Global Textile Yarn Market Size, Share, And Business Benefits By Type (Artificial (Polyester, Nylon , Acrylic, Viscose), Natural (Plant Yarn, Cotton, Ramie, Flax, Jute, Hemp), Animal Yarn (Wool, Silk, Others)), By Application (Apparel, Home Textile, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159162

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

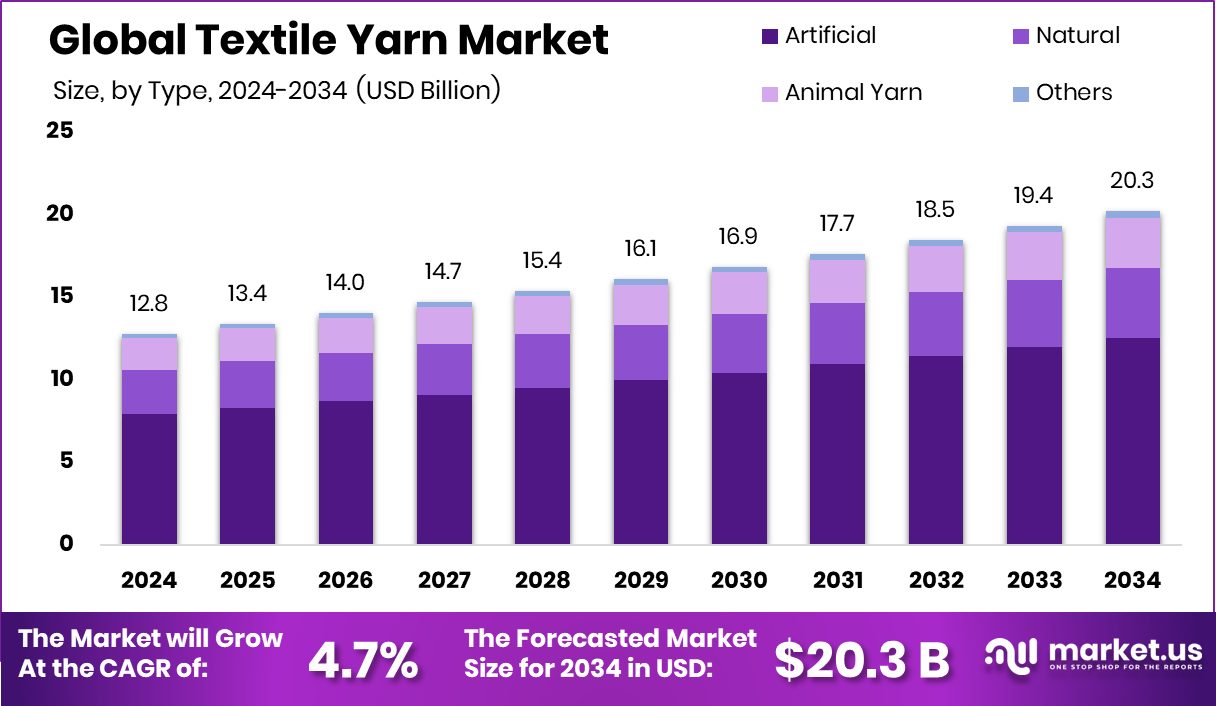

The Global Textile Yarn Market is expected to be worth around USD 20.3 billion by 2034, up from USD 12.8 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. Textile yarn demand in Asia-Pacific reached USD 4.4 Bn, securing 34.60% of the regional market.

Textile yarn is a long, continuous strand of fibers that are twisted or spun together, used in weaving, knitting, and other fabric-making processes. It can be made from natural fibers like cotton, wool, or silk, or from synthetic materials such as polyester and nylon. Yarn forms the basic building block of the textile industry, providing the strength, flexibility, and texture needed to create a wide range of fabrics used in apparel, home furnishings, and industrial applications.

The textile yarn market represents the global trade and demand for various yarn types across fashion, technical textiles, and home décor industries. Growth in this market is shaped by consumer trends, technological innovation, and sustainable manufacturing methods. Recent funding news highlights this direction, such as Syntetica raising €4.2M to scale nylon recycling technology, aimed at creating a closed loop in textile production, and Fantail Nets securing investment from Riverwalk and others to advance yarn-based manufacturing.

Growth factors are largely tied to the rising global population and increasing demand for apparel and lifestyle products. The fashion and home textile sectors continue to expand, encouraging large-scale yarn production. Additionally, eco-friendly yarn innovations and recycling technologies are creating fresh momentum for market expansion.

Demand is increasing due to the popularity of sustainable and performance-oriented fabrics. With consumers becoming more conscious about durability, comfort, and environmental impact, textile yarns that balance strength with sustainability are gaining ground. Funding like Syntetica’s €4.2M raise reflects industry efforts to meet these changing consumer preferences.

Opportunities lie in the adoption of circular economy models, advanced recycling processes, and the blending of natural with synthetic fibers for efficiency and sustainability. Startups receiving funding, such as Fantail Nets and Syntetica, signal the growing investor interest in sustainable yarn innovations, making this sector well-positioned for long-term growth.

Key Takeaways

- The Global Textile Yarn Market is expected to be worth around USD 20.3 billion by 2034, up from USD 12.8 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Artificial yarn holds 61.9%, showing strong demand for cost-effective and versatile textile materials.

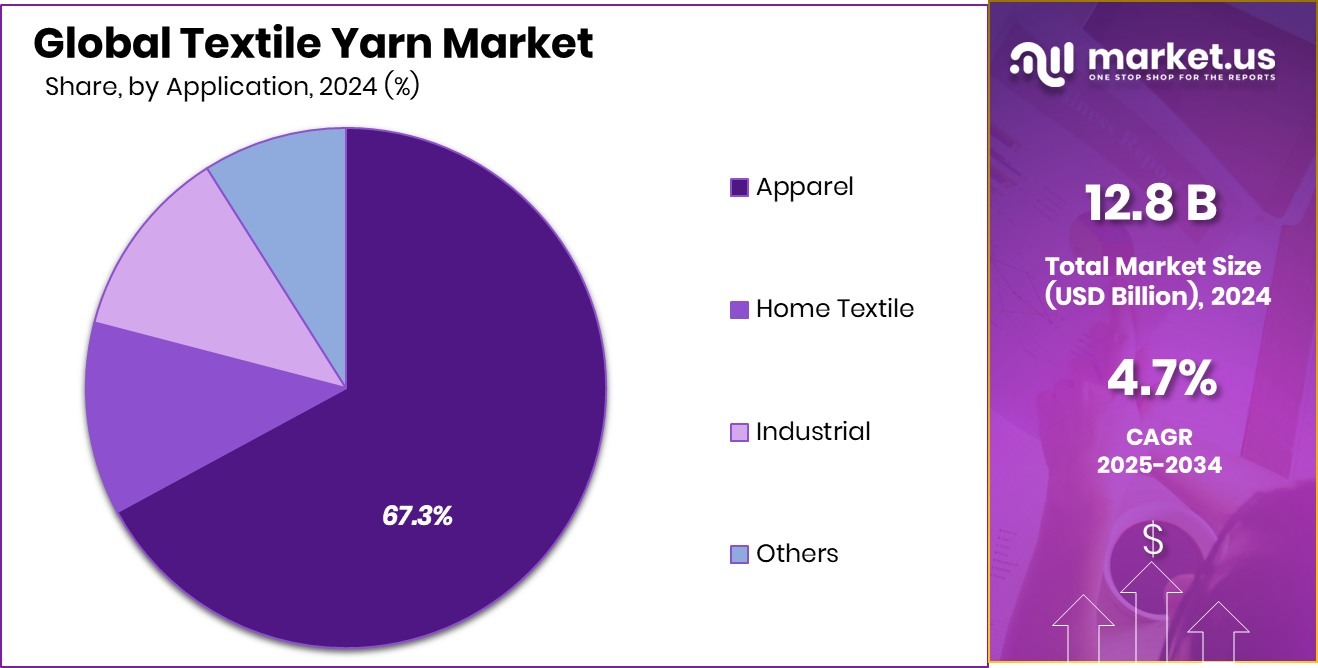

- Apparel leads with 67.3%, as fashion and clothing industries drive global textile yarn market growth.

- The Asia-Pacific region, contributing USD 4.4 Bn, continues driving growth with a 34.60% market share.

By Type Analysis

Artificial textile yarn holds 61.9%, showing strong dominance in production.

In 2024, Artificial held a dominant market position in the By Type segment of the Textile Yarn Market, with a 61.9% share. This strong presence is largely attributed to the high usage of synthetic fibers such as polyester, nylon, and acrylic, which offer durability, cost-effectiveness, and versatility compared to natural alternatives.Artificial yarn is widely adopted in apparel, industrial textiles, and home furnishings, driven by its resistance to shrinking, wrinkling, and environmental factors like moisture. Growing demand for affordable fashion and technical textiles further supports this segment’s expansion. With increasing applications across diverse industries, artificial yarn continues to be the preferred choice for manufacturers, ensuring its leading role in the textile yarn market landscape.

By Application Analysis

Apparel leads with 67.3%, highlighting yarn’s central role in fashion.

In 2024, Apparel held a dominant market position in the By Application segment of the Textile Yarn Market, with a 67.3% share. The strong demand for yarn in apparel is driven by the continuous rise in global population, changing fashion trends, and the growing preference for comfortable and durable fabrics.

Yarn plays a vital role in producing everyday clothing, sportswear, and luxury garments, supporting steady consumption levels. The segment also benefits from the increasing popularity of blended fabrics, which combine performance with style. With consumers seeking both affordability and sustainability in apparel, the apparel application of textile yarn maintains its leadership, reflecting its central role in shaping the global textile and fashion industries.

Key Market Segments

By Type

- Artificial

- Polyester

- Nylon

- Acrylic

- Viscose

- Natural

- Plant Yarn

- Cotton

- Ramie

- Flax

- Jute

- Hemp

- Animal Yarn

- Wool

- Silk

- Others

By Application

- Apparel

- Home Textile

- Industrial

- Others

Driving Factors

Boost from Government Incentives & Policy Support

One major driving factor for the textile yarn market is strong government incentive schemes and supportive policies that reduce costs and encourage investment. In India, for example, the Production-Linked Incentive (PLI) scheme has spurred textile sector investments of over ₹7,343 crore, improved turnover, and increased exports.

The 2024-25 Union Budget also significantly increased allocations to the textile ministry (from about ₹3,342 crore to ₹5,252 crore), bolstering support for schemes like ATUF (Amended Technology Upgradation Fund) and the PLI scheme to help industries upgrade their machinery and infrastructure.

Government programs such as the National Technical Textiles Mission are providing grants to startups working on advanced technical fibers like Kevlar and Spandex. This policy supports lower barriers for both large and small manufacturers, reduces financing and operational costs, and stimulates growth in yarn production capacity.

Restraining Factors

High Raw Material Costs Impacting Yarn Production

A significant challenge facing the textile yarn market is the escalating cost of raw materials, particularly natural fibers like cotton and wool. These materials are essential for yarn production, but their prices are influenced by factors such as weather conditions, geopolitical events, and trade policies. For instance, the Indian government extended the exemption on cotton import duties until December 2025, aiming to stabilize input costs across the textile supply chain. This move underscores the critical role of raw material costs in determining the overall production expenses and pricing strategies within the industry.

The volatility in raw material prices can lead to unpredictable production costs, making it challenging for manufacturers to maintain consistent pricing and profit margins. This uncertainty can deter investment and hinder the growth of the textile yarn market. While government interventions like duty exemptions provide temporary relief, the underlying issue of raw material cost fluctuations remains a persistent concern for the industry.

Addressing this challenge requires a multifaceted approach, including exploring alternative materials, investing in sustainable sourcing practices, and enhancing supply chain resilience to mitigate the impact of raw material price volatility.

Growth Opportunity

Government Support for Technical Textiles & MMF Yarn

A significant growth opportunity in the textile yarn market lies in the government’s strategic support for technical textiles and man-made fiber (MMF) yarn production. The Indian government has launched several initiatives to boost this sector, including the National Technical Textiles Mission (NTTM), which aims to position India as a global leader in technical textiles. Under this mission, the Grant for Research & Entrepreneurship across Aspiring Innovators in Technical Textiles (GREAT) scheme provides funding to startups for translating prototypes into commercial products.

Additionally, the Special Scheme for Technical Textiles and MMF Yarn from Recycled Materials offers a 15% capital subsidy to projects manufacturing eligible products, encouraging investment in sustainable practices. These initiatives not only promote innovation but also enhance the competitiveness of the Indian textile industry on a global scale.

With the government’s focus on fostering growth in technical textiles and MMF yarn production, there is a substantial opportunity for manufacturers to leverage these schemes, invest in advanced technologies, and expand their market reach. This support is pivotal in driving the sector towards achieving higher production capacities and meeting the increasing global demand for specialized textile products.

Latest Trends

Government Backing for Sustainable MMF Yarn Growth

A significant trend in the textile yarn market is the government’s emphasis on promoting sustainable man-made fiber (MMF) yarn production. Recognizing the environmental impact of synthetic fibers, the Indian government has introduced initiatives to encourage the use of recycled materials and eco-friendly production processes. These efforts align with global sustainability goals and aim to reduce the carbon footprint of textile manufacturing.

By supporting the development and adoption of sustainable MMF yarns, the government is fostering innovation and driving the industry toward more environmentally responsible practices. This trend not only addresses ecological concerns but also meets the growing consumer demand for sustainable products, positioning the textile yarn market for long-term growth and competitiveness.

Regional Analysis

In 2024, Asia-Pacific dominated the Textile Yarn Market with a 34.60% share, valued at USD 4.4 Bn.

In 2024, the Asia-Pacific region emerged as the dominating market for textile yarn, capturing a 34.60% share and generating USD 4.4 Bn in revenue. This leadership is primarily driven by high textile production capacity, growing apparel demand, and increasing investments in manufacturing infrastructure across countries like China, India, and Bangladesh. The region’s strong presence in both natural and synthetic yarn production supports its dominance, with a focus on meeting domestic and export-oriented requirements.

North America and Europe also contribute significantly to the global textile yarn market, benefiting from advanced manufacturing technologies and established supply chains. In these regions, demand is largely fueled by high-quality fashion, technical textiles, and home furnishing applications, although growth rates are comparatively moderate.

The Middle East & Africa and Latin America are emerging markets for textile yarn, witnessing steady growth due to rising apparel consumption, urbanization, and investments in industrial textiles. These regions are gradually increasing production capacities while adopting modern technologies to enhance product quality and efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Celanese Corporation has advanced its position by developing the NEOLAST™ fiber in collaboration with Under Armour. This elastane alternative offers enhanced stretch performance while addressing sustainability challenges associated with traditional elastane fibers. The partnership underscores Celanese’s commitment to providing high-performance materials that meet the evolving demands of the textile industry.

Asahi Kasei Corporation continues to lead in premium stretch fibers with its ROICA™ brand. The company emphasizes sustainability and performance, catering to modern fashion needs. Asahi Kasei’s investment in global production ensures consistent quality and ethical standards across regions, reinforcing its position in the textile yarn market.

TORAY INDUSTRIES, INC. has expanded its portfolio with the development of Lightfix™ D, a premium textile product offering high stretchability. This innovation reflects TORAY’s focus on sustainable growth and high profitability through advanced products and operational excellence.

Top Key Players in the Market

- Celanese Corporation

- Asahi Kasei Corporation.

- TORAY INDUSTRIES, INC.

- Indorama Ventures Public Company

- KURARAY CO., LTD.

- PARKDALE.

- Vardhman Textiles Limited.

- Huvis

- Grasim Industries Limited.

- Raymond

Recent Developments

- In February 2024, Toray Industries, Inc. introduced Lightfix™ D, an advanced textile product characterized by high stretchability. This premium offering is part of Toray’s Lightfix™ line, which focuses on providing high-performance materials for the textile industry. The development of Lightfix™ D reflects Toray’s commitment to innovation and meeting the evolving demands of the textile market

- In January 2024, Celanese Corporation introduced NEOLAST™, a groundbreaking alternative to traditional elastane fibers, developed in collaboration with Under Armour. This innovative fiber offers enhanced stretch performance while addressing sustainability challenges associated with elastane, including recyclability. NEOLAST™ fibers are produced using recyclable elastomer polymers through a proprietary solvent-free melt-extrusion process, eliminating potentially hazardous chemicals typically used in elastane-based stretch fabrics.

Report Scope

Report Features Description Market Value (2024) USD 12.8 Billion Forecast Revenue (2034) USD 20.3 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Artificial (Polyester, Nylon, Acrylic, Viscose), Natural (Plant Yarn, Cotton, Ramie, Flax, Jute, Hemp), Animal Yarn (Wool, Silk, Others)), By Application (Apparel, Home Textile, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Celanese Corporation, Asahi Kasei Corporation, TORAY INDUSTRIES, INC., Indorama Ventures Public Company, KURARAY CO., LTD., PARKDALE, Vardhman Textiles Limited., Huvis, Grasim Industries Limited., Raymond Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Celanese Corporation

- Asahi Kasei Corporation.

- TORAY INDUSTRIES, INC.

- Indorama Ventures Public Company

- KURARAY CO., LTD.

- PARKDALE.

- Vardhman Textiles Limited.

- Huvis

- Grasim Industries Limited.

- Raymond