Global Tofu Market Size, Share, And Business Benefits By Product(Processed, Unprocessed), By Type (Organic, Conventional), By Application (Hotels, Restaurants and Catering, Food Processing, Household, Others), By Distribution Channel (Direct Sales, Hypermarkets/supermarkets, Convenience Stores, Specialist Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151944

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

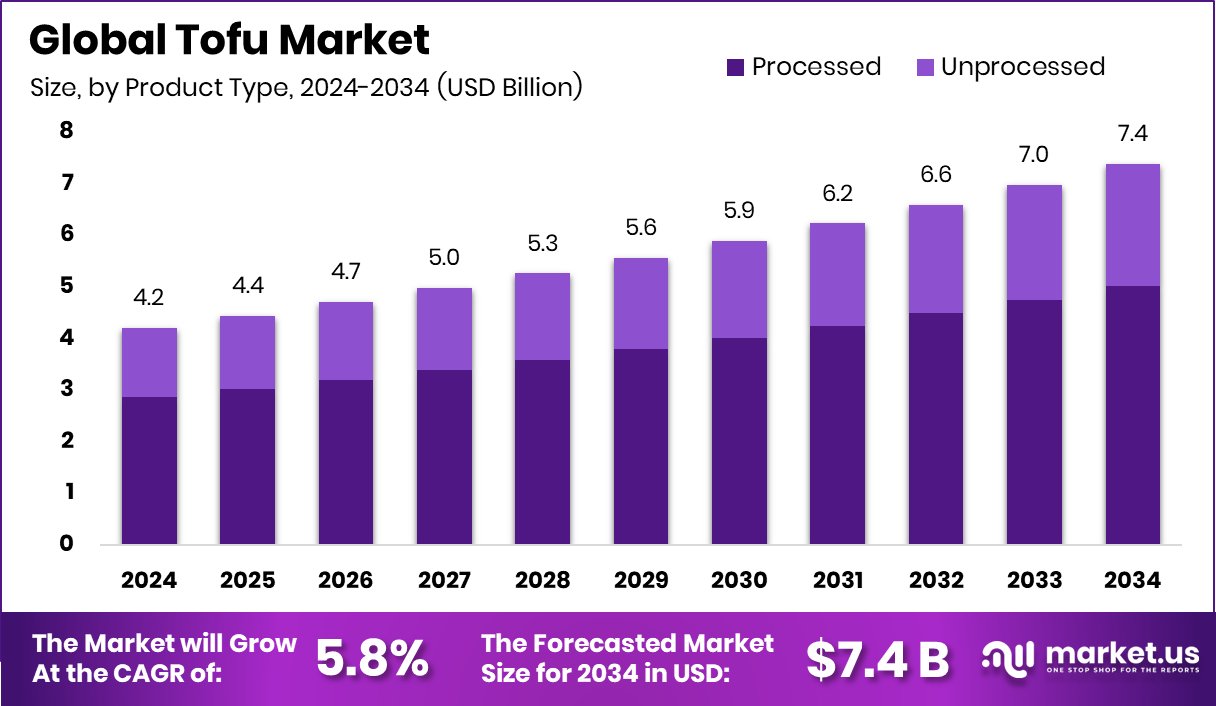

Global Tofu Market is expected to be worth around USD 7.4 billion by 2034, up from USD 4.2 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

Tofu, also known as bean curd, is a plant-based food made from soy milk that is coagulated and then pressed into soft white blocks. It has been a traditional staple in many Asian cuisines for centuries due to its mild flavor, versatility, and high protein content. Tofu is commonly consumed in various forms, including silken, firm, and extra-firm textures, and can be grilled, fried, blended, or added to soups, salads, and desserts.

The tofu market is steadily growing due to the rising demand for plant-based protein and increasing awareness about healthy eating. As more consumers shift toward vegetarian and flexitarian diets, tofu is becoming a popular meat alternative thanks to its nutritional value and sustainability. According to an industry report, Big Mountain Foods Secures $1.4 Million from Canadian Government to Grow Operations and Introduce Chickpea-Based Tofu

One of the key growth factors for the tofu market is the rising global focus on sustainability and animal welfare. Consumers are increasingly looking for food products that reduce environmental impact, and tofu, being soy-based, offers a lower carbon footprint compared to animal proteins. According to an industry report, the Government of Canada has committed over $1.4 million to support the expansion of plant-based food production in British Columbia.

Key Takeaways

- Global Tofu Market is expected to be worth around USD 7.4 billion by 2034, up from USD 4.2 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- In the tofu market, processed tofu holds the largest share, accounting for 68.1% of total sales.

- Conventional tofu dominates the tofu market, contributing approximately 72.8% due to wider availability and consumer preference.

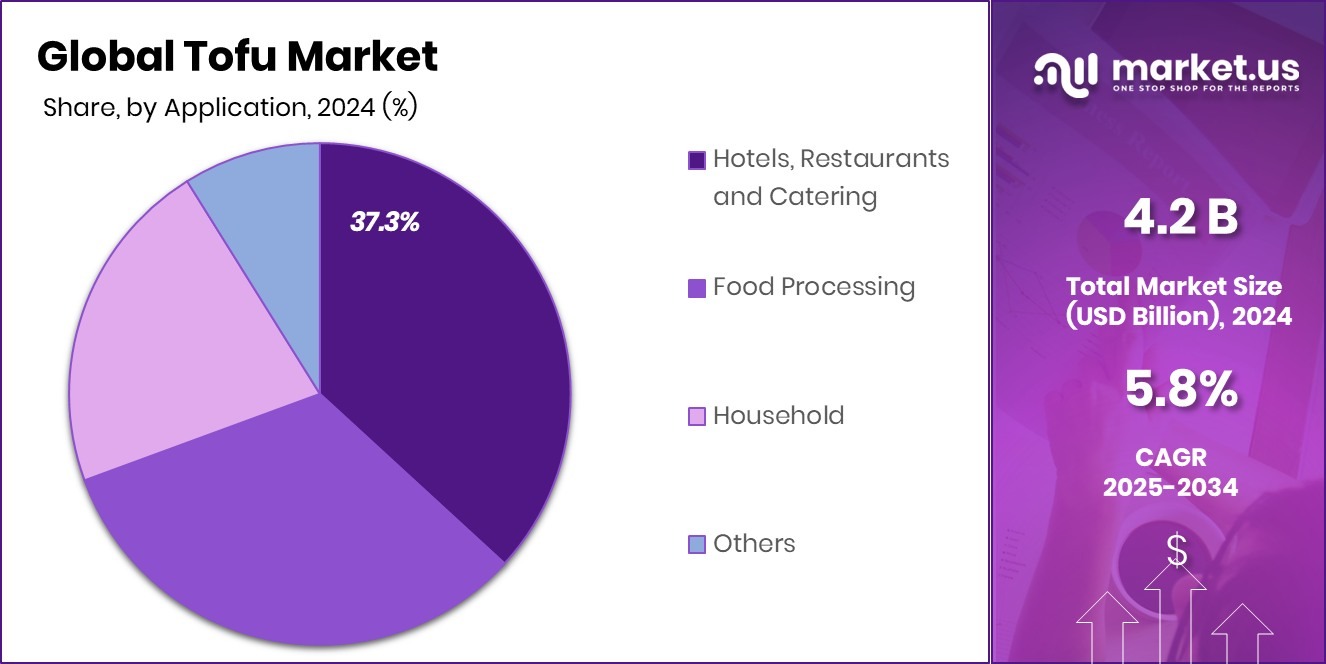

- Hotels, restaurants, and catering services represent 37.3% of tofu market applications, showing strong institutional demand growth.

- Hypermarkets and supermarkets lead tofu distribution, capturing 42.5% share through wide accessibility and consistent shelf placement.

By Product Analysis

Processed tofu holds a 68.1% share, driven by demand for convenient protein alternatives.

In 2024, Processed held a dominant market position in the By Product segment of the Tofu Market, accounting for a substantial 68.1% share. This dominance can be attributed to the widespread consumer preference for convenience-oriented food products and the increasing adoption of ready-to-cook or pre-seasoned tofu varieties across urban households.

Processed tofu, which includes firm, smoked, flavored, or pre-packaged forms, has gained significant traction due to its longer shelf life and ease of use in both traditional and contemporary recipes. The growing inclination toward plant-based diets, particularly among working professionals and health-conscious individuals, has further propelled the demand for processed tofu that offers nutritional benefits without the need for extensive preparation.

The dominance of processed tofu is also supported by its extensive availability in supermarkets, grocery stores, and online platforms. Manufacturers are responding to consumer expectations by offering a wide range of processed tofu products with enhanced textures and flavors, thereby reinforcing the category’s growth.

Additionally, the segment’s performance is being strengthened by advancements in packaging technology, which help retain freshness and extend product life. With changing dietary preferences and the rising appeal of quick, nutritious meals, processed tofu is expected to maintain its stronghold in the market in the near term.

By Type Analysis

Conventional tofu dominates with 72.8%, reflecting strong consumer preference for traditional options.

In 2024, Conventional held a dominant market position in the By Type segment of the Tofu Market, with a significant 72.8% share. This dominance reflects the strong consumer reliance on traditional tofu manufacturing methods that prioritize cost-efficiency and mass availability.

Conventional tofu continues to be the preferred choice across a broad consumer base due to its affordability, familiarity, and consistent taste profile. It remains widely accessible through various retail channels, including supermarkets, local stores, and wholesale outlets, making it a staple in both household and foodservice consumption.

The high market share of conventional tofu is also supported by its widespread use in regular diets, particularly among budget-conscious consumers and those in emerging markets. Its lower production cost compared to alternative or specialty types enables manufacturers to maintain competitive pricing, which strengthens its presence in both domestic and export markets.

Additionally, conventional tofu production benefits from established supply chains and standardized processing practices, ensuring steady output and uniform quality. As dietary shifts continue toward plant-based eating habits, the conventional segment remains well-positioned to meet growing demand due to its scalability and broad consumer acceptance. This has allowed it to retain its leading position in the type segment of the tofu market.

By Application Analysis

Hotels, restaurants, and catering sectors account for 37.3% of tofu market applications.

In 2024, Hotels, Restaurants, and Catering (HoReCa) held a dominant market position in the By Application segment of the Tofu Market, with a 37.3% share. This leading position can be attributed to the rising demand for tofu-based dishes in commercial foodservice settings, driven by shifting consumer preferences toward plant-based and healthier menu options. Tofu has increasingly become a versatile protein substitute in professional kitchens, offering chefs a flexible ingredient that adapts well to various cuisines, including Asian, Western, and fusion formats.

The HoReCa segment’s strong performance is also supported by the growing trend of vegan and vegetarian offerings across restaurants, hotel buffets, and catering services. With more consumers seeking nutritious and low-cholesterol meals while dining out, tofu-based recipes are being widely integrated into breakfast, lunch, and dinner menus. In addition, the expansion of quick-service and casual dining establishments that cater to health-conscious urban populations has further boosted the use of tofu in food preparation.

Furthermore, consistent bulk purchasing by hotels and catering firms has contributed to increased volume sales, helping the segment maintain its leading share. As foodservice operators continue to innovate and diversify their plant-based offerings, tofu remains a reliable, cost-effective, and appealing protein choice in the HoReCa industry.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead distribution, covering 42.5% of tofu product sales.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Tofu Market, with a 42.5% share. This strong market presence is driven by the high consumer preference for one-stop shopping destinations that offer a wide variety of tofu products under a single roof. These retail outlets provide easy access to both domestic and imported tofu varieties, supported by organized shelf displays, promotional offers, and in-store sampling that attract health-conscious and convenience-seeking shoppers.

Hypermarkets and supermarkets also benefit from well-established cold chain infrastructure, ensuring product freshness and quality, which is critical for tofu’s relatively short shelf life. Their ability to maintain stock consistency, offer competitive pricing, and cater to both branded and private-label tofu has further contributed to their leadership in this segment.

The segment’s dominance is further reinforced by urbanization and the expansion of large-format retail chains in metro and tier-1 cities, where tofu consumption is notably higher due to lifestyle and dietary changes. With continued growth in health and wellness product categories, hypermarkets and supermarkets are expected to retain their leading role in tofu distribution.

Key Market Segments

By Product

- Processed

- Unprocessed

By Type

- Organic

- Conventional

By Application

- Hotels, Restaurants, and Catering

- Food Processing

- Household

- Others

By Distribution Channel

- Direct Sales

- Hypermarkets/supermarkets

- Convenience Stores

- Specialist Stores

- Online Stores

- Others

Driving Factors

Rising Shift Toward Plant-Based Protein Choices

One of the main driving factors of the tofu market is the increasing global shift toward plant-based protein sources. More people are now moving away from meat and animal products due to health concerns, ethical reasons, and environmental awareness. Tofu, made from soybeans, is a rich source of plant-based protein and fits well into vegetarian, vegan, and flexitarian diets.

It is also low in saturated fats and cholesterol-free, making it a heart-healthy option for many consumers. As awareness grows around the health risks linked to excessive meat consumption, tofu is gaining popularity as a safe, nutritious, and affordable protein alternative. This trend is especially strong among young urban consumers and health-conscious individuals worldwide.

Restraining Factors

Limited Shelf Life and Storage Challenges Persist

One of the key restraining factors in the tofu market is its limited shelf life and the need for proper cold storage. Tofu is a perishable product that requires refrigeration to maintain freshness and prevent spoilage. In regions with underdeveloped cold chain infrastructure or inconsistent power supply, it becomes difficult to transport and store tofu safely.

This creates logistical issues for retailers and suppliers, especially in rural or remote areas. Additionally, consumers may hesitate to purchase tofu in bulk due to concerns about spoilage, reducing the frequency of purchases. These storage challenges limit tofu’s availability and accessibility in certain markets, slowing its growth despite rising demand for plant-based food options.

Growth Opportunity

Expansion into Untapped Emerging Markets Drives Growth

A major growth opportunity for the tofu market lies in its potential expansion into untapped emerging markets. While tofu is well established in parts of Asia and is gaining popularity in Western countries, many developing regions remain largely unexplored. As awareness about healthy eating and plant-based diets continues to rise globally, consumers in emerging economies are beginning to seek affordable and nutritious food alternatives.

Tofu, being high in protein and relatively low in cost, fits these needs well. With increasing urbanization, improved retail infrastructure, and changing dietary habits, there is a strong chance for tofu brands to enter new markets through local partnerships, education campaigns, and distribution expansion. This can significantly boost global tofu consumption in the coming years.

Latest Trends

Surge in Ready‑to‑Eat Flavored Tofu Varieties

A notable emerging trend in the tofu market is the rise of ready-to-eat flavored tofu products. These variants come pre-marinated, smoked, or seasoned, allowing consumers to enjoy flavorful tofu without added preparation. They cater to fast-paced lifestyles, providing convenient and nutritious options for on-the-go meals or quick snacks.

This trend is gaining traction among busy professionals, students, and urban dwellers seeking plant-based protein solutions that require minimal time. Retailers have responded by expanding the availability of these convenient tofu types in chilled sections. As consumer interest in diverse and flavorful food experiences grows, ready-to-eat flavored tofu stands out as a promising trend that combines taste, health, and convenience.

Regional Analysis

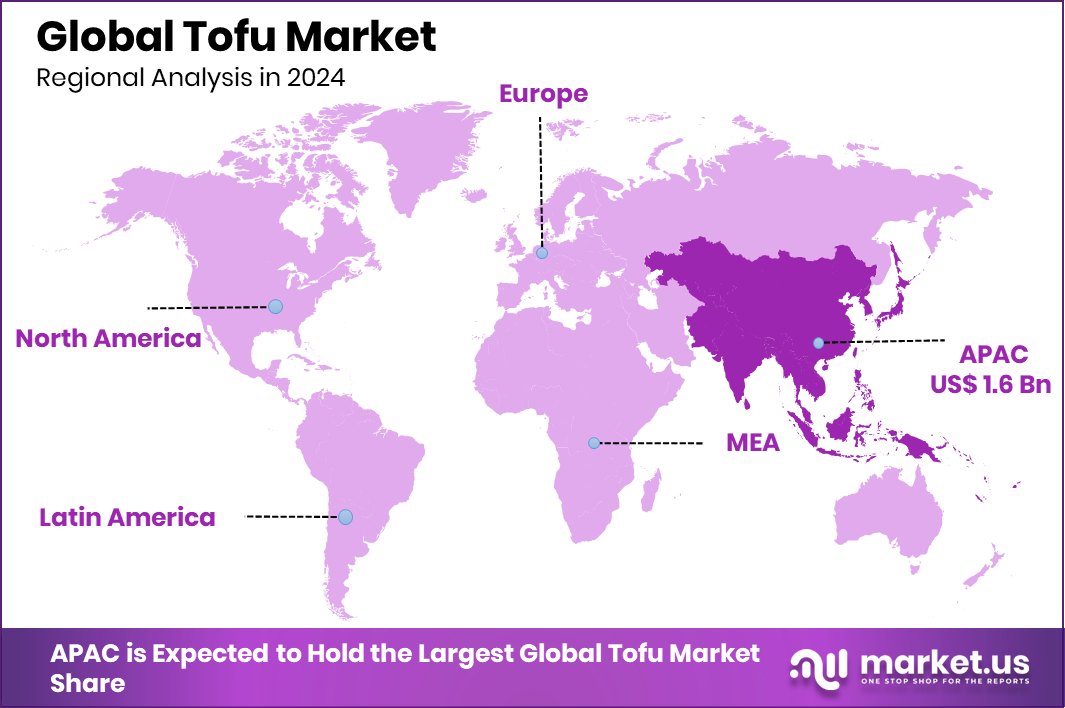

In 2024, Asia-Pacific held the dominant position in the global tofu market, accounting for 38.9% of the total market share, valued at USD 1.6 billion. This strong regional performance is rooted in tofu’s historical and cultural significance across Asian countries such as China, Japan, South Korea, and Indonesia, where it serves as a dietary staple. The region benefits from high domestic consumption, well-established production methods, and broad culinary integration, which together sustain strong market demand.

North America and Europe are witnessing steady growth, driven by increasing health awareness, rising vegan populations, and a growing preference for plant-based proteins. The Middle East & Africa and Latin America represent emerging regions where the adoption of tofu is gradually increasing due to shifting food trends and urbanization. However, these regions remain comparatively smaller in value terms.

The global expansion of tofu is further encouraged by rising demand in international cuisines and increased shelf presence in both retail and foodservice outlets. With Asia-Pacific continuing to lead the market by a wide margin, its contribution remains central to the tofu industry’s overall growth, supported by local production, affordability, and deep-rooted consumer acceptance within daily diets across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bell Food Group has leveraged its expertise in food processing and robust European supply chain to increase tofu penetration within its product portfolio. Its commitment to product consistency and quality assurance has reinforced its appeal among retail partners. Although primarily renowned for meat alternatives, the company’s entry into tofu signifies a diversified approach aimed at capturing the growing demand for plant-based proteins across Europe.

Eden Foods, with its longstanding heritage in organic and natural foods, has cultivated a distinctive brand identity within the tofu segment. Its focus on organic, non-GMO soybeans and traditional French tofu styles meets the expectations of health-conscious consumers in North America. Eden Foods’ artisanal appeal and transparency in sourcing resonate strongly in specialty grocers and natural food outlets, enabling it to tap into premium market segments.

Hain Celestial, as a global leader in natural and organic consumer products, has capitalized on its expansive distribution networks to drive tofu penetration. Its agility in introducing flavored and convenience-focused tofu formats aligns with current consumer preferences for quick, healthy meal options. By integrating tofu into its existing plant-based brands, Hain Celestial benefits from cross-category promotions and economies of scale, positioning itself competitively in mainstream retail stores.

House Foods Group, Inc., headquartered in Japan, brings deep expertise in tofu manufacturing and innovation. Its mastery of traditional Japanese tofu varieties, coupled with R&D investments, allows it to introduce high-quality soy-based products tailored to diverse regional tastes. The company’s global expansion strategy targets established Asian markets while exploring growth in the Americas and Europe, systematically introducing regional flavors and formats to meet localized consumer demands.

Top Key Players in the Market

- Bell Food Group

- Eden Foods

- Hain Celestial

- House Foods Group Inc.

- Invigorate Foods

- Kikkoman Corporation

- Morinaga & Company

- Pulmuone Co., Ltd

- San Jose Tofu

- The Nisshin Oillio Group, Ltd.

- Tofurky

- Vitasoy International Holdings

Recent Developments

- In March 2025, House Foods Holding USA Inc.—a subsidiary focused on plant-based foods including soybean tofu—made its debut at Natural Products Expo West in Anaheim, California. The company showcased an expanded product lineup, featuring House Foods and Franklin Farms tofu, chickpea tofu, tempeh, and other ready-to-eat plant-based items.

- In February 2025, Kikkoman launched a global website dedicated to its soymilk business outside Japan. While focused on soymilk, this initiative reflects an expansion into soy-based beverages, potentially strengthening consumer awareness and cross-promoting tofu products.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Billion Forecast Revenue (2034) USD 7.4 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Processed, Unprocessed), By Type (Organic, Conventional), By Application (Hotels, Restaurants and Catering, Food Processing, Household, Others), By Distribution Channel (Direct Sales, Hypermarkets/supermarkets, Convenience Stores, Specialist Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bell Food Group, Eden Foods, Hain Celestial, House Foods Group Inc., Invigorate Foods, Kikkoman Corporation, Morinaga & Company, Pulmuone Co., Ltd, San Jose Tofu, The Nisshin Oillio Group, Ltd., Tofurky, Vitasoy International Holdings Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bell Food Group

- Eden Foods

- Hain Celestial

- House Foods Group Inc.

- Invigorate Foods

- Kikkoman Corporation

- Morinaga & Company

- Pulmuone Co., Ltd

- San Jose Tofu

- The Nisshin Oillio Group, Ltd.

- Tofurky

- Vitasoy International Holdings