Global Voltage Regulator Market Size, Share, Industry Analysis Report By Type (Electromechanical Voltage Regulators, Automatic Voltage Regulators (AVRs), Ferroresonant Voltage Regulators, Static Voltage Regulators, Linear, Switching), By Application (Industrial, Commercial, Residential), By Voltage (Less than 250 kVA, 250 kVA to 500 kVA, More than 500 kVA), By Phase (Single Phase, Three Phase), By End-Use Industry (Manufacturing, Healthcare, IT & Telecom, Energy & Power, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158486

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business benefits

- By Type Analysis

- By Application Analysis

- By Voltage Analysis

- By Type Analysis

- By Phase Analysis

- By End-Use Industry Analysis

- Emerging Trends

- Growth Factors

- By Region: Asia-Pacific

- By Country: China

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

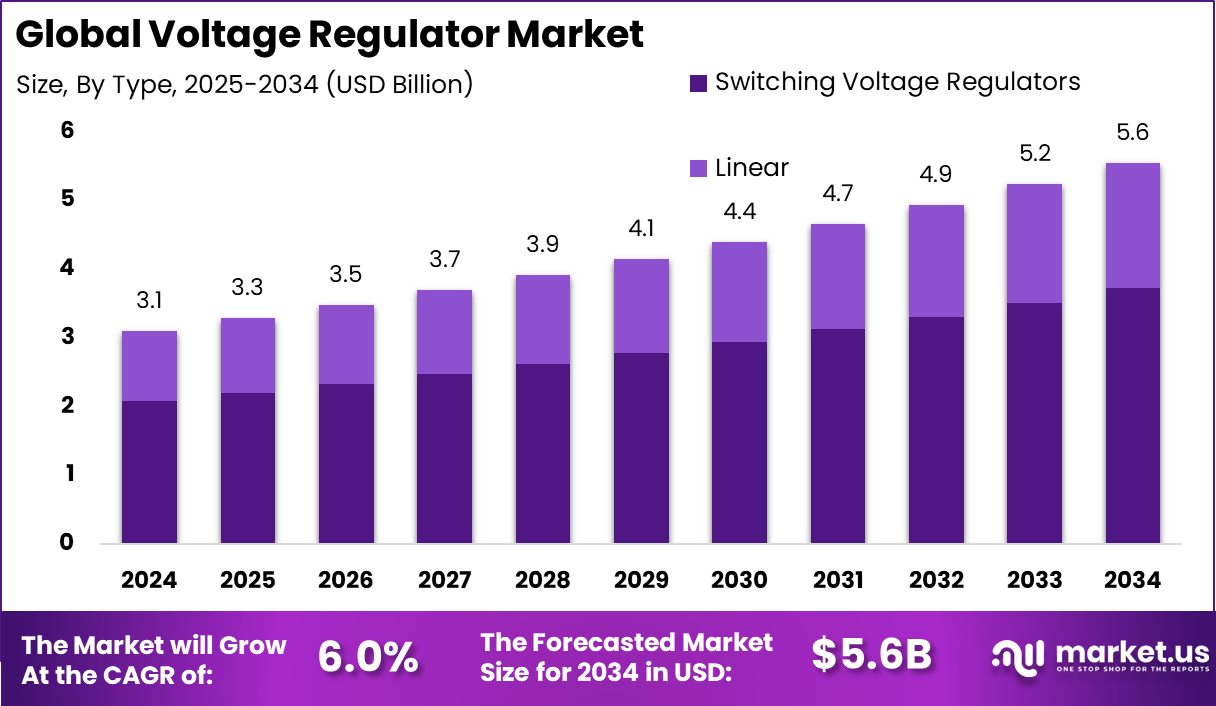

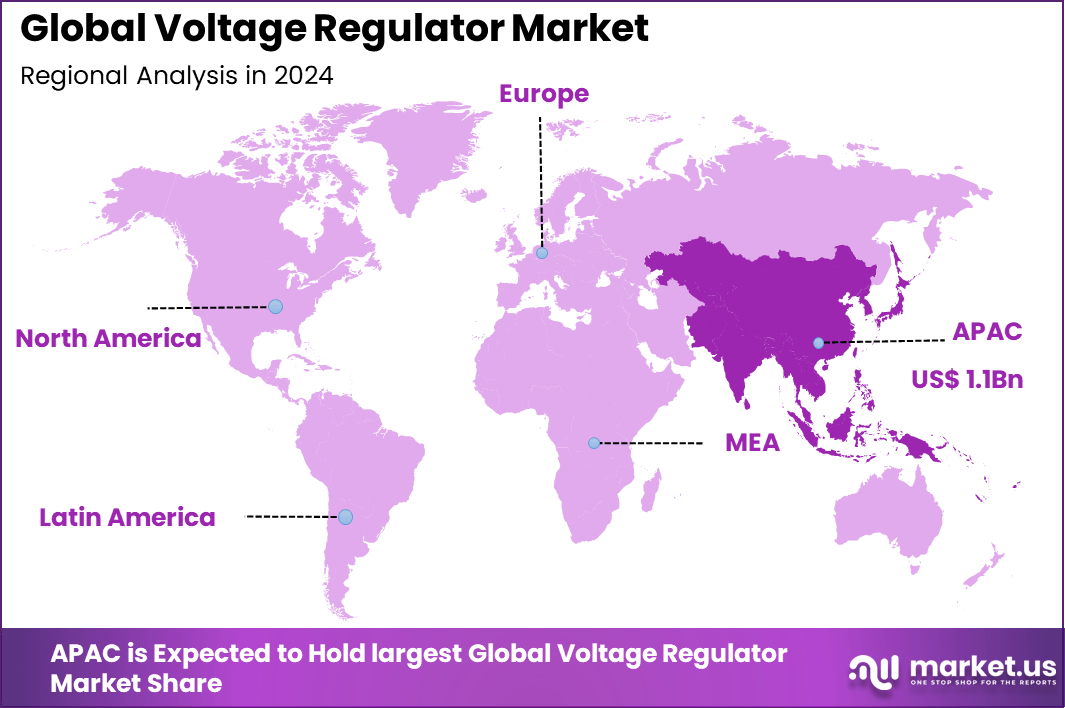

The Global Voltage Regulator Market size is expected to be worth around USD 5.6 Billion By 2034, from USD 3.1 billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 36% share, holding USD 1.1 Billion revenue.

The Voltage Regulator Market refers to the industry focused on devices that maintain a stable output voltage regardless of fluctuations in input voltage or changes in load conditions. Voltage regulators are essential in ensuring reliable power supply for electronic systems, industrial equipment, consumer devices, automotive electronics, and communication networks.

The market includes linear voltage regulators, switching voltage regulators, and automatic voltage regulators (AVRs), along with integrated circuits designed for power management. The market is driven by the increasing demand for reliable power supply in consumer electronics, automotive systems, industrial automation, and telecommunication infrastructure.

The growth of renewable energy generation and integration into grids is also creating a need for voltage regulation to manage intermittent supply. Expanding data centers and 5G networks are further fueling adoption. The rising use of electric vehicles, which require stable power management for battery systems and electronic control units, is another key driver.

Key Insight Summary

- By type, Automatic Voltage Regulators (AVRs) accounted for 45% share, while Switching Voltage Regulators dominated with 67% share, reflecting strong demand for efficiency and advanced control features.

- By application, the Industrial sector led the market, capturing 38% share, owing to continuous demand for stable power supply in heavy industries.

- By voltage, systems rated less than 250 kVA held a 40% share, showing strong adoption in small- and medium-scale applications.

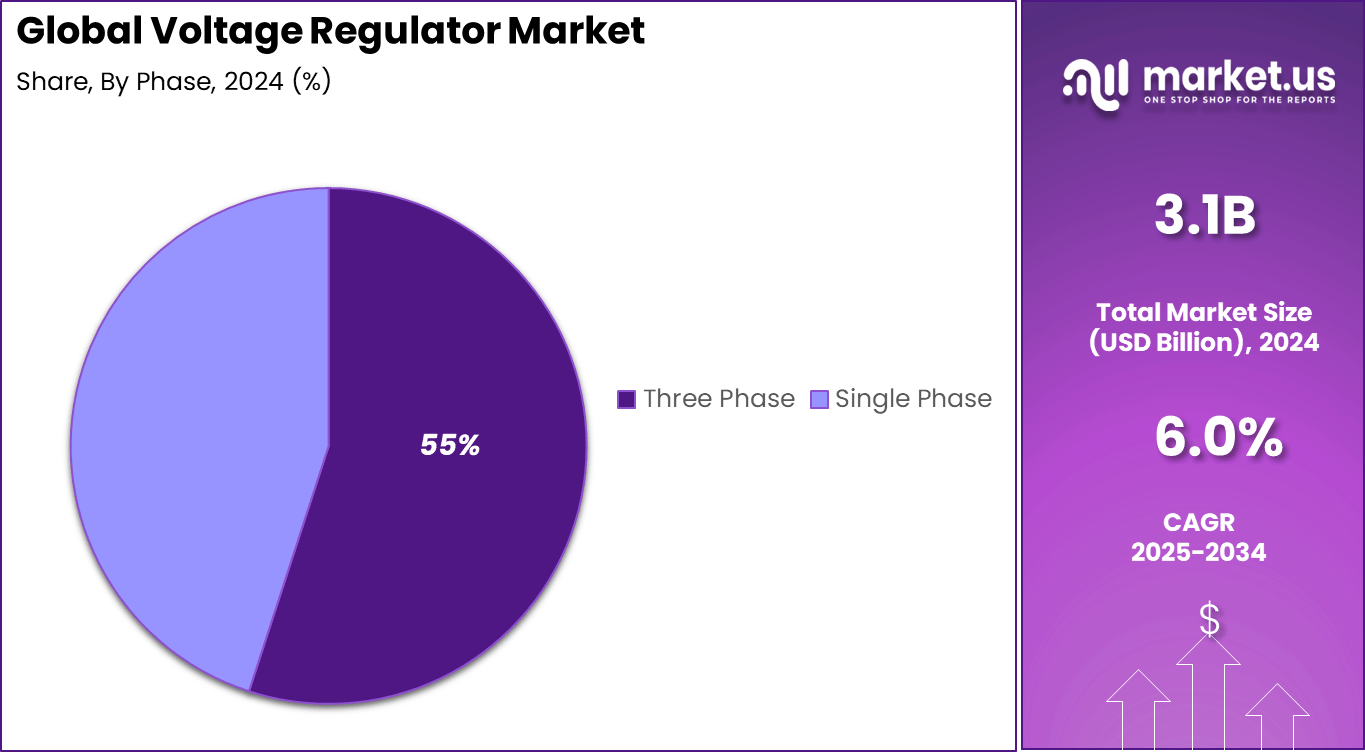

- By phase, Three-Phase voltage regulators led with 55% share, driven by their use in large-scale industrial and commercial operations.

- By end-use industry, the Manufacturing sector contributed 30% share, highlighting its reliance on regulated power for production stability.

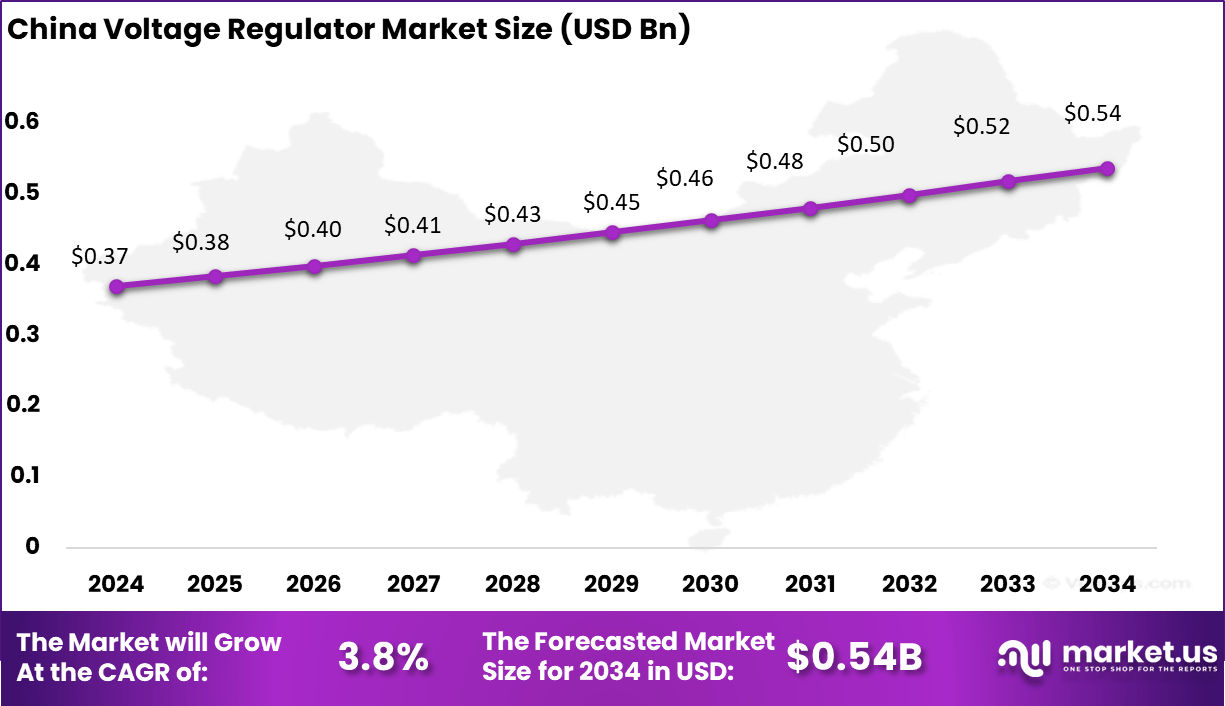

- Regionally, Asia-Pacific captured 36% share, with China valued at USD 0.37 Billion in 2024 and expanding steadily at a CAGR of 3.8%.

Analysts’ Viewpoint

Demand is strong in consumer electronics, where voltage regulators ensure stable performance of smartphones, laptops, and wearables. The automotive sector is emerging as a major consumer, as modern vehicles rely heavily on electronics for infotainment, safety systems, and electric drivetrains. Industrial automation systems use regulators to stabilize equipment and reduce downtime.

The power and energy sector depends on regulators for grid stability and renewable integration. Telecommunications infrastructure, particularly 5G deployments, is also a growing area of demand. Technological advancements are reshaping the voltage regulator market. Switching regulators are gaining popularity due to their higher efficiency compared to linear regulators, particularly in battery-powered devices.

Smart voltage regulators integrated with microcontrollers and sensors are being adopted for adaptive power management. Advances in semiconductor manufacturing are enabling miniaturization, higher efficiency, and better thermal performance. The integration of voltage regulators into system-on-chip (SoC) designs is becoming common in compact electronic devices.

Investment and Business benefits

Investment opportunities lie in upgrading existing infrastructure, expanding renewable energy projects, and servicing the growing electric vehicle market. Emerging regions present attractive prospects where industrialization and urbanization push power stability needs. There are also significant opportunities in R&D for novel materials, more efficient designs, and smarter regulation systems with predictive and adaptive controls.

Early adoption of advanced technologies and regulatory compliance solutions will provide competitive advantage and market share growth. Business benefits for companies offering voltage regulation solutions include strong market demand driven by essential power stability needs, growing cross-industry application scope, and long-term contracts in utility and industrial sectors.

Integration with digital and IoT platforms adds value through service differentiation and new revenue streams from data analytics and remote management. The continuous push towards energy efficiency and regulatory compliance secures steady demand, while innovation in semiconductor and control technologies supports premium product segments.

By Type Analysis

In 2024, Automatic voltage regulators (AVRs) hold 45% share of the market. Their widespread adoption is due to their role in maintaining stable voltage output critical for sensitive electrical equipment. AVRs are a preferred choice in sectors where reliability of power supply is non-negotiable, including data centers and industrial units.

A key reason for their strong position is the growth of automation and precision-based manufacturing environments. As more industries rely on controlled energy output to safeguard machinery and processes, AVRs provide the consistent regulation required to avoid downtime or equipment failure.

By Application Analysis

In 2024, the industrial sector contributes 38% share in voltage regulator applications. High-power machinery and production systems demand reliable voltage control to run optimally. This makes voltage stabilizers vital to ensuring efficiency and extending the operational life of equipment.

Industrial growth, particularly in heavy engineering, energy, and production facilities, accelerates demand for stable power solutions. The emphasis on uninterrupted operations and reduced maintenance costs has reinforced the reliance of industries on voltage regulators.

By Voltage Analysis

In 2024, Voltage regulators with a capacity of less than 250 kVA represent 40% share globally. These systems are widely used in small- to mid-sized facilities, commercial establishments, and residential applications. Their affordability and ease of installation make them attractive for widespread use.

The segment continues to expand due to rising electricity demand in developing economies. Smaller regulators balance cost-effectiveness with adequate performance, making them suitable for localized distribution and smaller scale industrial operations.

By Type Analysis

In 2024, Switching voltage regulators dominate with 67% share. Their efficiency and compact design compared to linear regulators have made them the mainstream choice in modern electronics and industrial systems. They offer greater precision with less energy wastage, making them suitable for both high-performance and portable applications.

As power efficiency becomes a priority across sectors, switching regulators are preferred for their adaptability. They address a broad spectrum of needs from consumer electronics to grid-level operations, strengthening their dominance.

By Phase Analysis

In 2024, Three-phase voltage regulators account for 55% share. They play a critical role in handling high power loads required by large industrial equipment and commercial units. Multi-phase power management not only ensures even load distribution but also supports more efficient operation compared to single-phase networks.

Their dominance is linked to growing industrial investments and the spread of three-phase electricity infrastructure across both developed and emerging economies. Industries dependent on heavy machinery and transmission systems view three-phase regulators as an operational standard.

By End-Use Industry Analysis

In 2024, The manufacturing sector holds 30% of the market share. The reliance on automated production lines, robotics, and high-load machinery has led manufacturers to integrate voltage regulation systems for stable operations. Managing fluctuations is essential to avoid costly production interruptions and equipment damage.

The growing modernization of factories with smart systems and connected machinery further fuels the need for efficient voltage regulation. As digital manufacturing practices evolve, the role of regulators in creating safe and consistent power environments becomes more prominent.

Emerging Trends

Several trends are shaping the current voltage regulator market. The rapid growth of renewable energy sources like solar and wind requires regulators capable of managing fluctuating power outputs. Compact and integrated regulators, designed to fit into smaller, mobile, or automated devices, are gaining traction. There is also a rising shift from traditional linear regulators to more efficient switching types due to better performance and energy savings.

Additionally, materials advancements, including wide bandgap semiconductors, improve efficiency and thermal management. Another key trend is the push for smart, digitally controlled voltage regulators that support real-time monitoring and advanced diagnostics. These trends reflect a broad move towards more efficient, reliable, and flexible voltage regulation systems to support various applications from consumer electronics to industrial automation.

Growth Factors

The growth of the voltage regulator market is driven by expanding electronics usage, including smart home devices, consumer gadgets, and industrial automation. The growth in electric vehicles also significantly fuels demand, as these vehicles rely heavily on stable voltage management for battery and powertrain systems.

Infrastructure investments in power grids, especially for renewable energy integration and smart grid development, contribute strongly to market growth. The need for energy-efficient power management solutions to reduce wastage and improve device lifespan further pushes market expansion.

Industrial growth and urbanization, particularly in the Asia-Pacific region, support this growth by increasing overall electricity consumption and infrastructure modernization. Regulatory standards focusing on energy efficiency and grid reliability also promote voltage regulator adoption.

By Region: Asia-Pacific

Asia-Pacific leads the market with 36% share. The region’s rapid industrialization, infrastructure development, and increasing power consumption sustain the demand for voltage regulators. Growing deployment in factories, commercial centers, and energy projects continues to drive adoption.

The diversity of industries in Asia-Pacific, from heavy engineering to consumer electronics, creates a wide application base for regulators. The rising investments in automation and smart production further amplify the need for reliable voltage control solutions.

By Country: China

China stands out as a high-growth market with a 3.8% CAGR. The country’s drive toward industrial modernization and expanding power infrastructure has created strong market needs. Voltage regulators are key to supporting both heavy manufacturing and the growing renewable energy ecosystem.

China’s dominance also comes from large-scale infrastructure projects and adoption of advanced automation in industries. The push toward energy efficiency and stable power environments makes the country a critical contributor to regional and global voltage regulator demand.

Key Market Segments

By Type

- Electromechanical Voltage Regulators

- Automatic Voltage Regulators (AVRs)

- Ferroresonant Voltage Regulators

- Static Voltage Regulators

By Application

- Industrial

- Commercial

- Residential

By Voltage

- Less than 250 kVA

- 250 KVA to 500 kVA

- More than 500 kVA

By Type

- Linear

- Switching

By Phase

- Single Phase

- Three Phase

By End-Use Industry

- Manufacturing

- Healthcare

- IT & Telecom

- Energy & Power

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Stable Power Supply

One of the main drivers for the voltage regulator market is the strong demand for consistent and reliable power supply. Electronic devices and equipment in consumer, industrial, and telecommunications sectors need stable voltage to function properly and avoid damage.

For instance, the rapid adoption of sensitive electronics in homes and factories requires voltage regulators to maintain steady electrical output, ensuring safety and reducing downtime. This growing reliance on electronics helps fuel continuous market growth.

Additionally, industries such as healthcare and information technology depend heavily on uninterrupted power to keep critical systems operational. The rise of smart homes and smart grids also contributes to increased demand, as these systems rely on voltage regulators to prevent sudden power fluctuations. This widespread necessity for stable energy in modern technology landscapes is a steady growth factor in the market.

Restraint Analysis

High Cost and Maintenance Requirements

A key restraint in the voltage regulator market is the relatively high cost and maintenance needs associated with some traditional voltage regulators, especially mechanical types. For example, mechanical voltage regulators often require regular maintenance and component replacements, leading to higher operational costs and more downtime for users. This factor discourages some potential buyers, particularly in cost-sensitive markets.

Moreover, electronic voltage regulators sometimes come with higher upfront prices and can have limitations with overload capacity. These issues make adoption tougher in certain applications where budget constraints are critical. For instance, small businesses or low-margin industries may hesitate due to total cost of ownership concerns. Such economic factors slow the adoption rate despite the clear functional benefits.

Opportunity Analysis

Expansion in Renewable Energy Systems

The growing integration of renewable energy sources like solar and wind power presents a significant opportunity for voltage regulators. Renewable energy systems typically face variable power output, and voltage regulators are critical to managing these fluctuations and ensuring stable grid supply.

For instance, as countries increase their reliance on renewables to meet sustainability goals, demand for advanced voltage regulation technologies rises sharply. This trend is evident in installations where renewable plants require precise voltage control to synchronize with the larger power grid.

Government incentives and growing investment in smart grids further boost this opportunity, opening markets for new voltage regulation products designed specifically for renewable energy applications. Consequently, this area holds promise for manufacturers to innovate and expand sales.

Challenge Analysis

Raw Material Price Volatility

A significant challenge facing the voltage regulator market is the volatility of raw material prices, including copper, aluminum, and silicon. These materials are essential for manufacturing voltage regulators, and fluctuations in their costs directly impact production expenses.

For example, sudden price hikes in copper can increase the cost of regulators, squeezing manufacturer margins and potentially leading to higher prices for customers. This instability makes long-term planning difficult for companies and can disrupt supply chains, leading to delays or shortages.

Firms must balance sourcing strategies and manage cost pressures without compromising product quality. This challenge is especially acute in markets with tight price competition, where any cost increase can reduce competitiveness. Managing raw material volatility is therefore a crucial hurdle for steady market growth.

Competitive Analysis

In the voltage regulator market, ABB, Siemens, Eaton, and General Electric are leading players with strong portfolios in power management and industrial automation. Their solutions are widely used in utility grids, manufacturing plants, and critical infrastructure to ensure stable power supply.

With global distribution networks and continuous R&D investment, these companies focus on enhancing efficiency, reliability, and smart grid integration, making them essential partners for large-scale industrial and energy applications.

Semiconductor leaders such as Texas Instruments, Analog Devices, Infineon Technologies, NXP Semiconductors, STMicroelectronics, and Toshiba dominate the electronic voltage regulator segment. Their products support applications in consumer electronics, automotive, telecommunications, and industrial equipment.

Other contributors including Howard Industries, J. Schneider Elektrotechnik, Schweitzer Engineering Laboratories, Belotti Variatori, Daihen Corporation, Utility Systems Technologies, Maschinenfabrik Reinhausen, and TBEA Co. play significant roles in regional and specialized markets. Their focus on customized solutions for utilities, renewable energy systems, and industrial applications adds diversity to the competitive landscape.

Top Key Players in the Market

- ABB Ltd.

- Analog Devices Inc.

- Eaton Corporation Inc.

- General Electric Company

- Howard Industries Inc.

- Infineon Technologies AG

- J. Schneider Elektrotechnik GmbH

- NXP Semiconductors NV

- Schweitzer Engineering Laboratories Inc.

- Siemens AG

- STMicroelectronics SA

- Texas Instruments Incorporated

- Toshiba Corporation.

- Belotti Variatori SRL

- Daihen Corporation

- Utility Systems Technologies

- Maschinenfabrik Reinhausen GmbH

- TBEA Co., Ltd.

- Other Key Players

Recent Developments

- June 2025: Hitachi Energy introduced a compact line voltage regulator integrated with transformer technology that improves active voltage control for distribution utilities, highlighting advances in grid management systems.

- December 2024: GE Vernova T&D India secured a major contract worth over USD 48 million for supplying high-voltage equipment under a competitive bidding framework, extending its infrastructure footprint in India. This signals strong investment and growth in power transmission infrastructure supporting voltage regulator demand in the region.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 5.6 CAGR(2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Electromechanical Voltage Regulators, Automatic Voltage Regulators (AVRs), Ferroresonant Voltage Regulators, Static Voltage Regulators, Linear, Switching), By Application (Industrial, Commercial, Residential), By Voltage (Less than 250 kVA, 250 kVA to 500 kVA, More than 500 kVA), By Phase (Single Phase, Three Phase), By End-Use Industry (Manufacturing, Healthcare, IT & Telecom, Energy & Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Analog Devices Inc., Eaton Corporation Inc., General Electric Company, Howard Industries Inc., Infineon Technologies AG, J. Schneider Elektrotechnik GmbH, NXP Semiconductors NV, Schweitzer Engineering Laboratories Inc., Siemens AG, STMicroelectronics SA, Texas Instruments Incorporated, Toshiba Corporation, Belotti Variatori SRL, Daihen Corporation, Utility Systems Technologies, Maschinenfabrik Reinhausen GmbH, TBEA Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Analog Devices Inc.

- Eaton Corporation Inc.

- General Electric Company

- Howard Industries Inc.

- Infineon Technologies AG

- J. Schneider Elektrotechnik GmbH

- NXP Semiconductors NV

- Schweitzer Engineering Laboratories Inc.

- Siemens AG

- STMicroelectronics SA

- Texas Instruments Incorporated

- Toshiba Corporation.

- Belotti Variatori SRL

- Daihen Corporation

- Utility Systems Technologies

- Maschinenfabrik Reinhausen GmbH

- TBEA Co., Ltd.

- Other Key Players