Global Tablet POS Systems Market Size, Share, Industry Analysis Report By Type (Card Reader, Chip & Pin Reader), By Application (Retail, Hospitality, Hotels & Restaurants, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160549

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Mobile POS (mPOS) Statistics

- Cloud-Based POS Insights

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- Emerging Trends

- Growth factors

- By Type: Card Reader

- By Application: Retail

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

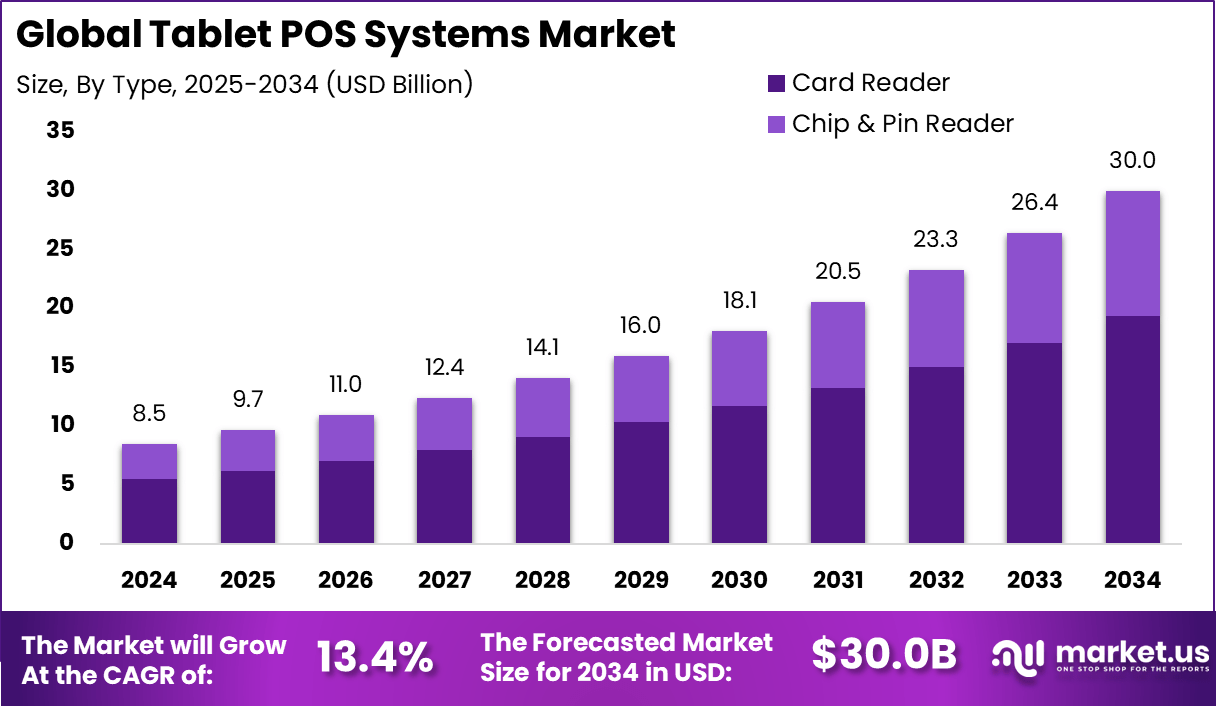

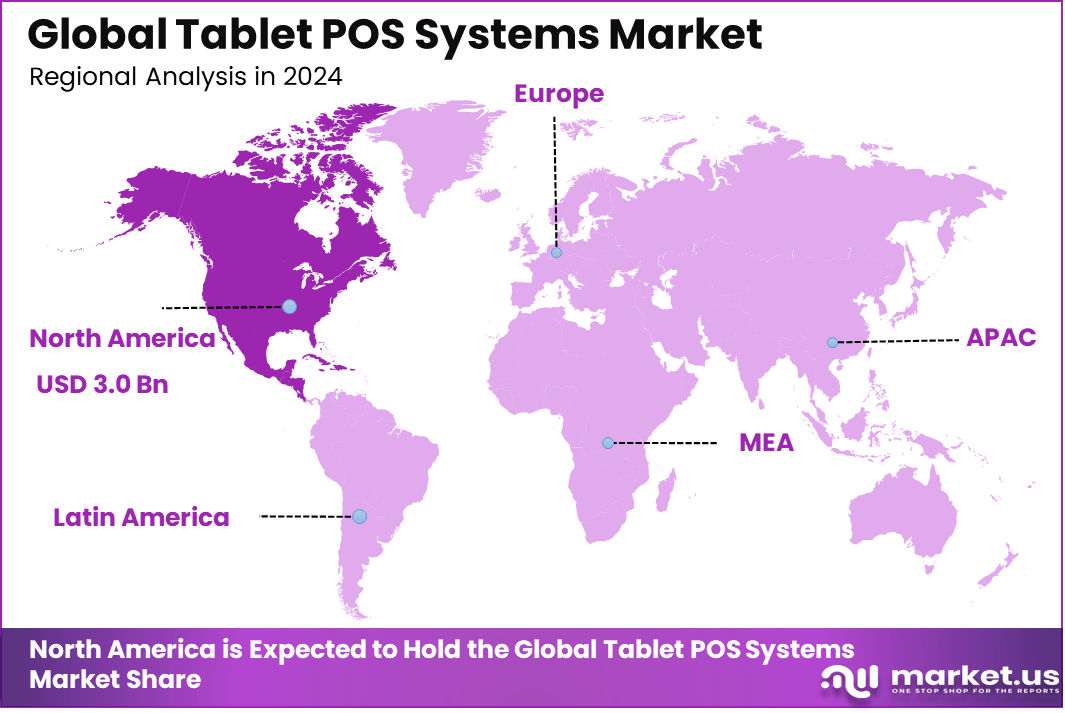

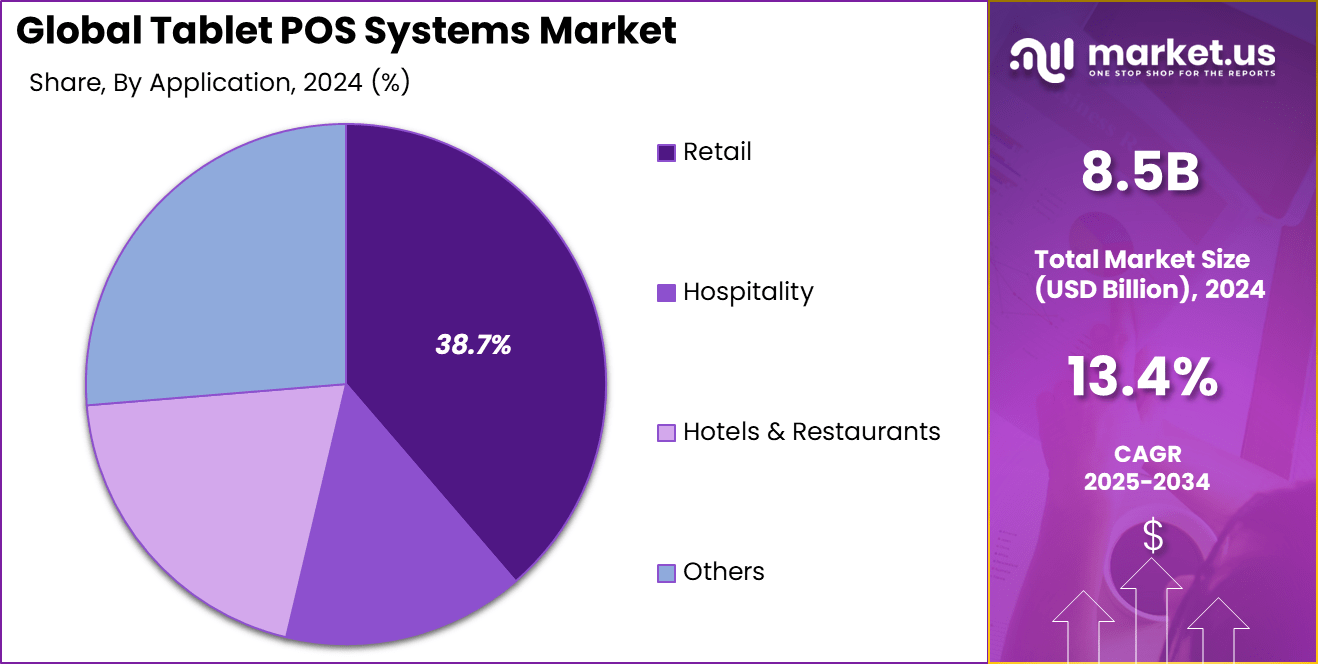

The Global Tablet POS Systems Market generated USD 8.5 billion in 2024 and is predicted to register growth from USD 9.7 billion in 2025 to about USD 30 billion by 2034, recording a CAGR of 13.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.7% share, holding USD 3.0 Billion revenue.

The Tablet POS Systems market is evolving steadily, driven by increasing demand for flexible, mobile, and efficient transaction solutions across retail and hospitality sectors. These systems use tablets as the primary interface for sales, offering portability and ease of use compared to traditional bulky POS terminals. Over recent years, the market has experienced significant growth due to the surge in cloud-based deployments and the push for enhanced restaurant management.

Key driving factors influencing this market include the integration of AI and data analytics, which improves personalization, dynamic pricing, fraud detection, and inventory management. AI-powered features enable businesses to offer tailored product recommendations and targeted promotions, boosting sales opportunities. Cloud-based POS adoption is rising as it lowers upfront costs and enables real-time access from anywhere.

According to Keevee, 79% of businesses now rely on POS systems for core functions like inventory tracking, sales monitoring, and transaction processing. Around 82% of retailers are actively upgrading their POS setups to improve speed, accuracy, and customer experience. Mobile POS solutions are projected to grow by 20% annually as businesses seek greater flexibility, while cloud-based POS adoption has reached 64%, driven by lower upfront costs and easy remote management.

Businesses are increasingly adopting tablet POS systems for their inherent mobility and ease of deployment. They allow seamless transaction processing even while on the move and support omnichannel retail strategies. The hospitality and restaurant sectors benefit particularly, managing high turnover and complex workflows more effectively. Mobile payments and digital receipts further elevate customer experience by making transactions quick and convenient, contributing to stronger customer loyalty

Top Market Takeaways

- Card reader type dominates with 64.6%, reflecting its role as the primary hardware in tablet-based POS solutions.

- Retail applications account for 38.7%, driven by demand for mobile and efficient checkout systems.

- North America holds 35.7%, supported by strong digital payment infrastructure and adoption by SMEs and large retailers.

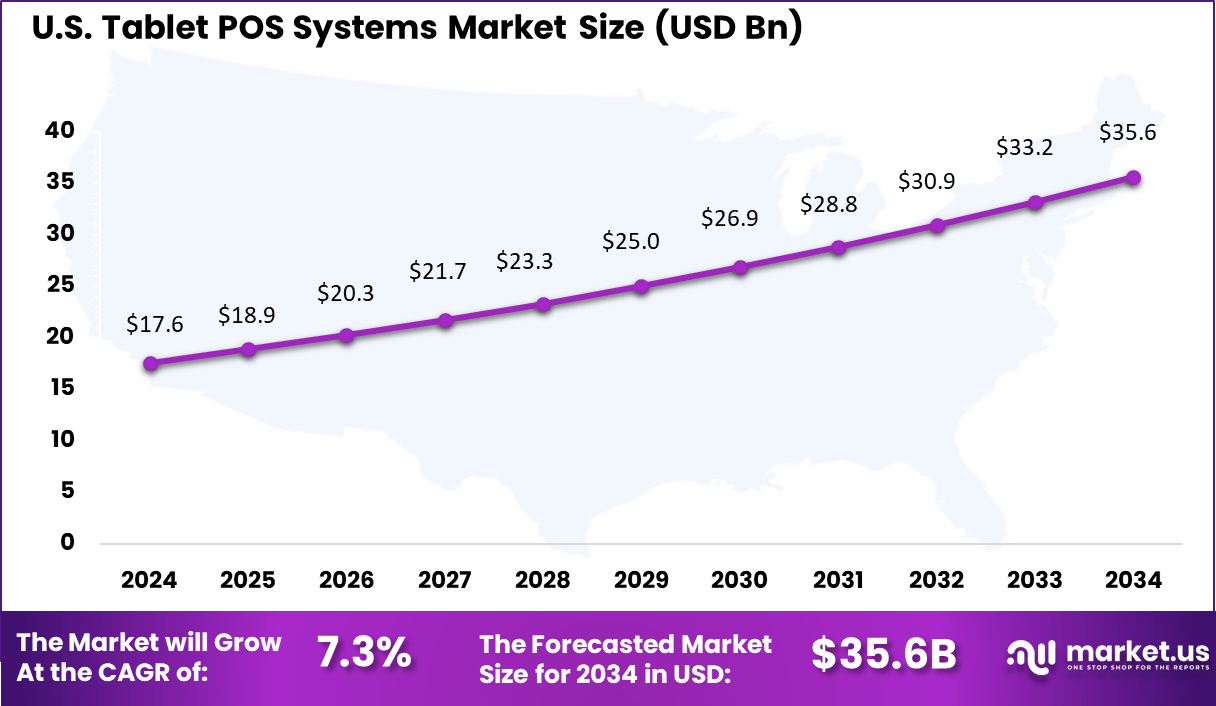

- The US market reached USD 17.6 billion and is expanding at a steady CAGR of 7.3%, highlighting consistent growth in mobile-driven payment solutions.

Mobile POS (mPOS) Statistics

Mobile POS systems are reshaping how businesses manage transactions, offering flexibility, convenience, and faster service delivery.

- 56% of small businesses use mPOS systems, mainly for affordability and ease of use.

- Nearly 40% of transactions are processed via mPOS, reflecting consumer preference for mobile payments in quick-service industries.

- Retailers adopting mPOS report 25% faster checkout times, improving efficiency and customer satisfaction.

- Around 73% of retailers identify mPOS as a top investment priority, aligning with demand for seamless omnichannel experiences.

Cloud-Based POS Insights

- Cloud-based POS solutions are driving efficiency and scalability by replacing costly, on-premise infrastructures.

- Companies using cloud POS achieve a 45% reduction in IT costs, as they avoid heavy server maintenance expenses.

- Businesses report an 18% increase in sales with cloud POS, supported by real-time insights and remote management.

- About 40% of businesses prefer cloud POS for its scalability, enabling growth without major infrastructure changes.

- Nearly 90% of cloud POS users value automatic updates, ensuring security and system optimization without manual intervention.

Analysts’ Viewpoint

Technologies driving adoption include cloud computing, AI, and integration with customer relationship management (CRM) and loyalty programs. Cloud deployment enables automatic software updates, data security, and remote inventory management, making it highly attractive.

AI enhances business intelligence capabilities, providing real-time insights to optimize staffing and stock levels. These technological advancements make tablet POS systems indispensable tools in modern business operations. Key reasons businesses adopt tablet POS systems center around operational efficiency, improved customer engagement, and cost savings.

Tablets offer a lower cost entry point compared to traditional POS, with installation often much cheaper. Speedier checkouts, elimination of data re-entry errors, and integrated analytics significantly improve staff productivity and sales accuracy. Enhanced customer data collection leads to better-targeted marketing and loyalty initiatives, driving repeat business.

Role of Generative AI

The role of generative AI in tablet POS systems is becoming notably prominent in 2025. Around 73% of retailers using generative AI have reported faster decision-making and enhanced automation for daily operations. This technology supports personalized shopping experiences by analyzing past customer behavior to deliver tailored product recommendations and marketing messages.

It also improves inventory optimization and automates routine tasks like fraud detection, thereby streamlining business efficiency and increasing customer trust. Generative AI is also helping businesses forecast demand more accurately and maintain real-time customer engagement.

Its integration in POS systems is rapidly transforming how businesses operate, leading to smarter workflows and enhanced sales performance. This trend is expected to continue as more tablet POS providers embed generative AI features to maintain competitiveness and drive innovation in customer interaction

Investment and Business Benefits

Investment opportunities lie in the development of AI-driven POS solutions and expanding cloud infrastructure that supports secure, scalable tablet POS platforms. The fast growth of digital payments and contactless transactions offers further potential for innovative software and hardware integrations. Startups focused on personalization engines and advanced analytics are particularly attractive for investors looking to tap into evolving retail technology trends.

The business benefits of adopting tablet POS systems include improved workflow, reduced operational overhead, and enhanced decision-making through data analytics. Real-time reporting enables businesses to monitor sales, inventory, and staff performance dynamically. The portability of tablets allows businesses to extend sales capabilities outside fixed locations, such as tableside ordering or mobile retail setups, increasing revenue potential and customer satisfaction.

Regarding the regulatory environment, data security and privacy have become critical considerations. Tablet POS systems handle sensitive customer payment information, making them targets for cyberattacks. Compliance with standards such as PCI-DSS (Payment Card Industry Data Security Standard) is essential to protect data and maintain consumer trust. Providers and users must invest in robust cybersecurity measures to mitigate risks of breaches and maintain operational continuity.

US Market Size

The United States alone accounts for substantial market activity, with a market value of approximately USD 17.6 billion and a steady CAGR of 7.3%. The market growth in the U.S. is powered by factors such as widespread smartphone and tablet penetration, increasing preference for non-cash transactions, and rising integration of advanced technologies like AI-driven analytics in POS systems.

Restaurants, retail outlets, and hospitality venues are adopting tablet POS to improve customer service, inventory management, and sales operations. Moreover, the shift towards omnichannel commerce and the emphasis on enhancing customer engagement are pivotal in expanding the tablet POS market in the U.S.

Consumer spending on food and leisure activities remains high, providing businesses with incentives to invest in efficient, tech-forward POS solutions that facilitate seamless purchases and personalized experiences. The U.S. market’s growth reflects both technology adoption trends and consumer lifestyle changes demanding speed and convenience.

In 2024, North America holds a commanding 35.7% share of the tablet POS systems market, reflecting the region’s advanced technological infrastructure and retail sophistication. The U.S. serves as the primary growth engine, driven by a large base of retail stores, restaurants, and hospitality services seeking to modernize operations with mobile and flexible payment solutions.

The fast-paced lifestyle and high disposable incomes in North America also support the adoption of these systems to enhance customer convenience and speed up service delivery. Consumer preferences in North America favor contactless and mobile payments, prompting retailers to invest heavily in tablet POS technology.

This demand extends beyond retail into sectors like hospitality, where automated check-in and order management solutions enhance operational efficiency. The region’s digital readiness and regulatory support for secure payment systems contribute to sustained growth and innovation in the tablet POS landscape.

Emerging Trends

Emerging trends in tablet POS systems in 2025 focus heavily on cloud-based deployment and integration with AI-driven data analytics. Cloud adoption dominates the market with about 67% of POS installations now cloud-based, which adds flexibility, scalability, and real-time monitoring capabilities.

Additionally, features such as mobile payment integration and CRM tools are becoming standard to enhance customer personalization and operational efficiency. The retail sector leads in POS adoption, accounting for approximately 52% of installations worldwide in 2025, followed by restaurants and quick-service outlets at about 28%.

The healthcare sector is also increasing its use of tablet POS systems, with a 19% rise in adoption for patient billing and service efficiency. There is a notable shift toward hybrid deployment models combining cloud and on-premises solutions, which saw a 30% growth, offering businesses more deployment flexibility.

Growth factors

Growth factors driving the tablet POS systems market include the demand for mobility, efficiency, and flexibility across industries such as retail, hospitality, and healthcare. The rise in digitization and the need for streamlined payment processing fuel adoption. Additionally, advancements in AI for predictive analytics, inventory management, and dynamic pricing further accelerate growth. The cloud-based segment is growing at a CAGR of 6.24%, highlighting its increasing preference among businesses.

Small and medium-sized enterprises (SMEs) are leading the adoption with a 25% year-over-year increase in deploying POS systems due to affordability and ease of use. Increased emphasis on security and compliance, along with integration capabilities for loyalty programs, are also key contributors pushing the market forward.

By Type: Card Reader

In 2024, the card reader segment commands a significant lead in the tablet POS systems market, holding 64.6% of the share. This dominance is largely due to the simplicity and familiarity of card reader technology with both merchants and consumers.

Card readers support swiping, dipping chip cards, and contactless payments, which remain the preferred payment methods for a broad range of retail businesses, especially small to medium enterprises. The ubiquity of card usage, coupled with increasing demand for quick and secure transaction processing, firmly positions this segment as the backbone of tablet POS hardware.

Beyond convenience, the card reader segment benefits from its robustness and ease of integration with various tablet POS software solutions. Retailers value this reliability as it minimizes transaction errors and supports seamless customer interactions. Its widespread adoption is indicative of mainstream retail environments where speed, security, and cost-effectiveness are fundamental.

By Application: Retail

In 2024, Retail stands out as the largest application segment, accounting for 38.7% of tablet POS system usage. The retail sector’s push towards digital payment solutions and efficient sales management has accelerated the adoption of tablet POS systems.

These systems allow retailers to streamline transactions, track inventory in real time, and gather customer insights, which are crucial steps in enhancing store operations and improving customer experience. Retailers benefit from mobility, as tablet POS systems enable flexible checkout options anywhere in the store, reducing wait times and improving service.

The growth in retail app adoption is strongly linked to the rise of omnichannel retailing, where integration between online and offline channels is vital. Tablet POS systems help retailers better manage cross-channel sales and inventory, driving sales efficiency. Moreover, the increased use of loyalty programs and personalized marketing through these systems further solidifies their role in the evolving retail landscape.

Key Market Segments

By Type

- Card Reader

- Chip & Pin Reader

By Application

- Retail

- Hospitality

- Hotels & Restaurants

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Adoption of Cloud-Based Deployments

The growing shift towards cloud-based tablet POS deployments is a key factor driving market growth. Cloud solutions reduce upfront investment costs and offer flexibility, allowing businesses to manage sales and inventory remotely in real time.

This accessibility suits small and medium-sized enterprises seeking scalable, cost-effective systems that automate updates and integrate easily with other software platforms, enhancing overall efficiency and user experience. This trend is boosting demand worldwide as companies transition from traditional, hardware-heavy POS systems to cloud-powered solutions that support mobility and remote management.

Restraint

Risk of Cybersecurity Threats

A significant restraint for the tablet POS systems market is the heightened risk of cybersecurity threats and data breaches. As these systems increasingly rely on internet connectivity and cloud technology, they become vulnerable to malware, hacking, and theft of sensitive payment and customer data.

These security concerns can deter some businesses from adopting tablet POS systems or delay their implementation until stronger protections and compliance standards are assured. The risk of cyberattacks presents an ongoing barrier that companies need to address carefully to maintain customer trust and avoid operational disruptions.

Opportunity

Integration of AI and Data Analytics

The integration of artificial intelligence and data analytics represents a major opportunity for tablet POS systems to transform business operations. By leveraging AI, businesses can use predictive analytics for inventory management, fraud detection, and personalized customer recommendations.

Data-driven insights empower retailers and restaurateurs to optimize pricing, boost upselling, and improve customer loyalty through targeted promotions. As AI becomes more accessible and embedded in POS systems, this feature is set to enhance the value proposition of tablet POS and unlock new revenue streams.

Challenge

Dependence on Stable Internet Connectivity

One of the main challenges tablet POS systems face is the reliance on stable internet connections, especially for cloud-based solutions. Any disruption or slow connectivity can interrupt transaction processing, delaying customer payments and causing operational issues.

This challenge is especially critical for businesses in areas with unreliable network infrastructure. Ensuring continuous, fast, and secure internet access is crucial for maintaining smooth POS operations, which may require additional investments in network services or offline capabilities to mitigate risks.

Competitive Analysis

The Tablet POS Systems Market is led by major digital payment and retail technology providers such as Square, Inc., Clover Network, Inc., Toast, Inc., and Lightspeed POS Inc. These companies offer cloud-based POS solutions optimized for restaurants, retail stores, and service businesses. Their platforms integrate payment processing, inventory tracking, and customer management features, making them popular among small and medium-sized enterprises.

Specialized vendors including ShopKeep by Lightspeed, Revel Systems, Inc., TouchBistro Inc., Vend Limited, and Shopify Inc. focus on ease of deployment, multi-device synchronization, and mobile compatibility. Their systems enable quick setup, offline functionality, and support for omnichannel selling, helping businesses transition from traditional cash registers to digital checkout environments.

Additional players such as Bindo Labs, Inc., Loyverse POS, eHopper POS, Upserve, Inc., Lavu Inc., Epos Now, iZettle AB, NCR Corporation, Oracle Corporation, Ingenico Group, and Verifone Systems, Inc. contribute with hardware-integrated and enterprise-grade POS offerings. Their solutions serve larger retail chains, hospitality brands, and international merchants.

Top Key Players in the Market

- Square, Inc.

- ShopKeep by Lightspeed

- Toast, Inc.

- Clover Network, Inc.

- Revel Systems, Inc.

- TouchBistro Inc.

- Lightspeed POS Inc.

- Vend Limited

- Shopify Inc.

- Bindo Labs, Inc.

- Loyverse POS

- eHopper POS

- Upserve, Inc.

- Lavu Inc.

- Epos Now

- iZettle AB

- NCR Corporation

- Oracle Corporation

- Ingenico Group

- Verifone Systems, Inc.

- Others

Recent Developments

- April 2025: Lightspeed updated its fiscal outlook but continued to invest in innovative commerce solutions, focusing on its flagship POS systems for retail and hospitality. Despite macroeconomic challenges, it projects ongoing profitable growth and product development to empower merchants with omnichannel capabilities, including integration of acquired platforms like ShopKeep, which it acquired earlier (2020) to increase its US market presence

- March 2025: Square, Inc. launched a next-generation Square Point of Sale app that consolidates its payment and business operations tools into a single, unified app. This new version supports personalization for diverse business needs, improving sellers’ ability to manage restaurant, retail, and service operations from one platform. Testing showed an 80% increase in feature discovery among new users compared to the previous app, highlighting its user-friendly design and efficiency.

Report Scope

Report Features Description Market Value (2024) USD 8.5 Bn Forecast Revenue (2034) USD 30.0 Bn CAGR(2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Card Reader, Chip & Pin Reader), By Application (Retail, Hospitality, Hotels & Restaurants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Square, Inc., ShopKeep by Lightspeed, Toast, Inc., Clover Network, Inc., Revel Systems, Inc., TouchBistro Inc., Lightspeed POS Inc., Vend Limited, Shopify Inc., Bindo Labs, Inc., Loyverse POS, eHopper POS, Upserve, Inc., Lavu Inc., Epos Now, iZettle AB, NCR Corporation, Oracle Corporation, Ingenico Group, Verifone Systems, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-