Global Umami Flavors Market Size, Share, And Business Benefits By Type (Natural, Synthetic), By Source (Mushroom, Glutamates, Inosinates, Guanylate, Yeast, Animal Source, Fermented Products, Others), By Form (Powder, Liquid, Paste), By Application (Food and Beverages, Pet Food and Supplements, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157118

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

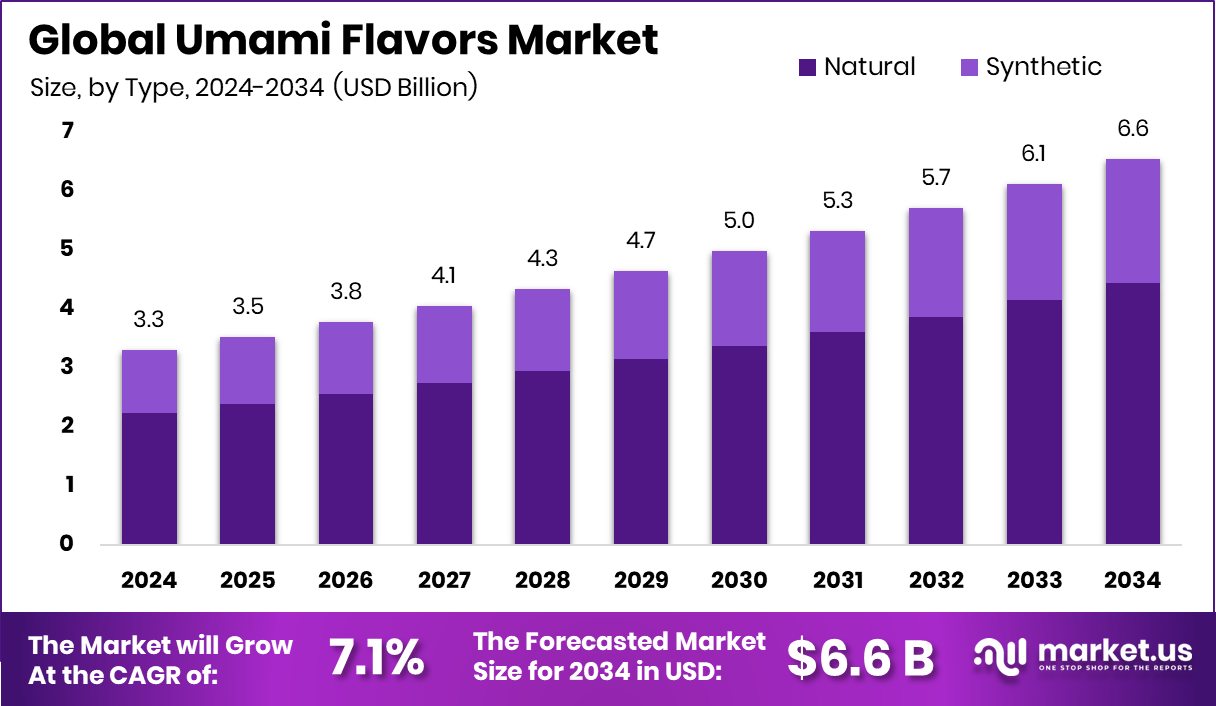

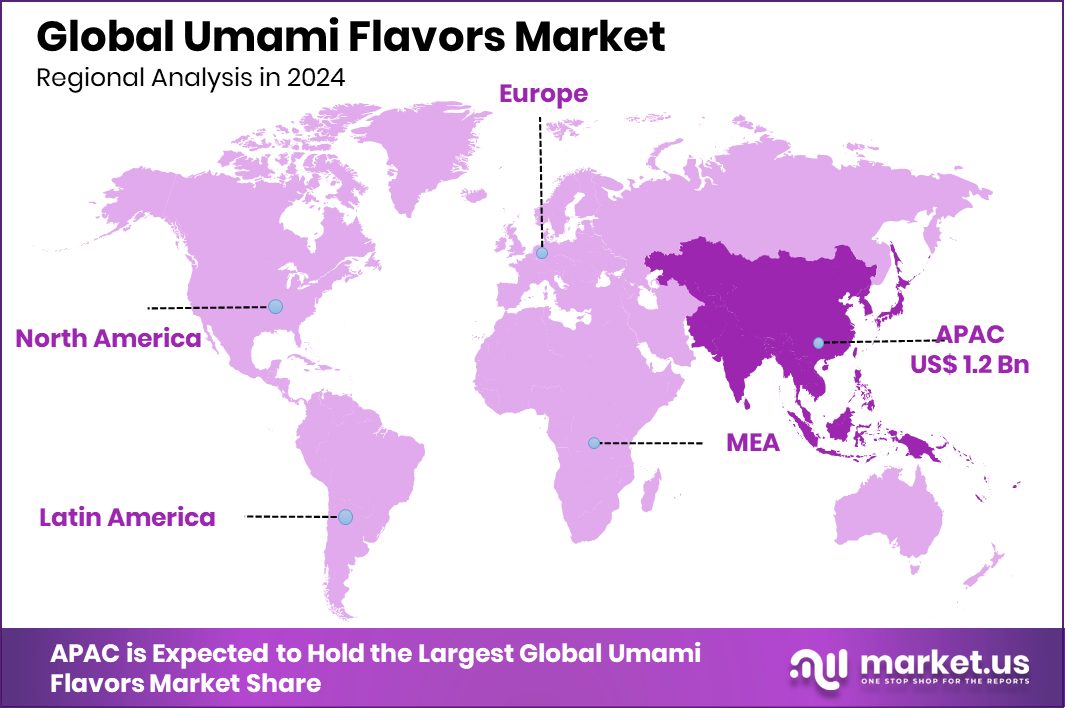

The Global Umami Flavors Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034. The Umami Flavors Market in Asia Pacific, valued at USD 1.2 Bn, captured 38.50%.

Umami flavors are often described as the “fifth taste,” alongside sweet, salty, sour, and bitter. They are savory, rich, and deep, commonly found in foods like tomatoes, mushrooms, soy sauce, and aged cheeses. The science behind umami comes from glutamates and nucleotides naturally present in these foods, giving them a mouth-watering, lingering taste that enhances overall flavor perception. Today, umami is not just a culinary concept but also an essential element in food innovation. According to an industry report, Ayrshire-based Wilsons Pet Food is set for expansion with £1 million support from IFS.

The umami flavors market refers to the global demand and supply of ingredients, additives, and formulations designed to replicate or enhance savory taste in packaged foods, beverages, and culinary applications. This market is gaining traction as consumers increasingly seek bold, authentic flavors in their meals, while food producers explore natural and sustainable ways to improve taste without relying on excessive salt or artificial enhancers. According to an industry report, Vegdog, a German plant-based dog food company, secured $10 million after achieving 66% sales growth.

One of the major growth factors is the rising preference for healthier diets, where people want reduced salt intake but still crave full flavor. Umami serves as a natural solution because it enhances taste without overwhelming sodium, making it appealing for health-focused food development. According to an industry report, Tupu Secures $3.2M to Boost Efficient Indoor Mushroom Farming

The demand for umami flavors is also fueled by the surge in ready-to-eat meals, instant noodles, plant-based products, and snacks, especially in urban areas where convenience drives food choices. The savory profile of umami perfectly fits these product categories, boosting its global usage. According to an industry report, Wipro Consumer Care Ventures invested $1 million in the pet food startup Goofy Tails.

Key Takeaways

- The Global Umami Flavors Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- In 2024, Natural Umami Flavors dominated the market, capturing 67.8% share due to consumer preference.

- Glutamates held a 26.5% share in 2024, driving demand for savory taste enhancers in multiple food products.

- Powder form accounted for 56.2% market share, reflecting its easy application and longer shelf-life across industries.

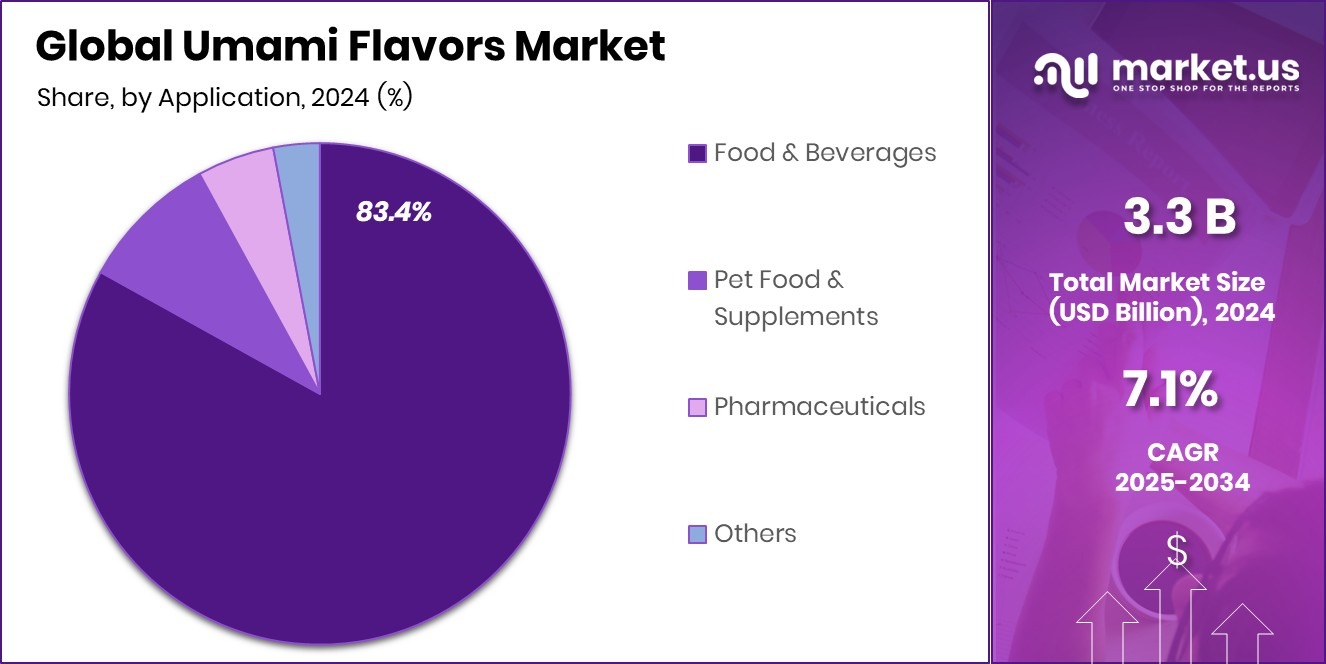

- Food and Beverages application led with 83.4% share, highlighting strong adoption in everyday meals and snacks.

- Asia Pacific, holding 38.50% share and a USD 1.2 Bn value, reflects strong regional demand.

By Type Analysis

In 2024, natural umami flavors led the market with 67.8%.

In 2024, Natural held a dominant market position in By Type segment of the Umami Flavors Market, with a 67.8% share. This strong lead reflects the growing global preference for clean-label and naturally derived ingredients.

Consumers are becoming increasingly aware of the health impacts of synthetic additives and artificial enhancers, which has fueled demand for flavoring solutions rooted in natural sources such as seaweed, mushrooms, tomatoes, and fermented products. The move toward natural umami flavors is also closely linked to the rising shift toward reduced salt formulations.

Natural umami helps maintain taste intensity and depth while cutting down sodium content, making it an attractive option for both manufacturers and health-conscious buyers.

This trend has been particularly strong in packaged food and beverage categories where transparency and authenticity are key selling points. Urban populations, especially younger consumers, are seeking products that offer not only convenience but also natural and sustainable value. As a result, food producers are reformulating recipes and developing new product lines around natural umami.

The 67.8% share underscores how natural solutions are becoming the industry standard rather than a niche choice. Going forward, the natural segment is expected to solidify its leadership as global taste preferences continue to align with healthier and sustainable consumption patterns.

By Source Analysis

Glutamates remained a key source, capturing 26.5% market share globally.

In 2024, Glutamates held a dominant market position in By Source segment of the Umami Flavors Market, with a 26.5% share. This dominance is driven by their well-established role in delivering the signature savory taste associated with umami.

Glutamates, whether naturally occurring in foods such as seaweed, mushrooms, and tomatoes, or added in processed forms, provide the deep and lingering flavor that enhances a wide range of culinary and packaged food applications. Their versatility makes them a preferred choice for food manufacturers looking to balance taste enhancement with cost efficiency.

The 26.5% share highlights how glutamates have become a cornerstone in flavor formulation, particularly in ready-to-eat meals, sauces, seasonings, and snack products. Their ability to intensify flavor without overwhelming salt usage has aligned well with the global demand for healthier food options.

Moreover, the familiarity and long-standing acceptance of glutamates across different cuisines have contributed to their continued relevance, especially in expanding urban markets where convenience foods dominate consumer habits.

With strong functional benefits and widespread consumer recognition, glutamates remain a critical driver of growth in the umami flavors space, ensuring their continued leadership in shaping taste innovation and supporting evolving dietary preferences worldwide.

By Form Analysis

Powder form dominated the segment, accounting for 56.2% of overall consumption.

In 2024, Powder held a dominant market position in the By Form segment of the Umami Flavors Market, with a 56.2% share. This leadership is largely due to the convenience, stability, and wide applicability of powdered umami flavor solutions across multiple food categories.

Powdered forms are easier to transport, store, and blend, making them highly suitable for large-scale food processing as well as small-scale culinary applications. Their long shelf life and consistency also allow manufacturers to maintain flavor quality across different product lines, from instant noodles and soups to seasonings, sauces, and snack coatings.

The 56.2% share reflects the strong demand from both industrial and consumer markets that value flexibility in usage. In fast-growing urban centers, powdered umami flavors are a critical ingredient in packaged and ready-to-eat foods, which continue to dominate consumer lifestyles.

Additionally, the adaptability of powders in plant-based and low-sodium product formulations makes them an attractive choice for brands responding to shifting dietary preferences.

The format’s scalability and cost-effectiveness further strengthen its dominance, as food producers seek efficient flavoring options that enhance taste while meeting modern health and sustainability standards. As a result, powdered umami flavors remain the most influential form, shaping the market’s growth trajectory.

By Application Analysis

Food and beverage applications strongly ruled, holding 83.4% market share worldwide.

In 2024, Food and beverages held a dominant market position in By Application segment of the Umami Flavors Market, with an 83.4% share. This commanding lead is a direct result of the extensive use of umami flavors in everyday food products ranging from soups, sauces, and seasonings to snacks, dairy, and processed meals.

The savory depth provided by umami is essential in enhancing taste, creating a more balanced flavor profile, and offering consumers a satisfying eating experience. With changing lifestyles and busy routines, the reliance on packaged and ready-to-eat foods has surged, and umami flavors have become a key component in ensuring these products maintain authentic and appealing taste.

The 83.4% share also reflects how deeply integrated umami is in traditional and modern cuisines alike, bridging global culinary preferences. In the beverages space, the role of umami is expanding, particularly in functional drinks and health-focused formulations where taste balance is crucial.

The strong growth in plant-based alternatives has further amplified demand, as umami helps mimic the richness and mouthfeel associated with animal-based foods. With its critical role in product innovation and consumer satisfaction, the food and beverages segment continues to anchor the umami flavors market and drive its sustained expansion.

Key Market Segments

By Type

- Natural

- Synthetic

By Source

- Mushroom

- Glutamates

- Inosinates

- Guanylate

- Yeast

- Animal Source

- Fermented Products

- Others

By Form

- Powder

- Liquid

- Paste

By Application

- Food and Beverages

- Pet Food and Supplements

- Pharmaceuticals

- Others

Driving Factors

Rising Health Awareness Driving Demand for Natural Umami

One of the top driving factors for the Umami Flavors Market is the growing health awareness among consumers who are actively seeking tasty yet healthier food options. People are increasingly reducing their salt intake to avoid health risks such as hypertension and heart problems, but they still want food that tastes rich and satisfying.

Umami flavors, particularly from natural sources like mushrooms, tomatoes, and seaweed, provide the perfect solution by enhancing savory depth without relying on high sodium or artificial additives.

This balance between health and taste is pushing food companies to use more natural umami ingredients in snacks, sauces, and ready-to-eat meals, which is steadily fueling the market’s expansion worldwide.

Restraining Factors

Consumer Concerns Over the Safety of Artificial Umami

A key restraining factor for the Umami Flavors Market is the concern many consumers have about the safety of artificial or chemically processed flavor enhancers. While natural umami from foods like mushrooms and seaweed is widely accepted, synthetic options such as monosodium glutamate (MSG) often face skepticism.

Some consumers associate these additives with negative health effects, even though scientific evidence may not always support these fears. This perception creates hesitation in buying packaged foods that contain artificial umami sources.

As a result, manufacturers may struggle to build trust when using such ingredients, which can limit growth in certain regions. Overcoming this barrier requires greater awareness, clear labeling, and a stronger push toward natural umami alternatives.

Growth Opportunity

Expanding Plant-Based Foods Boosting Umami Flavor Demand

A major growth opportunity for the Umami Flavors Market lies in the rapid expansion of plant-based foods. As more consumers shift toward vegetarian, vegan, and flexitarian diets, the need for rich and satisfying flavors is growing.

Plant-based alternatives often lack the depth and savory richness found in animal-based foods, and this is where umami plays a vital role. By adding natural umami flavors from sources like fermented plants, seaweed, or mushrooms, companies can create products that closely mimic the taste and mouthfeel of meat or dairy.

This makes plant-based meals more appealing to mainstream consumers, not just niche groups. With global demand for sustainable and ethical food choices rising, umami flavors are positioned to capture significant growth.

Latest Trends

Clean-Label Innovations Shaping Natural Umami Flavor Market

One of the latest trends in the Umami Flavors Market is the strong movement toward clean-label innovations. Consumers today are reading product labels more carefully and want to see simple, natural, and recognizable ingredients rather than artificial additives or chemical names.

This shift is pushing food manufacturers to source umami flavors from natural fermentation, seaweed, mushrooms, and other plant-based origins. Clean-label umami not only meets health-conscious expectations but also supports sustainability, which has become a priority for modern buyers.

Companies are increasingly highlighting “naturally sourced umami” on packaging to attract trust and loyalty. This trend is redefining how umami flavors are positioned, making transparency and authenticity as important as taste in driving consumer choices.

Regional Analysis

In 2024, the Asia Pacific dominated the Umami Flavors Market with 38.50%, reaching USD 1.2 Bn.

The Umami Flavors Market shows diverse growth across regions, with the Asia Pacific emerging as the clear leader. In 2024, the Asia Pacific held a dominant position with 38.50% of the global market, valued at USD 1.2 billion. This dominance is driven by the region’s strong culinary heritage, where savory flavors play a central role in traditional dishes across countries like China, Japan, South Korea, and Southeast Asia.

The rising demand for packaged foods, instant noodles, sauces, and snacks has further accelerated the adoption of umami flavors in this region. Rapid urbanization, a growing middle-class population, and increasing consumer awareness of healthier taste solutions without excessive salt are also fueling expansion.

Additionally, the plant-based and functional food movements are gaining momentum in the Asia Pacific, making umami a preferred flavor enhancer for innovative product launches. While other regions such as North America, Europe, the Middle East & Africa, and Latin America also show steady growth influenced by changing consumer preferences, it is the Asia Pacific that continues to dominate the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Givaudan, with its strong reputation in flavors and fragrances, continues to emphasize natural and clean-label solutions. The company is actively investing in plant-based and fermentation-derived umami flavors to align with the rising global demand for healthier alternatives. Its wide customer base across packaged foods, snacks, and beverages positions it as a critical innovator in natural umami solutions.

Ajinomoto Co. Inc., recognized as one of the pioneers of umami discovery, remains a dominant force. With decades of expertise in amino acids and glutamate-based seasonings, Ajinomoto leverages its scientific edge to deliver consistent, savory flavor solutions. The brand’s global penetration, particularly in the Asia Pacific region, supports its leadership, as the region is central to umami consumption patterns. Ajinomoto’s focus on reduced-salt formulations using umami enhancement further strengthens its consumer trust.

Kerry Group plc, a global taste and nutrition leader, is making strides with its sustainable and health-driven approach. The company’s strength lies in combining technology with natural sourcing, allowing it to develop tailored umami flavor systems for both traditional and plant-based foods. Its ability to cater to evolving consumer expectations worldwide gives it a competitive edge in addressing demand for innovation and transparency.

Top Key Players in the Market

- Givaudan

- Ajinomoto Co. Inc.

- Kerry Group plc

- Sensient Technologies Corporation

- Symega

- International Flavors & Fragrances Inc.

- The MANE Group

- Jeneil Biotech Pvt. Ltd.

- Keva Flavours

- Nestle

Recent Developments

- In June 2025, Ajinomoto Health & Nutrition (North America) launched two smart platforms. “Salt Answer” uses umami and kokumi science to reduce sodium by up to 30% in snacks, sauces, dressings, and more—without losing taste. Meanwhile, “Palate Perfect”, featuring a tomato-flavor ingredient made by fermentation, offers a fresh‑tomato umami boost while replacing expensive tomato ingredients in many foods—especially helpful when real tomatoes are in short supply.

- In October 2024, Givaudan announced the groundbreaking of a state‑of‑the‑art production facility in Cikarang, Indonesia. The new plant represents a CHF 50 million investment spanning 24,000 m² (on a 50,000 m² site) and is designed to integrate sustainable technologies such as solar power, rainwater harvesting, LED lighting, and recycled water systems. It will focus on producing savory, sweet, and snack powders—ingredients essential to umami‑rich food products—and infant nutrition solutions. Operations are scheduled to begin in the first half of 2026.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Source (Mushroom, Glutamates, Inosinates, Guanylate, Yeast, Animal Source, Fermented Products, Others), By Form (Powder, Liquid, Paste), By Application (Food and Beverages, Pet Food and Supplements, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan, Ajinomoto Co. Inc., Kerry Group plc, Sensient Technologies Corporation, Symega, International Flavors & Fragrances Inc., The MANE Group, Jeneil Biotech Pvt. Ltd., Keva Flavours, Nestle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Givaudan

- Ajinomoto Co. Inc.

- Kerry Group plc

- Sensient Technologies Corporation

- Symega

- International Flavors & Fragrances Inc.

- The MANE Group

- Jeneil Biotech Pvt. Ltd.

- Keva Flavours

- Nestle