Global Vegetable Oil Market Size, Share, And Business Benefits By Type (Palm Oil, Olive Oil, Coconut Oil, Soybean Oil, Rapeseed Oil, Sunflower Oil, Others), By Nature (Conventional, Organic), By Application (Food Industry, Biofuels, Others), By Distribution Channel (HoReCa/Foodservice, Supermarkets/Hypermarkets, Convenience Stores/Grocery Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152867

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

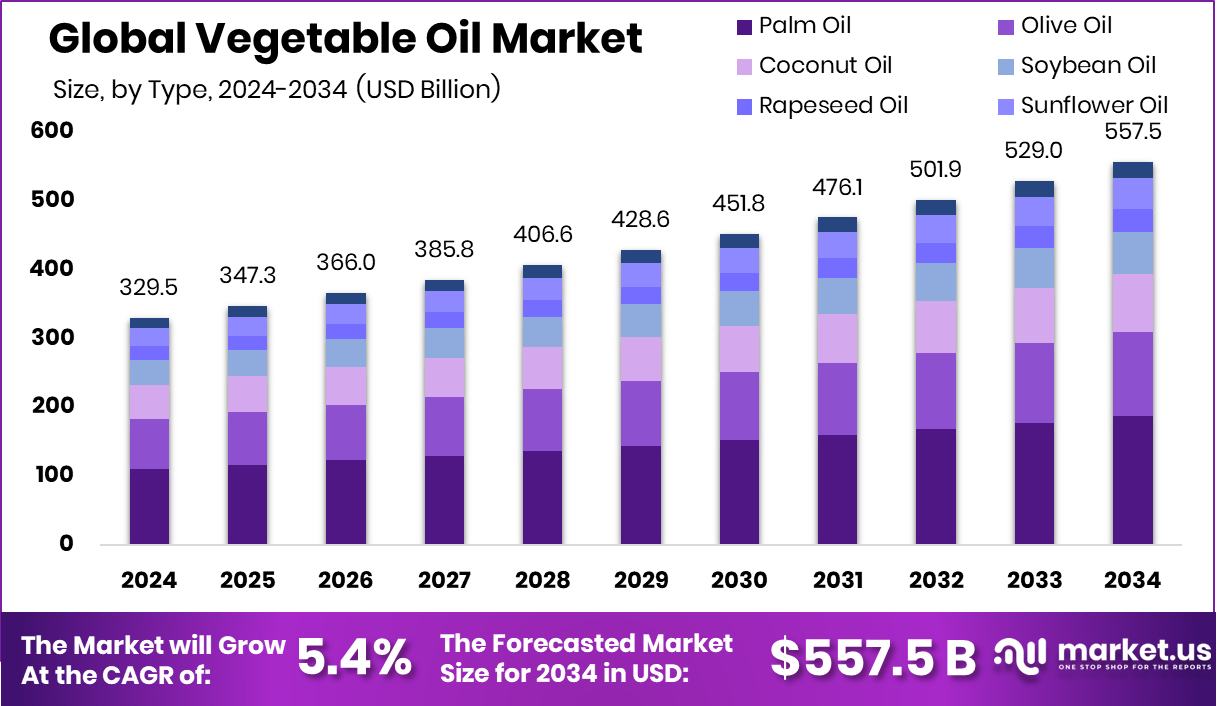

Global Vegetable Oil Market is expected to be worth around USD 557.5 billion by 2034, up from USD 329.5 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. Strong demand from food and industrial sectors supports Asia-Pacific’s 47.90% leading market position.

Vegetable oil refers to oils extracted from seeds or other parts of plants, commonly used in cooking, baking, and food processing. These oils include varieties such as soybean, sunflower, palm, canola, and olive oil. They are rich in unsaturated fats and are often chosen for their health benefits, neutral taste, and high smoke point. Edible oil imports have dropped by 21% since November, indicating a shift toward self-reliance and possibly increased domestic production or alternative sourcing strategies.

The vegetable oil market comprises the global production, trade, processing, and consumption of plant-based oils. It spans multiple industries, including food and beverage, biofuels, animal feed, and personal care. The market is shaped by factors such as crop yields, weather conditions, government policies, and changing dietary habits.

Growth is closely linked to population size, urbanization, and rising awareness of health and wellness, especially in developing economies where consumption patterns are shifting. Cano-ela receives €1.6 million funding to boost seed-based ingredient development, reflecting investment interest in sustainable oilseed innovations.

The growth of the vegetable oil market can be attributed to increasing food consumption globally and a growing preference for plant-based products. The expansion of the food processing sector, particularly in emerging economies, has further driven demand for vegetable oils. Health trends promoting unsaturated fats over animal fats also support market expansion. Holiferm raises US$23.36 million to expand production capacity, supporting innovations in fermentation-derived vegetable oils that align with these health trends.

Changing lifestyles, higher disposable incomes, and a shift toward home cooking have increased vegetable oil consumption, particularly in urban areas. Additionally, the use of vegetable oils in packaged and convenience foods is rising, reflecting demand from busy consumers seeking ready-to-use cooking ingredients with longer shelf life.

Romania allocates EUR 70 million in grants for replacing shut sunflower oil facilities, strengthening the supply chain for processed oils. Moreover, Sunflower Capital, founded by a Sequoia alum, secures $150 million in funding, indicating robust investor confidence in the oilseed and plant-based ingredient space.

Key Takeaways

- Global Vegetable Oil Market is expected to be worth around USD 557.5 billion by 2034, up from USD 329.5 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034

- In the vegetable oil market, palm oil held the largest share at 33.6% by type.

- Conventional vegetable oils dominated the market by nature, accounting for 89.1% of total consumption.

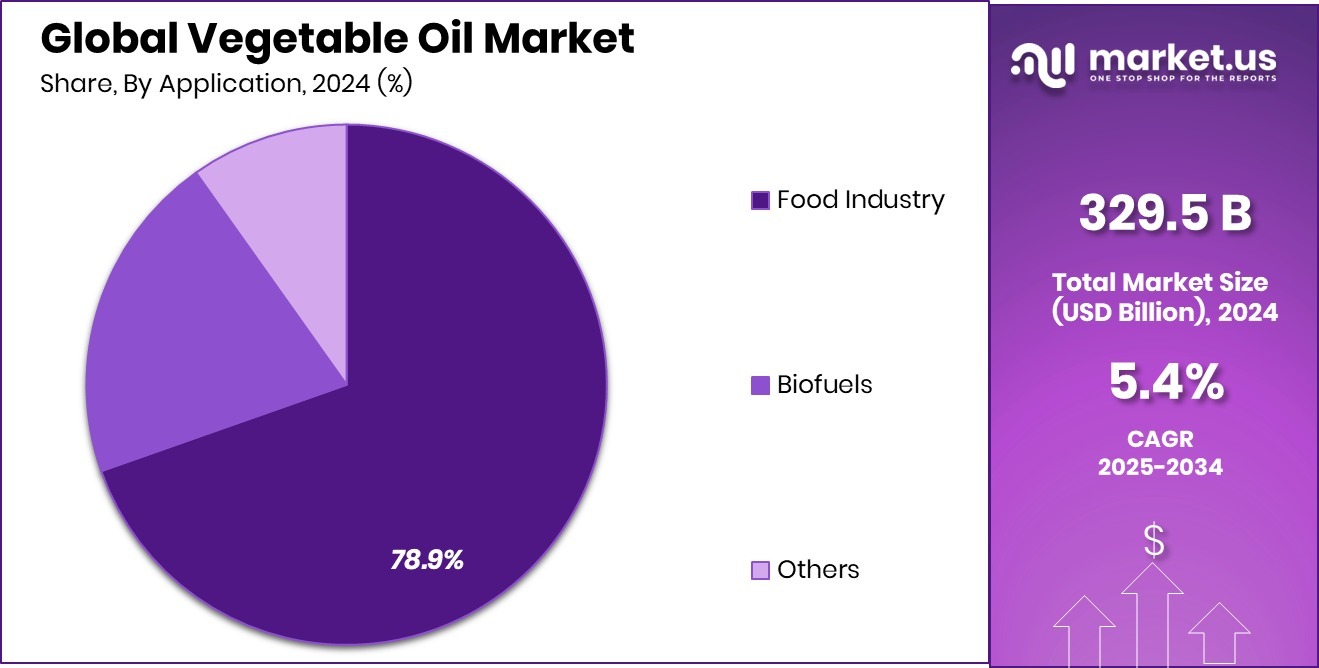

- The food industry led application-wise, utilizing 78.9% of the total vegetable oil market volume.

- HoReCa and foodservice channels contributed a 36.2% share in the vegetable oil market distribution.

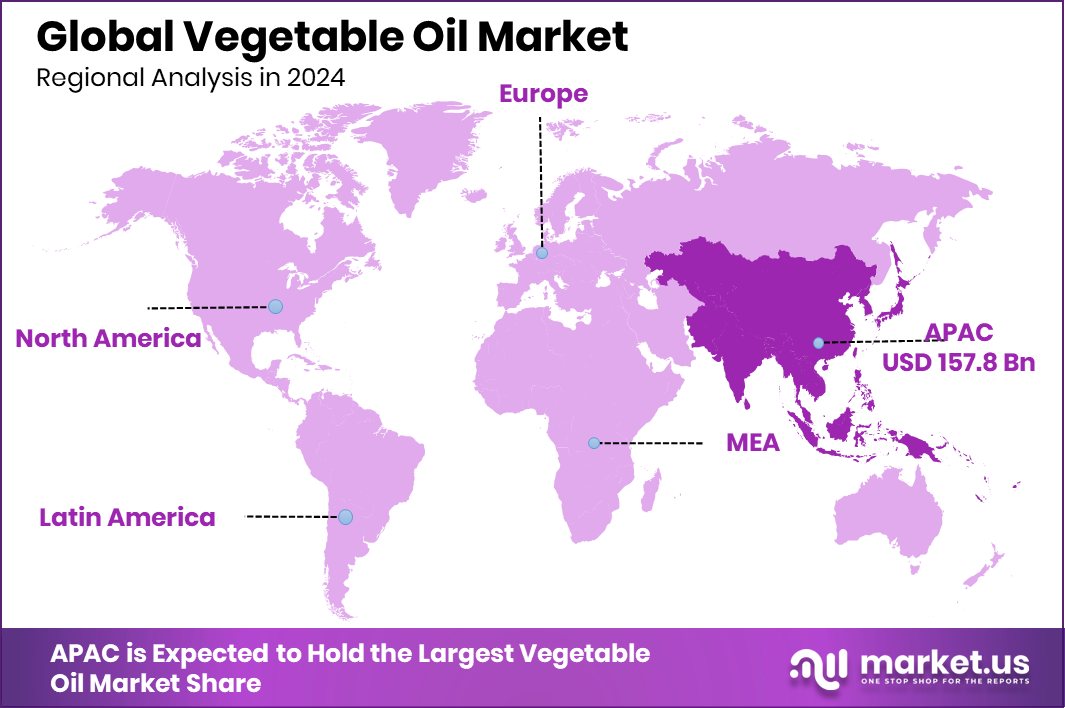

- The Asia-Pacific market value reached USD 157.8 billion due to high consumption levels.

By Type Analysis

Palm oil leads the vegetable oil market with a 33.6% share.

In 2024, Palm Oil held a dominant market position in the By Type segment of the Vegetable Oil Market, with a 33.6 share. This strong market presence was primarily driven by its widespread availability, cost-effectiveness, and diverse industrial applications.

Palm oil continues to be a staple in food manufacturing due to its neutral taste, long shelf life, and high yield per hectare, making it economically viable for both producers and processors. Its stability at high temperatures also makes it suitable for deep-frying and packaged food production, further reinforcing its demand in the global food sector.

The dominance of palm oil in the vegetable oil market is also supported by its extensive use in non-food sectors, such as personal care products, cleaning agents, and biofuels. These expanding applications, coupled with robust supply chains in major producing regions, have maintained palm oil’s leading role.

Additionally, growing population and urbanization trends in emerging economies have led to increased consumption of affordable edible oils, in which palm oil plays a central role. Despite global sustainability concerns, its dominant market share in 2024 underscores its crucial role in both domestic and industrial consumption across multiple regions.

By Nature Analysis

Conventional oils dominate the vegetable oil market at 89.1%.

In 2024, Conventional held a dominant market position in the By Application segment of the Vegetable Oil Market, with a 89.1% share. This dominance is largely attributed to the widespread use of conventional vegetable oils in everyday cooking, food preparation, and large-scale food processing.

Conventional vegetable oils are generally produced using traditional refining methods, making them more affordable and accessible for both household and commercial use. Their broad acceptance in global culinary practices, especially in developing economies, continues to support high-volume consumption.

The high market share of the conventional segment also reflects its integration into institutional and foodservice channels, where large quantities are required for consistent and cost-effective food production. Consumers in many parts of the world continue to prefer conventional oils for their versatility, neutral flavor, and familiarity.

Moreover, the infrastructure supporting conventional oil production, including supply chains and refining facilities, is well-established, further enabling its large-scale distribution. Despite the growing attention to alternative oil types, conventional vegetable oils remain the first choice for a significant portion of the global population, reaffirming their stronghold in the market throughout 2024.

By Application Analysis

The food industry drives 78.9% demand in the vegetable oil market.

In 2024, Food Industry held a dominant market position in the Product Type segment of the Vegetable Oil Market, with a 78.9% share. This significant share reflects the critical role vegetable oils play in food preparation, processing, and manufacturing across households and commercial sectors.

Their widespread use in cooking, frying, baking, salad dressings, margarine, and processed foods has made them an essential component of the modern diet. The dominance of this segment is supported by the global rise in food consumption, urbanization, and the growth of ready-to-eat and convenience food products.

The food industry’s demand for vegetable oils is further strengthened by the growing need for scalable and affordable ingredients that meet functional and nutritional requirements. Vegetable oils offer the required texture, shelf life stability, and cooking performance needed in high-volume food production.

Additionally, their use in institutional kitchens, restaurants, and packaged food facilities continues to be high, contributing to the segment’s leading share. The 78.9% dominance in 2024 illustrates how deeply integrated vegetable oils are in the food industry’s value chain, highlighting their continued importance in meeting global food demand and supporting both traditional and industrial food systems.

By Distribution Channel Analysis

The HoReCa segment holds 36.2% in vegetable oil distribution.

In 2024, HoReCa/Foodservice held a dominant market position in the By Application segment of the Vegetable Oil Market, with a 36.2% share. This leadership is primarily due to the heavy and consistent usage of vegetable oils in hotels, restaurants, cafés, and catering services.

These establishments rely on large volumes of oil for deep frying, sautéing, baking, and food preparation, where consistency, high-temperature stability, and cost-effectiveness are essential. Vegetable oils meet these requirements efficiently, making them a preferred choice across the global foodservice sector.

The 36.2% share also reflects the growing scale of the foodservice industry worldwide, especially in urban areas where dining out and food delivery services have become part of everyday life. The HoReCa segment continues to demand oils that can maintain food quality and shelf life, contributing to the segment’s growth.

Bulk purchasing, along with increasing footfall in quick-service restaurants and casual dining outlets, supports high-volume consumption. In 2024, the dominance of the HoReCa/Foodservice segment clearly underscores the central role of vegetable oils in commercial kitchens and institutional food operations, where performance and volume requirements align closely with the properties offered by vegetable oil products.

Key Market Segments

By Type

- Palm Oil

- Olive Oil

- Coconut Oil

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

- Others

By Nature

- Conventional

- Organic

By Application

- Food Industry

- Biofuels

- Others

By Distribution Channel

- HoReCa/Foodservice

- Supermarkets/Hypermarkets

- Convenience Stores/Grocery Stores

- Online Retail Stores

- Others

Driving Factors

Rising Food Consumption Boosting Vegetable Oil Demand

One of the key driving factors for the vegetable oil market is the increasing global demand for food. As the world population continues to grow, more people are consuming packaged, ready-to-cook, and restaurant-prepared meals, many of which rely on vegetable oils for cooking and food processing. Vegetable oils are essential in frying, baking, and flavoring, making them a core ingredient in daily diets.

Additionally, the rise in urbanization has led to changing lifestyles, where convenience foods are preferred, further boosting oil usage. Countries with expanding middle-class populations are also seeing higher consumption of edible oils due to increased income levels and improved access to diverse food products.

Restraining Factors

Environmental Concerns Slowing Growth of Vegetable Oil

A major restraining factor for the vegetable oil market is the growing concern over environmental issues linked to oil crop production. The large-scale cultivation of crops like palm and soybean oil often leads to deforestation, habitat loss, and high carbon emissions. These environmental impacts have raised strong criticism from environmental groups and prompted stricter regulations in many regions.

As a result, producers are facing increasing pressure to adopt sustainable farming practices, which can raise production costs and slow expansion. Consumers are also becoming more aware of sustainability and are demanding eco-friendly products.

Growth Opportunity

Rising Demand for Organic and Clean Label Oils

A major growth opportunity in the vegetable oil market lies in the increasing consumer preference for organic and clean label products. People today are more health-conscious and prefer oils that are free from chemicals, additives, and genetically modified ingredients. This shift in lifestyle is especially noticeable among younger populations and urban consumers who are willing to pay more for healthier and natural food choices.

Organic vegetable oils, such as cold-pressed and unrefined varieties, are becoming popular for home cooking as well as premium food manufacturing. As awareness grows around food safety and transparency, producers who focus on clean label and organic vegetable oils stand to benefit from rising demand, creating a strong pathway for future market expansion.

Latest Trends

Plant-Based Diets Fueling Healthier Oil Choices

A key trend in the vegetable oil market is the growing shift toward plant-based diets, which is encouraging the use of healthier oil options. More people are replacing animal fats like butter and lard with plant-based oils such as sunflower, canola, and olive oil. This trend is especially strong among consumers focused on heart health, weight control, and vegan or vegetarian lifestyles.

Vegetable oils are rich in unsaturated fats and are often seen as better alternatives for cooking and baking. Food manufacturers are also reformulating products to include plant-based oils to align with changing consumer preferences. As the plant-based movement continues to grow, demand for natural, minimally processed vegetable oils is expected to rise steadily across both home and commercial kitchens.

Regional Analysis

In 2024, Asia-Pacific dominated the vegetable oil market with a 47.90% share.

In 2024, Asia-Pacific held a dominant position in the global vegetable oil market, accounting for 47.90% of the total share, which translates to a market value of USD 157.8 billion. The region’s leadership is primarily driven by high consumption across densely populated countries, supported by expanding food processing industries and widespread use of vegetable oils in both household and industrial applications.

Rapid urbanization and dietary shifts toward packaged and convenience foods further reinforce demand in the region. North America continues to exhibit stable growth, supported by a well-established food industry and rising health awareness influencing oil preferences. Europe maintains a steady position in the market, backed by consumer demand for clean-label and sustainable oil products, alongside consistent usage in bakery and processed foods.

The Middle East & Africa region reflects moderate growth, mainly fueled by increasing food demand and economic development in key urban centers. Latin America also contributes to the market through rising domestic production and expanding consumption across foodservice sectors.

However, Asia-Pacific remains the clear market leader due to its large-scale consumption patterns and strong industrial base, making it the most influential region in shaping the global vegetable oil landscape in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bhushan Oils & Fats Pvt. Ltd., headquartered in Haryana, India, has established itself as a reliable edible oil supplier since its inception in 2000. Its manufacturing capabilities encompass refined oils, traditional vanaspati, mustard oil, and bakery shortenings. Operating as a private, unlisted entity, the company remains focused on domestic production and supplying bulk edible oils to both retail and institutional buyers.

Bunge Limited continues to operate as a preeminent player in oilseed processing, headquartered in St. Louis and Geneva. Its Refined and Specialty Oils segment remains central to its business, and the firm recently expanded production capacity via a new Canadian refinery. The 2024 merger with Viterra enhanced its global sourcing and distribution network, enabling a diversified offering across food, feed, and biofuel markets.

Cargill Incorporated, as a privately held global leader, offers extensive involvement in palm and other vegetable oils. In 2024, it became the first edible oil supplier to fully comply with WHO guidelines, eliminating industrial trans-fatty acids, a move recognized by the Access to Nutrition initiative. Its global supply chain encompasses sourcing, refining, and distribution across 70 countries, reflecting a deep commitment to sustainability and innovation.

Top Key Players in the Market

- Agro Tech Foods Limited

- Archer Daniels Midland Company

- Avril Group

- Bhushan Oils & Fats Pvt. Ltd.

- Bunge Limited

- Cargill Incorporated

- Fuji Oil Holding Inc.

- Golden Agri-Resources

- IFFCO Group

- KTC

- Kuala Lumpur Kepong Berhad

- Louis Dreyfus Company B.V.

- Marico Ltd.

- Olam International Limited

- Ottogi Co., Ltd.

- Patanjali Ayurveda Limited

- Pompeian

Recent Developments

- In April 2025, Closed Kershaw, South Carolina soybean plant: As part of a $500–700 million cost-saving initiative, ADM permanently shut its 50,000‑bushel/day Kershaw crush plant, citing policy uncertainty and biofuel sector slowdown.

- In February 2024, Conagra Brands completed the sale of its 51.8% stake in Agro Tech Foods, streamlining its focus and enabling ATFL to operate independently with continued licensing of ACT II popcorn and Sundrop oils.

Report Scope

Report Features Description Market Value (2024) USD 329.5 Billion Forecast Revenue (2034) USD 557.5 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Palm Oil, Olive Oil, Coconut Oil, Soybean Oil, Rapeseed Oil, Sunflower Oil, Others), By Nature (Conventional, Organic), By Application (Food Industry, Biofuels, Others), By Distribution Channel (HoReCa/Foodservice, Supermarkets/Hypermarkets, Convenience Stores/Grocery Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agro Tech Foods Limited, Archer Daniels Midland Company, Avril Group, Bhushan Oils & Fats Pvt. Ltd., Bunge Limited, Cargill Incorporated, Fuji Oil Holding Inc., Golden Agri-Resources, IFFCO Group, KTC, Kuala Lumpur Kepong Berhad, Louis Dreyfus Company B.V., Marico Ltd., Olam International Limited, Ottogi Co., Ltd., Patanjali Ayurveda Limited, Pompeian Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agro Tech Foods Limited

- Archer Daniels Midland Company

- Avril Group

- Bhushan Oils & Fats Pvt. Ltd.

- Bunge Limited

- Cargill Incorporated

- Fuji Oil Holding Inc.

- Golden Agri-Resources

- IFFCO Group

- KTC

- Kuala Lumpur Kepong Berhad

- Louis Dreyfus Company B.V.

- Marico Ltd.

- Olam International Limited

- Ottogi Co., Ltd.

- Patanjali Ayurveda Limited

- Pompeian