Global Walnuts Ingredient Market Size, Share, And Business Benefits By Category (In Shell, Shelled), By Form (Raw, Processed), By Nature (Organic, Conventional), By Product (Walnut Kernels, Walnut Oil, Walnut flour/meal, Others), By Application (Food Industry, Cosmetics and Personal Care, Pharmaceuticals, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153111

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

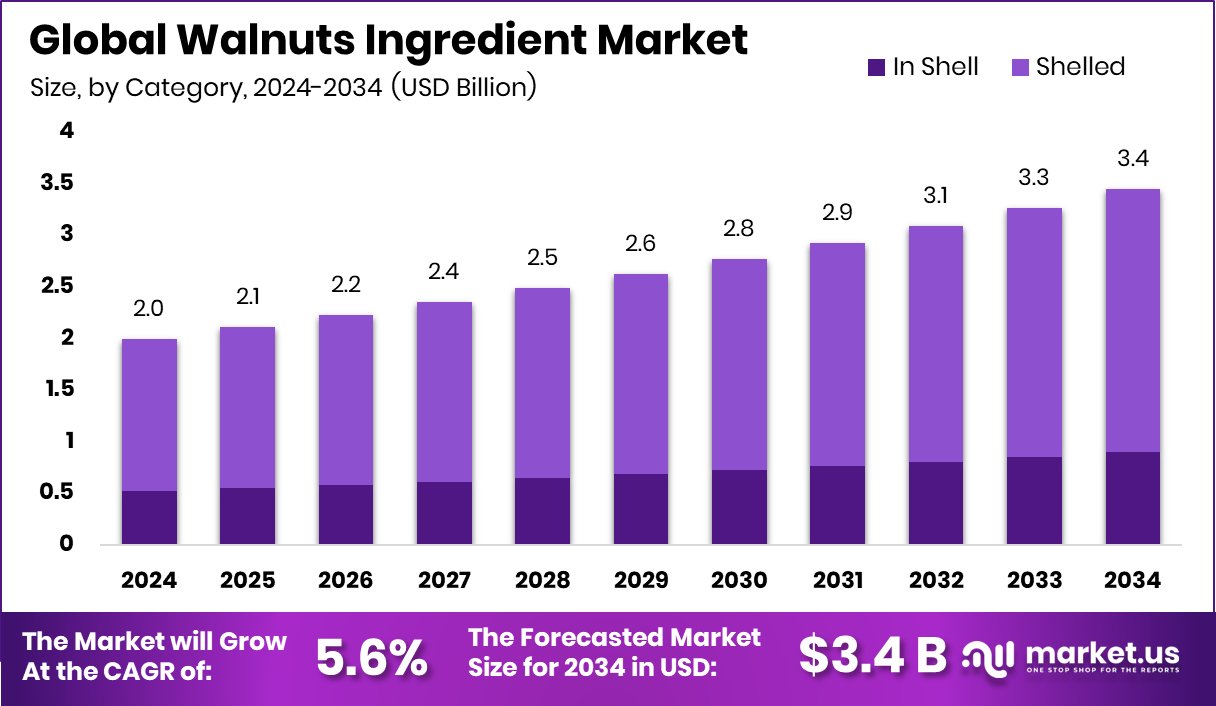

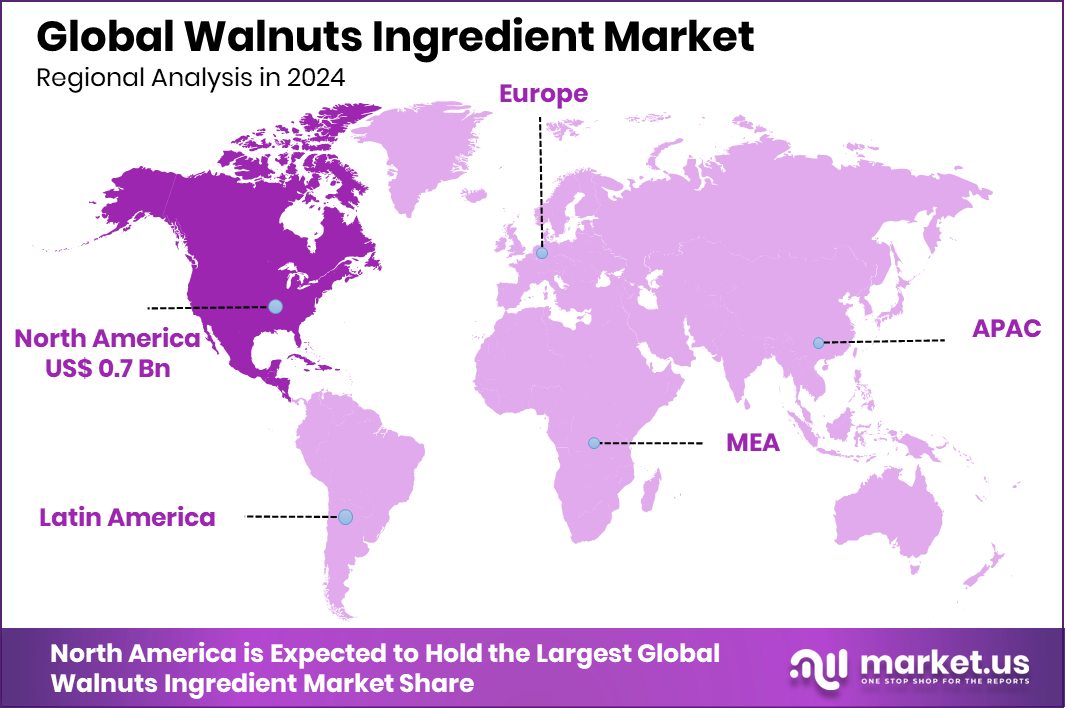

Global Walnuts Ingredient Market is expected to be worth around USD 3.4 billion by 2034, up from USD 2.0 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. North America, 37.2% shows strong demand for walnut-based products in the food and wellness sectors.

Walnuts Ingredient refers to any processed form of walnuts used as a component in food, beverage, cosmetic, or nutraceutical applications. These ingredients may include walnut kernels, walnut oil, walnut meal, walnut butter, and walnut extract, each offering distinct functional and nutritional benefits. Recently, the USDA allocated $7 million to support California walnut export promotion, further enhancing the global availability of such ingredients.

Walnuts are naturally rich in omega-3 fatty acids, antioxidants, fiber, and protein, making them a valuable ingredient in health-focused formulations. Their subtle flavor and versatile texture allow them to be incorporated into a wide range of products such as bakery goods, dairy alternatives, confectionery, sauces, and dietary supplements.

The Walnuts Ingredient Market is witnessing steady growth due to increasing awareness of heart-healthy and plant-based diets. Rising consumer preference for clean-label and natural food products is encouraging manufacturers to utilize walnut-derived components in various formulations. USDA’s $7 million funding for export initiatives supports this momentum, promoting wider market penetration of walnut ingredients globally.

One of the major growth factors is the increasing recognition of walnuts as a superfood. Their association with brain health, cardiovascular wellness, and anti-inflammatory properties is encouraging their adoption in functional food categories. This has led to rising demand from manufacturers seeking to enhance the nutritional profile of their products, particularly as USDA-backed programs aid in promoting such health-forward ingredients abroad.

Opportunities in the market lie in product diversification and innovation. The development of plant-based dairy and meat alternatives using walnut protein or oil is gaining traction. Moreover, the cosmetic industry is increasingly utilizing walnut oil and scrubs due to their antioxidant and exfoliating properties, opening new avenues beyond food applications.

Although separate from the ingredient space, companies like Walnut have secured $110 million in Series A funding to expand healthcare BNPL services and an additional $4.6 million from National Bank to grow embedded insurance capabilities, indicating strong investor interest in wellness-focused business models.

Key Takeaways

- Global Walnuts Ingredient Market is expected to be worth around USD 3.4 billion by 2034, up from USD 2.0 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- In the Walnuts Ingredient Market, shelled walnuts hold a dominant 74.2% share in 2024.

- Processed form leads the Walnuts Ingredient Market with a strong 69.5% share due to convenience.

- Conventional walnut ingredients dominate the Walnuts Ingredient Market, capturing 87.4% share due to cost-effectiveness.

- Walnut kernels remain the most preferred product, holding 58.3% share in the Walnuts Ingredient Market.

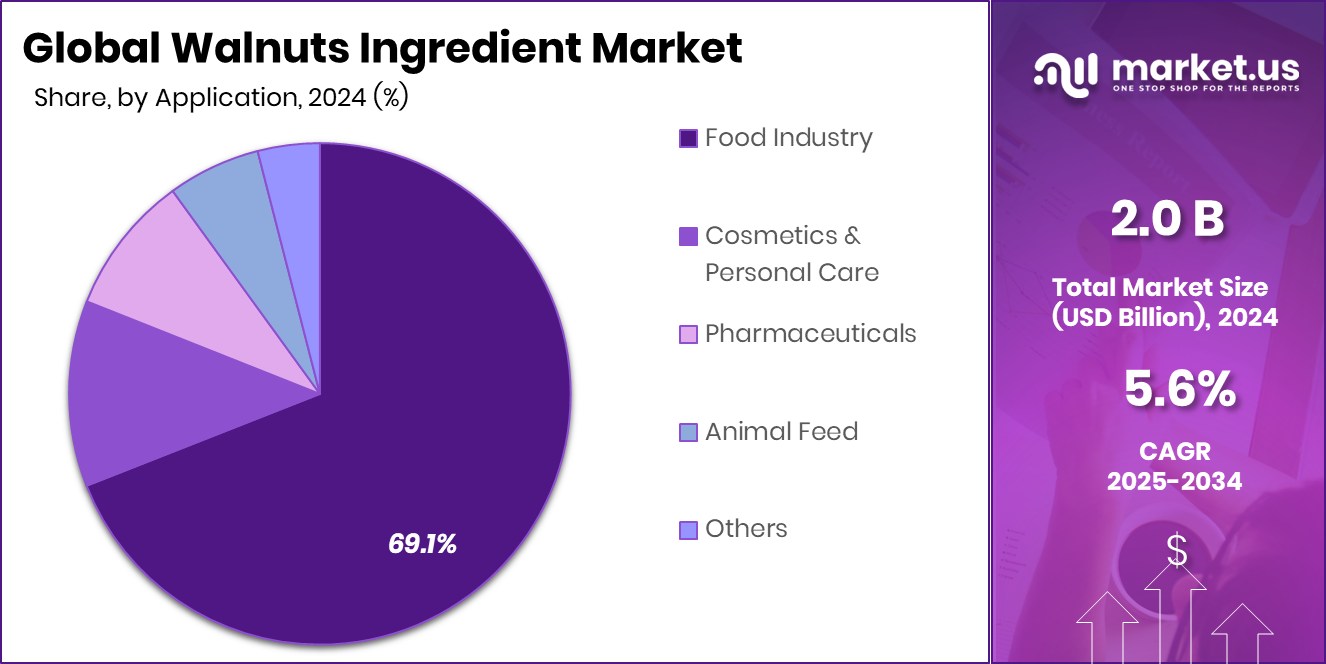

- The food industry accounts for 69.1% of demand in the growing Walnuts Ingredient Market segment.

- The North American market value reached USD 0.7 billion, driven by health-focused consumers.

By Category Analysis

Shelled walnuts dominate the Walnuts Ingredient Market with a 74.2% share.

In 2024, Shelled held a dominant market position in the By Category segment of the Walnuts Ingredient Market, accounting for a significant 74.2% share. This commanding presence can be attributed to the widespread application of shelled walnuts across food processing, culinary, and nutrition sectors.

Shelled walnuts offer convenience, a longer shelf life, and ease of integration into various formulations, which makes them highly preferred among both industrial and household users. Their versatility in texture and compatibility with a wide array of ingredients has reinforced their adoption in bakery items, snacks, cereals, and plant-based recipes.

Moreover, shelled walnuts retain the full nutritional profile of the nut, providing essential fatty acids, protein, fiber, and antioxidants. This makes them particularly attractive to manufacturers developing health-oriented and clean-label products. The high share also reflects the growing consumer shift toward natural, unprocessed ingredients, where shelled formats align well with dietary trends promoting whole foods.

As awareness of walnuts’ health benefits continues to grow, the shelled category is expected to maintain its leadership in the market. The dominance of this segment underscores the increasing demand for minimally processed, nutrient-rich components across multiple end-use sectors.

By Form Analysis

Processed form leads in the Walnuts Ingredient Market at 69.5% share.

In 2024, Processed held a dominant market position in the By Form segment of the Walnuts Ingredient Market, capturing a notable 69.5% share. This strong market presence is driven by the broad functionality and diverse applications of processed walnut ingredients in food, beverage, and personal care formulations.

Processed forms such as walnut oil, powder, butter, and extracts offer manufacturers consistency, extended shelf life, and enhanced ease of use in large-scale production settings. Their adaptable nature allows for seamless incorporation into a variety of finished products, ranging from baked goods and sauces to nutritional supplements and skincare formulations.

The high market share of processed walnut ingredients also reflects their growing demand in health-focused and value-added product lines. These forms retain essential nutrients like omega-3 fatty acids, antioxidants, and protein while offering refined textures and concentrated flavors suited to modern consumer preferences.

The increased adoption of processed walnut ingredients by formulators aiming to develop clean-label, functional, and plant-based offerings has reinforced their market dominance. As consumer interest in natural and wholesome ingredients continues to shape product innovation, the processed segment remains a preferred choice for its efficiency, scalability, and broad industry acceptance.

By Nature Analysis

Conventional products hold 87.4% in Walnuts Ingredient Market category.

In 2024, Conventional held a dominant market position in the By Nature segment of the Walnuts Ingredient Market, securing a substantial 87.4% share. This dominance is largely attributed to the widespread availability, established farming practices, and cost-efficiency associated with conventionally produced walnut ingredients.

Conventional walnuts are extensively used across food manufacturing, cosmetic formulations, and nutritional applications due to their consistent quality, volume scalability, and reliable supply chain infrastructure.

The high share also reflects purchasing patterns among industrial buyers who prioritize affordability and volume for large-scale production. Conventional walnut ingredients offer the same core nutritional benefits—such as healthy fats, protein, and antioxidants—while meeting formulation standards for a wide variety of end-use products. Their presence in mainstream consumer goods, including bakery products, processed snacks, spreads, and meal supplements, further reinforces their strong market position.

The dominance of the conventional segment underscores its entrenched role in the global ingredient landscape. As demand for walnut-based formulations continues to rise across sectors, conventional production remains a key enabler for maintaining stable pricing, uninterrupted supply, and broader accessibility.

By Product Analysis

Walnut kernels account for 58.3% in the Walnuts Ingredient Market.

In 2024, Walnut Kernels held a dominant market position in the By Product segment of the Walnuts Ingredient Market, accounting for a leading 58.3% share. This strong market presence is primarily driven by the versatility, high nutritional value, and widespread consumer acceptance of walnut kernels in both household and industrial applications. Walnut kernels are widely utilized in bakery items, confectioneries, cereals, snacks, and culinary preparations due to their rich texture, mild flavor, and ease of incorporation into diverse recipes.

The dominance of this segment also reflects growing health consciousness among consumers, as walnut kernels are naturally rich in omega-3 fatty acids, fiber, protein, and antioxidants. Their whole, minimally processed form appeals to the demand for natural, clean-label ingredients, especially in premium and health-focused food categories. Manufacturers favor kernels for their consistency, ready-to-use form, and compatibility with both sweet and savory formulations.

With increasing demand for nutrient-dense, plant-based ingredients, walnut kernels continue to serve as a foundational product in the development of wellness-oriented food solutions. Their 58.3% market share in 2024 underscores their central role in the walnut ingredient market, supported by strong adoption across retail, foodservice, and industrial segments seeking quality and functionality.

By Application Analysis

The food industry drives 69.1 of % demand in the walnut ingredient market.

In 2024, the Food Industry held a dominant market position in the By Application segment of the Walnuts Ingredient Market, capturing a significant 69.1% share. This leadership is largely driven by the extensive incorporation of walnut ingredients across a wide range of food products, including bakery items, breakfast cereals, snacks, dairy alternatives, sauces, and ready-to-eat meals.

The food industry values walnut ingredients for their natural richness in essential fatty acids, protein, fiber, and antioxidants, which align well with rising consumer demand for healthier, nutrient-dense options.

The 69.1% market share highlights the strong integration of walnuts as functional and flavorful ingredients in both traditional and modern food formulations. Food manufacturers prefer walnut derivatives not only for their nutritional profile but also for their textural appeal and ability to enhance the overall quality of finished products. As wellness and clean-label trends continue to shape consumer choices, walnut ingredients have become central to product innovation within the food sector.

The dominance of the food industry in this segment reflects the growing emphasis on plant-based and functional foods, where walnut ingredients meet both taste and health expectations. Their consistent demand across food processing applications has firmly established this segment’s leadership in the walnut ingredient market.

Key Market Segments

By Category

- In Shell

- Shelled

By Form

- Raw

- Processed

By Nature

- Organic

- Conventional

By Product

- Walnut Kernels

- Walnut Oil

- Walnut flour/meal

- Others

By Application

- Food Industry

- Cosmetics and Personal Care

- Pharmaceuticals

- Animal Feed

- Others

Driving Factors

Rising Health Awareness Boosts Walnut Ingredient Demand

One of the top driving factors for the growth of the walnut ingredient market is the increasing awareness of health and wellness among consumers. As more people become conscious of the benefits of healthy eating, walnuts are gaining popularity due to their rich nutritional profile. They are naturally high in omega-3 fatty acids, antioxidants, protein, and fiber—nutrients known to support heart health, brain function, and weight management.

Because of these health benefits, food and beverage companies are using walnut ingredients in products like granola bars, cereals, baked goods, and smoothies. This rising demand for natural and functional ingredients is encouraging manufacturers to include more walnut-based options in their offerings, driving consistent growth across global markets.

Restraining Factors

High Cost of Walnuts Limits Market Growth

One of the key restraining factors in the walnut ingredient market is the high cost of walnuts, which affects both producers and end-users. Walnut cultivation requires fa favorable climate, quality soil, and significant agricultural inputs, making it more expensive compared to other nuts. Additionally, price fluctuations due to seasonal variations, limited growing regions, and supply chain challenges further contribute to cost instability.

For food manufacturers, the high price of walnut ingredients can raise overall production costs, limiting their use in budget-sensitive product lines. This cost barrier often pushes smaller companies to choose alternative, more affordable ingredients.

Growth Opportunity

Expansion into Plant-Based Dairy and Meat Alternatives

The walnuts ingredient market holds a strong growth opportunity in the emerging plant-based dairy and meat alternatives sector. As consumer demand increases for vegan, lactose-free, and sustainable options, walnut-derived products such as walnut milk, creamers, nut-based spreads, and meat substitutes are becoming more prominent.

Walnuts naturally offer a creamy texture and rich flavor, making them well-suited for recreating dairy and meat experiences. Additionally, the health-conscious profile—being high in omega-3s, protein, and antioxidants—aligns with consumer preferences for nutritious alternatives.

Manufacturers can leverage walnut ingredients to develop clean-label, allergen-friendly formulations that appeal to environmentally and health-conscious consumers. This application area presents a compelling avenue for innovation and market expansion, especially as the plant-based food trend continues its upward trajectory.

Latest Trends

Integration of Walnut Oil in Skincare Products

A significant trend emerging in the walnut ingredient market is the use of walnut oil in skincare and cosmetic products. Known for its natural antioxidants and moisturizing properties, walnut oil is well-suited for inclusion in lotions, serums, face masks, and lip care items. Consumers are increasingly seeking clean-label beauty solutions, favoring ingredients that are plant-based, gentle, and effective.

Walnut oil offers benefits like improving skin hydration, promoting elasticity, and helping combat signs of aging. Formulators find it attractive due to its light texture, rich nutrient profile, and compatibility with sensitive skin types.

As wellness and self-care trends continue to rise, the integration of walnut oil into personal care products is gaining momentum, creating new opportunities for both nut-processing companies and skincare brands.

Regional Analysis

In 2024, North America held a 37.2% share of the walnut ingredient market.

In 2024, North America emerged as the dominant region in the global Walnuts Ingredient Market, accounting for a significant 37.2% share and reaching a market value of USD 0.7 billion. This leadership is largely driven by strong consumer awareness of nutrition and the high demand for plant-based, functional ingredients in food and wellness applications.

The region’s mature food processing industry continues to incorporate walnut derivatives in a variety of products, from snacks to dietary supplements, reflecting the preference for natural and nutrient-rich components.

Europe follows as a key participant, supported by rising health consciousness and steady demand for clean-label and fortified food products that include walnut-based ingredients. The Asia Pacific region is gaining momentum due to increasing interest in westernized diets and functional foods, particularly in urban centers.

Meanwhile, the Middle East & Africa, and Latin America represent emerging markets where awareness of the health benefits of walnut ingredients is gradually expanding. These regions are witnessing slow but consistent growth as walnut-based formulations begin to gain traction in food manufacturing and consumer diets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM has leveraged its extensive global supply chain and processing capabilities to offer a diverse portfolio of walnut-based ingredients. The company’s integrated operations—from raw walnut procurement to advanced ingredient manufacturing—have enabled reliable product consistency and scale. This focus has allowed ADM to cater to major food and wellness manufacturers seeking functional ingredients with predictable performance.

Barry Callebaut, with a core strength in chocolate and confectionery ingredient innovation, has extended its reach by incorporating walnut derivatives into its product offerings. Through this move, the company is exploiting synergies between walnut nutrition and indulgent taste profiles. Its strong R&D and co-manufacturing partnerships have facilitated the creation of novel formulations that pair walnut inclusions with premium chocolate applications.

Blue Diamond Growers, a producer-owned cooperative, has focused on delivering high-quality walnut kernels and oils under transparent origin and sustainability credentials. Its emphasis on traceability and member-farmer support enhances consumer trust and aligns with growing clean-label trends. By prioritizing minimally processed, origin-validated ingredients, Blue Diamond holds a strategic advantage in health-driven market segments.

California Walnut, a well-established supplier, emphasizes production efficiency and varietal optimization. Through investments in processing infrastructure and product standardization, it has ensured a consistent supply for bakery, snack, and ingredient manufacturers. The company’s volume-driven approach has helped maintain cost competitiveness and support customer needs in mass-market formulations.

Top Key Players in the Market

- ADM

- Barry Callebaut,

- Blue Diamond Growers

- California Walnut

- Callebaut

- Carriere Family Farms

- Diamond of California

- Hammons

- Jabsons Foods

- Kanegrade Limited

- Kerry Group

- Mondelez Inteational

- Morada Nut Company

- Olam International

- Poindexter Nut Company

Recent Developments

- In May 2025, Diamond of California launched long-awaited gluten‑free Nut Pie Crusts, available nationwide. This new product offers consumers a ready-to-use walnut and pecan–based pie crust alternative for gluten‑sensitive diets.

- In September 2024, Carriere Family Farms expanded its walnut processing with a 200% increase in facility size, including a new 277,520 sq ft area and storage for 25 million lbs of walnuts, boosting speed and capacity. This upgrade enhances their processing and supply chain efficiency.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (In Shell, Shelled), By Form (Raw, Processed), By Nature (Organic, Conventional), By Product (Walnut Kernels, Walnut Oil, Walnut flour/meal, Others), By Application (Food Industry, Cosmetics and Personal Care, Pharmaceuticals, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Barry Callebaut, Blue Diamond Growers, California Walnut, Callebaut, Carriere Family Farms, Diamond of California, Hammons, Jabsons Foods, Kanegrade Limited, Kerry Group, Mondelez Inteational, Morada Nut Company, Olam International, Poindexter Nut Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Barry Callebaut,

- Blue Diamond Growers

- California Walnut

- Callebaut

- Carriere Family Farms

- Diamond of California

- Hammons

- Jabsons Foods

- Kanegrade Limited

- Kerry Group

- Mondelez Inteational

- Morada Nut Company

- Olam International

- Poindexter Nut Company