Global Transmission Towers Market Size, Share, And Business Benefit By Voltage (Greater Than 220 kV to 660 kV, Greater Than 660 kV, 132 kV to 220 kV), By Structure (Double Circuit Tower, Waist Type Tower, TubularSteel Pole, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 165417

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

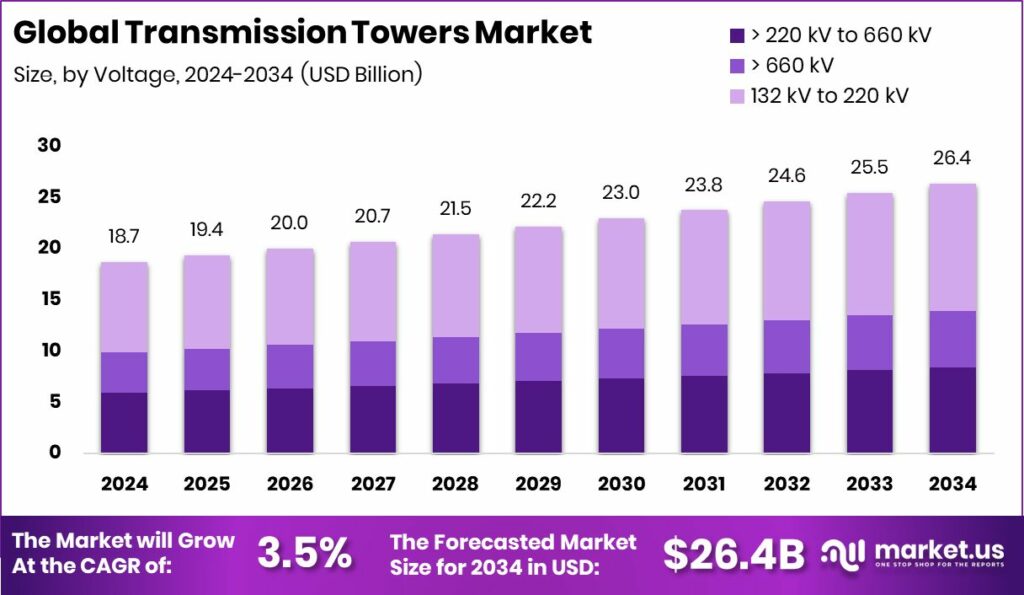

The Global Transmission Towers Market is expected to be worth around USD 26.4 billion by 2034, up from USD 18.7 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034. Strong infrastructure investments helped North America achieve a 42.20% share, valuing USD 7.8 Bn.

Transmission towers are the upright steel or composite structures that carry high-voltage power lines across long distances, serving as the backbone of electrical grid infrastructure. These towers enable electricity generated at power plants or renewable sites to travel to substations and ultimately to end-users. The transmission towers market refers to the entire value chain associated with designing, manufacturing, installing, and maintaining these towers globally—including the demand for different voltage levels, tower types (lattice, tubular, and guyed masts), and the services around grid expansion and modernization.

One major growth factor is the global surge in electricity demand driven by urbanization, industrialization, and the electrification of rural areas. Many countries are rapidly building out power networks to keep up with consumption, which naturally increases the deployment of transmission towers. For example, the market is being shaped by large infrastructure-financing activities such as the GCC power grid expansion, securing AED 752 million from Abu Dhabi, CABEI approving US$165.0 million to modernize Honduras’ electricity grid, and the African Development Bank Group approving US$104 million in funding for a transmission project in eastern Ethiopia. These kinds of injections accelerate grid build-out and tower installation.

In terms of demand, the transition to renewable energy and the need for inter-regional grid links are creating a robust need for advanced transmission structures. Integrating variable wind and solar generation, often located remotely, means new long-distance corridors, higher-voltage systems, and stronger towers are required. At the same time, aging transmission infrastructure in many regions is prompting replacement and upgrade cycles. This combination of new build and retrofit drives demand for towers and supporting hardware.

Finally, a significant opportunity lies in technology innovation and regional expansion. Towers made of higher-strength, lighter materials (including eco-friendly composites) are gaining traction, which opens room for specialized manufacturing and premium value-adds. Furthermore, developing markets in Asia-Pacific, Africa, and the Middle East present underserved grid build-out opportunities. As governments and development finance institutions continue financing grid growth and interconnection, companies positioned to deliver modern tower solutions in these regions can capture meaningful growth.

Key Takeaways

- The Global Transmission Towers Market is expected to be worth around USD 26.4 billion by 2034, up from USD 18.7 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- The Transmission Towers Market sees a 47.9% share from 132 kV to 220 kV networks supporting regional grid expansion.

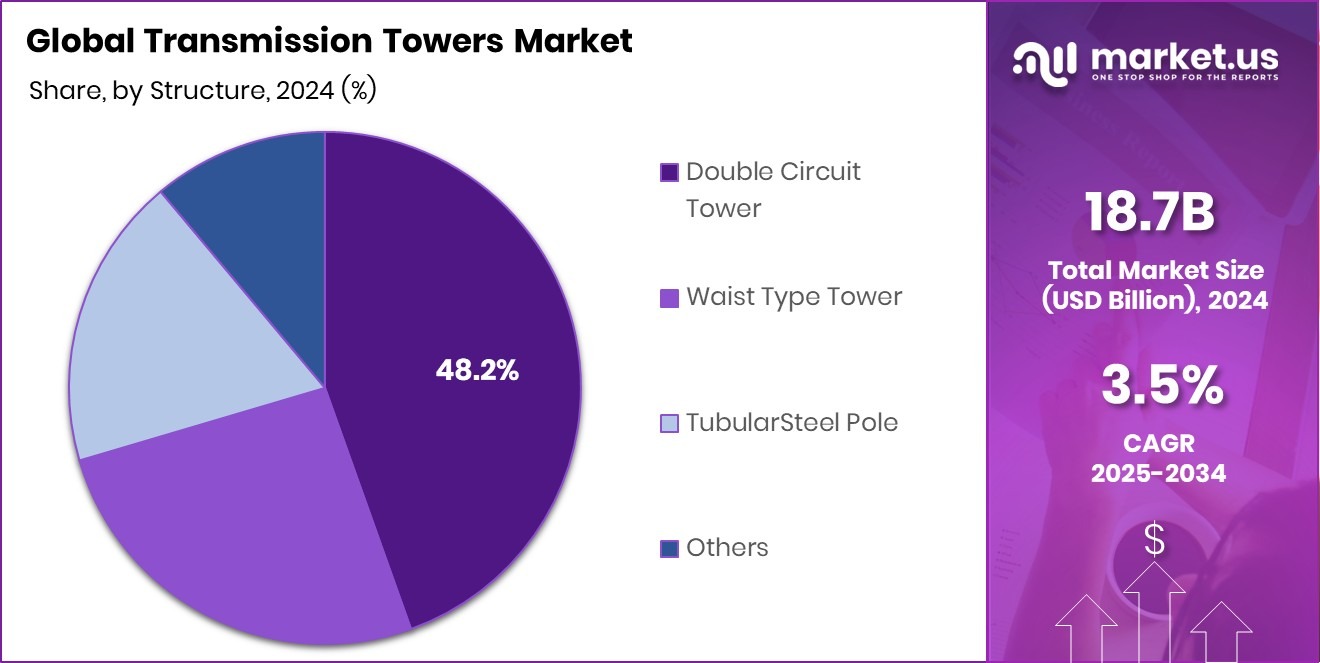

- The Transmission Towers Market records a 48.2% share for double-circuit towers, enabling reliable dual-line power delivery.

- North America’s 42.20% share, worth USD 7.8 Bn, reflects expanding grid modernization efforts.

By Voltage Analysis

Transmission Towers Market 132 kV to 220 kV segment holds 47.9% share globally.

In 2024, 132 kV to 220 kV held a dominant market position in the By Voltage segment of the Transmission Towers Market, accounting for a 47.9% share. This voltage range forms the core of regional and national grid systems, enabling reliable medium-to-long-distance electricity transmission. Its dominance reflects extensive deployment in both urban and semi-urban distribution networks, where stability and efficiency are critical for industrial and residential supply.

Growing grid interconnections, modernization of substations, and rising energy consumption have strengthened the preference for this voltage category. The segment’s wide adaptability and cost-effective transmission performance continue to make it the preferred choice for utilities and grid expansion programs, thereby maintaining its leading market position through 2024.

By Structure Analysis

Transmission Towers Market Double Circuit Tower segment dominates with 48.2% share worldwide.

In 2024, Double Circuit Tower held a dominant market position in the By Structure segment of the Transmission Towers Market, with a 48.2% share. This structure type is favored for its ability to carry two independent electrical circuits on a single tower line, optimizing land use and minimizing right-of-way costs. Its design ensures continuous power transmission even during maintenance or fault conditions, enhancing grid reliability.

The segment’s leadership reflects growing adoption in densely populated and industrial regions where space constraints demand compact yet high-capacity transmission infrastructure. Double-circuit towers also support energy efficiency and grid stability, making them an essential choice for expanding transmission networks and sustaining power demand in 2024.

Key Market Segments

By Voltage

- > 220 kV to 660 kV

- > 660 kV

- 132 kV to 220 kV

By Structure

- Double Circuit Tower

- Waist Type Tower

- Tubular Steel Pole

- Others

Driving Factors

Rising Electricity Demand Boosting Grid Expansion Globally

A major driving factor for the Transmission Towers Market is the continuous rise in global electricity demand. Rapid industrialization, urban development, and population growth have increased the need for stable and efficient power distribution networks. As electricity consumption expands, countries are investing heavily in grid extension and strengthening transmission capacity to reduce power losses and improve reliability.

Transmission towers play a central role in connecting generation plants with consumption centers across vast distances. The growing integration of renewable energy sources such as wind and solar, often located in remote areas, further accelerates tower installations. This consistent demand for power transmission infrastructure continues to drive market growth and ensures long-term development of the sector.

Restraining Factors

High Installation and Maintenance Costs Limit Growth

One key restraining factor for the Transmission Towers Market is the high cost involved in installation and maintenance. Building transmission towers requires significant investment in steel, conductors, insulators, and labor, along with complex design and regulatory approvals. The cost further increases in difficult terrains such as mountains, forests, or urban zones, where land acquisition and logistics become challenging.

Additionally, maintenance of these tall structures demands skilled manpower and specialized equipment to ensure safety and reliability. Developing countries often face financial and technical limitations that delay large-scale grid projects. These factors collectively slow down infrastructure expansion, making cost management a major challenge for utilities and governments working to enhance power transmission capacity.

Growth Opportunity

Expanding Renewable Energy Integration Across Grids

A major growth opportunity in the Transmission Towers Market lies in the rapid integration of renewable energy sources into national and regional grids. As wind and solar power projects expand across remote and offshore locations, new high-voltage transmission lines are needed to connect them to demand centers. This drives strong demand for modern transmission towers capable of handling higher voltages and harsher environments.

Governments worldwide are focusing on green energy transition goals, which require robust grid infrastructure to carry clean power efficiently and safely. The ongoing shift toward decentralized and renewable-based generation creates a continuous need for innovative tower designs, opening large-scale opportunities for construction, engineering, and maintenance providers within the transmission tower ecosystem.

Latest Trends

Adoption of Smart and Composite Transmission Towers

A leading trend in the Transmission Towers Market is the growing shift toward smart and composite tower technologies. Traditional steel structures are being replaced with towers made from lightweight, corrosion-resistant composite materials such as fiber-reinforced polymers. These materials reduce maintenance needs, extend tower lifespan, and improve installation efficiency, especially in coastal or extreme-weather areas.

Additionally, smart sensors are increasingly being embedded into tower systems to monitor temperature, vibration, and structural integrity in real time. This helps operators detect faults early and enhance grid reliability. The trend reflects a broader move toward digital and sustainable infrastructure, as utilities focus on building resilient, low-maintenance transmission networks for future energy systems.

Regional Analysis

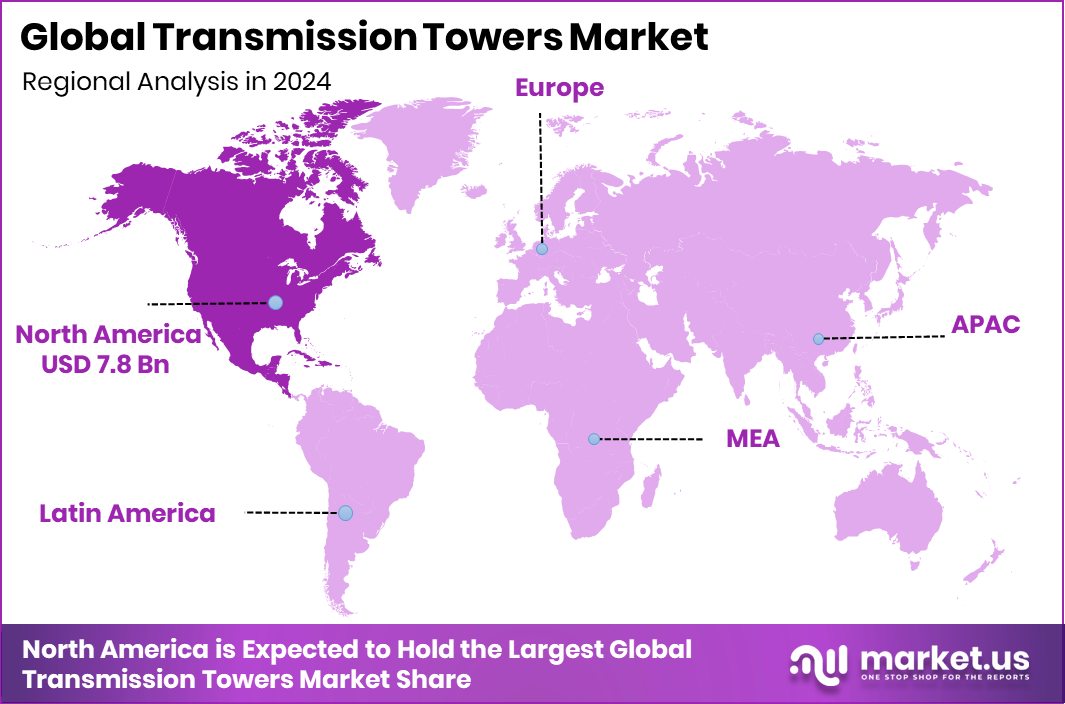

In North America, the Transmission Towers Market reached USD 7.8 Bn, holding 42.20% share.

In 2024, the Transmission Towers Market showed strong regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America emerged as the dominant region, holding a 42.20% share valued at USD 7.8 Bn, driven by large-scale grid modernization projects and growing electricity demand from industrial and urban sectors. The region’s focus on upgrading aging power infrastructure and integrating renewable energy sources strengthened market leadership.

Europe continued progressing with renewable grid connections and cross-border electricity interconnections, while the Asia Pacific region experienced expansion through rural electrification and industrial power needs. The Middle East & Africa advanced through capacity enhancement programs to meet regional energy demand, and Latin America focused on expanding grid reach for remote communities.

North America’s dominance reflected its established utilities, steady investments in transmission infrastructure, and regulatory emphasis on improving grid resilience and efficiency, maintaining its lead in the global transmission towers market in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Utkarsh India Limited strengthened its presence with advanced galvanizing and fabrication technologies, supporting reliable and durable tower structures for various voltage ranges. The company’s focus on quality manufacturing and timely project delivery enhanced its contribution to global transmission infrastructure.

Jyoti Structures Limited maintained its position through efficient turnkey solutions, covering design, supply, and construction of transmission lines across multiple regions. Its experience in high-voltage projects reinforced its reputation for technical competence and execution reliability.

KEC International Ltd., a diversified infrastructure major, continued leading through cross-border transmission projects, offering end-to-end EPC services, and adopting modern construction techniques. Its wide geographic presence and operational excellence allowed it to execute complex projects across varied terrains.

Top Key Players in the Market

- UtkarshIndia Limited

- JyotiStructures Limited

- KECInternational Ltd.

- QUANTASERVICES

- NEXANS

- ValardConstruction

- Burns&McDonnell

- PLHGroup

- Wilson Construction

- PowerLineServices, Inc

Recent Developments

- In September 2025, KEC announced its largest ever EPC order of ₹3,243 crore for T&D work — including 400 kV transmission lines in the UAE and supply of towers, hardware & poles in the Americas.

- In July 2024, Jyoti Structures secured an order valued at ₹1,177.4 million (about ₹117.74 crore) from Adani Energy Solutions Limited (AESL) for the construction and part-supply of a ~111 km 765 kV D/C transmission line in Gujarat (Khavda Phase IV-Part A).

Report Scope

Report Features Description Market Value (2024) USD 18.7 Billion Forecast Revenue (2034) USD 26.4 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage (> 220 kV to 660 kV, > 660 kV, 132 kV to 220 kV), By Structure (Double Circuit Tower, Waist Type Tower, Tubular Steel Pole, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape UtkarshIndia Limited, JyotiStructures Limited, KECInternational Ltd., QUANTASERVICES, NEXANS, ValardConstruction, Burns&McDonnell, PLHGroup, Wilson Construction, PowerLineServices, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transmission Towers MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Transmission Towers MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UtkarshIndia Limited

- JyotiStructures Limited

- KECInternational Ltd.

- QUANTASERVICES

- NEXANS

- ValardConstruction

- Burns&McDonnell

- PLHGroup

- Wilson Construction

- PowerLineServices, Inc