Global Tissue Engineered Skin Substitutes Market Analysis By Product (Biologic Skin Substitutes (Allograft, Xenograft), Biosynthetic Skin Substitutes, Synthetic Skin Substitutes), By Application (Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Other Chronic Wounds), Acute Wounds (Surgery & Trauma, Burn Injuries)), By End-User (Hospitals, Ambulatory Surgical Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150793

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

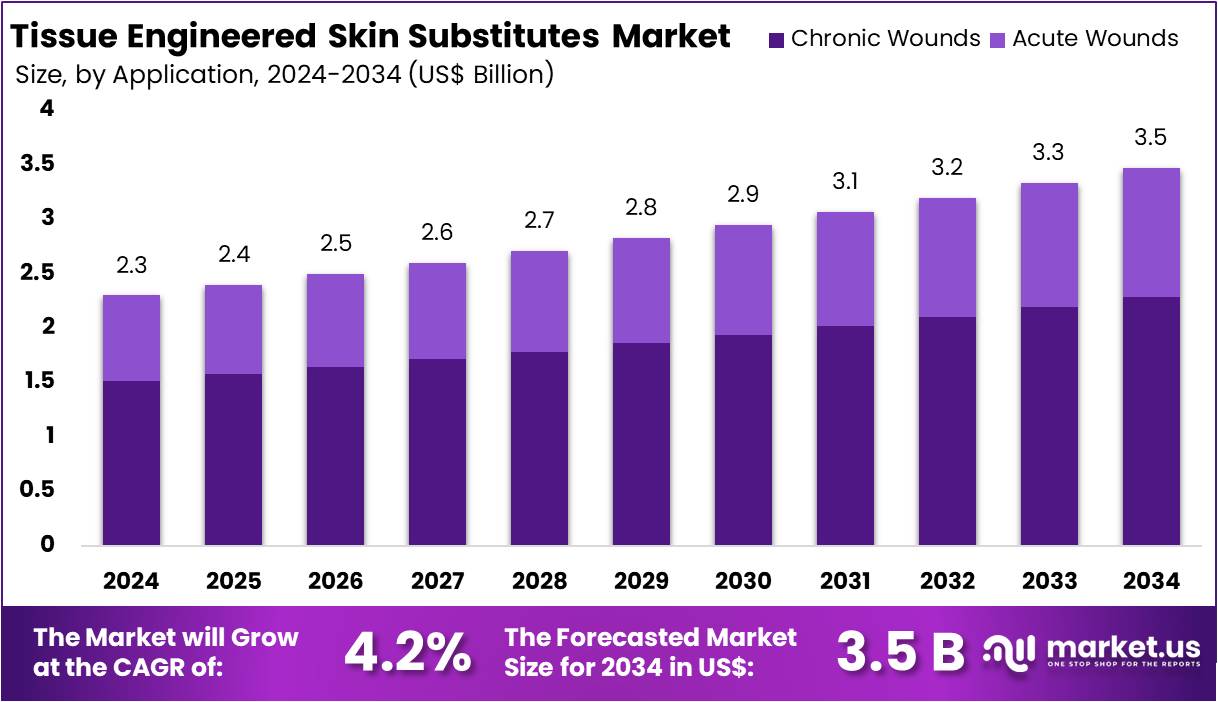

The Global Tissue Engineered Skin Substitutes Market size is expected to be worth around US$ 3.5 Billion by 2034, from US$ 2.3 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

Tissue Engineered Skin Substitutes (TESS) are advanced bioengineered products designed to replace or repair damaged human skin. These substitutes are developed using skin cells like keratinocytes and fibroblasts, combined with natural proteins such as collagen or synthetic scaffolds. They are widely used in treating severe burns, diabetic foot ulcers, chronic wounds, and trauma-related skin damage. Depending on their composition, TESS can be acellular (without cells), cellular (with living cells), or composite (combining structural layers).

The global burden of burns and wounds continues to drive demand for engineered skin. According to the World Health Organization (WHO), approximately 180,000 deaths occur annually due to burn injuries, primarily in low- and middle-income countries. A study from India reports over 1 million moderate to severe burn cases each year. For example, adolescents aged 10–19 years are most affected, with the total health burden reaching 7.46 million DALYs. These figures underscore the urgent clinical need for effective skin replacement solutions.

In 2019, the Global Burden of Disease study recorded around 8.38 million new burn cases, with 111,000 related deaths. The WHO Global Burn Registry reports approximately 9 million burn injuries and 120,000 deaths annually. However, this may be an underestimation due to limited global reporting. The economic impact is also significant. For instance, the global cost of burn-related injuries was estimated at USD 112 billion, or 0.09% of world GDP.

The rise in diabetes further increases the clinical need for TESS. According to WHO, 830 million people had diabetes globally in 2022, up from 200 million in 1990. Approximately 34% of people with diabetes develop foot ulcers in their lifetime. Each year, 18.6 million new foot ulcer cases occur. For example, these ulcers contribute to 84% of diabetes-related lower-leg amputations and carry a 5-year mortality rate of 30%, which rises to 70% after major amputations.

Scientific advancements are also contributing to market expansion. A study by the NIH-supported Regenerative Medicine Innovation Project has enabled the development of 3D bioprinted skin with vascular networks. For instance, cellular therapies using mesenchymal stem cells have shown promising results in scar reduction and tissue regeneration. These developments are improving graft integration, healing rates, and clinical outcomes in chronic and acute wound care.

Supportive government funding and regulatory frameworks are further fueling growth. In FY 2023, the U.S. National Institute of Dental and Craniofacial Research (NIDCR) invested over US $82 million in regenerative tissue research. Additionally, WHO has established guidance for regulating advanced therapy medicinal products (ATMPs), which include tissue-engineered products. These measures promote safety, reduce clinical adoption barriers, and encourage global product development.

Key Takeaways

- By 2034, the global Tissue Engineered Skin Substitutes market is projected to reach US$ 3.5 billion, growing from US$ 2.3 billion in 2024.

- The market is forecasted to expand at a compound annual growth rate (CAGR) of 4.2% during the period from 2025 to 2034.

- In 2024, Biologic Skin Substitutes led the product segment, accounting for over 51.1% of the total market share globally.

- Chronic Wounds emerged as the primary application area in 2024, holding a dominant market share of more than 65.8%.

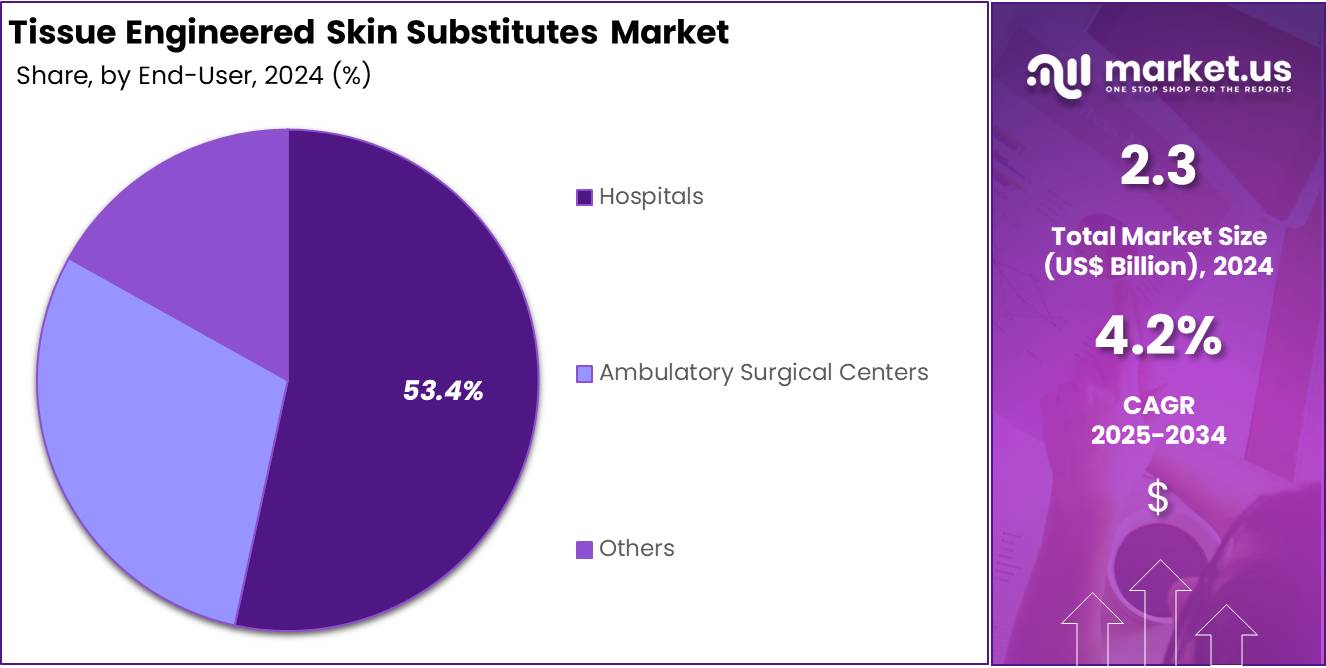

- Hospitals were the leading end users in 2024, capturing a market share exceeding 53.4% in the tissue engineered skin substitutes segment.

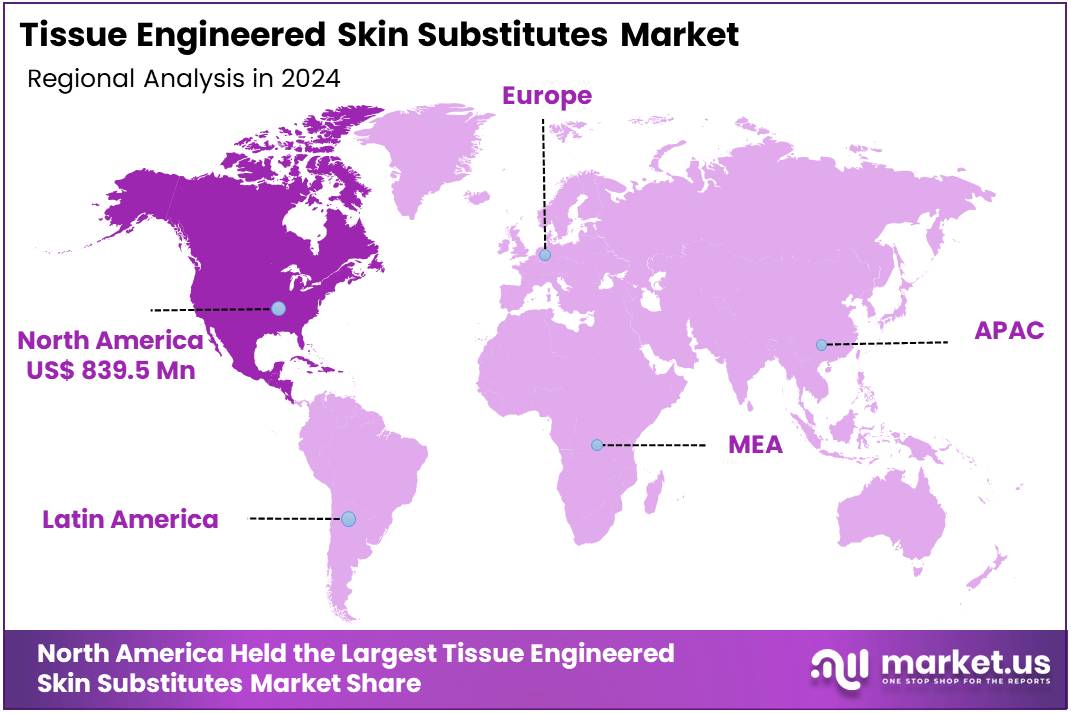

- North America maintained a dominant regional position in 2024, securing over 36.5% of the market and generating US$ 839.5 million in revenue.

Product Analysis

In 2024, the Biologic Skin Substitutes section held a dominant market position in the product segment of the tissue engineered skin substitutes market and captured more than a 51.1% share. This category includes allografts and xenografts, which are widely used in wound care. Their ability to mimic natural skin structure makes them ideal for treating deep and chronic wounds. Hospitals and burn care centers prefer biologic materials due to their integration potential and reduced risk of immune rejection.

Allografts, derived from human donors, are highly suitable for treating severe burns. They offer better compatibility and reduced inflammatory response. Surgeons use allografts as a temporary covering that supports healing while protecting exposed tissue. Xenografts, often sourced from pigs or cows, serve as cost-effective solutions in large-scale injury care. They are mostly used when human grafts are unavailable, especially in trauma and emergency care settings across developing regions.

Biosynthetic skin substitutes gained moderate market traction in 2024. These products are a mix of synthetic and natural components. They help in balancing durability with biological activity. Commonly used in post-surgical recovery, they promote cell migration and tissue regeneration. Their structure can be modified to suit different wound types. Hospitals are adopting these substitutes for complex ulcers, trauma wounds, and reconstructive surgery support.

Synthetic skin substitutes represent a smaller portion of the market but are growing steadily. These products are designed from polymer-based materials. They offer long shelf life and minimal contamination risk. Their use is expanding in outpatient and cosmetic treatments. Synthetic substitutes are particularly useful in superficial wounds and skin abrasions. Innovations in nanomaterials and smart polymers are expected to further enhance their effectiveness in the near future.

Application Analysis

In 2024, the Chronic Wounds section held a dominant market position in the application segment of the Tissue Engineered Skin Substitutes market and captured more than a 65.8% share. This high share is due to the increasing burden of chronic, non-healing wounds. Diabetic foot ulcers remain a key driver. As per the U.S. National Institutes of Health, nearly 15% of diabetic individuals are at risk of developing foot ulcers, often leading to serious complications including infections and amputations.

Within the chronic wound category, diabetic foot ulcers lead the demand for advanced skin substitutes. Pressure ulcers and venous leg ulcers also play a significant role. These conditions are common among elderly and immobile patients. Their prevalence is increasing due to longer life expectancy and higher hospitalization rates. North America and Europe are major regions using such substitutes due to better access to wound care technologies and a larger elderly population needing long-term treatment.

The acute wounds segment covers injuries from surgery, trauma, and burns. Though smaller in market share, this segment is expanding steadily. Burn injuries particularly require rapid healing and infection control. The need for effective treatment options has increased demand for bioengineered skin substitutes in emergency and surgical wound care.

End-User Analysis

In 2024, the Hospitals section held a dominant market position in the End-User Segment of the Tissue Engineered Skin Substitutes Market and captured more than a 53.4% share. This leadership is linked to the high number of advanced wound treatments performed in hospitals. These include burn management, diabetic ulcers, and post-operative wound care. Hospitals have specialized units and advanced surgical setups. They also often participate in clinical research programs. These factors contribute to a wider adoption of tissue-engineered skin products in hospital settings.

Hospitals are supported by favorable reimbursement systems, especially in developed countries. This encourages the use of premium wound care technologies. In addition, public and private hospitals often receive higher patient volumes, especially in trauma cases. The clinical staff in hospitals are more experienced with complex graft procedures. Their access to regulated and approved skin substitute products further strengthens their role. These reasons explain the continued market dominance of hospitals in this segment.

Ambulatory Surgical Centers held a moderate share in 2024, driven by their role in elective skin procedures. These centers are chosen for minor outpatient interventions that do not require hospital admission. Despite lower operational costs, their limited infrastructure restricts the use of advanced skin substitutes. The Others category, which includes clinics and home care services, accounted for a smaller share. However, this segment is growing slowly due to rising demand for decentralized wound care services in both urban and rural areas.

Key Market Segments

By Product

- Biologic Skin Substitutes

- Allograft

- Xenograft

- Biosynthetic Skin Substitutes

- Synthetic Skin Substitutes

By Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgery & Trauma

- Burn Injuries

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Increasing Incidence and Economic Burden of Diabetic Foot Ulcers and Chronic Wounds

The rising prevalence of chronic wounds, particularly diabetic foot ulcers (DFUs), is significantly boosting the demand for tissue engineered skin substitutes. According to the U.S. National Institutes of Health (NIH), over 6.5 million Americans suffer from chronic wounds annually. These conditions require advanced wound care solutions to avoid complications such as infections and amputations. Tissue engineered skin substitutes offer faster healing and improved outcomes, making them essential in managing wounds in aging populations and individuals with diabetes.

Diabetic foot ulcers alone affect approximately 18.6 million people globally and 1.6 million in the U.S. every year. These ulcers are linked with a high risk of infection, gangrene, and limb loss. Studies indicate that nearly 50% of ulcers become infected, and 15% to 20% of these lead to amputations. Moreover, patients with DFUs face a 5-year mortality rate of up to 30%, which increases to over 70% in cases involving above-foot amputations. This clinical severity highlights the urgent need for effective treatment options like bioengineered skin substitutes.

The financial impact of treating DFUs also adds to the demand for efficient wound care products. In the U.S., Medicare data shows the cost of care for a patient with DFUs averages USD 33,000 per year. This rises to USD 52,000 for those undergoing amputations. Frequent hospital visits and outpatient care increase this economic burden. Tissue engineered skin substitutes help lower these costs by promoting faster healing and reducing hospital stays.

Restraints

High Cost and Limited Reimbursement Hindering Adoption

The high cost of tissue-engineered skin substitutes remains a significant barrier to broader market adoption. Many of these advanced biologic products are priced well above what typical healthcare settings can afford. For instance, some substitutes exceed USD 4,000 per square centimeter. Such elevated pricing limits access, particularly in resource-constrained hospitals and outpatient facilities. This cost challenge is especially critical in treating chronic wounds, where extensive coverage is often required, significantly increasing the financial burden on healthcare providers and patients.

In addition to product costs, reimbursement limitations further constrain market growth. Medicare data illustrates the financial challenges: Dermagraft, a commonly used skin substitute, averages USD 14,424 per diabetic foot ulcer treatment, while Apligraf averages USD 5,364. Both exceed USD 5,000 per procedure, placing strain on reimbursement systems. Inconsistent or limited insurance coverage discourages hospitals from adopting these therapies on a large scale. The financial risk of partial or delayed reimbursement contributes to cautious procurement and usage decisions by care providers.

Although some cost offsets exist—such as reported annual Medicare savings of USD 365 million due to improved healing outcomes—these benefits do not fully alleviate the upfront financial burden. Many facilities continue to face difficulty in justifying initial expenditures despite potential long-term savings. This imbalance between cost, reimbursement, and clinical benefit continues to restrict widespread integration of tissue-engineered skin substitutes across healthcare systems.

Opportunities

Integration of 3D Bioprinting and Stem Cell Technologies in Skin Substitutes

The integration of 3D bioprinting and stem cell technologies into tissue engineered skin substitutes presents a transformative opportunity. These advanced methods allow the layer-by-layer construction of skin that closely mimics native tissue. By using biocompatible scaffolds and patient-derived cells, bioprinted skin substitutes can achieve better structural and functional outcomes. Research agencies such as the NIH and European Commission have actively supported these innovations, especially for complex wound care applications. This support indicates growing institutional confidence in the future of engineered skin constructs.

Recent advancements in 3D bioprinting have enhanced cell viability, graft customization, and integration in skin substitute applications. Modular bioprinted skin grafts, particularly those using patient-specific stem cells, offer improved compatibility and regeneration capacity. These constructs also show reduced risks of immune rejection and enable targeted vascularization, which is critical for chronic wound healing. The ability to produce tailored skin layers for dermal and epidermal reconstruction aligns well with personalized medicine trends. These capabilities mark a shift toward precision-engineered wound management solutions.

Bioprinted skin substitutes are gaining attention as next-generation alternatives for burns, diabetic ulcers, and trauma wounds. Their ability to reduce transplant wait times and promote faster healing gives them a significant edge. As bioprinting becomes more refined and clinically validated, it is expected to create new pathways for scalable and cost-effective skin regeneration. This trend positions bioprinting as a key growth driver in the future of tissue engineered skin substitute markets.

Trends

Growing Adoption of Engineered Skin Substitutes in Pediatric and Burn Care

The clinical use of tissue engineered skin substitutes is rising rapidly, especially in pediatric and burn care units. Updated guidelines from the American Burn Association (ABA) now recommend skin substitutes as standard therapy for treating deep burns and acute skin loss. These substitutes are clinically shown to reduce pain, limit dressing changes, and accelerate healing. As hospitals seek advanced wound care solutions, tissue engineered skin is increasingly adopted for its efficiency in managing severe injuries, especially in third-degree burn cases.

In the United States, burn injuries remain a significant healthcare burden. In 2021, approximately 398,000 burn injuries were reported, of which 252,000 were due to contact burns. A notable share of these cases involves children. Pediatric burn injuries represent around 22.5% of all burns in the country. Among these, 42% occur in children aged 5 to 16. This high prevalence has prompted medical institutions to adopt safer and more effective treatments, including bioengineered skin substitutes, to manage long-term complications and improve outcomes.

Clinical evidence supports the efficacy of tissue engineered skin in critical pediatric settings. In specialized trials, mortality dropped to 6.25% in children treated with engineered skin, compared to 30.3% with standard autografts (P < .05). This substantial reduction demonstrates the potential of these products in saving lives. As evidence grows, healthcare systems are steadily integrating engineered skin as a primary intervention in pediatric trauma and burn care pathways.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 36.5% share and holds US$ 839.5 million market value for the year. This leadership is driven by a rising number of burn and trauma cases in the region. The American Burn Association reports nearly 450,000 burn injuries requiring treatment every year in the U.S. Such cases have increased the demand for advanced wound care options, including tissue engineered skin substitutes, across major hospitals and trauma centers.

The healthcare infrastructure in North America is highly developed. Hospitals and clinics are well-equipped with the latest regenerative technologies. This strong system has made it easier for healthcare providers to adopt new products. Many facilities offer advanced wound care units, helping patients with severe injuries and chronic wounds. These developments continue to support the demand for skin substitutes across clinical settings in the United States and Canada.

Increased public and private funding has also supported market growth. The National Institutes of Health (NIH) provides research grants for regenerative medicine. These funds help accelerate product innovation and testing. Additionally, the region benefits from an active pipeline of clinical trials. Academic institutions and biotech organizations are collaborating to develop next-generation skin replacement solutions using tissue engineering techniques.

The U.S. Food and Drug Administration (FDA) has granted approvals for various bioengineered skin products in recent years. These approvals improve patient access to new treatments. They also help companies expand their market presence. As a result, hospitals are now offering a wider range of advanced skin grafts. This regulatory support is helping boost the adoption of skin substitutes in North America.

Furthermore, the growing elderly population has increased the demand for skin regeneration therapies. Older adults are more likely to develop pressure ulcers and diabetic foot wounds. With more awareness of chronic wound care, patients and caregivers now seek faster healing options. Combined with rising healthcare spending, these factors make North America a strong market. The region is expected to maintain its lead in the global tissue engineered skin substitutes sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Tissue Engineered Skin Substitutes market is led by several established companies. These firms focus on product innovation, regulatory alignment, and global expansion. Continuous investment in research and development helps them cater to acute and chronic wound care needs. Smith & Nephew plc is a notable leader with a strong wound management portfolio. It offers bioengineered skin substitutes widely used in diabetic foot and venous leg ulcers. Strategic acquisitions and increased focus on biologics have helped the company expand its global market presence.

Mölnlycke Health Care, based in Sweden, plays a strong role in advanced wound care. The company invests heavily in regenerative solutions and tissue repair products. It offers a broad range of skin graft substitutes and biologically derived dressings. Integra Life Sciences is another major innovator in the field. Its Integra® Dermal Regeneration Template is widely used for complex wound healing. This includes burns and surgical wounds. Its steady stream of product approvals supports its strong market position.

Acelity L.P. Inc., now part of 3M Company, is known for its wound care technologies. It offers tissue-engineered skin products that complement its NPWT systems. The 3M acquisition has improved global reach and research capabilities. Other key players include smaller regional firms and cost-focused companies. These organizations help meet unmet needs in underserved regions. They also develop synthetic or customized tissue substitutes. Together, all these companies drive innovation and expand access to effective wound healing solutions.

Market Key Players

- Smith & Nephew plc.

- Mölnlycke Health Care

- Integra Life Sciences

- Acelity L.P. Inc.

- Allergan plc

- Organogenesis Inc.

- Regenicin

- Medline Industries Inc.

- LifeNet Health

- MiMedx

- Kerecis

- Avita Medical

- Tissue Regenix

Recent Developments

- In January 2024: Launch of Medline UNITE Lisfranc Plating & Screw System: At the 2024 ACFAS Annual Scientific Conference, Medline introduced its Lisfranc Plating & Screw System, featuring 18 dual‑ray titanium plates and screws designed for precise anatomical fit and improved stabilization in mid‑foot trauma. Although primarily focused on foot reconstruction, this launch reflects Medline’s broader commitment to advancing surgical device platforms that intersect wound healing and tissue regeneration.

- In May 2023: Acquisition of CartiHeal : Smith & Nephew completed the acquisition of CartiHeal, the developer of the AGILI-C cartilage repair implant, during the fourth quarter of 2023. This strategic move was intended to bolster the company’s regenerative orthopaedic portfolio, complementing products such as REGENETEN, and expanding its footprint in cartilage regeneration technologies.

Report Scope

Report Features Description Market Value (2024) US$ 2.3 Billion Forecast Revenue (2034) US$ 3.5 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Biologic Skin Substitutes (Allograft, Xenograft), Biosynthetic Skin Substitutes, Synthetic Skin Substitutes), By Application (Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Other Chronic Wounds), Acute Wounds (Surgery & Trauma, Burn Injuries)), By End-User (Hospitals, Ambulatory Surgical Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith & Nephew plc., Mölnlycke Health Care, Integra Life Sciences, Acelity L.P. Inc., Allergan plc, Organogenesis Inc., Regenicin, Medline Industries Inc., LifeNet Health, MiMedx, Kerecis, Avita Medical, Tissue Regenix Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tissue Engineered Skin Substitutes MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Tissue Engineered Skin Substitutes MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smith & Nephew plc.

- Mölnlycke Health Care

- Integra Life Sciences

- Acelity L.P. Inc.

- Allergan plc

- Organogenesis Inc.

- Regenicin

- Medline Industries Inc.

- LifeNet Health

- MiMedx

- Kerecis

- Avita Medical

- Tissue Regenix