Global Triazine Market Size, Share, And Business Benefit By Type (Water Soluble, Oil Soluble, Gas Phase), By Product (MEA Triazine, MMA Triazine), By End-use (Crude Oil, Natural Gas, Geothermal Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164233

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

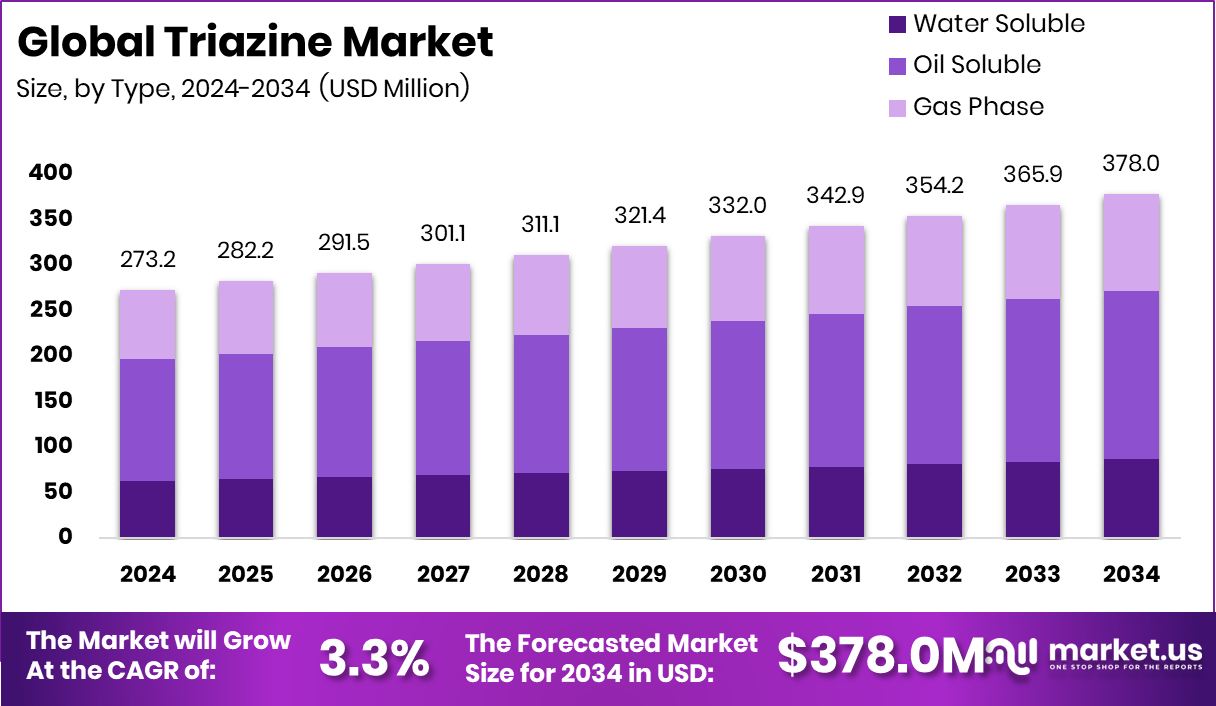

The Global Triazine Market is expected to be worth around USD 378.0 million by 2034, up from USD 273.2 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034. Growing energy investments and gas-processing activities strengthened North America’s 37.40% leading market position.

Triazine is an organic compound consisting of a six-membered ring with three nitrogen atoms and three carbon atoms. It serves as a key intermediate in chemical synthesis and is widely used in herbicides, resins, and gas-treatment formulations. Its strong thermal stability and chemical reactivity make it valuable in several industrial applications such as agriculture, coatings, and oil & gas processing.

The triazine market represents the global trade and industrial utilization of triazine derivatives across different sectors. It is primarily driven by its role in removing hydrogen sulfide (H₂S) from natural gas streams and as a raw material for specialty chemicals. With rising industrial gas production, the demand for triazine continues to grow. Recent funding projects like CPV’s $1.1 billion investment for a 1,350 MW gas-fired power plant in Texas and Ohio’s $100 million initiative for gas and nuclear production have further strengthened the energy sector’s chemical needs.

The expansion of gas-fired power infrastructure and ongoing investment in cleaner energy technologies are stimulating higher triazine consumption in gas purification and corrosion control. Texas’s creation of a $7.2 billion fund for gas plants highlights growing opportunities for triazine-based gas treatment agents.

Rising gas exploration, agricultural productivity, and resin manufacturing are boosting triazine usage. Additional government support, such as the $625 million Department of Energy program for advanced gas and coal projects and the £6.5 million Europa and Egdon gas plans, reflects broader industrial adoption.

The triazine market is poised for expansion through innovative applications in specialty polymers and environmental remediation. Continuous funding and safety initiatives—such as the $250,000 grant for emergency preparedness at gas wells—indicate strong prospects for sustainable, high-performance triazine solutions in industrial processes.

Key Takeaways

- The Global Triazine Market is expected to be worth around USD 378.0 million by 2034, up from USD 273.2 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034.

- In 2024, the oil-soluble segment dominated the Triazine Market, capturing 48.9% of the overall share.

- The MEA Triazine product type led the Triazine Market in 2024, holding a 73.3% share.

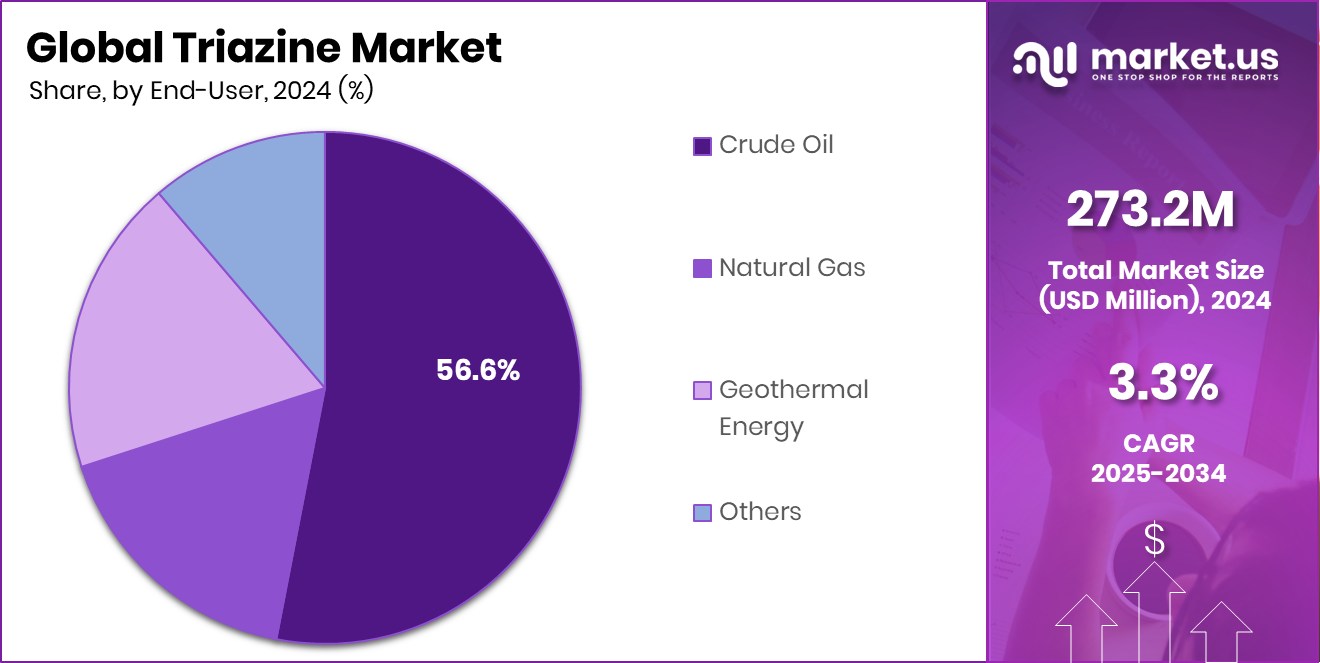

- The crude oil segment accounted for a 56.6% share in the global Triazine Market.

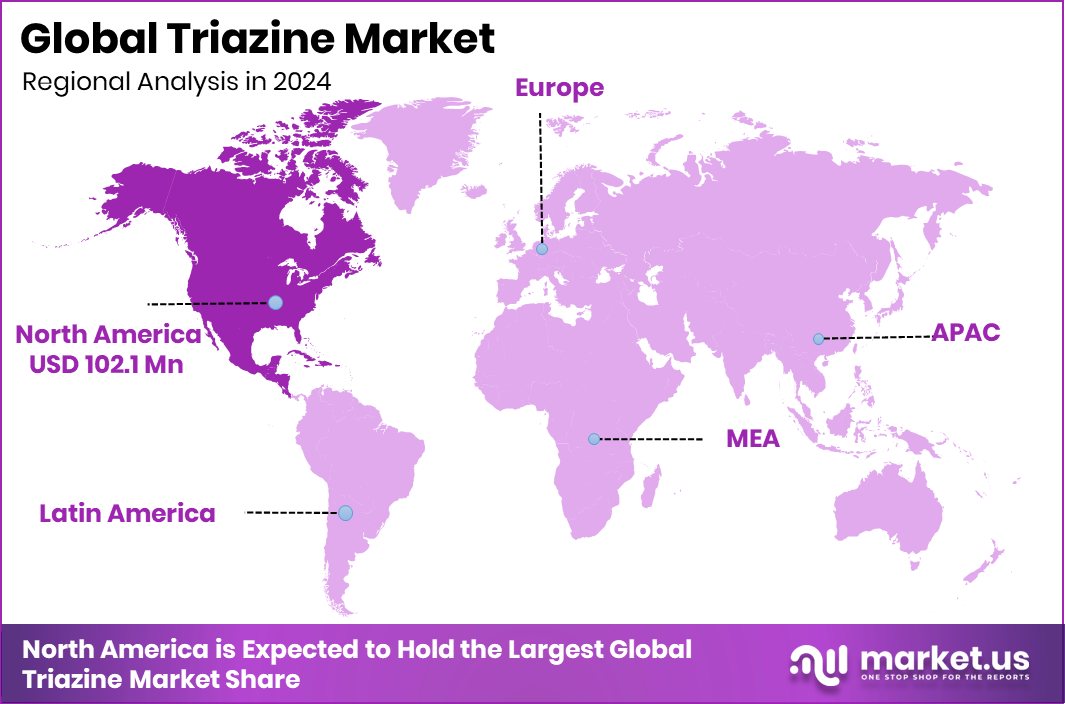

- The North American market value reached approximately USD 102.1 million, showing strong industrial demand.

By Type Analysis

In 2024, oil-soluble triazine dominated the Triazine Market with a 48.9% share.

In 2024, Oil Soluble held a dominant market position in the By Type segment of the Triazine Market, capturing a 48.9% share. This dominance reflects its extensive use in the oil and gas industry, primarily for hydrogen sulfide (H₂S) scavenging during gas sweetening and crude oil treatment processes. The oil-soluble form ensures better compatibility with hydrocarbons, allowing efficient sulfur removal and corrosion prevention.

Its effectiveness under high-temperature and pressure conditions further strengthens its preference across refineries and gas-processing facilities. Supported by rising investments in gas infrastructure and expanding energy production projects in regions like Texas and Ohio, the demand for oil-soluble triazine continues to rise, consolidating its leading position within the overall triazine market landscape.

By Product Analysis

MEA triazine held a strong 73.3% share in the global triazine market.

In 2024, MEA Triazine held a dominant market position in the By Product segment of the Triazine Market, capturing a 73.3% share. This leadership is attributed to its widespread use as an efficient hydrogen sulfide (H₂S) scavenger in the oil and gas industry. MEA Triazine offers high reactivity, stability, and compatibility with hydrocarbon streams, making it ideal for gas sweetening and crude oil treatment applications.

Its strong solubility and effectiveness under varying operational conditions contribute to its growing industrial preference. With continuous investments in gas-fired power projects and expanded natural gas production facilities, demand for MEA Triazine has remained strong, solidifying its leading share and reinforcing its vital role in global gas purification processes.

By End-use Analysis

Crude oil applications accounted for a 56.6% share of the triazine market.

In 2024, Crude Oil held a dominant market position in the by-end-use segment of the Triazine Market, capturing a 56.6% share. This strong share reflects the extensive utilization of triazine compounds in crude oil treatment processes, particularly for removing hydrogen sulfide (H₂S) and preventing corrosion during extraction and refining. The compound’s high efficiency and compatibility with hydrocarbon systems make it a preferred choice for maintaining crude quality and operational safety.

Growing investments in gas and oil infrastructure, such as new gas-fired power projects and natural gas developments, further supported this demand. The dominance of crude oil end-use highlights triazine’s critical role in ensuring cleaner, more stable fuel production within the global energy supply chain.

Key Market Segments

By Type

- Water Soluble

- Oil Soluble

- Gas Phase

By Product

- MEA Triazine

- MMA Triazine

By End-use

- Crude Oil

- Natural Gas

- Geothermal Energy

- Others

Driving Factors

Expanding Energy Investments Drive Triazine Market Growth

One of the major driving factors for the Triazine Market is the rising investment in energy infrastructure and cleaner fuel technologies across developing and developed regions. The growing use of triazine in natural gas purification and crude oil processing has been strongly supported by new funding initiatives that aim to improve energy efficiency.

For example, the Asian Development Bank (ADB) approved a $180 million loan to boost Indonesia’s geothermal expansion, which encourages the adoption of sustainable and cleaner energy processes.

Such initiatives indirectly increase the demand for triazine-based treatment chemicals used in gas processing and power plants. This continuous investment in renewable and gas-based energy infrastructure strengthens the overall growth momentum of the global triazine market.

Restraining Factors

Stringent Environmental Rules Restrict Market Expansion

A major restraining factor for the Triazine Market is the growing stringency of environmental regulations governing the use and disposal of chemical substances. Triazine compounds, though effective in removing hydrogen sulfide and improving industrial efficiency, can generate harmful by-products if not managed responsibly.

Governments worldwide are implementing stricter safety norms and waste treatment standards to reduce potential environmental harm. These regulatory pressures often increase production costs, delay approvals, and limit large-scale adoption in sensitive sectors like oil and gas.

Moreover, industries are gradually shifting toward eco-friendly alternatives, which further restricts triazine demand. As sustainability and environmental safety gain importance, compliance challenges continue to slow down the overall growth potential of the global triazine market.

Growth Opportunity

Rising Gas Infrastructure Creates New Market Opportunities

A key growth opportunity for the Triazine Market lies in the rapid expansion of global gas infrastructure and cleaner energy projects. As countries invest in new gas-fired power plants, pipelines, and processing facilities, the need for effective gas treatment chemicals like triazine continues to rise.

Triazine’s strong ability to remove hydrogen sulfide and prevent corrosion makes it essential for maintaining safety and efficiency in gas operations. Growing industrialization in the Asia-Pacific, along with modernization efforts in North America and Europe, further widens its application base.

Additionally, the development of advanced triazine formulations with lower toxicity and improved stability offers opportunities for sustainable market growth, aligning well with evolving environmental and industrial performance standards worldwide.

Latest Trends

Shift Toward Cleaner Energy Boosts Triazine Innovation

One of the latest trends in the Triazine Market is the growing focus on developing cleaner, more sustainable chemical formulations aligned with the global energy transition. As industries move toward low-emission power generation, triazine manufacturers are creating eco-friendly variants that maintain high performance while reducing environmental impact.

The market is seeing greater adoption in natural gas purification and renewable-linked industrial projects. A strong example is Germany’s Factor2 Energy raising €7.7 million to unlock scalable geothermal power from geologically stored CO₂, which reflects the broader shift toward carbon-neutral technologies.

Such initiatives drive demand for efficient treatment chemicals like triazine that support cleaner processes, ensuring their relevance in both traditional and emerging renewable energy systems.

Regional Analysis

In 2024, North America dominated the Triazine Market with a 37.40% share.

In 2024, North America held a dominant position in the global Triazine Market, accounting for a 37.40% share valued at USD 102.1 million. The region’s leadership is driven by its well-established oil and gas infrastructure, growing energy investments, and strong focus on industrial chemical applications.

Expanding gas-fired power generation and ongoing refinery developments across the United States and Canada continue to drive high consumption of triazine compounds, primarily for hydrogen sulfide (H₂S) removal and corrosion prevention.

In Europe, the market is supported by advancements in specialty chemicals and the shift toward cleaner energy systems, while Asia Pacific shows growing potential due to rapid industrialization and increasing energy demand in emerging economies.

The Middle East & Africa region demonstrates steady adoption, supported by gas processing and petrochemical expansion, whereas Latin America benefits from its rising oil production activities. Overall, North America remains the most influential region in shaping global triazine market trends, with robust demand from the energy sector and chemical manufacturing industries reinforcing its dominant share and stable market outlook.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow continued to leverage its strong chemical manufacturing expertise to enhance the performance of triazine compounds used in gas treatment and industrial processing. The company focused on optimizing product formulations to ensure greater efficiency in hydrogen sulfide (H₂S) removal, aligning with cleaner and more sustainable energy operations. Its innovations supported consistent demand across North America and other industrial regions.

Baker Hughes Company maintained its focus on delivering high-performance triazine solutions for gas treatment within the oil and gas industry. The company’s advanced chemical technologies contributed to improving operational safety, reducing emissions, and extending the lifespan of critical infrastructure. Through its integrated energy services and digital capabilities, Baker Hughes strengthened its market presence in both upstream and midstream applications.

Halliburton, with its extensive expertise in energy services, utilizes triazine-based chemical solutions to enhance gas sweetening operations and corrosion control processes. The company’s ongoing innovations in production chemicals and process optimization reinforced its position as a major market influencer.

Top Key Players in the Market

- Dow

- Baker Hughes Company

- Halliburton

- Clariant

- Ashland

- BASF SE

- Eastman Chemical Company

- Evonik Industries AG

- Haihang Industry Co., Ltd.

- Hexion

Recent Developments

- In June 2025, Baker Hughes announced the acquisition of Continental Disc Corporation, a company specializing in pressure-management safety devices such as rupture discs, relief valves, and flame arrestors.

- In October 2024, Halliburton launched its iCruise® Force intelligent, high-performance motorized rotary steerable system. This new tech, when paired with their LOGIX™ automation and remote-operations platform, is designed to enhance drilling capabilities by enabling deeper and more efficient well drilling.

Report Scope

Report Features Description Market Value (2024) USD 378.0 Million Forecast Revenue (2034) USD 273.2 Million CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Water Soluble, Oil Soluble, Gas Phase), By Product (MEA Triazine, MMA Triazine), By End-use (Crude Oil, Natural Gas, Geothermal Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow, Baker Hughes Company, Halliburton, Clariant, Ashland, BASF SE, Eastman Chemical Company, Evonik Industries AG, Haihang Industry Co., Ltd, Hexion Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dow

- Baker Hughes Company

- Halliburton

- Clariant

- Ashland

- BASF SE

- Eastman Chemical Company

- Evonik Industries AG

- Haihang Industry Co., Ltd.

- Hexion