Global Triethylene Glycol Market By Grade (Technical Grade, Pharmaceutical Grade, Food Grade), By Application (Natural Gas Dehydration, Solvents, Plasticizers, Humectants, Polyester Resins, Others), By End-use (Oil And Gas, Automotive, Textile, Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150978

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

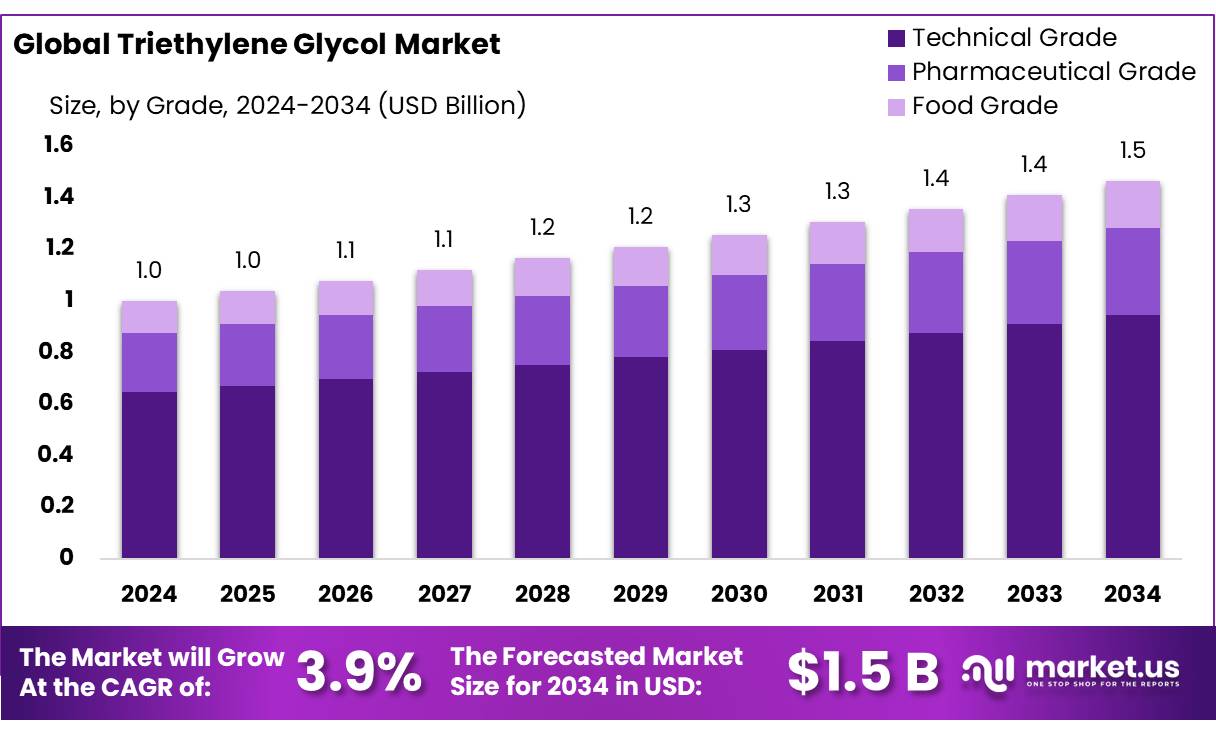

The Global Triethylene Glycol Market size is expected to be worth around USD 1.5 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

Triethylene glycol (TEG), a high-boiling, hygroscopic compound, is integral to various industrial applications, including natural gas dehydration, antifreeze formulations, and as a solvent in chemical processes. In India, TEG’s production and utilization are closely linked to the country’s robust chemical and petrochemical sectors, which have been experiencing significant growth in recent years.

The demand for TEG is primarily fueled by its essential role in natural gas dehydration processes, which remove water vapor to prevent pipeline corrosion and ensure efficient energy production. The International Energy Agency (IEA) reported a 2.8% increase in global natural gas consumption in 2024, further driving the need for TEG in this sector. Additionally, the growing use of TEG in the production of polyester resins, which are extensively used in the textile and automotive industries, contributes to its rising demand.

India’s chemical industry is one of the fastest-growing sectors in the economy, with the government estimating an investment of INR 8 lakh crore in the chemicals and petrochemicals sector by 2025 . This growth is driven by increasing demand from end-user industries such as automotive, textiles, and pharmaceuticals.

Capacity Expansion, such as Reliance Industries’ Jamnagar Ethylene Glycol Plant 2, with a capacity of 4.50 million tonnes per annum, are expected to commence production in 2026, significantly increasing the domestic supply of ethylene glycol and its derivatives, including TEG.

Key Takeaways

- Triethylene Glycol Market size is expected to be worth around USD 1.5 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 3.9%.

- Technical Grade held a dominant market position, capturing more than a 64.5% share of the Triethylene Glycol (TEG) market.

- Natural Gas Dehydration held a dominant market position, capturing more than a 47.3% share of the Triethylene Glycol (TEG) market.

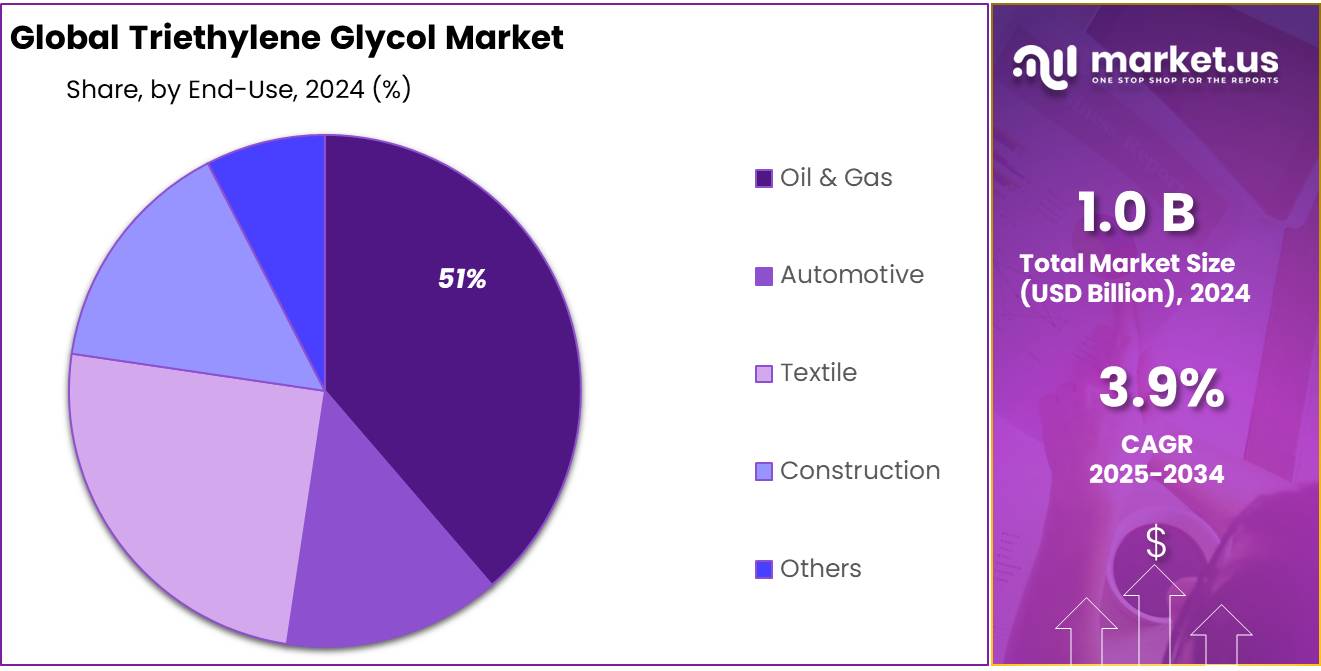

- Oil & Gas held a dominant market position, capturing more than a 51.2% share of the Triethylene Glycol (TEG) market.

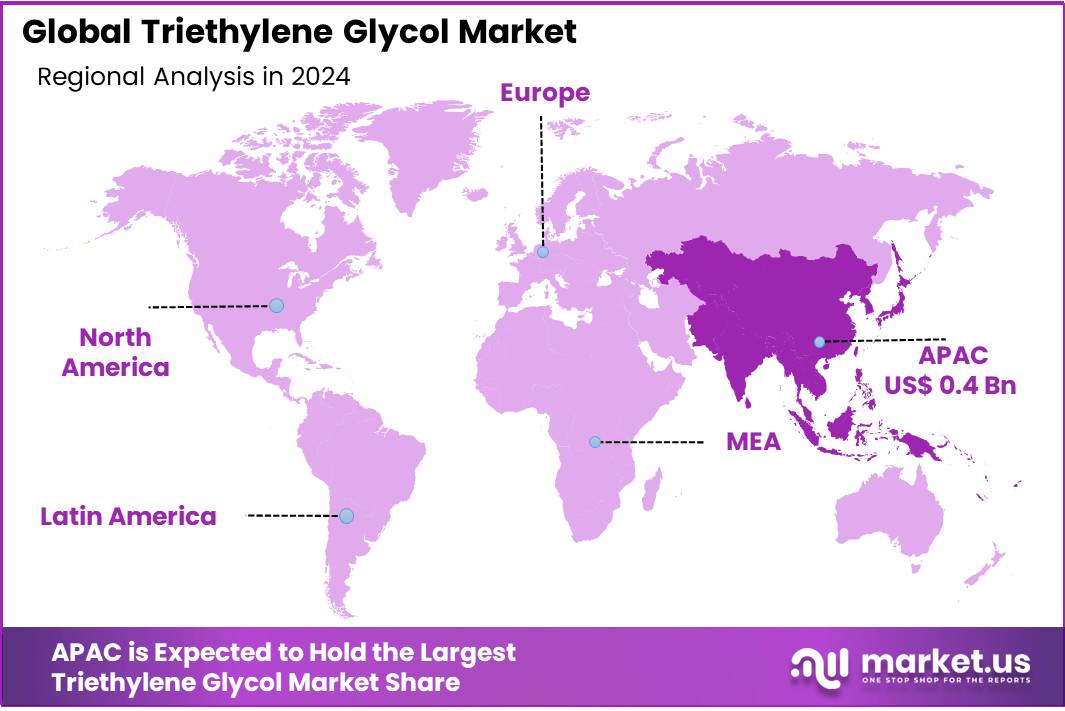

- Asia-Pacific (APAC) region held a dominant market position in the Triethylene Glycol (TEG) market, capturing more than 46.3% of the share, valued at approximately USD 0.4 billion.

By Grade

Technical Grade Dominates with 64.5% in 2024

In 2024, Technical Grade held a dominant market position, capturing more than a 64.5% share of the Triethylene Glycol (TEG) market. This significant share can be attributed to its widespread use in industrial applications, particularly in the production of natural gas dehydration systems and various chemical manufacturing processes.

The growing demand for high-quality TEG in sectors such as textiles, automotive, and plastics further strengthens the dominance of the Technical Grade segment. As companies prioritize efficiency and consistency in their industrial operations, Technical Grade TEG remains the preferred choice for a wide range of applications.

By Application

Natural Gas Dehydration Leads with 47.3% in 2024

In 2024, Natural Gas Dehydration held a dominant market position, capturing more than a 47.3% share of the Triethylene Glycol (TEG) market. This segment’s significant share is largely driven by the increasing demand for efficient natural gas processing technologies. TEG is widely used in the dehydration process of natural gas to prevent the formation of hydrates, which can cause blockages and damage equipment in pipelines. The growing global demand for natural gas, especially from regions focusing on energy expansion, has amplified the need for reliable and efficient dehydration systems.

Looking ahead to 2025, the Natural Gas Dehydration application is expected to maintain its leadership, as the energy sector continues to expand and focus on ensuring the smooth and safe transport of natural gas. With increasing investments in natural gas infrastructure and technological advancements in gas processing, the demand for TEG in this application is projected to continue its steady growth, retaining a prominent share of the market.

By End-use

Oil & Gas Dominates with 51.2% in 2024

In 2024, Oil & Gas held a dominant market position, capturing more than a 51.2% share of the Triethylene Glycol (TEG) market. This strong market presence is primarily driven by the extensive use of TEG in natural gas dehydration, which is a critical process for preventing the formation of ice-like hydrates in pipelines. As oil and gas companies seek to enhance the safety and efficiency of their operations, the demand for TEG continues to rise. Its role in ensuring the smooth transport of natural gas, particularly in offshore drilling and long-distance pipelines, is crucial in maintaining operational efficiency.

In 2025, the Oil & Gas segment is expected to sustain its dominance, with continued growth in natural gas extraction and transportation projects globally. As the energy industry expands, especially in emerging markets where oil and gas infrastructure is growing, TEG’s importance in the sector will likely remain high. With advancements in extraction technologies and increasing investments in energy infrastructure, this end-use segment is anticipated to maintain a significant market share throughout the year.

Key Market Segments

By Grade

- Technical Grade

- Pharmaceutical Grade

- Food Grade

By Application

- Natural Gas Dehydration

- Solvents

- Plasticizers

- Humectants

- Polyester Resins

- Others

By End-use

- Oil & Gas

- Automotive

- Textile

- Construction

- Others

Drivers

Government Initiatives Boosting Triethylene Glycol Demand in India

In 2024, the Indian government’s strategic initiatives significantly contributed to the growth of the Triethylene Glycol (TEG) market. Programs like ‘Make in India’ and ‘Aatma Nirbhar Bharat’ have been pivotal in fostering domestic manufacturing and reducing reliance on imports. These policies have encouraged both public and private sectors to invest in local production facilities, thereby increasing the availability and affordability of TEG in the country.

Additionally, the government’s focus on infrastructure development, particularly in the oil and gas sector, has created a conducive environment for the expansion of TEG applications. For instance, the establishment of new natural gas pipelines and processing plants has led to a higher demand for TEG in natural gas dehydration processes. This not only supports the energy sector but also stimulates the chemical industry by creating a steady demand for TEG.

Furthermore, India’s emphasis on sustainability and environmental regulations has prompted industries to adopt eco-friendly chemicals like TEG. TEG’s role in reducing environmental impact aligns with the government’s objectives, making it a preferred choice in various applications. This alignment has further propelled the growth of the TEG market, reflecting the positive impact of government initiatives on the chemical industry.

Restraints

Volatility in Raw Material Prices Impedes Triethylene Glycol Market Growth

A significant challenge facing the Triethylene Glycol (TEG) market is the volatility in the prices of raw materials, particularly ethylene oxide. Ethylene oxide, a primary feedstock for TEG production, is derived from petrochemical feedstocks such as naphtha and natural gas.

The prices of these feedstocks are subject to fluctuations due to various factors, including global oil price changes, geopolitical tensions, and supply-demand imbalances. For instance, in 2024, the price of naphtha experienced a 15% increase, impacting the overall cost structure of TEG production. Such price volatility makes it challenging for manufacturers to maintain stable production costs and can lead to unpredictable pricing for end-users.

Moreover, the unpredictability in raw material costs affects the profitability and competitiveness of TEG producers. Manufacturers may face difficulties in forecasting expenses and setting prices, leading to potential financial instability. This uncertainty can also deter new investments in TEG production facilities, as investors seek more stable and predictable markets.

Opportunity

India’s Push for Bio-Based Chemicals Sparks TEG Market ExpansionA significant growth opportunity for the Triethylene Glycol (TEG) market lies in India’s increasing emphasis on bio-based chemicals. The Indian government has been actively promoting the use of bio-based chemicals to reduce dependency on fossil fuels and mitigate environmental impacts. This initiative is in line with the country’s broader sustainability goals and is supported by various policies aimed at encouraging the production and utilization of renewable resources.In particular, the demand for bio-based ethylene oxide derivatives, such as bio-based TEG, is gaining momentum. Industries like pharmaceuticals, textiles, and personal care are increasingly adopting bio-based TEG due to its environmentally friendly properties and alignment with sustainable practices. For instance, bio-based TEG is produced from renewable sources like bioethanol, offering a greener alternative to traditional petrochemical-based TEG.The government’s support for this transition includes facilitating the establishment of infrastructure for bio-based chemical production and providing incentives for research and development in this sector. These efforts are fostering a conducive environment for the growth of the bio-based TEG market in India. As industries continue to prioritize sustainability and eco-friendly solutions, the adoption of bio-based TEG is expected to rise, presenting a promising avenue for market expansion.Trends

Surge in Demand for Bio-Based Triethylene Glycol

A significant trend in the Triethylene Glycol (TEG) market is the increasing demand for bio-based TEG, driven by growing environmental concerns and the push for sustainable industrial practices. Bio-based TEG is derived from renewable resources, offering an eco-friendly alternative to traditional petrochemical-based TEG. This shift aligns with global sustainability goals and is supported by various government initiatives promoting green chemistry and renewable energy sources.

In India, the government’s “Make in India” and “Aatma Nirbhar Bharat” initiatives have been instrumental in encouraging domestic production of bio-based chemicals. These programs provide incentives for research and development, infrastructure development, and the establishment of manufacturing units focused on renewable resources. Such policies have created a conducive environment for the growth of the bio-based TEG market.

Moreover, the increasing consumer preference for sustainable and eco-friendly products has prompted industries to adopt bio-based TEG in various applications, including personal care products, pharmaceuticals, and textiles. For instance, bio-based TEG is used as a humectant in skincare products, offering moisturizing benefits while reducing environmental impact.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a dominant market position in the Triethylene Glycol (TEG) market, capturing more than 46.3% of the share, valued at approximately USD 0.4 billion. This substantial market share can be attributed to the rapid industrialization and growing demand for TEG across various sectors, including textiles, automotive, and natural gas processing.

APAC’s increasing reliance on natural gas for energy production, coupled with the region’s large-scale infrastructure projects, has further boosted the demand for TEG in natural gas dehydration processes. Countries like China, India, and Japan are among the top consumers of TEG, with India alone contributing significantly to the market due to its thriving oil and gas sector.

The region is also benefiting from robust government initiatives, such as India’s “Make in India” and “Aatma Nirbhar Bharat” programs, which encourage domestic manufacturing and investment in sustainable technologies. These initiatives create a favorable environment for the growth of the TEG market by providing incentives for manufacturing and research in renewable chemical production.

Additionally, the increased adoption of bio-based TEG in consumer goods and industrial applications aligns with the sustainability goals of APAC countries, further driving the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arham Petrochem is a key player in the Triethylene Glycol (TEG) market, known for its high-quality chemical products and reliable supply chain. The company specializes in producing TEG for industrial applications such as natural gas dehydration and textile manufacturing. With a strong presence in the Indian market, Arham Petrochem has focused on expanding its operations to meet the growing demand for eco-friendly and sustainable chemicals, particularly in the oil and gas sector.

BASF is a global leader in the chemical industry, offering a broad range of products, including Triethylene Glycol. The company is committed to innovation, with a focus on sustainable chemical production. BASF’s TEG solutions are used in a variety of industries, including automotive, pharmaceuticals, and textiles. With a strong emphasis on research and development, BASF continues to expand its market reach through strategic investments and collaborations, particularly in the Asia-Pacific and European regions.

Clariant is a prominent player in the specialty chemicals industry, offering Triethylene Glycol for diverse industrial uses, including natural gas dehydration and as a solvent in personal care products. With a commitment to sustainability and innovation, Clariant focuses on providing eco-friendly chemical solutions to its clients. The company’s strong global presence, especially in Europe and APAC, along with its emphasis on high-quality and reliable TEG production, makes it a significant contributor to the market’s growth.

Top Key Players in the Market

- Reliance Industries Ltd.

- Arham Petrochem

- BASF

- Brenntag Nederland BV

- China Petroleum & Chemical Corporation

- Clariant.

- Dow

- Eastman Chemicals

- ExxonMobil

- Formosa Plastics

- Helm AG

- Huntsman Corporation

- India Glycols Limited

- Indorama Venture

- INEOS Group Ltd.

- Lotte Chemical Corporation

- Mitsubishi Chemical Corporation

- Royal Dutch Shell

- SABIC

- Shell Chemicals

- Sinopec

Recent Developments

In 2024 Arham Petrochem Private Limited, operates two refineries with a combined nameplate capacity of 250,000 metric tons per year, with plans for an additional 300,000 metric tons per year, reflecting its commitment to scaling operations.

In 2024, BASF’s global chemical production grew by 3.9%, reflecting the increasing demand for chemicals like TEG, which is widely used as a solvent and plasticizer in various industrial and consumer products such as lubricants, coolants, and textile treatments.

Report Scope

Report Features Description Market Value (2024) USD 1.0 Bn Forecast Revenue (2034) USD 1.5 Bn CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Technical Grade, Pharmaceutical Grade, Food Grade), By Application (Natural Gas Dehydration, Solvents, Plasticizers, Humectants, Polyester Resins, Others), By End-use (Oil And Gas, Automotive, Textile, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Reliance Industries Ltd, Arham Petrochem, BASF, Brenntag Nederland BV, China Petroleum & Chemical Corporation, Clariant., Dow, Eastman Chemicals, ExxonMobil, Formosa Plastics, Helm AG, Huntsman Corporation, India Glycols Limited, Indorama Venture, INEOS Group Ltd., Lotte Chemical Corporation, Mitsubishi Chemical Corporation, Royal Dutch Shell, SABIC, Shell Chemicals, Sinopec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Reliance Industries Ltd.

- Arham Petrochem

- BASF

- Brenntag Nederland BV

- China Petroleum & Chemical Corporation

- Clariant.

- Dow

- Eastman Chemicals

- ExxonMobil

- Formosa Plastics

- Helm AG

- Huntsman Corporation

- India Glycols Limited

- Indorama Venture

- INEOS Group Ltd.

- Lotte Chemical Corporation

- Mitsubishi Chemical Corporation

- Royal Dutch Shell

- SABIC

- Shell Chemicals

- Sinopec