends in the waste gas treatment market. Industries are integrating sensors and control software to track emission levels in real time. This improves compliance accuracy and reduces manual intervention.

- The use of combined treatment technologies. Instead of relying on a single method, industries are adopting hybrid systems that improve removal efficiency for complex gas mixtures. The U.S. power sector shows how strong policy pressure can reshape an industry’s waste-gas systems. Annual SO₂ emissions from power plants fell by 95%, and annual NOₓ emissions fell by 89%.

Energy-efficient system design is also gaining traction. Manufacturers are focusing on low-pressure-drop equipment and heat recovery integration. These designs help reduce operating costs while maintaining emission standards. Modular and skid-mounted units are becoming popular. These systems allow faster installation and easier expansion as production capacity grows.

Drivers

Stringent Air Emission Regulations Are Driving Adoption

Governments across the world are tightening rules on industrial air pollution, which is a major driver for the waste gas treatment market. Industries are required to control sulfur oxides, nitrogen oxides, volatile organic compounds, and particulate emissions before releasing gases into the atmosphere.

Rapid industrialization is another strong driver. Power plants, steel units, chemical factories, and cement plants generate large volumes of exhaust gases. Treating these gases has become essential to continue operations without penalties or shutdown risks. This pushes steady demand for reliable waste gas treatment systems.

Growing public awareness about air quality also supports market growth. Communities near industrial zones increasingly demand cleaner air, forcing industries to upgrade their emission control infrastructure. Waste gas treatment helps reduce odors, visible smoke, and toxic exposure.

Restraints

High Capital and Maintenance Costs Limit Adoption

The high upfront cost of waste gas treatment systems is a key restraint in the market. Advanced equipment such as catalytic oxidizers, thermal systems, and multi-stage scrubbers requires significant capital investment. For small and mid-sized industries, this cost often delays adoption.

- Waste gas treatment units need regular inspection, catalyst replacement, and skilled operation. The World Bank’s 2025 Global Gas Flaring Tracker puts strong numbers behind the scale of this opportunity. It reports that in 2024, flaring increased by 3 billion cubic meters to 151 bcm.

Energy consumption also acts as a restraint. Some treatment technologies consume large amounts of electricity or fuel, especially thermal-based systems. This can raise overall production costs and impact profitability, particularly in energy-intensive industries.

Growth Factors

Industrial Expansion in Emerging Economies Creates Opportunities

Rapid industrial growth in emerging economies presents strong opportunities for the waste gas treatment market. New power plants, refineries, chemical units, and metal processing facilities are being built, all of which require emission control systems from the start.

Retrofitting older plants is another major opportunity. Many existing facilities operate with outdated or inefficient gas treatment systems. Upgrading these units helps industries meet current environmental norms while improving operational efficiency. The shift toward cleaner manufacturing also opens growth avenues.

Waste gas treatment supports environmental reporting and sustainability goals. Technological innovation further boosts opportunities. Compact systems, modular designs, and hybrid treatment solutions reduce space and cost barriers. This makes advanced gas treatment accessible to smaller industrial facilities, expanding the overall market reach.

Regional Analysis

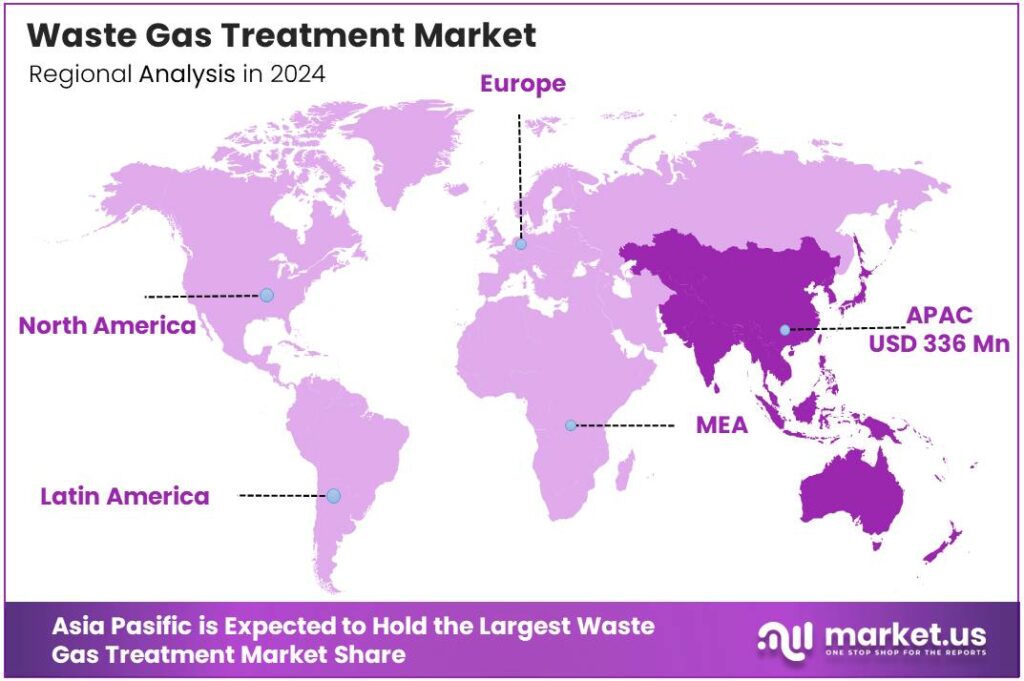

Asia Pacific Dominates the Waste Gas Treatment Market with a Market Share of 39.7%, Valued at USD 336.0 Million

The Asia Pacific region held the leading position in the waste gas treatment market, accounting for 39.7% of global demand and generating revenues of approximately USD 336.0 million. This dominance is supported by rapid industrialization, expanding power generation capacity, and strict air-emission regulations across key manufacturing economies.

North America represents a mature yet steadily growing market, driven by stringent environmental standards and strong enforcement of emission control policies. The region benefits from widespread adoption of advanced gas treatment technologies across the power, chemical, and manufacturing sectors. Ongoing upgrades to aging industrial facilities further support consistent demand for waste gas treatment solutions.

Europe’s waste gas treatment market is shaped by rigorous climate policies and long-term decarbonization goals. Industrial operators increasingly invest in efficient emission reduction systems to comply with tightening air quality directives. The focus on sustainability and energy efficiency continues to drive technology upgrades across heavy industries and municipal installations.

The Middle East and Africa region is witnessing gradual growth, supported by expanding oil, gas, and power generation activities. Governments are increasingly emphasizing the control of emissions to balance industrial growth with environmental protection. Investments in modern gas treatment infrastructure are gaining traction, particularly in energy-intensive industrial hubs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

General Electric Company maintained strong positioning in 2024 by aligning waste gas treatment offerings with power and heavy-industry decarbonization goals. Its edge comes from integrating controls, digital monitoring, and plant-level optimization so operators can stabilize emissions performance while managing fuel variability and load cycling.

Mitsubishi Hitachi Power Systems Ltd. (now operating under Mitsubishi Power branding in many markets) remained closely tied to large thermal assets, where flue-gas cleaning upgrades and retrofit-friendly engineering matter most. In 2024, its strength was execution at scale, supporting complex project delivery, long equipment lifecycles, and performance guarantees that utilities and EPCs typically demand.

Babcock & Wilcox Enterprises Inc. continued to be relevant where clients need practical, compliance-first solutions that can be installed without prolonged shutdowns. The company’s 2024 market stance benefited from its experience in boilers and downstream cleanup, helping customers connect combustion improvements with end-of-pipe controls to reduce operational risk.

DuPont de Nemours Inc. played a different role in the value chain, leaning more into materials and process know-how that supports gas treatment efficiency and reliability. In 2024, DuPont’s influence showed up in how plants select performance materials and engineered components that improve durability, reduce maintenance frequency, and support consistent emissions capture under demanding conditions.

Top Key Players in the Market

- General Electric Company

- Mitsubishi Hitachi Power Systems Ltd.

- Babcock & Wilcox Enterprises Inc.

- DuPont de Nemours Inc.

- Thermax Limited

- Dürr AG

- BASF SE

- John Wood Group PLC

- Catalytic Products International (CPI)

- Anguil Environmental Systems Inc.

Recent Developments

- In 2025, GE will focus on advancements in gas turbine technologies aimed at reducing emissions, including developments in ammonia and hydrogen combustion, carbon capture, and transitions to lower-emission fuels. Collaborated with IHI to develop a two-stage combustor for gas turbines capable of burning ammonia while meeting emission requirements, advancing low-emission power generation.

- In 2025, Mitsubishi Power emphasized hydrogen-ready gas turbines, decarbonization projects, and advanced control systems for thermal power plants to improve efficiency and reduce emissions. Completed functional testing of a next-generation gas turbine control system for thermal power plants, integrating advanced control and high-speed data processing to enhance operational efficiency and emissions management.

Report Scope

Report Features Description Market Value (2024) USD 846.4 Million Forecast Revenue (2034) USD 1649.5 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Combustion, Absorption Equipment, Adsorption Equipment, Catalytic Equipment, Others), By Applications (Power Industry, Steel Industry, Chemical Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape General Electric Company, Mitsubishi Hitachi Power Systems Ltd., Babcock & Wilcox Enterprises Inc., DuPont de Nemours Inc., Thermax Limited, Dürr AG, BASF SE, John Wood Group PLC, Catalytic Products International (CPI), Anguil Environmental Systems Inc. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Waste Gas Treatment MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Waste Gas Treatment MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric Company

- Mitsubishi Hitachi Power Systems Ltd.

- Babcock & Wilcox Enterprises Inc.

- DuPont de Nemours Inc.

- Thermax Limited

- Dürr AG

- BASF SE

- John Wood Group PLC

- Catalytic Products International (CPI)

- Anguil Environmental Systems Inc.