Global Vertical Axis Wind Turbine Market Size, Share, And Business Benefits By Type (Darrieus, Savonius, Giromill), By Blade Type (Straight-Bladed Vertical Axis Wind Turbine, Curved-Bladed Vertical Axis Wind Turbine), By Rotor Configuration (H-Type, V-Type), By Power Outlook (Less than 1 MW1-5 MW, 5 MW and Above), By End Use (Commercial and Industrial, Residential, Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150106

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

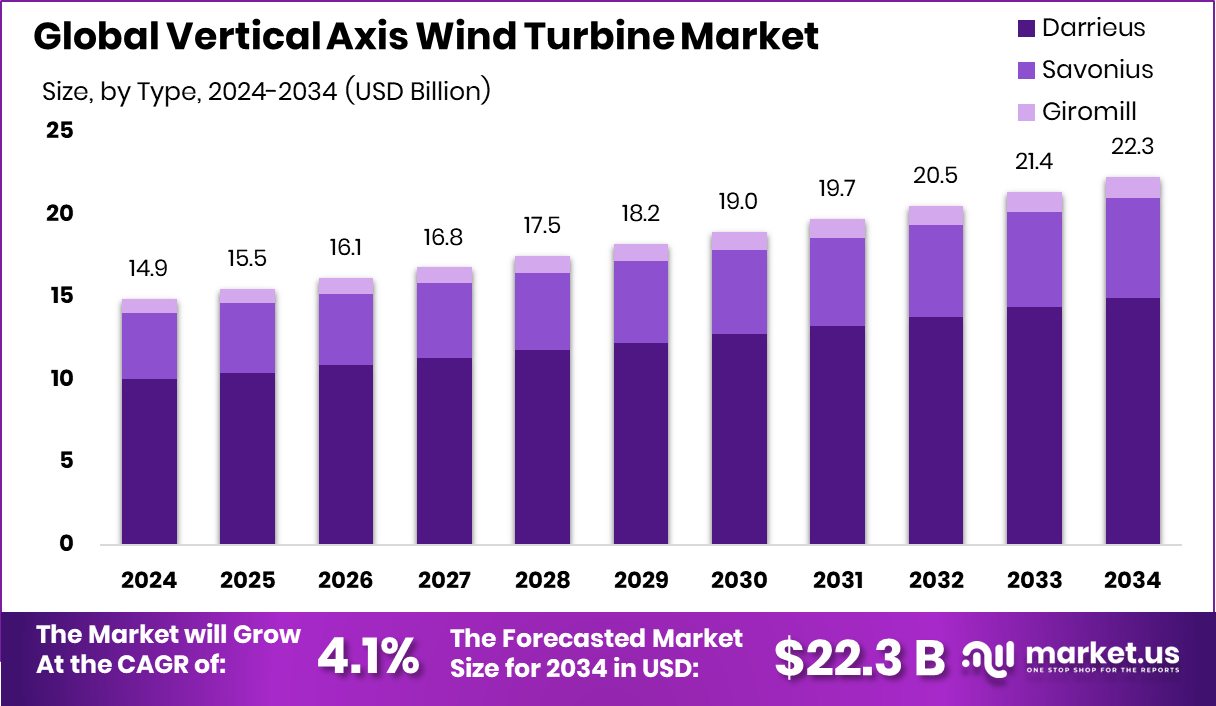

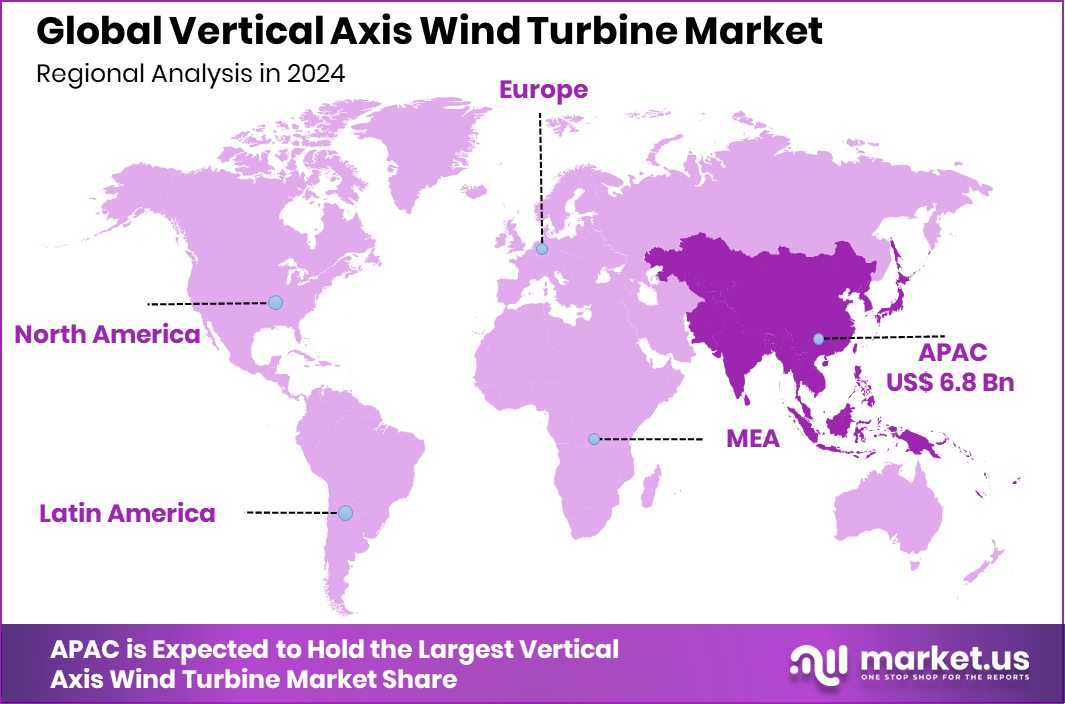

Global Vertical Axis Wind Turbine Market is expected to be worth around USD 22.3 billion by 2034, up from USD 14.9 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. Growing clean energy demand supports Asia-Pacific’s 45.8% share, worth USD 6.8 billion.

A Vertical Axis Wind Turbine (VAWT) is a type of wind turbine where the main rotor shaft is set vertically, unlike traditional horizontal turbines. This design allows the turbine to capture wind from any direction, making it effective in urban areas or places where wind direction is inconsistent. VAWTs usually have a compact structure and operate well at lower wind speeds, which makes them suitable for residential, commercial, and off-grid energy applications.

The Vertical Axis Wind Turbine market is growing as cities focus more on distributed renewable energy. Governments are supporting small-scale wind installations through subsidies and policies. The demand is rising in regions where rooftop and compact wind solutions are preferred over large-scale turbines. The flexibility of VAWTs in tight or complex spaces is drawing attention from developers and small business owners.

One major growth factor is the increasing push toward decarbonization and energy independence. As the cost of energy rises and environmental concerns grow, VAWTs are becoming a practical solution for localized, clean electricity generation. Their low noise, easy maintenance, and aesthetic appeal are also encouraging adoption.

The demand for vertical turbines is particularly strong in urban settings and remote locations. They can be installed on rooftops, buildings, or near infrastructure where horizontal turbines are not feasible. This has opened up new applications in telecom towers, agricultural facilities, and community microgrids.

Key Takeaways

- Global Vertical Axis Wind Turbine Market is expected to be worth around USD 22.3 billion by 2034, up from USD 14.9 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- In 2024, Darrieus-type held a 67.3% share in the Vertical Axis Wind Turbine Market.

- Straight-bladed vertical axis turbines accounted for 65.9% of the blade type segment in the market.

- H-type rotor configuration dominated with a 71.4% share, driven by design efficiency and easier installation.

- The less than 1 MW power segment led with a 49.1% share due to small-scale renewable installations.

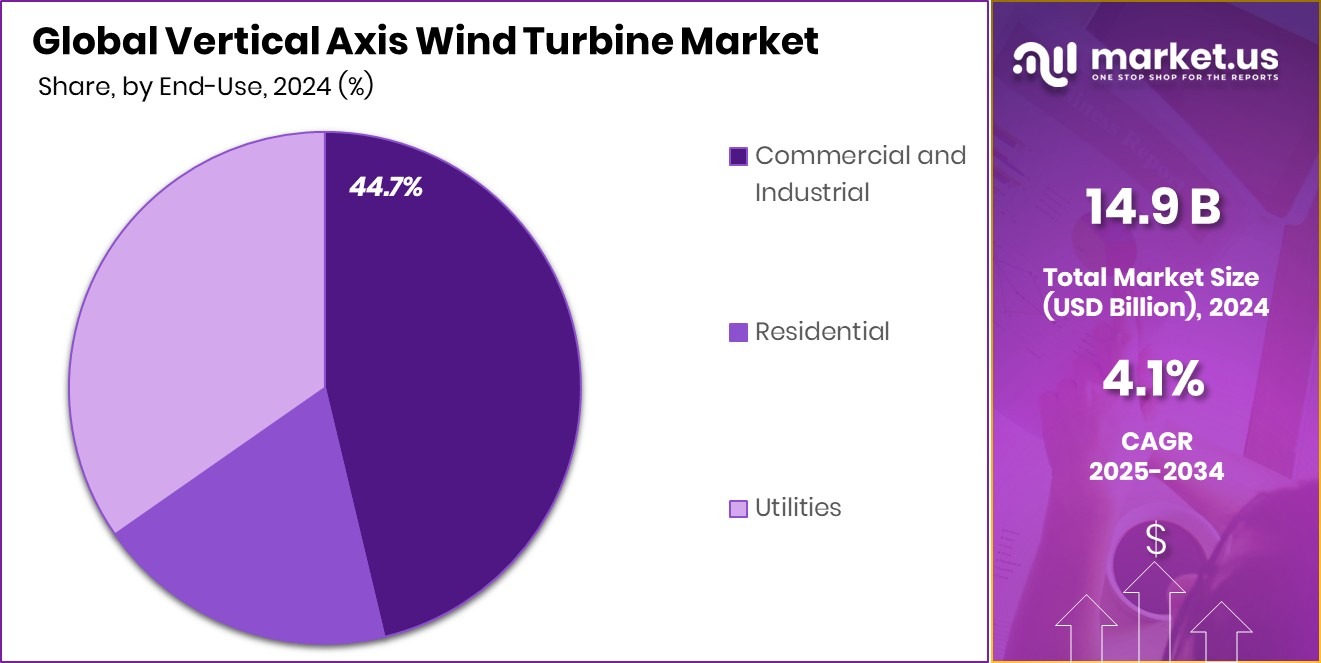

- The commercial and industrial end-use segment captured 44.7% market share, driven by rising energy independence initiatives.

- The market value in Asia-Pacific reached a strong USD 6.8 billion in 2024.

By Type Analysis

Darrieus type dominates the Vertical Axis Wind Turbine Market with 67.3% share.

In 2024, Darrieus held a dominant market position in the By Type segment of the Vertical Axis Wind Turbine Market, with a 67.3% share. This dominance is primarily attributed to its higher efficiency and ability to operate effectively at a wider range of wind speeds compared to other vertical-axis designs.

Darrieus turbines, known for their eggbeater-like appearance, leverage aerodynamic lift rather than drag, allowing for better energy conversion and smoother operation. Their ability to harness wind from any direction with minimal turbulence makes them suitable for both urban and semi-urban settings where wind patterns are variable.

The segment’s growth has also been driven by increased installations in commercial and industrial setups where continuous power generation is vital. Additionally, the ease of integrating Darrieus turbines with hybrid energy systems and their reduced noise output compared to horizontal turbines further strengthens their appeal among environmentally conscious users.

The structural robustness and long lifespan of Darrieus models contribute to lower maintenance costs, offering long-term benefits for investors and operators. As governments push for clean energy adoption in decentralized grids, the Darrieus type is expected to retain its market leadership through the near term, supported by ongoing technological improvements and favorable policy frameworks.

By Blade Type Analysis

Straight-bladed design leads the blade type segment, holding 65.9% market share globally.

In 2024, Straight-Bladed Vertical Axis Wind Turbines held a dominant market position in the By Blade Type segment of the Vertical Axis Wind Turbine Market, with a 65.9% share. This strong market presence is largely due to the blade design’s simplicity, structural stability, and ease of manufacturing. The straight-bladed configuration, often associated with the H-type Darrieus turbine, allows for more straightforward assembly and maintenance, which reduces overall operational costs.

Their fixed blade structure provides consistent performance and can handle turbulent and variable wind conditions without requiring complex pitch control mechanisms. This reliability is important for applications in remote or grid-edge areas where consistent energy output is critical. Furthermore, the aerodynamic performance of straight blades ensures relatively higher efficiency at lower tip speeds, reducing noise and making them suitable for noise-sensitive areas such as residential or educational zones.

The dominance of the straight-bladed type is further supported by its adaptability across different scales, ranging from small rooftop systems to larger installations in community microgrids. Its cost-effectiveness and compatibility with hybrid energy systems have contributed to its wide adoption, reinforcing its leading position in the market.

By Rotor Configuration Analysis

H-Type rotor configuration accounts for 71.4% of the turbine installations worldwide.

In 2024, H-Type held a dominant market position in the By Rotor Configuration segment of the Vertical Axis Wind Turbine Market, with a 71.4% share. This leadership is primarily driven by the H-Type rotor’s structural simplicity and high efficiency, especially in low-to-moderate wind conditions. The H-Type configuration features straight vertical blades connected to the central shaft by horizontal supports, resulting in better balance and reduced mechanical stress during operation.

Its aerodynamic stability and ease of construction have made H-Type rotors the preferred choice for both small and medium-scale applications, particularly in urban and semi-urban environments. Additionally, the compact footprint of H-Type turbines supports installations on rooftops, towers, and constrained land areas where traditional horizontal axis designs are not feasible. The absence of yaw mechanisms or complex blade pitch systems further reduces maintenance needs and improves operational reliability.

The segment’s growth is further reinforced by the H-Type’s compatibility with hybrid renewable systems and battery storage solutions. Its ability to operate quietly and efficiently in turbulent winds makes it ideal for distributed energy projects. As the market continues to favor modular, scalable, and low-maintenance solutions, the H-Type configuration is expected to sustain its dominant share.

By Power Outlook Analysis

Less than 1 MW turbines represent a 49.1% share in the power capacity segment.

In 2024, Less than 1 MW held a dominant market position in the By Power Output segment of the Vertical Axis Wind Turbine Market, with a 49.1% share. This dominance reflects the growing preference for small-scale wind solutions tailored to residential, commercial, and community-level power needs. Turbines in this category are compact, cost-effective, and well-suited for decentralized energy generation, especially in urban and semi-urban settings where large installations are not practical.

The less than 1 MW segment has gained traction due to increasing demand for clean energy in off-grid and grid-supportive applications. These systems are often used to power individual buildings, telecom towers, agricultural operations, and remote infrastructure. The lower capital investment required for installation and the reduced permitting complexities make these turbines attractive for a broader range of end-users.

Furthermore, their ease of integration with solar panels and battery storage has accelerated their deployment in hybrid renewable setups. These small-scale turbines also appeal to environmentally conscious consumers and businesses aiming to reduce dependence on fossil fuels. As sustainability goals become more localized and energy autonomy gains importance, the under-1 MW segment is expected to maintain its leading position in the VAWT market through continued adoption across diverse geographies.

By End Use Analysis

Commercial and industrial usage captures 44.7% of the Vertical Axis Wind Turbine Market.

In 2024, Commercial and Industrial held a dominant market position in the By End Use segment of the Vertical Axis Wind Turbine Market, with a 44.7% share. This leading position reflects the increasing adoption of onsite renewable energy solutions by businesses seeking to reduce energy costs and meet sustainability goals. Vertical axis wind turbines are particularly attractive to commercial and industrial users due to their ability to operate efficiently in variable wind conditions and limited space conditions often present in urban and industrial zones.

The commercial and industrial segment benefits from the versatility of VAWTs, which can be installed on rooftops, within facility premises, or as part of hybrid energy systems. These turbines help stabilize energy supply while reducing reliance on conventional grid electricity. As energy prices fluctuate and carbon reduction targets become more stringent, many companies are turning to decentralized wind energy as a strategic asset.

Moreover, the relatively low maintenance and long operational lifespan of VAWTs align well with industrial requirements for durable and low-intervention technologies. Their quiet operation and visual adaptability also support integration in business parks and industrial estates.

Key Market Segments

By Type

- Darrieus

- Savonius

- Giromill

By Blade Type

- Straight-Bladed Vertical Axis Wind Turbine

- Curved-Bladed Vertical Axis Wind Turbine

By Rotor Configuration

- H-Type

- V-Type

By Power Outlook

- Less than 1 MW

- 1-5 MW

- 5 MW and Above

By End Use

- Commercial and Industrial

- Residential

- Utilities

Driving Factors

Urban Energy Demand Boosts Vertical Turbine Adoption

One of the main driving factors in the Vertical Axis Wind Turbine (VAWT) market is the growing demand for clean and compact energy solutions in urban areas. Cities are getting more crowded, and people are looking for ways to generate electricity locally without taking up too much space. VAWTs are perfect for this need because they are small, quiet, and work well even when the wind changes direction often.

Many businesses, schools, and public buildings are now using these turbines to reduce their electricity bills and support green energy. Governments are also helping by giving tax benefits and grants for installing small wind systems. All this is helping the VAWT market grow steadily in city regions.

Restraining Factors

Lower Efficiency Compared To Horizontal Axis Turbines

One major restraining factor in the Vertical Axis Wind Turbine (VAWT) market is their lower energy efficiency compared to Horizontal Axis Wind Turbines (HAWTs). While VAWTs are great for small spaces and can capture wind from any direction, they usually produce less power for the same wind speed and rotor size. This makes them less suitable for large-scale energy production, especially in areas where high wind speeds are common.

Because of this, many utility companies and big investors still prefer horizontal turbines. The lower efficiency can also lead to longer payback periods, which discourages some businesses and homeowners from choosing VAWTs. This performance gap continues to limit their adoption in certain wind energy projects.

Growth Opportunity

Rising Off-Grid Applications In Remote Areas

A key growth opportunity in the Vertical Axis Wind Turbine (VAWT) market lies in the rising demand for off-grid energy in remote and rural areas. Many places around the world still lack reliable access to electricity, especially in developing countries or hard-to-reach terrains like mountains and islands. VAWTs are a good solution because they are easy to install, require less maintenance, and can generate power even in low or shifting wind conditions.

These turbines can power small homes, schools, hospitals, or telecom towers without needing to connect to the main power grid. As the need for energy independence grows and governments push for rural electrification, VAWTs are becoming a smart and scalable option for off-grid power supply.

Latest Trends

Integration With Smart Grids And IoT Systems

A top trend in the Vertical Axis Wind Turbine (VAWT) market is the growing integration with smart grids and Internet of Things (IoT) technology. Today, many small wind turbines are being connected to smart systems that monitor wind speed, power output, and turbine health in real-time. This helps users get the most out of their wind energy setup by adjusting operations based on weather or energy demand.

IoT sensors also make maintenance easier by sending alerts before something goes wrong. Smart grid integration allows the turbine to work smoothly with solar panels or batteries, making energy use more efficient. This trend is making VAWTs smarter, safer, and more useful for homes, businesses, and communities.

Regional Analysis

In 2024, Asia-Pacific led the Vertical Axis Wind Turbine Market with 45.8%.

In 2024, Asia-Pacific emerged as the leading region in the Vertical Axis Wind Turbine Market, capturing a dominant 45.8% share, which translates to a market value of USD 6.8 billion. The region’s leadership is supported by strong investments in decentralized renewable energy systems and increased deployment of wind technologies in both urban and rural areas. Countries such as China, India, Japan, and South Korea are focusing on integrating small-scale wind systems into their broader clean energy mix, especially in off-grid and semi-urban zones.

North America continues to see steady growth, driven by increasing adoption of vertical wind turbines for residential and commercial power generation, particularly in the U.S. and Canada. Europe is also an active market, leveraging supportive policy frameworks and a shift toward smart energy infrastructure. The Middle East & Africa region is witnessing gradual adoption, mainly through pilot projects and off-grid installations in remote areas.

Meanwhile, Latin America is exploring vertical wind technologies as part of rural electrification efforts and small-scale green energy projects. Overall, regional momentum is shaped by differing levels of infrastructure, government incentives, and application-specific demand, with Asia-Pacific firmly leading the global market in both value and adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Goldwind maintained a strong presence in the Vertical Axis Wind Turbine (VAWT) market through its consistent focus on technological innovation and sustainable solutions. While traditionally recognized for large horizontal wind turbines, Goldwind has strategically diversified into the vertical segment to tap into urban and distributed energy applications. The company’s engineering capabilities and global supply chain position it well to deliver compact wind solutions for residential, commercial, and off-grid installations, particularly in Asia-Pacific.

Helix Wind continues to stand out in the market with its signature helical blade designs, which offer both visual appeal and functional benefits. The company emphasizes rooftop and low-wind installations, leveraging the aerodynamic stability of its turbines to cater to individual households and small commercial setups. Helix Wind’s designs are particularly well-suited for noise-sensitive and architecturally constrained environments, making them attractive in urban locations.

Kliux Energies has built a niche by integrating wind and solar hybrid systems with vertical turbines. Focused on sustainable building integration, Kliux Energies delivers aesthetically pleasing and efficient energy solutions for public infrastructure, commercial rooftops, and community spaces. Their compact VAWT units reflect a design-forward approach aligned with modern urban planning goals.

Top Key Players in the Market

- Aeolos

- Astralux

- Eastern Wind Power

- Envergate Energy

- Envision Energy

- Goldwind

- Helix Wind

- Kliux Energies

- Lagerwey

- Norvento

- Siemens Gamesa Renewable Energy

- Sumitomo Heavy Industries

- Suzlon Energy

- V-Air Wind Technologies

- Vestas Wind Systems

- Wind Harvest

- Windspire Energy

Recent Developments

- In June 2024, Goldwind successfully installed its first Medium-Speed Permanent-Magnet (MSPM) turbine outside of China as part of the Lagoa do Barro Retrofit project in Brazil. This installation marks a significant step in Goldwind’s international expansion and showcases its commitment to advancing wind turbine technology.

- In June 2024, Norvento Enerxía began the shipment of its nED100 wind turbines to the Portuguese island of Corvo, demonstrating the company’s ongoing efforts to expand its presence in the renewable energy sector.

Report Scope

Report Features Description Market Value (2024) USD 14.9 Billion Forecast Revenue (2034) USD 22.3 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Darrieus, Savonius, Giromill), By Blade Type (Straight-Bladed Vertical Axis Wind Turbine, Curved-Bladed Vertical Axis Wind Turbine), By Rotor Configuration (H-Type, V-Type), By Power Outlook (Less than 1 MW1-5 MW, 5 MW and Above), By End Use (Commercial and Industrial, Residential, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aeolos, Astralux, Eastern Wind Power, Envergate Energy, Envision Energy, Goldwind, Helix Wind, Kliux Energies, Lagerwey, Norvento, Siemens Gamesa Renewable Energy, Sumitomo Heavy Industries, Suzlon Energy, V-Air Wind Technologies, Vestas Wind Systems, Wind Harvest, Windspire Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vertical Axis Wind Turbine MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Vertical Axis Wind Turbine MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aeolos

- Astralux

- Eastern Wind Power

- Envergate Energy

- Envision Energy

- Goldwind

- Helix Wind

- Kliux Energies

- Lagerwey

- Norvento

- Siemens Gamesa Renewable Energy

- Sumitomo Heavy Industries

- Suzlon Energy

- V-Air Wind Technologies

- Vestas Wind Systems

- Wind Harvest

- Windspire Energy